by Adam Hartung | May 22, 2015 | In the Whirlpool, Leadership, Lock-in, Web/Tech

Hewlett Packard yesterday announced second quarter results. And they were undoubtedly terrible. Revenue compared to a year ago is down 7%, net income is down 21% as the growth stall at HP continues.

Yet, CEO Meg Whitman remains upbeat. She is pleased with “the continued success of our turnaround.” Which is good, because nobody else is. Rather than making new products and offering new solutions, HP has become a company that does little more than constantly restructure!

This latest effort, led by CEO Whitman, has been a split of the company into two corporations. For “strategic” (red flag) reasons, HP is dividing into a software company and a hardware company so that each can “focus” (second red flag) on its “core market” (third red flag.) But there seems to be absolutely no benefit to this other than creating confusion.

This latest restructuring is incredibly expensive. $1.8billion in restructuring charges, $1billion in incremental taxes, $400million annually in duplicated overhead services, then another $3billion in separation charges across the two new companies. That’s over $5B – which is more than HP’s net income in 2014 and 2013. There is no way this is a win for investors.

Additionally, HP has eliminated 48,000 jobs this this latest restructuring began in 2012. And the total will reach 55,000. So this is clearly not a win for employees.

The old HP will now be a hardware company, focused on PCs and printers. Both of which are declining markets as the world goes mobile. This is like the newspaper part of a media company during a split. An old business in serious decline with no clear path to sustainable sales and profits – much less growth. And in HP’s case it will be in a dog-eat-dog competitive battle to try and keep customers against Dell, Acer and Lenovo. Prices will keep dropping, and profits eroding as the world goes mobile. But despite spending $1.2billion to buy Palm (written off,) without any R&D, hard to see how this company returns profits to shareholders, generates new jobs, or launches new products for distributors and customers.

The new HP will be a software company. But it comes to market with almost no share against monster market leader Amazon, and competitors Microsoft and Cisco who are fighting to remain relevant. Even though HP spent $10B to buy ERP company Autonomy (written off) everyone has newer products, more innovation, more customers and more resources than HP.

Together there was faint hope for HP. The company could offer complete solutions. It could work with its distributors and value added resellers to develop unique vertical market solutions. By tweaking the various parts, hardware and software, HP had the possibility of building solutions that could justify premium prices and possibly create growth. But separated, these are now 2 “focused” companies that lack any new innovations, sell commodity products and lack enough share to matter in markets where share leads to winning developers and enterprise customers.

This may be the last stop for investors, and employees, to escape HP before things get a lot worse.

This may be the last stop for investors, and employees, to escape HP before things get a lot worse.

HP was the company that founded silicon valley. It was the tech place to work in the 1960s, 1970s and early 1980s. It was the Google, Facebook or Apple of that earlier time. When Carly Fiorina took over the dynamic and highly new product driven company in July, 1999 it was worth $45/share. She bought Compaq and flung HP into the commodity PC business, cutting new products and R&D. By the time the Board threw her out in 2005 the company was worth $35/share.

Mark Hurd took the CEO job, and he slashed and burned everything in sight. R&D was almost eliminated, as was new product development. If it could be outsourced, it was. And he whacked thousands of jobs. By killing any hope of growing the company, he improved the bottom line and got the stock back to $45.

Which is where it was 5 years ago today. But now HP is worth $35/share, once again. For investors, it’s been 25 years of up, down and sideways. The last 5 years the DJIA went up 80%; HP down 24%.

Companies cannot add value unless they develop new products, new solutions, new markets and grow. Restructuring after restructuring adds no value – as HP has demonstrated. For long-term investors, this is a painful lesson to learn. Let’s hope folks are getting the message loud and clear now.

by Adam Hartung | Mar 15, 2011 | Defend & Extend, In the Rapids, Innovation, Leadership, Openness, Web/Tech

You gotta love the revenue growth in companies like Apple and Google. From 2000 to 2010 Apple revenues jumped from $8B to $65B. Google grew from nothing to $29B. But for some organizations, amidst market shifts, simply maintaining revenues is an enormous challenge.

In a dynamic world, many companies are losing revenues to new competitors who seem on a suicide mission to destroy industry profitability! In this situation, the ability to grow takes on an entirely different flavor. As “core” markets retract (in revenues or profits,) can the company find a way to enter new markets in order to maintain revenues – and possibly grow profits? For many organizations, facing radical market shifts, moving from no-growth, declining profit markets into higher growth, better profit markets is a huge challenge.

Recall that IBM once completely dominated the computer industry. An IBM skunk works program in Florida is credited for creating the modern day personal computer – and because of the team’s decision to use external componentry (an IBM heresy at the time) creating Microsoft. As the market shifted toward these smaller computers, IBM focused on defending its traditional mainframe base, eschewing PC sales entirely. By the 1990s IBM was almost bankrupt! In trying to preserve its old, “core,” mainframe business IBM completely missed the market shift and waited until its customers started disappearing before taking action. But by then new competitors had claimed the new market!

In came an outsider, Louis Gerstner, who saw the trend toward far greater user of external services by people in information technology. He pushed IBM from being a “hardware” company to an “IT services” provider (overly simplified explanation, to be sure) and IBM roared back as a tremendous turnaround success story.

But, what would be next? As Mr. Gerstner left IBM the company’s “core” market was in for another huge upheaval. Vast armies of IT consultants had been created in other companies, such as Electronic Data Systems (EDS), Computer Sciences Corporation (CSC) and audit firms such as Anderson (now named Accenture) Coopers & Lybrand and Deloitte & Touche. This created rampant competition and margin pressures from so much capacity.

Simultaneously, the emergence of similar armies, often even more highly trained, of consultants in India at companies such as Tata Consultancy Services (TCS) and Infosys – at dramatically lower cost and using development standards such as the Capability Maturity Model – was further transforming the landscape of service providers. More and more services contracts were going to these new competitors in foreign countries at prices a fraction of historical rates. Domestic margins were tanking!

As IT integration and services lost its margin several big competitors began paying enormous premiums to buy customer computer shops, completely taking them over customer via a new approach called “outsourcing” – a solution offering that nearly bankrupted EDS due to the razor thin margins. The market IBM entered to save itself, and make Mr. Gerstner famous, was no longer capable of keeping IBM a profitably growing concern.

In 2002 it was by no means clear whether IBM would remain successful, or end up again in dire straights. But, as detailed in Fortune’s CNNMoney web site, “IBM’s Sam Palmisano: A Super Second Act” things haven’t gone too badly for IBM this decade as profits have grown 4 fold.

Rather than simply trying to do more of what Mr. Gerstner did, Mr. Palmisano lead IBM into developing a new scenario of the future, leading to the birth of the Smarter Planet program. Not dissimilar from how Steve Jobs used Apple’s scenario planning to push the company from Macs into new growth product markets, the scenario planning such as Smarter Planet opened many doors for new business opportunities at IBM. The result has been a dramatic increase (well more than doubling) its more profitable software sales, as well as development of new solutions for everything from global banking to transportation management, government systems and a whole lot more. New solutions driven by the desire to fulfill the future scenario – and solutions that are considerably more profitable than the gladiator war that had become IT services.

Using scenario planning to create White Space where employees can develop new solutions is a hallmark of successful companies. By redirecting resources away from defensive activities, new solutions can be created before the proverbial roof collapses in the declining margin business. By spending money on new product development, and new market development, new revenues are generated where there is more growth – and less competition. And that allows the company to shift with the marketplace, rather than be stuck in a bad business when it’s way too late to shift — because new competitors have already captured the new markets.

(For a White Space primer, check out the InnovationManagement.com article “White Space Mapping – Seeing the Future Beyond the Core.”)

When markets shift the first sign is intense competition, driving down margins. Too many leaders decide to “hunker down” and put all resources into defending the old business. Costs are slashed and all spending is put into competitive warfare. This, inevitably, leads to ugly results, because such behavior ignores the market shift. Being Smarter means recognizing the market shift, and changing investments – putting more money into new projects directed at finding new revenues, and most often higher rates of return.

Not all companies are growing like Apple, Google, Facebook or Groupon. But that doesn’t mean they aren’t on the road to growth by shifting their revenues into new markets – like IBM. What ties these companies together is their use of scenario planning to focus on the future, rather than relying on traditional planning systems firmly tied to the past. And investing in White Space so the company can find new markets, and new solutions, before competition eliminates the margin altogether.

If Mr. Palmisano is soon to leave IBM, as the article indicates is likely, we can surely hope the Board will seek out a replacement who is equally willing to make the right investments. Keeping the company pushing forward by developing future scenarios, and creating solutions that fulfill them.

by Adam Hartung | May 4, 2010 | Current Affairs, Defend & Extend, In the Rapids, Leadership, Openness, Web/Tech

"What business are you in?" is one of the most common business questions asked. People usually want a simple answer, like "I make widgets" or "I provide widget services." A simple answer allows people to easily cubbyhole the business, and remember what it does. And many think it provides for a well run business – through a simple focus – sort of like the Kentucky Fried Chicken ad "We only do chicken, and we do chicken right." Because the business's Identity is easy to understand employees can focus on Defending that Identity.

But in reality when your Identity is tightly tied to a product or service bad things happen when demand for that item wanes — or demand turns flat while supply is ample (or possibly growing). Competitors start trading punishing blows back and forth, and profits wane as competition intensifies. Business leaders start acting like gladiators trapped in a coliseum pit, undertaking ever more dangerous actions to survive amidst punishing competitiveness. Many don't survive. As results are increasingly threatened, the business's Identity is under attack, and the tendency to Defend that Identity is extremely strong. Such defense usually grows, even as results continue deteriorating.

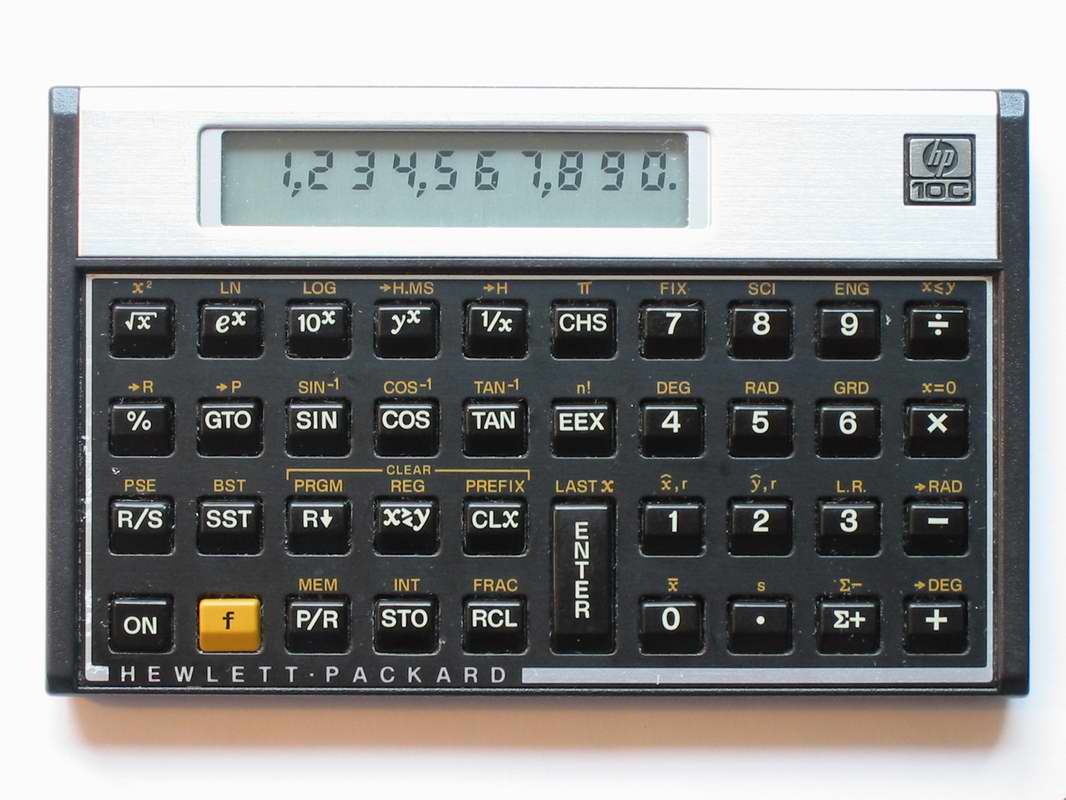

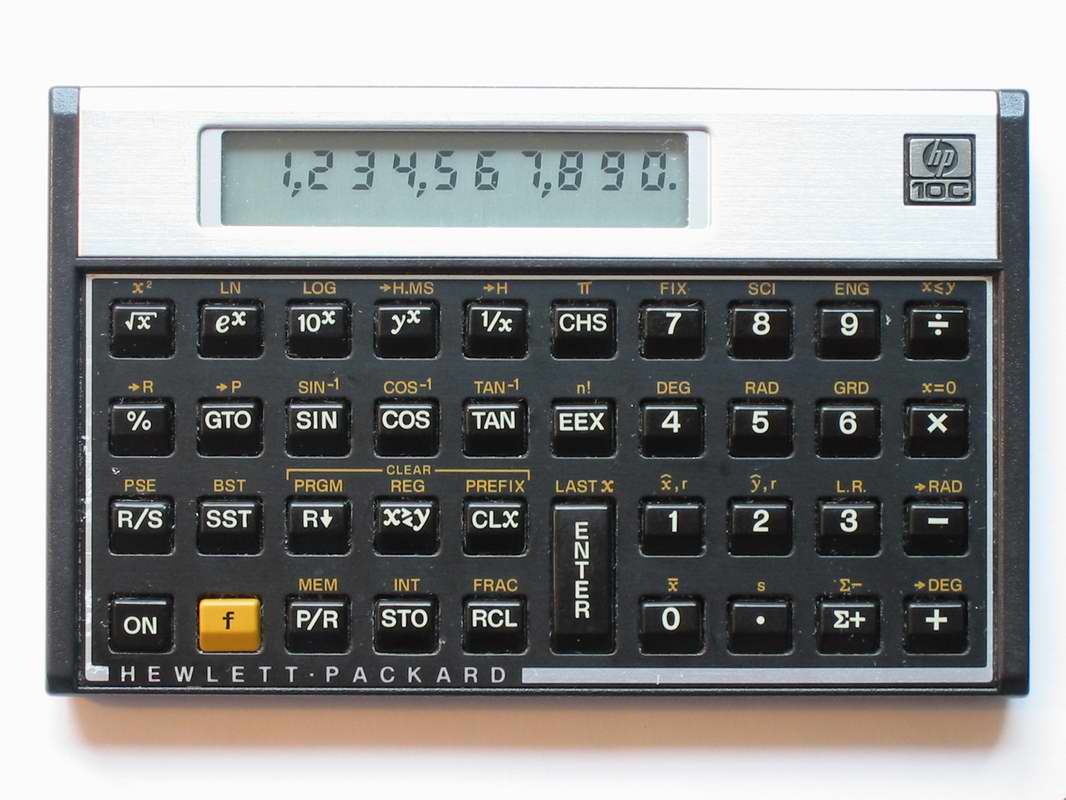

There is an alternative. Instead of trying to always be what you always were, you can do something different. Think about Hewlett Packard. HP started as an instrumentation company, making electronic tools, such as oscilliscopes, for engineers. But as the market shifted, HP's leaders have moved the company into new business – allowing the company to keep growing.

Source: Business Insider

By entering new businesses, some organically and some via acquisition, HP has been able to continue growing sales and profits. By letting each of these businesses do whatever they need to do to succeed, by giving them permission to do what the market demands and providing these new businesses with resources, HP has been able to compete in old businesses, while developing new businesses toward which the Success Formula can migrate. Thus, HP has become a company with a less simple Identity – but it also has been able to continue years of profitable growth.

Too often, opening these White Space projects for growth causes the traditional business to feel threatened. Those in the old Success Formula will often say that the company is "abandoning its past" and "walking away from a very profitable business." Like the old story of Homer, this is a "siren's song" – very dangerously pulling you toward the rocks which can sink your ship – because each month profitabiilty is becoming more and more threatened. While it might have been a profitable business in the past, as growth slows profitability is less and less likely in the future. As sales growth slows it is important the business do its best to develop a new Success Formula so it can maintain growth.

"Has Apple Forgotten the Mac?" is a recent PCWorld article. The authors point out that as Apple's revenues have transitioned toward new businesses, such as music and now mobile computing/telephony, the Mac business receives less attention and resources. Those who support the Mac business question if Apple should spend more resources on what has recently returned to profitability.

This is the kind of internal threat that can be very risky. While the Mac is a great product, with a loyal following, and regained profitability – we can see that in the future there will be less and less need for such desktop and laptop products. Apple is migrating toward the new mobile future – and as a result it must reduce the resources on the Mac business. Each year, more resource needs to be allocated toward the new, faster growing businesses, and less invested in the slower growing traditional computing products.

Apple's Identity was once all Mac. And that nearly bankrupted the company – as it almost ran out of cash back at the century's turn. Only by overcoming its Identity as a single product company, and rapidly moving into White Space with new products in new markets, was Apple able to regain its profitable growth path.

HP and Apple both show us that an Identity, created early in the lifecycle, is very powerful. But inevitably markets shift, and the results possible from a simple, easy to understand identity will decline. Only by overcoming that original Identity via entering new markets – and using White Space to evolve the Success Formula, can a business hope to have long-term revenue and profit growth.

by Adam Hartung | Apr 21, 2009 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lock-in, Web/Tech

"With Oracle, Sun avoids becoming another Yahoo," headlines Marketwatch.com today. As talks broke down because IBM was unwilling to up its price for Sun Microsystems, Oracle Systems swept in and made a counter-offer that looks sure to acquire the company. Unlike Yahoo – Sun will now disappear. The shareholders will get about 5% of the value Sun was worth a decade ago at its peak. That's a pretty serious value destruction, in any book. And if you don't think this is bad news for the employees and vendors just wait a year and see how many remain part of Oracle. A sale to IBM would have fared no better for investors, employees or vendors.

It was clear Sun wasn't able to survive several years ago. That's why I wrote about the company in my book Create Marketplace Disruption. Because the company was unwilling to allow any internal Disruptions to its Success Formula and any White Space to exist which might transform the company. In the fast paced world of information products, no company can survive if it isn't willing to build an organization that can identify market shifts and change with them.

I was at a Sun analyst conference in 1995 where Chairman McNealy told the analysts "have you seen the explosive growth over at Cisco System? I ask myself, how did we miss that?" And that's when it was clear Sun was in for big, big trouble. He was admitting then that Sun was so focused on its business, so focused on its core, that there was very little effort being expended on evaluating market shifts – which meant opportunities were being missed and Sun would be in big trouble when its "core" business slowed – as happens to all IT product companies. Sun had built its Success Formula selling hardware. Even though the real value Sun created shifted more and more to the software that drove its hardware, which became more and more generic (and less competitive) every year, Sun wouldn't change its strategy or tactics – which supported its identity as a hardware company – its Success Formula. Even though Sun became a leader in Unix operating systems, extensions for networking and accessing lots of data, as well as the creator and developer of Java for network applications because software was incompatible with the Success Formula, the company could not maintain independent software sales and the company failed.

Sort of like Xerox inventing the GUI (graphical user interface), mouse, local area network to connect a PC to a printer, and the laser printer but never capturing any of the PC, printer or desktop publishing market. Just because Xerox (and Sun) invented a lot of what became future growth markets did not insure success, because the slavish dedication to the old Success Formula (in Xerox's case big copiers) kept the company from moving forward with the marketplace.

Instead, Sun Microsystems kept trying to Defend & Extend its old, original Success Formula to the end. Even after several years struggling to sell hardware, Sun refused to change into the software company it needed to become. To unleash this value, Sun had to be acquired by another software company, Oracle, willing to let the hardware go and keep the software – according to the MercuryNews.com "With Oracle's acquisition of Sun, Larry Ellison's empire grows." Scott McNealy wouldn't Disrupt Sun and use White Space to change Sun, so its value deteriorated until it was a cheap buy for someone who could use the software pieces to greater value in another company.

Compare this with Steve Jobs. When Jobs left Apple in disrepute he founded NeXt to be another hardware company – something like a cross between Apple and Sun. But he found the Unix box business tough sledding. So he changed focus to a top application for high powered workstations – graphics – intending to compete with Silicon Graphics (SGI). But as he learned about the market, he realized he was better off developing application software, and he took over leadership of Pixar. He let NeXt die as he focused on high end graphics software at Pixar, only to learn that people weren't as interesed in buying his software as he thought they would be. So he transitioned Pixar into a movie production company making animated full-length features as well as commercials and short subjects. Mr. Jobs went through 3 Success Formulas getting the business right – using Disruptions and White Space to move from a box company to a software company to a movie studio (that also supplied software to box companies). By focusing on future scenarios, obsessing about competitors and Disrupting his approach he kept pushing into White Space. Instead of letting Lock-in keep him pushing a bad idea until it failed, he let White Space evolve the business into something of high value for the marketplace. As a result, Pixar is a viable competitor today – while SGI and Sun Microsystems have failed within a few months of each other.

It's incredibly easy to Defend & Extend your Success Formula, even after the business starts failing. It's easy to remain Locked-in to the original Success Formula and keep working harder and faster to make it a little better or cheaper. But when markets shift, you will fail if you don't realize that longevity requires you change the Success Formula. Where Unix boxes were once what the market wanted (in high volume), shifts in competitive hardware (PC) and software (Linux) products kept sucking the value out of that original Success Formula.

Sun needed to Disrupt its Lock-ins – attack them – in order to open White Space where it could build value for its software products. Where it could learn to sell them instead of force-bundling them with hardware, or giving them away (like Java.) And this is a lesson all companies need to take to heart. If Sun had made these moves it could have preserved much more of its value – even if acquired by someone else. Or it might have been able to survive as a different kind of company. Instead, Sun has failed costing its investors, employees and vendors billions.

This may be the last stop for investors, and employees, to escape HP before things get a lot worse.

This may be the last stop for investors, and employees, to escape HP before things get a lot worse.