by Adam Hartung | Jul 22, 2020 | Disruptions, Innovation, Leadership, Marketing, Trends

As the pandemic dropped on the USA with full force mid-April the price of oil dropped to less than $0. OK, it was something of a fluke. Demand dropped so fast that supply couldn’t fall fast enough, so oil was flowing into refineries and tanks and pipelines so fast that nobody knew where to put it – and that resulted in suppliers having to pay someone to take their oil.

But… the point was very real. Oil prices depend on demand – every bit as much as supply. Even though for a generation we’ve taken growing oil demand for granted, and focused on how to create additional supply, it is a fact that NOW declining demand will limit the value of oil and gas (which is, after all, a commodity.) The TREND has changed course, with demand in the USA barely, or not, growing – and globally demand growth primarily all in Asia (mostly China.) Overall, supply growth has beaten demand growth by a wide margin, and prices are not only low now – they will likely go lower. Even oil company CEOs are predicting US production will decline – but to lower demand

In 2015, I predicted that Tesla could put a big hurt on Exxon. Most people thought that was a joke. Tesla was a fraction the size of GM, and “small potatoes” in the car industry. Meanwhile Exxon was one of the world’s largest oil producers and refiners. That really would be a very small David smacking a very big Goliath – and with a very small rock. But what I pointed out in 2015 was that traditional analysts predicted a very gradual growth in electric cars, and a continued growth in petroleum powered cars, and pretty much constant growth in oil & gas consumption with economic growth. In other words,analysts were using old assumptions all around and expecting only a tiny impact from a few weirdos buying electric cars.

But I asked, what if those assumptions were wrong? In 2015, the world was awash in oil, inventories were then at record levels, and electric car sales were taking off. And the truth was, a lot was happening to reduce demand for oil. Renewable energy programs, conservation, and a change in economic activity from basic manufacturing and commodity processing to a knowledge economy. These trends were all putting big dampers on oil demand. And electric auto sales were poised for a big boom. I predicted demand for oil would drop substantially, inventories would skyrocket and industry problems would worsen as prices cratered.

Uh-hum – what was the price of oil in April?

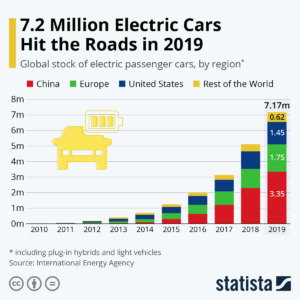

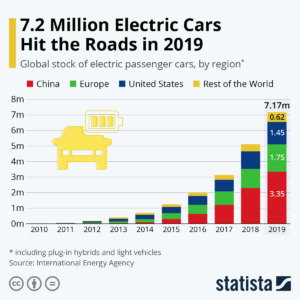

In 2009, I made the case that electric cars were a small base, but that geometric demand growth would make them an important economic impact . Today, most Americans still think that’s the case. In 2009 less than 100,000 new cars were electric. But by 2015, over 1 million electric cars had been sold. Then, with the help of game changers like the Tesla Model 3 in 2019 sales exceeded 7 million! A 7-fold increase in 5 years, or nearly 50%/year market growth!!

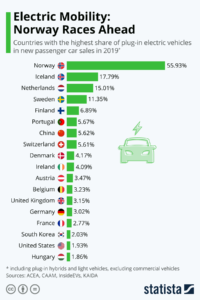

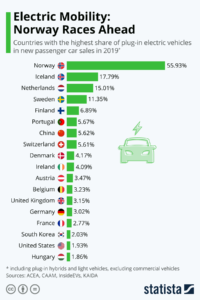

Americans aren’t aware of this phenomenon largely because the big growth centers are outside the USA. Where electrics are ~2% of US car sales, in some European countries they are well over 10% of the market. Even in China they represent over 5% of sales!

Remember what I said above about demand growth depending on China? Look again at who’s buying the most electric cars.

Lessons:

1 – Never think your product is beyond attack by market forces. Be paranoid.

2 – Very small, fringe competition can sneak up and steal your market faster than you think.

3 – Fringe changers don’t have to take a huge market share to make a BIG impact on your market and pricing.

4 – Disruptive events favor the upstarts, who are on trend, and hurt big incumbents, who depend on “business as usual.”

5 – Don’t expect markets to “return to normal.” Markets always move forward, with trends.

6 – Don’t plan from the past, plan for the future – and pay attention to disruptions, they can break you.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Jun 28, 2013 | Current Affairs, Defend & Extend, In the Rapids, In the Whirlpool, Innovation, Leadership, Web/Tech

The last 12 months Tesla Motors stock has been on a tear. From $25 it has more than quadrupled to over $100. And most analysts still recommend owning the stock, even though the company has never made a net profit.

There is no doubt that each of the major car companies has more money, engineers, other resources and industry experience than Tesla. Yet, Tesla has been able to capture the attention of more buyers. Through May of 2013 the Tesla Model S has outsold every other electric car – even though at $70,000 it is over twice the price of competitors!

During the Bush administration the Department of Energy awarded loans via the Advanced Technology Vehicle Manufacturing Program to Ford ($5.9B), Nissan ($1.4B), Fiskar ($529M) and Tesla ($465M.) And even though the most recent Republican Presidential candidate, Mitt Romney, called Tesla a "loser," it is the only auto company to have repaid its loan. And did so some 9 years early! Even paying a $26M early payment penalty!

How could a start-up company do so well competing against companies with much greater resources?

Firstly, never underestimate the ability of a large, entrenched competitor to ignore a profitable new opportunity. Especially when that opportunity is outside its "core."

A year ago when auto companies were giving huge discounts to sell cars in a weak market I pointed out that Tesla had a significant backlog and was changing the industry. Long-time, outspoken industry executive Bob Lutz – who personally shepharded the Chevy Volt electric into the market – was so incensed that he wrote his own blog saying that it was nonsense to consider Tesla an industry changer. He predicted Tesla would make little difference, and eventually fail.

For the big car companies electric cars, at 32,700 units January thru May, represent less than 2% of the market. To them these cars are simply not seen as important. So what if the Tesla Model S (8.8k units) outsold the Nissan Leaf (7.6k units) and Chevy Volt (7.1k units)? These bigger companies are focusing on their core petroleum powered car business. Electric cars are an unimportant "niche" that doesn't even make any money for the leading company with cars that are very expensive!

This is the kind of thinking that drove Kodak. Early digital cameras had lots of limitations. They were expensive. They didn't have the resolution of film. Very few people wanted them. And the early manufacturers didn't make any money. For Kodak it was obvious that the company needed to remain focused on its core film and camera business, as digital cameras just weren't important.

Of course we know how that story ended. With Kodak filing bankruptcy in 2012. Because what initially looked like a limited market, with problematic products, eventually shifted. The products became better, and other technologies came along making digital cameras a better fit for user needs.

Tesla, smartly, has not tried to make a gasoline car into an electric car – like, say, the Ford Focus Electric. Instead Tesla set out to make the best car possible. And the company used electricity as the power source. By starting early, and putting its resources into the best possible solution, in 2013 Consumer Reports gave the Model S 99 out of 100 points. That made it not just the highest rated electric car, but the highest rated car EVER REVIEWED!

As the big car companies point out limits to electric vehicles, Tesla keeps making them better and addresses market limitations. Worries about how far an owner can drive on a charge creates "range anxiety." To cope with this Tesla not only works on battery technology, but has launched a program to build charging stations across the USA and Canada. Initially focused on the Los-Angeles to San Franciso and Boston to Washington corridors, Tesla is opening supercharger stations so owners are never less than 200 miles from a 30 minute fast charge. And for those who can't wait Tesla is creating a 90 second battery swap program to put drivers back on the road quickly.

This is how the classic "Innovator's Dilemma" develops. The existing competitors focus on their core business, even though big sales produce ever declining profits. An upstart takes on a small segment, which the big companies don't care about. The big companies say the upstart products are pretty much irrelevant, and the sales are immaterial. The big companies choose to keep focusing on defending and extending their "core" even as competition drives down results and customer satisfaction wanes.

Meanwhile, the upstart keeps plugging away at solving problems. Each month, quarter and year the new entrant learns how to make its products better. It learns from the initial customers – who were easy for big companies to deride as oddballs – and identifies early limits to market growth. It then invests in product improvements, and market enhancements, which enlarge the market.

Eventually these improvements lead to a market shift. Customers move from one solution to the other. Not gradually, but instead quite quickly. In what's called a "punctuated equilibrium" demand for one solution tapers off quickly, killing many competitors, while the new market suppliers flourish. The "old guard" companies are simply too late, lack product knowledge and market savvy, and cannot catch up.

- The integrated steel companies were killed by upstart mini-mill manufacturers like Nucor Steel.

- Healthier snacks and baked goods killed the market for Hostess Twinkies and Wonder Bread.

- Minolta and Canon digital cameras destroyed sales of Kodak film – even though Kodak created the technology and licensed it to them.

- Cell phones are destroying demand for land line phones.

- Digital movie downloads from Netflix killed the DVD business and Blockbuster Video.

- CraigsList plus Google stole the ad revenue from newspapers and magazines.

- Amazon killed bookstore profits, and Borders, and now has its sites set on WalMart.

- IBM mainframes and DEC mini-computers were made obsolete by PCs from companies like Dell.

- And now Android and iOS mobile devices are killing the market for PCs.

There is no doubt that GM, Ford, Nissan, et. al., with their vast resources and well educated leadership, could do what Tesla is doing. Probably better. All they need is to set up white space companies (like GM did once with Saturn to compete with small Japanese cars) that have resources and free reign to be disruptive and aggressively grow the emerging new marketplace. But they won't, because they are busy focusing on their core business, trying to defend & extend it as long as possible. Even though returns are highly problematic.

Tesla is a very, very good car. That's why it has a long backlog. And it is innovating the market for charging stations. Tesla leadership, with Elon Musk thought to be the next Steve Jobs by some, is demonstrating it can listen to customers and create solutions that meet their needs, wants and wishes. By focusing on developing the new marketplace Tesla has taken the lead in the new marketplace. And smart investors can see that long-term the odds are better to buy into the lead horse before the market shifts, rather than ride the old horse until it drops.

by Adam Hartung | Jun 24, 2009 | Current Affairs, Disruptions, General, Leadership, Openness

"Reborn Chrysler gets a European makeover" is the headline at the Detroit Free Press. Now that Fiat is in charge, can we expect Chrysler to turn around?

There is no doubt Chrysler has been severely Challenged. But that alone did not Disrupt Chrysler – you can be challenged a lot and still not Disrupt Lock-ins. On the other hand, the new CEO appears to have stepped in and made significant changes in the organization structure, as well as the product line-up at Chrysler. We also know that bankruptcy changed the union rules as well as employee compensation and retirement programs. These are Disruptions. That's good news. Disruptions precede real change. No matter the outcome, the level of Disruption ensures the future Chrysler will be different from the old Chrysler. Step one in the right direction.

But, the Fiat leadership under Sergio Marcchione appears to be rapidly installing the Fiat Success Formula at Chrysler. The organization, product, branding and manufacturing decisions appear to be aligned with what Fiat has been doing in Europe. So this makes our analysis a lot trickier. Companies that effectively turn around align with market needs. They meet customer requirements in new, better ways. For Chrysler to now succeed requires that the American market needs are closely enough aligned with what Fiat has been doing to make Chrysler a success.

If this gives you doubts, you're well served. It's not like Fiat has been a household name in America for a long time. Nor have I perceived Fiat was gaining substantial share over its competitors in Europe. Nor do I have awareness of Fiat being noticably successful in emerging auto markets like China, India or Eastern Europe. They aren't doing as badly as Chrysler, but are they winning?

The new management is rolling in like Macarthur's team taking over Japan. They clearly have already made many decisions, and are now focused on execution. What worries me is

- what if the product lineup isn't really what Americans want?

- what if dealers don't make enough margin on the new lineup?

- what if the cost/quality tradeoffs don't fit American needs?

- what if competitors match their product capabilities?

- what if competitors have lower cost?

- what if competitors have measurably better quality?

- what if competitors bring out new innovations, like electric, hybrid or diesel, change the market significantly from what Fiat has to offer?

- what if customers simply have doubts about Fiat quality?

- what if customers like the Charger, Challenger and 300 more than they like the new Fiat products?

I don't have to be right or wrong on many of these questions and it portends problems for the new Chrysler/Fiat. And that's the problem with having such a tight plan when you start a turn-around. What if you get something wrong? How will you know? What will tell you early you need to change your plan fast, and possibly dramatically? Nowhere in the article, nor elsewhere, have I read about White Space projects being created that would produce an entirely new Success Formula. Only how Chrysler is being converted to the Fiat Success Formula.

I want the best for the new owners, employees and vendors of Fiat. I'm really happy to see the level of Disruption. But until we see White Space, more discussion of market testing and experimentation, as well as greater discussion of competitiors, I'd reserve judgement on the company's future.

If you read about White Space at Chrysler/Fiat please let me know. This is a story worth watching closely. Americans have a lot riding on the outcome – good or bad. So if you read about Disruptions or White Space share them with me or here on the blog for everyone.

PS – Don't forget to download my new ebook "The Fall of GM" for additional insight on managing Success Formulas in the auto industry.

PPS – There have been a lot of great comments related to recent blogs. I appreciate the personal notes, but don't hesitate to blog directly on the site. Also, keep up the comments. I don't feel compelled to re-comment on them all. Suffice it to say that the quality is excellent, and comments make the blog all that much more powerful. So please keep up the responses.