by Adam Hartung | Dec 11, 2018 | eBooks, Investing, social media

Since 2012, I’ve been a huge fan of Facebook, Apple, Amazon, Netflix and Google. And they have dramatically outperformed the market. In the last few weeks their values have fallen dramatically, and I’ve heard grumblings that these are no longer the stocks to own.

I virulently disagree. Great companies are where you should invest. If you don’t think these are great companies, you would be right to sell them (such as GE, Sears, and many others.) But despite complaints about privacy, usage rates, nefarious users, and other attacks on technology, the reality is that we love the convenience these companies gave us. We may not think things are perfect, but we are a lot happier than we used to be, and we are pretty happy with how these companies respond to product concerns.

- These companies are still global leaders in some of the biggest and most powerful trends everywhere

- The shift to e-commerce from traditional retail continues unabated

- The movement to mobile devices continues

- Using the cloud to replace device storage and network storage will not slow

- Entertainment continues to move to streaming from TV and other sources

- Ad growth remains firmly on the internet and mobile devices

- Platform usage (such as social networks) keeps growing as more uses are developed

These mega-trends are the foundation of the FAANG companies. These companies became great by understanding these trends, then developing products for these trends that have attracted billions of customers. Their revenue growth continues, just as their product development continues. And their profits keep growing as well. Nobody ever saved their way to prosperity. To increase value you must increase profitable revenues. And that capability has not left these companies.

Some of these company’s leaders have recently been called to Washington to testify. Will they be attacked, split up, further regulated? Will the government kill the golden goose? Given that the US House of Representatives has not firmly moved to the Democrats, I see almost no sign of that happening. Democrats like happy constituents, and given how happy consumers are with these companies the Democrats are very unlikely to intervene. There has long been a deep friendship, built on significant campaign financing and lobbyist involvement, between these companies and Democrats. The change in government almost insures that the actions in Washington will prove to just be a lot of short-term heat, with little change in the overall lighting.

I don’t know when these stocks will reach a short-term bottom. Just like nobody can predict market highs, it is impossible to predict lows. But the one thing I feel very strongly about is that in a year these companies will be worth more than they are valued today.

For insight into my strong favorability for these companies, take a look at the infographic I’ve provided regarding Facebook. Despite the Facebook stock ups-and-downs, this infographic explains why long-term it has been very smart to buy Facebook. Despite how people have “felt” about the company, it is a GREAT company built on powerful trends. To understand even better, buy the ebook “Facebook, The Making of a Great Company” on Amazon for 99 cents.

by Adam Hartung | Nov 25, 2018 | Innovation, Investing, Trends, Web/Tech

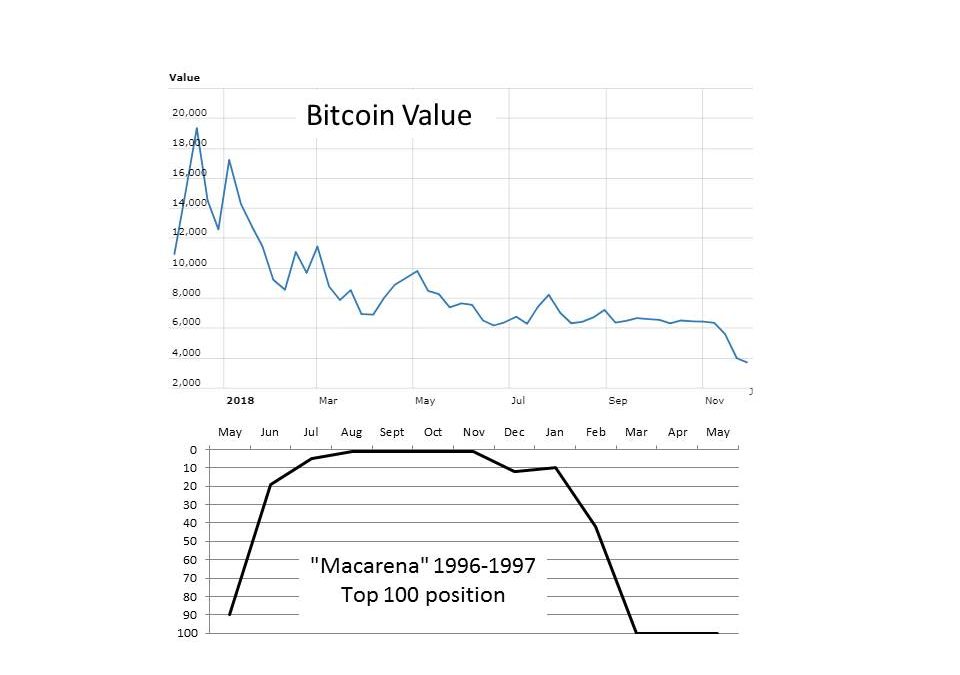

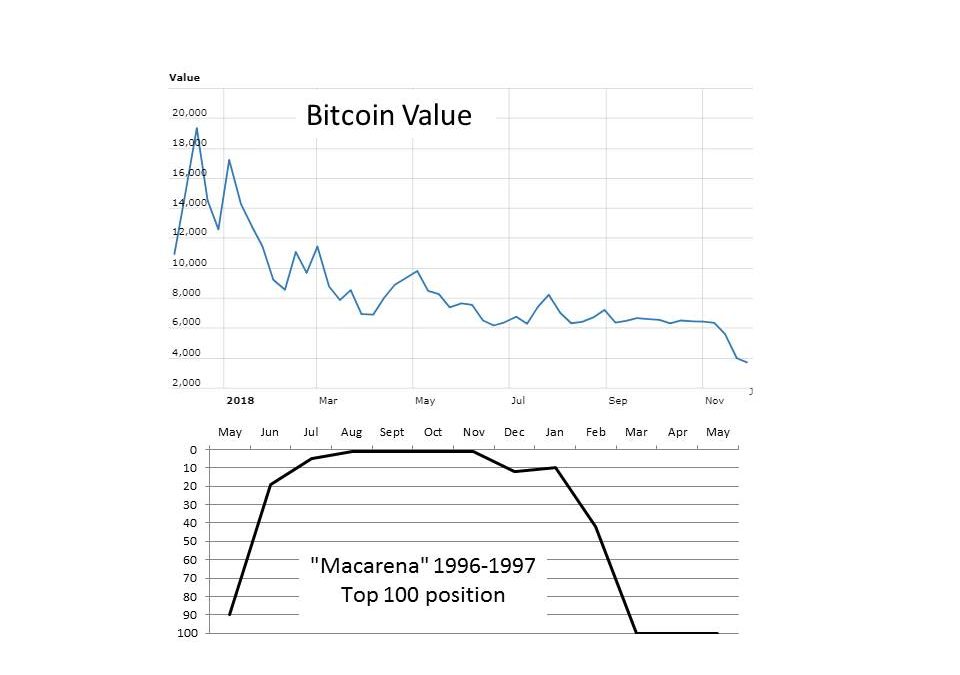

It was August 15, 2017 when I wrote the column “A Bitcoin Is Worth $4,000 – Why You Probably Should Not Own One.” At the time Bitcoin’s value had increased in value by 750% in just one year, and some investors were becoming very excited about Bitcoins. Journal articles were nearly all bullish, with some big Bitcoin owners projecting they would increase in value to over $250,000 each – or possibly into the millions!

But I was far more pragmatic. I pointed out that Bitcoins had no inherent value – unlike a Picasso painting, for example. There will be no more original Picasso’s, and no more signed Picasso prints. The supply is completely known, and the price is determined by what people will pay for the artistic history of them. But anybody can make a Bitcoin. And even though there was some theoretical limit of 21 million, why anybody would want to own these non-physical data bits was unclear. Were people going to say “come, look at this hard drive. It contains 400,000 Bitcoins. Isn’t it cool?” Bitcoins were a lot more like Pokemon cards. There are a LOT of them, more coming all the time, and their value was only to people who wanted to play the Bitcoin game.

And I had a very low opinion of the necessity of Bitcoins as a currency. Everyone is pretty happy to use dollars, yen, euros, etc. And if you fear inflation there is an open market to exchange any currency for any other, so you can quickly keep your savings in the currency of your choice. The only valuable use of Bitcoins was as a currency for illegal activity you don’t want traced – such as sex trafficking, drug trafficking or gun running. While the outlaws in those occupations my enjoy a non-government currency, those folks are relatively few and far between, and the need for such currency is therefore pretty weak. Not to mention illegal.

It was pretty clear that Bitcoin was a fad. Like the famous Dutch Tulip Bulb fad that drove the price of a Tulip bulb higher than a house. While a fad the value went up, but because there was no inherent value to the bulb greater than a flower, it’s value was sure to collapse. And the same would happen to Bitcoins. To a long-term trend watcher, and person skilled at understanding trends for planning, Bitcoin had all the signs of a fad.

I remember this well because when I published this column in Forbes there was a Bitcoin editor that went ballistic. This person had no background in economics, banking, currency, stock markets, or art; the editor was a journalist who had decided Bitcoin was “the next big thing.” Bitcoin was going to overtake traditional currencies, and save the world from central banks dead-set on destroying free trade and economic growth.

Honestly, I never understood the argument. Baseless, and senseless. Bitcoin was a fad, I said clearly, and no investor should be buying them – especially small investors. And it was a fools folly to spend money becoming a Bitcoin miner. Simply invest somewhere else where trends supported growth.

But the editorial staff at Forbes landed on me like a herd of elephants coming down the Himalayas. Apparently Forbes was buying into the Bitcoin craze, and they didn’t want anyone writing bad things about Bitcoin. I pointed out that in 9 years my predictions about the future of Netflix, Amazon, Tesla – and GE, Sears, and Windows 8 and 10 – had all turned out to be accurate.

I tended to be very early with my predictions, and quite contrarian, but within 2 years I was proven right. I knew the difference between a trend and a fad, and it was important to help readers understand the difference. Bitcoins had no inherent value, and they were/are not an investment vehicle.

In the end the rancor about my Bitcoin prediction, and my unwillingness to reverse my position, caused a break between myself and Forbes. Even as Bitcoins soared in value to $19,000 by December, 2017 I held firm to the position that no sound, long-term investor should touch them. If Forbes couldn’t understand my surety, then it was their problem.

This week Bitcoins traded for $4,400. Where they traded on August 20, 2017 just as my prediction went public. Bitcoins were/are a fad. Now, there are a slew of authors writing about the lack of any reason for Bitcoins to exist. Almost all are predicting the value will continue eroding, as more and more people see there was never any value in them to begin with. Many predict this will not end until Bitcoins are worth nothing, or possibly a few cents, and all the Bitcoin miners disappear.

The important lesson is that it is not impossible to know the difference between a trend and a fad. Trends are based upon behaviors that have a basis in gain. We trended away from physical stores and toward e-commerce because the latter was more convenient, and sometimes cheaper. We trended away from PC’s with hard drives and toward mobile devices connected to the cloud because they made our lives more convenient, and often cheaper. We are watching more entertainment via on-line downloads, and less on television, because it is more convenient, and often better. These are trends. They are observable, measurable and good trends generate a better outcome for people, while bad trends are due to consumer movement toward new solutions.

When you work a job all week trying to get more done better, faster, cheaper you may not have time to study trends. When you see something new it can seem hard to know whether it is a fad, or trend. Or if a trend, how fast it will “take hold” and alter behavior. That is understandable.

And that’s where people like me make a difference. I focus on trends. Demographics, regulations, technology – all kinds of trends. I watch them, measure them, and project outcomes for the trend, and those who adopt the trend. I build scenarios that stretch out the trend, and look for when more people are following a trend than doing things the “old way.” And because I do that all day, every day, for 20 years it is possible to forecast with high accuracy what the future will look like.

Almost always it takes a bit longer than I think, but likewise it almost always takes a lot less time than almost everyone else thinks. I didn’t think it would take 5 quarters for Bitcoins to peak and then fall back to $4,400. But most people were projecting the value of Bitcoins would go up for YEARS. They couldn’t visualize the peak. Even though it happened just 4 months after I said “don’t buy Bitcoins.” Only a very, very lucky trader would have bought in August, and sold in December. For true investors, this was a roller coaster ride with an unhappy ending.

I don’t meet many company executives that do future scenario planning. They are too busy running their business to do trend analysis, projections and make long-term forecasts. But that doesn’t mean these things aren’t important. It just means you need to look for outsiders, who specialize in trend analysis and long-term scenario planning, to help you guide your business in the right direction. Because you’d much rather be Microsoft, shifting from PC’s to cloud and holding onto your value, than GE or Sears. You need a partner to help you forecast – and grow.

by Adam Hartung | Aug 15, 2017 | Disruptions, Web/Tech

Even though most people don’t even know what they are, Bitcoins increased in value from about $570 to more than $4,300 — an astounding 750% — in just the last year. Because of this huge return, more people, hoping to make a fast fortune, are becoming interested in possibly owning some Bitcoins. That would be very risky.

Bitcoins are a crypto-currency. That means they can be used like a currency, but don’t physically exist like dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

Being virtual is not inherently a bad thing. The dollars on our financial institution statement, viewed online, are considered real money, even though those are just digital dollars. The fact that Bitcoins aren’t available in physical form is not really a downside, any more than the numbers on your financial statement are not available as physical currency either. Just like we use credit cards or debit cards to transfer value, Bitcoins can be spent in many locations, just like dollars.

What makes Bitcoins unique, versus other currencies, is that there is no financial system, like the U.S. Federal Reserve, managing their existence and value. Instead Bitcoins are managed by a bunch of users who track them via blockchain technology. And blockchain technology itself is not inherently a problem; there are folks figuring out all kinds of uses, like accounting, using blockchain. It is the fact that no central bank controls Bitcoin production that makes them a unique currency. Independent people watch who buys and sells, and owns, Bitcoins, and in some general fashion make a market in Bitcoins. This makes Bitcoins very different from dollars, euros or rupees. There is no “good faith and credit” of the government standing behind the currency.

Why are currencies different from everything else?

Currencies are sort of magical things. If we didn’t have them we would have to do all transactions by barter. Want some gasoline? Without currency you would have to give the seller a chicken or something else the seller wants. That is less than convenient. So currencies were created to represent the value of things. Instead of saying a gallon of gas is worth one chicken, we can say it is worth $2.50. And the chicken can be worth $2.50. So currency represents the value of everything. The dollar, itself, is a small piece of paper that is worth nothing. But it represents buying power. Thus, it is stored value. We hold dollars so we can use the value they represent to obtain the things we want.

Currencies are not the only form of stored value. People buy gold and lock it in a safe because they believe the demand for gold will rise, increasing its value, and thus the gold is stored value. People buy collectible art or rare coins because they believe that as time passes the demand for such artifacts will increase, and thus their value will increase. The art becomes a stored value. Some people buy real estate not just to live on, but because they think the demand for that real estate will grow, and thus the real estate is stored value.

But these forms of stored value are risky, because the stored value can disappear. If new mines suddenly produce vast new quantities of gold, its value will decline. If the art is a fake, its value will be lost. If demand for an artist or for ancient coins cools, its value can fall. The stored value is dependent on someone else, beyond the current owner, determining what that person will pay for the item.

Assets held as stored value can crash

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

But there were no controls on tulip bulb production. Eventually it became clear that more tulip bulbs were being created, and the value was much, much greater than one could ever get for the tulips once planted and flowered. Even though it took many months for the value of tulip bulbs to become so high, their value crashed in a matter of two months. When tulip bulb holders realized there was nobody guaranteeing the value of their tulip bulbs, everyone wanted to sell them as fast as possible, causing a complete loss of all value. What people thought was stored value evaporated, leaving the tulip bulb holders with worthless bulbs.

While a complete collapse is unlikely, people should approach owning Bitcoins with great caution. There are other risks. Someone could hack the exchange you are using to trade or store Bitcoins. Also, cryptocurrencies are subject to wild swings of volatility, so large purchases or sales of Bitcoin can move prices 30% or more in a single day.

Be an investor, not a speculator, and avoid Bitcoins

There are speculators and traders who make markets in things like Bitcoins. They don’t care about the underlying value of anything. All they care about is the value right now, and the momentum of the pricing. If something looks like it is going up they buy it, simply on the hope they can sell it for more than they paid and take a profit on the trade. They don’t see the things they trade as having stored value because they intend to spin the transaction very quickly in order to make a fast buck. Even if value falls they sell, taking a loss. That’s why they are speculators.

Most of us work hard to put a few dollars, euros, pounds, rupees or other currencies into our bank accounts. Most of those dollars we spend on consumption, buying food, utilities, entertainment and everything else we enjoy. If we have extra money and want the value to grow we invest that money in assets that have an underlying value, like real estate or machinery or companies that put assets to work making things people want. We expect our investment to grow because the assets yield a return. We invest our money for the long-term, hoping to create a nest egg for future consumption.

Unless you are a professional trader, or you simply want to gamble, stay away from Bitcoins. They have no inherent value, because they are a currency which represents value rather than having value themselves. The Bitcoin currency is not managed by any government agency, nor is it backed by any government. Bitcoin values are purely dependent upon holders having faith they will continue to have value. Right now the market looks a lot more like tulip mania than careful investing.

by Adam Hartung | Sep 16, 2016 | Leadership

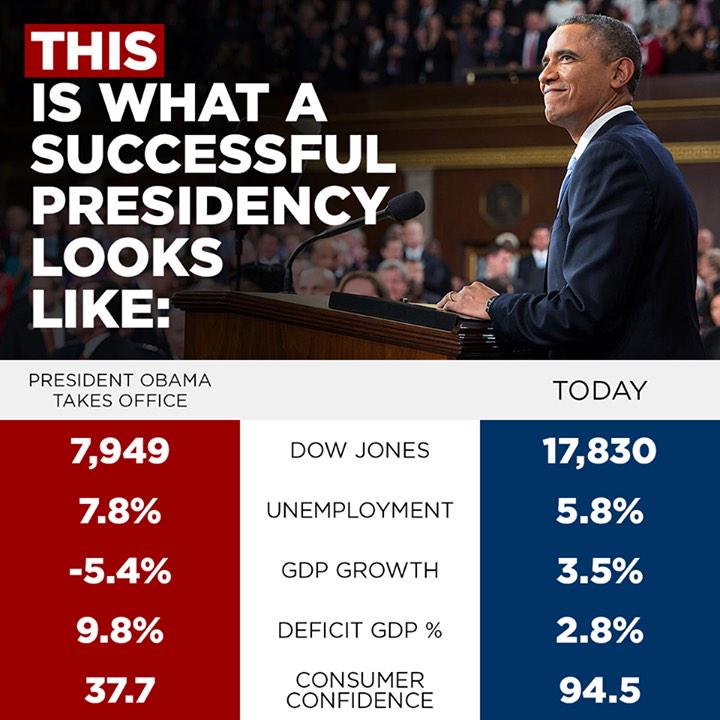

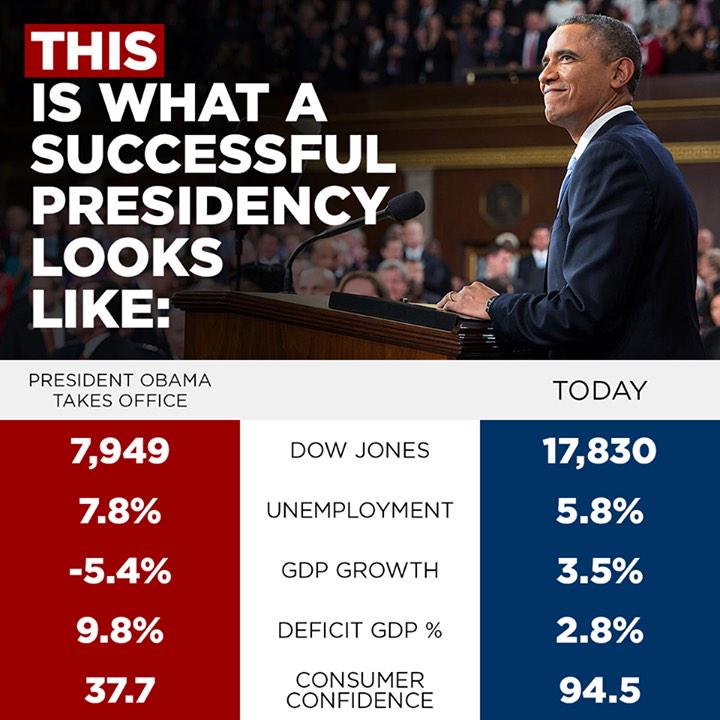

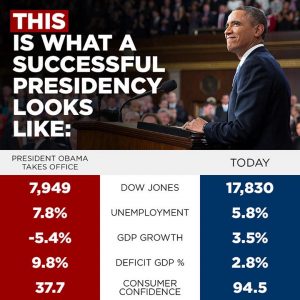

Donald Trump has been campaigning on how poorly America’s economy is doing. Yet, the headlines don’t seem to align with that position. Today we learned that U.S. household net worth climbed by over $1trillion in the second quarter. Rising stock values and rising real estate values made up most of the gain. And owners’ equity in their homes grew to 57.1%, highest in over a decade. Simultaneously this week we learned that middle-class earnings rose for the first time since the Great Recession, and the poverty rate fell by 1.2 percentage points.

Gallup reminded us this month that the percentage of Americans who perceive they are “thriving” has increased consistently the last 8 years, from 48.9% to 55.4%. And Pew informed us that across the globe, respect for Americans has risen the last 8 years, doubling in many countries such as Britain, Germany and France – and reaching as high as 84% favorability in Isreal.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

I thought it would be a good idea to revisit the author of “Bulls, Bears and the Ballot Box,” Bob Deitrick. Bob contributed to my 2012 article on Democrats actually being better for the economy than Republicans, despite popular wisdom to the contrary.

AH – Bob, there are a lot of people saying that the Obama Presidency was bad for the economy. Is that true?

Deitrick – To the contrary Adam, the Obama Presidency has economically been one of the best in modern history. Let’s start by comparing stock market performance, an indicator of investor sentiment about the economy using average annual compounded growth rates:

DJIA S&P 500 NASDAQ

Obama 11.1% 13.2% 17.7%

Bush -3.1% -5.6% -7.1%

Clinton 16.0% 15.1% 18.8%

Bush 4.8% 5.3% 7.5%

Reagan 11.0% 10.0% 8.8%

As you can see, Democrats have significantly outperformed Republicans. If you had $10,000 in an IRA, during the 16 years of Democratic administrations it would have grown to $72,539. During the 16 years of Republican administrations it would have grown to only $14,986. That is almost a 5x better performance by Democrats.

Obama’s administration has recovered all losses from the Bush crash, and gained more. Looking back further, we can see this is a common pattern. All 6 of the major market crashes happened under Republicans – Hoover (1), Nixon (2), Reagan (1) and Bush (2). The worst crash ever was the 58% decline which happened in 17 months of 2007-2009, during the Bush administration. But we’ve had one of the longest bull market runs in Presidential history under Obama. Consistency, stability and predictability have been recent Democratic administration hallmarks, keeping investors enthusiastic.

AH – But what about corporate profits?

Deitrick – During the 8 years of Reagan’s administration, the best for a Republican, corporate profits grew 26.82%. During the last 8 years corporate profits grew 55.79%. It’s hard to see how Mr. Trump identifies poor business conditions in America during Obama’s administration.

AH – What about jobs?

Deitrick – Since the recession ended in September, 2010 America has created 14,226,00 new jobs. All in, including the last 2 years of the Great Recession, Obama had a net increase in jobs of 10,545,000. Compare this to the 8 years of George W. Bush, who created 1,348,000 jobs and you can see which set of policies performed best.

AH – What about the wonkish stuff, like debt creation? Many people are very upset at the large amount of debt added the last 8 years.

Deitrick – All debt has to be compared to the size of the base. Take for example a mortgage. Is a $1million mortgage big? To many it seems huge. But if that mortgage is on a $5million house, it is only 20% of the asset, so not that large. Likewise, if the homeowner makes $500,000 a year it is far less of an issue (2x income) than if the homeowner made $50,000/year (20x income.)

The Reagan administration really started the big debt run-up. During his administration national debt tripled – increased 300%. This was an astounding increase in debt. And the economy was much smaller then than today, so the debt as a percent of GDP doubled – from 31.1% to 62.2%%. This was the greatest peacetime debt increase in American history.

During the Obama administration total debt outstanding increased by 63.5% – which is just 20% of the debt growth created during the Reagan administration. As a percent of GDP the debt has grown by 28% – just about a quarter of the 100% increase during Reagan’s era. Today we have an $18.5trillion economy, 4 to 6 times larger than the $3-$5trillion economy of the 1980s. Thus, the debt number may appear large, but it is nothing at all as important, or an economic drag, as the debt added by Republican Reagan.

Digging into the details of the Obama debt increase (for the wonks,) out of a total of $8.5trillion added 70% was created by 2 policies implemented by Republican Bush. Ongoing costs of the Afghanistan war has accumulated to $3.6trillion, and $2.9trillion came from the Bush tax cuts which continued into 2003. Had these 2 Republican originated policies not added drastically to the country’s operating costs, debt increases would have been paltry compared to the size of the GDP. So it hasn’t been Democratic policies, like ACA (Affordable Care Act), or even the American Reinvestment and Recovery Act which has led to home values returning to pre-crisis levels, that created recent debt, but leftover activities tied to Republican Bush’s foray into Afghanistan and Republican policies of cutting taxes (mostly for the wealthy.)

Since Reagan left office the U.S. economy has grown by $13.5trillion. 2/3 of that (67%) happened during Clinton and Obama (Democrats) with only 1/3 happening during Bush and Bush (Republicans.)

AH – What about public sentiment? Listening to candidate Trump one would think Americans are extremely unhappy with President Obama.

Deitrick – The U.S. Conference Board’s Consumer Confidence Index was at a record high 118.9 when Democrat Clinton left office. Eight years later, ending Republican Bush’s administration, that index was at a record low 26.8. Today that index is at 101.1. Perhaps candidate Trump should be reminded of Senator Daniel Patrick Moynihan’s famous quote “everyone is entitled to his own opinion, but not to his own facts.”

Candidate Trump’s rhetoric makes it sound like Americans live in a crime-filled world – all due to Democrats. But FBI data shows that violent crime has decreased steadily since 1990 – from 750 incidents per 100,000 people to about 390 today. Despite the rhetoric, Americans are much safer today than in the past. Interestingly, however, violent crime declined 10.2% in the second Bush’s 8 year term. But during the Clinton years violent crime dropped 34%, and during the Obama administration violent crime has dropped 17.8%. Democratic policies of adding federal money to states and local communities has definitely made a difference in crime.

Despite the blistering negativity toward ACA, 20million Americans are insured today that weren’t insured previously. That’s almost 6.25% of the population now with health care coverage – a cost that was previously born by taxpayers at hospital emergency rooms.

AH – Final thoughts?

Deitrick – We predicted that the Obama administration would be a great boon for Americans, and it has. Unfortunately there are a lot of people who obtain media coverage due to antics, loud voices, and access obtained via wealth that have spewed false information. When one looks at the facts, and not just opinions, it is clear that like all administrations the last 90 years Democrats have continued to be far better economic stewards than Republicans.

It is important people know the facts. For example, it would have kept an investor in this great bull market – rather than selling early on misplaced fear. It would have helped people to understand that real estate would regain its lost value. And understand that the added debt is not a great economic burden, especially at the lowest interest rates in American history.

[Author’s note: Bob Deitrick is CEO of Polaris Financial Partners, a private investment firm in suburban Columbus, Ohio. His firm uses economic and political tracking as part of its analysis to determine the best investments for his customers – and is proud to say they have remained long in the stock market throughout the Obama administration gains. For more on their analysis and forecasts contact PolarsFinancial.net]

by Adam Hartung | Mar 9, 2015 | Current Affairs, In the Rapids, Leadership, Television

The Netflix hit series “House of Cards” was released last night. Most media reviewers and analysts are expecting huge numbers of fans will watch the show, given its tremendous popularity the last 2 years. Simultaneously, there are already skeptics who think that releasing all episodes at once “is so last year” when it was a newsworthy event, and no longer will interest viewers, or generate subscribers, as it once did. Coupled with possible subscriber churn, some think that “House of Cards” may have played out its hand.

So, the success of this series may have a measurable impact on the valuation of Netflix. If the “House of Cards” download numbers, which are up to Netflix to report, aren’t what analysts forecast many may scream for the stock to tumble; especially since it is on the verge of reaching new all-time highs. The Netflix price to earnings (P/E) multiple is a lofty 107, and with a valuation of almost $29B it sells for just under 4x sales.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

Since Netflix started trading in 2002, it has risen from (all numbers adjusted) $8.5 to $485. That is a whopping 57x increase. That is approximately a 40% compounded rate of return, year after year, for 13 years!

But it has not been a smooth ride. After starting (all numbers rounded for easier reading) at $8.50 in May, 2002 the stock dropped to $3.25 in October – a loss of over 60% in just 5 months. But then it rallied, growing to $38.75, a whopping 12x jump, in just 14 months (1/04!) Only to fall back to $9.80, a 75% loss, by October, 2004 – a mere 9 months later. From there Netflix grew in value by about 5.5x – to $55/share – over the next 5 years (1/10.) When it proceeded to explode in value again, jumping to $295, an almost 6-fold increase, within 18 months (7/11). Only to get creamed, losing almost 80% of its value, back down to $63.85, in the next 4 months (11/11.) The next year it regained some loss, improving in value by 50% to $91.35 (12/12,) only to again explode upward to $445 by February, 2014 a nearly 5-fold increase, in 14 months. Two months later, a drop of 25% to $322 (4/14). But then in 4 months back up to $440 (8/14), and back down 4 months later to $341 (12/14) only to approach new highs reaching $480 last week – just 2 months later.

That is the definition of volatility.

Netflix is a disruptive innovator. And, simply put, stock analysts don’t know how to value disruptive innovators. Because their focus is all on historical numbers, and then projecting those historicals forward. As a result, analysts are heavily biased toward expecting incumbents to do well, and simultaneously being highly skeptical of any disruptive company. Disruptors challenge the old order, and invalidate the giant excel models which analysts create. Thus analysts are very prone to saying that incumbents will remain in charge, and that incumbents will overwhelm any smaller company trying to change the industry model. It is their bias, and they use all kinds of historical numbers to explain why the bigger, older company will project forward well, while the smaller, newer company will stumble and be overwhelmed by the entrenched competitor.

And that leads to volatility. As each quarter and year comes along, analysts make radically different assumptions about the business model they don’t understand, which is the disruptor. Constantly changing their assumptions about the newer kid on the block, they make mistake after mistake with their projections and generally caution people not to buy the disruptor’s stock. And, should the disruptor at any time not meet the expectations that these analysts invented, then they scream for shareholders to dump their holdings.

Netflix first competed in distribution of VHS tapes and DVDs. Netflix sent them to people’s homes, with no time limit on how long folks could keep them. This model was radically different from market leader Blockbuster Video, so analysts said Blockbuster would crush Netflix, which would never grow. Wrong. Not only did Blockbuster grow, but it eventually drove Blockbuster into bankruptcy because it was attuned to trends for convenience and shopping from home.

As it entered streaming video, analysts did not understand the model and predicted Netflix would cannibalize its historical, core DVD business thus undermining its own economics. And, further, much larger Amazon would kill Netflix in streaming. Analysts screamed to dump the stock, and folks did. Wrong. Netflix discovered it was a good outlet for syndication, created a huge library of not only movies but television programs, and grew much faster and more profitably than Amazon in streaming.

Then Netflix turned to original programming. Again, analysts said this would be a huge investment that would kill the company’s financials. And besides that people already had original programming from historical market leaders HBO and Showtime. Wrong. By using analysis of what people liked from its archive, Netflix leadership hedged its bets and its original shows, especially “House of Cards” have been big hits that brought in more subscribers. HBO and Showtime, which have depended on cable companies to distribute their programming, are now increasingly becoming additional programming on the Netflix distribution channel.

Investors should own Netflix because the company’s leadership, including CEO Reed Hastings, are great at disruptive innovation. They identify unmet customer needs and then fulfill those needs. Netflix time and again has demonstrated it can figure out a better way to give certain user segments what they want, and then expand their offering to eat away at the traditional market. Once it was retail movie distribution, increasingly it is becoming cable distribution via companies like ComCast, AT&T and Time Warner.

And investors must be long-term. Netflix is an example of why trading is a bad idea – unless you do it for a living. Most of us who have full time day jobs cannot try timing the ups and downs of stock movements. For us, it is better to buy and hold. When you’re ready to buy, buy. Don’t wait, because in the short term there is no way to predict if a stock will go up or down. You have to buy because you are ready to invest, and you expect that over the next 3, 5, 7 years this company will continue to drive growth in revenues and profits, thus expanding its valuation.

Netflix, like Apple, is a company that has mastered the skills of disruptive innovation. While the competition is trying to figure out how to sustain its historical position by doing the same thing better, faster and cheaper Netflix is figuring out “the next big thing” and then delivering it. As the market shifts, Netflix is there delivering on trends with new products – and new business models – which push revenues and profits higher.

That’s why it would have been smart to buy Netflix any time the last 13 years and simply held it. And odds are it will continue to drive higher valuations for investors for many years to come. Not only are HBO, Showtime and Comcast in its sites, but the broadcast networks (ABC, CBS, NBC) are not far behind. It’s a very big media market, which is shifting dramatically, and Netflix is clearly the leader. Not unlike Apple has been in personal technology.

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web.

dollar bills. They are an online currency which can be used to buy things. They are digital cash that exist as bits on people’s computers. You can’t put them in a drawer, like dollar bills or gold Krugerrands. Bitcoins are used to complete transactions – just like any currency. Even though they are virtual, rather than physical, they are used like cash when transferred between people through the web. In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

In the 1630s, people in Holland thought of tulip bulbs as stored value. Tulips were desired, giving tulip bulbs value. But over time, people acquired tulip bulbs not to plant but rather for the stored value they represented. As more people bought bulbs, and put them in a drawer, the price was driven higher, until one tulip bulb was worth 10 times the typical annual salary of a Dutch worker — and worth more than entire houses. People thought the value of tulip bulbs would go up forever.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.

Meanwhile Oxford Economics projected that a Republican/Trump Presidency would knock $1trillion out of America’s economy, and lower the GDP by 5%, mostly due to trade and tax policies. These would be far-reaching globally, likely not only creating a deep recession in America, but quite possibly the first global recession. But a Clinton Presidency should maintain a 1.5%-2.3% annual GDP growth rate.