by Adam Hartung | Jun 30, 2017 | Innovation, Lifecycle

Tuesday American celebrates Independence Day, and the decision to break away as a colony from England. Since then America has been on quite a growth journey, and today most Americans cannot imagine a world where the USA is not the dominant power. They were born post World War II and simply believe that America was once the great world power, and always will be. Like it is some God-given immutable right.

But it’s not.

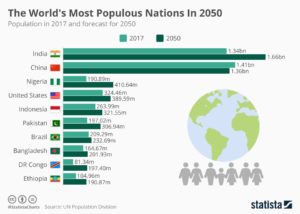

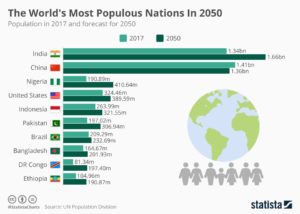

Statista, UN Division

From the early 1800s well into the middle 1900s America had one of the fastest population growth rates in the world. “Bring us your tired, your poor, your huddled masses yearning to breathe free” is on the Statue of Liberty for no small reason – America accepted floods of immigrants from around the world as westward expansion and the industrial age created huge opportunity for everyone. People flooded America, and many people had very large families. Well into the 1900s it was not uncommon for people to have 6, 8 or 10 siblings.

- Boomers were raised being told “eat your dinner, there’s a starving child in India who would love to have that. India struggled to build its own economy after Ghandi evicted the English. And in the 1950s and 1960s it was a remarkably poor country. But today, India is a thriving, growing advanced society. Yes, there are still many poor in India. But it is no longer a country to be pooh-poohed as an also ran. It has a flourishing economy, advanced home developed technology and a sophisticated military. Today about 15% of Indians are Muslim; so about 175M people. But the Muslim population is the fastest growing, and by 2050 there will be 310M Indian Muslims, or a population about 80% the size of the entire United States.

- American’s treat Africa as the home of former slaves. Far too many Americans simply ignore the continent and its issues of civil wars and genocide entirely – as if it is unimportant. However, by 2050 there will be more people in Nigeria than America. Today about half of Nigerians are Muslim. By 2050 that will grow to 60%, or 245M, which will be almost 2/3 the entire U.S. population. Additionally, Nigeria is an oil rich country that is a major player in energy markets. And a strong trading partner with China.

- Americans think of countries like Indonesia and Pakistan as small and remote. But by 2050 these two countries will have 630M people, which will be 50% more than the USA. And their populations are almost entirely Muslim. Additionally, Indonesia is an oil rich country that is also a major player in energy markets.

- Americans’ ignorance of Africa will be forced to change, as other African countries continue to grow. Areas Americans think of as barren, poverty-stricken wastelands in the Congo and Ethiopia will grow to over 300M people. The famine and bloodshed from internal strife will expand, creating ongoing refugee problems and spreading of global diseases.

- While China’s population is shrinking, the country’s emergence from the draconian times of Chairman Mao and his infamous Gang of Four is long gone. China is no longer a backwater country lacking infrastructure, technology or an advanced military. China now has nuclear capability, and has an active space program. The Chinese have demonstrated they can move resources very fast on everything from infrastructure projects to technology, and China is a very active investor in projects across Africa and Latin America. As American policy has retrenched from these areas, the Chinese are actively stepping in with money, one-upping the USA in using capitalism to win hearts, minds and foreign policy partners.

When the boomers were born America was rich in natural resources, had a growing economy, and had avoided the devastation that was left behind in Japan, Europe parts of southeast Asia and north Africa. India was an emerging country, finding its way after refuting colonialism. And China was off the world stage due to the inwardly focused leadership. So Americans have lived a very long time thinking that the world will always be a Christian, capitalist, democratic place where the USA’s domination could not be challenged.

But many things have changed dramatically, and many more changes are coming soon enough. In a few short years population growth will make America a relatively far smaller country. And both technology skill development and understanding how to use capitalism have unleashed dramatic growth in what were formerly derisively referred to as “emerging” countries. “Emerging” implying that America had nothing to concern itself as regards these countries.

Zulu were some of the most feared warriors in Africa. But, they had a practice of being inwardly focused. As they looked inward they did not fear external enemies, but only those who came into their inner circle. Approaching their internal circle could invite attack, and demolition. But, eventually the external enemies became too many, and too far reaching, and the inwardly focused Zulu were attacked on multiple fronts from a growing host of enemies. The Zulu lost their domination as Africa’s military leaders.

Americans must address their inclination for inwardly focusing on “what’s good for America.” It is naively affixing self-blinders to think policy decisions can be made independently of the world community, and without harmful retribution. There are a lot more “of them” than their are “of us.” And the majority of “them” have nuclear weapons just as powerful as “ours.” And “their” economies are just as strong as “ours.” In many cases actually a lot stronger. These countries can stand on their own without U.S. support, and they can implement policies which can be very destructive to U.S. economic interests globally. And they can form their own coalitions to avoid working with America.

As other countries grow, those that choose to ignore immigration and the global movement of people will be big losers. Today Japan is struggling, losing economic power annually, because it refuses to endorse a robust immigration policy. Unfortunately, the same thing cold happen to America as its population growth rate falls, and its economic growth falls with it. Outlawing sanctuary cities that help immigrants merge into American society is a misbegotten policy based on false assumptions about America’s lack of need for immigrants to remain globally competitive.

If America chooses to start all-out trade wars to protect its economy, America could be isolated and likely lose more than it gains. Where once American resources and technology were essential, that is far less true today. European countries have every bit the technology and investment skills of Americans, as do the Chinese and many other countries. Just look at how many of your beloved products, such as mobile phones, computers, TVs, and game consoles, are not made in America at all. There are ample trade opportunities between all countries to supply each other with goods and products, including commodities such as wheat, coal, oil, lumber and gold, that could bypass America entirely.

If America starts a shooting war it is far from clear that it will be as untouched as WWII. And far from clear who will “win,” especially if nuclear war ensues.

And while it is tempting to think that God is on the side of Christians, ignoring the growth of Islam is as foolish as the Romans attempting to ignore the growth of Christianity. Thinking that the growth of Islam is a “Middle Eastern problem” is a dramatic understatement of the situation. Population growth rates of Muslims are far greater globally than other religions. It is ridiculous to think that Islam will not be a major part of the world religious landscape. Thinking that Islam is a problem is hyperbole. Thinking America can isolate itself from Islam is simply an hallucination.

Demographic trends are powerful forecasters. They are very easy to predict, and almost always correct. And they foretell a lot about how we will live and work in the future. The key to good policy making is understanding these trends and working to take advantage of them for growth. Ignoring them is a perilous journey that always ends very badly. Since many of the trends are obvious, isn’t it time to plan for them effectively?

by Adam Hartung | Sep 30, 2016 | Immigration, Leadership, Lifecycle, Trends

I write about trends. Technology trends are exciting, because they can come and go fast – making big winners of some companies (Apple, Facebook, Tesla, Amazon) and big losers out of others (Blackberry, Motorola, Saab, Sears.) Leaders that predict technology trends can make lots of money, in a hurry, while those who miss these trends can fail faster than anyone expected.

But unlike technology, one of the most important trends is also the most predictable trend. That is demographics. Quite simply, it is easy to predict the population of most countries, and most states. And predict the demographic composition of countries by age, gender, ancestry, even religion. And while demographic trends are remarkably easy to predict very accurately, it is amazing how few people actually plan for them. Yet, increasingly, ignoring demographic trends is a bad idea.

Take for example the aging world population. Quite simply, in most of the world there have not been enough births to keep up with those who ar\e getting older. Fewer babies, across decades, and you end up with a population that is skewed to older age. And, eventually, a population decline. And that has a lot of implications, almost all of which are bad.

Look at Japan. Every September 19 the Japanese honor Respect for the Aged Day by awarding silver sake dishes to those who are 100 or older. In 1966, they gave out a few hundred. But after 46 straight years of adding centenarians to the population, including adding 32,000 in just the last year, there are over 65,000 people in Japan over 100 years old. While this is a small percentage, it is a marker for serious economic problems.

Over 25% of all Japanese are over 65. For decades Japan has had only 1.4 births per woman, a full third less than the necessary 2.1 to keep a population from shrinking. That means today there are only 3 people in Japan for every “retiree.” So a very large percentage of the population are no longer economically productive. They no longer are creating income, spending and growing the economy. With only 3 people to maintain every retiree, the national cost to maintain the ageds’ health and well being soon starts becoming an enormous tax, and economic strain.

What’s worse, by 2060 demographers expect that 40% of Japanese will be 65+. Think about that – there will be almost as many over 65 as under 65. Who will cover the costs of maintaining this population? The country’s infrastructure? Japan’s defense from potentially being overtaken by neighbors, such as China? How does an economy grow when every citizen is supporting a retiree in addition to themselves?

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

This means that China’s aging population problem will not recover for several more decades. Today there are 5 workers for every retiree in China. But there are already more people exiting China’s workforce than entering it each year. We can easily predict there will be both an aging, and a declining, population in China for another 40 years. Thus, by 2040 (just 24 years away) there will be only 1.6 workers for each retiree. The median age will shift from 30 to 46, making China one of the planet’s oldest populations. There will be more people over age 65 in China than the entire populations of Germany, Japan, France and Britain combined!

While it is popular to discuss an emerging Chinese middle class, that phenomenon will be short-lived as the country faces questions like – who will take care of these aging people? Who will be available to work, and grow the economy? To cover health care costs? Continued infrastructure investment? Lacking immigration, how will China maintain its own population?

“OK,” American readers are asking, “that’s them, but what about us?” In 1970 there were about 20M age 65+ in the USA. Today, 50M. By 2050, 90M. In 1980 this was 11% of the population. But 2040 it will be over 20% (stats from Population Reference Bureau.)

While this is a worrisome trend, one could ask why the U.S. problem isn’t as bad as other countries? The answer is simply immigration. While Japan and China have almost no immigration, the U.S. immigrant population is adding younger people who maintain the workforce, and add new babies. If it were not for immigration, the U.S. statistics would look far more like Asian countries.

Think about that the next time it seems appealing to reduce the number of existing immigrants, or slow the number of entering immigrants. Without immigrants the U.S. would be unable to care for its own aging population, and simultaneously unable to maintain sufficient economic growth to maintain a competitive lead globally. While the impact is a big shift in the population from European ancestry toward Latino, Indian and Asian, without a flood of immigrants America would crush (like Japan and China) under the weight of its own aging demographics.

Like many issues, what looks obvious in the short-term can be completely at odds with a long-term solution. In this case, the desire to remove and restrict immigration sounds like a good idea to improve employment and wages for American citizens. And shutting down trade with China sounds like a positive step toward the same goals. But if we look at trends, it is clear that demographic shifts indicate that the countries that maximize their immigration will actually do better for their indigenous population, while improving international competitiveness.

Demographic trends are incredibly accurately predictable. And they have enormous implications for not only countries (and their policies,) but companies. Do your forward looking plans use demographic trends to plan for:

- maintaining a trained workforce?

- sourcing products from a stable, competitive country?

- having a workplace conducive to employees who speak English as a second language?

- a workplace conducive to religions beyond Christianity?

- investing in more capital to produce more with fewer workers?

- products that appeal to people not born in the USA?

- selling products in countries with growing populations, and economies?

- paying higher costs for more retirees who live longer?

Most planning systems, unfortunately, are backward-looking. They bring forward lots of data about what happened yesterday, but precious few projections about trends. Yet, we live in an ever changing world where trends create important, large shifts – often faster than anticipated. And these trends can have significant implications. To prepare everyone should use trends in their planning, and you can start with the basics. No trend is more basic than understanding demographics.

by Adam Hartung | Apr 25, 2015 | Defend & Extend, Food and Drink, In the Rapids, In the Swamp, Innovation, Leadership, Transparency

If you don’t drink gin you may not know the brand Tanqueray, a product owned by Diageo. But Tanqueray has been around for almost 190 years, going back to the days when London Dry Gin was first created. Today Tanqueray is one of the most dominant gin brands in the world, and the leading brand in the USA.

But gin is not a growth category. And Tanqueray, despite its great product heritage and strong brand position, has almost no growth prospects.

But gin is not a growth category. And Tanqueray, despite its great product heritage and strong brand position, has almost no growth prospects.

Any product that doesn’t grow sales cannot generate profits to spend on brand maintenance. Firstly, if due to nothing more than inflation, costs always go up over time. It takes rising sales to offset higher costs. Additionally, small competitors can niche the market with new products, cutting into leader sales. And competitors will undercut the leader’s price to steal volume/share in a stagnant market, causing margin erosion.

Category growth stalls are usually linked to substitute products stealing share in a larger definition of the marketplace. For example sales of laptop/desktop PCs stalled because people are now substituting tablets and smartphones. The personal technology market is growing, but it is in the newer product category stealing sales from the older product category.

This is true for gin sales, because older drinkers – who dominate today’s gin market – are drinking less spirits, and literally dying from old age. In the overall spirits market, younger liquor drinkers have preferred vodkas and flavored vodkas which are “smoother,” sweeter, and perceived as “lighter.”

So, what is a brand manager to do? Simply let trends obsolete their product line? Milk their category and give up money for investing somewhere else?

That may sound fine at a corporate level, where category portfolios can be managed by corporate vice presidents. But if you’re a brand manager and you want to become a future V.P., managing declining product sales will not get you into that promotion. And defending market share with price cuts, rebates and deals will cut into margin, ruin the brand position and likely kill your marketing career.

Keith Scott is the Senior Brand Manager for Tanqueray, and his team has chosen to regain product growth by using sustaining innovations in a smart way to attract new customers into the gin category. They are looking beyond the currently dwindling historical customer base of London Dry Gin drinkers, and working to attract new customers which will generate category growth and incremental Tanqueray sales. He’s looking to build the brand, and the category, rather than get into a price war.

Building on demographic trends, Tanqueray’s brand management is targeting spirit drinkers from 28-38. Three new Tanqueray brand extensions are being positioned for greatest appeal to increasingly adult tastes, while offering sophistication and linkage to one of the longest and strongest spirits brands.

#1 – Tanqueray Rangpur is a highly citrus-flavored gin taking a direct assault on flavored vodkas. Although still very much a gin, with its specific herb-based taste, Rangpur adds a hefty, and uniquely flavored, dose of lime. This makes for a fast, easy to prepare gin and tonic or lime-based gimlet – 2 classic cocktails that have their roots in England but have been popular in the US since before prohibition. And, in defense of the brand, Rangpur is priced about 10-20% higher than London Dry.

#1 – Tanqueray Rangpur is a highly citrus-flavored gin taking a direct assault on flavored vodkas. Although still very much a gin, with its specific herb-based taste, Rangpur adds a hefty, and uniquely flavored, dose of lime. This makes for a fast, easy to prepare gin and tonic or lime-based gimlet – 2 classic cocktails that have their roots in England but have been popular in the US since before prohibition. And, in defense of the brand, Rangpur is priced about 10-20% higher than London Dry.

#2 – Tanqueray Old Tom and Tanqueray Milacca appeal to the demographic that loves specialty, crafted products. The “craft” product movement has grown dramatically, and nowhere more powerfully than amongst 28-42 year old beer drinkers. Old Tom and Milacca leverage this trend. Both are “retro” products, harkening to gins over 100 years ago. They are made in small batches and have limited availability. They are targeted at the consumer that wants something new, unique, unusual and yet tied to old world notions of hand-made production and high quality. These craft products are priced 25-35% higher than traditional London Dry.

#2 – Tanqueray Old Tom and Tanqueray Milacca appeal to the demographic that loves specialty, crafted products. The “craft” product movement has grown dramatically, and nowhere more powerfully than amongst 28-42 year old beer drinkers. Old Tom and Milacca leverage this trend. Both are “retro” products, harkening to gins over 100 years ago. They are made in small batches and have limited availability. They are targeted at the consumer that wants something new, unique, unusual and yet tied to old world notions of hand-made production and high quality. These craft products are priced 25-35% higher than traditional London Dry.

#3 – Tanqueray No. 10 is a “super-premium” product pointed at the customer who wants to project maximum sophistication and wealth. No 10 uses a special manufacturing process creating a uniquely smooth and slightly citrus flavor. But this process loses 40% of the product to “tailings” compared to the industry standard 10% loss. No. 10 is the high-end defense of the Tanqueray brand (a “top shelf” product as its known in the industry) priced 75-90% higher than London Dry.

No. 10 is being promoted with “invitation only” events being held in major U.S. cities such as New York, Chicago and Atlanta. No. 10 “trunk events” bring in some of the hottest, newest designers to showcase the latest in apparel trends, accompanied by hot, new musical talent. No. 10 is associated with the sophistication of super-premium brands – individualized and rare products – in a members-only environment. Targeted at the primary demographic of 28-38, No. 10 events are designed to lure these consumers to this product they otherwise might overlook .

Rather than addressing their gin category growth stall with price cuts and other sales incentives, which would lead to brand erosion, price erosion, and margin erosion, the Tanqueray brand team is leveraging trends to bring new consumers to their category and generate profitable growth. These innovative brand extensions actually build brand value while leveraging identifiable market trends. Notice that all these sustaining innovations are actually priced higher than the highest volume London Dry core product, thus augmenting price – and hopefully margin.

Too often leaders see their market stagnate and use that as an excuse lower expectations and accept sales decline. They don’t look beyond their core market for new customers and sources of growth. They react to competition with the blunt axe of pricing actions, seeking to maintain volume as margins erode and competition intensifies. This accelerates product genericization, and kills brand value.

The Tanqueray brand team demonstrates how critical sustaining innovation can be for maintaining growth at all levels of an organization. Even the level of a single product or brand. They are using sustaining innovations to lure in new customers and grow the brand umbrella, while growing the category and achieving desired price realization. This is a lesson many brands, and companies, should emulate.

by Adam Hartung | Dec 18, 2014 | Current Affairs, Defend & Extend, Food and Drink, Leadership, Lifecycle

It is that time of year when many of us celebrate with an alcoholic beverage. But increasingly in America, that beverage is not beer. Since 2008, American beer sales have fallen about 4%.

But that decline has not been equally applied to all brands. The biggest, old line brands have suffered terribly. Nearly gone are old brands like Milwaukee’s Best, which were best known for being low priced – and certainly not focused on taste. But the most hurt, based on volume declines, have been what were once the largest brands; Budweiser, Miller Lite and Miller High Life. These have lost more than a quarter of their volume, losing a whopping 13million barrels/year of demand. These 3 brand declines account for 6% reduction in the entire beer market.

The popular myth is that this has been due to the rise of craft beers. And there is no doubt, craft beer sales have done well. Sales are up 80%. Many articles (including the WSJ)tout the growth of craft beers, which are ostensibly more tasty and appealing, as being the reason old-line brands have declined. It is an easy explanation to accept, and has largely gone unchallenged. Even the brewer of Budweiser, Annheuser-Busch InBev, has reacted to this argument by taking the incredible action of dropping clydesdale horses from their ads after 81 years – in an effort to woo craft beer drinkers, which are thought to be younger and less sentimental about large horses.

This all makes sense. Too bad it’s the wrong conclusion – and the wrong actions being taken.

Realize that craft beer sales are up from a small base, and today ALL craft beer sales still account for only 7.6% of the market. In fact, ALL craft beers combined sell only the same volume as the now smaller Budweiser. The problem with Budweiser sales – and sales of other big name brand beers – is a change in demographics.

Drinkers of Budweiser and Lite are simply older. These brands rose to tremendous dominance in the 1970s. Many of those who loved this brand are simply older – or dead. Where a hard working fellow in his 30s or 40s might enjoy a six pack after work, today that Boomer (if still alive) is somewhere between late 50s and 70s. Now, a single beer, or maybe two, will suffice thank you very much. And, equally challenging for sales, today’s Boomer is more often drinking a hard liquor cocktail, and a glass of wine with dinner. Beer drinking has its place, but less often and in lower quantities.

Meanwhile, Hispanics are a growing demographic. Hispanics are the largest non-white population in America, at 54million, and represent over 17% of all Americans. With a growth rate of 2.1%, Hispanics are also one of the fastest growing demographic segments – and increasingly important given their already large size. Hispanics are truly becoming a powerful buying group in American economics.

So, just as decline in Boomer population and consumption has hurt the once great beer brands, we can look at the growth in Hispanic demographics and see a link to sales of growing brands. Two significant (non-craft volume) beer brands that more than doubled sales since 2008 are Modelo Especial and Dos Equis. In fact, these were the 2 fastest growing brands in America, even though the first does no English language advertising at all, and the latter only lightly funds advertising with an iconic multi-year campaign. Together their sales total almost 5.4M barrels – which makes these 2 brands equal to 1/3 the ENTIRE craft beer marketplace. And growing 33% faster!

Chasing the myth of craft sales is doing nothing for InBev and MillerCoors as they try to defend and extend outdated brands. On the other hand, Heineken controls Dos Equis, and Constellation Brands controls Modello Especial. These two companies are squarely aligned with demographic trends, and well positioned for growth.

So, be careful the next time you hear some simple explanation for why a product or service is declining. The answer might sound appealing, but have little economic basis. Instead, it is much smarter to look at big trends and you’ll likely see why in the same market one product is growing, while another is declining. Trends – such as demographics – often explain a lot about what is happening, and lead you to invest much smarter.

by Adam Hartung | Feb 5, 2013 | Current Affairs, Food and Drink, Innovation, Leadership, Sports, Television

Reading reviews of Super Bowl ads I was struck by two observations:

- The reviewers got the value of most ads backwards

- They missed the most important ad of all – on Twitter

Super Bowl ads cost $1M+ to make. Then they cost $2M+ to air. So it is an expensive proposition. This isn't fine art, like a Picasso, with a long shelf life to create a rate of return. These ads need to pay off fast. They need to build the brand with existing and/or new customers to drive sales and make back that money now.

So let's start with one of the best reviewed ads – Chrysler's "God Made a Farmer". Reviewers liked the home-spun approach of using a dead conservative radio commentator voicing over pictures of farmers in pick-ups. Unfortunately, from a rate of return perspective my bet is this ad will end up near the very bottom.

- Firstly, the 50 year trend is to urbanization. In 1900 9 out of 10 Americans had something to do with agriculture. Now it is fewer than 1 in 20. Trucks are used for lots of things, but farming makes up a small percentage. It has been a full generation since most 2nd generation Americans had anything to do with a farm. Showing people using a product in ways that almost nobody uses it, and with a message most of your target market doesn't even recognize, leaves most people confused rather than ready to buy.

- Secondly, first generation Americans are changing the demographics of America quickly. First generation Americans (can I say immigrant?) proved large enough, and powerful enough, to play a spoiler role in Mitt Romney's run for the Presidency. To them, farming in America has no history, appeal or meaning to their lives.

- Thirdly, no one under the age of 35 has any idea who Paul Harvey is. Perhaps Chrysler could have used Bill O'Reilly and achieved its message mission. But as it was, there were two of us +50 people who spent 5 minutes trying to tell the group watching the game at my home who Paul Harvey even was – and why he was being quoted.

A 24 year old boy watching the game with me in suburban Chicago listened to my explanation about Paul Harvey and farming. He drives a Ford F-250 4×4 pick-up. After I finished he looked me square in the eyes and said "Swing, and a miss." And that's what I'd say to Chrysler. Whoever made this ad had more money than market research and common sense.

Simultaneously, reviewers hated GoDaddy.com's "Perfect Match, Bar Rafieli's Big Kiss." This portrayed a very stereotypical engineer enjoying a long kiss with a pretty girl – referring to how the company's products well serve client needs. Reviewers found the ad in bad taste. My bet is this ad will have immediate payback for GoDaddy.com

Have you ever heard of the monstrously successful situation comedy "The Big Bang Theory?" At just about any time you can find this in reruns on at least one, if not more than one, cable channel. The show is so successful that to pull people viewers to its Monday night schedule CBS actually chose to rerun "Big Bang" episodes amidst new episodes of its other programs in January. The show thrives on the tension of male technical professionals seeking to solve the age old question of how a man can appeal to desirable ladies. Politically correct or not, the show is successful because it is a timeless message. Most boys want to be liked by girls.

Today the world of people who have technical, or quasi-technical jobs, is HUGE. GoDaddy's target audience of people buying, and servicing, web domains just happens to be mostly male under-40 men with technical or quasi-technical backgrounds. This little, tasteless demonstration may have upset the high ethics of ad execs (or has "Mad Men" unraveled that myth?) but to its target group this ad was pure gold. And same for GoDaddy.com.

But most importantly, none of these ads will have the payback of 9 words a marketer tweeted when the lights went out at the game. Because it had blown a huge wad of money on a traditional game ad the Oreo brand folks at Mondelez were watching the game with their media agency 360i. Thinking quickly the creatives came up with an idea, and the brand guys approved it – so out went the tweet from Oreo Cookies "No problem. You can still dunk in the dark."

"Booya" as my young friends say. 10,000 retweets and an entire Monday news cycle devoted to the quick thinking folks who posted this tweet. ROI? Given that the incremental cost was zero, pretty darn high. If I was investing, I'd take the tweet over the video. The equivalent of a kick return for a TD.

The world has changed. We now live in a 24×7, real-time, always-on world. We no longer wait for the weekly magazine for analysis, or the daily newspaper for information. Or even the 11:00 television daily recap. We pick up alerts on our mobile devices constantly. Receive highlights from friends on Facebook and Twitter. We want our information NOW. And those who connect to this new way of living for providing us information are not only accepted, but admired by those thriving on the social networks.

This year's Super Bowl social media postings were triple last year's; over 30million. This is the world of immediate feedback. Immediate discussion. And the place were ads need to be immediate as well. Those who understand this, and connect to it, will succeed. Others, who spend too much to make and then distribute ads on traditional media, will not. Just as newspaper ads have lost of their relevance – TV ads are destined for the same conclusion.

The good news is that Mondelez and its Oreos team was ready, and willing, to take advantage. Where were most of the other advertisers? Audi, VW and P&G's Tide also jumped in. But of all those millions spent on once-run ads, these major corporate advertisers – and their extremely highly paid ad agencies – were absent. When the easy money was to be made, they simply weren't there. Off drinking beer and watching the game when they should have been working!

Today we learned Twitter is buying Bluefin to make its information on who is tweeting, about what, in real time even better. This will be helpful for any smart advertiser. And not just the multi-billion dollar giants. The good news is anyone, anywhere in any size company can play in this real-time, on-line social media world. You don't have to be huge, or rich.

Where were you when the lights went out? Were you taking advantage of what we may later call a "once in a lifetime" opportunity?

Where will you be the next time? Are you ready to invest in the new world of social media advertising? Or are you stuck spending too much to come in too late?

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.

Government policies had a lot to do with creating this aging trend. For example in China there was a 1 child per family policy from 1978 to 2015 – 37 years. The result is a massive population of people born prior to 1978 (their own “baby boom”) who are ready to retire. But there are now far fewer people available to replace this workforce. Worse, the 1 child policy also caused young families to abort – or even kill – baby girls, thus causing the population to skew heavily male, and reduce the available women to reproduce.