by Adam Hartung | Mar 9, 2015 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership

Best Buy, the venerable electronics retailer, is hitting 52 week highs. Coming off a low of $24 in April, 2014 the current price of about $40 is a 67% increase in just 10 months. Analysts are now cheering investors to own the stock, with Marketwatch pronouncing that the last bearish analyst has thrown in the towel.

If you are a trader, perhaps you want to consider this stock. But if you aren’t an investment professional, and you buy and hold stocks for years, then Best Buy is not a stock you should own.

The bullish case for owning Best Buy is based on recovering sales per store, and recovering earnings, after a reduction in the number of stores, and employees, lowered costs. Further, with Radio Shack now in bankruptcy sales are showing an uptick as customers swing over. And that is expected to continue as Sears closes more stores on its marches toward bankruptcy. Additionally, it is hoped that lower gasoline prices will allow consumers to spend more on electronics and appliances at Best Buy.

But, this completely ignores the trend toward on-line retail sales, and the long-term deleterious impact this trend will have on Best Buy. According to the U.S. Census Bureau, on-line sales as a percent of all retail have grown from less than 2.4% in 2005 to over 7.6% by end of 2014 – more than tripling! But more critical to this discussion, all retail sales includes automobiles, lumber, groceries – lots of things where there is little or no online volume.

As most folks know, the number one category for online sales is computers and consumer electronics, which consistently accounts for about 20% of ALL online retail. In fact, about 25% of all consumer electronics are sold online. So the growth in online retail is disproportionately in the Best Buy wheelhouse. The segment where Best Buy competes against streamlined online retailers such as NewEgg.com, ThinkGeek.com and the ever-dominant Amazon.com.

So while in the short term some traditional retail customers will now shift demand to Best Buy, this is not unlike the revenue “bounce” Best Buy received when Circuit City failed. Short term up, but the long term trend continued hammering away at Best Buy’s core market.

This is a big deal because the marginal economic impact of this shift is horrific to Best Buy. In traditional retail most costs are “fixed,” meaning they can’t be changed much month to month. The cost of real estate, store maintenance, utilities and staff cannot be easily adjusted – unless there is a decision to close a gob of stores. Thus losing even a few sales, what economists call “marginal” sales, wreaks havoc on earnings.

Back in 2010 and 2011 Best Buy made a net income (’12 and ’13 were losses) of about 2.6% – or about $2.60 on every $100 revenue. Cost of Goods sold is about 75% of revenue. So on $100 of revenue, $25 is available to cover fixed costs. If revenue falls by just $10, Best Buy loses $2.50 of margin to cover fixed costs. Remember, however, that the net income is only $2.60. So losing 10% of revenue ($10 out of the $100) means Best Buy loses $2.50 of contribution to fixed costs, and that is deducted from net income of $2.60, leaving Best Buy with a meager 10cents of profitability. A 10% loss of revenue wipes out 96% of profits!

Now you know why retailers who lose even a small part of their sales are suddenly closing stores right and left.

Looking forward, online retail sales are forecast to grow by another 57%, reaching 11% of total retail by 2018. But, as we know, this is disproportionately going to be driven by consumer electronics. Which means that while sales for Best Buy stores are up short term, long term they will plummet. That means there will be more store closings, and layoffs as sales shrink. And, increasingly Best Buy will have to compete head-to-head online against entrenched, leading competitors who have been stealing market share for 10+ years.

If you want to trade on the short-term uptick in revenue, and return to slight profitability, then hold your breath and see if you can outsmart the market by picking the right time, and price, for buying and selling Best Buy. But, if you like to invest in strong companies you expect to grow for another 5 years without having to be a market timer, then avoid Best Buy.

Quite simply, it is never a good idea to bet against a long term trend. Short term aberrations will happen, and it may look like the trend has changed. But the trend to online commerce is picking up steam, not reducing. If you want to invest in retail, you want to invest in those companies that demonstrate they can capture the customer’s revenue in the growing, online marketplace.

by Adam Hartung | Dec 31, 2014 | General, In the Rapids, Transparency

Results, results, results. We frequently hear that we should focus on results.

More often than not, focusing on results is a waste of time. Because it is looking in the rear view mirror, rather than the windshield.

Someone asked me today what I thought of Janet Yellen as head of the Federal Reserve. I found this hard to answer. Even though Chairperson Yellen has been in the job since February, her job as lead policy setter has almost no short term ramifications. It takes quarters – not months – to see the results of those policy decisions. Even after a year in office, it is very difficult to render an opinion on her performance as Fed leader. The fantastic 5% growth in the U.S. economy last quarter has much more to do with what happened before she took office – in fact years of policy setting before she took office – than what has happened since she became the top Fed governor.

We often forget what the word “results” means. It is the outcome of previous decisions. Results tell us something about decisions that happened in the past. Sometimes, far into the past. We all can remember companies where looking backward all looked well, right up until the company fell off a cliff. Circuit City. Brachs Candy. Sun Microsystems.

Further, “results” are impacted dramatically by things outside the control of management, such as:

- Changes in interest rates (or no changes when they remain low)

- Changes in oil prices (which have been dramatically lower the last 6 months)

- Changes in investor expectations and the overall stock market (which has been on a record-setting bull run)

- Inflation expectations (which remain at historical lows)

- Expectations about labor rates (which remain low, despite trends toward higher minimum wages)

- Technology advances (including rapid mobile growth in apps, beacons, payments, etc.)

We too often forget that last quarter’s (or even last year’s) results are due to decisions made months before. Gloating, or apologizing, about those results has little meaning. Results, no matter how recent, are meaningless when looking forward. Decisions made long ago caused those results. “Results” are actually unimportant when investing for the future.

What really matters are the decisions being made today which can cause future results to be wildly different – better or worse. What we need to focus upon are these current decisions and their ability to create future results:

- What are the goals being set for next year – or better yet for 2020?

- What are the trends upon which goals are being set? How are future goals aligned to major trends?

- What are the future expected scenarios, and how are goals being set to align with those scenarios?

- Who will be the likely future competitors, and how are goals being set make sure we the organization is prepared to compete with the right companies?

Far too often management will say “we just had great results. We plan to continue executing on our plans, and investors should expect similar future results.” But that makes no sense. The world is a fast changing place. Past results are absolutely not any indicator of future performance.

For 2015, and beyond, investors (and employees, suppliers and communities sponsoring companies) should resolve to hold management far more accountable for its future goals, and the process used to set those goals. Amazon.com maintains a valuation far higher than its historical indicates it should primarily because it is excellent at communicating key trends it watches, future scenarios it expects and how the company plans to compete as it creates those future scenarios.

In the 1981 Burt Reynolds’ movie “Cannonball Run” a character begins a trans-country auto race by ripping the rear view mirror from his car and throwing it out the window. “What’s behind me is not important” he proudly states. This should be the 2015 resolution of investors, and all leaders. Past results are not important. What matters are plans for the future, and future goals. Only by focusing on those can we succeed in creating growth and better results in the future.

by Adam Hartung | May 30, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Sports, Web/Tech

Anyone who reads my column knows I’ve been no fan of Steve Ballmer as CEO of Microsoft. On multiple occasions I chastised him for bad decisions around investing corporate funds in products that are unlikely to succeed. I even called him the worst CEO in America. The Washington Post even had difficulty finding reputable folks to disagree with my argument.

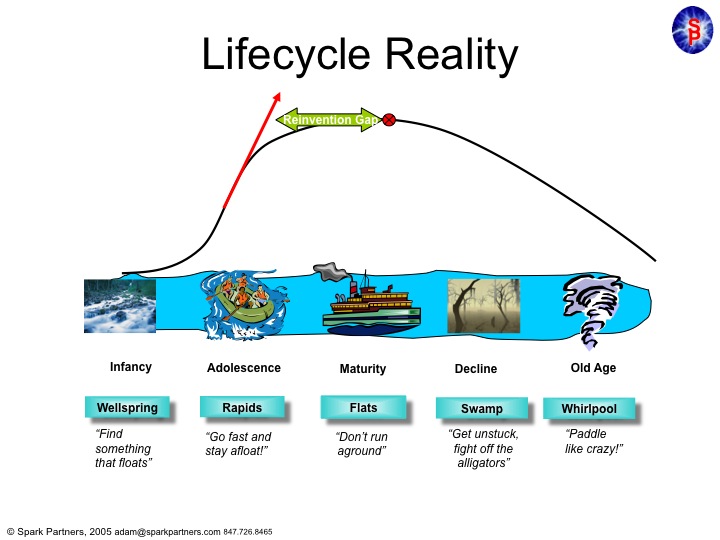

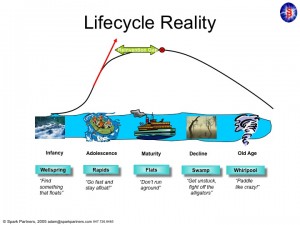

Unfortunately, Microsoft suffered under Mr. Ballmer. And Windows 8, as well as the Surface tablet, have come nowhere close to what was expected for their sales – and their ability to keep Microsoft relevant in a fast changing personal technology marketplace. In almost all regards, Mr. Ballmer was simply a terrible leader, largely because he had no understanding of business/product lifecycles.

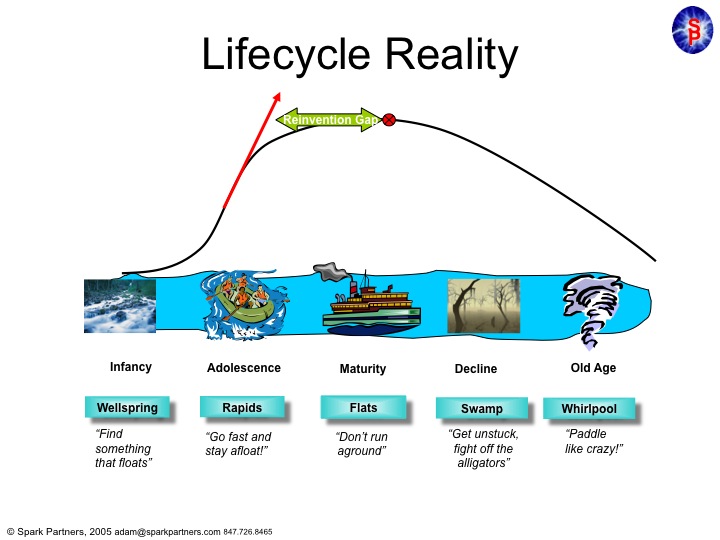

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Under Mr. Gates leadership Microsoft single-handedly overtook the original PC innovator – Apple – and left it a niche company on the edge of bankruptcy in little over a decade.

Mr. Gates kept Microsoft’s growth constantly in the double digits by not only making superior operating system software, but by pushing the company into application software which dominated the desktop (MS Office.) And when the internet came along he had the vision to be out front with Internet Explorer which crushed early innovator, and market maker, Netscape.

But then Mr. Gates turned the company over to Mr. Ballmer. And Mr. Ballmer was a leader lacking vision, or innovation. Instead of pushing Microsoft into new markets, as had Mr. Gates, he allowed the company to fixate on constant upgrades to the products which made it dominant – Windows and Office. Instead of keeping Microsoft in the Rapids of growth, he offered up a leadership designed to simply keep the company from going backward. He felt that Microsoft was a company that was “mature” and thus in need of ongoing enhancement, but not much in the way of real innovation. He trusted the market to keep growing, indefinitely, if he merely kept improving the products handed him.

As a result Microsoft stagnated. A “Reinvention Gap” developed as Vista, Windows 7, then Windows 8 and one after another Office updates did nothing to develop new customers, or new markets. Microsoft was resting on its old laurels – monopolistic control over desktop/laptop markets – without doing anything to create new markets which would keep it on the old growth trajectory of the Gates era.

Things didn’t look too bad for several years because people kept buying traditional PCs. And Ballmer famously laughed at products like Linux or Unix – and then later at entertainment devices, smart phones and tablets – as Microsoft launched, but then abandoned products like Zune, Windows CE phones and its own tablet. Ballmer kept thinking that all the market wanted was a faster, cheaper PC. Not anything really new.

And he was dead wrong. The Reinvention Gap emerged to the public when Apple came along with the iPod, iTunes, iPhone and iPad. These changed the game on Microsoft, and no longer was it good enough to simply have a better edition of an outdated technology. As PC sales began declining it was clear that Ballmer’s leadership had left the company in the Swamp, fighting off alligators and swatting at mosquitos with no strategy for how it would regain relevance against all these new competitors.

So the Board pushed him out, and demoted Gates off the Chairman’s throne. A big move, but likely too late. Fewer than 7% of companies that wander into the Swamp avoid the Whirlpool of demise. Think Univac, Wang, Lanier, DEC, Cray, Sun Microsystems (or Circuit City, Montgomery Wards, Sears.) The new CEO, Satya Nadella, has a much, much more difficult job than almost anyone thinks. Changing the trajectory of Microsoft now, after more than a decade creating the Reinvention Gap, is a task rarely accomplished. So rare we make heros of leaders who do it (Steve Jobs, Lou Gerstner, Lee Iacocca.)

So what will happen at the Clippers?

Critically, owning an NBA team is nothing like competing in the real business world. It is a closed marketplace. New competitors are not allowed, unless the current owners decide to bring in a new team. Your revenues are not just dependent upon you, but are even shared amongst the other teams. In fact your revenues aren’t even that closely tied to winning and losing. Season tickets are bought in advance, and with so many games away from home a team can do quite poorly and still generate revenue – and profit – for the owner. And this season the Indiana Pacers demonstrated that even while losing, fans will come to games. And the Philadelphia 76ers drew crowds to see if they would set a new record for the most consecutive games lost.

In America the major sports only modestly overlap, so you have a clear season to appeal to fans. And even if you don’t make it into the playoffs, you still share in the profits from games played by other teams. As a business, a team doesn’t need to win a championship to generate revenue – or make a profit. In fact, the opposite can be true as Wayne Huizenga learned owning the Championship winning Florida Marlins baseball team. He payed so much for the top players that he lost money, and ended up busting up the team and selling the franchise!

In short, owning a sports franchise doesn’t require the owner to understand lifecycles. You don’t have to understand much about business, or about business competition. You are protected from competitors, and as one of a select few in the club everyone actually works together – in a wholly uncompetitive way – to insure that everyone makes as much money as possible. You don’t even have to know anything about managing people, because you hire coaches to deal with players, and PR folks to deal with fans and media. And as said before whether or not you win games really doesn’t have much to do with how much money you make.

Most sports franchise owners are known more for their idiosyncrasies than their business acumen. They can be loud and obnoxious all they want (with very few limits.) And now that Mr. Ballmer has no investors to deal with – or for that matter vendors or cooperative parties in a complex ecosystem like personal technology – he doesn’t have to fret about understanding where markets are headed or how to compete in the future.

When it comes to acting like a person who knows little about business, but has a huge ego, fiery temper and loves to be obnoxious there is no better job than being a sports franchise owner. Mr. Ballmer should fit right in.

by Adam Hartung | Feb 9, 2014 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, Leadership, Lifecycle, Lock-in

There is a definite trend to raising the minimum wage. Regardless your political beliefs, the pressure to increase the minimum wage keeps growing. The important question for business leaders is, “Are we prepared for a $12 or $15 minimum wage?”

President Obama began his push for raising the minimum wage above $10 a year ago in his 2013 State of the Union. Since then, several articles have been written on income inequality and raising the minimum wage. Although the case to raise it is not clear cut, there is no doubt it has increased the rhetoric against the top 1% of earners. And now the President is mandating an increase in the minimum wage for federal workers and contractors to $10.10/hour, despite lack of congressional support and flak from conservatives.

Whether the economic case is provable, it appears that public sentiment is greatly in favor of a much higher minimum wage. And it will not affect all companies the same. Those that depend upon low priced labor, such as retailers like Wal-Mart and fast food companies like McDonald’s have a much higher concern. As should their employees, suppliers and investors.

A recent Federal Reserve report took a specific look at what happens to fast food companies when the minimum wage goes up, such as happened in Illinois, California and New Jersey. And the results were interesting. Because they discovered that a higher minimum wage really did hurt McDonald’s, causing stores to close. But….. and this is a big but…. those closed stores were rapidly replaced by competitors that could pay the higher wages, leading to no loss of jobs (and an overall increase in pay for labor.)

The implications for businesses that use low-priced labor are clear. It is time to change the business model – to adapt for a different future. A higher minimum wage does not doom McDonald’s – but it will force the company to adapt. If McDonald’s (and Burger King, Wendy’s, Subway, Dominos, Pizza Hut, and others) doesn’t adapt the future will be very ugly for their customers and the company. But if these companies do adapt there is no reason the minimum wage will hurt them particularly hard.

The chains that replaced McDonald’s closed stores were Five Guys, Chick-fil-A and Chipotle. You might remember that in 1998 McDonald’s started investing in Chipotle, and by 2001 McDonald’s owned the chain. And Chipotle’s grew rapidly, from a handful of restaurants to over 500. But then in 2006 McDonald’s sold all its Chipotle stock as the company went IPO, and used the proceeds to invest in upgrading McDonald’s stores and streamlining the supply chain toward higher profits on the “core” business.

Now, McDonald’s is shrinking while Chipotle is growing. Bloomberg/BusinessWeek headlined “Chipotle: The One That Got Away From McDonalds” (Oct. 3, 2013.) Investors were well served to trade in McDonald’s stock for Chipotle’s. And franchisees have suffered through sales problems as they raised prices off the old “dollar menu” while suffering higher food costs creating shrinking margins. Meanwhile Chipotle’s franchisees have been able to charge more, while keeping customers very happy, and maintain margins while paying higher wages. In a nutshell, Chipotle’s (and similar competitors) has captured the lost McDonald’s business as trends favor their business.

So McDonald’s obviously made a mistake. But that does not mean “game over.” All McDonald’s, Burger King and Wendy’s need to do is adapt. Fighting the higher minimum wage will lead to a lot of grief. There is no doubt wages will go up. So the smart thing to do is figure out what these stores will look like when minimum wages double. What changes must happen to the menu, to the store look, to the brand image in order for the company to continue attracting customers profitably.

This will undoubtedly include changes to the existing brands. But, these companies also will benefit from revisiting the kind of strategy McDonald’s used in the 1990s when buying Chipotle’s. Namely, buying chains with a different brand and value proposition which can flourish in a higher wage economy. These old-line restaurants don’t have to forever remain dominated by the old brands, but rather can transition along with trends into companies with new brands and new products that are more desirable, and profitable, as trends change the game. Like The Limited did when selling its stores and converting into L Brands to remain a viable company.

Now is the time to take action. Waiting until forced to take action will be too late. If McDonald’s and its brethren (and Wal-Mart and its minimum-wage-paying retail brethren) remain locked-in to the old way of doing business, and do everything possible to defend-and-extend the old success formula, they will follow Howard Johnson’s, Bennigan’s, Circuit City, Sears and a plethora of other companies into brand, and profitability, failure. Fighting trends is a route to disaster.

However, by embracing the trend and taking action to be successful in a future scenario of higher labor these companies can be very successful. There is nothing which dictates they have to follow the road to irrelevance while smarter brands take their place. Rather, they need to begin extensive scenario planning, understand how these competitors succeed and take action to disrupt their old approach in order to create a new, more profitable business that will succeed.

Disruptions happen all the time. In the 1970s and 1980s gasoline prices skyrocketed, allowing offshore competitors to upend the locked-in Detroit companies that refused to adapt. On-line services allowed Google Maps to wipe out Rand-McNally, Travelocity to kill OAG and Wikipedia to kill bury Encyclopedia Britannica. These outcomes were not dictated by events. Rather, they reflect an inability of an existing leader to adapt to market changes. An inability to embrace disruptions killed the old competitors, while opening doors for new competitors which embraced the trend.

Now is the time to embrace a higher minimum wage. Every business will be impacted. Those who wait to see the impact will struggle. But those who embrace the trend, develop future scenarios that incorporate the trend and design new business opportunities can turn this disruption into a big win.

by Adam Hartung | Jan 8, 2013 | Defend & Extend, In the Rapids, Innovation, Leadership, Web/Tech

The Harvard Business Review recently published its list of the 100 Best Performing CEOs. This list is better than most because it looks at long-term performance of the CEO during his or her time in the job – with many on the list in service more than a decade.

#1 was Steve Jobs. #2 is Jeff Bezos – making him the greatest living CEO. It is startling just how well these two CEOs performed. During Jobs' tenure Apple investors achieved a return of 66.8 times their money. During Mr. Bezos' tenure shareholders achieved a remarkable 124.3 times return on their money. In an era when most of us are happy to earn 5-10%/year – which equates to doubling your money about once a decade – these CEOs exceeded expectations 30-60 fold!

Both of these CEOs achieved greatness by transforming an industry. We all know the Apple story. From near bankruptcy as the Mac company Mr. Jobs led Apple into the mobile devices business, and created a transformation from Walkmen, Razrs and PCs to iPods, iPhones and iPads – to the detriment of Sony, Motorola, Nokia, Microsoft, HP and Dell.

The Amazon story is all the more remarkable because it has been written in the far more mundane world of retail – not known for being nearly as fast-changing at tech.

Lest we forget, Amazon started as an on-line seller of books frequently unavailable at your local bookstore. "What's a local bookstore?" you may now ask, because through continuous upgrading of its capability to build on the advances in internet usage – across machines, browsers, wi-fi and mobile – Amazon drove into bankruptcy such large booksellers as B.Dalton and Borders – leaving Barnes & Noble a mere shell of its former self and on tenous footing. And the number of small bookshops has dropped dramatically.

But Amazon's industry transformation has gone far beyond bookselling. Amazon was one of the first, and by most users considered the best, at offering a complete on-line storefront for any retailer who wants to sell goods through Amazon's site. You can set up your inventory, display products, provide user information, manage a shopping cart and handle check out all through Amazon – with minimal technical skill. This allowed Amazon to bring vastly more products to customers; and without adding all the inventory or warehousing cost.

As digital uses grew, Amazon moved beyond the slow-paced publishers to launch the Kindle and give us eReaders displacing paper books and periodicals. But this was just the first salvo in the effort to promote additional on-line buying, as Amazon next launched Kindle Fire which at remarkably low cost gave people a tablet already set up for doing retail shopping at Amazon.

As Amazon launched its book downloads and on-line services, it built its own cloud services business to aid businesses and people in using tablets, and doing more things on-line; which further reinforced the digital retail world in which Amazon dominates.

And make no doubt about it, Kindle Fire – and the use of all other tablets – is the WalMart and other traditional brick-and-mortar retail killer. Amazon is now a player in all pieces of the transition which is happening in retail, from traditional shopping to on-line.

Demand for retail space in the USA began declining in 2009 and has not stopped. Most analysts blamed it on the great recession. But in retrospect we can now see it was the watershed year for customers to begin looking more, and buying more, on-line. Now each year growth in on-line retail continues, while demand at traditional stores wanes.

Just look at this last holiday season. To (hopefully) drive revenue stores were opening on Thanksgiving, and doing 24 and 48 hours of non-stop staffing and promotions to drive sales. But it was mostly in vain, as traditional retail saw almost no gains. Despite doing more and more of what they've always done – trying to be better, faster and cheaper – they simply could not change the trend away from shopping on-line and back into the stores.

For the last year the #1 trend in retailing has been "showrooming" where customers stand in a store with a smartphone comparison pricing on-line (most frequently Amazon) to the product on the shelf. Retailers were forced to match on-line prices, despite their higher overhead, or lose the business. And now Target has implemented a policy of price-matching Amazon for all of 2013 in hopes of slowing the trend to on-line purchasing.

Circuit City went bankrupt, which saved Best Buy as it picked up their lost business. But now Best Buy is close to failure. Same store sales at WalMart have been flat. JCPenney recruited Apple's retail store wizard as CEO – but he's learned when you have to compete with Amazon life simply sucks. Nobody in traditional retail has found a way to reverse the on-line shopping trend, which is still dominated by Amazon.

We all can learn from these two CEOs and the companies they built. First, and foremost, is understand trends and align with them. If you help people move in the direction they want to go life is easy, and growth can be phenomenal. Trying to slow, stop or reverse a trend doesn't work, and is expensive.

Second, don't ask customers what they want, instead give them what they need. Customers may be on a trend, but they will frame their requests in the old paradigm. By creating new trend-promoting products and solutions you can capture the customer and avoid head-to-head competition with the "old guard" titans selling the increasingly outdated solutions. Don't build better brick-and-mortar, make brick-and-mortar obsolete.

So, what's stopping you from growing your business like Apple or Amazon? What keeps you from being the next Steve Jobs, or Jeff Bezos? Can you spot trends and provide trend-supporting solutions for customers? Or are you stymied because you're spending too much time trying to defend and extend your old business in the face of game changing trends.