by Adam Hartung | Apr 21, 2016 | In the Rapids, Leadership, Lifecycle, Television, Web/Tech

Netflix has been a remarkable company. Because it has accomplished something almost no company has ever done. It changed its business model, leading to new growth and higher profits.

Almost nobody pulls that off, because they remain stuck defending and extending their old model until they become irrelevant, or fail. Think about Blackberry, that gave us the smartphone business then lost it to Apple and its creation of the app market. Consider Circuit City, that lost enough customers to Amazon it could no longer survive. Sun Microsystems disappeared after PC servers caught up to Unix servers in capability. Remember the Bell companies and their land-line and long distance services, made obsolete by mobile phones and cable operators? These were some really big companies that saw their market shifts, but failed to “pivot” their strategy to remain competitive.

Netflix built a tremendous business delivering physical videos on tape and CD to homes, wiping out the brick-and-mortar stores like Blockbuster and Hollywood Video. By 2008 Netflix reached $1B revenues, reducing Blockbuster by a like amount. By 2010 Blockbuster was bankrupt. Netflix’ share price soared from $50/share to almost $300/share during 2011. By the end of 2012 CD shipments were dropping precipitously as streaming viewership was exploding. People thought Netflix was missing the wave, and the stock plummeted 75%. Most folks thought Netflix couldn’t pivot fast enough, or profitably, either.

But in 2013 Netflix proved the analysts wrong, and the company built a very successful – in fact market leading – streaming business. The shares soared, recovering all that lost value. By 2015 the company had more than doubled its previous high valuation.

But Netflix may be breaking entirely new ground in 2016. It is becoming a market leader in original programming. Something we long attributed to broadcasters and/or cable distributors like HBO and Showtime.

Today’s broadcast companies, like NBC, CBS and ABC, are offering less and less original programming. Overall there are 3 hours/night of prime time television which broadcasters used to “own” as original programming hours. Over the course of a year, allowing for holidays and one open night per week, that meant about 900 hours of programming for each network (including reruns as original programming.) But that was long ago.

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.

Against that backdrop, Netflix has announced it will program 600 hours of original programming this year. That will approximately double any single large broadcast network. In a very real way, if you don’t want to watch sports or reality TV any more you probably will be watching some kind of “on demand” program. Either streamed from a cable service, or from a provider such as Netflix, Hulu or Amazon.

When it comes to original programming, the old broadcast networks are losing their relevancy to streaming technology, personal video devices and the customer’s ability to find what they want, when they want it – and increasingly at a quality they prefer – from streaming as opposed to broadcast media.

To complete this latest “pivot,” from a video streaming company to a true media company with its own content, Morgan Stanley has published that Netflix is now considered by customers as the #1 quality programming across streaming services. 29% of viewers said Netflix was #1, followed by long-time winner HBO now #2 with 21% of customers saying their programming is best. Amazon, Showtime and Hulu were seen as the best quality by 4%-5% of viewers.

So a decade ago Netflix was a CD distribution company. The largest customer of the U.S. Postal Service. Signing up folks to watch physical videos in their homes. Now they are the largest data streaming company on the planet, and one of the largest original programming producers and programmers in the USA – and possibly the world. And in this same decade we’ve watched the network broadcast companies become outlets for sports and reality TV, while cutting far back on their original shows. Sounds a lot like a market shift, and possibly Netflix could be the game changer, as it performs the first strategy double pivot in business history.

by Adam Hartung | Mar 9, 2015 | Current Affairs, In the Rapids, Leadership, Television

The Netflix hit series “House of Cards” was released last night. Most media reviewers and analysts are expecting huge numbers of fans will watch the show, given its tremendous popularity the last 2 years. Simultaneously, there are already skeptics who think that releasing all episodes at once “is so last year” when it was a newsworthy event, and no longer will interest viewers, or generate subscribers, as it once did. Coupled with possible subscriber churn, some think that “House of Cards” may have played out its hand.

So, the success of this series may have a measurable impact on the valuation of Netflix. If the “House of Cards” download numbers, which are up to Netflix to report, aren’t what analysts forecast many may scream for the stock to tumble; especially since it is on the verge of reaching new all-time highs. The Netflix price to earnings (P/E) multiple is a lofty 107, and with a valuation of almost $29B it sells for just under 4x sales.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

But investors should ignore any, and in fact all, hype about “House of Cards” and whatever analysts say about Netflix. So far, they’ve been wildly wrong when making forecasts about the company. Especially when projecting its demise.

Since Netflix started trading in 2002, it has risen from (all numbers adjusted) $8.5 to $485. That is a whopping 57x increase. That is approximately a 40% compounded rate of return, year after year, for 13 years!

But it has not been a smooth ride. After starting (all numbers rounded for easier reading) at $8.50 in May, 2002 the stock dropped to $3.25 in October – a loss of over 60% in just 5 months. But then it rallied, growing to $38.75, a whopping 12x jump, in just 14 months (1/04!) Only to fall back to $9.80, a 75% loss, by October, 2004 – a mere 9 months later. From there Netflix grew in value by about 5.5x – to $55/share – over the next 5 years (1/10.) When it proceeded to explode in value again, jumping to $295, an almost 6-fold increase, within 18 months (7/11). Only to get creamed, losing almost 80% of its value, back down to $63.85, in the next 4 months (11/11.) The next year it regained some loss, improving in value by 50% to $91.35 (12/12,) only to again explode upward to $445 by February, 2014 a nearly 5-fold increase, in 14 months. Two months later, a drop of 25% to $322 (4/14). But then in 4 months back up to $440 (8/14), and back down 4 months later to $341 (12/14) only to approach new highs reaching $480 last week – just 2 months later.

That is the definition of volatility.

Netflix is a disruptive innovator. And, simply put, stock analysts don’t know how to value disruptive innovators. Because their focus is all on historical numbers, and then projecting those historicals forward. As a result, analysts are heavily biased toward expecting incumbents to do well, and simultaneously being highly skeptical of any disruptive company. Disruptors challenge the old order, and invalidate the giant excel models which analysts create. Thus analysts are very prone to saying that incumbents will remain in charge, and that incumbents will overwhelm any smaller company trying to change the industry model. It is their bias, and they use all kinds of historical numbers to explain why the bigger, older company will project forward well, while the smaller, newer company will stumble and be overwhelmed by the entrenched competitor.

And that leads to volatility. As each quarter and year comes along, analysts make radically different assumptions about the business model they don’t understand, which is the disruptor. Constantly changing their assumptions about the newer kid on the block, they make mistake after mistake with their projections and generally caution people not to buy the disruptor’s stock. And, should the disruptor at any time not meet the expectations that these analysts invented, then they scream for shareholders to dump their holdings.

Netflix first competed in distribution of VHS tapes and DVDs. Netflix sent them to people’s homes, with no time limit on how long folks could keep them. This model was radically different from market leader Blockbuster Video, so analysts said Blockbuster would crush Netflix, which would never grow. Wrong. Not only did Blockbuster grow, but it eventually drove Blockbuster into bankruptcy because it was attuned to trends for convenience and shopping from home.

As it entered streaming video, analysts did not understand the model and predicted Netflix would cannibalize its historical, core DVD business thus undermining its own economics. And, further, much larger Amazon would kill Netflix in streaming. Analysts screamed to dump the stock, and folks did. Wrong. Netflix discovered it was a good outlet for syndication, created a huge library of not only movies but television programs, and grew much faster and more profitably than Amazon in streaming.

Then Netflix turned to original programming. Again, analysts said this would be a huge investment that would kill the company’s financials. And besides that people already had original programming from historical market leaders HBO and Showtime. Wrong. By using analysis of what people liked from its archive, Netflix leadership hedged its bets and its original shows, especially “House of Cards” have been big hits that brought in more subscribers. HBO and Showtime, which have depended on cable companies to distribute their programming, are now increasingly becoming additional programming on the Netflix distribution channel.

Investors should own Netflix because the company’s leadership, including CEO Reed Hastings, are great at disruptive innovation. They identify unmet customer needs and then fulfill those needs. Netflix time and again has demonstrated it can figure out a better way to give certain user segments what they want, and then expand their offering to eat away at the traditional market. Once it was retail movie distribution, increasingly it is becoming cable distribution via companies like ComCast, AT&T and Time Warner.

And investors must be long-term. Netflix is an example of why trading is a bad idea – unless you do it for a living. Most of us who have full time day jobs cannot try timing the ups and downs of stock movements. For us, it is better to buy and hold. When you’re ready to buy, buy. Don’t wait, because in the short term there is no way to predict if a stock will go up or down. You have to buy because you are ready to invest, and you expect that over the next 3, 5, 7 years this company will continue to drive growth in revenues and profits, thus expanding its valuation.

Netflix, like Apple, is a company that has mastered the skills of disruptive innovation. While the competition is trying to figure out how to sustain its historical position by doing the same thing better, faster and cheaper Netflix is figuring out “the next big thing” and then delivering it. As the market shifts, Netflix is there delivering on trends with new products – and new business models – which push revenues and profits higher.

That’s why it would have been smart to buy Netflix any time the last 13 years and simply held it. And odds are it will continue to drive higher valuations for investors for many years to come. Not only are HBO, Showtime and Comcast in its sites, but the broadcast networks (ABC, CBS, NBC) are not far behind. It’s a very big media market, which is shifting dramatically, and Netflix is clearly the leader. Not unlike Apple has been in personal technology.

by Adam Hartung | Dec 11, 2014 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lifecycle, Television, Web/Tech

The trend toward the death of broadcast TV as we’ve known it keeps moving forward. This trend may not happen as fast as the death of desktop computers, but it is a lot faster than glacier melting.

This television season (through October) Magna Global has reported that even the oldest viewers (the TV Generation 55-64) watched 3% less TV. Those 35-54 watched 5% less. Gen Xers (25-34) watched 8% less, and Millenials (18-24) watched a whopping 14% less TV. Live sports viewing is not even able to maintain its TV audience, with NFL viewership across all networks down 10-19%.

Everyone knows what is happening. People are turning to downloaded entertainment, mostly on their mobile devices. With a trend this obvious, you’d think everyone in the media/TV and consumer goods industries would be rethinking strategy and retooling for a new future.

But, you would be wrong. Because despite the obviousness of the trend, emotional ties to hoping the old business sticks around are stronger than logic when it comes to forecasting.

CBS predicted at the beginning of 2014 TV ad revenue would grow 4%. Oops. Now CBS’s lead forecaster is admitting he was way off, and adjusted revenues were down 1% for the year. But, despite the trend in viewer behavior and ad expenditures in 2014, he now predicts a growth of 2% for 2015.

That, my young friends, is how “hockey stick” forecasts are created. A lot of old assumptions, combined with a willingness to hope trends will be delayed, and you can ignore real data while promising people that the future will indeed look like the past – even when it defies common sense.

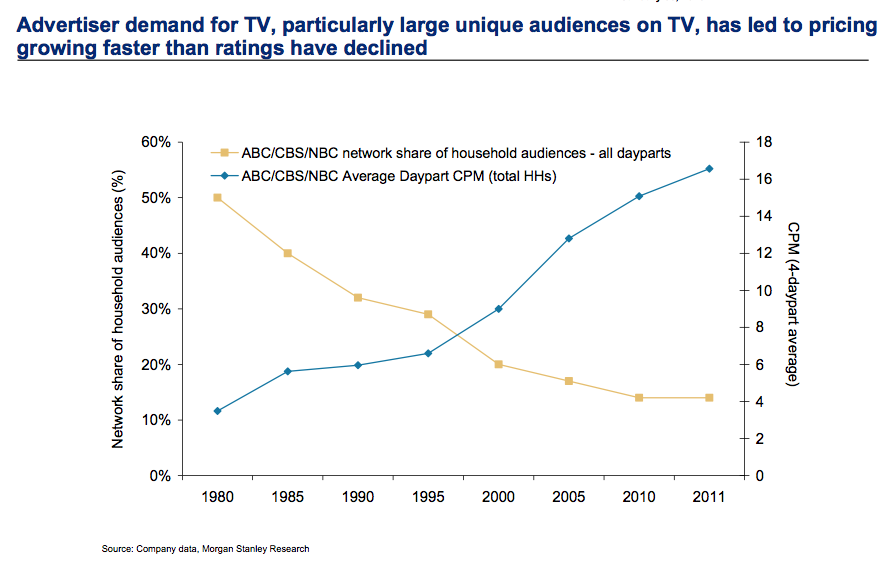

To compensate for fewer ads the networks have raised prices on all ads. But how long can that continue? This requires a really committed buyer (read more about CMO weaknesses below) who simply refuses to acknowledge the market has shifted and the dollars need to shift with it. That cannot last forever.

Meanwhile, us old folks can remember the days when Nielsen ratings determined what was programmed on TV, as well as what advertisers paid. Nielsen had a lock on measuring TV audience viewing, and wielded tremendous power in the media and CPG world.

But now AC Nielsen is struggling to remain relevant. With TV viewership down, time shifting of shows common and streaming growing like the proverbial weed Nielsen has no idea what entertainment the public watches. They don’t know what, nor when, nor where. Unwilling to move quickly to develop tools for catching all the second screen viewing, Nielsen has no plan for telling advertisers what the market really looks like – and the company looks to become a victim of changing markets.

Which then takes us to looking at those folks who actually buy ads that drive media companies. The Chief Marketing Officers (CMOs) of CPG companies. Surely these titans of industry are on top of these trends, and rapidly shifting their spending to catch the viewers with the most ads placed for the lowest cost.

You would wish.

Unfortunately, because these senior executives are in the oldest age groups, they are a victim of their own behavior. They still watch TV, so assume others must as well. If there is cyber-data saying they are wrong, well they simply discount that data. The Nielsen’s aren’t accurate, but these execs still watch the ratings “because it’s the best info we have” – a blatant untruth by the way. But Nielsen does conveniently reinforce their built in assumptions, and their hope that they won’t have to change their media spend plans any time soon.

Further, very few of these CMOs actually use social media. The vast majority watch their children, grandchildren and young employees use mobile devices constantly – and they bemoan all the activity on YouTube, Facebook, Instagram and Twitter – or for the most part even Linked-in. But they don’t actually USE these products. They don’t post information. They don’t set up and follow channels. They don’t connect with people, share information, exchange photos or tell stories on social media. Truthfully, they ignore these trends in their own lives. Which leaves them woefully inept at figuring out how to change their company marketing so it can be more relevant.

The trend is obvious. The answer, equally so. Any modern marketer should be an avid user of social media. Most network heads and media leaders are farther removed from social media than the Pope! They don’t constantly download entertainment, and exchanging with others on all the platforms. They can’t manage the use of these channels when they don’t have a clue how they work, or how other people use them, or understand why they are actually really valuable tools.

Are you using these modern tools? Are you actually living, breathing, participating in the trends? Or are you, like these outdated execs, biding your time wasting money on old programs while you look forward to retirement? And likely killing your company.

When trends emerge it is imperative we become part of that trend. You can’t simply observe it, because your biases will lead you to hope the trend reverts as you continue doing more of the same. A leader has to adopt the trend as a leader, be a practicing participant, and learn how that trend will make a substantial difference in the business. And then apply some vision to remain relevant and successful.

by Adam Hartung | Jul 8, 2014 | Current Affairs, Food and Drink, In the Whirlpool, Leadership

Crumbs Bake Shop – a small chain of cupcake shops, almost totally unknown outside of New York City and Washington, DC – announced it was going out of business today. Normally, this would not be newsworthy. Even though NASDAQ traded, Crumbs small revenues, losses and rapidly shrinking equity made it economically meaningless. But, it is receiving a lot of attention because this minor event signals to many people the end of the “cupcake trend” which apparently was started by cable TV show “Sex and the City.”

However, there are actually 2 very important lessons all of us can learn from the rise, and fall, of Crumbs Bake Shop:

1 – Don’t believe in the myth of passion when it comes to business

Many management gurus, and entrepreneurs, will tell you to go into business following something about which you are passionate. The theory goes that if you have passion you will be very committed to success, and you will find your way to success with diligence, perseverance, hard work and insight driven by your passion. Passion will lead to excellence, which will lead to success.

And this is hogwash.

Customers don’t care about your passion. Customers care about their needs. Rather than being a benefit, passion is a negative because it will cause you to over-invest in your passion. You will “never say die” as you keep trying to make success out of an idea that has no chance. Rather than investing your resources into something that fulfills people’s needs, you are likely to invest in your passion until you burn through all your resources. Like Crumbs.

The founders of Crumbs had a passion for cupcakes. But, they had no way to control an onslaught of competitors who could make different variations of the product. All those competitors, whether isolated cupcake shops or cupcakes offered via kiosks or in other shops, meant Crumbs was in a very tough fight to maintain sales and make money. It’s not you (and your passion) that controls your business destiny. Nor is your customers. Rather, it is your competition.

When there are lots of competitors, all capable of matching your product, and of offering countless variations of your product, then it is unlikely you can sustain revenues – or profits. There are many industries where cutthroat competition means profits are fleeting, or downright elusive. Airlines come to mind. Magazines. And many retail segments. It doesn’t matter how much passion you have, when there are too many competitors it’s a lousy business.

2 – Trends really do matter

Cupcakes were a hot product for a while. And that’s great. But it wasn’t hard to imagine that the trend would shift, and cupcakes would be displaced by something else. Whatever profits you might have when you sit on a trend, those profits evaporate fast when the trend shifts and all competitors are fighting for sales in a declining market.

Remember Mrs. Field’s cookies? In the 1980s an attractive cook and her investment banker husband built a business on soft, chewy, warm cookies sold in malls and retail streets across America. It seemed nobody could get enough of those chocolate chip cookies.

But then, one day, we did. We’d collectively had enough cookies, and we simply quit buying them. Mrs. Fields (and other cookie brand) stores were rapidly replaced with pretzels and other foodstuffs.

Or look at Krispy Kreme donuts. In the 1990s people went crazy for them, often lining up at stores waiting for the neon sign to come on saying “hot donuts”. The company exploded into 400 stores as the stock flew like a kite. But then, in a very short time, people had enough donuts. There were a lot more donut shops than necessary, and Krispy Kreme went bankrupt.

So it wasn’t hard to predict that shifting food tastes would eventually put an end to cupcake sales growth. Yet, Crumbs really didn’t prepare for trends to change. Despite revenue and profit problems, the leadership did not admit that cupcake sales had peaked, the market was going to decline, competition would become even more intense and Crumbs would need to find another business if it was to survive.

Few trends move as fast as tastes in sweets. But, trends do affect all businesses. Once we bought cameras (and film,) but now we use phones – too bad for Kodak. Once we used copiers, now we use email – too bad for Xerox. Once we watched TV, now we download from Netflix or Amazon – too bad for NBC, ABC, CBS and Comcast. Once we went to stores, now we order on-line – too bad for Sears. Once we used PCs, now we use mobile devices – too bad for Microsoft. These trends did not affect these companies as fast as shifting tastes affected Crumbs, but the importance of understanding trends and preparing for change is a constant part of leadership.

So Crumbs Bake Shop failure was one which could have been avoided. Leadership needed to overcome its passion for cupcakes and taken a much larger look at customer needs to find alternative products. It wasn’t hard to identify that some diversification was going to be necessary. And that would have been much easier if they had put in place a system to track trends, observing (and admitting) that their “core” market was stalled and they needed to move into a new trend category.

by Adam Hartung | Dec 10, 2012 | Current Affairs, Defend & Extend, In the Whirlpool, Leadership, Lifecycle, Television

Remember when almost everyone read a daily newspaper?

Newspaper readership peaked around 2000. Since then printed media has declined, as readers shifted on-line. Magazines have folded, and newspapers have disappeared, quit printing, dramatically cut page numbers and even more dramatically cut staff.

Amazingly, almost no major print publisher prepared for this, even though the trend was becoming clear in the late 1990s.

Newspapers are no longer a viable business. While industry revenue grew for

almost 2 centuries, it collapsed in a mere decade.

Chart Source: BusinessInsider.com

This market shift created clear winners, and losers. On-line news sites like Marketwatch and HuffingtonPost were clear winners. Losers were traditional newspaper companies such as Tribune Corporation, Gannett, McClatchey, Dow Jones and even the New York Times Company. And investors in these companies either saw their values soar, or practically disintegrate.

In 2012 it is equally clear that television is on the brink of a major transition. Fewer people are content to have their entertainment programmed for them when they can program it themselves on-line. Even though the number of television channels has exploded with pervasive cable access, the time spent watching television is not growing. While simultaneously the amount of time people spend looking at mobile internet displays (tablets, smartphones and laptops) is growing at double digit rates.

Chart Source: Silicone Alley Insider Chart of the Day 12/5/12

It would be easy to act like newspaper defenders and pretend that television as we've known it will not change. But that would be, at best, naive. Just look around at broadband access, the use of mobile devices, the convenience of mobile and the number of people that don't even watch traditional TV any more (especially younger people) and the trend is clear. One-way preprogrammed advertising laden television is not a sustainable business.

So, now is the time to prepare. And change your business to align with impending new realities.

Losers, and winners, will be varied – and not entirely obvious. Firstly, a look at those trying to maintain the status quo, and likely to lose the most.

Giant consumer goods and retail companies benefitted from the domination of television. Only huge companies like P&G, Kraft, GM and Target could afford to lay out billions of dollars for television ads to build, and defend, a brand. But what advantage will they have when TV budgets no longer control brand building? They will become extremely vulnerable to more innovative companies that have better products and move on fast lifecycles. Their size, hierarchy and arcane business practices will lead to huge problems. Imagine a raft of new Hostess Brands experiences.

Even as the trends have started changing these companies have continued pumping billions into the traditional TV networks as they spend to defend their brand position. This has driven up the value of companies like CBS, Comcast (owns NBC) and Disney (owns ABC) over the last 3 years substantially. But don't expect that to last forever. Or even a few more years.

Just like newspaper ad spending fell off a cliff when it was clear the eyeballs were no longer there, expect the same for television ad spending. As giant advertisers find the cost of television harder and harder to justify their outlays will eventually take the kind of cliff dive observed in the chart (above) for newspaper advertising. Already some consumer goods and ad agency executives are alluding to the fact that the rate of return on traditional TV is becoming sketchy.

So far, we've seen little at the companies which own TV networks to demonstrate they are prepared for the floor to fall out of their revenue stream. While some have positions in a few internet production and delivery companies, most are clearly still doing their best to defend & extend the old business – just like newspaper owners did. Just as newspapers never found a way to replace the print ad dollars, these television companies look very much like businesses that have no apparent solution for future growth. I would not want my 401K invested in any major network company.

And there will be winners.

For smaller businesses, there has never been a better time to compete. A company as small as Tesla or Fisker can now create a brand on-line at a fraction of the old cost. And that brand can be as powerful as Ford, and potentially a lot more trendy. There are very low entry barriers for on-line brand building using not only ad words and web page display ads, but also using social media to build loyal followers who use and promote a brand. What was once considered a niche can become well known almost overnight simply by applying the new dynamics of reaching customers on-line, and increasingly via mobile. Look at the success of Toms Shoes.

Zappos and Amazon have shown that with almost no television ads they can create powerhouse retail brands. The new retailers do not compete just on price, but are able to offer selection, availability and customer service at levels unachievable by traditional brick-and-mortar retailers. They can suggest products and prices of things you're likely to need, even before you realize you need them. They can educate better, and faster, than most retail store employees. And they can offer great prices due to less overhead, along with the convenience of shipping the product right into your home.

And as people quit watching preprogrammed TV, where will they go for content? Anybody streaming will have an advantage – so think Netflix (which recently contracted for all the Disney content,) Amazon, Pandora, Spotify and even AOL. But, this will also benefit those companies providing content access such as Apple TV, Google TV, YouTube (owned by Google) to offer content channels and the increasingly omnipresent Facebook will deliver up not only friends, but content — and ads.

As for content creation, the deep pockets of traditional TV production companies will likely disappear along with their ability to control distribution. That means fewer big-budget productions as risk goes up without revenue assurances.

But that means even more ability for newer, smaller companies to create competitive content seeking audiences. Where once a very clever, hard working Seth McFarlane (creator of Family Guy) had to hardscrabble with networks to achieve distribution, and live in fear of a single person controlling his destiny, in the future these creative people will be able to own their content and capture the value directly as they build a direct audience. A phenomenon like George Lucas will be more achievable than ever before as what might look like chaos during transition will migrate to a much more competitive world where audiences, rather than network executives, will decide what content wins – and loses.

So, with due respects to Don McLean, will today be the day TV Died? We will only know in historical context. Nobody predicted newspapers had peaked in 2000, but it was clear the internet was changing news consumption behavior. And we don't know if TV viewership will begin its rapid decline in 2013, or in a couple more years. But the inevitable change is clear – we just don't know exactly when.

So it would be foolish to not think that the industry is going to change dramatically. And the impact on advertising will be even more profound, much more profound, than it was in print. And that will have an even more profound impact on American society – and how business is done.

What are you doing to prepare?

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.

These days most of those hours are filled with sports – think evening games of football, basketball, baseball including playoffs and “March Madness” events. Sports are far cheaper to program, and can fill a lot of hours. Next think reality programming. Showing people race across countries, or compete to survive a political battlefield on an island, or even dancing or dieting, uses no expensive actors or directors or sets. It is far, far less expensive than writing, casting, shooting and programming a drama (like Blacklist) or comedy (like Big Bang Theory.) Plan on showing every show twice in reruns, plus intermixing with the sports and reality shows, and most networks get away with around 200-250 hours of original programming per year.