by Adam Hartung | Oct 6, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Web/Tech

Hewlett Packard is splitting in two. Do you find yourself wondering why? You aren’t alone.

Hewlett Packard is nearly 75 years old. One of the original “silicone valley companies,” it started making equipment for engineers and electronic technicians long before computers were every day products. Over time HP’s addition of products like engineering calculators moved it toward more consumer products. And eventually HP became a dominant player in printers. All of these products were born out of deep skills in R&D, engineering and product development. HP had advantages because its products were highly desirable and unique, which made it nicely profitable.

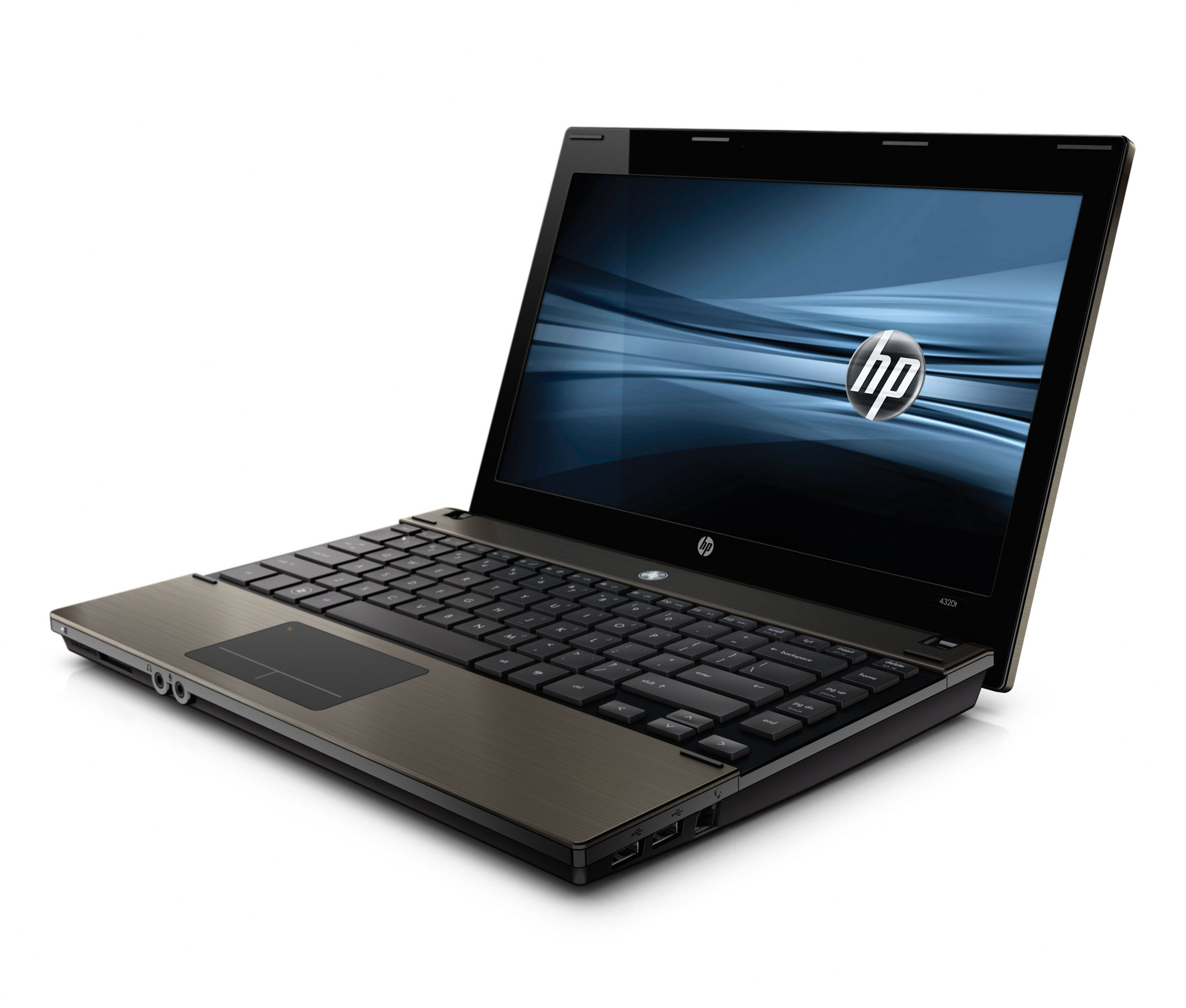

But along came a CEO named Carly Fiorina, and she decided HP needed to grow much bigger, much more quickly. So she bought Compaq, which itself had bought Digital Equipment, so HP could sell Wintel PCs. PCs were a product in which HP had no advantage. PC production had always been an assembly operation of other companies’ intellectual property. It had been a very low margin, brutally difficult place to grow unless one focused on cost lowering rather than developing intellectual capital. It had nothing in common with HP’s business.

To fight this new margin battle HP replaced Ms. Fiorina with Mark Hurd, who recognized the issues in PC manufacturing and proceeded to gut R&D, product development and almost every other function in order to push HP into a lower cost structure so it could compete with Dell, Acer and other companies that had no R&D and cultures based on cost controls. This led to internal culture conflicts, much organizational angst and eventually the ousting of Mr. Hurd.

But, by that time HP was a company adrift with no clear business model to help it have a sustainably profitable future.

Now HP is 4 years into its 5 year turnaround plan under Meg Whitman’s leadership. This plan has made HP much smaller, as layoffs have dominated the implementation. It has weakened the HP brand as no important new products have been launched, and the gutted product development capability is still no closer to being re-established. And PC sales have stagnated as mobile devices have taken center stage – with HP notably weak in mobile products. The company has drifted, getting no better and showing no signs of re-developing its historical strengths.

So now HP will split into two different companies. Following the old adage “if you can’t dazzle ’em with brilliance, baffle ’em with bulls**t.” When all else fails, and you don’t know how to actually lead a company, then split it into pieces, push off the parts to others to manage and keep at least one CEO role for yourself.

Let’s not forget how this mess was created. It was a former CEO who decided to expand the company into an entirely different and lower margin business where the company had no advantage and the wrong business model. And another that destroyed long-term strengths in innovation to increase short-term margins in a generic competition. And then yet a third who could not find any solution to sustainability while pushing through successive rounds of lay-offs.

This was all value destruction created by the persons at the top. “Strategic” decisions made which, inevitably, hurt the organization more than helped it. Poorly thought through actions which have had long-term deleterious repercussions for employees, suppliers, investors and the communities in which the businesses operate.

The game of musical chairs has been very good for the CEOs who controlled the music. They were paid well, and received golden handshakes. They, and their closest reports, did just fine. But everyone else….. well…..

by Adam Hartung | Jul 9, 2009 | Current Affairs, Defend & Extend, In the Rapids, In the Whirlpool, Leadership, Lock-in, Openness

Google is growing, and GM is trying to get out of bankruptcy. On the surface there are lots of obvious differences. Different markets, different customers, different products, different size of company, different age. But none of these get to the heart of what's different about the two companies. None of these really describe why one is doing well while the other is doing poorly.

GM followed, one could even say helped create, the "best practices" of the industrial era. GM focused on one industry, and sought to dominate that market. GM eschewed other businesses, selling off profitable businesses in IT services and aircraft electronics. Even selling off the parts business for its own automobiles. GM focused on what it knew how to do, and didn't do anything else.

GM also figured out its own magic formula to succeed, and then embedded that formula into its operating processes so the same decisions were replicated again and again. GM Locked-in on that Success Formula, doing everything possible to Defend & Extend it. GM built tight processes for everything from procurement to manufacturing operations to new product development to pricing and distribution. GM didn't focus on doing new things, it focused on trying to make its early money making processes better. As time went by GM remained committed to reinforcing its processes, believing every year that the tide would turn and instead of losing share to competitors it would again gain share. GM believed in doing what it had always done, only better, faster and cheaper. Even into bankruptcy, GM believed that if it followed its early Success Formula it would recapture earlier rates of return.

Google is an information era company, defining the new "best practices". It's early success was in search engine development, which the company turned into a massive on-line advertising placement business that superceded the first major player (Yahoo!). But after making huge progress in that area, Google did not remain focused alone on doing "search" better year after year. Since that success Google has also launched an operating system for mobile phones (Android), which got it into another high-growth market. It has entered the paid search marketplace. And now, "Google takes on Windows with Chrome OS" is the CNN headline.

"Google to unveil operating system to rival Microsoft" is the Marketwatch headline. This is not dissimilar from GM buying into the airline business. For people outside the industry, it seems somewhat related. But to those inside the industry this seems like a dramatic move. For participants, these are entirely different technologies and entirely different markets. Not only that, but Microsoft's Windows has dominated (over 90% market share) the desktop and laptop computer markets for years. To an industrial era strategist the Windows entry barriers would be considered insurmountable, making it not worthwhile to pursue any products in this market.

Google is unlike GM in that

- it has looked into the future and recognizes that Windows has many obstacles to operating effictively in a widely connected world. Future scenarios show that alternative products can make a significant difference in the user experience, and even though a company currently dominates the opportunity exists to Disrupt the marketplace;

- Google remains focused on competitors, not just customers. Instead of talking to customers, who would ask for better search and ad placement improvements, Google has observed alternative, competitive operating system products, like Unix and Linux, making headway in both servers and the new netbooks. While still small share, these products are proving adept at helping people do what they want with small computers and these customers are not switching to Windows;

- Google is not afraid to Disrupt its operations to consider doing something new. It is not focused on doing one thing, and doing it right. Instead open to bringing to market new technologies rapidly when they can Disrupt a market; and

- Google uses extensive White Space to test new solutions and learn what is needed in the product, distribution, pricing and promotion. Google gives new teams the permission and resources to investigate how to succeed – rather than following a predetermined path toward an internally set goal (like GM did with its failed electric car project).

Nobody today wants to be like GM. Struggling to turn around after falling into bankruptcy. To be like Google you need to quit following old ideas about focusing on your core and entry barriers – instead develop scenarios about the future, study competitors for early market insights, Disrupt your practices so you can do new things and test lots of ideas in White Space to find out what the market really wants so you can continue growing.

Don't forget to download the new, free ebook "The Fall of GM: What Went Wrong and How To Avoid Its Mistakes"

by Adam Hartung | Jun 22, 2009 | Current Affairs, Defend & Extend, Disruptions, In the Rapids, In the Swamp, In the Whirlpool, Leadership, Lifecycle, Web/Tech

For years business leaders have sought advice which would allow their organizations to become "evergreen." Evergreen businesses constantly renew themselves, remaining healthy and growing constantly without even appearing to turn dormant. Of course, as I often discuss, most companies never achieve this status. Today investors, employees and vendors of Apple should be very pleased. Apple is showing the signs of becoming evergreen.

For the last few years Apple has done quite well. Resurgent from a near collapse as an also-ran producer of niche computers, Apple became much more as it succeeded with the iPod, iTunes and iPhone. But many analysts, business news pundits and investors wanted all the credit to go to CEO Steve Jobs. It's popular to use the "CEO as hero" thinking, and say Steve Jobs singlehandedly saved Apple. But, as talented as Steve Jobs is, we all know that there are a lot of very talented people at Apple and it was Mr. Jobs willingness to Disrupt the old Success Formula and implement White Space which let that talent come out that really turned around Apple. The question remained, however, whether Disruptions and White Space were embedded, or only happening as long as Mr. Jobs ran the show. And largely due to this question, the stock price tumbled and people grew anxious when he took medical leave (chart here).

This weekend we learned that yes, Mr. Jobs has been very sick. The Wall Street Journal today reported "Jobs had liver transplant". With this confirmation, we know that the company has been run by the COO Tim Cook and not a "shadow" Mr. Jobs. Simultaneously, first report on the Silicon Valley/San Jose Business Journal is "Apple Claims 1M iPhone Sales" last weekend in the launch of its new 3G S mobile phone and operating system. This is a huge number by the measure of any company, exceeded analysts expectations by 33-50%, and equals the last weekend launch of a new model – despite the currently horrible economy. This performance indicates that Apple is building a company that can survive Mr. Jobs.

On the other side of the coin, "Walgreen's profit drops as costs hit income" is the Crain's Chicago Business report. Walgreen's is struggling because it's old Success Formula, which relied very heavily on opening several new stores a week, no longer produces the old rates of return. Changes in financing, coupled with saturation, means that Walgreen's has to change its Success Formula to make money a different way, and that has been tough for them to find. The retail market shifted. Although Walgreen's opened White Space projects the last few years, there have been no Disruptions and thus none of the new ideas "stuck." Growth has slowed, profits have fallen and Walgreen's has gone into a Growth Stall. Now all projects are geared at inventory reduction and cost cutting, as described at Marketwatch.com in "Higher Costs Hurt Walgreen's Profits."

Now the company is saying it wants to take out $1B in costs in 2011. No statement about how to regain growth, just a cost reduction — one of the first, and most critical, signs of Defend & Extend Management doing the wrong things when the company hits the Flats. And now management is saying that costs will be higher in 2009/2010 in order to allow it to cut costs in 2011. If you're asking yourself "say what?" you aren't alone. This is pure financial machination. Raise costs today, declare a lower profit, in order to try padding the opportunity to declare a ferocious improvement in future year(s). This has nothing to do with growth, and never helps a company. To the contrary, it's the second most critical sign of D&E Management doing the wrong thing at the most critical time in the company's history. When in the Flats, instead of Disrupting and using White Space to regain growth these actions push the company into the Swamp of low growth and horrible profit performance.

We now can predict performance at Walgreen's pretty accurately. They will do more of the same, trying to do it better, faster and cheaper. They will have little or no revenue growth. They may sell stores and use that to justify a flat to down revenue line. The use of accounting tricks will help management to "engineer" short-term profit reporting. But the business has slid into a Growth Stall from which it has only a 7% chance of ever again growing consistently at a mere 2%. This is exactly the kind of behavior that got GM into bankruptcy – see "The Fall of GM."

The right stuff seems to be happening at Apple. But keep your eyes open, a new iPhone is primarily Extend behavior – not requiring a Disruption or necessarily even White Space. We need to see Apple exhibit more Disruptions and White Space to make us true believers. On the other hand, it's definitely time to throw in the towel on Walgreen's. Management is resorting to financial machinations to engineer profits, and that's always a bad sign. When management attention is on accounting rather than Disruptions and White Space to grow the future is sure to be grim.

by Adam Hartung | Jun 1, 2009 | Current Affairs, Disruptions, In the Rapids, Leadership, Openness

June 1, 2009 will be remembered for a really long time. As I last blogged, I think the iconic impact of GM as one of the most successful and profitable of all industrial companies makes its bankruptcy more important than almost any other company.

As GM loses its market value, it was forced off the Dow Jones Industrial Average. In "What's behind the Dow changes?" (Marketwatch.com) we can read about how the Wall Street Journal editors selected Cisco to replace GM. I've long been a detractor of GM for its slavik devotion to its outdated Success Formula. For an equally long time I've long been a fan of Cisco and how it keeps its Success Formula evergreen. Cisco reflects the behaviors needed to succeed in an information economy, and its addition to the DJIA is a big improvement in measuring the American economy and its potential for growth.

What I most admire about Cisco is management's requirement to obsolete the company's own products. This one element has proven to be critical to Cisco's ongoing growth – and the company's ability to avoid being another Sun Microsystems. By forcing themselves to obsolete their own products, Cisco doesn't get trapped in "cannibalization" arguments. Management doesn't get trapped into listening to big customers who want Cisco to slow its product introduction cycle. Leaders end up Disrupting the company internally to do new things that will replace outdated revenues. It sounds so simple, yet it's been so incredibly powerful. "Obsolete your own products" is a statement that has helped keep Cisco a long-term winner.

Since even before writing "Create Marketplace Disruption" I've espoused that Cisco is a Phoenix Principle kind of company. One that uses extensive scenario planning to plan for the future, one that obsesses about competitors in order to never have second-place products, willing to Disrupt its product plans and markets to continue growing, and loaded with White Space developing new solutions for new markets. It's a great choice to be on the Dow – which will eventually have to replace all the outdated companies (like Kraft) with companies that rely on information – rather than industrial production – to make money.

by Adam Hartung | Apr 21, 2009 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lock-in, Web/Tech

"With Oracle, Sun avoids becoming another Yahoo," headlines Marketwatch.com today. As talks broke down because IBM was unwilling to up its price for Sun Microsystems, Oracle Systems swept in and made a counter-offer that looks sure to acquire the company. Unlike Yahoo – Sun will now disappear. The shareholders will get about 5% of the value Sun was worth a decade ago at its peak. That's a pretty serious value destruction, in any book. And if you don't think this is bad news for the employees and vendors just wait a year and see how many remain part of Oracle. A sale to IBM would have fared no better for investors, employees or vendors.

It was clear Sun wasn't able to survive several years ago. That's why I wrote about the company in my book Create Marketplace Disruption. Because the company was unwilling to allow any internal Disruptions to its Success Formula and any White Space to exist which might transform the company. In the fast paced world of information products, no company can survive if it isn't willing to build an organization that can identify market shifts and change with them.

I was at a Sun analyst conference in 1995 where Chairman McNealy told the analysts "have you seen the explosive growth over at Cisco System? I ask myself, how did we miss that?" And that's when it was clear Sun was in for big, big trouble. He was admitting then that Sun was so focused on its business, so focused on its core, that there was very little effort being expended on evaluating market shifts – which meant opportunities were being missed and Sun would be in big trouble when its "core" business slowed – as happens to all IT product companies. Sun had built its Success Formula selling hardware. Even though the real value Sun created shifted more and more to the software that drove its hardware, which became more and more generic (and less competitive) every year, Sun wouldn't change its strategy or tactics – which supported its identity as a hardware company – its Success Formula. Even though Sun became a leader in Unix operating systems, extensions for networking and accessing lots of data, as well as the creator and developer of Java for network applications because software was incompatible with the Success Formula, the company could not maintain independent software sales and the company failed.

Sort of like Xerox inventing the GUI (graphical user interface), mouse, local area network to connect a PC to a printer, and the laser printer but never capturing any of the PC, printer or desktop publishing market. Just because Xerox (and Sun) invented a lot of what became future growth markets did not insure success, because the slavish dedication to the old Success Formula (in Xerox's case big copiers) kept the company from moving forward with the marketplace.

Instead, Sun Microsystems kept trying to Defend & Extend its old, original Success Formula to the end. Even after several years struggling to sell hardware, Sun refused to change into the software company it needed to become. To unleash this value, Sun had to be acquired by another software company, Oracle, willing to let the hardware go and keep the software – according to the MercuryNews.com "With Oracle's acquisition of Sun, Larry Ellison's empire grows." Scott McNealy wouldn't Disrupt Sun and use White Space to change Sun, so its value deteriorated until it was a cheap buy for someone who could use the software pieces to greater value in another company.

Compare this with Steve Jobs. When Jobs left Apple in disrepute he founded NeXt to be another hardware company – something like a cross between Apple and Sun. But he found the Unix box business tough sledding. So he changed focus to a top application for high powered workstations – graphics – intending to compete with Silicon Graphics (SGI). But as he learned about the market, he realized he was better off developing application software, and he took over leadership of Pixar. He let NeXt die as he focused on high end graphics software at Pixar, only to learn that people weren't as interesed in buying his software as he thought they would be. So he transitioned Pixar into a movie production company making animated full-length features as well as commercials and short subjects. Mr. Jobs went through 3 Success Formulas getting the business right – using Disruptions and White Space to move from a box company to a software company to a movie studio (that also supplied software to box companies). By focusing on future scenarios, obsessing about competitors and Disrupting his approach he kept pushing into White Space. Instead of letting Lock-in keep him pushing a bad idea until it failed, he let White Space evolve the business into something of high value for the marketplace. As a result, Pixar is a viable competitor today – while SGI and Sun Microsystems have failed within a few months of each other.

It's incredibly easy to Defend & Extend your Success Formula, even after the business starts failing. It's easy to remain Locked-in to the original Success Formula and keep working harder and faster to make it a little better or cheaper. But when markets shift, you will fail if you don't realize that longevity requires you change the Success Formula. Where Unix boxes were once what the market wanted (in high volume), shifts in competitive hardware (PC) and software (Linux) products kept sucking the value out of that original Success Formula.

Sun needed to Disrupt its Lock-ins – attack them – in order to open White Space where it could build value for its software products. Where it could learn to sell them instead of force-bundling them with hardware, or giving them away (like Java.) And this is a lesson all companies need to take to heart. If Sun had made these moves it could have preserved much more of its value – even if acquired by someone else. Or it might have been able to survive as a different kind of company. Instead, Sun has failed costing its investors, employees and vendors billions.