by Adam Hartung | Apr 24, 2017 | Newsletter Post

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Stop Throwing Your Company’s Resources Away

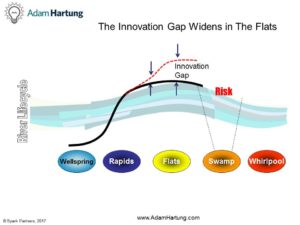

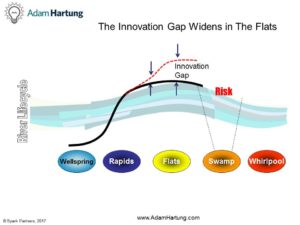

Is your organization stuck in the Flats of the River Lifecycle  while the Innovation Gap grows? Are you pouring your resources into doing more of what you’ve done, even though you aren’t achieving the results you want – and need? Are competitors outflanking you with innovations? Are your customers telling you everything is fine, then buying from competitors? OUCH!!!

while the Innovation Gap grows? Are you pouring your resources into doing more of what you’ve done, even though you aren’t achieving the results you want – and need? Are competitors outflanking you with innovations? Are your customers telling you everything is fine, then buying from competitors? OUCH!!!

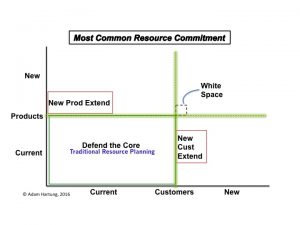

You need to change how you use your resources. You need to figure out how to put more resources into new products and customers, and less into trying to defend & extend sales of current products to current customers.

You need to change how you use your resources. You need to figure out how to put more resources into new products and customers, and less into trying to defend &extend sales of current products to current customers.

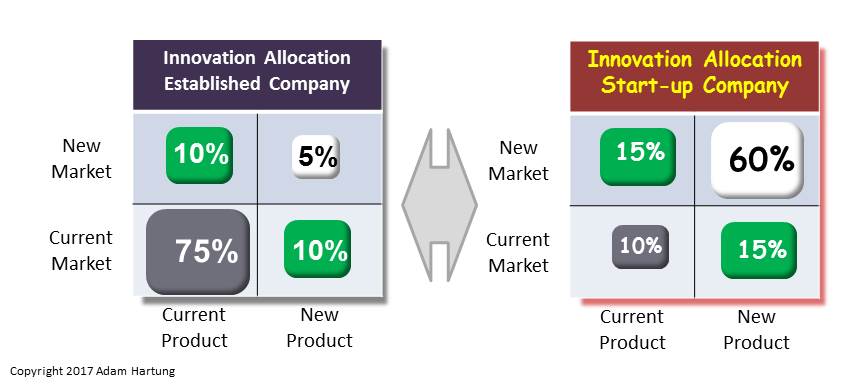

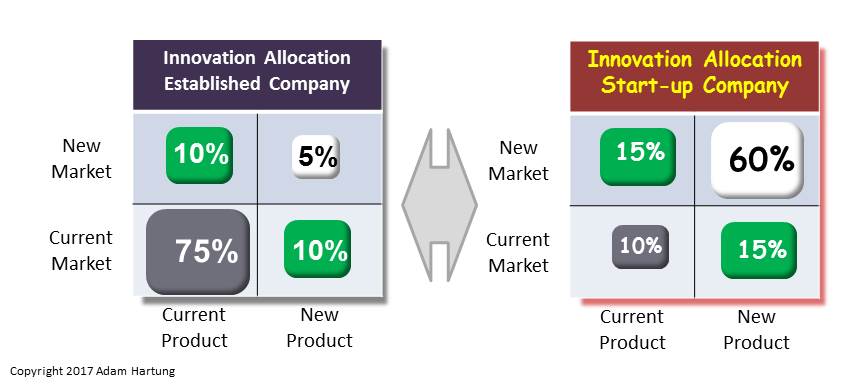

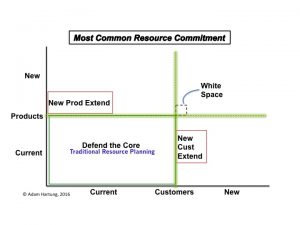

For established companies, the investment mix often looks like this.

But for start-ups would you be surprised to know their resources are allocated more like this?

Our experience taught us that when the Current/Current investment exceeds 40% the company is “Stuck in the Flats;” over-resourcing slow growth business while under-resourcing new opportunities. After the frenzied growth in the Rapids, it feels like a relief to reach the Flats – where leadership would love to cruise along on auto-pilot, fine-tuning a few things and watching costs. But, the drift into decline begins at that moment- because the focus shifts to internal process optimization at the expense of monitoring external market trends. (Click here for last month’s newsletter on the River.)

Remember, the Ansoff matrix doesn’t just apply to where you put the money. As the Bain alums wrote in “Time,Talent, Energy” (see my review here,) you can use the Ansoff matrix to manage your talented people. In the Flats, leadership puts the best people in the Existing/Existing corner – optimizing the OLD business. The unintended effect is to dry up the Wellspring of new ideas, and leave precious little talent available for focusing on new growth.

To remain on the growth curve, companies need to put their best people onto new efforts, including projects in the New/New corner! By moving more investment capital, and talent clusters, into other cells any company can keep the Wellspring flowing with ideas and find The Next Big thing.

“Knowing your purpose helps you in using all available resources in achieving your goals.”

Sunday Adelaja

Pastor and Author

Examine or audit your investment in innovation. Try to assess the investment in each cell of the Ansoff matrix. Be rigorous about your classification because your competitors may be innovating or “pivoting” just to survive. Look for an outside source to provide some objective feedback on investment of people, funds and assets. Don’t hesitate to ask for help in making your organization more adaptable, and your strategy embedded with options to pivot based on market shifts. You could start with an underperforming product or brand.

We are your experts at identifying trends, creating scenarios and building monitoring systems. We’ve done this kind of work for over 20 years, and bring a wealth of experience, and tools, to the task. You don’t have to go into scenario planning alone; we can be your coach and mentor to speed learning, and success.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my Status Quo Risk Management Playbook.

Give us a call today, or send an email, so we can talk about how you can be a leader, rather than follower. Or check out the rest of the website to read up on what we do so we can create the right level of engagement for you.

Forbes Posts- Hartung on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Jun 9, 2016 | Innovation, Investing, Software, Teamwork

Last week Bloomberg broke a story about how Microsoft’s Chairman, John Thompson, was pushing company management for a faster transition to cloud products and services. He even recommended changes in spending might be in order.

Really? This is news?

Let’s see, how long has the move to mobile been around? It’s over a decade since Blackberry’s started the conversion to mobile. It was 10 years ago Amazon launched AWS. Heck, end of this month it will be 9 years since the iPhone was released – and CEO Steve Ballmer infamously laughed it would be a failure (due to lacking a keyboard.) It’s now been 2 years since Microsoft closed the Nokia acquisition, and just about a year since admitting failure on that one and writing off $7.5B And having failed to achieve even 3% market share with Windows phones, not a single analyst expects Microsoft to be a market player going forward.

So just now, after all this time, the Board is waking up to the need to change the resource allocation? That does seem a bit like looking into barn lock acquisition long after the horses are gone, doesn’t it?

The problem is that historically Boards receive almost all their information from management. Meetings are tightly scheduled affairs, and there isn’t a lot of time set aside for brainstorming new ideas. Or even for arguing with management assumptions. The work of governance has a lot of procedures related to compliance reporting, compensation, financial filings, senior executive hiring and firing – there’s a lot of rote stuff. And in many cases, surprisingly to many non-Directors, the company’s strategy may only be a topic once a year. And that is usually the result of a year long management controlled planning process, where results are reviewed and few challenges are expected. Board reviews of resource allocation are at the very, very tail end of management’s process, and commitments have often already been made – making it very, very hard for the Board to change anything.

And these planning processes are backward-oriented tools, designed to defend and extend existing products and services, not predict changes in markets. These processes originated out of financial planning, which used almost exclusively historical accounting information. In later years these programs were expanded via ERP (Enterprise Resource Planning) systems (such as SAP and Oracle) to include other information from sales, logistics, manufacturing and procurement. But, again, these numbers are almost wholly historical data. Because all the data is historical, the process is fixated on projecting, and thus defending, the old core of historical products sold to historical customers.

Copyright Adam Hartung

Efforts to enhance the process by including extensions to new products or new customers are very, very difficult to implement. The “owners” of the planning processes are inherent skeptics, inclined to base all forecasts on past performance. They have little interest in unproven ideas. Trying to plan for products not yet sold, or for sales to customers not yet in the fold, is considered far dicier – and therefore not worthy of planning. Those extensions are considered speculation – unable to be forecasted with any precision – and therefore completely ignored or deeply discounted.

And the more they are discounted, the less likely they receive any resource funding. If you can’t plan on it, you can’t forecast it, and therefore, you can’t really fund it. And heaven help some employee has a really novel idea for a new product sold to entirely new customers. This is so “white space” oriented that it is completely outside the system, and impossible to build into any future model for revenue, cost or – therefore – investing.

Take for example Microsoft’s recent deal to sell a bunch of patent rights to Xiaomi in order to have Xiaomi load Office and Skype on all their phones. It is a classic example of taking known products, and extending them to very nearby customers. Basically, a deal to sell current software to customers in new markets via a 3rd party. Rather than develop these markets on their own, Microsoft is retrenching out of phones and limiting its investments in China in order to have Xiaomi build the markets – and keeping Microsoft in its safe zone of existing products to known customers.

The result is companies consistently over-investment in their “core” business of current products to current customers. There is a wealth of information on those two groups, and the historical info is unassailable. So it is considered good practice, and prudent business, to invest in defending that core. A few small bets on extensions might be OK – but not many. And as a result the company investment portfolio becomes entirely skewed toward defending the old business rather than reaching out for future growth opportunities.

This can be disastrous if the market shifts, collapsing the old core business as customers move to different solutions. Such as, say, customers buying fewer PCs as they shift to mobile devices, and fewer servers as they shift to cloud services. These planning systems have no way to integrate trend analysis, and therefore no way to forecast major market changes – especially negative ones. And they lack any mechanism for planning on big changes to the product or customer portfolio. All future scenarios are based on business as it has been – a continuation of the status quo primarily – rather than honest scenarios based on trends.

How can you avoid falling into this dilemma, and avoiding the Microsoft trap? To break this cycle, reverse the inputs. Rather than basing resource allocation on financial planning and historical performance, resource allocation should be based on trend analysis, scenario planning and forecasts built from the future backward. If more time were spent on these plans, and engaging external experts like Board Directors in discussions about the future, then companies would be less likely to become so overly-invested in outdated products and tired customers. Less likely to “stay at the party too long” before finding another market to develop.

If your planning is future-oriented, rather than historically driven, you are far more likely to identify risks to your base business, and reduce investments earlier. Simultaneously you will identify new opportunities worthy of more resources, thus dramatically improving the balance in your investment portfolio. And you will be far less likely to end up like the Chairman of a huge, formerly market leading company who sounds like he slept through the last decade before recognizing that his company’s resource allocation just might need some change.

by Adam Hartung | Aug 31, 2010 | Current Affairs, Defend & Extend, In the Whirlpool, Innovation, Leadership, Lock-in, Quotes

Summary:

- The Wall Street Journal is calling for a dramatic shift in how business is managed

- Most corporations are designed for the industrial age, and thus not well suited for today’s competition

- Change is happening more quickly, and organizations must become more agile

- CEOs today are concerned about dealing with rapid, chronic change – and obsolescence

- Resource deployment, from financial to people, must be tied more closely to market needs and not defending historical strengths

A FANTASTIC article in the Wall Street Journal entitled “The End of Management” by Alan Murray, If you have time, I encourage you to click the link and read the entire thing. Below are some insightful quotes from the article I hope you enjoy as much as I did:

- Corporations, whose leaders portray themselves as champions of the free

market, were in fact created to circumvent that market. They were an

answer to the challenge of organizing thousands of people in different

places and with different skills to perform large and complex tasks,

like building automobiles or providing nationwide telephone service.

- the managed corporation—an answer to the central problem of the industrial age.

- Corporations are bureaucracies and managers are bureaucrats. Their

fundamental tendency is toward self-perpetuation… They were designed and tasked, not with

reinforcing market forces, but with supplanting and even resisting the

market.

- it took radio 38 years and television 13 years to reach audiences of 50

million people, while it took the Internet only four years, the iPod

three years and Facebook two years to do the same.

- It’s no surprise that

fewer than 100 of the companies in the S&P 500 stock index were

around when that index started in 1957.

- When I asked members of The Wall Street Journal’s CEO Council… to name the most influential business book they had read,

many cited Clayton Christensen’s “The Innovator’s Dilemma.” That book

documents how market-leading companies have missed game-changing

transformations in industry after industry

- They allocated capital to the innovations that promised the largest

returns. And in the process, they missed disruptive innovations that

opened up new customers and markets for lower-margin, blockbuster

products.

- the ability of human beings on different continents and with vastly

different skills and interests to work together and coordinate complex

tasks has taken quantum leaps. Complicated enterprises, like maintaining

Wikipedia or building a Linux operating system, now can be accomplished

with little or no corporate management structure at all.

- the trends here are big and undeniable. Change is rapidly accelerating.

Transaction costs are rapidly diminishing. And as a result, everything

we learned in the last century about managing large corporations is in

need of a serious rethink. We have both a need [for]… a new science of

management, that can deal with the breakneck realities of 21st century

change.

- The new model will have to be more like the marketplace, and less like

corporations of the past. It will need to be flexible, agile, able to

quickly adjust to market developments, and ruthless in reallocating

resources to new opportunities.

- big companies… failed, not…

because they didn’t see the coming innovations, but because they failed

to adequately invest in those innovations. To avoid this problem, the

people who control large pools of capital need to act more like venture

capitalists, and less like corporate finance departments… make lots of bets, not just a few big ones, and… be willing

to cut their losses.

- have to push power and decision-making down the organization as much as

possible, rather than leave it concentrated at the top. Traditional

bureaucratic structures will have to be replaced with something more

like ad-hoc teams of peers, who come together to tackle individual

projects, and then disband

- New mechanisms will have to be created for harnessing the “wisdom of

crowds.” Feedback loops will need to be built that allow products and

services to constantly evolve in response to new information. Change,

innovation, adaptability, all have to become orders of the day.

Well said. Traditional management best practices were designed for the industrial age. For bringing people together to efficiently build planes, trains and automobiles. This is now the information age. Organizations must be more agile, more flexible, and tightly aligned with market needs – while eschewing focus on “core” capabilities.

Companies must understand Lock-in, and how to manage it. Instead of planning for yesterday to continue, we must develop future scenarios and prepare for different likely outcomes. We have to understand competitors, and how quickly they can move to rob us of sales and profits. We have to be willing to disrupt our patterns of behavior, and our markets, in order to drive for higher value creation. And we must understand that constantly creating and implementing White Space teams that are focused on new opportunities is a key to long-term success.

With an endorsement for change from nothing less than the stodgy Wall Street Journal, perhaps more leaders and managers will begin moving forward, implementing The Phoenix Principle, so they can recapture a growth agenda and rebuild profitability.

by Adam Hartung | May 26, 2010 | Defend & Extend, In the Swamp, Leadership, Lock-in, Web/Tech

In theory, Sustaining Innovations that help a company Defend & Extend its products are supposed to be cheap. The breakthrough is done, and the investments on variations, derivatives and enhancements are "engineering" as opposed to "science" so the development is supposedly more easily planned, the costs better understood and the returns more predictable. That's the theory, anyway, and as a result most managers constantly defend their decision to keep investing more in Defending & Extending past products rather than investing in new things which would develop new markets and new revenue streams.

But, like a lot of business myths, there's really no proof for this theory. It just sounds good. It seems "to make sense", and the big issue is that "it simply has to be less risky to spend on what you know rather than what you don't know." And "after all, this is investing in our own market and what could have a higher rate of return than defending our mother ship?" I'm sure everyone has heard these kind of comments when it comes time to allocate resources. Management supports doing more of what's been done, reinforcing Defend & Extend behavior. It just HAS to make sense to do more of what we know rather than invest in something new that we don't know as well – right?

But look at this chart from Business Insider:

Microsoft has spent billions of dollars in R&D Defending its desktop PC near-monopoly with enhancements to Office (Office 2007 and now Office 2010) and the operating System (Vista and System 7). It has spent heavily on other things as well, but in the end its entertainment division and mobile O/S products as well as others have not successfully grown revenues. As a result, Microsoft's value has not risen and Apple is about to eclipse Microsoft's value despite being a smaller company (see yesterday's blog for a more thorough review of valuation issues).

Now we can see that all this spending on R&D to Defend & Extend is in no way cheap. In dollars, Microsoft spent 3.5 times as much as Google and 8 times as much as Apple in 2009 – companies which as a result of their spending generated considerably more growth than Microsoft. Microsoft even spent more dollars, and more money as a percent of revenue, than IBM and Cisco (companies that rely heavily on hardware as well as software sales)! By any measure, Microsoft's efforts to Defend & Extend its "base," or its "core" has come at a very, very high price – in dollars or as a percent of revenue.

Consider that a good measure of R&D should be its ability to generate incremental revenue. Using that yardstick, Microsoft is a disaster, while Apple is a star.

Far too many companies Lock-in R&D and New Product Development to the existing business. The decision-making systems are geared to invest more in what is known. New investments are tagged with "risk adjustments" and "cannibalization charges" and a host of other costs to make them look less positive than doing more of what has historically been done. Lock-in to the Success Formula means that the financial review system, along with the technology assessments, are designed to give a major benefit to doing more of the same, while dramatically penalizing anything new!

In almost all companiess decision-making systems are designed to reinforce the Success Formula, not give an "independent" answer based upon markets. The processes are designed to do more, not do something new. And in the case of Microsoft, we can see how that has led to huge investments in simply defending the PC business while the technology marketplace is now rapidly shifting to new platforms – like mobile devices (smartphones and tablets), cloud-based applications and data access, and even gaming consoles. Competitors are developing a huge advantage by investing R&D and New Product Development dollars in new markets which provide greater growth opportunities – and higher rates of return over any time period other than the very short term.

Even if you're not in the computer/tech business, you don't want to end up like Microsoft. You don't want to over-invest in yesterday's solution trying to Defend it in the face of market shifts. That did not work out well for Polaroid, Kodak or Xerox which lost their luster as customers switched to new solutions and new competitors. Be sure to look not just at how much you spend, but that your spending is linked to markets and their growth, not simply doing more of what you already know!

by Adam Hartung | Sep 16, 2009 | Current Affairs, Defend & Extend, In the Rapids, Innovation, Leadership, Openness

Is Google a company who's growth and innovation worry you? Not me. Which is why I was disturbed by a recent blog at Harvard Business School Publishing's web site "Google Grows Up." In this article Scott Anthony, a consultant and writer for HBS, says that he thinks Google has been immature about its innovation management, and he thinks the company needs to change it's approach to innovation. Unfortunately, his comments replay the core of outdated management approaches which lead companies into lower returns.

No doubt Google's revenues are highly skewed toward on-line ad placement. But with the market growing at more than 2x/year, and Google maintaining (or growing) share it's not surprising that such high revenues would dwarf other projects. Google created, and has remained, in the Rapids of growth by leading the market. From its Disruptive innovation, offering advertising through products like Google AdWords to people who previously couldn't afford it or manage it, allowed Google to lead a market shift for advertising. And ever since Google has implemented sustaining innovations to maintain its leadership position. That's great management. No reason to worry about a lot of revenue in ad placement today, with the market growing. Not as long as Google keeps breeding lots of new, big ideas to help grow in the future.

But Mr. Anthony flogs Google for its "unrestrained" approach to innovation. He recommends the company push hard to implement a process for innovation management – and he uses Proctor & Gamble as his role model – in order to curtail so many innovations and funnel resources to "the right" innovations. Even though he's obviously flogging his consulting, and pushing that all "good management" requires some significant stage gate management of innovation – he couldn't be more wrong.

Firstly, P&G is far from a role model for innovation. As recently discussed in this blog, the company recently said one of its major innovations was cutting prices on Tide while introducing less a less-good formulation. As commenters said loudly, this is not innovation. It's merely price cutting – taking another step on the demand/supply curve of price vs. performance. It doesn't change the shape of the curve – it doesn't help people get a far superior return – nor does it bring in new customers who's needs were not previously met.

In a Wall Street Journal article "P&G Plots Course To Turn Lackluster Tide," the CEO freely admits the company has had insufficient organic growth. Additionally, his big future opportunities are to "reposition Tide," to cut the price of Cheer by another 13% and to use Defend & Extend practices to try pushing the P&G Success Formula into other countries. Like people in China, India and elsewhere are in need of 1.5 gallon containers of laundry detergent sold through enormous stores which have big parking lots for all those cars to lug stuff home. None of these ideas have helped P&G grow, nor helped the company achieve above-average returns, nor demonstrate the company is going to be a leader for the next 10 years in new products, new distribution systems or new business models for the developed or developing world.

This urge to "grow up" is a huge downfall of business thinking. It smacks of arrogance and superiority by those who say it – like they somehow are "in the know" while everyone else is incapable of making smart resource allocation decisions. In "Create Marketplace Disruption" I provide a long discussion about how introducing "professional management' causes companies to enter growth stalls. The very act of saying "gee, we could be more efficient about how we manage innovation" immediately applies braking power well beyond what was imagined. If Mr. Anthony were worried about Google managers leaving to start new companies in the past (like Twitter) he should be apoplectic at the rate they'll now leave – when it's harder to get management attention and funding for new potentially disruptive innovations.

Google is doing a great job of innovating. Largely because it doesn't try to manage innovation. It maintains robust pipelines of both disruptive, and sustaining, innovations. Google allows everybody in the company to work at innovation – providing wide permission to try new things and ample resources to test ideas. Then Google lets the market determine what goes forward. It lets the innovators use supply chain partners, customers, emerging customers, lost customers and anybody who can provide market input guide where the innovation processes go. As a result, the company has developed several new products — such as new network applications that replace over-sized desktop apps, and a new, slimmer mobile operating system that expands the capabilities of mobile devices —- and we can well imagine that it may be coming close to additional revenue breakthroughs.

Unfortunately, Mr. Anthony would like readers, and his clients, to believe they are better at managing innovation than the marketplace. However, all research points in the opposite direction. When managers start guessing at the future their Lock-ins to historical processes, products and market views consistently causes them to guess wrong. They over-invest in things that don't work out well, and investing for really good ideas dries up. All resource allocation approaches use things like technology risk, market risk, cost risk and revenue risk to downplay breakthrough ideas. Management cannot help but "extend the past" and in doing so over-invest in what's known, rather than let ideas get to market so real customers can say what is valuable.

Google is doing great. In a recession that has put several companies out of business (Silicon Graphics and Sun Microsystems are two neighbors) and challenged the returns of several stalwarts (Microsoft and Dell just 2 examples) Google has grown and seen its value rise dramatically. To think that hierarchy and managers can apply better decision-making about innovation is – well – absurd. It's always best to get the idea surfaced, push for permission to do things that might appear crazy at first, and get them to market as fast as possible so the real decision-makers can react, and give input, to innovation.

while the Innovation Gap grows? Are you pouring your resources into doing more of what you’ve done, even though you aren’t achieving the results you want – and need? Are competitors outflanking you with innovations? Are your customers telling you everything is fine, then buying from competitors? OUCH!!!

while the Innovation Gap grows? Are you pouring your resources into doing more of what you’ve done, even though you aren’t achieving the results you want – and need? Are competitors outflanking you with innovations? Are your customers telling you everything is fine, then buying from competitors? OUCH!!!