by Adam Hartung | Apr 5, 2016 | Disruptions, In the Rapids, Leadership, Web/Tech

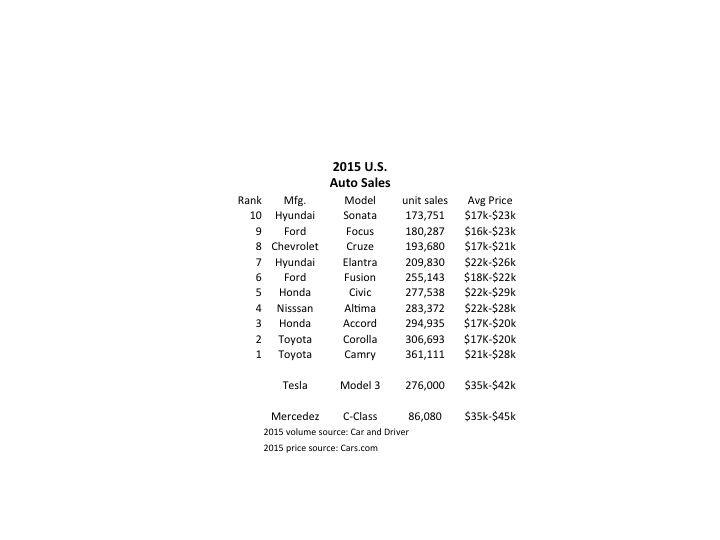

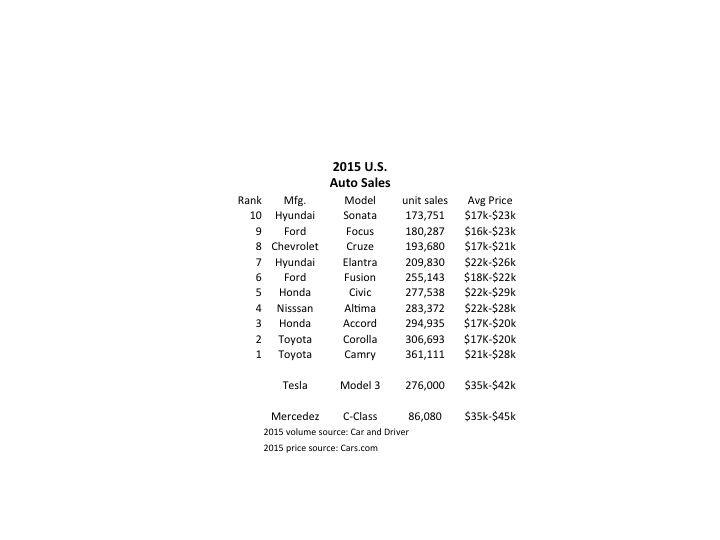

Tesla started taking orders for the Model 3 last week, and the results were remarkable. In 24 hours the company took $1,000 deposits for 198,000 vehicles. By end of Saturday the $1,000 deposits topped 276,000 units. And for a car not expected to be available in any sort of volume until 2017. Compare that with the top selling autos in the U.S. in 2015:

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Even more astonishing is the average selling price. Note that top 10 cars are not highly priced, mostly in the $17,000 to $25,000 price range. But the Tesla is base priced at $35,000, and expected with options to sell closer to $42,000. That is almost twice as expensive as the typical top 10 selling auto in the U.S.

Tesla has historically been selling much more expensive cars, the Model S being its big seller in 2015. So if we classify Tesla as a “luxury” brand and compare it to like-priced Mercedes Benz C-Class autos we see the volumes are, again, remarkable. In under 1 week the Model 3 took orders for 3 times the volume of all C-Class vehicles sold in the U.S. in 2015.

[Car and Driver top 10 cars; Mercedes Benz 2015 unit sales; Tesla 2015 unit sales; Model 3 pricing]

Although this has surprised a large number of people, the signs were all pointing to something extraordinary happening. The Tesla Model S sold 50,000 vehicles in 2015 at an average price of $70,000 to $80,000. That is the same number of the Mercedes E-Class autos, which are priced much lower in the $50,000 range. And if you compare to the top line Mercedes S-Class, which is only slightly more expensive at an average $90,0000, the Model S sold over 2 times the 22,000 units Mercedes sold. And while other manufacturers are happy with single digit percentage volume growth, in Q4 Tesla shipments were 75% greater in 2015 than 2014.

In other words, people like this brand, like these cars and are buying them in unprecedented numbers. They are willing to plunk down deposits months, possibly years, in advance of delivery. And they are paying the highest prices ever for cars sold in these volumes. And demand clearly outstrips supply.

Yet, Tesla is not without detractors. From the beginning some analysts have said that high prices would relegate the brand to a small niche of customers. But by outselling all other manufacturers in its price point, Tesla has demonstrated its cars are clearly not a niche market. Likewise many analysts argued that electric cars were dependent on high gasoline prices so that “economic buyers” could justify higher prices. Yet, as gasoline prices have declined to prices not seen for nearly a decade Tesla sales keep going up. Clearly Tesla demand is based on more than just economic analysis of petroleum prices.

People really like, and want, Tesla cars. Even if the prices are higher, and if gasoline prices are low.

Emerging is a new group of detractors. They point to the volume of cars produced in 2015, and first quarter output of just under 15,000 vehicles, then note that Tesla has not “scaled up” manufacturing at anywhere near the necessary rate to keep customers happy. Meanwhile, constructing the “gigafactory” in Nevada to build batteries has slowed and won’t meet earlier expectations for 2016 construction and jobs. Even at 20,000 cars/quarter, current demand for Model S and Model 3 They project lots of order cancellations would take 4.5 years to fulfill.

Which leads us to the beauty of sales growth. When products tap an under- or unfilled need they frequently far outsell projections. Think about the iPod, iPhone and iPad. There is naturally concern about scaling up production. Will the money be there? Can the capacity come online fast enough?

Of course, of all the problems in business this is one every leader should want. It is certainly a lot more fun to worry about selling too much rather than selling too little. Especially when you are commanding a significant price premium for your product, and thus can be sure that demand is not an artificial, price-induced variance.

With rare exceptions, investors understand the value of high sales at high prices. When gross margins are good, and capacity is low, then it is time to expand capacity because good returns are in the future. The Model 3 release projects a backlog of almost $12B. Booked orders at that level are extremely rare. Further, short-term those orders have produced nearly $300million of short-term cash. Thus, it is a great time for an additional equity offering, possibly augmented with bond sales, to invest rapidly in expansion. Problematic, yes. Insolvable, highly unlikely.

On the face of it Tesla appears to be another car company. But something much more significant is afoot. This sales level, at these prices, when the underlying economics of use seem to be moving in the opposite direction indicates that Tesla has tapped into an unmet need. It’s products are impressing a large number of people, and they are buying at premium prices. Based on recent orders Tesla is vastly outselling competitive electric automobiles made by competitors, all of whom are much bigger and better resourced. And those are all the signs of a real Game Changer.

by Adam Hartung | Sep 22, 2015 | Current Affairs, Disruptions, In the Rapids, Innovation

A recent analyst took a look at the impact of electric vehicles (EVs) on the demand for oil, and concluded that they did not matter. In a market of 95million barrels per day production, electric cars made a difference of 25,000 to 70,000 barrels of lost consumption; ~.05%.

You can’t argue with his arithmetic. So far, they haven’t made any difference.

But then he goes on to say they won’t matter for another decade. He forecasts electric vehicle sales grow 5-fold in one decade, which sounds enormous. That is almost 20% growth year over year for 10 consecutive years. Admittedly, that sounds really, really big. Yet, at 1.5million units/year this would still be only 5% of cars sold, and thus still not a material impact on the demand for gasoline.

But then he goes on to say they won’t matter for another decade. He forecasts electric vehicle sales grow 5-fold in one decade, which sounds enormous. That is almost 20% growth year over year for 10 consecutive years. Admittedly, that sounds really, really big. Yet, at 1.5million units/year this would still be only 5% of cars sold, and thus still not a material impact on the demand for gasoline.

This sounds so logical. And one can’t argue with his arithmetic.

But one can argue with the key assumption, and that is the growth rate.

Do you remember owning a Walkman? Listening to compact discs? That was the most common way to listen to music about a decade ago. Now you use your phone, and nobody has a walkman.

Remember watching movies on DVDs? Remember going to Blockbuster, et.al. to rent a DVD? That was common just a decade ago. Now you likely have shelved the DVD player, lost track of your DVD collection and stream all your entertainment. Bluckbuster, infamously, went bankrupt.

Do you remember when you never left home without your laptop? That was the primary tool for digital connectivity just 6 years ago. Now almost everyone in the developed world (and coming close in the developing) carries a smartphone and/or tablet and the laptop sits idle. Sales for laptops have declined for 5 years, and a lot faster than all the computer experts predicted.

Markets that did not exist for mobile products 10 years ago are now huge. Way beyond anyone’s expectations. Apple alone has sold over 48million mobile devices in just 3 months (Q3 2015.) And replacing CDs, Apple’s iTunes was downloading 21million songs per day in 2013 (surely more by now) reaching about 2billion per quarter. Netflix now has over 65million subscribers. On average they stream 1.5hours of content/day – so about 1 feature length movie. In other words, 5.85billion streamed movies per quarter.

What has happened to old leaders as this happened? Sony hasn’t made money in 6 years. Motorola has almost disappeared. CD and DVD departments have disappeared from stores, bankrupting Circuit City and Blockbuster, and putting a world of hurt on survivors like Best Buy.

The point? When markets shift, they often shift a lot faster than anyone predicts. 20%/year growth is nothing. Growth can be 100% per quarter. And the winners benefit unbelievably well, while losers fall farther and faster than we imagine.

Tesla was barely an up-and-comer in 2012 when I said they would far outperform GM, Ford and Toyota. The famous Bob Lutz, a long-term widely heralded auto industry veteran chastised me in his own column “Tesla Beating Detroit – That’s Just Nonsense.”

Mr. Lutz said I was comparing a high-end restaurant to McDonald’s, Wendy’s and Pizza Hut, and I was foolish because the latter were much savvier and capable than the former. He should have used as his comparison Chipotle, which I predicted would be a huge winner in 2011. Those who followed my advice would have made more money owning Chipotle than any of the companies Mr. Lutz preferred.

The point? Market shifts are never predicted by incumbents, or those who watch history. The rate of change when it happens is so explosive it would appear impossible to achieve, and far more impossible to sustain. The trends shift, and one market is rapidly displaced by another.

While GM, Ford and Toyota struggle to maintain their mediocrity, Tesla is winning “best car” awards one after another – even “breaking” Consumer Reports review system by winning 103 points out of a maximum 100, the independent reviewer liked the car so much. Tesla keeps selling 100% of its production, even at its +$100K price point.

So could the market for EVs wildly grow? BMW has announced it will make all models available as electrics within 10 years, as it anticipates a wholesale market shift by consumers promoted by stricter environmental regulations. Petroleum powered car sales will take a nosedive.

The International Energy Agency (IEA) points out that EVs are just .08% of all cars today. And of the 665,000 on the road, almost 40% are in the USA, where they represent little more than a rounding error in market share. But there are smaller markets where EV sales have strong share, such as 12% in Norway and 5% in the Netherlands.

So what happens if Tesla’s new lower priced cars, and international expansion, creates a sea change like the iPod, iPhone and iPad? What happens if people can’t get enough of EVs? What happens if international markets take off, due to tougher regulations and higher petrol costs? What happens if people start thinking of electric cars as mainstream, and gasoline cars as old technology — like two-way radios, VCRs, DVD players, low-definition picture tube TVs, land line telephones, fax machines, etc?

What if demand for electric cars starts doubling each quarter, and grows to 35% or 50% of the market in 10 years? If so, what happens to Tesla? Apple was a nearly bankrupt, also ran, tiny market share company in 2000 before it made the world “i-crazy.” Now it is the most valuable publicly traded company in the world.

Already awash in the greatest oil inventory ever, crude prices are down about 60% in the last year. Oil companies have already laid-off 50,000 employees. More cuts are planned, and defaults expected to accelerate as oil companies declare bankruptcy.

It is not hard to imagine that if EVs really take off amidst a major market shift, oil companies will definitely see a precipitous decline in demand that happens much faster than anticipated.

To little Tesla, which sold only 1,500 cars in 2010 could very well be positioned to make an enormous difference in our lives, and dramatically change the fortunes of its shareholders — while throwing a world of hurt on a huge company like Exxon (which was the most valuable company in the world until Apple unseated it.)

[Note: I want to thank Andreas de Vries for inspiring this column and assisting its research. Andreas consults on Strategy Management in the Oil & Gas industry, and currently works for a major NOC in the Gulf.]

by Adam Hartung | Jan 6, 2015 | Current Affairs, In the Rapids, Innovation, Leadership

Crude oil has dropped 50% in just 6 months. At under $50/barrel, gasoline is now selling for under $2/gallon in many places. This is a price rollback to 2008 prices – something almost no one expected in early 2014.

It is easy to jump to conclusions about what this will mean for sales of some products. And many analysts have been saying this is a terrible scenario for Tesla, which sells all electric cars. The theory is pretty simple, and goes something like this: People buy electric cars to save on petrol costs, so when petrol prices fall their interest in electric cars decline. With gasoline cheap again, nobody will want an electric car, so Tesla will do poorly.

But this is just an example of where common wisdom is completely wrong. And now that Tesla has lost about 1/3 of its value, due to this popular belief, it is offering investors a tremendous buying opportunity.

There are three big reasons we can expect Tesla to continue to do well, even if gasoline prices are low in the USA.

First, Teslas are great cars. Not simply great electric cars. So quickly we forget that Consumer Reports gave the Model S 99 out of a possible 100 points – the highest rating for an automobile ever. In 2013 Motor Trend had its first ever unanimous selection of the Best Car of the Year when all the judges selected the Model S. The Model S, and the Roadster before it, have won over customers not just because they use less petroleum – but rather because the speed, handling, acceleration, fit and detail, design and ride are considered extremely good – even when comparing with the likes of Mercedes and BMW – and when you don’t even consider it is an electric car.

It is a gross mis-assumption to say people buy Teslas because they are electric powered. People are buying Teslas because they are great cars which are fun to drive, perform well, look stylish, have low maintenance costs and very low operating costs. And they are more ecological in a world where people increasingly care about “going green.” In 2015 consumers will be able to choose not only the Roadster, and the fairly pricey Model S, but soon enough the smaller, and less expensive, Model 3 which is targeted squarely at BMW Series 3 customers. Teslas are designed to compete with all cars for consumer dollars, not just electric cars and not just on the basis of using less fuel.

Second, the market for autos is global and gasoline isn’t cheap everywhere. Take for example Hong Kong, where gasoline still retails for $8.50/gallon (as of 31Dec. 2014.) Or in Paris or Munich where gasoline costs $5/gallon – even though the Euro’s value has shrunk to only $1.20. Outside the USA most developed countries have a lot more demand for oil than they have production (if they have any at all.)

Almost all of these countries offer incentives for buying electric cars. For example, in Hong Kong and Singapore the import tax on an auto can be 100-200% of the car’s price (literally double or triple the price due to import taxes.) But in these same countries the tax is greatly reduced, or eliminated entirely, for buying an electric car for policy reasons to promote lower oil consumption and cleaner city air. So a $100,000 Mercedes E class in Hong Kong will cost $200,000+, while a $100,000 Model S costs $100,000.

Further, outside the USA most countries heavily tax gasoline and diesel in order to discourage consumption and yield infrastructure funds. So even as oil prices go down, gasoline prices do not decline in lock-step with oil price declines. Consumers in these countries have a much greater demand than U.S. consumers for high mileage (and electric) cars almost regardless of crude oil prices. So thinking that low USA gasoline prices reduces demand for electric cars is actually quite myopic.

Third, do you really think oil prices will stay low forever? Oil is a commodity with incredible political impact. Pricing is based on much more than “supply and demand.” At any given time Aramco, or its lead partners such as Saudi Arabia and the UAE, can decide to simply pump more, or less fuel. Today they are happy to pump a lot of oil because it hurts countries with which they have a bone to pick – such as Russia (now almost out of bank reserves due to low oil prices) and Iran. And it helps USA consumers, reducing domestic interest in things like the Keystone Pipeline which could lessen long-term reliance on Aramco oil. And investing in risky development projects like the arctic ocean. Tomorrow these countries could decide to pump less, as they did in the mid-1970s, driving up prices and almost killing the U.S. economy.

Oil prices have a long history of instability. Like most commodities. That’s why a state economy like Texas, where they produce a lot of oil, could boom the last 4 years, while manufacturing states (like Wisconsin and Illinois) suffered. With oil back under $50/barrel drilling rigs will go into mothballs, oil leases will go undeveloped, fracking projects will be stalled and the economy of oil producing states will suffer. Like happened in the mid-1980s when Saudi Arabia once again began flooding the market with oil and exploration and production companies across Texas went out of business.

Most people are smart enough to realize you look at all aspects of owning a new car. There are a lot of reasons to buy Tesla automobiles. Not only are they good cars, but they are changing the sales model by eliminating those undesirable auto dealers most consumers hate. And they are offering charging stations in many locations to make refills painless. And you don’t have to change the oil, or do quite a bit of other maintenance. And you do less damage to the environment. It’s not simply a matter of the price of fuel.

It is always risky to oversimplify consumer behavior. Decisions are rarely based entirely on price. And, as Apple has shown with sales if iOS devices and Macs, people often buy more expensive products when they offer a better experience and brand. Long term investors know that when a stock is beaten down by a short-term reaction to a short-term phenomenon (such as this fast decline in oil prices) it often creates an opportunity to buy into a company with a great future potential for growth.

by Adam Hartung | Apr 8, 2014 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership

“Car dealers are idiots” said my friend as she sat down for a cocktail.

It was evening, and this Vice President of a large health care equipment company was meeting me to brainstorm some business ideas. I asked her how her day went, when she gave the response above. She then proceeded to tell me she wanted to trade in her Lexus for a new, small SUV. She had gone to the BMW dealer, and after being studiously ignored for 30 minutes she asked “do the salespeople at this dealership talk to customers?” Whereupon the salespeople fell all over themselves making really stupid excuses like “we thought you were waiting for your husband,” and “we felt you would be more comfortable when your husband arrived.”

My friend is not married. And she certainly doesn’t need a man’s help to buy a car.

She spent the next hour using her iPhone to think up every imaginable bad thing she could say about this dealer over Twitter and Facebook using various interesting hashtags and @ references.

Truthfully, almost nobody likes going to an auto dealership. Everyone can share stories about how they were talked down to by a salesperson in the showroom, treated like they were ignorant, bullied by salespeople and a slow selling process, overcharged compared to competitors for service, forced into unwanted service purchases under threat of losing warranty coverage – and a slew of other objectionable interactions. Most Americans think the act of negotiating the purchase of a new car is loathsome – and far worse than the proverbial trip to a dentist. It’s no wonder auto salespeople regularly top the list of least trusted occupations!

When internet commerce emerged in the 1990s, buying an auto on-line was the #1 most desired retail transaction in emerging customer surveys. And today the vast majority of Americans, especially Millennials, use the web and social media to research their purchase before ever stepping foot in the dreaded dealership.

Tesla heard, and built on this trend. Rather than trying to find dealers for its cars, Tesla decided it would sell them directly from the manufacturer. Which created an uproar amongst dealers who have long had a cushy “almost no way to lose money” business, due to a raft of legal protections created to support them after the great DuPont-General Motors anti-trust case.

When New Jersey regulators decided in March they would ban Tesla’s factory-direct dealerships, the company’s CEO, Elon Musk, went after Governor Christie for supporting a system that favors the few (dealers) over the customer. He has threatened to use the federal courts to overturn the state laws in favor of consumer advocacy.

It would be easy to ignore Tesla’s position, except it is not alone in recognizing the trend. TrueCar is an on-line auto shopping website which received $30M from Microsoft co-founder Paul Allen’s venture fund. After many state legal challenges TrueCar now claims to have figured out how to let people buy on-line with dealer delivery, and last week filed papers to go public. While this doesn’t eliminate dealers, it does largely take them out of the car-buying equation. Call it a work-around for now that appeases customers and lawyers, even if it doesn’t actually meet consumer desires for a direct relationship with the manufacturer.

Apple’s direct-to-consumer retail stores were key to saving the company

Distribution is always a tricky question for any consumer good. Apple wanted to make sure its products were positioned correctly, and priced correctly. As Apple re-emerged from near bankruptcy with new music products in the early 2000’s Apple feared electronic retailers would discount the product, be unable to feature Apple’s advantages, and hurt the brand which was in the process of rebuilding. So it opened its own stores, staffed by “geniuses” to help customers understand the brand positioning and the products’ advantages. Those stores are largely considered to have been a turning point in helping consumers move from a world of Microsoft-based laptops, Sony music products and Blackberry mobile devices to new iDevices and resurging Macintosh popularity – and sales levels.

Attacking regulations sounds – and is – a daunting task. But, when regulations support a minority of people outside the public good there is reason to expect change. American’s wanted a more pristine society, so in 1920 the 18th Amendment was passed prohibiting alcohol. However, after a decade in which rampant crime developed to support illegal alcohol production Americans passed the 21st Amendment in 1933 to repeal prohibition. What seemed like a good idea at first turned out to have more negatives than positives.

Auto dealer regulations hurt competition, and consumers

Today Americans do not need a protected group of dealers to save them from big, bad auto companies. To the contrary, forced distribution via protected dealers inhibits competition because it keeps new competitors from entering the U.S. market. Small production manufacturers, and large ones in countries like India, are effectively blocked from reaching American customers because they lack a dealer base and existing dealers are uninterested in taking the risks inherent in taking these new products to market. Likewise, starting up an auto company is fraught with distribution risks in the USA, leaving Tesla the only company to achieve any success since the dealer protection laws were passed decades ago.

And that’s why Tesla has a very good chance of succeeding. The trends all support Americans wanting to buy directly from manufacturers. At the very least this would force dealers to justify their existence, and profits, if they want to stay in business. But, better yet, it would create greater competition – as happened in the case of Apple’s re-emergence and impact on personal technology for entertainment and productivity.

Litigating to fight a trend might work for a while. Usually those in such a position are large political contributors, and use both the political process as well as legal precedent to protect their unjustified profits. NADA (National Automobile Dealers Association) is a substantial organization with very large PAC money to use across Washington. The Association can coordinate election contributions at national and state levels, as well as funding for judge elections and contributions for legal defense.

But, trends inevitably win out. Today Millennials are true on-line shoppers. They have no patience for traditional auto dealer shenanigans. After watching their parents, and grandparents, struggle for fairness with dealers they are eager for a change. As are almost all the auto buyers out there. And they are supported by consumer advocates long used to edgy tactics of auto dealers well known for skirting ethics and morality when dealing with customers. Those seeking change just need someone positioned to lead the legal effort.

Tesla wins because it uses trends to be a game changer

Tesla has shown it is well attuned to trends and what customers want. When other auto companies eschewed Tesla’s first entry as a 2-passenger sports car using laptop batteries, Tesla proceeded to sell out the product at a price much higher competitive gas-powered cars. When other auto companies thought a $70,000 electric sedan would never appeal to American buyers, Tesla again showed it understood the market best and sold out production. When industry pundits, and traditional auto company execs, said it was impossible to build a charging grid to support users driving up the coast, or cross-country, Tesla built the grid and demonstrated its functionality.

Now Tesla is the right company, in the right place, to change not only the autos Americans drive, but how Americans buy them. It’s rarely smart to refuse a trend, and almost always smart to support it. Tesla looks to be positioning itself as much smarter than older, larger auto companies once again.

by Adam Hartung | Jun 28, 2013 | Current Affairs, Defend & Extend, In the Rapids, In the Whirlpool, Innovation, Leadership, Web/Tech

The last 12 months Tesla Motors stock has been on a tear. From $25 it has more than quadrupled to over $100. And most analysts still recommend owning the stock, even though the company has never made a net profit.

There is no doubt that each of the major car companies has more money, engineers, other resources and industry experience than Tesla. Yet, Tesla has been able to capture the attention of more buyers. Through May of 2013 the Tesla Model S has outsold every other electric car – even though at $70,000 it is over twice the price of competitors!

During the Bush administration the Department of Energy awarded loans via the Advanced Technology Vehicle Manufacturing Program to Ford ($5.9B), Nissan ($1.4B), Fiskar ($529M) and Tesla ($465M.) And even though the most recent Republican Presidential candidate, Mitt Romney, called Tesla a "loser," it is the only auto company to have repaid its loan. And did so some 9 years early! Even paying a $26M early payment penalty!

How could a start-up company do so well competing against companies with much greater resources?

Firstly, never underestimate the ability of a large, entrenched competitor to ignore a profitable new opportunity. Especially when that opportunity is outside its "core."

A year ago when auto companies were giving huge discounts to sell cars in a weak market I pointed out that Tesla had a significant backlog and was changing the industry. Long-time, outspoken industry executive Bob Lutz – who personally shepharded the Chevy Volt electric into the market – was so incensed that he wrote his own blog saying that it was nonsense to consider Tesla an industry changer. He predicted Tesla would make little difference, and eventually fail.

For the big car companies electric cars, at 32,700 units January thru May, represent less than 2% of the market. To them these cars are simply not seen as important. So what if the Tesla Model S (8.8k units) outsold the Nissan Leaf (7.6k units) and Chevy Volt (7.1k units)? These bigger companies are focusing on their core petroleum powered car business. Electric cars are an unimportant "niche" that doesn't even make any money for the leading company with cars that are very expensive!

This is the kind of thinking that drove Kodak. Early digital cameras had lots of limitations. They were expensive. They didn't have the resolution of film. Very few people wanted them. And the early manufacturers didn't make any money. For Kodak it was obvious that the company needed to remain focused on its core film and camera business, as digital cameras just weren't important.

Of course we know how that story ended. With Kodak filing bankruptcy in 2012. Because what initially looked like a limited market, with problematic products, eventually shifted. The products became better, and other technologies came along making digital cameras a better fit for user needs.

Tesla, smartly, has not tried to make a gasoline car into an electric car – like, say, the Ford Focus Electric. Instead Tesla set out to make the best car possible. And the company used electricity as the power source. By starting early, and putting its resources into the best possible solution, in 2013 Consumer Reports gave the Model S 99 out of 100 points. That made it not just the highest rated electric car, but the highest rated car EVER REVIEWED!

As the big car companies point out limits to electric vehicles, Tesla keeps making them better and addresses market limitations. Worries about how far an owner can drive on a charge creates "range anxiety." To cope with this Tesla not only works on battery technology, but has launched a program to build charging stations across the USA and Canada. Initially focused on the Los-Angeles to San Franciso and Boston to Washington corridors, Tesla is opening supercharger stations so owners are never less than 200 miles from a 30 minute fast charge. And for those who can't wait Tesla is creating a 90 second battery swap program to put drivers back on the road quickly.

This is how the classic "Innovator's Dilemma" develops. The existing competitors focus on their core business, even though big sales produce ever declining profits. An upstart takes on a small segment, which the big companies don't care about. The big companies say the upstart products are pretty much irrelevant, and the sales are immaterial. The big companies choose to keep focusing on defending and extending their "core" even as competition drives down results and customer satisfaction wanes.

Meanwhile, the upstart keeps plugging away at solving problems. Each month, quarter and year the new entrant learns how to make its products better. It learns from the initial customers – who were easy for big companies to deride as oddballs – and identifies early limits to market growth. It then invests in product improvements, and market enhancements, which enlarge the market.

Eventually these improvements lead to a market shift. Customers move from one solution to the other. Not gradually, but instead quite quickly. In what's called a "punctuated equilibrium" demand for one solution tapers off quickly, killing many competitors, while the new market suppliers flourish. The "old guard" companies are simply too late, lack product knowledge and market savvy, and cannot catch up.

- The integrated steel companies were killed by upstart mini-mill manufacturers like Nucor Steel.

- Healthier snacks and baked goods killed the market for Hostess Twinkies and Wonder Bread.

- Minolta and Canon digital cameras destroyed sales of Kodak film – even though Kodak created the technology and licensed it to them.

- Cell phones are destroying demand for land line phones.

- Digital movie downloads from Netflix killed the DVD business and Blockbuster Video.

- CraigsList plus Google stole the ad revenue from newspapers and magazines.

- Amazon killed bookstore profits, and Borders, and now has its sites set on WalMart.

- IBM mainframes and DEC mini-computers were made obsolete by PCs from companies like Dell.

- And now Android and iOS mobile devices are killing the market for PCs.

There is no doubt that GM, Ford, Nissan, et. al., with their vast resources and well educated leadership, could do what Tesla is doing. Probably better. All they need is to set up white space companies (like GM did once with Saturn to compete with small Japanese cars) that have resources and free reign to be disruptive and aggressively grow the emerging new marketplace. But they won't, because they are busy focusing on their core business, trying to defend & extend it as long as possible. Even though returns are highly problematic.

Tesla is a very, very good car. That's why it has a long backlog. And it is innovating the market for charging stations. Tesla leadership, with Elon Musk thought to be the next Steve Jobs by some, is demonstrating it can listen to customers and create solutions that meet their needs, wants and wishes. By focusing on developing the new marketplace Tesla has taken the lead in the new marketplace. And smart investors can see that long-term the odds are better to buy into the lead horse before the market shifts, rather than ride the old horse until it drops.

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]