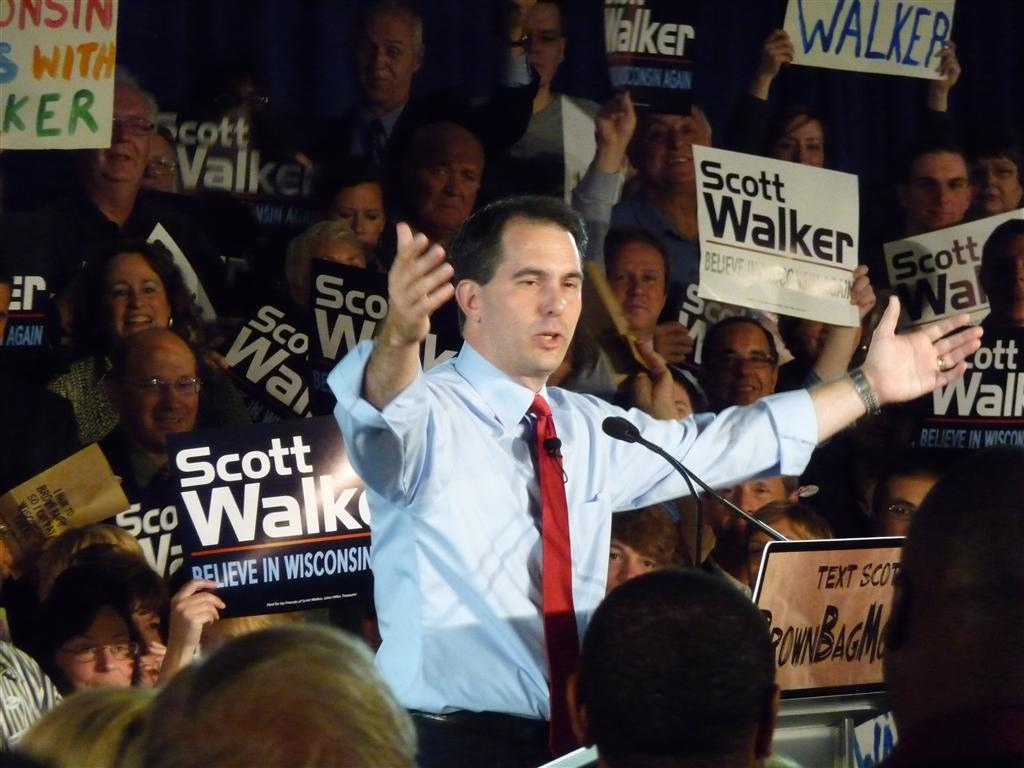

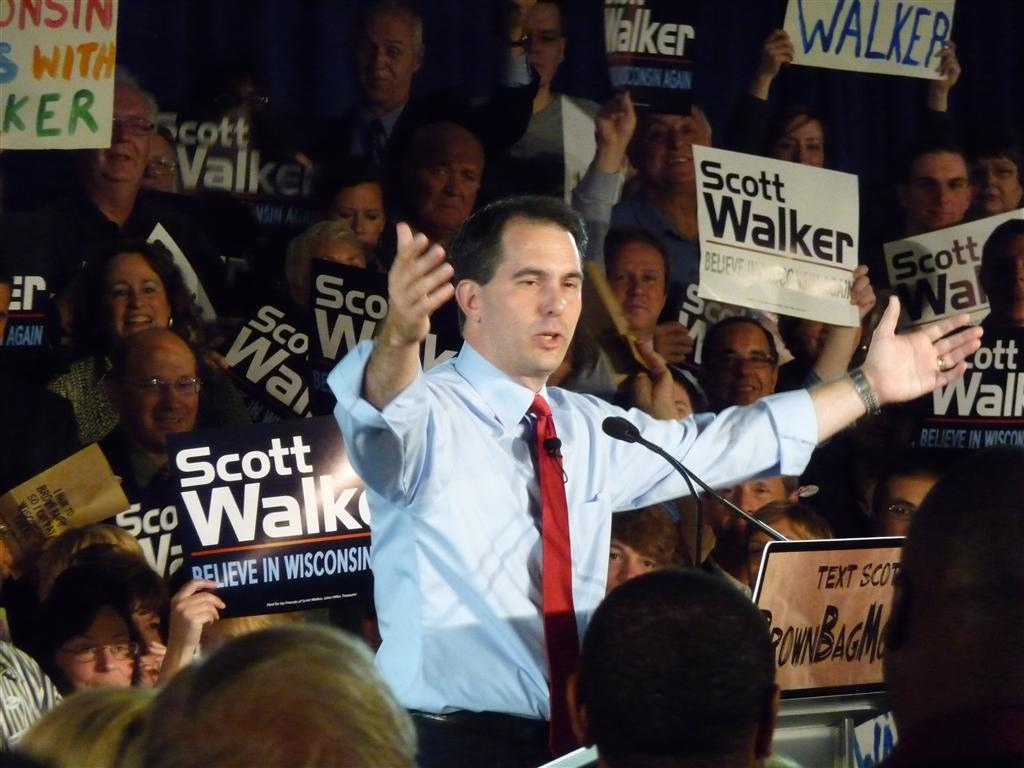

by Adam Hartung | Feb 18, 2015 | Current Affairs, Leadership

There has been a hullabaloo lately about Wisconsin Governor Walker’s lack of a degree. Some think this is a big deal, while others think almost nobody cares. In the end, we all should care about the formal education of any of our leaders. In government, business and elsewhere.

In Forbes magazine, 1998, famed management guru Peter Drucker wrote, “Get the assumptions wrong and everything that follows from them is wrong.” This is really important, because most leaders make most of their decisions based on assumptions. And many of those assumptions are based on how much, and how broad, that leader’s education.

We all make decisions on beliefs. It is easy to have incorrect beliefs. Early doctors believed that infections were due to bad blood, so they used bleeding as a cure-all for many wounds and illnesses. Untold millions of people died from this practice. A bad assumption, based on belief rather than formal study (in this case of the circulatory system) proved fatal.

In business, for thousands of years most sailors had no education about the curvature of the earth and its rotation the sun, thus they believed the world was flat and refused to sail further out to sea than the ability to keep their eyes on a shoreline. This limited trade, and delayed expansion into new markets.

Or, more recently, Steve Ballmer assumed that anyone using a smartphone would want a keyboard – because Blackberry dominated the market and had a keyboard. Thus he laughed at the iPhone launch. Oops. His assumption, and belief about the user experience, caused Microsoft to delay its entry into mobile markets and smartphones several years. Even though he had not studied smartphone user needs. Now Apple has half the smartphone market, while Blackberry and Microsoft each have less than 5%.

There are countless examples of bad decisions made when people use the wrong assumptions. At this time in Oklahoma, Texas and Colorado politicians are voting to refuse upgrading history education because the new curriculum is unacceptable to them. Their assumptions about America’s history are so strong that any factual evidence which might change those assumptions is so threatening that these politicians would prefer students be taught a fictitious history.

Our assumptions are built early in life. All through childhood our parents, aunts, uncles, religious leaders, mentors and teachers fill us with information. We process this information and build layers of assumptions. These assumptions help us to make decisions by allowing us to react based upon what we believe, rather than having to scurry around and do a research project every time a decision is required. Thus, the older we become the deeper these assumptions lie – and the more we rely on them as we undertake less and less education. As we age we decide based upon our beliefs, and less based upon any observable facts. Actually, we’ll often choose to ignore facts which indicate our assumptions and beliefs might be wrong (we call this a bias in others, and common sense when we do it ourselves.)

The more education you have, the more you can build assumptions that are likely to align with reality. It is no accident that the U.S. military uses education as a basis for promotions – rather than battlefield heroics. To move up requires officers go to war college and learn about history, politics, leadership and battles going back to long before the birth of Jesus. Good knowledge helps officers to be smarter about how to prepare for battle, organize for battle, conduct warfare, lead troops, treat a vanquished enemy and talk to the politicians for whom they work. Just look at the degrees amongst our military’s Colonels and General Officers and you find a plethora of masters and doctorate degrees. Education has long proven to be a superior warfare skill – especially when the enemy is operating on belief, guts and fight.

There are many accomplished people lacking degrees. But we should note they were successful very narrowly, and frequently in business. Steve Jobs, Bill Gates and Mark Zuckerberg are clearly high IQ people. But their success was based on founding a business at a time of technological revolution, and then building that business with zealousness. And the luck of being in the right place at the right time with a new piece of technology. They were/are not asked to be widely acclaimed in a broad spectrum of capabilities such as diplomacy, historical accuracy, legal limitations, cultural differences, the arts, scientific advances in multiple fields, warfare tactics, etc. They were not asked to develop a turnaround plan for a bankrupt auto manufacturer at the height of the Great Recession. For all their great wealth creation, they would not be what were once called “Renaissance men.”

When Governor Walker attacks the educated, and labels them as “elites,” it should be noted that their backgrounds often mean they have more points of view to evaluate, and are more considered about the various risks which are being created by taking any specific action. Many Harvard or Columbia MBAs could never be entrepreneurs because they see the many reasons a business would likely fail, and thus they are reticent to commit. Yet, that same wider knowledge allows them to be more thoughtful when evaluating the options and making decisions regarding opening new plants, negotiating with unions, expanding distribution and financing options.

Further, while it is true that you can be smart and not have a degree, the number of those who have degrees yet lack intelligence is a much, much smaller number. If one is to err in picking those you want to have advise you, or represent you, the degree(s) is not a bad first step toward identifying who is likely to provide the best insight and offer the most help.

Further, there is nothing about a degree which limits one’s ability to fight. Look at Senator Cruz from Texas. Senator Cruz’s politics seem to be somewhat aligned with Governor Walker’s, and he is widely acknowledged as a serious fighter, yet he boasts an undergraduate degree from Princeton as well as graduating from Harvard Law School. An educational background anyone would label as “elitist” and remarkably similar to President Obama’s – whose background Governor Walker has thoroughly maligned.

We expect our leaders to be widely read, and keenly aware of the complexities of life. We want our attorney’s to have law degrees and pass the bar exam. We want our physicians to have medical degrees and pass the Boards. Increasingly we want our business leaders to have MBAs. We understand that education informs our minds, and helps us develop assumptions for making good decisions. We should not belittle this, nor be accepting of someone who implies that lacking a formal education is meaningless.

by Adam Hartung | Jul 1, 2014 | Current Affairs, Defend & Extend, Leadership, Religion

Yesterday the U.S. Supreme Court ruled in favor of Hobby Lobby and against the U.S. government in a case revolving around health care for employees. I’m a business person, not a lawyer, so to me it was key to understand from a business viewpoint exactly what Hobby Lobby “won.”

It appears Hobby Lobby’s leaders “won” the right to refuse to provide certain kinds of health care to their employees as had been mandated by the Affordable Care Act. The justification primarily being that such health care (all associated with female birth control) violated religious beliefs of the company owners.

As a business person I wondered what the outcome would be if the next case is brought to the court by a business owner who happens to be a Christian Scientist. Would this next company be allowed to eliminate offering vaccines – or maybe health care altogether – because the owners don’t believe in modern medical treatments?

This may sound extreme, and missing the point revolving around the controversy over birth control. But not really. Because the point of business is to legally create solutions for customer needs at a profit. Doing this requires doing a lot of things right in order to attract and retain the right employees, the right suppliers and customers by making all of them extremely happy. I don’t recall Adam Smith, Milton Friedman, Peter Drucker, Edward Demming, John Galbraith or any other historically noted business writer saying the point of business to set the moral compass of its customers, suppliers or employees.

I’m not sure where enforcing the historical religious beliefs of founders or owners plays a role in business. At all. Even if they have the legal right to do so, is it smart business leadership?

Hobby Lobby Store

Hobby Lobby competes in the extraordinarily tough retail market. The ground is littered with failures, and formerly great companies which are struggling such as Sears, KMart, JCPenney, Best Buy, etc. And recently the industry has been rocked with security breaches, reducing customer faith in stalwarts like Target. And profits are being challenged across all brick-and-mortar traditional retailers by on-line companies led by Amazon, who have much lower cost structures.

All the trends in retail bode poorly for Hobby Lobby. Hobby Lobby does almost no business on-line, and even closes its stores on Sunday. Given consumer desires to have what they want, when they want it, unfettered by time or location, a traditional retailer like Hobby Lobby already has its hands full just figuring out how to keep competitors at bay. Customers don’t need much encouragement to skip any particular store in search of easily available products and instant price information across retailers.

Social trends are also very clear in the USA. The great majority of Americans support health care for everyone. Including offering birth control, and all other forms of women’s health needs. This has nothing to do with the Affordable Care Act. Health care, and women’s rights to manage their individual reproductiveness, is something that is clearly a majority viewpoint – and most people think it should be covered by health insurance.

So, given the customer options available, is it smart for any retailer to brag that they are unwilling to offer employees health care? Although not tied to any specific social issues, Wal-Mart has long dealt with customer and employee defections due to policies which reduce employee benefits, such as health care. Is this an issue which is likely to help Hobby Lobby grow?

Is it smart, as Hobby Lobby competes for merchandise from suppliers, negotiates on leases with landlords, seeks new store permits from local governments, recruits employees as buyers, merchandisers, store managers and clerks, and seeks customers who can shop on-line or at competitors to brandish the sword of intolerance on a specific issue which upsets the company owner? And one where this owner is on the opposite side of public opinion?

Long ago a group of retired U.S. military Generals told me that in Vietnam America won every battle, but lost the war. Through overwhelming firepower and manpower, there was no way we would not win any combat mission. But that missed the point. As a result of focusing on the combat, America’s leaders missed the opportunity win “the hearts and minds” of most Vietnamese. In the end America left Vietnam in a rushed abandonment of Saigon, and the North Vietnamese took over all of South Vietnam. Although we did what leaders believed was “right,” and fought each battle to a win, in the end America lost the objective of maintaining a free, independent and democratic Vietnam.

The leaders of Hobby Lobby won this battle. But is this good for the customers, suppliers, communities where stores are located, and employees of Hobby Lobby? Will these constituents continue to support Hobby Lobby, or will they possibly choose alternatives? If in its actions, including legal arguing at the Supreme Court, Hobby Lobby may have preserved what its leaders think is an important legal precedent. But, have their strengthened their business competitiveness so they will be a long-term success?

Perhaps Hobby Lobby might want to listen to the CEO of Chick-fil-A, which suffered a serious media firestorm when it became public their owners donated money to anti-gay organizations. CEO Cathy decided it was best to “just shut up and go sell chicken.” Business is tough enough, loaded with plenty of battles, without looking for fights that are against trends.

by Adam Hartung | Jan 15, 2014 | Current Affairs, Leadership

The S&P 500 had a great 2013. Up 29.7% – its best performance since 1997. The Dow Jones Industrial Average (DJIA) ended the year up 26.5% – its best performance since 1995. And this happened as economic growth lowered the unemployment rate to 6.7% in December – the lowest rate in 5 years. And overall real estate had double-digit price gains, lowering significantly the number of underwater mortgages.

But if we go back to the beginning of 2013, most Wall Street forecasters were predicting a very different outcome. Long suffering bear Harry Dent predicted a stock crash in 2013 that would last through 2014, and ongoing cratering in real estate values. And bear Gina Martin Adams of Wells Fargo Securities predicted a market decline in 2013, a forecast she clung to and fully supported, despite a rising market, when predicting an imminent crash in September. Morgan Stanley’s Adam Parker also predicted a flat market, as did UBS analyst Jonathan Golub.

How could professionals who are paid so much money, have so many resources and the backing of such outstanding large and qualified institutions be so wrong?

An over-reliance on quantitative analysis, combined with using the wrong assumptions.

The conventional approach to Wall Street forecasting is to use computers to amass enormously complex spreadsheets combining reams of numbers. Computer models are built with thousands of inputs, and tens of millions of data points. Eventually the analysts start to believe that the sheer size of the models gives them validity. In the analytical equivalent of “mine is bigger than yours” the forecasters rely on their model’s complexity and sheer size to self-validate their output and forecasts.

In the end these analysts come up with specific forecast numbers for interest rates, earnings, momentum indicators and multiples (price/earnings being key.) Their faith that the economy and market can be reduced to numbers on spreadsheets leads them to similar faith in their forecasts.

But, numbers are often the route to failure. In the late 1990s a team of Wall Street traders and Nobel economists became convinced their ability to model the economy and markets gave them a distinct investing advantage. They raised $1billion and formed Long Term Capital (LTC) to invest using their complex models. Things worked well for 3 years, and faith in their models grew as they kept investing greater amounts.

But then in 1998 downdrafts in Asian and Russian markets led to a domino impact which cost Long Term Capital $4.6B in losses in just 4 months. LTC lost every dime it ever raised, or made. But worse, the losses were so staggering that LTC’s failure threatened the viability of America’s financial system. The banks, and economy, were saved only after the Federal Reserve led a bailout financed by 14 of the leading financial institutions of the time.

Incorrect assumptions played a major part in how Wall Street missed the market prediction for 2013. All models are based on assumptions. And, as Peter Drucker famously said, “if you get the assumptions wrong everything you do thereafter will be wrong as well” — regardless how complex and vast the models.

Conventional wisdom held that conservative economic policies underpin market growth, and the more liberal Democratic fiscal policies combined with a liberal federal reserve monetary program would bode poorly for investors and the economy in 2013. These deeply held assumptions were, of course, reinforced by a slew of conservative commentators that supported the notion that America was on the brink of runaway inflation and economic collapse. The BIAS (Beliefs, Interpretations, Assumptions and Strategies) of the forecasters found reinforcement almost daily from the rhetoric on CNBC, Bloomberg, Fox News and other programs widely watched by business people from Wall Street to Main Street.

Interestingly, when Obama was re-elected in 2012 a not-so-well-known investment firm in Columbus, OH – far from Wall Street – took an alternative look at the data when forecasting 2013. Polaris Financial Partners took a deep dive into the history of how markets perform when led by traditional conservative vs. liberal policies and reached the startling conclusion that Obama’s programs, including the Affordable Care Act, would actually spur investment, market growth, jobs and real estate! They had forecast a double digit increase in all major averages for 2012 and extended that same double digit forecast into 2013 – far more optimistic than anyone on Wall Street.

CEO Bob Deitrick and partner Steven Morgan concluded that the millenium’s first decade had been lost. Despite Republican leadership, the eqity markets were, at best, sideways. There were fewer people actually working in 2008 than in 2000; a net decrease in jobs. After a near-collapse in the banking system, due to deregulated computer-model based trading in complex derivatives, real estate and equity prices had collapsed.

“Fourteen years of stock market gains were wiped out in 17 months from October, 2007 to March, 2009” lamented Deitrick.

Polaris Partners concluded the situation was eerily similar to the 1920s at the end of Hoover’s administration. A situation which was eventually resolved via Keynesian policies of increased fiscal spending while interest rates were low, and federal reserve intervention to both expand the money supply and increase the velocity of money under Republican Fed chief Marriner Eccles and Democratic President Franklin Roosevelt.

While most people conventionally think that tax cuts led to economic growth during the Reagan administration, Polaris Financial turned that assumption upside down and put the biggest positive economic impact on the roll-back of tax cuts a year after being pushed by Reagan and passing Congress. Their analysis of the 1980 recovery focused on higher defense and infrastructure spending (fiscal policy,) a massive increase in debt (the largest peacetime debt increase ever) coupled with a more balanced tax code post-TEFRA.

Thus, eschewing complex econometric models, elaborately detailed spreadsheets of earnings and rolling momentum indicators, Polaris Financial focused instead on identifying the assumptions they believeed would most likely drive the economy and markets in 2013. They focused on the continuation of Chairman Bernanke’s easy monetary policy, and long-term fiscal policies designed to funnel money into investments which would incent job creation and GDP growth leading to an improvement in house values, and consumer spending, while keeping interest rates at historically low levels. All of which would bode extremely well for thriving equity markets.

The vitriol has been high amongst those who support, and those who oppose, the economic policies of Obama’s administration since 2008. But vitriol does not support, nor replace, good forecasting. Too often forecasters predict what they want to happen, what they hope will happen, based upon their view of history, their traing and background, and their embedded assumptions. They believe in the certainty of long-held assumptions, and forecast from that base.

But as Polaris Financial pointed out, in beating every major Wall Street firm over the last 2 years, good forecasting relies on looking carefully at historical outcomes, and understanding the context in which those results happened. Rather than relying on an interpretation of the outcome,they looked instead at the facts and the situation; the actions and the outcomes in its context. In an economy, everything is relative to the context. There are no absolute programs that are universally the right thing to do. Every policy action, and every monetary action, is dependent upon initial conditions as well as the action itself.

Too few forecasters take into account both the context as well as the action. And far too few do enough analysis of assumptions, preferring instead to rely on reams of numerical analysis which may, or may not, relate to the current situation. And are often linked to assumptions underlying the model’s construction – assumptions which could be out of date or simply wrong.

The folks at Polaris Financial Partners remain optimistic about the economy and markets for the next two years. They point out that unemployment has dropped faster under Obama, and from a much higher level, than during the Reagan administration. They see the Affordable Care Act opening more flexibility for health care, creating a rise in entrepreneurship and innovation (especially biotechnology) that will spur economic growth. Deitrick and Morgan see tax programs, and rising minimum wage trends, working toward better income balancing, and greater monetary velocity aiding GDP growth. Their projection is for improving real estate values, jobs growth, and minimal inflation leading to higher indexes – such as 20,000 on the DJIA and 2150 on the S&P.

Bob Deitrick co-authored, with Lew Goldfarb, “Bulls, Bears and the Ballot Box” in 2012 analyzing Presidential economic policies, Federal Reserve policies and stock market performance.