by Adam Hartung | Apr 15, 2016 | Defend & Extend, In the Whirlpool, Lifecycle, Web/Tech

Leading tech tracking companies IDC and Gartner both announced Q1, 2016 PC sales results, and they were horrible. Sales were down 9.5%-11.5% depending on which tracker you asked. And that’s after a horrible Q4, 2015 when sales were off more than 10%. PC sales have now declined for 6 straight quarters, and sales are roughly where they were in 2007, 9 years ago.

Oh yeah, that was when the iPhone launched – June, 2007. And just a couple of years before the iPad launched. Correlation, or causation?

Amazingly, when Q4 ended the forecasters were still optimistic of a stabilization and turnaround in PC sales. Typical analyst verbage was like this from IDC, “Commercial adoption of Windows 10 is expected to accelerate, and consumer buying should also stabilize by the second half of the year. Most PC users have delayed an upgrade, but can only maintain this for so long before facing security and performance issues.” And just to prove that hope springs eternal from the analyst breast, here is IDC’s forecast for 2016 after the horrible Q1, “In the short term, the PC market must still grapple with limited consumer interest and competition from other infrastructure upgrades in the commercial market. Nevertheless….things should start picking up in terms of Windows 10 pilots turning into actual PC purchases.”

Fascinating. Once again, the upturn is just around the corner. People have always looked forward to upgrading their PCs, there has always been a “PC upgrade cycle” and one will again emerge. Someday. At least, the analysts hope so. Maybe?

Microsoft investors must hope so. The company is selling at a price/earnings multiple of 40 on hopes that Windows 10 sales will soon boom, and re-energize PC growth. Surely. Hopefully. Maybe?

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was so little interest that its launch barely made any news at all. This market, these products, are really no longer relevant to the growth of personal technology.

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was so little interest that its launch barely made any news at all. This market, these products, are really no longer relevant to the growth of personal technology.

Back when I predicted that Windows 8 would be a flop I was inundated with hate mail. It was clear that Ballmer was a terrible CEO, and would soon be replaced by the board. Same when I predicted that Surface tablets would not sell well, and that all Windows devices would not achieve significant share. People called me “an Apple Fanboy” or a “Microsoft hater.” Actually, neither was true. It was just clear that a major market shift was happening in computing. The world was rapidly going mobile, and cloud-based, and the PC just wasn’t going to be relevant. As the PC lost relevancy, so too would Microsoft because it completely missed the market, and its entries were far too tied to old ways of thinking about personal and corporate computing – not to mention the big lead competitors had in devices, apps and cloud services.

I’ve never said that modern PCs are bad products. I have a son half way through a PhD in Neurobiological Engineering. He builds all kinds of brain models and 3 dimensional brain images and cell structure plots — and he does all kinds of very exotic math. His world is built on incredibly powerful, fast PCs. He loves Windows 10, and he loves PCs — and he really “doesn’t get” tablets. And I truly understand why. His work requires local computational power and storage, and he loves Windows 10 over all other platforms.

But he is not a trend. His deep understanding of the benefits of Windows 10, and some of the PC manufacturers as well as those who sell upgrade componentry, is very much a niche. While he depends heavily on Microsoft and Wintel manufacturers to do his work, he is a niche user. (BTW he uses a Nexus phone and absolutely loves it, as well. And he can wax eloquently about the advantages he achieves by using an Android device.)

Today, I doubt I will receive hardly any comments to this column. Because to most people, the PC is nearly irrelevant. People don’t actually care about PC sales results, or forecasts. Not nearly as much as, say, care about whether or not the iPhone 6se advances the mobile phone market in a meaningful way.

Most people do their work, almost if not all their work, on a mobile device. They depend on cloud and SaaS (software-as-a-service) providers and get a lot done on apps. What they can’t do on a phone, they do on a tablet, by and large. They may, or may not, use a PC of some kind (Mac included in that reference) but it is not terribly important to them. PCs are now truly generic, like a refrigerator, and if they need one they don’t much care who made it or anything else – they just want it to do whatever task they have yet to migrate to their mobile world.

The amazing thing is not that PC sales have fallen for 6 quarters. That was easy to predict back in 2013. The amazing thing is that some people still don’t want to accept that this trend will never reverse. And many people, even though they haven’t carried around a laptop for months (years?) and don’t use a Windows mobile device, still think Microsoft is a market leader, and has a great future. PCs, and for the most part Microsoft, are simply no more relevant than Sears, Blackberry, or the Encyclopedia Britannica. Yet it is somewhat startling that some people have failed to think about the impact this has on their company, companies that make PC software and hardware – and the impact this will have on their lives – and likely their portfolios.

by Adam Hartung | Apr 5, 2016 | Disruptions, In the Rapids, Leadership, Web/Tech

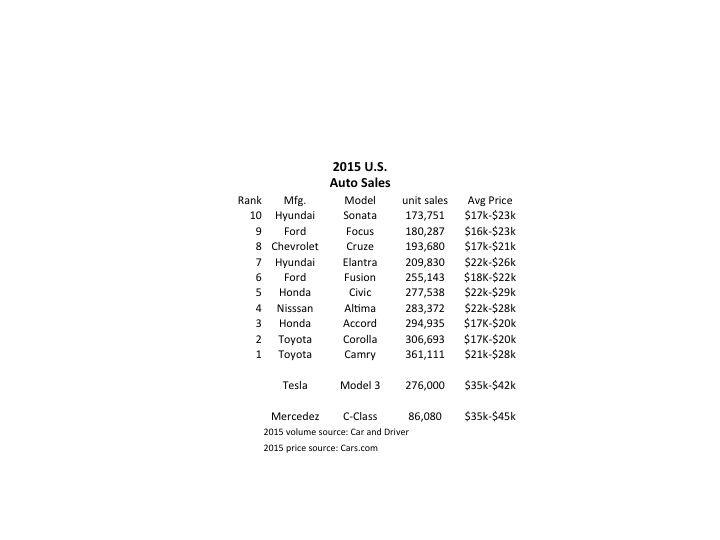

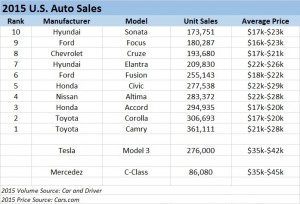

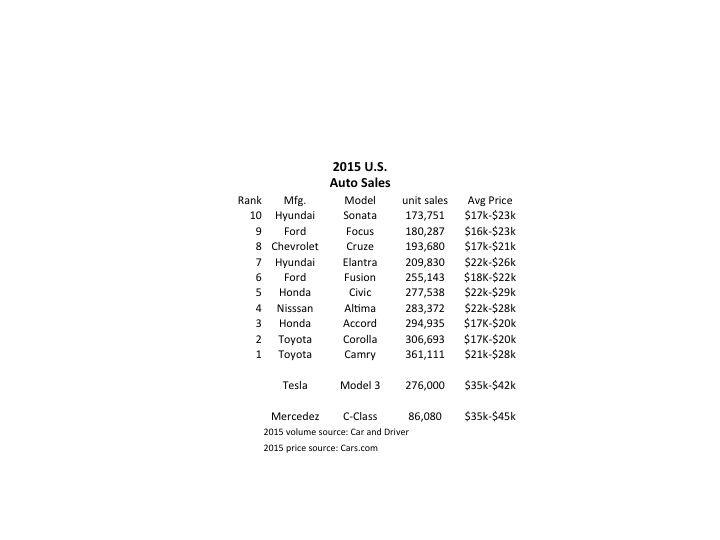

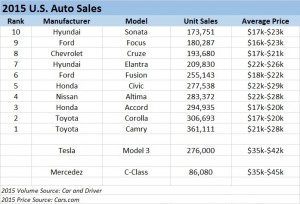

Tesla started taking orders for the Model 3 last week, and the results were remarkable. In 24 hours the company took $1,000 deposits for 198,000 vehicles. By end of Saturday the $1,000 deposits topped 276,000 units. And for a car not expected to be available in any sort of volume until 2017. Compare that with the top selling autos in the U.S. in 2015:

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Even more astonishing is the average selling price. Note that top 10 cars are not highly priced, mostly in the $17,000 to $25,000 price range. But the Tesla is base priced at $35,000, and expected with options to sell closer to $42,000. That is almost twice as expensive as the typical top 10 selling auto in the U.S.

Tesla has historically been selling much more expensive cars, the Model S being its big seller in 2015. So if we classify Tesla as a “luxury” brand and compare it to like-priced Mercedes Benz C-Class autos we see the volumes are, again, remarkable. In under 1 week the Model 3 took orders for 3 times the volume of all C-Class vehicles sold in the U.S. in 2015.

[Car and Driver top 10 cars; Mercedes Benz 2015 unit sales; Tesla 2015 unit sales; Model 3 pricing]

Although this has surprised a large number of people, the signs were all pointing to something extraordinary happening. The Tesla Model S sold 50,000 vehicles in 2015 at an average price of $70,000 to $80,000. That is the same number of the Mercedes E-Class autos, which are priced much lower in the $50,000 range. And if you compare to the top line Mercedes S-Class, which is only slightly more expensive at an average $90,0000, the Model S sold over 2 times the 22,000 units Mercedes sold. And while other manufacturers are happy with single digit percentage volume growth, in Q4 Tesla shipments were 75% greater in 2015 than 2014.

In other words, people like this brand, like these cars and are buying them in unprecedented numbers. They are willing to plunk down deposits months, possibly years, in advance of delivery. And they are paying the highest prices ever for cars sold in these volumes. And demand clearly outstrips supply.

Yet, Tesla is not without detractors. From the beginning some analysts have said that high prices would relegate the brand to a small niche of customers. But by outselling all other manufacturers in its price point, Tesla has demonstrated its cars are clearly not a niche market. Likewise many analysts argued that electric cars were dependent on high gasoline prices so that “economic buyers” could justify higher prices. Yet, as gasoline prices have declined to prices not seen for nearly a decade Tesla sales keep going up. Clearly Tesla demand is based on more than just economic analysis of petroleum prices.

People really like, and want, Tesla cars. Even if the prices are higher, and if gasoline prices are low.

Emerging is a new group of detractors. They point to the volume of cars produced in 2015, and first quarter output of just under 15,000 vehicles, then note that Tesla has not “scaled up” manufacturing at anywhere near the necessary rate to keep customers happy. Meanwhile, constructing the “gigafactory” in Nevada to build batteries has slowed and won’t meet earlier expectations for 2016 construction and jobs. Even at 20,000 cars/quarter, current demand for Model S and Model 3 They project lots of order cancellations would take 4.5 years to fulfill.

Which leads us to the beauty of sales growth. When products tap an under- or unfilled need they frequently far outsell projections. Think about the iPod, iPhone and iPad. There is naturally concern about scaling up production. Will the money be there? Can the capacity come online fast enough?

Of course, of all the problems in business this is one every leader should want. It is certainly a lot more fun to worry about selling too much rather than selling too little. Especially when you are commanding a significant price premium for your product, and thus can be sure that demand is not an artificial, price-induced variance.

With rare exceptions, investors understand the value of high sales at high prices. When gross margins are good, and capacity is low, then it is time to expand capacity because good returns are in the future. The Model 3 release projects a backlog of almost $12B. Booked orders at that level are extremely rare. Further, short-term those orders have produced nearly $300million of short-term cash. Thus, it is a great time for an additional equity offering, possibly augmented with bond sales, to invest rapidly in expansion. Problematic, yes. Insolvable, highly unlikely.

On the face of it Tesla appears to be another car company. But something much more significant is afoot. This sales level, at these prices, when the underlying economics of use seem to be moving in the opposite direction indicates that Tesla has tapped into an unmet need. It’s products are impressing a large number of people, and they are buying at premium prices. Based on recent orders Tesla is vastly outselling competitive electric automobiles made by competitors, all of whom are much bigger and better resourced. And those are all the signs of a real Game Changer.

by Adam Hartung | Apr 2, 2015 | Current Affairs, Defend & Extend, In the Rapids, Innovation, Leadership, Web/Tech

Microsoft launched its new Surface 3 this week, and it has been gathering rave reviews. Many analysts think its combination of a full Windows OS (not the slimmed down RT version on previous Surface tablets,) thinness and ability to operate as both a tablet and a PC make it a great product for business. And at $499 it is cheaper than any tablet from market pioneer Apple.

Meanwhile Apple keeps promoting the new Apple Watch, which was debuted last month and is scheduled to release April 24. It is a new product in a market segment (wearables) which has had very little development, and very few competitive products. While there is a lot of hoopla, there are also a lot of skeptics who wonder why anyone would buy an Apple Watch. And these skeptics worry Apple’s Watch risks diverting the company’s focus away from profitable tablet sales as competitors hone their offerings.

Looking at these launches gives a lot of insight into how these two companies think, and the way they compete. One clearly lives in red oceans, the other focuses on blue oceans.

Blue Ocean Strategy (Chan Kim and Renee Mauborgne) was released in 2005 by Harvard Business School Press. It became a huge best-seller, and remains popular today. The thesis is that most companies focus on competing against rivals for share in existing markets. Competition intensifies, features blossom, prices decline and the marketplace loses margin as competitors rush to sell cheaper products in order to maintain share. In this competitively intense ocean segments are niched and products are commoditized turning the water red (either the red ink of losses, or the blood of flailing competitors, choose your preferred metaphor.)

On the other hand, companies can choose to avoid this margin-eroding competitive intensity by choosing to put less energy into red oceans, and instead pioneer blue oceans – markets largely untapped by competition. By focusing beyond existing market demands companies can identify unmet needs (needs beyond lower price or incremental product improvements) and then innovate new solutions which create far more profitable uncontested markets – blue oceans.

Obviously, the authors are not big fans of operational excellence and a focus on execution, but instead see more value for shareholders and employees from innovation and new market development.

If we look at the new Surface 3 we see what looks to be a very good product. Certainly a product which is competitive. The Surface 3 has great specifications, a lot of adaptability and meets many user needs – and it is available at what appears to be a favorable price when compared with iPads.

But …. it is being launched into a very, very red ocean.

The market for inexpensive personal computing devices is filled with a lot of products. Don’t forget that before we had tablets we had netbooks. Low cost, scaled back yet very useful Microsoft-based PCs which can be purchased at prices that are less than half the cost of a Surface 3. And although Surface 3 can be used as a tablet, the number of apps is a fraction of competitive iOS and Android products – and the developer community has not yet embraced creating new apps for Windows tablets. So Surface 3 is more than a netbook, but also a lot more expensive.

Additionally, the market has Chromebooks which are low-cost devices using Google Chrome which give most of the capability users need, plus extensive internet/cloud application access at prices less than a third that of Surface 3. In fact, amidst the Microsoft and Apple announcements Google announced it was releasing a new ChromeBit stick which could be plugged into any monitor, then work with any Bluetooth enabled keyboard and mouse, to turn your TV into a computer. And this is expected to sell for as little as $100 – or maybe less!

This is classic red ocean behavior. The market is being fragmented into things that work as PCs, things that work as tablets (meaning run apps instead of applications,) things that deliver the functionality of one or the other but without traditional hardware, and things that are a hybrid of both. And prices are plummeting. Intense competition, multiple suppliers and eroding margins.

Ouch. The “winners” in this market will undoubtedly generate sales. But, will they make decent profits? At low initial prices, and software that is either deeply discounted or free (Google’s cloud-based MSOffice competitive products are free, and buyers of Surface 3 receive 1 year free of MS365 Office in the cloud, as well as free upgrade to Windows 10,) it is far from obvious how profitable these products will be.

Amidst this intense competition for sales of tablets and other low-end devices, Apple seems to be completely focused on selling a product that not many people seem to want. At least not yet. In one of the quirkier product launch messages that’s been used, Apple is saying it developed the Apple Watch because its other innovative product line – the iPhone – “is ruining your life.”

Apple is saying that its leaders have looked into the future, and they think today’s technology is going to move onto our bodies. Become far more personal. More interactive, more knowledgeable about its owner, and more capable of being helpful without being an interruption. They see a future where we don’t need a keyboard, mouse or other artificial interface to connect to technology that improves our productivity.

Right. That is easy to discount. Apple’s leaders are betting on a vision. Not a market. They could be right. Or they could be wrong. They want us to trust them. Meanwhile, if tablet sales falter….. if Surface 3 and ChromeBit do steal the “low end” – or some other segment – of the tablet market…..if smartphone sales slip….. if other “forward looking” products like ApplePay and iBeacon don’t catch on……

This week we see two companies fundamentally different methods of competing. Microsoft thinks in relation to its historical core markets, and engaging in bloody battles to win share. Microsoft looks at existing markets – in this case tablets – and thinks about what it has to do to win sales/share at all cost. Microsoft is a red ocean competitor.

Apple, on the other hand, pioneers new markets. Nobody needed an iPod… folks were happy enough with Sony Walkman and Discman. Everybody loved their Razr phones and Blackberries… until Apple gave them an iPhone and an armload of apps. Netbook sales were skyrocketing until iPads came along providing greater mobility and a different way of getting the job done.

Apple’s success has not been built upon defending historical markets. Rather, it has pioneered new markets that made existing markets obsolete. Its success has never looked obvious. Contrarily, many of its products looked quite underwhelming when launched. Questionable. And it has cannibalized its own products as it brought out new ones (remember when iPods were so new there was the iPod mini, iPod nano and iPod Touch? After 5 years of declining iPod sale Apple has stopped reporting them.) Apple avoids red oceans, and prefers to develop blue ones.

Which company will be more successful in 2020? Time will tell. But, since 2000 Apple has gone from nearly bankrupt to the most valuable publicly traded company in the USA. Since 1/1/2001 Microsoft has gone up 32% in value. Apple has risen 8,000%. While most of us prefer the competition in red oceans, so far Apple has demonstrated what Blue Ocean Strategy authors claimed, that it is more profitable to find blue oceans. And they’ve shown us they can do it.

by Adam Hartung | Dec 18, 2014 | Current Affairs, Defend & Extend, Food and Drink, Leadership, Lifecycle

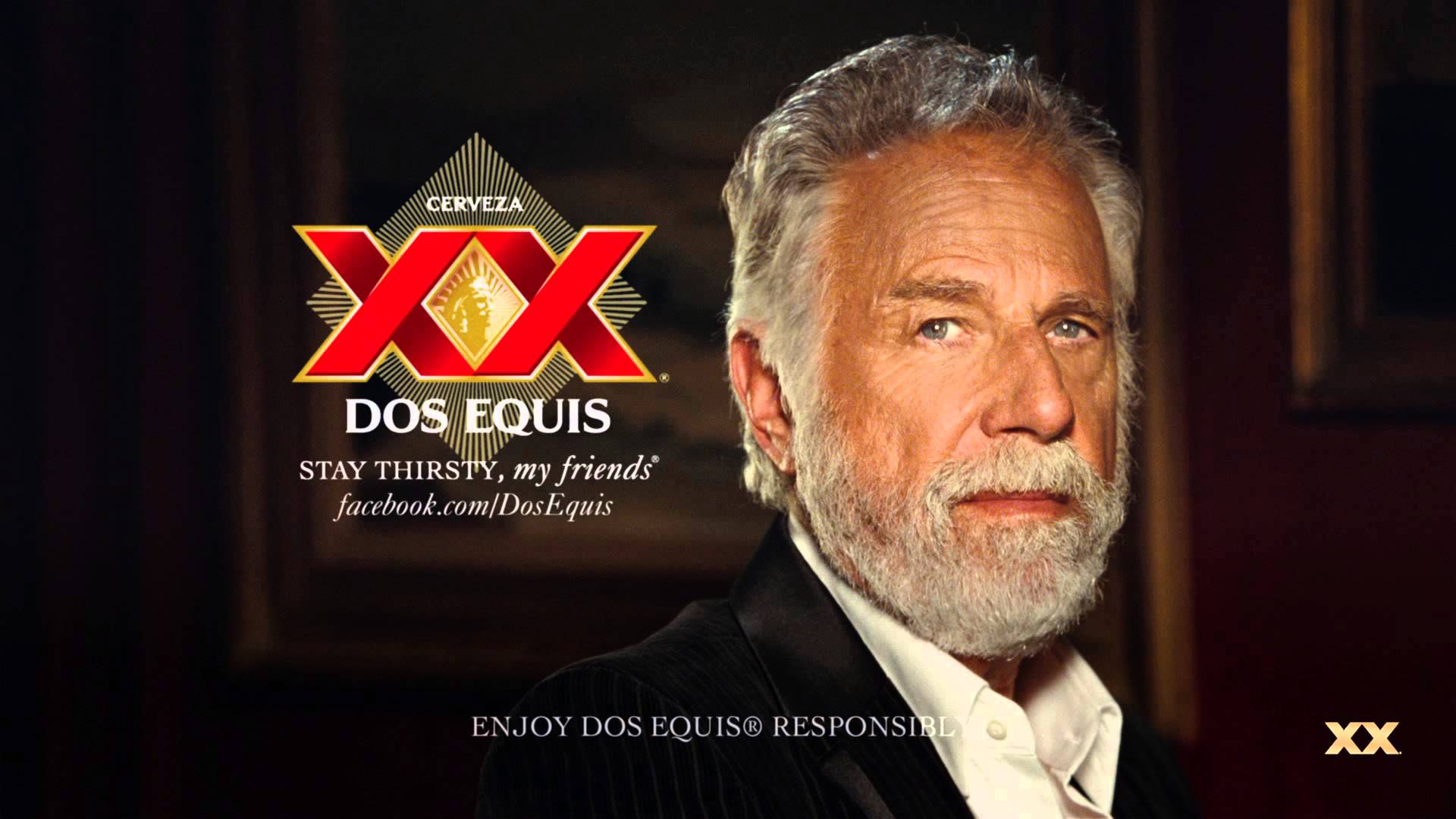

It is that time of year when many of us celebrate with an alcoholic beverage. But increasingly in America, that beverage is not beer. Since 2008, American beer sales have fallen about 4%.

But that decline has not been equally applied to all brands. The biggest, old line brands have suffered terribly. Nearly gone are old brands like Milwaukee’s Best, which were best known for being low priced – and certainly not focused on taste. But the most hurt, based on volume declines, have been what were once the largest brands; Budweiser, Miller Lite and Miller High Life. These have lost more than a quarter of their volume, losing a whopping 13million barrels/year of demand. These 3 brand declines account for 6% reduction in the entire beer market.

The popular myth is that this has been due to the rise of craft beers. And there is no doubt, craft beer sales have done well. Sales are up 80%. Many articles (including the WSJ)tout the growth of craft beers, which are ostensibly more tasty and appealing, as being the reason old-line brands have declined. It is an easy explanation to accept, and has largely gone unchallenged. Even the brewer of Budweiser, Annheuser-Busch InBev, has reacted to this argument by taking the incredible action of dropping clydesdale horses from their ads after 81 years – in an effort to woo craft beer drinkers, which are thought to be younger and less sentimental about large horses.

This all makes sense. Too bad it’s the wrong conclusion – and the wrong actions being taken.

Realize that craft beer sales are up from a small base, and today ALL craft beer sales still account for only 7.6% of the market. In fact, ALL craft beers combined sell only the same volume as the now smaller Budweiser. The problem with Budweiser sales – and sales of other big name brand beers – is a change in demographics.

Drinkers of Budweiser and Lite are simply older. These brands rose to tremendous dominance in the 1970s. Many of those who loved this brand are simply older – or dead. Where a hard working fellow in his 30s or 40s might enjoy a six pack after work, today that Boomer (if still alive) is somewhere between late 50s and 70s. Now, a single beer, or maybe two, will suffice thank you very much. And, equally challenging for sales, today’s Boomer is more often drinking a hard liquor cocktail, and a glass of wine with dinner. Beer drinking has its place, but less often and in lower quantities.

Meanwhile, Hispanics are a growing demographic. Hispanics are the largest non-white population in America, at 54million, and represent over 17% of all Americans. With a growth rate of 2.1%, Hispanics are also one of the fastest growing demographic segments – and increasingly important given their already large size. Hispanics are truly becoming a powerful buying group in American economics.

So, just as decline in Boomer population and consumption has hurt the once great beer brands, we can look at the growth in Hispanic demographics and see a link to sales of growing brands. Two significant (non-craft volume) beer brands that more than doubled sales since 2008 are Modelo Especial and Dos Equis. In fact, these were the 2 fastest growing brands in America, even though the first does no English language advertising at all, and the latter only lightly funds advertising with an iconic multi-year campaign. Together their sales total almost 5.4M barrels – which makes these 2 brands equal to 1/3 the ENTIRE craft beer marketplace. And growing 33% faster!

Chasing the myth of craft sales is doing nothing for InBev and MillerCoors as they try to defend and extend outdated brands. On the other hand, Heineken controls Dos Equis, and Constellation Brands controls Modello Especial. These two companies are squarely aligned with demographic trends, and well positioned for growth.

So, be careful the next time you hear some simple explanation for why a product or service is declining. The answer might sound appealing, but have little economic basis. Instead, it is much smarter to look at big trends and you’ll likely see why in the same market one product is growing, while another is declining. Trends – such as demographics – often explain a lot about what is happening, and lead you to invest much smarter.

by Adam Hartung | Feb 18, 2014 | Current Affairs, Games, In the Swamp, Leadership

Microsoft has a new CEO. And a new Chairman. The new CEO says the company needs to focus on core markets. And analysts are making the same cry.

Amidst this organizational change, xBox continues its long history of losing money – as much as $2B/year. And early 2014 results show that xBox One is selling at only half the rate of Sony’s Playstation 4, with cumulative xBox One sales at under 70% of PS4, leading Motley Fool to call xBox One a “total failure.”

While calling xBox One a failure may be premature, Microsoft investors have plenty to worry about.

Firstly, the console game business has not been a profitable market for anyone for quite a while.

The old leader, Nintendo, watched sales crash in 2013, first quarter 2014 estimates reduced by 67% and the CEO now projecting the company will be unproftable for the year. Nintendo stock declined by 2/3 between 2010 and 2012, then after some recovery in 2013 lost 17% on the January day of its disappointing sales expectation. Not a great market indicator.

The new sales leader is Sony, but that should give no one reason to cheer. Sony lost money for 4 straight years (2008-2012), and was barely able to squeek out a 2013 profit only because it took a massive $4.6B 2012 loss which cleared the way to show something slightly better than break-even. Now S&P has downgraded Sony’s debt to near junk status. While PS4 sales are better than xBox One, in the fast shifting world of gaming this is no lock on future sales as game developers constantly jockey dollars between platforms.

Whether Sony will make money on PS4 in 2014 is far from proven. Especially since it sells for $100/unit (20%) less than xBox One – which compresses margins. What investors (and customers) can expect is an ongoing price war between Nintendo, Sony and Microsoft to attract sales. A competition which historically has left all competitors with losses – even when they win the market share war.

And on top of all of this is the threat that console market growth may stagnate as gamers migrate toward games on mobile devices. How this will affect sales is unknown. But given what happened to PC sales it’s not hard to imagine the market for consoles to become smaller each year, dominated by dedicated game players, while the majority of casual game players move to their convenient always-on device.

Due to its limited product range, Nintendo is in a “fight to the death” to win in gaming. Sony is now selling its PC business, and lacks strong offerings in most consumer products markets (like TVs) while facing extremely tough competition from Samsung and LG. Sony, likewise, cannot afford to abandon the Playstation business, and will be forced to engage in this profit killing battle to attract developers and end-use customers.

When businesses fall into profit-killing price wars the big winner is the one who figures out how to exit first. Back in the 1970s when IBM created domination in mainframes the CEO of GE realized it was a profit bloodbath to fight for sales against IBM, Sperry Rand and RCA. Thinking fast he made a deal to sell the GE mainframe business to RCA so the latter could strengthen its campaign as an IBM alternative, and in one step he stopped investing in a money-loser while strenghtening the balance sheet in alternative markets like locomotives and jet engines – which went on to high profits.

With calls to focus, Microsoft is now abandoning XP. It is working to force customers to upgrade to either Windows 7 or Windows 8. As PC sales continue declining, Microsoft faces an epic battle to shore up its position in cloud services and maintain its enterprise customers against competitors like Amazon.

After a decade in gaming, where it has never made money, now is the time for Microsoft to recognize it does not know how to profit from its technology – regardless how good. Microsoft could cleve off Kinect for use in its cloud services, and give its installed xBox base (and developer community) to Nintendo where the company could focus on lower cost machines and maintain its fight with Sony.

Analysts that love focus would cheer. They would cheer the benefit to Nintendo, and the additional “focus” to Microsoft. Microsoft would stop investing in the unprofitable game console market, and use resources in markets more likely to generate high returns. And, with some sharp investment bankers, Microsoft could also probably keep a piece of the business (in Nintendo stock) that it could sell at a future date if the “suicide” console business ever turns into something profitable.

Sometimes smart leadership is knowing when to “cut and run.”

Links:

2012 recognition that Sony was flailing without a profitable strategy

January, 2013 forecast that microsoft would abandon gaming

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was so little interest that its launch barely made any news at all. This market, these products, are really no longer relevant to the growth of personal technology.

The world has shifted, and far too many people don’t like to recognize the shift. When Windows 8 launched it was clear that interest in PC software was diminishing. What was once a major front page event, a Windows upgrade, was unimportant. By the time Windows 10 came along there was so little interest that its launch barely made any news at all. This market, these products, are really no longer relevant to the growth of personal technology.

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]