by Adam Hartung | May 10, 2016 | Defend & Extend, In the Swamp, Leadership, Lifecycle, Web/Tech

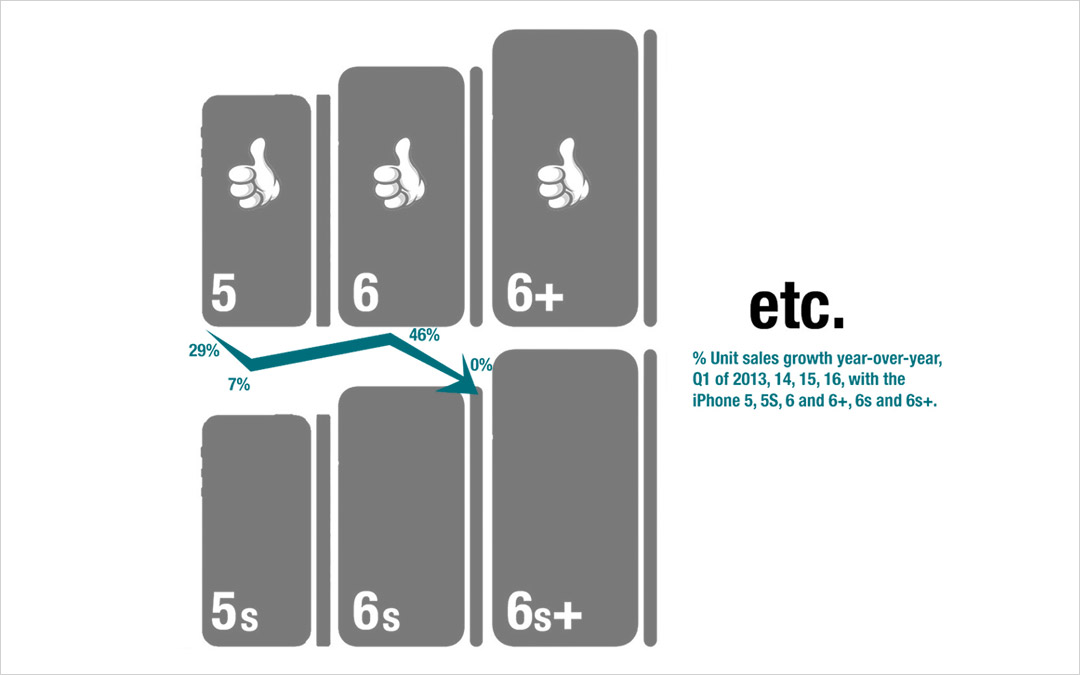

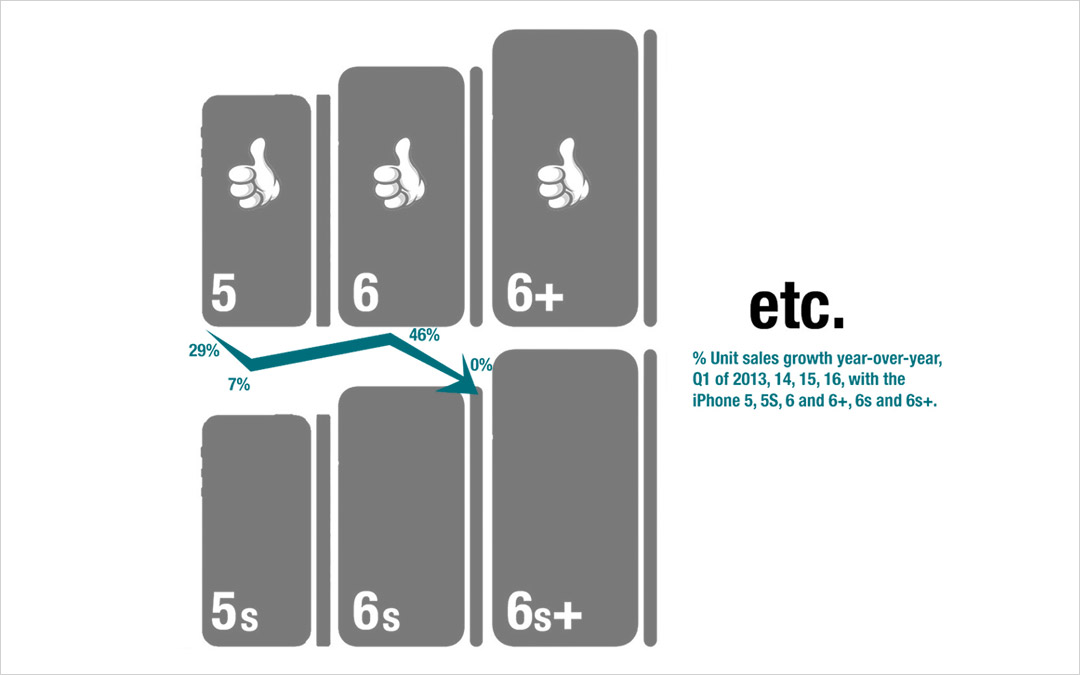

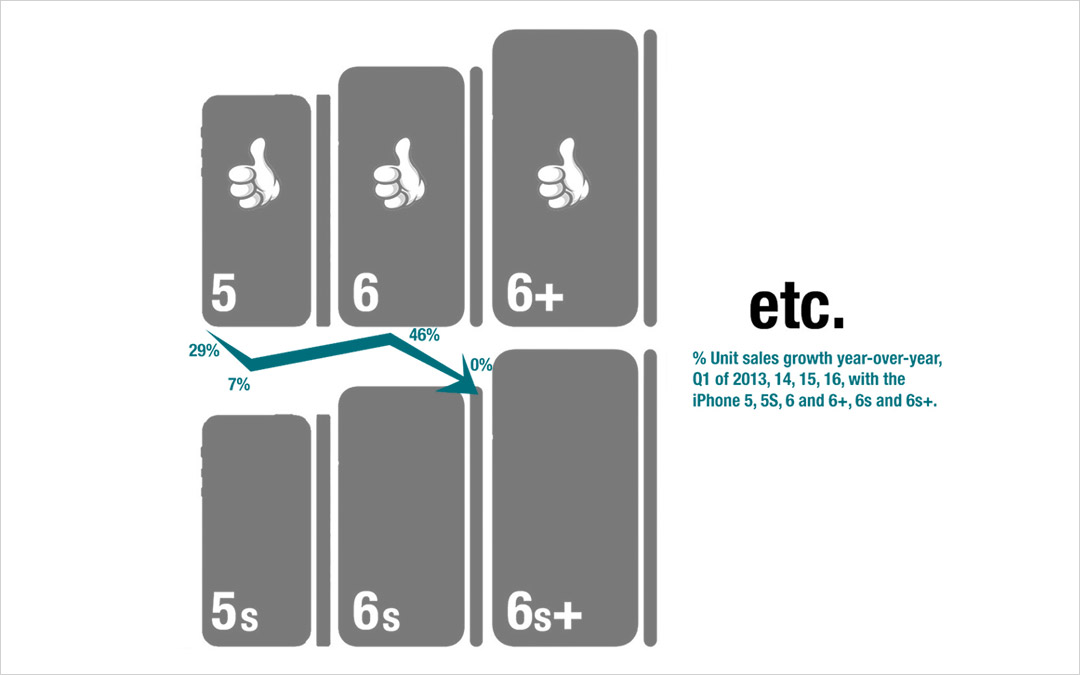

My last column focused on growth, and the risks inherent in a Growth stall. As I mentioned then, Apple will enter a Growth Stall if its revenue declines year-over-year in the current quarter. This forecasts Apple has only a 7% probability of consistently growing just 2%/year in the future.

This usually happens when a company falls into Defend & Extend (D&E) management. D&E management is when the bulk of management attention, and resources, flow into protecting the “core” business by seeking ways to use sustaining innovations (rather than disruptive innovations) to defend current customers and extend into new markets. Unfortunately, this rarely leads to high growth rates, and more often leads to compressed margins as growth stalls. Instead of working on breakout performance products, efforts are focused on ways to make new versions of old products that are marginally better, faster or cheaper.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

For example, Apple’s CEO has trumpeted the company’s installed base of 1B iPhones, and stated they will be a future money maker. He bragged about the 20% growth in “services,” which are iPhone users taking advantage of Apple Music, iCloud storage, Apps and iTunes. This shows management’s desire to extend sales to its “installed base” with sustaining software innovations. Unfortunately, this 20% growth was a whopping $1.2B last quarter, which was 2.4% of revenues. Not nearly enough to make up for the decline in “core” iPhone, iPad or Mac sales of approximately $9.5B.

Apple has also been talking a lot about selling in China and India. Unfortunately, plans for selling in India were at least delayed, if not thwarted, by a decision on the part of India’s regulators to not allow Apple to sell low cost refurbished iPhones in the country. Fearing this was a cheap way to dispose of e-waste they are pushing Apple to develop a low-cost new iPhone for their market. Either tactic, selling the refurbished products or creating a cheaper version, are efforts at extending the “core” product sales at lower margins, in an effort to defend the historical iPhone business. Neither creates a superior product with new features, functions or benefits – but rather sustains traditional product sales.

Of even greater note was last week’s announcement that Apple inked a partnership with SAP to develop uses for iPhones and iPads built on the SAP ERP (Enterprise Resource Planning) platform. This announcement revealed that SAP would ask developers on its platform to program in Swift in order to support iOS devices, rather than having a PC-first mentality.

This announcement builds on last year’s similar announcement with IBM. Now 2 very large enterprise players are building applications on iOS devices. This extends the iPhone, a product long thought of as great for consumers, deeply into enterprise sales. A market long dominated by Microsoft. With these partnerships Apple is growing its developer community, while circumventing Microsoft’s long-held domain, promoting sales to companies as well as individuals.

And Apple has shown a willingness to help grow this market by introducing the iPhone 6se which is smaller and cheaper in order to obtain more traction with corporate buyers and corporate employees who have been iPhone resistant. This is a classic market extension intended to sustain sales with more applications while making no significant improvements in the “core” product itself.

And Apple’s CEO has said he intends to make more acquisitions – which will surely be done to shore up weaknesses in existing products and extend into new markets. Although Apple has over $200M of cash it can use for acquisitions, unfortunately this tactic can be a very difficult way to actually find new growth. Each would be targeted at some sort of market extension, but like Beats the impact can be hard to find.

Remember, after all revenue gains and losses were summed, Apple’s revenue fell $7.6B last quarter. Let’s look at some favorite analyst acquisition targets to explain:

- Box could be a great acquisition to help bring more enterprise developers to Apple. Box is widely used by enterprises today, and would help grow where iCloud is weak. IBM has already partnered with Box, and is working on applications in areas like financial services. Box is valued at $1.45B, so easily affordable. But it also has only $300M of annual revenue. Clearly Apple would have to unleash an enormous development program to have Box make any meaningful impact in a company with over $500B of revenue. Something akin of Instagram’s growth for Facebook would be required. But where Instagram made Facebook a pic (versus words) site, it is unclear what major change Box would bring to Apple’s product lines.

- Fitbit is considered a good buy in order to put some glamour and growth onto iWatch. Of course, iWatch already had first year sales that exceeded iPhone sales in its first year. But Apple is now so big that all numbers have to be much bigger in order to make any difference. With a valuation of $3.7B Apple could easily afford FitBit. But FitBit has only $1.9B revenue. Given that they are different technologies, it is unclear how FitBit drives iWatch growth in any meaningful way – even if Apple converted 100% of Fitbit users to the iWatch. There would need to be a “killer app” in development at FitBit that would drive $10B-$20B additional annual revenue very quickly for it to have any meaningful impact on Apple.

- GoPro is seen as a way to kick up Apple’s photography capabilities in order to make the iPhone more valuable – or perhaps developing product extensions to drive greater revenue. At a $1.45B valuation, again easily affordable. But with only $1.6B revenue there’s just not much oomph to the Apple top line. Even maximum Apple Store distribution would probably not make an enormous impact. It would take finding some new markets in industry (enterprise) to build on things like IoT to make this a growth engine – but nobody has said GoPro or Apple have any innovations in that direction. And when Amazon tried to build on fancy photography capability with its FirePhone the product was a flop.

- Tesla is seen as the savior for the Apple Car – even though nobody really knows what the latter is supposed to be. Never mind the actual business proposition, some just think Elon Musk is the perfect replacement for the late Steve Jobs. After all the excitement for its products, Tesla is valued at only $28.4B, so again easily affordable by Apple. And the thinking is that Apple would have plenty of cash to invest in much faster growth — although Apple doesn’t invest in manufacturing and has been the king of outsourcing when it comes to actually making its products. But unfortunately, Tesla has only $4B revenue – so even a rapid doubling of Tesla shipments would yield a mere 1.6% increase in Apple’s revenues.

- In a spree, Apple could buy all 4 companies! Current market value is $35B, so even including a market premium $55B-$60B should bring in the lot. There would still be plenty of cash in the bank for growth. But, realize this would add only $8B of annual revenue to the current run rate – barely 25% of what was needed to cover the gap last quarter – and less than 2% incremental growth to the new lower run rate (that magic growth percentage to pull out of a Growth Stall mentioned earlier in this column.)

Such acquisitions would also be problematic because all have P/E (price/earnings) ratios far higher than Apple’s 10.4. FitBit is 24, GoPro is 43, and both Box and Tesla are infinite because they lose money. So all would have a negative impact on earnings per share, which theoretically should lower Apple’s P/E even more.

Acquisitions get the blood pumping for investment bankers and media folks alike – but, truthfully, it is very hard to see an acquisition path that solves Apple’s revenue problem.

All of Apple’s efforts big efforts today are around sustaining innovations to defend & extend current products. No longer do we hear about gee whiz innovations, nor do we hear about growth in market changing products like iBeacons or ApplePay. Today’s discussions are how to rejuvenate sales of products that are several versions old. This may work. Sales may recover via growth in India, or a big pick-up in enterprise as people leave their PCs behind. It could happen, and Apple could avoid its Growth Stall.

But investors have the right to be concerned. Apple can grow by defending and extending the iPhone market only so long. This strategy will certainly affect future margins as prices, on average, decline. In short, investors need to know what will be Apple’s next “big thing,” and when it is likely to emerge. It will take something quite significant for Apple to maintain it’s revenue, and profit, growth.

The good news is that Apple does sell for a lowly P/E of 10 today. That is incredibly low for a company as profitable as Apple, with such a large installed base and so many market extensions – even if its growth has stalled. Even if Apple is caught in the Innovator’s Dilemma (i.e. Clayton Christensen) and shifting its strategy to defending and extending, it is very lowly valued. So the stock could continue to perform well. It just may never reach the P/E of 15 or 20 that is common for its industry peers, and investors envisioned 2 or 3 years ago. Unless there is some new, disruptive innovation in the pipeline not yet revealed to investors.

by Adam Hartung | Apr 5, 2016 | Disruptions, In the Rapids, Leadership, Web/Tech

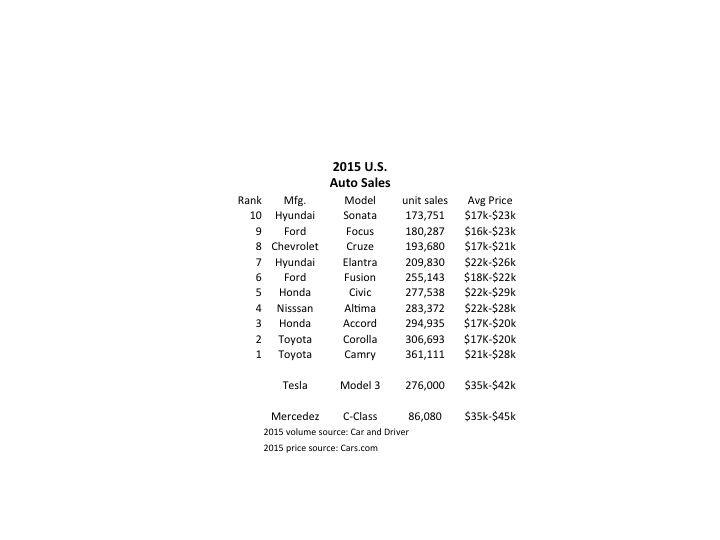

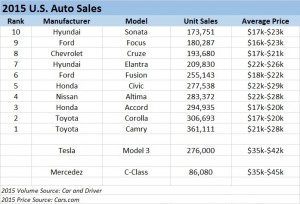

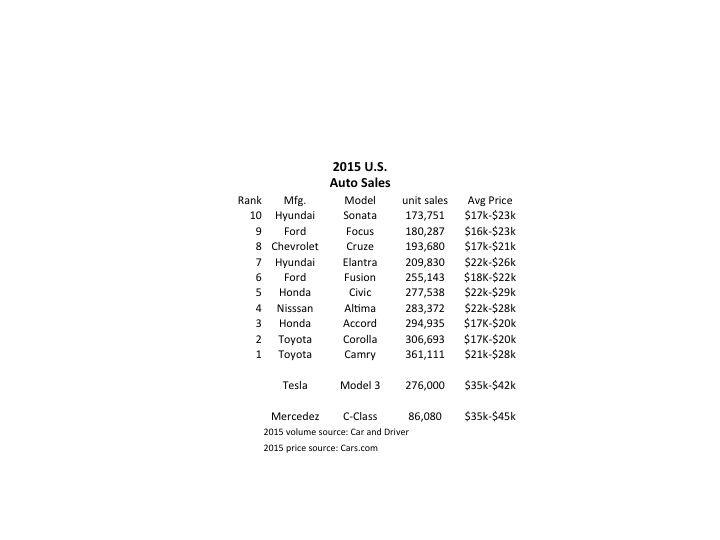

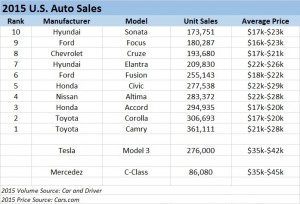

Tesla started taking orders for the Model 3 last week, and the results were remarkable. In 24 hours the company took $1,000 deposits for 198,000 vehicles. By end of Saturday the $1,000 deposits topped 276,000 units. And for a car not expected to be available in any sort of volume until 2017. Compare that with the top selling autos in the U.S. in 2015:

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Even more astonishing is the average selling price. Note that top 10 cars are not highly priced, mostly in the $17,000 to $25,000 price range. But the Tesla is base priced at $35,000, and expected with options to sell closer to $42,000. That is almost twice as expensive as the typical top 10 selling auto in the U.S.

Tesla has historically been selling much more expensive cars, the Model S being its big seller in 2015. So if we classify Tesla as a “luxury” brand and compare it to like-priced Mercedes Benz C-Class autos we see the volumes are, again, remarkable. In under 1 week the Model 3 took orders for 3 times the volume of all C-Class vehicles sold in the U.S. in 2015.

[Car and Driver top 10 cars; Mercedes Benz 2015 unit sales; Tesla 2015 unit sales; Model 3 pricing]

Although this has surprised a large number of people, the signs were all pointing to something extraordinary happening. The Tesla Model S sold 50,000 vehicles in 2015 at an average price of $70,000 to $80,000. That is the same number of the Mercedes E-Class autos, which are priced much lower in the $50,000 range. And if you compare to the top line Mercedes S-Class, which is only slightly more expensive at an average $90,0000, the Model S sold over 2 times the 22,000 units Mercedes sold. And while other manufacturers are happy with single digit percentage volume growth, in Q4 Tesla shipments were 75% greater in 2015 than 2014.

In other words, people like this brand, like these cars and are buying them in unprecedented numbers. They are willing to plunk down deposits months, possibly years, in advance of delivery. And they are paying the highest prices ever for cars sold in these volumes. And demand clearly outstrips supply.

Yet, Tesla is not without detractors. From the beginning some analysts have said that high prices would relegate the brand to a small niche of customers. But by outselling all other manufacturers in its price point, Tesla has demonstrated its cars are clearly not a niche market. Likewise many analysts argued that electric cars were dependent on high gasoline prices so that “economic buyers” could justify higher prices. Yet, as gasoline prices have declined to prices not seen for nearly a decade Tesla sales keep going up. Clearly Tesla demand is based on more than just economic analysis of petroleum prices.

People really like, and want, Tesla cars. Even if the prices are higher, and if gasoline prices are low.

Emerging is a new group of detractors. They point to the volume of cars produced in 2015, and first quarter output of just under 15,000 vehicles, then note that Tesla has not “scaled up” manufacturing at anywhere near the necessary rate to keep customers happy. Meanwhile, constructing the “gigafactory” in Nevada to build batteries has slowed and won’t meet earlier expectations for 2016 construction and jobs. Even at 20,000 cars/quarter, current demand for Model S and Model 3 They project lots of order cancellations would take 4.5 years to fulfill.

Which leads us to the beauty of sales growth. When products tap an under- or unfilled need they frequently far outsell projections. Think about the iPod, iPhone and iPad. There is naturally concern about scaling up production. Will the money be there? Can the capacity come online fast enough?

Of course, of all the problems in business this is one every leader should want. It is certainly a lot more fun to worry about selling too much rather than selling too little. Especially when you are commanding a significant price premium for your product, and thus can be sure that demand is not an artificial, price-induced variance.

With rare exceptions, investors understand the value of high sales at high prices. When gross margins are good, and capacity is low, then it is time to expand capacity because good returns are in the future. The Model 3 release projects a backlog of almost $12B. Booked orders at that level are extremely rare. Further, short-term those orders have produced nearly $300million of short-term cash. Thus, it is a great time for an additional equity offering, possibly augmented with bond sales, to invest rapidly in expansion. Problematic, yes. Insolvable, highly unlikely.

On the face of it Tesla appears to be another car company. But something much more significant is afoot. This sales level, at these prices, when the underlying economics of use seem to be moving in the opposite direction indicates that Tesla has tapped into an unmet need. It’s products are impressing a large number of people, and they are buying at premium prices. Based on recent orders Tesla is vastly outselling competitive electric automobiles made by competitors, all of whom are much bigger and better resourced. And those are all the signs of a real Game Changer.

by Adam Hartung | Apr 23, 2014 | Current Affairs, Leadership

Every quarter I have to be reminded that “earnings season” is again upon us. The ritual of public companies announcing their sales and profits from recent quarters that generates a lot of attention in the business press. And I always wonder why this is a big deal.

What really matters to investors, employees, customers and vendors is “what will your business be like next quarter, and year?” We really don’t much care about the past. What we really want to know is “what should we expect in the future?”

For example, two companies announce quarterly results. One has a Price/Earnings (P/E) multiple of 12.8 and a dividend yield of 2.05%. The other has a multiple of 13.0, and a yield of 3.05%. For both companies net earnings overall were pretty much flat, but Earnings Per Share (EPS) improved due to an aggressive stock repurchase program. Both companies say they have new products in the pipeline, but they conservatively estimate full year results for 2014 to be flat or maybe even declining.

Do you know enough to make a decision on whether to buy either stock? Both?

Truthfully, the two companies are Xerox and Apple. Now does it matter?

While both companies have similar results and forward looking statements, how you view that information is affected by your expectations for each company’s future. So, in other words, the actual results are pretty meaningless. They are interpreted through the lens of expectations, which controls your decision.

You can say Xerox has been irrelevant for years, and its products increasingly look unlikely to change its future course, so you are disheartened by results you see as unspectacular and likewise see no reason to own the stock. For Apple you could say the same thing, and bring up the growing competitor sales of Android-based products. Or, you might say that Apple is undervalued because you have great faith in the growth of mobile products sales and you believe new devices will spur Apple to even better results. Whatever your conclusion about the announced earnings, those conclusions are driven by your view of the future – not the actual results.

Another example. Two companies have billions in sales, and devote their discussion of company value to technology and the use of new technology to pioneer new markets. Both companies report they continue a string of losses, and have no projection for when losses will become profits. There are no dividends. There is no P/E multiple, because there is no E. There is no EPS, again because there is no E. One company is losing $12.86/share, the other is losing $.61/share. Again, do these results tell you whether to buy either, one or both?

What if the first one (with the larger losses) is Sears Holdings, and the latter is Tesla? Now, suddenly your view on the data changes – based upon your view of the future. Either Sears is on the precipice of a turnaround to becoming a major on-line retailer that will sell some real estate and leverage the balance of its stores to grow, so you buy it, or you think Sears has lost all relevancy and you don’t buy it. Either you think Tesla is an industry game changer, so you buy it, or you think it is an over-rated fad that will never become big enough to matter and the giant global auto companies will destroy it, so you don’t buy it. It’s your future view that guides your conclusions about past results.

The critical factor when reviewing earnings is actually not the reported results. The critical factor is what you think the future is for these 4 companies. No matter how good or bad the historical results, your decision about whether to own the stock, buy the company products, work for the company or join its vendor program all hinges on your view about the company’s future.

Which makes not only the “earnings season” hoopla foolish, but puts a pronounced question mark on how executives – especially CEOs – in public companies spend their time as it relates to reporting results.

Enormous energy is spent by most CEOs and their staff on managing earnings. From the beginning to the end of every quarter the CFO and his/her staff pour over weekly outcomes in divisions and functions to understand revenues and costs in order to gain advance knowledge on likely results. Then, for the next several days/weeks the CFO’s staff, with the CEO and the leadership team, will pour over those results to make a myriad number of adjustments – from depreciation and amortization to deferring revenue changing tax structures or time-matching various costs – in order to further refine the reported results. Literally thousands of person-hours will be devoted to managing the reported results in order to provide the number they think is most appropriate. And this cycle is repeated every quarter.

But how many hours will be spent by that same CEO and the leadership team managing expectations about the company’s next year? How much time do these leaders spend developing scenarios, and communications, that will describe their vision, in order to manage investor expectations?

While every company has a CFO leading a large organization dedicated to reporting historical results, how many companies have a like-powered C level exec managing the expectations, and leading a large staff to create and deliver communications about the future?

It seems pretty clear that most management teams should consider reallocating their precious resources. Instead of spending so much time managing earnings, they should spend more time managing expectations. If we think about the difference between Xerox and Apple, one is quickly aware of the difference the CEOs made in setting expectations. People still wax eloquently about the future vision for Apple created by CEO Steve Jobs, who’s been dead 2.5 years, while almost no one can tell you the name of Xerox’ CEO. If you think about the difference between Sears and Tesla one only needs to think briefly about the difference between the numbers driven hedge fund manager and cost-cutting CEO Ed Lampert compared with the “visionary” communications of Elon Musk.

Investors should all think long term. Investors should care completely about what the next 3 to 5 years will mean for companies in which they place their money. What sales and earnings are reported from months ago is pretty meaningless. What really matters is what is yet to happen.

What we don’t need is a lot of time spent talking about old earnings. What we need is a lot more time spent talking about the future, and what we should expect from our investments.

by Adam Hartung | Apr 8, 2014 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership

“Car dealers are idiots” said my friend as she sat down for a cocktail.

It was evening, and this Vice President of a large health care equipment company was meeting me to brainstorm some business ideas. I asked her how her day went, when she gave the response above. She then proceeded to tell me she wanted to trade in her Lexus for a new, small SUV. She had gone to the BMW dealer, and after being studiously ignored for 30 minutes she asked “do the salespeople at this dealership talk to customers?” Whereupon the salespeople fell all over themselves making really stupid excuses like “we thought you were waiting for your husband,” and “we felt you would be more comfortable when your husband arrived.”

My friend is not married. And she certainly doesn’t need a man’s help to buy a car.

She spent the next hour using her iPhone to think up every imaginable bad thing she could say about this dealer over Twitter and Facebook using various interesting hashtags and @ references.

Truthfully, almost nobody likes going to an auto dealership. Everyone can share stories about how they were talked down to by a salesperson in the showroom, treated like they were ignorant, bullied by salespeople and a slow selling process, overcharged compared to competitors for service, forced into unwanted service purchases under threat of losing warranty coverage – and a slew of other objectionable interactions. Most Americans think the act of negotiating the purchase of a new car is loathsome – and far worse than the proverbial trip to a dentist. It’s no wonder auto salespeople regularly top the list of least trusted occupations!

When internet commerce emerged in the 1990s, buying an auto on-line was the #1 most desired retail transaction in emerging customer surveys. And today the vast majority of Americans, especially Millennials, use the web and social media to research their purchase before ever stepping foot in the dreaded dealership.

Tesla heard, and built on this trend. Rather than trying to find dealers for its cars, Tesla decided it would sell them directly from the manufacturer. Which created an uproar amongst dealers who have long had a cushy “almost no way to lose money” business, due to a raft of legal protections created to support them after the great DuPont-General Motors anti-trust case.

When New Jersey regulators decided in March they would ban Tesla’s factory-direct dealerships, the company’s CEO, Elon Musk, went after Governor Christie for supporting a system that favors the few (dealers) over the customer. He has threatened to use the federal courts to overturn the state laws in favor of consumer advocacy.

It would be easy to ignore Tesla’s position, except it is not alone in recognizing the trend. TrueCar is an on-line auto shopping website which received $30M from Microsoft co-founder Paul Allen’s venture fund. After many state legal challenges TrueCar now claims to have figured out how to let people buy on-line with dealer delivery, and last week filed papers to go public. While this doesn’t eliminate dealers, it does largely take them out of the car-buying equation. Call it a work-around for now that appeases customers and lawyers, even if it doesn’t actually meet consumer desires for a direct relationship with the manufacturer.

Apple’s direct-to-consumer retail stores were key to saving the company

Distribution is always a tricky question for any consumer good. Apple wanted to make sure its products were positioned correctly, and priced correctly. As Apple re-emerged from near bankruptcy with new music products in the early 2000’s Apple feared electronic retailers would discount the product, be unable to feature Apple’s advantages, and hurt the brand which was in the process of rebuilding. So it opened its own stores, staffed by “geniuses” to help customers understand the brand positioning and the products’ advantages. Those stores are largely considered to have been a turning point in helping consumers move from a world of Microsoft-based laptops, Sony music products and Blackberry mobile devices to new iDevices and resurging Macintosh popularity – and sales levels.

Attacking regulations sounds – and is – a daunting task. But, when regulations support a minority of people outside the public good there is reason to expect change. American’s wanted a more pristine society, so in 1920 the 18th Amendment was passed prohibiting alcohol. However, after a decade in which rampant crime developed to support illegal alcohol production Americans passed the 21st Amendment in 1933 to repeal prohibition. What seemed like a good idea at first turned out to have more negatives than positives.

Auto dealer regulations hurt competition, and consumers

Today Americans do not need a protected group of dealers to save them from big, bad auto companies. To the contrary, forced distribution via protected dealers inhibits competition because it keeps new competitors from entering the U.S. market. Small production manufacturers, and large ones in countries like India, are effectively blocked from reaching American customers because they lack a dealer base and existing dealers are uninterested in taking the risks inherent in taking these new products to market. Likewise, starting up an auto company is fraught with distribution risks in the USA, leaving Tesla the only company to achieve any success since the dealer protection laws were passed decades ago.

And that’s why Tesla has a very good chance of succeeding. The trends all support Americans wanting to buy directly from manufacturers. At the very least this would force dealers to justify their existence, and profits, if they want to stay in business. But, better yet, it would create greater competition – as happened in the case of Apple’s re-emergence and impact on personal technology for entertainment and productivity.

Litigating to fight a trend might work for a while. Usually those in such a position are large political contributors, and use both the political process as well as legal precedent to protect their unjustified profits. NADA (National Automobile Dealers Association) is a substantial organization with very large PAC money to use across Washington. The Association can coordinate election contributions at national and state levels, as well as funding for judge elections and contributions for legal defense.

But, trends inevitably win out. Today Millennials are true on-line shoppers. They have no patience for traditional auto dealer shenanigans. After watching their parents, and grandparents, struggle for fairness with dealers they are eager for a change. As are almost all the auto buyers out there. And they are supported by consumer advocates long used to edgy tactics of auto dealers well known for skirting ethics and morality when dealing with customers. Those seeking change just need someone positioned to lead the legal effort.

Tesla wins because it uses trends to be a game changer

Tesla has shown it is well attuned to trends and what customers want. When other auto companies eschewed Tesla’s first entry as a 2-passenger sports car using laptop batteries, Tesla proceeded to sell out the product at a price much higher competitive gas-powered cars. When other auto companies thought a $70,000 electric sedan would never appeal to American buyers, Tesla again showed it understood the market best and sold out production. When industry pundits, and traditional auto company execs, said it was impossible to build a charging grid to support users driving up the coast, or cross-country, Tesla built the grid and demonstrated its functionality.

Now Tesla is the right company, in the right place, to change not only the autos Americans drive, but how Americans buy them. It’s rarely smart to refuse a trend, and almost always smart to support it. Tesla looks to be positioning itself as much smarter than older, larger auto companies once again.

by Adam Hartung | Jun 28, 2013 | Current Affairs, Defend & Extend, In the Rapids, In the Whirlpool, Innovation, Leadership, Web/Tech

The last 12 months Tesla Motors stock has been on a tear. From $25 it has more than quadrupled to over $100. And most analysts still recommend owning the stock, even though the company has never made a net profit.

There is no doubt that each of the major car companies has more money, engineers, other resources and industry experience than Tesla. Yet, Tesla has been able to capture the attention of more buyers. Through May of 2013 the Tesla Model S has outsold every other electric car – even though at $70,000 it is over twice the price of competitors!

During the Bush administration the Department of Energy awarded loans via the Advanced Technology Vehicle Manufacturing Program to Ford ($5.9B), Nissan ($1.4B), Fiskar ($529M) and Tesla ($465M.) And even though the most recent Republican Presidential candidate, Mitt Romney, called Tesla a "loser," it is the only auto company to have repaid its loan. And did so some 9 years early! Even paying a $26M early payment penalty!

How could a start-up company do so well competing against companies with much greater resources?

Firstly, never underestimate the ability of a large, entrenched competitor to ignore a profitable new opportunity. Especially when that opportunity is outside its "core."

A year ago when auto companies were giving huge discounts to sell cars in a weak market I pointed out that Tesla had a significant backlog and was changing the industry. Long-time, outspoken industry executive Bob Lutz – who personally shepharded the Chevy Volt electric into the market – was so incensed that he wrote his own blog saying that it was nonsense to consider Tesla an industry changer. He predicted Tesla would make little difference, and eventually fail.

For the big car companies electric cars, at 32,700 units January thru May, represent less than 2% of the market. To them these cars are simply not seen as important. So what if the Tesla Model S (8.8k units) outsold the Nissan Leaf (7.6k units) and Chevy Volt (7.1k units)? These bigger companies are focusing on their core petroleum powered car business. Electric cars are an unimportant "niche" that doesn't even make any money for the leading company with cars that are very expensive!

This is the kind of thinking that drove Kodak. Early digital cameras had lots of limitations. They were expensive. They didn't have the resolution of film. Very few people wanted them. And the early manufacturers didn't make any money. For Kodak it was obvious that the company needed to remain focused on its core film and camera business, as digital cameras just weren't important.

Of course we know how that story ended. With Kodak filing bankruptcy in 2012. Because what initially looked like a limited market, with problematic products, eventually shifted. The products became better, and other technologies came along making digital cameras a better fit for user needs.

Tesla, smartly, has not tried to make a gasoline car into an electric car – like, say, the Ford Focus Electric. Instead Tesla set out to make the best car possible. And the company used electricity as the power source. By starting early, and putting its resources into the best possible solution, in 2013 Consumer Reports gave the Model S 99 out of 100 points. That made it not just the highest rated electric car, but the highest rated car EVER REVIEWED!

As the big car companies point out limits to electric vehicles, Tesla keeps making them better and addresses market limitations. Worries about how far an owner can drive on a charge creates "range anxiety." To cope with this Tesla not only works on battery technology, but has launched a program to build charging stations across the USA and Canada. Initially focused on the Los-Angeles to San Franciso and Boston to Washington corridors, Tesla is opening supercharger stations so owners are never less than 200 miles from a 30 minute fast charge. And for those who can't wait Tesla is creating a 90 second battery swap program to put drivers back on the road quickly.

This is how the classic "Innovator's Dilemma" develops. The existing competitors focus on their core business, even though big sales produce ever declining profits. An upstart takes on a small segment, which the big companies don't care about. The big companies say the upstart products are pretty much irrelevant, and the sales are immaterial. The big companies choose to keep focusing on defending and extending their "core" even as competition drives down results and customer satisfaction wanes.

Meanwhile, the upstart keeps plugging away at solving problems. Each month, quarter and year the new entrant learns how to make its products better. It learns from the initial customers – who were easy for big companies to deride as oddballs – and identifies early limits to market growth. It then invests in product improvements, and market enhancements, which enlarge the market.

Eventually these improvements lead to a market shift. Customers move from one solution to the other. Not gradually, but instead quite quickly. In what's called a "punctuated equilibrium" demand for one solution tapers off quickly, killing many competitors, while the new market suppliers flourish. The "old guard" companies are simply too late, lack product knowledge and market savvy, and cannot catch up.

- The integrated steel companies were killed by upstart mini-mill manufacturers like Nucor Steel.

- Healthier snacks and baked goods killed the market for Hostess Twinkies and Wonder Bread.

- Minolta and Canon digital cameras destroyed sales of Kodak film – even though Kodak created the technology and licensed it to them.

- Cell phones are destroying demand for land line phones.

- Digital movie downloads from Netflix killed the DVD business and Blockbuster Video.

- CraigsList plus Google stole the ad revenue from newspapers and magazines.

- Amazon killed bookstore profits, and Borders, and now has its sites set on WalMart.

- IBM mainframes and DEC mini-computers were made obsolete by PCs from companies like Dell.

- And now Android and iOS mobile devices are killing the market for PCs.

There is no doubt that GM, Ford, Nissan, et. al., with their vast resources and well educated leadership, could do what Tesla is doing. Probably better. All they need is to set up white space companies (like GM did once with Saturn to compete with small Japanese cars) that have resources and free reign to be disruptive and aggressively grow the emerging new marketplace. But they won't, because they are busy focusing on their core business, trying to defend & extend it as long as possible. Even though returns are highly problematic.

Tesla is a very, very good car. That's why it has a long backlog. And it is innovating the market for charging stations. Tesla leadership, with Elon Musk thought to be the next Steve Jobs by some, is demonstrating it can listen to customers and create solutions that meet their needs, wants and wishes. By focusing on developing the new marketplace Tesla has taken the lead in the new marketplace. And smart investors can see that long-term the odds are better to buy into the lead horse before the market shifts, rather than ride the old horse until it drops.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]

Remarkably, the Model 3 would rank as the 6th best selling vehicle all of last year! And with just a few more orders, it will likely make the top 5 – or possibly top 3! And those are orders placed in just one week, versus an entire year of sales for the other models. And every buyer is putting up a $1,000 deposit, something none of the buyers of top 10 cars did as they purchased product widely available in inventory. [Update 7 April – Tesla reports sales exceed 325,000, which would make the Model 3 the second best selling car in the USA for the entire year 2015 – accomplished in less than one week.]