by Adam Hartung | Oct 5, 2015 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Twitter’s Board decided in July to oust the CEO, Dick Costolo, due to frustration over company profits. As I wrote at the time, Twitter had continued to add members, at a rate comparable to its social media competition. And it had grown revenues, while remaining the industry leader in revenue per active user.

But the concern was a lack of profits. Oh my, if rapid revenue growth but weak profits were a reason to fire a CEO, how does Jeff Bezos keep his job?

Anyway, Mr. Costolo was replaced by an original founder and former Twitter CEO Jack Dorsey on an interim basis. Four months later, after failing in its effort to find a suitable full-time CEO, the Board has made Mr. Dorsey the permanent CEO. While he simultaneously remains full time CEO of Square, a mobile payments processing company.

Anyway, Mr. Costolo was replaced by an original founder and former Twitter CEO Jack Dorsey on an interim basis. Four months later, after failing in its effort to find a suitable full-time CEO, the Board has made Mr. Dorsey the permanent CEO. While he simultaneously remains full time CEO of Square, a mobile payments processing company.

As I said in my last column on this subject, investors better beware.

Facebook is tearing up the social media market. It has grown to be not only #1 in active monthly users, but at 1.5B monthly active users (MSUs) the site has 5 times the number of users that Twitter has. By adding a slew of new features and functions Facebook has become more valuable to its users – and advertisers.

According to Statista, simultaneously Facebook has grown Facebook Messenger to 700M MSUs, acquired WhatsApp with 800M MSUs and Instagram with 400M MSUs. By constantly expanding the ecosphere Facebook now has 3.4B MSUs – over 10 times the number of Twitter. Facebook is so dominant that even muscular Google, with all its resources, abandoned its efforts to compete with the juggernaut by killing Google+ (which had 300M MSUs) earlier in 2015.

Twitter had great organic growth numbers, but unlike competitors it does not dominate any particular category of social media. Linked in, with only 100M MSUs dominates business networking, and bosts a user base that skews older and more professional. Pinterest and Instagram are battling it out for leadership in photo sharing. But it is unclear how one would describe a social growth category that Twitter dominates.

I actively use Twitter. But among my peers I am the exception. When I ask people over 40 if they use Twitter I regularly hear “I don’t get it. It all looks completely chaotic. Why would I want to follow people on Twitter, and why would I want to post.” This sounds a lot like what people said of Facebook and Linked in 5 years ago. But those companies found their connection with users and people now “get it.”

So the question is whether Mr. Dorsey will make Twitter into a site that is ubiquitous, at least for one category. Can he make the product so useful that users can’t live without it, and that continues drawing in massive new numbers of users?

Twitter has not changed much at all since it was founded. It still depends on users to sign on, start tweeting, and search out others a user wants to follow. And that means follow for some reason other than that person is a celebrity or politician that simply can’t stop spouting off. The Twitter user has to hunt for like minded individuals, find a way to connect with folks who are informative to their needs and then create a dialogue — and all with pretty much the same character limits and shrunken link technology available many years ago.

Apple floundered as a manufacturer of niche PCs. The returning CEO, Steve Jobs, resurrected the company by putting all his money on mobile. It wasn’t an improved Mac that turned around Apple, but rather the launch of the iPod and iTunes, followed by the iPhone and the iPad. The way Apple stole the thunder from previously dominant Microsoft was by creating new products built on the mobile trend that led to explosive growth.

Mr. Costolo left Twitter in far better shape than Apple was in when Mr. Jobs retook the reins. But will Mr. Dorsey be able to launch a series of new products that can create an Apple-like growth explosion?

Square, where Mr. Dorsey ostensibly spends half his time, is preparing to go public. But, even though it is currently considered by many the leader in its marketplace, Square is looking down the barrel of ApplePay – a technology on every iPhone that could make it obsolete. Then there’s also Google Wallet that is on all the other smartphones. Plus well funded outfits like PayPal and Mastercard. Square will need a very competent, capable and visionary CEO to guide its development competing with these – and other – well funded and powerful companies. Square will need to add features, functions and benefits if it is create long-term value.

A lot of new products are needed by two relatively small companies in short order if they are to survive. Success will not happen by cutting costs in either. It will require intensive product development with very rapid product cycles that bring in millions upon millions of new users.

Twitter was once a disruptive innovator. Now it is hard to recognize any innovation at Twitter. Does Mr. Dorsey get it? And if he does, can he do it? And do it twice, simultaneously?

by Adam Hartung | Jan 29, 2015 | Current Affairs, In the Whirlpool, Leadership, Web/Tech

This week Yahoo announced it is spinning off the last of its Alibaba holdings. This is a big deal, because it might well signal the end of Yahoo.

Yahoo created internet advertising. Yahoo was once the #1 home page for browsers across America. But the company has floundered for years, riddled with CEO problems, a contentious Board of Directors and no strategy for dealing with Google which overtook it in all markets.

To much fanfare the Board hired Marissa Mayer, a Google wunderkind we were told, in July, 2012 to mount a serious turnaround. And during her leadership the company’s stock value has tripled – from about $14.50/share to about $43.50. You would think investors would be thrilled and the company would be on the right track.

Only almost all that value creation was due to a stock investment made in 2005 – when Jerry Yang invested $1B to buy 40% of Alibaba. And Alibaba in 2014 became the most valuable IPO in history.

Yahoo today is valued at about $46B. The Alibaba shares being spun out are valued at between $40B and $44B. Which means that after adjusting for the ownership in Yahoo Japan (valued at $2.3B) the core Yahoo ad and portal business is worth between $2B and $4.7B. With just over $1B shares outstanding, that puts a value on Yahoo’s core business of between $2.00-$4.70/share – or about 1/6 to 1/3 the value when Ms. Mayer became CEO.

A highest value of $4.7B for the operating business of Yahoo puts it on par with Groupon. And worth far less than competitors Google ($347B) and Facebook ($212B). Even upstart, and often maligned, social media companies Twitter ($24B) and LinkedIn ($27B) have valuations 5 times Yahoo.

Unfortunately, this latest leader and her team haven’t been any more effective at improving the company’s business than previous regimes. Under CEO Mayer Yahoo used gains from Alibaba’s valuation to invest about $2.1B in 49 outside companies – with $2B of that being acquisitions of technology companies Flurry ($200M), BrightRoll ($640M) and Tumblr ($1.1). Under the most optimistic view of Yahoo, leadership spent 40% of the company’s value in acquisitions that have made no difference to ad revenues or profits.

In fact, Yahoo’s business revenues, and profits, have declined for 6 consecutive quarters. Despite the CEO’s mandate that employees could no longer work from home. A kerfuffle that proved yet another management distraction, and apparently an effort to cut staff without it looking like a layoff.

Meanwhile there have been big efforts to boost people going to the Yahoo portal. Such as hiring broadcaster Katie Couric to beef up the news section, and former New York Times tech columnist David Pogue to deepen tech coverage and New York Times Magazine political writer Matt Bai to draw in more readers. But these have done nothing to move the needle.

Consistently declining display advertising has left search ads a bigger, and more profitable, business. And while Yahoo’s CEO has been teasing ad agencies that she might begin another big brand campaign, including TV, to bring Yahoo more attention – and hopefully more advertisers – there is no evidence anyone cares as more and more dollars flow to “programmatic” ad buying where Google is king. In the digital ad marketplace Google has 31% share, Facebook 7.75% share and Yahoo a meager 2.36% share.

Soon there will be little left of the once mighty Yahoo. It has pretty much lost relevancy. Large investors are crying for a merger with AOL, whose inability to grow its portal, ad and media businesses has left its market cap at a mere $3.7B. But combining two companies that are market irrelevant, and declining, will probably have the same outcome as happened when merging KMart and Sears. The Yahoo growth stall remains intact, and revenues will decline along with profits as the market continues shifting to powerful and growing competitors Google, Facebook and other social media companies. Only now Yahoo’s leaders won’t have the Alibaba value mountain to hide behind

by Adam Hartung | Dec 11, 2014 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lifecycle, Television, Web/Tech

The trend toward the death of broadcast TV as we’ve known it keeps moving forward. This trend may not happen as fast as the death of desktop computers, but it is a lot faster than glacier melting.

This television season (through October) Magna Global has reported that even the oldest viewers (the TV Generation 55-64) watched 3% less TV. Those 35-54 watched 5% less. Gen Xers (25-34) watched 8% less, and Millenials (18-24) watched a whopping 14% less TV. Live sports viewing is not even able to maintain its TV audience, with NFL viewership across all networks down 10-19%.

Everyone knows what is happening. People are turning to downloaded entertainment, mostly on their mobile devices. With a trend this obvious, you’d think everyone in the media/TV and consumer goods industries would be rethinking strategy and retooling for a new future.

But, you would be wrong. Because despite the obviousness of the trend, emotional ties to hoping the old business sticks around are stronger than logic when it comes to forecasting.

CBS predicted at the beginning of 2014 TV ad revenue would grow 4%. Oops. Now CBS’s lead forecaster is admitting he was way off, and adjusted revenues were down 1% for the year. But, despite the trend in viewer behavior and ad expenditures in 2014, he now predicts a growth of 2% for 2015.

That, my young friends, is how “hockey stick” forecasts are created. A lot of old assumptions, combined with a willingness to hope trends will be delayed, and you can ignore real data while promising people that the future will indeed look like the past – even when it defies common sense.

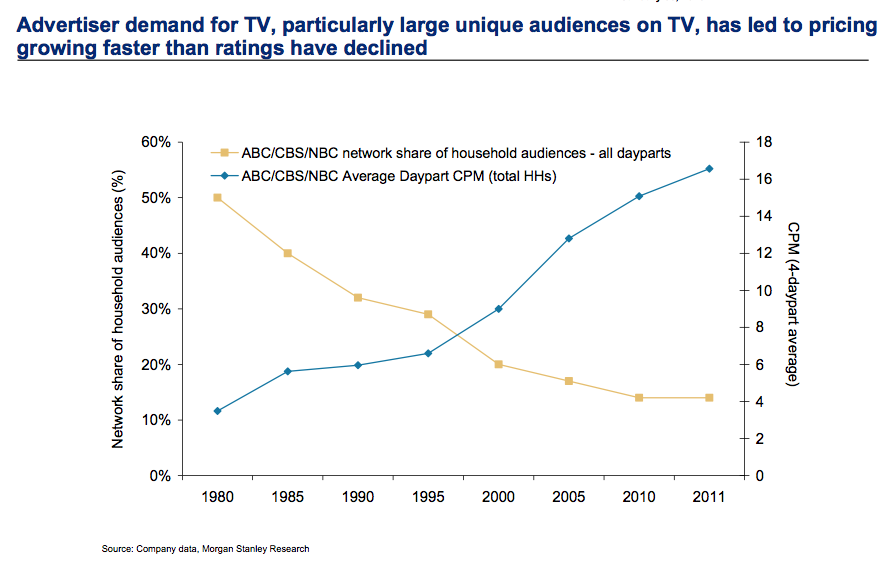

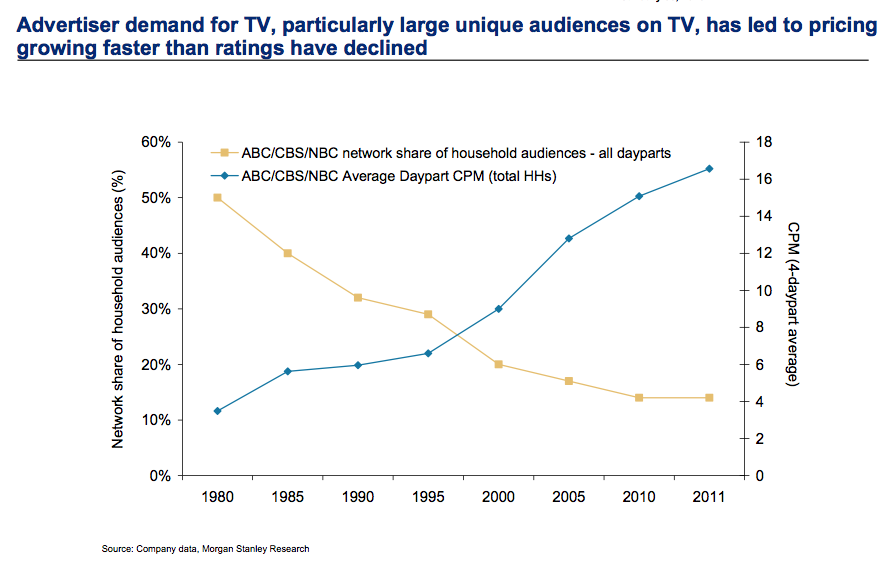

To compensate for fewer ads the networks have raised prices on all ads. But how long can that continue? This requires a really committed buyer (read more about CMO weaknesses below) who simply refuses to acknowledge the market has shifted and the dollars need to shift with it. That cannot last forever.

Meanwhile, us old folks can remember the days when Nielsen ratings determined what was programmed on TV, as well as what advertisers paid. Nielsen had a lock on measuring TV audience viewing, and wielded tremendous power in the media and CPG world.

But now AC Nielsen is struggling to remain relevant. With TV viewership down, time shifting of shows common and streaming growing like the proverbial weed Nielsen has no idea what entertainment the public watches. They don’t know what, nor when, nor where. Unwilling to move quickly to develop tools for catching all the second screen viewing, Nielsen has no plan for telling advertisers what the market really looks like – and the company looks to become a victim of changing markets.

Which then takes us to looking at those folks who actually buy ads that drive media companies. The Chief Marketing Officers (CMOs) of CPG companies. Surely these titans of industry are on top of these trends, and rapidly shifting their spending to catch the viewers with the most ads placed for the lowest cost.

You would wish.

Unfortunately, because these senior executives are in the oldest age groups, they are a victim of their own behavior. They still watch TV, so assume others must as well. If there is cyber-data saying they are wrong, well they simply discount that data. The Nielsen’s aren’t accurate, but these execs still watch the ratings “because it’s the best info we have” – a blatant untruth by the way. But Nielsen does conveniently reinforce their built in assumptions, and their hope that they won’t have to change their media spend plans any time soon.

Further, very few of these CMOs actually use social media. The vast majority watch their children, grandchildren and young employees use mobile devices constantly – and they bemoan all the activity on YouTube, Facebook, Instagram and Twitter – or for the most part even Linked-in. But they don’t actually USE these products. They don’t post information. They don’t set up and follow channels. They don’t connect with people, share information, exchange photos or tell stories on social media. Truthfully, they ignore these trends in their own lives. Which leaves them woefully inept at figuring out how to change their company marketing so it can be more relevant.

The trend is obvious. The answer, equally so. Any modern marketer should be an avid user of social media. Most network heads and media leaders are farther removed from social media than the Pope! They don’t constantly download entertainment, and exchanging with others on all the platforms. They can’t manage the use of these channels when they don’t have a clue how they work, or how other people use them, or understand why they are actually really valuable tools.

Are you using these modern tools? Are you actually living, breathing, participating in the trends? Or are you, like these outdated execs, biding your time wasting money on old programs while you look forward to retirement? And likely killing your company.

When trends emerge it is imperative we become part of that trend. You can’t simply observe it, because your biases will lead you to hope the trend reverts as you continue doing more of the same. A leader has to adopt the trend as a leader, be a practicing participant, and learn how that trend will make a substantial difference in the business. And then apply some vision to remain relevant and successful.

by Adam Hartung | Jan 8, 2014 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Most investors really aren’t. They are traders. They sell too fast, and make too many transactions. That’s why most small “investors” don’t do as well as the market averages. In fact, most don’t even do as well as if they simply put money into certificates of deposit or treasury bills.

I subscribe to the idea you should be able to invest in a company, and then simply forget about it. Whether you invest $10 or $100,000, you should feel confident when you buy a stock that you won’t touch it for 3, 5 or even 10 years. Let the traders deal with volatility, just wait and let the company do its thing and go up in value. Then sometime down the road sell it for a multiple of what you paid.

That means investing in big trends. Find a trend that is long-lasting, perhaps permanent, and invest in the leader. Then let the trend do all the work for you.

Imagine you bought AT&T in the 1950s as communication was about to proliferate and phones went into every business and home. Or IBM in the 1960s as computer technology overtook slide rules, manual databases and bookkeeping. Microsoft in the 1980s as personal computers became commonplace. Oracle in the 1990s as applications were built on relational databases. Google, Amazon and Apple in the last decade as people first moved to the internet in droves, and as mobile computing became the next “big thing.”

In each case investors put their money in a big trend, and invested in a leader far ahead of competitors with a strong management team and product pipeline. Then they could forget about it for a few years. All of these went up and down, but over time the vicissitudes were obliterated by long-term gains.

Today the biggest trend is social media. While many people still decry its use, there is no doubt that social media platforms are becoming commonplace in how we communicate, look for information, share information and get a lot of things done. People inherently like to be social; like to communicate. They trust referrals and comments from other people a lot more than they trust an ad – and often more than they trust conventional media. Social media is the proverbial fast flowing river, and getting in that boat is going to take you to a higher value destination.

And the big leader in this trend is Facebook. Although investors were plenty upset when Facebook tumbled after its IPO in 2012, if you had simply bought then, and kept buying a bit each quarter, you’d already be well up on your investment. Almost any purchase made in the first 12 months after the IPO would now have a value 2 to 3 times the acquisition price – so a 100% to 200% return.

But, things are just getting started for Facebook, and it would be wrong to think Facebook has peaked.

Few people realize that Facebook became a $5B revenue company in 2012 – growing revenue 20X in 4 years. And revenue has been growing at 150% per year since reaching $1B. That’s the benefit of being on the “big trend.” Revenues can grow really, really, really fast.

And the market growth is far from slowing. In 2013 the number of U.S. adults using Facebook grew to 71% from 67% in 2012. And that is 3.5 times as often as they used Linked-In or Twitter (22% and 18%.) And Facebook is not U.S. user dependent. Europe, Asia and Rest-of-World have even more users than the USA. ROW is 33% bigger than the USA, and Facebook is far from achieving saturation in these much higher population markets.

Advertisers desiring to influence these users increased their budgets 40% in 2013. And that is sure to grow as users and their interactions climb. According to Shareaholic, over 10% of all internet referrals come from Facebook, up from 7% share of market the previous year. This is 10 times the referral level of Twitter (1%) and 100 times the levels of Linked in and Google+ (less than .1% each.) Thus, if an advertiser wants to users to go to its products Facebook is clearly the place to be.

Facebook acquires more of these ad dollars than all of its competition combined (57% share of market,) and is 4 times bigger than competitors Twitter and YouTube (a Google business.) The list of Grade A advertisers is long, including companies such as Samsung ($100million,) Proctor & Gamble ($60million,) Microsoft ($35million,) Amazon, Nestle, Unilever, American Express, Visa, Mastercard and Coke – just to name a few.

And Facebook has a lot of room to grow the spending by these companies. Google, the internet’s largest ad revenue generator, achieves $80 of ad revenue per user. Facebook only brings in $13/user – less than Yahoo ($18/user.) So the opportunity for advertisers to reach users more often alone is a 6x revenue potential – even if the number of users wasn’t growing.

But on top of Facebook’s “core” growth there are new revenue sources. Since buying revenue-free Instagram, Facebook has turned it into what Evercore analysts estimate will be a $340M revenue in 2014. And as its user growth continues revenue is sure to be even larger in future years.

Even a larger opportunity for growth is the 2013 launched Facebook Ad Exchange (FBX) which is a powerful tool for remarketing unused digital ad space and targeting user behavior – even in mid-purchase. According to BusinessInsider.com FBX already sells to advertisers millions of ads every second – and delivers up billions of impressions daily. All of which is happening in real-time, allowing for exponential growth as Facebook and advertisers learn how to help people use social media to make better purchase decisions. FBX is currently only a small fraction of Facebook revenue.

Stock investing can seem like finding a needle in a haystack. Especially to small investors who have little time to do research. Instead of looking for needles, make investing easier. Eschew complicated mathematical approaches, deep portfolio theory and reams of analyst reports and spreadsheets. Invest in big trends that are growing, and the leaders building insurmountable market positions.

In 2014, that means buy Facebook. Then see where your returns are in 2017.

by Adam Hartung | Aug 9, 2012 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership, Web/Tech

Mark Zuckerberg was Time magazine's Person of the Year in December, 2010. He was given that honor because Facebook dominated the emerging social media marketplace, and social media had clearly begun changing how people do things. Despite his young age, Mr. Zuckerberg had created a phenomenon demonstrated by the hundreds of million new Facebook users.

But things have turned pretty rough for the young Mr. Zuckerberg.

- Facebook was pretty much forced, legally, to go public because it had accumulated so many shareholders. The stock hit the NASDAQ with much fanfare in May, 2012 – only to have gone pretty much straight down since. It now trades at about 50% of IPO pricing, and is under constant pressure from analysts who say it may still be overpriced.

- Facebook discovered perhaps 83million accounts were fake (about 9%) unleashing a torrent of discussion that perhaps the fake accounts was a much, much larger number.

- User growth has fallen to some 35% – which is much slower than initial investors hoped. Combined with concerns about fake accounts, there are people wondering if Facebook growth is stalling.

- Facebook has not grown revenues commensurate with user growth, and people are screaming that despite its widespread use Facebook doesn't know how to "monetize" its base into revenues and profits.

- Mobile use is growing much faster than laptop/PC use, and Facebook has not revealed any method to monetize its use on mobile devices – causing concerns that it has no plan to monetize all those users on smartphones and tablets and thus future revenues may decline.

- Zynga, a major web games supplier, announced weak earnings and said its growth was slowing – which affects Facebook because people play Zinga games on Facebook.

- GM, one of the 10 largest U.S. advertisers, publicly announced it was dropping Facebook advertising because executives believed it had insufficient return on investment. Investors now fret Facebook won't bring in major advertisers.

- Google keeps plugging away at competitive product Google+. And while Facebook disappointed investors with its earnings, much smaller competitor Linked-in announced revenues and earnings which exceeded expectations. Investors now worry about competitors dicing up the market and minimalizing Facebook's future growth.

Wow, this is enough to make 50-something CEOs of low-growth, non-tech companies jump with joy at the upending of the hoody-wearing 28 year old Facebook CEO. Zynga booted its Chief Operating Officer and has shaken up management, and not suprisingly, there are analysts now calling for Mr. Zuckerberg to step aside and install a new CEO.

Yet, Mr. Zuckerberg has been wildly successful. Much more than almost anyone else in American business today. He may well feel he needs no advice. But…. what do you suppose Steve Jobs would tell him to do?

Recall that Mr. Jobs was once the young head of Apple, only to be displaced by former Pepsi exec John Sculley — and run out of Apple. As everyone now famously knows, after a string of Apple CEOs led the company to the brink of disaster Mr. Jobs agreed to return and completely turned around Apple making it the most successful tech company of the last decade. Given what we've observed of Mr. Jobs career, and read in his biography, what advice might he give Mr. Zuckerberg?

- Don't give up your job. Not even partly. If you create a "shadow" or "co" CEO you'll be gone soon enough. Lead, quit or make the Board fire you. If you had the vision to take the company this far, why would you quit?

- Nothing is more important than product. Make Facebook's the best in the world. Nothing less will allow a tech company to survive, much less thrive. Don't become so involved with financials and analysts that you lose sight of your #1 job, which is to make the very, very best social media product in the world. Never stop improving and perfecting. If your product isn't obviously superior to other solutions you haven't accomplished your #1 priority.

- Be unique. Make sure your products fulfill needs no one else fulfills – at least not well. Meet unserved and underserved needs so that people talk about your product and what it does – not how much it costs. Make sure that Facebook has devoted, diehard customers that believe your products meet their needs so well they would not consider your competition.

- Don't ask customers what they want – give them what they need. Understand the trends and create future scenarios so you are constantly striving to create a better future, not just improve on history. Never look backward at what you've done, but instead always look forward at creating what noone else has ever done. Push your staff to create solutions that meet user needs so well that you can tell customers why they need your product in ways they never before considered.

- Turn your product releases into a show. Don't just run out new products willy-nilly, or on a random timeline. Make sure you bundle products together and make a big show of each release so you can describe the upgrades, benefits and superiority of what you offer for customers. People need to understand the trends you are meeting, and need to see the future scenario you are creating, and you have to tell them that story or they won't "get it."

- Price for profit. You run a business, not a hobby or not-for-profit society. If you do the product right you shouldn't even be talking about price – so price to make ridiculous margins by industry standards. At Apple, Next and Pixar the products were never the cheapest, but they accomplished what customers needed so well that we could price high enough to make margins that supported additional product development. And you can't remain the best solution if you don't have enough margin to keep developing future products.

- Don't expect products to sell themselves. Be the #1 passionate spokesperson for the elegance and superiority of your products. Never stop beating the drum for the unique capability and superiority of your product, in every meeting, all the time, never ending. People like to "revert to the mean" so you have to keep telling them that isn't good enough – and you have something far superior that will greatly improve their success.

- Never miss an opportunity to compare your products to competition and tell everyone why your products are far better. Don't disparage the competition, but constantly reinforce that you are first, you are ahead of everyone else, you are far better — and the best is yet to come! Competition is everywhere, and listen to the Andy Groves advice "only the paranoid survive." You aren't satisfied with what the competition offers, and customers should not be satisfied either. Every once in a while give people a small glimpse as to the radically different world you see in 3-5 years so they buy what you are selling in order to prepare for that future world.

- Identify key customers that need your solution and SELL THEM. Disney needed Pixar, so we made sure they knew it. Identify the customers who can gain the most from doing business with you and SELL THEM. Turn them into lead customers, obtain their testimonials and spread the word. If GM isn't your target, who is? Find them and sell them, then tell us all how you will build on those early accounts to eventually dominate the market – even displacing current solutions that are more popular. If GM is your target then make the changes you need to make so you can SELL THEM. Everyone wants to do business with a winner, so you must show you are a winner.

- Identify 5 of your competition's biggest customers (at Google, Yahoo, Linked-in, etc.) and make them yours. Demonstrate your solutions are superior with competitive wins.

- Hire someone who can talk to the financial community for you – and do it incredibly well. While you focus on future markets and solutions someone has to tell this story to the financial analysts in their lingo so they don't lose faith (and they are a sacrilegious lot who have no faith.) Keep Facebook out of the forecasting game, but you MUST create and maintain good communication with analysts so you need someone who can tell the story not only with products and case studies but numbers. Facebook is a disruptive innovation company, so someone has to explain why this will work. You blew the IPO road show horribly by showing up at meetings in a hoodie – so now you need to make amends by hiring someone who will give them faith that you know what you're doing and can make it happen.

These are my ideas for what Steve Jobs would tell Mark Zuckerberg. What are yours? What do you think the #1 CEO of the last decade would say to the young, embattled CEO as he faces his first test under fire leading a public company?

Anyway, Mr. Costolo was replaced by an original founder and former Twitter CEO Jack Dorsey on an interim basis. Four months later, after failing in its effort to find a suitable full-time CEO, the Board has made Mr. Dorsey the permanent CEO. While he simultaneously remains full time CEO of Square, a mobile payments processing company.

Anyway, Mr. Costolo was replaced by an original founder and former Twitter CEO Jack Dorsey on an interim basis. Four months later, after failing in its effort to find a suitable full-time CEO, the Board has made Mr. Dorsey the permanent CEO. While he simultaneously remains full time CEO of Square, a mobile payments processing company.