by Adam Hartung | Jun 14, 2015 | Current Affairs, In the Rapids, Leadership, Web/Tech

Dick Costolo was let go from his role as CEO of Twitter, to be replaced by a former CEO that was also fired. Unfortunately, it looks very strongly as if the Board made this decision for the wrong reasons.

Even though investors have been unhappy with Twitter’s share price, as CEO Mr. Costolo was doing a decent job of growing the company and improving profits. And even though analysts keep offering reasons why he was fired, it looks mostly as if this was a political decision in a company with a “soap opera” executive culture. Investors should be worried.

Let’s compare Mr. Costolo to CEO Zuckerberg’s performance at Facebook, and Mr. Bezos’ performance at Amazon. The latter two have been widely heralded for their leadership, so it sets a pretty good bar.

None of these three companies have enough earnings to matter. If you aren’t a growth investor, and you always value a company on earnings, then none of these are your cup of tea. All are evaluated on revenue and user metrics.

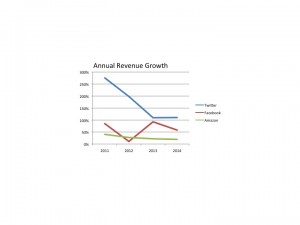

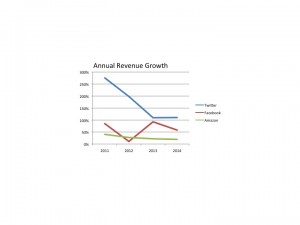

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon.

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon.

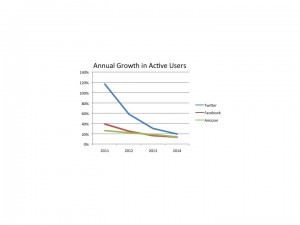

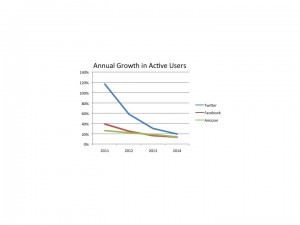

Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition.

Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition.

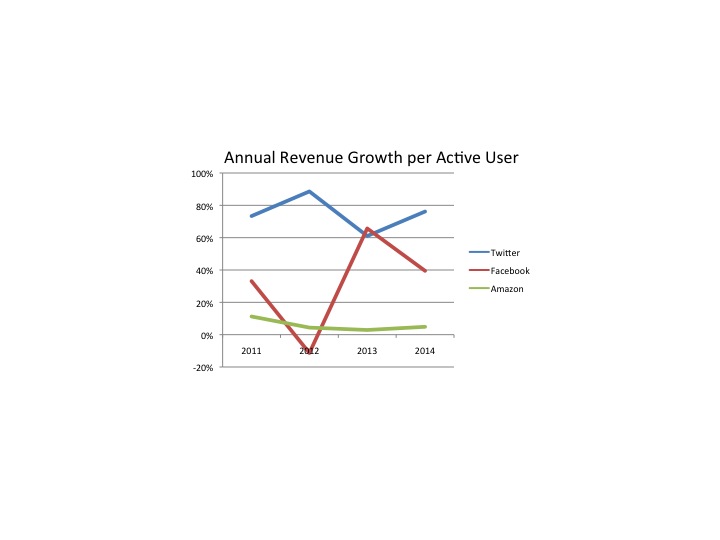

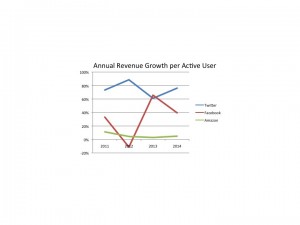

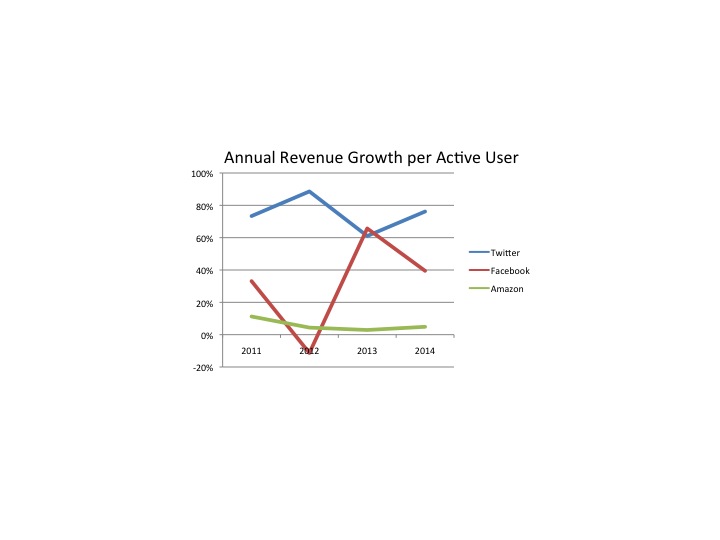

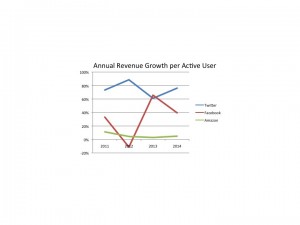

Lastly, let’s look at the “quality” of users. We can measure this by calculating the revenue per user. If this goes up, then the company is growing it top line by gaining more revenue per user – it is not “discounting” its way to higher volume. Instead,we can expect profits to improve based upon growth in this metric.

And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.

And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.

It isn’t hard to see that Mr. Costolo has been doing a pretty good job leading Twitter.

But Twitter has had a very checkered past when it comes to leaders. Several articles have been written about the revolving door on the CEO office, with founders back-stabbing each other as money is raised and efforts are made to improve company performance technologically and financially.

The Board has shown a proclivity to spend too much time listening to rumors, and previous CEOs. Rather than focusing on exactly how many users are coming aboard, and how much revenue is generated on those users.

The returning CEO was himself previously replaced. And during his tenure there were many technical problems. Why he would be inserted, and the best performing CEO in company history shunted aside is completely unclear. But for investors, employees, users (of which I am one) and customers this change in leadership looks to be poorly conceived, and quite concerning. Mr. Costolo was doing a pretty good job.

Data on revenues came from Marketwatch for Twitter, Facebook and Amazon. Data on users (in Amazon’s case customers) came from Statista.com for Twitter, Facebook and Amazon. Charts were created by Adam Hartung (C).

by Adam Hartung | May 22, 2014 | Current Affairs, Leadership

It is ironic that on this Memorial Day weekend (a remembrance of our fallen soldiers) America is learning that its military veterans have been ineffectively served by the Veterans Administration (VA) hospital system. Hundreds, if not thousands, have gone months without care – and some have even died while waiting.

No veteran should die while waiting for care. But we now know at least 40 have died. This is especially heinous because we now know those who provide care weren’t admitting to the fact that veterans were being denied care. And instead of tracking the waiting time these veterans underwent, the actual information was being tracked on hidden lists while factually inaccurate information was being disseminated.

At the top of all this is simply really bad leadership. That veterans were undergoing long waits is not a new story. In March, 2013 (14 months ago) Frontline ran a story that waits were inexcusably long (averaging 318 days,) and that the VA was doing little to solve the problem. Then, the day after Christmas, 2013, Military News ran a story quoting Secretary Shinseki providing several statistics indicating the backlog was down, wait times were down and this whole problem would disappear by 2015. Unfortunately, the American Legion – which has championed this issue – made it clear they thought the Secretary’s datapoints were inaccurate.

Now we are learning via CNN that the wait lists were being fudged in several hospitals, and that both hospital and VA leaders were well aware of this fudging. There were the reported facts, and then there were secret lists of people waiting for care.

How could this happen?

Chalk it up to lazy leadership, and an over-reliance on numbers and record-keeping. Instead of managing patients, Secretary Shinseki’s administration was managing numbers. And in this case, it caused people to die.

When long wait times were reported the President publicly admitted to being appalled, and he told Secretary Shinseki to do something. What the Secretary did was declare a standard of no more than 125 days from incident to care had to be met. And he told people to meet that goal, or they would risk losing their jobs.

As a leader, he didn’t offer a solution. He didn’t challenge his staff to find out the root cause of the problem and understand why these waits were so long. He didn’t hire outside consultants to evaluate the problem and propose solutions. He didn’t ask for “best practices” from industry. Instead, he pushed out a metric and a tracking system and threatened his team with pay cuts (or at least no bonuses,) demotions, career ending reviews and potentially termination. “Solve the problem, or else.” Then he was back to his office, and waiting for the “right” statistics to show up so he could say “all is well.”

This simply becomes a breeding ground for collusion, corruption and malfeasance as people try to save their income, careers and their jobs. If the order is to “make that number” then a way will be found to “make that number.” The command wasn’t to save lives, or improve care. The order was to reach a certain metric. So out comes all the creativity imaginable to give the boss what he wants. And in this case, it involved deception in record keeping, dual bookkeeping, hiding information, falsifying reports and even letting people die in order to give the Secretary the numbers he ordered them to report.

Meanwhile, the Secretary is so involved in managing his own career – and that of his boss – that he simply turned a blind eye to all other data. The American Legion was offering compelling statistics that things weren’t as the Secretary said. And there were multiple stories coming up in the press, and through the veteran networks, of patient experiences which did not match what the Secretary reported. But instead of listening to external information the Secretary ignored all of it and kept pushing his own organization to give him the numbers he wanted.

Leaders like to “manage by the numbers.” The study of business management was born around 1900 by Frederick Taylor and his theory of Scientific Management. Taylor believed all work could be broken down into inputs and outputs, everything could be measured, and if you set metrics for everyone then you could simply manage better. It was an engineering problem, and humans were just machines that needed to know the right metrics and produce to those metrics. Ah, the simplicity of Taylorism.

That management approach was greatly loved by business schools, and business leaders. Famously some Harvard Business School graduates and former Army officers (termed the “Whiz Kids”) in the 1940s went to a nearly failed Ford Motor company and turned it around. One of them, Robert McNamara, became the youngest President of Ford. They claimed their success was “statistical control.”

But McNamara left Ford to become Secretary of Defense for Lyndon Johnson and run the Vietnam War. He applied his same “statistical control” approach to the war that he used at Ford. Famous amongst these tracked, reported and closely watched statistics was the “body count.” Simply put, how many did you kill today? McNamara was sure if he could reach a “kill ratio” of 10 enemy dead to every 1 American dead the Vietnamese would give up.

How did that work out? Well, McNamara resigned in disgrace. Johnson was forced to step down after one term, realizing his failure in Vietnam made him unelectable. It turned out body counts included dogs, cats and cows as officers from Lieutenants to Generals were fudging the numbers. It encouraged burning down entire villages, and then simply deciding everyone – including Vietnamese civilians – would be included in the “body count.”

Needless to say, not America’s finest hour. And a mess that took another several years from which to extricate. There is a lot more to understanding international relations, and fighting a war, than simply tracking statistics. But unfortunately then Lieutenant Shinseki apparently learned the wrong message while he was in Vietnam. His penchant for using statistics to lead appears to have remained unwavered.

Unfortunately, far too many leaders like the lazy approach of using statistics. In the 1980s and 1990s a quality improvement program called Six Sigma caught on in America. But in many companies, Six Sigma became a management dogma rather than simply quality control. “You have to measure everything, or else it is simply not important” was a common part of Six Sigma. People suddenly had metrics given to them, even for jobs (like “Creative Director” or “Investor Relations”) where this made no sense. And they had charts on their doors tracking the data. If that chart didn’t point in an obviously northeasterly direction then it was clear the occupant was going to have pay, and longevity, problems.

Motorola was a leader in Six Sigma. The same Motorola that today is a shell of its former self. Although in the 1990s Motorola was heralded as a leader in modern management, today it has lost all relevance as its old businesses in radios and mobile phones have been made obsolete by new technologies, or taken over by companies like Google.

Far too often leaders think they can turn leadership into an engineering exercise. “Run business by the numbers” is a common refrain. Especially amongst leaders who come up via finance. “Everything can be turned into numbers, and spreadsheets, and if we manage the numbers the business will take care of itself.” We’ve all heard this.

But it simply isn’t true. We now know that even the famous Taylor falsified data in order to keep his guru status and promote Taylorism to client companies. Leadership involves going far, far beyond the numbers. It means understanding situations that defy simple measurement. It means knowing how to identify and solve problems – changing processes, procedures, directions, instructions, strategy and tactics. It means listening to external inputs to understand the greater marketplace, not just your own internal views. And it means understanding how to lead and manage people toward superior performance – not merely tracking performance statistics and slapping those who don’t return “the right numbers.”

Secretary Shinseki has a long and storied career. But as head of the VA, he truly blew it. And people died. This kind of lazy leadership cannot be tolerated in a field like health care, and hospital management.

Can your business tolerate it?

by Adam Hartung | Jun 1, 2012 | Current Affairs, In the Rapids, Innovation, Leadership, Television, Web/Tech

On May 18 Facebook went public with an opening price of $38/share. Now, after just 2 weeks, it's more like $28. Ouch – a 25%+ drop in such a short time makes nobody happy. Except buyers. And if you are interested in capturing a high rate of return with little risk, this is your lucky break!

The values of publicly traded companies change, often dramatically, based upon changes in performance and investor expectations about the future. Trying to profit off fast price changes is the world of traders – and the vast majority of them lose fortunes rather than create them. Knowing how to ignore whipsaw events, and invest in good companies when they are out of favor is important to long-term wealth creation.

Investors make money by understanding product markets and the companies supplying them, then investing in companies that build upon trends to create revenue growth with high rates of return over several years. In the forgettable 1999 movie "Blast from the Past" (Brendan Fraser, Christopher Walken, Sissy Spacek) a family moves into its nuclear blast shelter in 1960 during a panic, and doesn't come out for 35 years. Fortunately, the father had bought shares of AT&T and other companies aligned with 1960 trends, and the family discovers upon re-emergence it is quite wealthy.

Creating investment wealth means acting like them, buying shares in companies building on trends so you can hold shares for years without much worry.

If ever there was a company aligned with trends, it is Facebook. The company did not create 900million users in 8 years by being lucky. Facebook is the ultimate information era company. Facebook is not a fad – any more than television or telephones were fads in 1960. Just like they provided fundamental new ways of acquiring and disseminating information Facebook is the newest, most efficient and effective way for connecting and communicating in 2012.

When television appeared the mass population said "why?" There was radio, which was cheap, and older users said TV reduced the use of imagination. And television was not available many hours per day. But it didn't take long for CBS and its brethren to prove it could attract eyeballs, and soon Proctor & Gamble started paying for programming so it could promote its soaps (remember "soap operas?") Soon other companies developed programs strictly so they could promote their products. The "Ted Mack Amateur Hour" was sponsored by Geritol, and viewers were reminded of that over and over for 30 minutes every week. Eventually the TV ad model changed, but the lesson is clear - when you can attract eyeballs it has value and there will be businesses creative enough to take advantage.

Now television watching is declining. Instead, people are spending more time on the internet – including via mobile devices. And the location attracting the most people, and by far for the most minutes per day, is Facebook. Facebook's access to so many people, so often, creates an audience many businesses and non-profits want to tap.

Further, in the networked world Facebook not only has eyeballs, it delivers up to those eyeballs some 9 million apps, and knows what everyone wants, where they come from and where they go next. Beyond the industrial-era business of selling ads (like Google,) Facebook's information business has significant value for anyone trying to promote or sell a solution. Facebook is a repository of information about people, and their behavior, never before seen, understood or developed for use.

Around the IPO, General Motors decided to drop its Facebook advertising. That freaked some investors. Cries arose that social media is somehow broken, and unable to develop a business model.

Let's keep in mind who we're talking about here – GM. Not the most innovative, forward thinking company, to put it mildly. GM, like a lot of other plodding, but big spending, large companies has approached social media like it is just television on the web – and would prefer to simply put up a television ad on a Facebook like link. Whoa! That would be akin to a 1960s TV ad that was simply the text from a newspaper ad. Nobody would read it, and it simply wouldn't work.

Television required a new kind of communication to reach customers – and social media does as well. TV required the ad be entertaining, with movement, product use demonstrations, and video plus audio to go with the words. Connecting with users was harder, but the message (and connection) could be far more robust. And that is what advertisers are being forced to learn about Facebook/Social. It has new requirements, but once understood companies can be remarkably successful at connecting with potential customers – far more than the traditional one-way approach of historical advertising.

Paid promotion on Facebook is just the tip of the iceberg – a one-way approach to advertising sure to create short-term revenue but not terribly robust. Beyond that, social media changes everything. Retail, for example, is fast shifting from pushing inventory to being all about understanding the customer and offering them what they need in an anticipatory way (think Amazon rather than Best Buy.) And nowhere can you better understand customer needs than by social media participation. By being an information company, rather than an industrial company, FB is remarkably well positioned to create growth – for everybody that figures out how to use this remarkable platform.

As Facebook's shares kept falling this week, more attention was paid to whether traditional advertisers would buy FB. And much was made about whether the "metrics" were there to justify social media investments. This micro-management approach clearly misses the main point. People are already on Facebook, their numbers are growing, their uses are growing, their time on the site is growing, and the benefits of using Facebook are growing. Trying to measure Facebook use the way you would measure a print ad – or even a Google Adword buy – is simply using the wrong tool.

When P&G first started producing television "soaps" their competition sat back and said "look at what television advertising costs, compared to print and compared to pushing products into the local stores. What is the return for each of those television shows? Can it be justified? I think it is smarter to keep doing what we've done while P&G throws money at ads you can't measure." By moving beyond the historically myopic view of trying to find returns at the micro level P&G quickly became (at the time) the world's largest consumer goods company. Early TV advertisers followed the trend, knowing their participation would create returns far in excess of doing more of the old thing. And that is the direction of social media.

There was a lot of anticipatory excitement for the Facebook IPO. Lots of people wanted shares, and couldn't buy them in advance. The public, and the Morgan Stanley investment bankers, clearly thought the shares would go up. Oops. But that's a lucky thing for investors. Especially small investors, usually unable to participate in a "hot" IPO. Now anybody can buy FB shares at a 25% discount to the offering price – a better deal than the institutional buyers that usually get the "sweet" deal little guys never see.

If you are an employee, short term you might be unhappy. But if you are an investor, be happy that worries about Greece, the Euro's future, domestic politics, a lousy jobs report and simple myths like "sell in May and go away" have been a drag on equities this month – and diminished interest in Facebook.

Buy FB shares, then forget about them for a while. What you care about isn't the value of FB shares in 4 days, 4 weeks or 4 months – you care about 4 years. If you missed the chance to buy Microsoft in 1986, or Amazon in 1997, or Apple in 2000, or Google in 2004 then don't miss this one. There will be volatility, but the trends are all in your favor.

by Adam Hartung | Jan 12, 2010 | Defend & Extend, In the Swamp, Innovation, Leadership, Lock-in

Do all good ideas originate outside the organization? Of course not. Motorola understood all the critical technologies for smart phones, and taught Apple how to use them in a joint development project that created the ROKR. That's just one example of a company that had the idea for growth, but didn't move forward effectively. In this case Apple captured the value of new technology and a market shift.

On the Harvard Business Review blog site one of consulting firm Innosight's leaders, Mark Johnson, covers two stories of companies that had all the technology and capability to lead their markets, but got Locked-in to old practices. In "Have You Already Killed Your Next Big Thing" Mr. Johnson talks about Xerox and Kodak – two stories profiled in my 2008 book "Create Marketplace Disruption." Both companies developed the technology that replaced their early products (Xerox developed desktop publishing and Kodak developed the amateur digital camera.) But Lock-in kept them doing what they did rather than exploiting their own innovation.

One of the causes is a fascination with metrics. Again on the Harvard Business Review blog site Roger Martin, Dean of the Rotman School of Management at the University of Toronto, tells us in "Why Good Spreadsheets Make Bad Strategies" that you can't measure everything. And often the most important information about markets and what you must do to succeed is beyond measuring – at least in the short term.

Measurements are good control tools. Measurements can help force a focus on short term improvements. But measurements, and the concomitant focus, reduces an organization's ability to look laterally. They lose sight of information from lost customers, from small customers, from fringe customers and fringe competitors. Measurement often leads to obsession, and a deepening of Defend & Extend behavior. It's not accidental that doctors often find anorexia patients measure everything in (liquids and solids) and everything out (liquids and solids).

Measurements are created when a business is doing well. In the Rapids. Like Kodak during the 1960s and Xerox in the 1970s. Measurements are structural Lock-ins that help "institutionalize" the behavior which makes the Success Formula operate most effectively. And they help growth. But they do nothing for recognizing a market shift, and when new technology comes along, they stand in the way. That's why a powerful Six Sigma or Total Quality Management (TQM) or Lean Manufacturing project can help reduce costs short term, but become an enormous barrier to innovation over time when markets shift. These institutionalized efforts keep people doing what they measure, even if it doesn't really add much incremental value any longer.

To overcome measurement Lock-ins we all have to use scenario planning. Scenarios can help us see that in a future marketplace, a changed marketplace, measuring what we've been doing won't aid success. And because we don't yet know what the future market will really look like, we can't just swap out existing metrics for something different. As we proceed to do new things, in White Space, it's about learning what the right metrics are – about getting into the growth Rapids – before we tie ourselves up in metrics.

Note: To all readers of my Forbes article last week – there has been an update. The very professional and polite leadership at Tribune Corporation took the time to educate me about the LBO transition. As a result I learned that what I previously read, and reported in my column as well as on this blog, as being an investment of employee retirement funds into the LBO was inaccurate. Although Tribune is in hard times right now, the very good news is that the employee retirement funds were NOT wiped out by the bankruptcy. The Forbes article has been corrected, and I am thankful to the Tribune Corporation for helping me report accurately on that issue.

by Adam Hartung | Apr 15, 2009 | Books, Current Affairs, Disruptions, General, Leadership, Web/Tech

I was delighted recently to find a weekly blog named www.IsSurvivor.com. Bob Lewis writes in a clear and frank tone about what he often sees as not working correctly – especially in the world of information management. I would recommend this blog to everyone because his advice applies to all aspects of business – not just IT.

And I was delighted to recently read his book "Keep the Joint Running: A Manifesto for 21Century Information Technology." Despite the book's tagline, this is a book for everyone in business – not just IT people. As the author reminds readers over and again, IT is a really important, and integrated, part of the modern business. You can't consider it a stand-alone silo or you'll have really big problems. And I find myself thinking the same is true for all functions. The book is a great read as well. Not pompous (although the author has a mountain of experience to draw upon), very matter-of-fact, and incisive when cutting into multiple myths that detract from performance of functional groups as well as the corporation overall.

One thing all readers should love is the book's focus on getting work out the door. Mr. Lewis points out, with great examples, that if you aren't competent you can't be strategic. I was reminded of so many people I've worked with over the years who lacked prodigiously in competence yet seemed to maintain their positions by taking "the strategic view." Far too often we see in consulting firms the partner that's good at relationships, but couldn't actually do the work if his life depended upon it. In the end, when those without competency are in charge, problems happen. A simple rule – like the many Mr. Lewis gives us – that we so often ignore.

Business, and IT even moreso, are very new fields of academia. Unlike math, English, botany or geology, we've been studying business only a short time. Yet, the die-hard followers of early theories are surprising. Given the lack of any labs to test these theories, and the very visible number of failures these theories incur, the willingness to turn an idea into dogma (in incredibly short time) and then remain tied to that dogma should intrigue all investors and business leaders. Mr. Lewis shows himself a great Disruptor as he wastes no time taking an axe to many dogmas, exposing them as myths, as he works his way through the sea of bad approaches he finds functional heads utilizing. Best practices, process optimization, workforce optimization, applying metrics regardless of experience or ties to goals, development methodologies and documentation practices are just a few of the dogma he successfully analyzes, finds wanting, and discards in favor of better approaches that don't find enough use. (Read the book to get the magic answers.)

I spent my own time in IT working for vendor companies, as a CIO, and for several years as a partner in the giant IT services firm Computer Sciences Corporation. Item by item I found Mr. Lewis spot-on with his assessment of most IT firms, and IT practitioners. Not that folks can't get it right – but that for the most part their assumptions about what would work are so misguided that they have no hope of success. Only by rethinking the approach can the business do better. Which, after all, is the goal of all functional groups – to improve the sales and profits of the company.

But like I said earlier, I recommend Mr. Lewis's blog, and his book, for every CEO, executive, manager or front-line employee who works with IT – so that means everyone. His ideas will help improve the performance of any organization and its functions – not just IT. And for IT folks it offers a world of insight to why things in the past were often so hard, and how they can be much better going forward. You'll gain good insight for doing better planning, using Disruptions effectively instead of following outdated practices that simply don't work, and finding White Space where you can rapidly improve the success of your organization. His recommendations make sense, and you'll find them incredibly practical for improving performance today

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon.

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon. Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition.

Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition. And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.

And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.