by Adam Hartung | Apr 27, 2016 | Food and Drink, In the Rapids, In the Swamp, Retail, Software, Web/Tech

Growth fixes a multitude of sins. If you grow revenues enough (you don’t even need profits, as Amazon has proven) investors will look past a lot of things. With revenue growth high enough, companies can offer employees free meals and massages. Executives and senior managers can fly around in private jets. Companies can build colossal buildings as testaments to their brand, or pay to have thier names on public buildings. R&D budgets can soar, and product launches can fail. Acquisitions are made with no concerns for price. Bonuses can be huge. All is accepted if revenues grow enough.

Just look at Facebook. Today Facebook announced today that for the quarter ended March, 2016 revenues jumped to $5.4B from $3.5B a year ago. Net income tripled to $1.5B from $500M. And the company is basically making all its revenue – 82% – from 1 product, mobile ads. In the last few years Facebook paid enormous premiums to buy WhatsApp and Instagram – but who cares when revenues grow this fast.

Anticipating good news, Facebook’s stock was up a touch today. But once the news came out, after-hours traders pumped the stock to over $118//share, a new all time high. That’s a price/earnings (p/e) multiple of something like 84. With growth like that Facebook’s leadership can do anything it wants.

But, when revenues slide it can become a veritable poop puddle. As Apple found out.

Rumors had swirled that Apple was going to say sales were down. And the stock had struggled to make gains from lows earlier in 2016. When the company’s CEO announced Tuesday that sales were down 13% versus a year ago the stock cratered after-hours, and opened this morning down 10%. Breaking a streak of 51 straight quarters of revenue growth (since 2003) really sent investors fleeing. From trading around $105/share the last 4 days, Apple closed today at ~$97. $40B of equity value was wiped out in 1 day, and the stock trades at a p/e multiple of 10.

The new iPhone 6se outsold projections, iPads beat expectations. First year Apple Watch sales exceeded first year iPhone sales. Mac sales remain much stronger than any other PC manufacturer. Apple iBeacons and Apple Pay continue their march as major technologies in the IoT (Internet of Things) market. And Apple TV keeps growing. There are about 13M users of Apple’s iMusic. There are 1.5M apps on the iTunes store. And the installed base keeps the iTunes store growing. Share buybacks will grow, and the dividend was increased yet again. But, none of that mattered when people heard sales growth had stopped. Now many investors don’t think Apple’s leadership can do anything right.

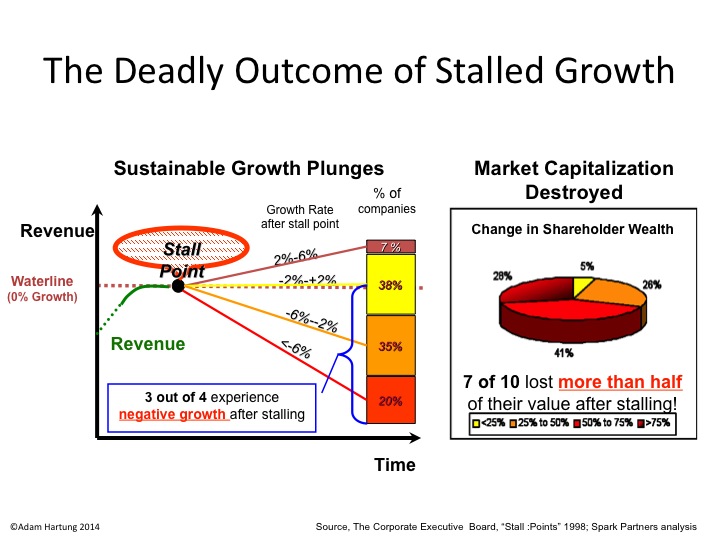

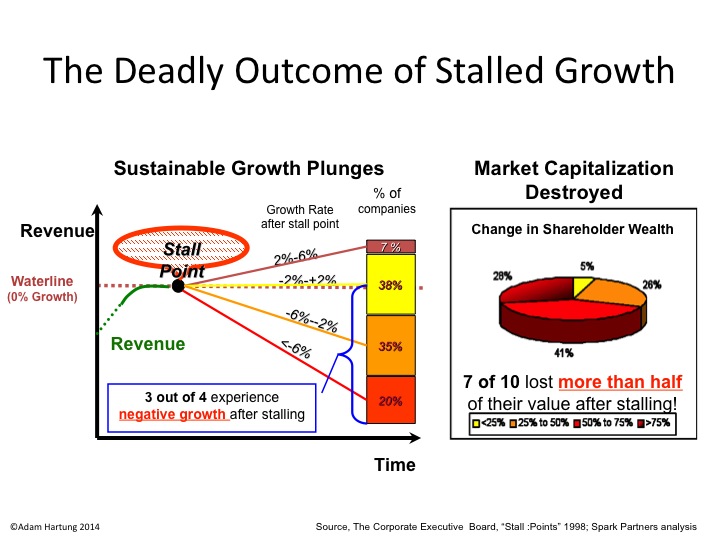

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Which leads us to Chipotle. Chipotle announced that same store sales fell almost 30% in Q1, 2016. That was after a 15% decline in Q4, 2015. And profits turned to losses for the quarter. That is a growth stall. Chipotle shares were $750/share back in early October. Now they are $417 – a drop of over 44%.

Customer illnesses have pointed to a company that grew fast, but apparently didn’t have its act together for safe sourcing of local ingredients, and safe food handling by employees. What seemed like a tactical problem has plagued the company, as more customers became ill in March.

Whether that is all that’s wrong at Chipotle is less clear, however. There is a lot more competition in the fast casual segment than 2 years ago when Chipotle seemed unable to do anything wrong. And although the company stresses healthy food, the calorie count on most portions would add pounds to anyone other than an athlete or construction worker – not exactly in line with current trends toward dieting. What frequently looks like a single problem when a company’s sales dip often turns out to have multiple origins, and regaining growth is nearly always a lot more difficult than leadership expects.

Growth is magical. It allows companies to invest in new products and services, and buoy’s a stock’s value enhancing acquisition ability. It allows for experimentation into new markets, and discovering other growth avenues. But lack of growth is a vital predictor of future performance. Companies without growth find themselves cost cutting and taking actions which often cause valuations to decline.

Right now Facebook is in a wonderful position. Apple has investors rightly concerned. Will next quarter signal a return to growth, or a Growth Stall? And Chipotle has investors heading for the exits, as there is now ample reason to question whether the company will recover its luster of yore.

by Adam Hartung | Jun 8, 2011 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Apple’s market value has struggled in 2011. When I ask people why, the overwhelming top 3 responses are:

- How can a company nearly bankrupt 10 years ago become the second most valuable company on the equity market?

- Apple has had a long run, isn’t it about to end?

- How can Apple be worth so much, when it has no “real” assets?

I’m struck by how these questions are based on looking backward, rather than looking into the future.

Firstly, it doesn’t matter where you start, but rather how well you run the race. What happened in the past is just that, the past. Changing technologies, products, solutions, customers, business practices, economic conditions and competitors cause markets to shift. When they shift, competitor positions change. The strong can remain strong, but it’s also possible for company’s fortunes to change drastically. Apple has taken advantage of market shifts – even created them – in order to change its fortunes. What investors should care about is the future.

Which leads to the second question; and the answer that there’s no reason to think Apple’s growth run will end any time soon. Perhaps Apple won’t maintain 100% annual growth forever, but it doesn’t have to grow at that rate to be a very valuable investment. And worth a lot more than the current value. That Apple can grow at 20% (or a lot more) for another several years is a very high probability bet:

- Apple’s growth markets are young, and the markets themselves are growing fast. Apple is not in a gladiator war to maintain old customers, but instead is creating new customers for digital/mobile entertainment, smartphones and mobile tablets. Because it is in high growth markets it’s odds of maintaining company growth are very good. Just look at the recent performance of iPad tablet sales, a market most analysts predicted would struggle against cheaper netbooks. Quarterly sales are blowing past early 2010 estimates of annual sales, and are 250% over last year (chart source Silicon Alley Insider):

- Apple’s products continue to improve. Apple is not resting upon its past success, but rather keeps adding new capability to its old offerings in order to migrate customers to its new platforms. At the recent developer’s conference,for example, Apple described how it was adding Twitter integration for enhanced social media to its platforms and introducing its own messenger service, bypassing 3rd party services (like SMS) and replacing competitive products like RIM’s BBM.

- Further, Apple is introducing new solutions like iCloud (TechStuffs.net “Apple iCloud Key Features and Price) offering free wireless synching between Apple platforms, free and seamless back-ups, and the ability to operate without a PC (even Mac flavor) if you want to be mobile-only (“The 10 Huge Things Apple Just Revealed” BusinessInsider.com). These solutions keep expanding the market for Apple sales into new markets – such as small businesses (Entrepreneur.com “What Lion Means for Small Business“) as it solves unmet needs ignored by historically powerful solutions providers, or offered at far too high a price.

Thirdly, investors wonder how a company can be worth so much without much in the way of “real” assets. The answer lies in understanding how the business world has shifted. In an industrial economy real assets – like land, building, machinery – was greatly valued. They were the means of production, and wealth generation. But we have transitioned to the information economy. Now the information around a business, and providing digital solutions, are worth considerably more than “real” assets.

How many closed manufacturing plants, retail stores or restaurants have you seen? How many real estate developers have shuttered? Contrarily, what’s the value of customer lists and customer access at companies like Amazon.com, GroupOn, Linked-In, Twitter and Facebook in today’s information economy? What’s the demand for printed books, and what’s the demand for ebooks (such as Kindle?) “Real” asset values are tumbling because they are easy to obtain, and owning them produces precious little value, or profit, in today’s globally competitive economy.

This same week that Apple announced a barrage of revenue-generating upgrades and new products asset rich Wal-Mart made an announcement as well. After a decade in which Apple’s value skyrocketed to over $330B (More than Microsoft and Intel Combined by the way), Wal-Mart’s value has gone nowhere, mired around $185B. Wal-Mart’s answer is to buy back it’s shares. The Board has authorized continuing and expanding a massive share buyback program of literally 1 million shares/day – 10% of all shares traded daily! The amount allocated is 1/6th the entire market cap! At this rate 24x7WallStreet.com headlined “Wal-Mart’s Buyback Plan Grows & Grows.. Could Take Itself Private by 2025.”

Share buybacks produce NO VALUE. They don’t produce any revenue, or profit. All they do is take company cash, and spend it to buy company shares. The asset (cash) is spent (removed) in the process of buying shares, which are then removed from the company’s equity. The company actually gets smaller, because it has less assets and less equity. (Compared to LInked-In, for example, that grew larger by selling shares and increasing its cash assets.) Over time the cash disappears, and the equity disappears. Eventually, you have no company left! Stock buybacks are an end of lifecycle investment, and should trigger great fear in investors as they demonstrate management has lost the ability to identify high-yield growth opportunities.

Wal-Mart is steeped in assets. It has land, buildings, stores, shelves, warehouses, trucks, huge computer systems. But these assets simply don’t produce a lot of profit, as competitors are squeezing margins every year. And there’s not much growth, because doing more of what it always did isn’t really wanted by a lot more people. So it has gobs of assets. So what? The assets simply aren’t worth a lot when the market doesn’t need any more retail stores; especially boring ones with limited product selection, limited imagination and nothing but “low price.”

Assets aren’t the “store of value” analysts gave them in an industrial economy, and it’s time we realize investing in “assets” is fraught with risk. Assets, like homes and autos have shown us, can go down in value even easier and faster than they can go up. Global competitors can match the assets, and drive down prices using cheap labor and operating by less onerous standards. In today’s market, assets are as likely to be an anchor on value as an asset.

I started 2011 saying Apple was a screaming buy. Today that’s even more true than it was then. Apple’s revenues, profits and cash flow are up. Sales in existing lines are still profitably growing at double (or triple) digit rates, and enhancements keep Apple in front of competitors. Meanwhile Apple is entering new markets every quarter, with solutions meeting existing, unmet needs. Because value has been stagnant, the value (price) to revenue, earnings and cash flow have all declined, making Apple cheaper than ever. It’s time to invest based on looking to the future, and not the past. Doing so means you buy Apple today, and start dumping asset intensive stocks like Wal-mart.

Update 12 June, 2011 – Chart from SeekingAlpha.com. Apple’s cash hoard grows faster than its valuation. When a company can grow cash flow and profits faster than revenues – and it’s doubling revenues – that’s a screaming buy!

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.