by Adam Hartung | May 22, 2018 | Innovation, Investing, Marketing, Software, Web/Tech

(Image: Troy Strange.)

Facebook’s CEO recently took a drubbing by America’s Congresspeople. And some thought it bode poorly for the internet giant. There were rumors of customer defections, and fears that privacy issues would sink the company. The stock dropped from a February high of $193 to a March low of $152 – down more than 20%.

But by mid-May Facebook had recovered to $186, and the concerns seemed largely ignored. As they should have been.

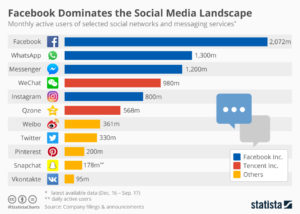

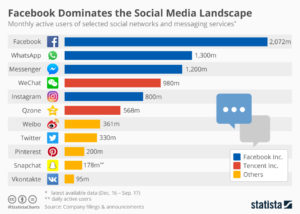

Facebook is much more than Facebook. As of January, 2018 Facebook had 2.1M monthly active users (MAUs,)  the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace.

the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace.

Facebook paid $1B for Instagram in 2012 though it had no revenues. Today, 1/3 of ALL USA mobile users use Instagram. 15 million businesses are registered on Instagram. In 2017 Instagram had $3.6B revenues, and projections for 2018 are $6.8B.

Facebook expands globally

Facebook paid $19B for WhatsApp in 2014, when it had just $15M in revenues. In 2015, WhatsApp had 1 billion users. It is the most used app on the planet – even though not a top app in the USA where mobile texting is generally free. Where texting is expensive, like India, over 90% of mobile users utilize WhatsApp, and users typically send over 1,000 messages/month. In 2017, WhatsApp revenue rose to $1B, and in 2018 it will cross over $2B.

Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

Unless you somehow think time will go backward, you have to recognize that social media – like all other personal technology – is constantly becoming more useful. It is gaining greater adoption, and more usage. And businesses are using social media to reach customers, thus paying for access, like they once did for newspapers, radio, television and then web sites.

Just the beginning…

Facebook is just getting started, sort of like Amazon did 20 years ago. That’s the Amazon that dominates on-line e-commerce sales. If you bought Amazon on the IPO 21 years ago (May, 2017) your investment would have risen from $18/share to $1,700 – a nearly 1,000-fold increase. Facebook’s IPO was 6 years ago (May, 2012) at $38 – 6 years later it is worth $185, almost a 5-fold increase. Not bad. But if Facebook performs like Amazon in the next 14 years it could rise to $3,600 – an almost 20x gain.

And that’s why you should ignore short–term blips like the Congressional investigation and realize that you, and everyone else, is a Facebook customer. And you want to share in that growth by being a Facebook shareholder.

(Featured image adapted from Troy Strange.)

by Adam Hartung | Feb 6, 2018 | Innovation, Mobile, Software, Web/Tech

InvestorPlace.com declared Snap stock will be a big disappointment in 2018. Bad news for investors, because SNAP was an enormous disappointment in 2017. After going public at $27/share in early March, the stock dropped to $20 by mid-March, then just kept dropping until it bottomed at just under $12 in August. Since then the stock has largely gone sideways at $15.

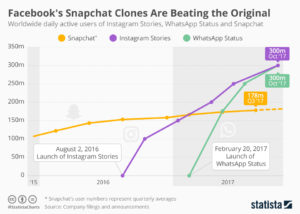

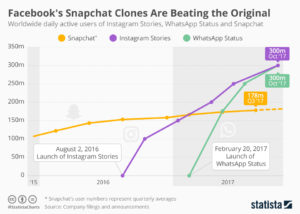

This was not unexpected. As I wrote in April, Snapchat was not without competition and was unlikely to be a long-term winner. Even though Snapchat and its Stories feature grew popular with teenagers 14 to 19, in August, 2016 Facebook launched Instagram Stories as a direct competitor. In just 7 months – just as SNAP went public – Instagram Stories had more users than Snapchat. It was clear then if you wanted to make money on the photo and video sharing trends, investors were better off to own Facebook stock and avoid the newly available SNAP shares (stock, not pix!)

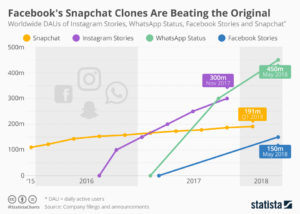

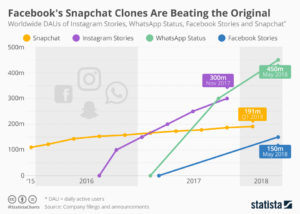

Now the situation is far worse. Facebook launched WhatsApp Status as another competitive product in February, 2017 and it took less than 3 months for its user base to exceed Snapchat. As the chart below shows, by October, 2017 Stories and Status each had 300 million users, while Snapchat was mired at 180 million users. With only 30% the users of Facebook, Snapchat has little chance to succeed against the social media powerhouse.

Statista

Facebook is now a very large company. But, it has shown it is adaptable. Rather than sticking to its original market, Facebook went mobile and has launched new products as fast as competitors tried to carve out niches. The question is, are you constantly scanning the horizon for new products and adapting – fast – to keep your customers and grow? Or are you stuck trying to defending your old business while upstarts carve up your market?”

by Adam Hartung | Apr 27, 2017 | Investing, Mobile, Web/Tech

People love to watch tech stocks, because there is so much volatility. Just today (April 27, 2017) Alphabet beat expectations and its shares rose $34 (about 4%) after hours. GOOG is up 15.5% in 2017, and 31% for the year. But not all tech stocks do this well. Twitter, for example, had a nice increase of late — but TWTR is down 33% since peaking in early October, and it is down 69% from 10/2014 highs.

So how is an investor to know which tech stocks to own, and which to eschew?

They key, of course, is to watch trends. And to recognize who absolutely dominates those trends. When it comes to the rapidly growing world of social media, it is increasingly clear there is only one Goliath — and that is Facebook.

Felix Richter, Statista

Felix Richter, Statista

Snapchat created a lot of interest when it hit the scene. A darling of the most youthful set, it was growing very fast and had exceeded 100 million users by January 2016. By January 2017 Snapchat added another 60 million users — growing 60%. But since going public the stock has dropped about 10%. And according to Marketwatch only 12 analysts rank it a “buy” while 23 rank it a “hold,” “underweight” or “sell.”

Should you buy Snapchat? After all, Facebook dropped after its IPO

As the chart from Statista shows, in just eight months Instagram Stories has blown way past the user base of Snapchat. In April 2012 Facebook paid $1 billion for Instagram, then a popular photo-sharing app, which had no revenues. The idea was to leverage Facebook’s installed base to grow the app. Since September, 2013 Instagram has been adding 50 million users per quarter. Instagram now has 600 million active users and became one of the five most popular mobile apps in the world.

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

The Facebook App Ecosystem Totally Dominates Mobile. Chart reproduced courtesy of Felix Richter at Statista

Looking at Facebook, one has to marvel at how the company has kept users in its ecosystem. As the Statista chart shows, since 2016 Facebook has had four of the top five mobile app downloads. Now that Instagram Stories has blown past Snapchat, Facebook holds all four top positions.

Does anyone remember when Facebook purchased Beluga in 2011 for about $20 million? That is now Messenger, and it opened the door for sending pictures and video. Do you remember the $19 billion acquisition of WhatsApp — which had only $10 million in revenues? Both have added multiple capabilities, and now Messenger has 1 billion active users, and WhatsApp has 1.2 billion users.

In fiscal 2012 Facebook hit $1 billion in quarterly revenue, and ended the year with just over $4 billion in annual revenues. Q4 2016 exceeded $8.8 billion, and for the year $27.6 billion.

It is for good reason that almost twice as many analysts are skeptical of Snapchat’s future value as those who think it will go up.

Snapchat is competing with Facebook, a company that has shown time and again it can watch the trends and put in place products that initially meet, but then eventually exceed customer expectations. One might like to think Snapchat is a good David, putting up a good fight. But this time, investors are likely to be much better off betting on Goliath. Facebook still has a lot of opportunity to grow.

by Adam Hartung | Apr 27, 2016 | Food and Drink, In the Rapids, In the Swamp, Retail, Software, Web/Tech

Growth fixes a multitude of sins. If you grow revenues enough (you don’t even need profits, as Amazon has proven) investors will look past a lot of things. With revenue growth high enough, companies can offer employees free meals and massages. Executives and senior managers can fly around in private jets. Companies can build colossal buildings as testaments to their brand, or pay to have thier names on public buildings. R&D budgets can soar, and product launches can fail. Acquisitions are made with no concerns for price. Bonuses can be huge. All is accepted if revenues grow enough.

Just look at Facebook. Today Facebook announced today that for the quarter ended March, 2016 revenues jumped to $5.4B from $3.5B a year ago. Net income tripled to $1.5B from $500M. And the company is basically making all its revenue – 82% – from 1 product, mobile ads. In the last few years Facebook paid enormous premiums to buy WhatsApp and Instagram – but who cares when revenues grow this fast.

Anticipating good news, Facebook’s stock was up a touch today. But once the news came out, after-hours traders pumped the stock to over $118//share, a new all time high. That’s a price/earnings (p/e) multiple of something like 84. With growth like that Facebook’s leadership can do anything it wants.

But, when revenues slide it can become a veritable poop puddle. As Apple found out.

Rumors had swirled that Apple was going to say sales were down. And the stock had struggled to make gains from lows earlier in 2016. When the company’s CEO announced Tuesday that sales were down 13% versus a year ago the stock cratered after-hours, and opened this morning down 10%. Breaking a streak of 51 straight quarters of revenue growth (since 2003) really sent investors fleeing. From trading around $105/share the last 4 days, Apple closed today at ~$97. $40B of equity value was wiped out in 1 day, and the stock trades at a p/e multiple of 10.

The new iPhone 6se outsold projections, iPads beat expectations. First year Apple Watch sales exceeded first year iPhone sales. Mac sales remain much stronger than any other PC manufacturer. Apple iBeacons and Apple Pay continue their march as major technologies in the IoT (Internet of Things) market. And Apple TV keeps growing. There are about 13M users of Apple’s iMusic. There are 1.5M apps on the iTunes store. And the installed base keeps the iTunes store growing. Share buybacks will grow, and the dividend was increased yet again. But, none of that mattered when people heard sales growth had stopped. Now many investors don’t think Apple’s leadership can do anything right.

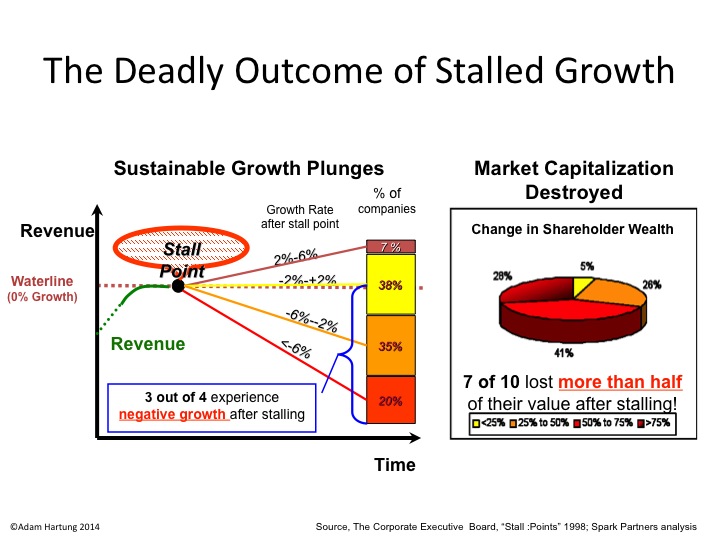

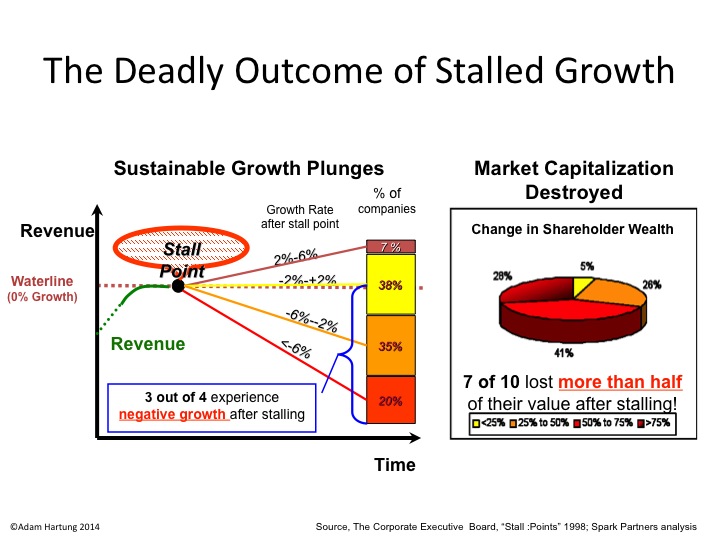

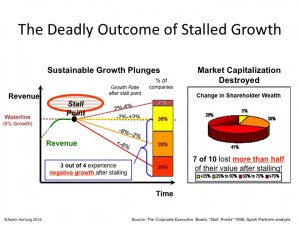

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Which leads us to Chipotle. Chipotle announced that same store sales fell almost 30% in Q1, 2016. That was after a 15% decline in Q4, 2015. And profits turned to losses for the quarter. That is a growth stall. Chipotle shares were $750/share back in early October. Now they are $417 – a drop of over 44%.

Customer illnesses have pointed to a company that grew fast, but apparently didn’t have its act together for safe sourcing of local ingredients, and safe food handling by employees. What seemed like a tactical problem has plagued the company, as more customers became ill in March.

Whether that is all that’s wrong at Chipotle is less clear, however. There is a lot more competition in the fast casual segment than 2 years ago when Chipotle seemed unable to do anything wrong. And although the company stresses healthy food, the calorie count on most portions would add pounds to anyone other than an athlete or construction worker – not exactly in line with current trends toward dieting. What frequently looks like a single problem when a company’s sales dip often turns out to have multiple origins, and regaining growth is nearly always a lot more difficult than leadership expects.

Growth is magical. It allows companies to invest in new products and services, and buoy’s a stock’s value enhancing acquisition ability. It allows for experimentation into new markets, and discovering other growth avenues. But lack of growth is a vital predictor of future performance. Companies without growth find themselves cost cutting and taking actions which often cause valuations to decline.

Right now Facebook is in a wonderful position. Apple has investors rightly concerned. Will next quarter signal a return to growth, or a Growth Stall? And Chipotle has investors heading for the exits, as there is now ample reason to question whether the company will recover its luster of yore.

by Adam Hartung | Jan 30, 2016 | Current Affairs, In the Rapids, Leadership, Web/Tech

Apple announced earnings for the 4th quarter this week, and the company was creamed. Almost universally industry analysts and stock analysts had nothing good to say about the company’s reports, and forecast. The stock ended the week down about 5%, and down a whopping 27.8% from its 52 week high.

Wow, how could the world’s #1 mobile device company be so hammered? After all, sales and earnings were both up – again! Apple’s brand is still one of the top worldwide brands, and Apple stores are full of customers. It’s PC sales are doing better than the overall market, as are its tablet sales. And it is the big leader in wearable devices with Apple Watch.

Yet, let’s compare the stock price to earnings (P/E) multiple of some well known companies (according to CNN Money 1/29/16 end of day):

- Apple – 10.3

- Used car dealer AutoNation – 10.7

- Food company Archer Daniel Midland (ADM) – 12.2

- Industrial equipment maker Caterpillar Tractor – 12.9

- Farm equipment maker John Deere – 13.3

- Defense equipment maker General Dynamics – 15.1

- Utility American Electric Power – 16.9

- Industrial product company Illinois Tool Works (ITW) – 17.7

- Industrial product company 3M – 19.5

What’s wrong with this picture? It all goes to future expectations. Investors watched Apple’s meteoric rise, and many wonder if it will have a similar, meteoric fall. Remember the rise and fall of Digital Equipment? Wang? Sun Microsystems? Palm? Blackberry (Research in Motion)? Investors don’t like companies where they fear growth has stalled.

What’s wrong with this picture? It all goes to future expectations. Investors watched Apple’s meteoric rise, and many wonder if it will have a similar, meteoric fall. Remember the rise and fall of Digital Equipment? Wang? Sun Microsystems? Palm? Blackberry (Research in Motion)? Investors don’t like companies where they fear growth has stalled.

And Apple’s presentation created growth stall fears. While iPhone sales are enormous (75million units/quarter,) there was little percentage growth in Q4. And CEO Tim Cook actually predicted a sales decline next quarter! iPod sales took off like a rocket years ago, but they have now declined for 6 straight quarters and there was no prediction of a return to higher sales volumes. And as for future products, the company seems only capable of talking about Apple Watch, and so far few people have seen any reason to buy one. Amidst this gloom, Apple presented an unclear story about a future based on services – a market that is at the very least vague, where Apple has no market presence, little experience and no brand position. And wasn’t that IBM’s story some 2.5 decades ago?

In other words, Apple fed investor’s worst fears. That growth had stopped. And usually, like in the examples above, when growth stops – especially in tech companies – it presages a dramatic reversal in sales and profits. Sales have been known to fall far, far faster than management predicts. Although Apple has not yet entered a Growth Stall (which is 2 consecutive quarters of declining sales and/or profits, or 2 consecutive quarters than the previous year’s sales or profits) investors are now worried that one is just around the corner.

Contrast this with Facebook. P/E – 113.3. Facebook said ad revenues rose 57%, and net income was up 2.2x the previous year’s quarter. But what was really important was Facebook’s story about its future:

- Facebook is now a “must buy” for advertisers

- Mobile is the #1 ad trend, and 80% of revenues are from mobile

- Revenue/user is up 33%, and growing

- There are multiple unmonetized new markets that Facebook is just developing – Instagram, WhatsApp, FB Messenger and Oculus

In other words, the past was great – but the future will be even better. The short-term result? FB stock rose 7.4% for the week, and intraday hit a new 52 week high. Facebook might have seemed like a fad 3 years ago, especially to older folks. But now the company’s story is all about market trends, and how Facebook is offering products on those trends that will drive future revenue and profit growth.

Amazon may be an even better example of smart communications. As everyone knows, Amazon makes no profit. So it sells for an astonishing P/E of 846.9. Amazon sales increased 22% in Q4, and Amazon continued gaining share of the fast growing, #1 trend in retail — ecommerce. While WalMart and Macy’s are closing stores, Amazon is expanding and even creating its own logistics system.

Profits were up, but only 2/3 of expectations – ouch! Anticipating higher sales and earnings announcements the stock had run up $40/share. But the earnings miss took all that away and more as the stock crashed about $70/share! A wild 12.5% peak-to-trough swing was capped at end of week down a mere 2.5%.

But, Amazon did a great job, once again, of selling its future. In addition to the good news on retail sales, there was ongoing spectacular growth in cloud services – meaning Amazon Web Services (AWS.) JPMorganChase, Wells Fargo, Raymond James and Benchmark all raised their future price forecasts after the announcement, based on future performance expectations. Even analysts who cut their price targets still kept price targets higher than where Amazon actually ended the week. And almost all analysts expect Amazon one year from now to be worth more than its historical 52 week high, which is 19% higher than current pricing.

So, despite bad earnings news, Amazon continued to sell its growth story. Growth can heal all wounds, if investors continue to believe. We’ll see how it plays out, but for now things appear at least stable.

Steve Jobs was, by most accounts, an excellent showman. But what he did particularly well was tell a great growth story. No matter Apple’s past results, or concerns about the company, when Steve Jobs took the stage his team had crafted a story about Apple’s future growth. It wasn’t about cash flow, cash in the bank, assets in place, market share or historical success – boring, boring. There was an Apple growth story. There was always a reason for investor’s to believe that competitors will falter, markets will turn to Apple, and growth will increase!

Should investors think Apple is without future growth? Unfortunately, the communications team at Apple last week let investors think so. It is impossible to believe this is true, but the communicators this week simply blew it. Because what they said led to nothing but headlines questioning the company’s future.

What should Apple have said?

- Give investors a great news story about wearables. Show applications in health care, retail, etc. that really makes investors think all those people with a Timex or Rolex will wear an AppleWatch in the future. Apple sold investors the future of iPhone apps long before most of people used anything other than maps and weather – and the story led investors to believe if people didn’t have an iPhone they would miss out on something important, so they were bound to go buy one. Where’s that story when it comes to wearables?

- ApplePay is going to change the world. While ApplePay is #1, investors are wondering if mobile payments is ever going to be big. What will make it big, when, and what is Apple doing to make this a multi-billion dollar business? ApplePay launched to a lot of hype, but very little has been said since. Is this going to be the Apple version of Microsoft’s Zune? Make investors believers in ApplePay. Convince them this is worth a lot of future value.

- iBeacons are one of the most important technology products in retail and inventory control. iBeacons were launched as a great tool for local businesses, but since then Apple has said almost nothing. B2B may not be as sexy as consumer markets, but Microsoft made investors believers in the value of enterprise products. Demonstrate that Apple’s technology is the best, and give investors some stories about how companies are winning. Most investors have forgotten about beacons and thus they no longer plan for substantial revenues.

- Apple has the #1 mobile developer community, and the best products are yet to come – so sales are far from stalling. Honestly, the developer war is critical. The platform with the most developers wins the most customers. Microsoft taught investors that. But Apple never talks about its developer community. IBM has made a huge commitment to develop iOS enterprise apps that should drive substantial future sales, but Apple isn’t exciting investors about that opportunity. Tell investors more stories about how Apple is king of the developer world, and will remain in the top spot – better than Android or anyone – for years. Tell investors this will turn users toward tablets from PCs faster, and iPod sales will start growing again as smartphone and wearable sales join suit.

- Apple will win big revenues in auto markets. There was lots of rumors about hiring people to design a car, and now firing the lead guy. What is going on? Google has been pretty clear about its plans, but Apple offers investors no encouragement to think the company will succeed at even winning the war to be in other manufacturer’s cars, much less build its own. Given that the story sounds limited for Apple’s “core” products, investors need some stories about Apple’s own “moonshot” projects.

- Apple is not a 1-pony, iPhone story. Make investors believe it.

Tim Cook and the rest of Apple leadership are obviously competent. But when it comes to storytelling, this week their messaging looked like it was created as a high school communications project. Growth is what matters, and Apple completely missed the target. And investors are moving on to better stories – fast.

Felix Richter, Statista

Felix Richter, Statista

the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace.

the most of all social media sites. But Facebook also owns the second most popular site WhatsApp with 1.3M MAUs, and the third most popular site Facebook Messenger with 1.2M MAUs, and the fifth most popular site Instagram with 800K MAUs. Instagram is 5 times larger than Snapchat. And Facebook Stories, which just started in 2017 is now almost as big as Snapchat and surely in the top 10. So, 5 of the top 10 social media sites are owned by Facebook, and they totally dominate the marketplace. Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

Facebook is smart at realizing new ways people can use the platform. It adds functionality constantly, exponentially growing the user base and time spent on its sites. It is untouchable in its social media market domination. And it has proven, more than any other platform (compare Snapchat and Twitter) that it can monetize users into revenues and profits. Facebook’s leadership is constantly in touch with trends and keeps making social media more relevant in the lives of every person.

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

Felix Richter, Statista, https://www.statista.com/chart/5055/top-10-apps-in-the-world/

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.