by Adam Hartung | Sep 14, 2016 | Immigration, In the Rapids, Innovation, Telecom, Trends

I’m amazed about Americans’ debate regarding immigration. And all the rhetoric from candidate Trump about the need to close America’s borders.

I was raised in Oklahoma, which prior to statehood was called The Indian Territory. I was raised around the only real Native Americans. All the rest of us are immigrants. Some voluntarily, some as slaves. But the fact that people want to debate whether we allow people to become Americans seems to me somewhat ridiculous, since 98% of Americans are immigrants. The majority within two generations.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

And almost since the beginning, immigrants have been not only abused but scammed. Those who have resources frequently took advantage of the newcomers that did not. And this persists. Immigrants that lack a social security card are unable to obtain a driver’s license, unable to open bank accounts, unable to apply for credit cards, unable to even sign up for phone service. Thus they remain at the will of others to help them, which creates the opportunity for scamming.

Take for example an immigrant trying to make a phone call to his relatives back home. For most immigrants this means using a calling card. Only these cards are often a maze of fees, charges and complex rules that result in much of the card’s value being lost. A 10-minute call to Ghana can range from $2.86 to $8.19 depending on which card you use. This problem is so bad that the FCC has fined six of the largest card companies for misleading consumers about calling cards. They continue to advise consumers about fraud. And even Congress has held hearings on the problem.

One outcome of immigrants’ difficulties has been the ingenuity and innovativeness of Americans. To this day around the world people marvel at how clever Americans are, and how often America leads the world in developing new things. As a young country, and due to the combination of resources and immigrants’ tough situation, America frequently is first at developing new solutions to solve problems – many of which are problems that clearly affect the immigrant population.

So, back to that phone call. Some immigrants can use Microsoft Skype to talk with their relatives, using the Internet rather than a phone. But this requires the people back home have a PC and an internet connection. Both of which could be dicey. Another option would be to use something like Facebook’s WhatsApp, but this requires the person back home have either a PC or mobile device, and either a wireless connection or mobile coverage. And, again, this is problematic.

But once again, ingenuity prevails. A Romanian immigrant named Daniel Popa saw this problem, and set out to make communications better for immigrants and their families back home. In 2014 he founded QuickCall.com to allow users to make a call over wireless technology, but which can then interface with the old-fashioned wired (or wireless) telecom systems around the world. No easy task, since telephone systems are a complex environment of different international, national and state players that use a raft of different technologies and have an even greater set of complicated charging systems.

But this new virtual phone network, which links the internet to the traditional telecom system, is a blessing for any immigrant who needs to contact someone in a rural, or poor, location that still depends on phone service. If the person on the other end can access a WiFi system, then the calls are free. If the connection is to a phone system then the WiFi interface on the American end makes the call much cheaper – and performs far, far better than any other technology. QuickCall has built the carrier relationships around the world to make the connections far more seamless, and the quality far higher.

But like all disruptive innovations, the initial market (immigrants) is just the early adopter with a huge need. Being able to lace together an internet call to a phone system is pretty powerful for a lot of other users. Travelers heading to a remote location, like Micronesia, Africa or much of South America — and even Eastern Europe – can lower the cost of planning their trip and connect with locals by using QuickCall.com. And for most Americans traveling in non-European locations their cell phone service from Sprint, Verizon, AT&T or another carrier simply does not work well (if at all) and is very expensive when they arrive. QuickCall.com solves that problem for these travelers.

Small businesspeople who have suppliers, or customers, in these locations can use QuickCall.com to connect with their business partners at far lower cost. Businesses can even have their local partners obtain a local phone number via QuickCall.com and they can drive the cost down further (potentially to zero). This makes it affordable to expand the offshore business, possibly even establishing small scale customer support centers at the local supplier, or distributor, location.

In The Innovator’s Dilemma Clayton Christensen makes the case that disruptive innovations develop by targeting a customer with an unmet need. Usually the innovation isn’t as good as the current “standard,” and is also more costly. Today, making an international call through the phone system is the standard, and it is fairly cheap. But this solution is often unavailable to immigrants, and thus QuickCall.com fills their unmet need, and at a cost substantially lower than the infamous calling cards, and with higher quality than a pure WiFi option.

But now that it is established, and expanding to more countries – including developed markets like the U.K. – the technology behind QuickCall.com is becoming more mainstream. And its uses are expanding. And it is reducing the need for people to have international calling service on their wired or wireless phone because the available market is expanding, the quality is going up, and the cost is going down. Exactly the way all disruptive innovations grow, and thus threaten the entrenched competition.

The end-game may be some form of Facebook in-app solution. But that depends on Facebook or one of its competitors seizing this opportunity quickly, and learning all QuickCall.com already knows about the technology and customers, and building out that network of carrier relationships. Notice that Skype was founded in 2003, and acquired by Microsoft in 2011, and it still doesn’t have a major presence as a telecom replacement. Will a social media company choose to make the investment and undertake developing this new solution?

As small as QuickCall.com is – and even though you may have never heard of it – it is an example of a disruptive innovation that has been successfully launched, and is successfully expanding. It may seem like an impossibility that this company, founded by an immigrant to solve an unmet need of immigrants, could actually change the way everyone makes international calls. But, then again, few of us thought the iPhone and its apps would cause us to give up Blackberries and quit carrying our PCs around.

America is known for its ingenuity and innovations. We can thank our heritage as immigrants for this, as well as the immigrant marketplace that spurs new innovation. America’s immigrants have the need to succeed, and the unmet needs that create new markets for launching new solutions. For all those conservatives who fear “European socialism,” they would be wise to realize the tremendous benefits we receive from our immigrant population. Perhaps these naysayers should use QuickCall.com to connect with a few more immigrants and understand the benefits they bring to America.

by Adam Hartung | May 10, 2016 | Defend & Extend, In the Swamp, Leadership, Lifecycle, Web/Tech

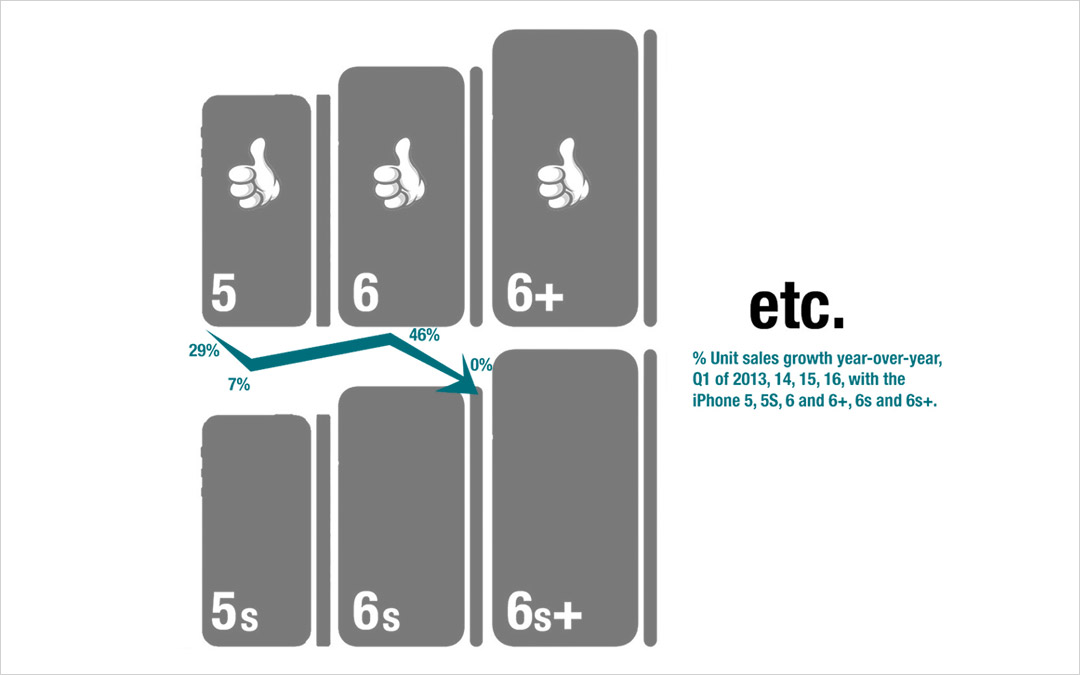

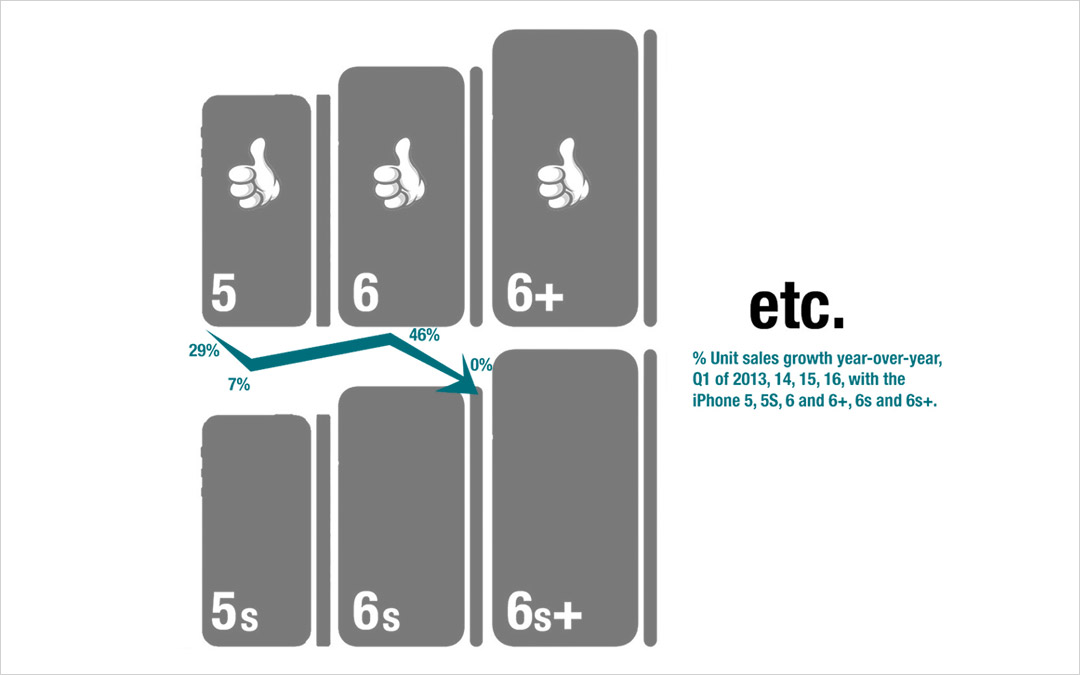

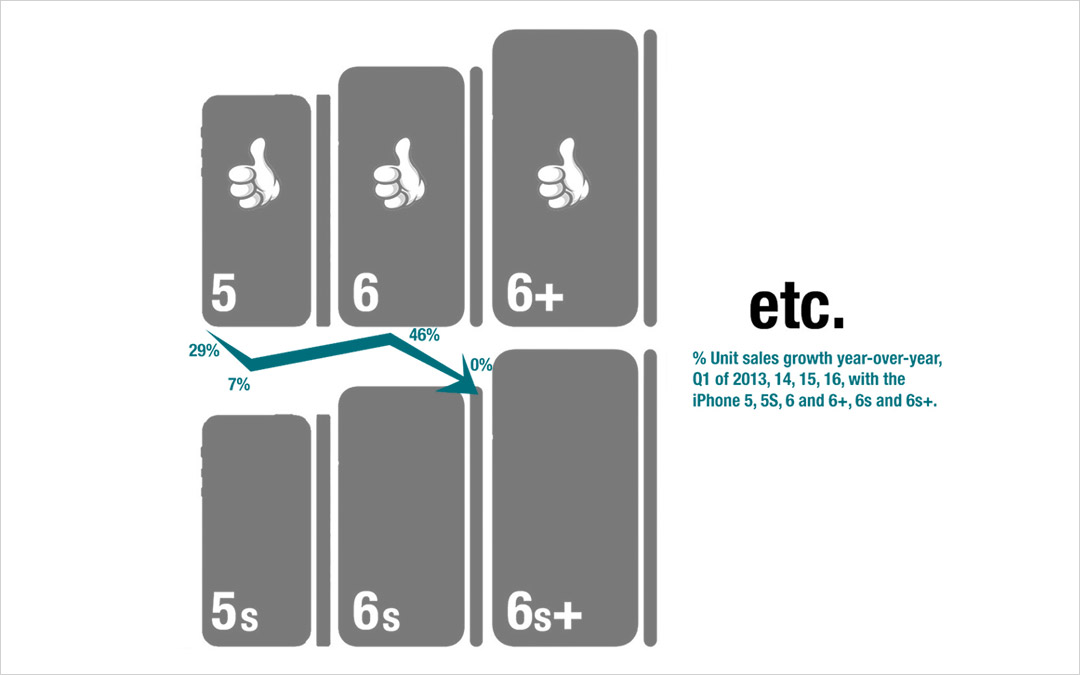

My last column focused on growth, and the risks inherent in a Growth stall. As I mentioned then, Apple will enter a Growth Stall if its revenue declines year-over-year in the current quarter. This forecasts Apple has only a 7% probability of consistently growing just 2%/year in the future.

This usually happens when a company falls into Defend & Extend (D&E) management. D&E management is when the bulk of management attention, and resources, flow into protecting the “core” business by seeking ways to use sustaining innovations (rather than disruptive innovations) to defend current customers and extend into new markets. Unfortunately, this rarely leads to high growth rates, and more often leads to compressed margins as growth stalls. Instead of working on breakout performance products, efforts are focused on ways to make new versions of old products that are marginally better, faster or cheaper.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

Using the D&E lens, we can identify what looks like a sea change in Apple’s strategy.

For example, Apple’s CEO has trumpeted the company’s installed base of 1B iPhones, and stated they will be a future money maker. He bragged about the 20% growth in “services,” which are iPhone users taking advantage of Apple Music, iCloud storage, Apps and iTunes. This shows management’s desire to extend sales to its “installed base” with sustaining software innovations. Unfortunately, this 20% growth was a whopping $1.2B last quarter, which was 2.4% of revenues. Not nearly enough to make up for the decline in “core” iPhone, iPad or Mac sales of approximately $9.5B.

Apple has also been talking a lot about selling in China and India. Unfortunately, plans for selling in India were at least delayed, if not thwarted, by a decision on the part of India’s regulators to not allow Apple to sell low cost refurbished iPhones in the country. Fearing this was a cheap way to dispose of e-waste they are pushing Apple to develop a low-cost new iPhone for their market. Either tactic, selling the refurbished products or creating a cheaper version, are efforts at extending the “core” product sales at lower margins, in an effort to defend the historical iPhone business. Neither creates a superior product with new features, functions or benefits – but rather sustains traditional product sales.

Of even greater note was last week’s announcement that Apple inked a partnership with SAP to develop uses for iPhones and iPads built on the SAP ERP (Enterprise Resource Planning) platform. This announcement revealed that SAP would ask developers on its platform to program in Swift in order to support iOS devices, rather than having a PC-first mentality.

This announcement builds on last year’s similar announcement with IBM. Now 2 very large enterprise players are building applications on iOS devices. This extends the iPhone, a product long thought of as great for consumers, deeply into enterprise sales. A market long dominated by Microsoft. With these partnerships Apple is growing its developer community, while circumventing Microsoft’s long-held domain, promoting sales to companies as well as individuals.

And Apple has shown a willingness to help grow this market by introducing the iPhone 6se which is smaller and cheaper in order to obtain more traction with corporate buyers and corporate employees who have been iPhone resistant. This is a classic market extension intended to sustain sales with more applications while making no significant improvements in the “core” product itself.

And Apple’s CEO has said he intends to make more acquisitions – which will surely be done to shore up weaknesses in existing products and extend into new markets. Although Apple has over $200M of cash it can use for acquisitions, unfortunately this tactic can be a very difficult way to actually find new growth. Each would be targeted at some sort of market extension, but like Beats the impact can be hard to find.

Remember, after all revenue gains and losses were summed, Apple’s revenue fell $7.6B last quarter. Let’s look at some favorite analyst acquisition targets to explain:

- Box could be a great acquisition to help bring more enterprise developers to Apple. Box is widely used by enterprises today, and would help grow where iCloud is weak. IBM has already partnered with Box, and is working on applications in areas like financial services. Box is valued at $1.45B, so easily affordable. But it also has only $300M of annual revenue. Clearly Apple would have to unleash an enormous development program to have Box make any meaningful impact in a company with over $500B of revenue. Something akin of Instagram’s growth for Facebook would be required. But where Instagram made Facebook a pic (versus words) site, it is unclear what major change Box would bring to Apple’s product lines.

- Fitbit is considered a good buy in order to put some glamour and growth onto iWatch. Of course, iWatch already had first year sales that exceeded iPhone sales in its first year. But Apple is now so big that all numbers have to be much bigger in order to make any difference. With a valuation of $3.7B Apple could easily afford FitBit. But FitBit has only $1.9B revenue. Given that they are different technologies, it is unclear how FitBit drives iWatch growth in any meaningful way – even if Apple converted 100% of Fitbit users to the iWatch. There would need to be a “killer app” in development at FitBit that would drive $10B-$20B additional annual revenue very quickly for it to have any meaningful impact on Apple.

- GoPro is seen as a way to kick up Apple’s photography capabilities in order to make the iPhone more valuable – or perhaps developing product extensions to drive greater revenue. At a $1.45B valuation, again easily affordable. But with only $1.6B revenue there’s just not much oomph to the Apple top line. Even maximum Apple Store distribution would probably not make an enormous impact. It would take finding some new markets in industry (enterprise) to build on things like IoT to make this a growth engine – but nobody has said GoPro or Apple have any innovations in that direction. And when Amazon tried to build on fancy photography capability with its FirePhone the product was a flop.

- Tesla is seen as the savior for the Apple Car – even though nobody really knows what the latter is supposed to be. Never mind the actual business proposition, some just think Elon Musk is the perfect replacement for the late Steve Jobs. After all the excitement for its products, Tesla is valued at only $28.4B, so again easily affordable by Apple. And the thinking is that Apple would have plenty of cash to invest in much faster growth — although Apple doesn’t invest in manufacturing and has been the king of outsourcing when it comes to actually making its products. But unfortunately, Tesla has only $4B revenue – so even a rapid doubling of Tesla shipments would yield a mere 1.6% increase in Apple’s revenues.

- In a spree, Apple could buy all 4 companies! Current market value is $35B, so even including a market premium $55B-$60B should bring in the lot. There would still be plenty of cash in the bank for growth. But, realize this would add only $8B of annual revenue to the current run rate – barely 25% of what was needed to cover the gap last quarter – and less than 2% incremental growth to the new lower run rate (that magic growth percentage to pull out of a Growth Stall mentioned earlier in this column.)

Such acquisitions would also be problematic because all have P/E (price/earnings) ratios far higher than Apple’s 10.4. FitBit is 24, GoPro is 43, and both Box and Tesla are infinite because they lose money. So all would have a negative impact on earnings per share, which theoretically should lower Apple’s P/E even more.

Acquisitions get the blood pumping for investment bankers and media folks alike – but, truthfully, it is very hard to see an acquisition path that solves Apple’s revenue problem.

All of Apple’s efforts big efforts today are around sustaining innovations to defend & extend current products. No longer do we hear about gee whiz innovations, nor do we hear about growth in market changing products like iBeacons or ApplePay. Today’s discussions are how to rejuvenate sales of products that are several versions old. This may work. Sales may recover via growth in India, or a big pick-up in enterprise as people leave their PCs behind. It could happen, and Apple could avoid its Growth Stall.

But investors have the right to be concerned. Apple can grow by defending and extending the iPhone market only so long. This strategy will certainly affect future margins as prices, on average, decline. In short, investors need to know what will be Apple’s next “big thing,” and when it is likely to emerge. It will take something quite significant for Apple to maintain it’s revenue, and profit, growth.

The good news is that Apple does sell for a lowly P/E of 10 today. That is incredibly low for a company as profitable as Apple, with such a large installed base and so many market extensions – even if its growth has stalled. Even if Apple is caught in the Innovator’s Dilemma (i.e. Clayton Christensen) and shifting its strategy to defending and extending, it is very lowly valued. So the stock could continue to perform well. It just may never reach the P/E of 15 or 20 that is common for its industry peers, and investors envisioned 2 or 3 years ago. Unless there is some new, disruptive innovation in the pipeline not yet revealed to investors.

by Adam Hartung | Feb 12, 2015 | Current Affairs, Disruptions, Innovation, Leadership, Web/Tech

Despite huge fanfare at launch, after a few brief months Google Glass is no longer on the market. The Amazon Fire Phone was also launched to great hype, yet sales flopped and the company recently took a $170M write off on inventory.

Fortune mercilessly blamed Fire Phone’s failure on CEO Jeff Bezos. The magazine blamed him for micromanaging the design while overspending on development, manufacturing and marketing. To Fortune the product was fatally flawed, and had no chance of success according to the article.

Similarly, the New York Times blasted Google co-founder and company leader Sergie Brin for the failure of Glass. He was held responsible for over-exposing the product at launch while not listening to his own design team.

Both these articles make the common mistake of blaming failed new products on (1) the product itself, and (2) some high level leader that was a complete dunce. In these stories, like many others of failed products, a leader that had demonstrated keen insight, and was credited with brilliant work and decision-making, simply “went stupid” and blew it. Really?

Unfortunately there are a lot of new products that fail. Such simplistic explanations do not help business leaders avoid a future product flop. But there are common lessons to these stories from which innovators, and marketers, can learn in order to do better in the future. Especially when the new products are marketplace disrupters; or as they are often called, “game changers.”

Do you remember Segway? The two wheeled transportation device came on the market with incredible fanfare in 2002. It was heralded as a game changer in how we all would mobilize. Founders predicted sales would explode to 10,000 units per week, and the company would reach $1B in sales faster than ever in history. But that didn’t happen. Instead the company sold less than 10,000 units in its first 2 years, and less than 24,000 units in its first 4 years. What was initially a “really, really cool product” ended up a dud.

There were a lot of companies that experimented with Segways. The U.S. Postal Service tested Segways for letter carriers. Police tested using them in Chicago, Philadelphia and D.C., gas companies tested them for Pennsylvania meter readers, and Chicago’s fire department tested them for paramedics in congested city center. But none of these led to major sales. Segway became relegated to niche (like urban sightseeing) and absurd (like Segway polo) uses.

Segway tried to be a general purpose product. But no disruptive product ever succeeds with that sort of marketing. As famed innovation guru Clayton Christensen tells everyone, when you launch a new product you have to find a set of unmet needs, and position the new product to fulfill that unmet need better than anything else. You must have a very clear focus on the product’s initial use, and work extremely hard to make sure the product does the necessary job brilliantly to fulfill the unmet need.

Nobody inherently needed a Segway. Everyone was getting around by foot, bicycle, motorcycle and car just fine. Segway failed because it did not focus on any one application, and develop that market as it enhanced and improved the product. Selling 100 Segways to 20 different uses was an inherently bad decision. What Segway needed to do was sell 100 units to a single, or at most 2, applications.

Segway leadership should have studied the needs deeply, and focused all aspects of the product, distribution, promotion, training, communications and pricing for that single (or 2) markets. By winning over users in the initial market Segway could have made those initial users very loyal, outspoken customers who would recommend the product again and again – even at a $4,000 price.

Segway should have pioneered an initial application market that could grow. Only after that could Segway turn to a second market. The first market could have been using Segway as a golfer’s cart, or as a walking assist for the elderly/infirm, or as a transport device for meter readers. If Segway had really focused on one initial market, developed for those needs, and won that market it would have started a step-wise program toward more applications and success. By thinking the general market would figure out how to use its product, and someone else would develop applications for specific market needs, Segway’s leaders missed the opportunity to truly disrupt one market and start the path toward wider success.

The Fire Phone had a great opportunity to grow which it missed. The Fire Phone had several features making it great for on-line shopping. But the launch team did not focus, focus, focus on this application. They did not keep developing apps, databases and ways of using the product for retailing so that avid shoppers found the Fire Phone superior for their needs. Instead the Fire Phone was launched as a mass-market device. Its retail attributes were largely lost in comparisons with other general purpose smartphones.

The Fire Phone had a great opportunity to grow which it missed. The Fire Phone had several features making it great for on-line shopping. But the launch team did not focus, focus, focus on this application. They did not keep developing apps, databases and ways of using the product for retailing so that avid shoppers found the Fire Phone superior for their needs. Instead the Fire Phone was launched as a mass-market device. Its retail attributes were largely lost in comparisons with other general purpose smartphones.

People already had Apple iPhones, Samsung Galaxy phones and Google Nexus phones. Simultaneously, Microsoft was pushing for new customers to use Nokia and HTC Windows phones. There were plenty of smartphones on the market. Another smartphone wasn’t needed – unless it fulfilled the unmet needs of some select market so well that those specific users would say “if you do …. and you need…. then you MUST have a FirePhone.” By not focusing like a laser on some specific application – some specific set of unmet needs – the “cool” features of the Fire Phone simply weren’t very valuable and the product was easy for people to pass by. Which almost everyone did, waiting for the iPhone 6 launch.

This was the same problem launching Google Glass. Glass really caught the imagination of many tech reviewers. Everyone I knew who put on Glass said it was really cool. But there wasn’t any one thing Glass did so well that large numbers of folks said “I have to have Glass.” There wasn’t any need that Glass fulfilled so well that a segment bought Glass, used it and became religious about wearing Glass all the time. And Google didn’t improve the product in specific ways for a single market application so that users from that market would be attracted to buy Glass. In the end, by trying to be a “cool tool” for everyone Glass ended up being something nobody really needed. Exactly like Segway.

Microsoft recently launched its Hololens. Again, a pretty cool gadget. But, exactly what is the target market for Hololens? If Microsoft proceeds down the road of “a cool tool that will redefine computing,” Hololens will likely end up with the same fate as Glass, Segway and Fire Phone. Hololens marketing and development teams have to find the ONE application (maybe 2) that will drive initial sales, cater to that application with enhancements and improvements to meet those specific needs, and create an initial loyal user base. Only after that can Hololens build future applications and markets to grow sales (perhaps explosively) and push Microsoft into a market leading position.

Microsoft recently launched its Hololens. Again, a pretty cool gadget. But, exactly what is the target market for Hololens? If Microsoft proceeds down the road of “a cool tool that will redefine computing,” Hololens will likely end up with the same fate as Glass, Segway and Fire Phone. Hololens marketing and development teams have to find the ONE application (maybe 2) that will drive initial sales, cater to that application with enhancements and improvements to meet those specific needs, and create an initial loyal user base. Only after that can Hololens build future applications and markets to grow sales (perhaps explosively) and push Microsoft into a market leading position.

All companies have opportunities to innovate and disrupt their markets. Most fail at this. Most innovations are thrown at customers hoping they will buy, and then simply dropped when sales don’t meet expectations. Most leaders forget that customers already have a way of getting their jobs done, so they aren’t running around asking for a new innovation. For an innovation to succeed launchers must identify the unmet needs of an application, and then dedicate their innovation to meeting those unmet needs. By building a base of customers (one at a time) upon which to grow the innovation’s sales you can position both the new product and the company as market leaders.

by Adam Hartung | Dec 24, 2014 | Defend & Extend, Disruptions

The Twelve Days of Christmas refers to an ancient festive season which begins on December 25. Colonial Americans modified this a bit by creating wreaths which they hung on neighbors’ doors on December 24 in anticipation of starting the festival of twelve days, which historically included feasts and celebrations.

Better known is the song “The Twelve Days of Christmas” which is believed to have started as a French folk rhyme, then later published in 1780 England. The song commemorates the twelve days of Christmas by offering ever grander gifts on each day of the holiday season.

So, it being Christmas Eve I am stealing this idea completely and offering my list of the 12 gifts investors would like to receive this holiday season from the companies into which they invest:

- Stop waxing eloquently about what you did last year or quarter. Yesterday has come and gone. Tell me about the future.

- Tell me about important trends that are going to impact your business. Is it demographics, aging population, the ecology movement, digitization, regulatory change, organic foods, mobility, mobile payments, nanotech, biotech… ? What are the critical trends that will impact your business going forward?

- Tell me your future scenarios. How will these trends change the way your customers and your company will behave? What are your most likely scenarios (and don’t try to be creative in an effort to preserve the status quo!)

- Tell me how the game will change for your industry over the next 1, 3, and 5 years. How will things be different for the industry, based on the trends and scenarios. The world is a fast changing place, and I want to know how this will change your industry.

- Tell me about the customers you lost last year. I gain no value from hearing about, or from, your favorite customers that love what currently do. Instead, bring me info on the customers who are buying alternative products, changing their behaviors, in ways that might impact sales. Even if these changes are only a small percentage of revenue.

- Tell me who the competitors are that are trying to change the game. Don’t tell me that these companies will fail. Tell me who the folks are that are really trying to do something new and different.

- Tell me about the fringe competitors. The ones you constantly say do not matter because they are small, or not part of the historical industry, or from some distant location where you don’t now compete. Tell me about the companies doing the new things which are seen as remote and immaterial, but are nibbling at the edges of the market.

- Tell me how you are reacting to potential game changers in your market. What are your plans to deal with disruptive competitors and disruptive innovations affecting your way of doing business? Other than working harder, faster, cheaper and planning to do better, what are you planning to do differently?

- Tell me how you intend to be a market game changer. Tell me what you intend to do that aligns with trends and leads the company toward fulfilling future scenarios as a market leader.

- Tell me what projects you are undertaking to experiment with new forms of competition, attracting new customers and creating new markets. Tell me about your teams that are working in white space to discover new opportunities.

- Tell me how you will disrupt your own organization so the constant effort to enhance the old success formula doesn’t kill any effort to do something new and different. How will you keep these experimental white space teams from being killed, or simply starved of resources, by the organizational inertia to defend and extend the status quo.

- Tell me the goals of these project teams, and how they will be nurtured and supplemented, as well as evaluated, to lead the company in new directions. Don’t just tell me that you will measure sales or profits, but rather real goals that measure market learning and ability to understand new customer behaviors.

If investors had this transparency, rather than merely reams and reams of historical data, just imagine how much smarter we could all invest.

Happy Holidays!

by Adam Hartung | Sep 30, 2014 | Current Affairs, Disruptions, In the Rapids, Innovation, Leadership, Web/Tech

Will the new Apple Pay product, revealed on iPhone 6 devices, succeed? There have been many entries into the digital mobile payments business, such as Google Wallet, Softcard (which had the unfortunate initial name of ISIS,) Square and Paypal. But so far, nobody has really cracked the market as Americans keep using credit cards, cash and checks.

But that looks like it might change, and Apple has a pretty good chance of making Apple Pay a success.

First, a look at some critical market changes. For decades we all thought credit card purchases were secure. But that changed in 2013, and picked up steam in 2014. With regularity we’ve heard about customer credit card data breaches at various retailers and restaurants. Smaller retailers like Shaw’s, Star Markets and Jewel caused some mild concern. But when top tier retailers like Target and Home Depot revealed security problems, across millions of accounts, people really started to notice. For the first time, some people are thinking an alternative might be a good idea, and they are considering a change.

In other words, there is now an underserved market. For a long time people were very happy using credit cards. But now, they aren’t as happy. There are people, still a minority, who are actively looking for an alternative to cash and credit cards. And those people now have a need that is not fully met. That means the market receptivity for a mobile payment product has changed.

Second let’s look at how Paypal became such a huge success fulfilling an underserved market. When people first began on-line buying transactions were almost wholly credit cards. But some customers lacked the ability to use credit cards. These folks had an underserved need, because they wanted to buy on-line but had no payment method (mailing checks or cash was risky, and COD shipments were costly and not often supported by on-line vendors.) Paypal jumped into that underserved market.

Quickly Paypal tied itself to on-line vendors, asking them to support their product. They went less to people who were underserved, and mostly to the infrastructure which needed to support the product. By encouraging the on-line retailers they could expand sales with Paypal adoption, Paypal gathered more and more sites. The 2002 acquisition by eBay was a boon, as it truly legitimized Paypal in minds of consumers and smaller on-line retailers.

After filling the underserved market, Paypal expanded as a real competitor for credit cards by adding people who simply preferred another option. Today Paypal accounts for $1 of every $6 spent on-line, a dramatic statistic. There are 153million Paypal digital wallets, and Paypal processes $203B of payments annually. Paypal supports 26 currencies, is in 203 markets, has 15,000 financial institution partners – all creating growth last year of 19%. A truly outstanding success story.

Back to traditional retail. As mentioned earlier, there is an underserved market for people who don’t want to use cash, checks or credit cards. They seek a solution. But just as Paypal had to obtain the on-line retailer backing to acquire the end-use customer, mobile payment company success relies on getting retailers to say they take that company’s digital mobile payment product.

Here is where Apple has created an advantage. Few end-use customers are terribly aware of retail beacons, the technology which has small (sometimes very small) devices placed in a store, fast food outlet, stadium or other environment which sends out signals to talk to smartphones which are in nearby proximity. These beacons are an “inside retail” product that most consumer don’t care about, just like they don’t really care about the shelving systems or price tag holders in the store.

Launched with iOS 7, Apple’s iBeacon has become the leader in this “recognize and push” technology. Since Apple installed Beacons in its own stores in December, 2013 tens of thousands of iBeacons have been installed in retailers and other venues. Macy’s alone installed 4,000 in 2014. Increasingly, iBeacons are being used by retailers in conjunction with consumer goods manufacturers to identify who is shopping, what they are buying, and assist them with product information, coupons and other purchase incentives.

Thus, over the last year Apple has successfully been courting the retailers, who are the infrastructure for mobile payments. Now, as the underserved payment issue comes to market it is natural for retailers to turn to the company with which they’ve been working on their “infrastructure” products.

Apple has an additional great benefit because it has by far the largest installed base of smartphones, and its products are very consistent. Even though Android is a huge market, and outsells iOS, the platform is not consistent because Android on Samsung is not like Android on Amazon’s Fire, for example. So when a retailer reaches out for the alternative to credit cards, Apple can deliver the largest number of users. Couple that with the internal iBeacon relationship, and Apple is really well positioned to be the first company major retailers and restaurants turn to for a solution – as we’ve already seen with Apple Pay’s acceptance by Macy’s, Bloomingdales, Duane Reed, McDonald’s Staples, Walgreen’s, Whole Foods and others.

This does not guarantee Apple Pay will be the success of Paypal. The market is fledgling. Whether the need is strong or depth of being underserved is marked is unknown. How consumers will respond to credit card use and mobile payments long-term is impossible to gauge. How competitors will react is wildly unpredictable.

But, Apple is very well positioned to win with Apple Pay. It is being introduced at a good time when people are feeling their needs are underserved. The infrastructure is primed to support the product, and there is a large installed base of users who like Apple’s mobile products. The pieces are in place for Apple to disrupt how we pay for things, and possibly create another very, very large market. And Apple’s leadership has a history of successfully managing disruptive product launches, as we’ve seen in music (iPod,) mobile phones (iPhone) and personal technology tools (iPad.)

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.