by Adam Hartung | Jul 7, 2016 | Books, Entrepreneurship, Leadership, Marketing

Summer is here, and everyone needs a business book or two to read. I’m recommending The Founder’s Mentality – How To Overcome the Predictable Crises of Growth by two very senior partners and strategy practice heads at Bain & Company — Chris Zook and James Allen. Bain is one of the top three management consulting firms in the world, with 8,000 consultants in 55 offices, and has been ranked as one of the best places to work in America by Glass Ceiling.

Since both authors are still part of Bain, the book is somewhat bridled by their positions. No partner can bad mouth current or former clients, as it obviously could reveal confidential information — and it certainly isn’t good for finding new clients who would never want to risk being bad-mouthed by their consultant. So don’t expect a lambasting of poorly performing companies in this review of global cases. But after reviewing the work at their clients for over 20 years, and many other cases available via research, these fellows concluded that most companies lose the original founder’s mentality, get bound up in organizational complexity, and simply lose competitiveness due to the wrong internal focus. And they offer insights for how underperformers can regain a growth agenda.

Photo courtesy of Chris Zook

Moving From Mediocre To Good

I interviewed Chris Zook, and found him rather candid in his observations. When I asked why people should read The Founder’s Mentality I really liked his response, “Many people have read Good to Great. But, honestly, for many organizations the challenge today is simply to move from mediocre to good. They are struggling, and they need some straightforward advice on how to make progress toward growth when the situation likely appears almost impossible.”

You should read the book to understand the common root cause of corporate growth problems, and how a company can address those issues. This column offers some interesting thoughts from Chris about how to apply The Founder’s Mentality to eliminate unnecessary complexity and make your organization more successful.

Adam Hartung: What is the most critical step toward undoing needless, costly, time consuming complexity?

Chris Zook: The biggest problem is blockages built between the front line and the top staff. Honestly, the people at the top lose any sense of what is actually happening in the marketplace — what is happening with customers. 80% of the time successfully addressing this requires eliminating 30-40% of the staff. You need non-incremental change. Leaders have to get rid of managers wedded to past decisions, and intent on defending those decisions. Leaders have to get rid of those who focus on managing what exists, and find competent replacements who can manage a transition.

Hartung: Market shifts make companies non-competitive, why do you focus so much on internal organizational health?

Zook: You can’t respond to a market shift if the company is bound up in complex decision-making. Unless a leader attacks complexity, and greatly simplifies the decision-making process, a company will never do anything differently. Being aware of changes in the market is not enough. You have to internalize those changes and that requires reorganizing, and usually changing a lot of people. You won’t ever get the information from the front line to top management unless you change the internal company so that it is receptive to that information.

Hartung: You say simplification is critical to reversing a company’s stall-out. But isn’t focusing on the “core” missing market opportunities?

Zook: Analysts cheered Nardeli’s pro-growth actions at Home Depot. But the company stalled. The growth opportunities that external folks liked hearing about diverted attention from implementing what had made Home Depot great — the “orange army” of store employees that were so customer helpful. It is very, very hard to keep “growth projects” from diverting attention to good operations, and that’s why few founders are willing to chase those projects when someone brings them up for investment.

Hartung: You talk positively about Cisco and 3M, yet neither has done anything lately, in any market, to appear exemplary

Zook: It takes a long time to turn around a huge company. Cisco and 3M are still the largest in their defined markets, and profitable. Their long-term future is still to be determined, but so far they are making progress. Investors and market gurus look for turnarounds to happen fast, but that does not fit the reality of what it takes when these companies become very large.

Hartung: You talk about “Next Generation Leaders.” Isn’t that just more ageism? Aren’t you simply saying “out with the old leaders, you have to be young to “get it.”

Zook: Next Generation Leadership is not about age. It’s about mentality. It’s about being young, and flexible, in your thinking. What’s core to a company may well not be what a previous leader thinks, and a Next Gen Leader will dig out what’s core. For example, at Marvel the core was not comics. It was the raft of stories, all of which had the potential to be repurposed. Next Gen Leaders are using new eyes, dialed in with clarity to discover what is in the company that can be reused as the core for future growth. You don’t have to be young to do that, just mentally agile. Unfortunately, there aren’t nearly as many of these agile leaders as there are those stuck in the old ways of thinking.

Hartung: Give me your take on some big companies that aren’t in your book, but that are in the news today and on the minds of leaders and investors. Apply The Founder’s Mentality to these companies:

Microsoft

Zook: Did well due to its monopoly. Lost its Founder’s Mentality. Now suffering low growth rates relative to its industry, and in the danger zone of a growth stall-out. They have to refocus. Leadership needs to regain the position of attracting developers to their platform rather than being raided for developers by competitive platforms.

Apple

Zook: Jobs implemented The Founder’s Mentality brilliantly. Apple got close to its customers again with the retail stores, a great move to learn what customers really wanted, liked and would buy. But where will they turn next? Apple needs to make a big bet, and focus less on upgrades. They need to be thinking about a possible stall-out. But will Apple’s current leadership make that next big bet?

WalMart

Zook: One of the greatest founder-led companies of all time. Walton’s retail insurgency was unique, clear and powerful. Things appear to be a bit stale now, and the company would benefit from a refocusing on the insurgency mission, and taking it into renewal of the distribution system and all the stores.”

It’s been almost a decade since I wrote Create Marketplace Disruption – How To Stay Ahead of the Competition. In it I detailed how companies, in the pursuit of best practices build locked-in decision-making systems that perpetuate the past rather than prepare for the future. The Founder’s Mentality provides several case studies in how organizations, especially large ones, can attack that lock-in to rediscover what made them great and set a chart for a better future. Put it on your reading list for the next plane flight, or relaxation time on your holiday.

by Adam Hartung | May 15, 2016 | In the Swamp, Investing, real estate, Retail

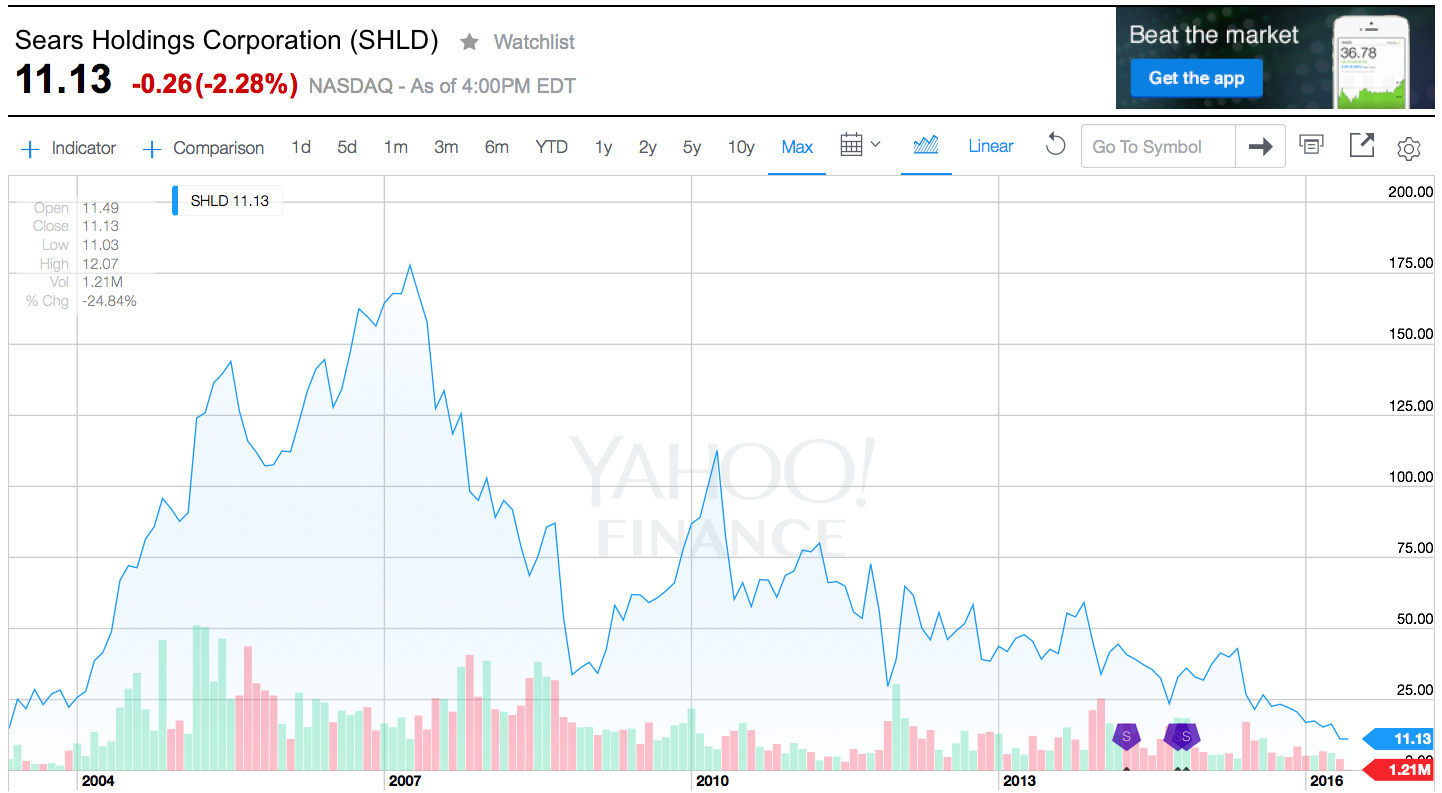

Last week Sears announced sales and earnings. And once again, the news was all bad. The stock closed at a record, all time low. One chart pretty much sums up the story, as investors are now realizing bankruptcy is the most likely outcome.

Chart Source: Yahoo Finance 5/13/16

Quick Rundown: In January, 2002 Kmart is headed for bankruptcy. Ed Lampert, CEO of hedge fund ESL, starts buying the bonds. He takes control of the company, makes himself Chairman, and rapidly moves through proceedings. On May 1, 2003, KMart begins trading again. The shares trade for just under $15 (for this column all prices are adjusted for any equity transactions, as reflected in the chart.)

Lampert quickly starts hacking away costs and closing stores. Revenues tumble, but so do costs, and earnings rise. By November, 2004 the stock has risen to $90. Lampert owns 53% of Kmart, and 15% of Sears. Lampert hires a new CEO for Kmart, and quickly announces his intention to buy all of slow growing, financially troubled Sears.

In March, 2005 Sears shareholders approve the deal. The stock trades for $126. Analysts praise the deal, saying Lampert has “the Midas touch” for cutting costs. Pumped by most analysts, and none moreso than Jim Cramer of “Mad Money” fame (Lampert’s former roommate,) in 2 years the stock soars to $178 by April, 2007. So far Lampert has done nothing to create value but relentlessly cut costs via massive layoffs, big inventory reductions, delayed payments to suppliers and store closures.

Homebuilding falls off a cliff as real estate values tumble, and the Great Recession begins. Retailers are creamed by investors, and appliance sales dependent Sears crashes to $33.76 in 18 months. On hopes that a recovering economy will raise all boats, the stock recovers over the next 18 months to $113 by April, 2010. But sales per store keep declining, even as the number of stores shrinks. Revenues fall faster than costs, and the stock falls to $43.73 by January, 2013 when Lampert appoints himself CEO. In just under 2.5 years with Lampert as CEO and Chairman the company’s sales keep falling, more stores are closed or sold, and the stock finds an all-time low of $11.13 – 25% lower than when Lampert took KMart public almost exactly 13 years ago – and 94% off its highs.

What happened?

Sears became a retailing juggernaut via innovation. When general stores were small and often far between, and stocking inventory was precious, Sears invented mail order catalogues. Over time almost every home in America was receiving 1, or several, catalogues every year. They were a major source of purchases, especially by people living in non-urban communities. Then Sears realized it could open massive stores to sell all those things in its catalogue, and the company pioneered very large, well stocked stores where customers could buy everything from clothes to tools to appliances to guns. As malls came along, Sears was again a pioneer “anchoring” many malls and obtaining lower cost space due to the company’s ability to draw in customers for other retailers.

To help customers buy more Sears created customer installment loans. If a young couple couldn’t afford a stove for their new home they could buy it on terms, paying $10 or $15 a month, long before credit cards existed. The more people bought on their revolving credit line, and the more they paid Sears, the more Sears increased their credit limit. Sears was the “go to” place for cash strapped consumers. (Eventually, this became what we now call the Discover card.)

In 1930 Sears expanded the Allstate tire line to include selling auto insurance – and consumers could not only maintain their car at Sears they could insure it as well. As its customers grew older and more wealthy, many needed help with financia advice so in 1981 Sears bought Dean Witter and made it possible for customers to figure out a retirement plan while waiting for their tires to be replaced and their car insurance to update.

To put it mildly, Sears was the most innovative retailer of all time. Until the internet came along. Focused on its big stores, and its breadth of products and services, Sears kept trying to sell more stuff through those stores, and to those same customers. Internet retailing seemed insignificantly small, and unappealing. Heck, leadership had discontinued the famous catalogues in 1993 to stop store cannibalization and push people into locations where the company could promote more products and services. Focusing on its core customers shopping in its core retail locations, Sears leadership simply ignored upstarts like Amazon.com and figured its old success formula would last forever.

But they were wrong. The traditional Sears market was niched up across big box retailers like Best Buy, clothiers like Kohls, tool stores like Home Depot, parts retailers like AutoZone, and soft goods stores like Bed, Bath & Beyond. The original need for “one stop shopping” had been overtaken by specialty retailers with wider selection, and often better pricing. And customers now had credit cards that worked in all stores. Meanwhile, for those who wanted to shop for many things from home the internet had taken over where the catalogue once began. Leaving Sears’ market “hollowed out.” While KMart was simply overwhelmed by the vast expansion of WalMart.

What should Lampert have done?

There was no way a cost cutting strategy would save KMart or Sears. All the trends were going against the company. Sears was destined to keep losing customers, and sales, unless it moved onto trends. Lampert needed to innovate. He needed to rapidly adopt the trends. Instead, he kept cutting costs. But revenues fell even faster, and the result was huge paper losses and an outpouring of cash.

To gain more insight, take a look at Jeff Bezos. But rather than harp on Amazon.com’s growth, look instead at the leadership he has provided to The Washington Post since acquiring it just over 2 years ago. Mr. Bezos did not try to be a better newspaper operator. He didn’t involve himself in editorial decisions. Nor did he focus on how to drive more subscriptions, or sell more advertising to traditional customers. None of those initiatives had helped any newspaper the last decade, and they wouldn’t help The Washington Post to become a more relevant, viable and profitable company. Newspapers are a dying business, and Bezos could not change that fact.

Mr. Bezos focused on trends, and what was needed to make The Washington Post grow. Media is under change, and that change is being created by technology. Streaming content, live content, user generated content, 24×7 content posting (vs. deadlines,) user response tracking, readers interactivity, social media connectivity, mobile access and mobile content — these are the trends impacting media today. So that was where he had leadership focus. The Washington Post had to transition from a “newspaper” company to a “media and technology company.”

So Mr. Bezos pushed for hiring more engineers – a lot more engineers – to build apps and tools for readers to interact with the company. And the use of modern media tools like headline testing. As a result, in October, 2015 The Washington Post had more unique web visitors than the vaunted New York Times. And its lead is growing. And while other newspapers are cutting staff, or going out of business, the Post is adding writers, editors and engineers. In a declining newspaper market The Washington Post is growing because it is using trends to transform itself into a company readers (and advertisers) value.

CEO Lampert could have chosen to transform Sears Holdings. But he did not. He became a very, very active “hands on” manager. He micro-managed costs, with no sense of important trends in retail. He kept trying to take cash out, when he needed to invest in transformation. He should have sold the real estate very early, sensing that retail was moving on-line. He should have sold outdated brands under intense competitive pressure, such as Kenmore, to a segment supplier like Best Buy. He then should have invested that money in technology. Sears should have been a leader in shopping apps, supplier storefronts, and direct-to-customer distribution. Focused entirely on defending Sears’ core, Lampert missed the market shift and destroyed all the value which initially existed in the great retail merger he created.

Impact?

Every company must understand critical trends, and how they will apply to their business. Nobody can hope to succeed by just protecting the core business, as it can be made obsolete very, very quickly. And nobody can hope to change a trend. It is more important than ever that organizations spend far less time focused on what they did, and spend a lot more time thinking about what they need to do next. Planning needs to shift from deep numerical analysis of the past, and a lot more in-depth discussion about technology trends and how they will impact their business in the next 1, 3 and 5 years.

Sears Holdings was a 13 year ride. Investor hope that Lampert could cut costs enough to make Sears and KMart profitable again drove the stock very high. But the reality that this strategy was impossible finally drove the value lower than when the journey started. The debacle has ruined 2 companies, thousands of employees’ careers, many shopping mall operators, many suppliers, many communities, and since 2007 thousands of investor’s gains. Four years up, then 9 years down. It happened a lot faster than anyone would have imagined in 2003 or 2004. But it did.

And it could happen to you. Invert your strategic planning time. Spend 80% on trends and scenario planning, and 20% on historical analysis. It might save your business.

by Adam Hartung | Jul 25, 2015 | Current Affairs, In the Whirlpool, Leadership

This week an important event happened on Wall Street. The value of Amazon (~$248B) exceeded the value of Walmart (~$233B.) Given that Walmart is world’s largest retailer, it is pretty amazing that a company launched as an on-line book seller by a former banker only 21 years ago could now exceed what has long been retailing’s juggernaut.

WalMart redefined retail. Prior to Sam Walton’s dynasty retailing was an industry of department stores and independent retailers. Retailing was a lot of small operators, primarily highly regional. Most retailers specialized, and shoppers would visit several stores to obtain things they needed.

But WalMart changed that. Sam Walton had a vision of consolidating products into larger stores, and opening these larger stores in every town across America. He set out to create scale advantages in purchasing everything from goods for resale to materials for store construction. And with those advantages he offered customers lower prices, to lure them away from the small retailers they formerly visited.

And customers were lured. Today there are very few independent retailers. WalMart has ~$488B in annual revenues. That is more than 4 times the size of #2 in USA CostCo, or #1 in France (#3 in world) Carrefour, or #1 in Germany (#4 in world) Schwarz, or #1 in U.K. (#5 in world) Tesco. Walmart directly employes ~.5% of the entire USA population (about 1 in every 200 people work for Walmart.) And it is a given that nobody living in America is unaware of Walmart, and very, very few have never shopped there.

But, Walmart has stopped growing. Since 2011, its revenues have grown unevenly, and on average less than 4%/year. Worse, it’s profits have grown only 1%/year. Walmart generates ~$220,000 revenue/employee, while Costco achieves ~$595,000. Thus its need to keep wages and benefits low, and chronically hammer on suppliers for lower prices as it strives to improve margins.

And worse, the market is shifting away from WalMart’s huge, plentiful stores toward on-line shopping. And this could have devastating consequences for WalMart, due to what economists call “marginal economics.”

And worse, the market is shifting away from WalMart’s huge, plentiful stores toward on-line shopping. And this could have devastating consequences for WalMart, due to what economists call “marginal economics.”

As a retailer, Walmart spends 75 cents out of every $1 revenue on the stuff it sells (cost of goods sold.) That leaves it a gross margin of 25 cents – or 25%. But, all those stores, distribution centers and trucks create a huge fixed cost, representing 20% of revenue. Thus, the net profit margin before taxes is a mere 5% (Walmart today makes about 5 cents on every $1 revenue.)

But, as sales go from brick-and-mortar to on-line, this threatens that revenue base. At Sears, for example, revenues per store have been declining for over 4 years. Suppose that starts to happen at Walmart; a slow decline in revenues. If revenues drop by 10% then every $100 of revenue shrinks to $90. And the gross margin (25%) declines to $22.50. But those pesky store costs remain stubbornly fixed at $20. Now profits to $2.50 – a 50% decline from what they were before.

A relatively small decline in revenue (10%) has a 5x impact on the bottom line (50% decline.) The “marginal revenue”, is that last 10%. What the company achieves “on the margin.” It has enormous impact on profits. And now you know why retailers are open 7 days a week, and 18 to 24 hours per day. They all desperately want those last few “marginal revenues” because they are what makes – or breaks – their profitability.

All those scale advantages Sam Walton created go into reverse if revenues decline. Now the big centralized purchasing, the huge distribution centers, and all those big stores suddenly become a cost Walmart cannot avoid. Without growing revenues, Walmart, like has happened at Sears, could go into a terrible profit tailspin.

And that is what Amazon is trying to do. Amazon is changing the way Americans shop. From stores to on-line. And the key to understanding why this is deadly to Walmart and other big traditional retailers is understanding that all Amazon (and its brethren on line) need to do is chip away at a few percentage points of the market. They don’t have to obtain half of retail. By stealing just 5-10% they put many retailers, they ones who are weak, right out of business. Like Radio Shack and Circuit City. And they suck the profits out of others like Sears and Best Buy. And they pose a serious threat to WalMart.

And Amazon is succeeding. It has grown at almost 30%/year since 2010. That growth has not been due to market growth, it has been created by stealing sales from traditional retailers. And Amazon achieves $621,000 revenue per employee, while having a far less fixed cost footprint.

What the marketplace looks for is that point at which the shift to on-line is dramatic enough, when on-line retailers have enough share, that suddenly the fixed cost heavy traditional retail business model is no longer supportable. When brick-and-mortar retailers lose just enough share that their profits start the big slide backward toward losses. Simultaneously, the profits of on-line retailers will start to gain significant upward momentum.

And this week, the marketplace started saying that time could be quite near. Amazon had a small profit, surprising many analysts. It’s revenues are now almost as big as Costco, Tesco – and bigger than Target and Home Depot. If it’s pace of growth continues, then the value which was once captured in Walmart stock will shift, along with the marketplace, to Amazon.

In May, 2010 Apple’s value eclipsed Microsoft. Five years later, Apple is now worth double Microsoft – even though its earnings multiple (stock Price/Earnings) is only half (AAPL P/E = 14.4, MSFT = 31.) And Apple’s revenues are double Microsoft’s. And Apple’s revenues/employee are $2.4million, 3 times Microsoft’s $731k.

While Microsoft has about doubled in value since the valuation pinnacle transferred to Apple, investors would have done better holding Apple stock as it has more than tripled. And, again, if the multiple equalizes between the companies (Apple’s goes up, or Microsoft’s goes down,) Apple investors will be 6 times better off than Microsoft’s.

Market shifts are a bit like earthquakes. Lots of pressure builds up over a long time. There are small tremors, but for the most part nobody notices much change. The land may actually have risen or fallen a few feet, but it is not noticeable due to small changes over a long time. But then, things pop. And the world quickly changes.

This week investors started telling us that the time for big change could be happening very soon in retail. And if it does, Walmart’s size will be more of a disadvantage than benefit.

by Adam Hartung | Nov 11, 2011 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lifecycle, Web/Tech

In the back half of the 1990s Apple was clearly on the route to bankruptcy. Sun Micrososystems seriously investigated buying Apple. After a review, leadership opted not to make the acquisition. Sun’s non-officer management, bouyed on rumors of the acquisition, was heartbroken upon hearing Sun would not proceed. When Chairman Scott McNeely was asked at a management retreat why the executive team passed on Apple, he responded with “Do you think you can fix that?”

Sun leadership clearly had answered “no.” Good for a lot of us that Steve Jobs said “yes.”

Sun has largely disappeared, losing 95% of its market cap after 2000 and being acquired by Oracle. Why did Mr. Jobs succeed where the leadership of Sun, which couldn’t save itself much less Apple, feared it would fail?

For insight, look no further than the recent failure of Filene’s Basement (“Filene’s Saga Ends” Boston.com) and its acquirer Sym’s (“Retailers’s Sym’s and Filene’s Go Out of Business” Chicago Tribune.) Most of the time, when a troubled business is acquirerd not only is the buyer unable to fix the poor performer, but investments incurred by the buyer jeapardizes its business to the point of failure as well. Given the track record of corporations at fixing bad businesses, Mr. McNeely was on statistically sound footing to reject buying Apple.

Why is the track record of corporate management so bad at fixing problem businesses? Largely because most of their time is spent tyring to extend the past, rather than create a business which can thrive in the future.

The leadership of Sun didn’t see a future filled with mobile devices for music, movies or telephony. They were fixated on the Unix-based computers Sun built and sold. It was unclear how Apple would help them sell more servers, so it was a management diversion – a “poor strategic fit” – for Sun to acquire a technology intensive, talent rich organization. They passed, stayed focused on Unix servers and high-end workstations, and failed as that market shifted to PC products.

Much is the same for Filene’s Basement. A great brand, Sym’s bought Filene’s in an effort to continue pushing the discount model both Filene’s and Sym’s had historically pursued. Unfortunately, the market for discount department store merchandise was rapidly shifting to higher end middle-market players like Kohl’s, and for deeply discounted goods the internet was making deal shopping a lot easier for everyone. Because management was fixated on the old business, they missed the opportunity to make Filene’s and Sym’s a leader in new retail markets – like Amazon has done.

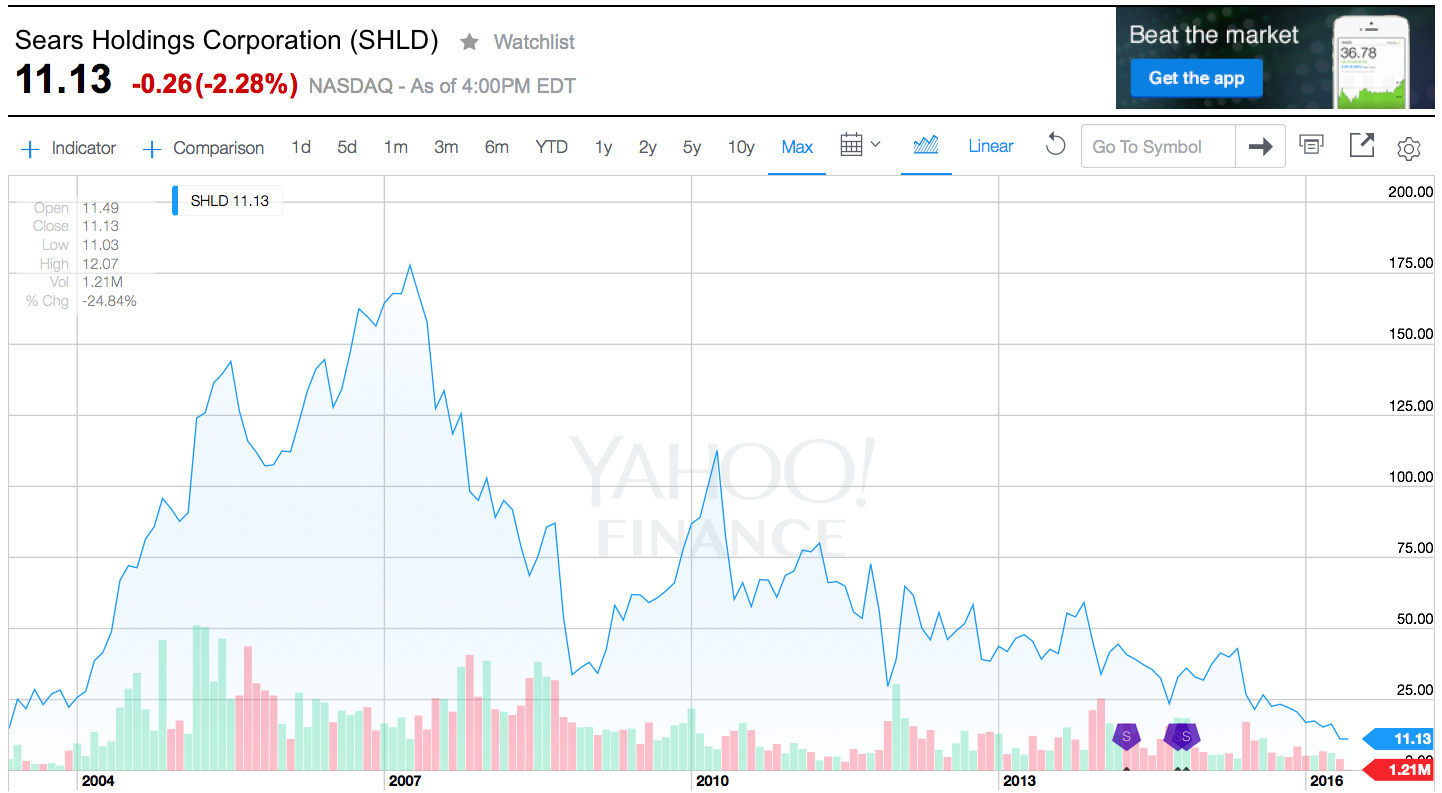

Remember in 2006 when Western Auto’s leader (and former hedge fund manager) Ed Lampert bought up the bonds of KMart, then used that position to acquire Sears? The market went gaga over the acquisition, heralding Mr. Lampert as a genius. Jim Cramer urged on his television program Mad Money that everyone buy Sears. Now the merged KMart/Sears company has lost much of its value, and 24×7 Wall Street claimed it was the #1 worst performing retail chain (“America’s Eight Worst-Performing Retail Chains“.)

Chart courtesy Yahoo.com 11/11/11 (note vertical scale is logarithmic)

Both KMart and Sears were deeply troubled when Mr. Lampert acquired them. But he largely followed a program of cost cutting, hoping people would return to the stores once he lowered prices. What he missed was a retail market which had shifted to Wal-Mart for the low-end products, and had fragmented into multiple competitors in the mid-priced market leaving Sears Holdings with no compelling value proposition.

Mr. Lampert has turned over management, fired scores of employees, closed stores and largely led both brands to retail irrelevancy. By trying to do more of the past, only better, faster and cheaper he ran into the buzz saw of competitors already positioned in the shifted market and created nothing new for shoppers, or investors.

And that’s why investors need to worry about Home Depot. The company was a shopper and investor darling as it maintained double digit growth through the 1980s and 1990s. But as competition matched, or beat, Home Depot’s prices – and often the capability of in-store help – growth slowed.

The Board replaced the founding leader with a senior General Electric leader named Robert Nardelli. He rapidly moved to operate the historical Home Depot success formula cheaper, better and faster by cutting costs — from employees to store operations and inventory. And customers moved even more quickly to the competition.

As the recessions worsened job growth remained scarce and eventually home values plummeted causing Home Depot’s growth to disappear. The company may be good at what it used to do, but that is simply a more competitive market that is a lot less interesting to shoppers today. Because Home Depot has not shifted into new markets, it is in a difficult situation (and considered the 5th worst performing retailer.) Who cares if you are a competitive home improvement store when your house is only worth 75% of the outstanding mortgage and you can’t refinance?

Chart source Yahoo Finance 11/11/11

And it is worth taking some time to look at Wal-Mart. The chain is famous for its rural and suburban stores selling at low prices, both as Wal-Mart and Sam’s Club. But looking forward, we see the company has failed at everything else it has tried. It’s offshore businesses have never met expectations and the company has left most markets. It’s efforts at more targeted merchandise, upscale stores and smaller stores have all been abandoned. And the company remains a serious lagger in understanding on-line sales as it has continued pouring money into defending its historical business, providing almost no return to investors for a decade.

The market is shifting, competitors have attacked its old “core,” but Wal-Mart remains stuck trying to do more, better, faster, cheaper with no clear sign it will make any difference as people change buying patterns. How can any brick-and-mortar retailer compete on cost with a web page?

Chart Source Yahoo Finance 11/11/11

All markets shift. All of them. Poor performance is most often an indication that the company has not shifted with the market. Competition in lower growth markets leads to weak revenue performance, and declining profits. Trying to “fix” the business by doing more of the same is almost always a money-losing proposition that hastens failure.

It is possble to fix a weak business. Moving with shifting markets into mobile has been very valuable for Apple investors. Two decades ago IBM shifted from hardware sales to a services focus, and the company not only escaped bankruptcy but now is worth more than Microsoft.

“Fixing” requires focusing on the future, and figuring out how to compete in the shifting market. Rather than applying cost-cutting and operational improvement, it is important to determine what future markets value, and deliver that. Zappos figured out that it could take a big lead in footwear and apparel if it offered people on-line convenience, and guaranteed taking back any products customers didn’t want (“What Other Businesses Can Learn from Zappos” CMSWire.com.) It’s sales exploded. Toms Shoes tapped into the market desire for helping others by donating a pair of shoes every time someone bought a pair, and sales are growing in double digits (CNBC video on Tom’s Shoes).

History has taught us to be pessimistic about fixing a troubled business. But that is largely because most management is fixated on trying to defend & extend the past. But turnarounds can be a lot more common if leaders instead focus on the future and meet emerging needs. It simply takes a different approach.

In the meantime, in retail it’s a lot smarter to invest in Amazon and retailers meeting emerging needs than those fixated on cost cutting and operational improvement. Be wary of Sears, Home Depot and Wal-Mart as long as management remains locked-in to its past.

by Adam Hartung | May 10, 2011 | Current Affairs, In the Whirlpool, Innovation, Leadership, Lifecycle

Sears is threatening to move its headquarters out of the Chicago area. It’s been in Chicago since the 1880s. Now the company Chairman is threatening to move its headquarters to another state, in order to find lower operating costs and lower taxes.

Predictably “Officals Scrambling to Keep Sears in Illinois” is the Chicago Tribune headlined. That is stupid. Let Sears go. Giving Sears subsidies would be tantamount to putting a 95 year old alcoholic, smoking paraplegic at the top of the heart/lung transplant list! When it comes to subsidies, triage is the most important thing to keep in mind. And honestly, Sears ain’t worth trying to save (even if subsidies could potentially do it!)

“Fast Eddie Lampert” was the hedge fund manager who created Sears Holdings by using his takeover of bankrupt KMart to acquire the former Sears in 2003. Although he was nothing more than a financier and arbitrager, Mr. Lampert claimed he was a retailing genius, having “turned around” Auto Zone. And he promised to turn around the ailing Sears. In his corner he had the modern “Mad Money” screaming investor advocate, Jim Cramer, who endorsed Mr. Lampert because…… the two were once in college togehter. Mr. Cramer promised investors would do well, because he was simply sure Mr. Lampert was smart. Even if he didn’t have a plan for fixing the company.

Sears had once been a retailing goliath, the originator of home shopping with the famous Sears catalogue, and a pioneer in financing purchases. At one time you could obtain all your insurance, banking and brokerage needs at a Sears, while buying clothes, tools and appliances. An innovator, Sears for many years was part of the Dow Jones Industrial Average. But the world had shifted, Home Depot displaced Sears on the DJIA, and the company’s profits and revenues sagged as competitors picked apart the product lines and locations.

Simultaneously KMart had been destroyed by the faster moving and more aggressive Wal-Mart. Wal-Mart’s cost were lower, and its prices lower. Even though KMart had pioneered discount retailing, it could not compete with the fast growing, low cost Wal-Mart. When its bonds were worth pennies, Mr. Lampert bought them and took over the money-losing company.

By combining two losers, Mr. Lampert promised he would make a winner. How, nobody knew. There was no plan to change either chain. Just a claim that both were “great brands” that had within them other “great brands” like Martha Stewart (started before she was convicted and sent to jail), Craftsman and Kenmore. And there was a lot of real estate. Somehow, all those assets simlply had to be worth more than the market value. At least that’s what Mr. Lampert said, and people were ready to believe. And if they had doubts, they could listen to Jim Cramer during his daily Howard Beale impersonation.

Only they all were wrong.

Retailing had shifted. Smarter competitors were everywhere. Wal-Mart, Target, Dollar General, Home Depot, Best Buy, Kohl’s, JCPenney, Harbor Freight Tools, Amazon.com and a plethora of other compeltitors had changed the retail market forever. Likewise, manufacturers in apparel, appliances and tools had brough forward better products at better prices. And financing was now readily available from credit card companies.

Surely the real estate would be worth a fortune everyone thought. After all, there was so much of it. And there would never be too much retail space. And real estate never went down in value. At least, that’s what everyone said.

But they were wrong. Real estate was at historic highs compared to income, and ability to pay. Real estate was about to crater. And hardest hit in the commercial market was retail space, as the “great recession” wiped out home values, killed personal credit lines, and wiped out disposable income. Additionally, consumers increasingly were buying on-line instead of trudging off to stores fueling growth at Amazon and its peers rather than Sears – which had no on-line presence.

Those who were optimistic for Sears were looking backward. What had once been valuable they felt surely must be valuable again. But those looking forward could see that market shifts had rendered both KMart and Sears obsolete. They were uncompetitive in an increasingly more competitive marketplace. As competitors kept working harder, doing more, better, faster and cheaper Sears was not even in the game. The merger only made the likelihood of failure greater, because it made the scale fo change even greater.

The results since 2003 have been abysmal. Sales per store, a key retail benchmark, have declined every quarter since Mr. Lampert took over. In an effort to prove his financial acumen, Mr. Lampert led the charge for lower costs. And slash his management team did – cutting jobs at stores, in merchandising and everywhere. Stores were closed every quarter in an effort to keep cutting costs. All Mr. Lampert discussed were earnings, which he kept trying to keep from disintegrating. But with every quarter Sears has become smaller, and smaller. Now, Crains Chicago Business headlined, even the (in)famous chairman has to admit his past failure “Sears Chief Lampert: We Ought to be Doing a Lot Better.”

Sears once built, and owned, America’s tallest structure. But long ago Sears left the Sears Tower. Now it’s called the Willis Tower by the way – there is no Sears Tower any longer. Sears headquarters are offices in suburban Hoffman Estates, and are half empty. Eighty percent of the apparel merchandisers were let go in a recent move, taking that group to California where the outcome has been no better. Constant cost cutting does that. Makes you smaller, and less viable.

And now Sears is, well….. who cares? Do you even know where the closest Sears or Kmart store is to you? Do you know what they sell? Do you know the comparative prices? Do you know what products they carry? Do you know if they have any unique products, or value proposition? Do you know anyone who works at Sears? Or shops there? If the store nearest you closed, would you miss it amidst the Home Depot, Kohl’s or Best Buy competitors? If all Sears stores closed – every single location – would you care?

And now Illinois is considering giving this company subsidies to keep the headquarters here?

Here’s an alternative idea. Using whatever logic the state leaders can develop, using whatever dream scenario and whatever desperation economics they have in mind to save a handful of jobs, figure out what the subsidy might be. Then invest it in Groupon. Groupon is currently the most famous technology start-up in Illinois. Over the next 10 years the Groupon investment just might create a few thousand jobs, and return a nice bit of loot to the state treasury. The Sears money will be gone, and Sears is going to disappear anyway. Really, if you want to give a subsidy, if you want to “double down,” why not bet on a winner?

It really doesn’t have to be Groupon. The state residents will be much better off if the money goes into any business that is growing. Investing in the dying horse simply makes no sense. Beg Amazon, Google or Apple to open a center in Illinois – give them the building for free if you must. At least those will be jobs that won’t disappear. Or invest the money into venture funds that can invest in the next biotech or other company that might become a Groupon. Invest in senior design projects from engineering students at the University of Illinois in Chicago or Urbana/Champaign. Invest in the fillies that have a chance of winning the race!

Sentimenatality isn’t bad. We all deserve the right to “remember the good old days.” But don’t invest your retirement fund, or state tax receipts, in sentimentality. That’s how you end up like Detroit. Instead put that money into things that will grow. So you can be more like silicon valley. Invest in businesses that take advantage of market shifts, and leverage big trends to grow. Let go of sentimentality. And let go of Sears. Before it makes you bankrupt!