by Adam Hartung | Sep 14, 2016 | Immigration, In the Rapids, Innovation, Telecom, Trends

I’m amazed about Americans’ debate regarding immigration. And all the rhetoric from candidate Trump about the need to close America’s borders.

I was raised in Oklahoma, which prior to statehood was called The Indian Territory. I was raised around the only real Native Americans. All the rest of us are immigrants. Some voluntarily, some as slaves. But the fact that people want to debate whether we allow people to become Americans seems to me somewhat ridiculous, since 98% of Americans are immigrants. The majority within two generations.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

And almost since the beginning, immigrants have been not only abused but scammed. Those who have resources frequently took advantage of the newcomers that did not. And this persists. Immigrants that lack a social security card are unable to obtain a driver’s license, unable to open bank accounts, unable to apply for credit cards, unable to even sign up for phone service. Thus they remain at the will of others to help them, which creates the opportunity for scamming.

Take for example an immigrant trying to make a phone call to his relatives back home. For most immigrants this means using a calling card. Only these cards are often a maze of fees, charges and complex rules that result in much of the card’s value being lost. A 10-minute call to Ghana can range from $2.86 to $8.19 depending on which card you use. This problem is so bad that the FCC has fined six of the largest card companies for misleading consumers about calling cards. They continue to advise consumers about fraud. And even Congress has held hearings on the problem.

One outcome of immigrants’ difficulties has been the ingenuity and innovativeness of Americans. To this day around the world people marvel at how clever Americans are, and how often America leads the world in developing new things. As a young country, and due to the combination of resources and immigrants’ tough situation, America frequently is first at developing new solutions to solve problems – many of which are problems that clearly affect the immigrant population.

So, back to that phone call. Some immigrants can use Microsoft Skype to talk with their relatives, using the Internet rather than a phone. But this requires the people back home have a PC and an internet connection. Both of which could be dicey. Another option would be to use something like Facebook’s WhatsApp, but this requires the person back home have either a PC or mobile device, and either a wireless connection or mobile coverage. And, again, this is problematic.

But once again, ingenuity prevails. A Romanian immigrant named Daniel Popa saw this problem, and set out to make communications better for immigrants and their families back home. In 2014 he founded QuickCall.com to allow users to make a call over wireless technology, but which can then interface with the old-fashioned wired (or wireless) telecom systems around the world. No easy task, since telephone systems are a complex environment of different international, national and state players that use a raft of different technologies and have an even greater set of complicated charging systems.

But this new virtual phone network, which links the internet to the traditional telecom system, is a blessing for any immigrant who needs to contact someone in a rural, or poor, location that still depends on phone service. If the person on the other end can access a WiFi system, then the calls are free. If the connection is to a phone system then the WiFi interface on the American end makes the call much cheaper – and performs far, far better than any other technology. QuickCall has built the carrier relationships around the world to make the connections far more seamless, and the quality far higher.

But like all disruptive innovations, the initial market (immigrants) is just the early adopter with a huge need. Being able to lace together an internet call to a phone system is pretty powerful for a lot of other users. Travelers heading to a remote location, like Micronesia, Africa or much of South America — and even Eastern Europe – can lower the cost of planning their trip and connect with locals by using QuickCall.com. And for most Americans traveling in non-European locations their cell phone service from Sprint, Verizon, AT&T or another carrier simply does not work well (if at all) and is very expensive when they arrive. QuickCall.com solves that problem for these travelers.

Small businesspeople who have suppliers, or customers, in these locations can use QuickCall.com to connect with their business partners at far lower cost. Businesses can even have their local partners obtain a local phone number via QuickCall.com and they can drive the cost down further (potentially to zero). This makes it affordable to expand the offshore business, possibly even establishing small scale customer support centers at the local supplier, or distributor, location.

In The Innovator’s Dilemma Clayton Christensen makes the case that disruptive innovations develop by targeting a customer with an unmet need. Usually the innovation isn’t as good as the current “standard,” and is also more costly. Today, making an international call through the phone system is the standard, and it is fairly cheap. But this solution is often unavailable to immigrants, and thus QuickCall.com fills their unmet need, and at a cost substantially lower than the infamous calling cards, and with higher quality than a pure WiFi option.

But now that it is established, and expanding to more countries – including developed markets like the U.K. – the technology behind QuickCall.com is becoming more mainstream. And its uses are expanding. And it is reducing the need for people to have international calling service on their wired or wireless phone because the available market is expanding, the quality is going up, and the cost is going down. Exactly the way all disruptive innovations grow, and thus threaten the entrenched competition.

The end-game may be some form of Facebook in-app solution. But that depends on Facebook or one of its competitors seizing this opportunity quickly, and learning all QuickCall.com already knows about the technology and customers, and building out that network of carrier relationships. Notice that Skype was founded in 2003, and acquired by Microsoft in 2011, and it still doesn’t have a major presence as a telecom replacement. Will a social media company choose to make the investment and undertake developing this new solution?

As small as QuickCall.com is – and even though you may have never heard of it – it is an example of a disruptive innovation that has been successfully launched, and is successfully expanding. It may seem like an impossibility that this company, founded by an immigrant to solve an unmet need of immigrants, could actually change the way everyone makes international calls. But, then again, few of us thought the iPhone and its apps would cause us to give up Blackberries and quit carrying our PCs around.

America is known for its ingenuity and innovations. We can thank our heritage as immigrants for this, as well as the immigrant marketplace that spurs new innovation. America’s immigrants have the need to succeed, and the unmet needs that create new markets for launching new solutions. For all those conservatives who fear “European socialism,” they would be wise to realize the tremendous benefits we receive from our immigrant population. Perhaps these naysayers should use QuickCall.com to connect with a few more immigrants and understand the benefits they bring to America.

by Adam Hartung | Jun 9, 2016 | Innovation, Investing, Software, Teamwork

Last week Bloomberg broke a story about how Microsoft’s Chairman, John Thompson, was pushing company management for a faster transition to cloud products and services. He even recommended changes in spending might be in order.

Really? This is news?

Let’s see, how long has the move to mobile been around? It’s over a decade since Blackberry’s started the conversion to mobile. It was 10 years ago Amazon launched AWS. Heck, end of this month it will be 9 years since the iPhone was released – and CEO Steve Ballmer infamously laughed it would be a failure (due to lacking a keyboard.) It’s now been 2 years since Microsoft closed the Nokia acquisition, and just about a year since admitting failure on that one and writing off $7.5B And having failed to achieve even 3% market share with Windows phones, not a single analyst expects Microsoft to be a market player going forward.

So just now, after all this time, the Board is waking up to the need to change the resource allocation? That does seem a bit like looking into barn lock acquisition long after the horses are gone, doesn’t it?

The problem is that historically Boards receive almost all their information from management. Meetings are tightly scheduled affairs, and there isn’t a lot of time set aside for brainstorming new ideas. Or even for arguing with management assumptions. The work of governance has a lot of procedures related to compliance reporting, compensation, financial filings, senior executive hiring and firing – there’s a lot of rote stuff. And in many cases, surprisingly to many non-Directors, the company’s strategy may only be a topic once a year. And that is usually the result of a year long management controlled planning process, where results are reviewed and few challenges are expected. Board reviews of resource allocation are at the very, very tail end of management’s process, and commitments have often already been made – making it very, very hard for the Board to change anything.

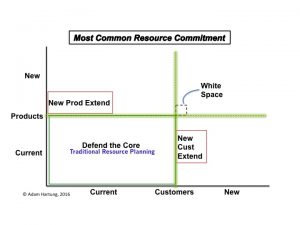

And these planning processes are backward-oriented tools, designed to defend and extend existing products and services, not predict changes in markets. These processes originated out of financial planning, which used almost exclusively historical accounting information. In later years these programs were expanded via ERP (Enterprise Resource Planning) systems (such as SAP and Oracle) to include other information from sales, logistics, manufacturing and procurement. But, again, these numbers are almost wholly historical data. Because all the data is historical, the process is fixated on projecting, and thus defending, the old core of historical products sold to historical customers.

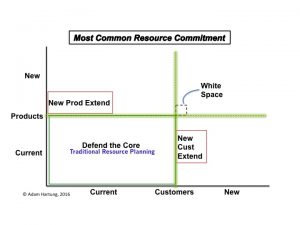

Copyright Adam Hartung

Efforts to enhance the process by including extensions to new products or new customers are very, very difficult to implement. The “owners” of the planning processes are inherent skeptics, inclined to base all forecasts on past performance. They have little interest in unproven ideas. Trying to plan for products not yet sold, or for sales to customers not yet in the fold, is considered far dicier – and therefore not worthy of planning. Those extensions are considered speculation – unable to be forecasted with any precision – and therefore completely ignored or deeply discounted.

And the more they are discounted, the less likely they receive any resource funding. If you can’t plan on it, you can’t forecast it, and therefore, you can’t really fund it. And heaven help some employee has a really novel idea for a new product sold to entirely new customers. This is so “white space” oriented that it is completely outside the system, and impossible to build into any future model for revenue, cost or – therefore – investing.

Take for example Microsoft’s recent deal to sell a bunch of patent rights to Xiaomi in order to have Xiaomi load Office and Skype on all their phones. It is a classic example of taking known products, and extending them to very nearby customers. Basically, a deal to sell current software to customers in new markets via a 3rd party. Rather than develop these markets on their own, Microsoft is retrenching out of phones and limiting its investments in China in order to have Xiaomi build the markets – and keeping Microsoft in its safe zone of existing products to known customers.

The result is companies consistently over-investment in their “core” business of current products to current customers. There is a wealth of information on those two groups, and the historical info is unassailable. So it is considered good practice, and prudent business, to invest in defending that core. A few small bets on extensions might be OK – but not many. And as a result the company investment portfolio becomes entirely skewed toward defending the old business rather than reaching out for future growth opportunities.

This can be disastrous if the market shifts, collapsing the old core business as customers move to different solutions. Such as, say, customers buying fewer PCs as they shift to mobile devices, and fewer servers as they shift to cloud services. These planning systems have no way to integrate trend analysis, and therefore no way to forecast major market changes – especially negative ones. And they lack any mechanism for planning on big changes to the product or customer portfolio. All future scenarios are based on business as it has been – a continuation of the status quo primarily – rather than honest scenarios based on trends.

How can you avoid falling into this dilemma, and avoiding the Microsoft trap? To break this cycle, reverse the inputs. Rather than basing resource allocation on financial planning and historical performance, resource allocation should be based on trend analysis, scenario planning and forecasts built from the future backward. If more time were spent on these plans, and engaging external experts like Board Directors in discussions about the future, then companies would be less likely to become so overly-invested in outdated products and tired customers. Less likely to “stay at the party too long” before finding another market to develop.

If your planning is future-oriented, rather than historically driven, you are far more likely to identify risks to your base business, and reduce investments earlier. Simultaneously you will identify new opportunities worthy of more resources, thus dramatically improving the balance in your investment portfolio. And you will be far less likely to end up like the Chairman of a huge, formerly market leading company who sounds like he slept through the last decade before recognizing that his company’s resource allocation just might need some change.

by Adam Hartung | Jan 30, 2016 | Current Affairs, In the Rapids, Leadership, Web/Tech

Apple announced earnings for the 4th quarter this week, and the company was creamed. Almost universally industry analysts and stock analysts had nothing good to say about the company’s reports, and forecast. The stock ended the week down about 5%, and down a whopping 27.8% from its 52 week high.

Wow, how could the world’s #1 mobile device company be so hammered? After all, sales and earnings were both up – again! Apple’s brand is still one of the top worldwide brands, and Apple stores are full of customers. It’s PC sales are doing better than the overall market, as are its tablet sales. And it is the big leader in wearable devices with Apple Watch.

Yet, let’s compare the stock price to earnings (P/E) multiple of some well known companies (according to CNN Money 1/29/16 end of day):

- Apple – 10.3

- Used car dealer AutoNation – 10.7

- Food company Archer Daniel Midland (ADM) – 12.2

- Industrial equipment maker Caterpillar Tractor – 12.9

- Farm equipment maker John Deere – 13.3

- Defense equipment maker General Dynamics – 15.1

- Utility American Electric Power – 16.9

- Industrial product company Illinois Tool Works (ITW) – 17.7

- Industrial product company 3M – 19.5

What’s wrong with this picture? It all goes to future expectations. Investors watched Apple’s meteoric rise, and many wonder if it will have a similar, meteoric fall. Remember the rise and fall of Digital Equipment? Wang? Sun Microsystems? Palm? Blackberry (Research in Motion)? Investors don’t like companies where they fear growth has stalled.

What’s wrong with this picture? It all goes to future expectations. Investors watched Apple’s meteoric rise, and many wonder if it will have a similar, meteoric fall. Remember the rise and fall of Digital Equipment? Wang? Sun Microsystems? Palm? Blackberry (Research in Motion)? Investors don’t like companies where they fear growth has stalled.

And Apple’s presentation created growth stall fears. While iPhone sales are enormous (75million units/quarter,) there was little percentage growth in Q4. And CEO Tim Cook actually predicted a sales decline next quarter! iPod sales took off like a rocket years ago, but they have now declined for 6 straight quarters and there was no prediction of a return to higher sales volumes. And as for future products, the company seems only capable of talking about Apple Watch, and so far few people have seen any reason to buy one. Amidst this gloom, Apple presented an unclear story about a future based on services – a market that is at the very least vague, where Apple has no market presence, little experience and no brand position. And wasn’t that IBM’s story some 2.5 decades ago?

In other words, Apple fed investor’s worst fears. That growth had stopped. And usually, like in the examples above, when growth stops – especially in tech companies – it presages a dramatic reversal in sales and profits. Sales have been known to fall far, far faster than management predicts. Although Apple has not yet entered a Growth Stall (which is 2 consecutive quarters of declining sales and/or profits, or 2 consecutive quarters than the previous year’s sales or profits) investors are now worried that one is just around the corner.

Contrast this with Facebook. P/E – 113.3. Facebook said ad revenues rose 57%, and net income was up 2.2x the previous year’s quarter. But what was really important was Facebook’s story about its future:

- Facebook is now a “must buy” for advertisers

- Mobile is the #1 ad trend, and 80% of revenues are from mobile

- Revenue/user is up 33%, and growing

- There are multiple unmonetized new markets that Facebook is just developing – Instagram, WhatsApp, FB Messenger and Oculus

In other words, the past was great – but the future will be even better. The short-term result? FB stock rose 7.4% for the week, and intraday hit a new 52 week high. Facebook might have seemed like a fad 3 years ago, especially to older folks. But now the company’s story is all about market trends, and how Facebook is offering products on those trends that will drive future revenue and profit growth.

Amazon may be an even better example of smart communications. As everyone knows, Amazon makes no profit. So it sells for an astonishing P/E of 846.9. Amazon sales increased 22% in Q4, and Amazon continued gaining share of the fast growing, #1 trend in retail — ecommerce. While WalMart and Macy’s are closing stores, Amazon is expanding and even creating its own logistics system.

Profits were up, but only 2/3 of expectations – ouch! Anticipating higher sales and earnings announcements the stock had run up $40/share. But the earnings miss took all that away and more as the stock crashed about $70/share! A wild 12.5% peak-to-trough swing was capped at end of week down a mere 2.5%.

But, Amazon did a great job, once again, of selling its future. In addition to the good news on retail sales, there was ongoing spectacular growth in cloud services – meaning Amazon Web Services (AWS.) JPMorganChase, Wells Fargo, Raymond James and Benchmark all raised their future price forecasts after the announcement, based on future performance expectations. Even analysts who cut their price targets still kept price targets higher than where Amazon actually ended the week. And almost all analysts expect Amazon one year from now to be worth more than its historical 52 week high, which is 19% higher than current pricing.

So, despite bad earnings news, Amazon continued to sell its growth story. Growth can heal all wounds, if investors continue to believe. We’ll see how it plays out, but for now things appear at least stable.

Steve Jobs was, by most accounts, an excellent showman. But what he did particularly well was tell a great growth story. No matter Apple’s past results, or concerns about the company, when Steve Jobs took the stage his team had crafted a story about Apple’s future growth. It wasn’t about cash flow, cash in the bank, assets in place, market share or historical success – boring, boring. There was an Apple growth story. There was always a reason for investor’s to believe that competitors will falter, markets will turn to Apple, and growth will increase!

Should investors think Apple is without future growth? Unfortunately, the communications team at Apple last week let investors think so. It is impossible to believe this is true, but the communicators this week simply blew it. Because what they said led to nothing but headlines questioning the company’s future.

What should Apple have said?

- Give investors a great news story about wearables. Show applications in health care, retail, etc. that really makes investors think all those people with a Timex or Rolex will wear an AppleWatch in the future. Apple sold investors the future of iPhone apps long before most of people used anything other than maps and weather – and the story led investors to believe if people didn’t have an iPhone they would miss out on something important, so they were bound to go buy one. Where’s that story when it comes to wearables?

- ApplePay is going to change the world. While ApplePay is #1, investors are wondering if mobile payments is ever going to be big. What will make it big, when, and what is Apple doing to make this a multi-billion dollar business? ApplePay launched to a lot of hype, but very little has been said since. Is this going to be the Apple version of Microsoft’s Zune? Make investors believers in ApplePay. Convince them this is worth a lot of future value.

- iBeacons are one of the most important technology products in retail and inventory control. iBeacons were launched as a great tool for local businesses, but since then Apple has said almost nothing. B2B may not be as sexy as consumer markets, but Microsoft made investors believers in the value of enterprise products. Demonstrate that Apple’s technology is the best, and give investors some stories about how companies are winning. Most investors have forgotten about beacons and thus they no longer plan for substantial revenues.

- Apple has the #1 mobile developer community, and the best products are yet to come – so sales are far from stalling. Honestly, the developer war is critical. The platform with the most developers wins the most customers. Microsoft taught investors that. But Apple never talks about its developer community. IBM has made a huge commitment to develop iOS enterprise apps that should drive substantial future sales, but Apple isn’t exciting investors about that opportunity. Tell investors more stories about how Apple is king of the developer world, and will remain in the top spot – better than Android or anyone – for years. Tell investors this will turn users toward tablets from PCs faster, and iPod sales will start growing again as smartphone and wearable sales join suit.

- Apple will win big revenues in auto markets. There was lots of rumors about hiring people to design a car, and now firing the lead guy. What is going on? Google has been pretty clear about its plans, but Apple offers investors no encouragement to think the company will succeed at even winning the war to be in other manufacturer’s cars, much less build its own. Given that the story sounds limited for Apple’s “core” products, investors need some stories about Apple’s own “moonshot” projects.

- Apple is not a 1-pony, iPhone story. Make investors believe it.

Tim Cook and the rest of Apple leadership are obviously competent. But when it comes to storytelling, this week their messaging looked like it was created as a high school communications project. Growth is what matters, and Apple completely missed the target. And investors are moving on to better stories – fast.

by Adam Hartung | Nov 18, 2015 | Current Affairs, Defend & Extend, In the Swamp, In the Whirlpool, Leadership, Web/Tech

Microsoft recently announced it was offering Windows 10 on xBox, thus unifying all its hardware products on a single operating system – PCs, mobile devices, gaming devices and 3D devices. This means that application developers can create solutions that can run on all devices, with extensions that can take advantage of inherent special capabilities of each device. Given the enormous base of PCs and xBox machines, plus sales of mobile devices, this is a great move that expands the Windows 10 platform.

Only it is probably too late to make much difference. PC sales continue falling – quickly. Q3 PC sales were down over 10% versus a year ago. Q2 saw an 11% decline vs year ago. The PC market has been steadily shrinking since 2012. In Q2 there were 68M PCs sold, and 66M iPhones. Hope springs eternal for a PC turnaround – but that would seem increasingly unrealistic.

The big market shift to mobile devices started back in 2007 when the iPhone began challenging Blackberry. By 2010 when the iPad launched, the shift was in full swing. And that’s when Microsoft’s current problems really began. Previous CEO Steve Ballmer went “all-in” on trying to defend and extend the PC platform with Windows 8 which began development in 2010. But by October, 2012 it was clear the design had so many trade-offs that it was destined to be an Edsel-like flop – a compromised product unable to please anyone.

The big market shift to mobile devices started back in 2007 when the iPhone began challenging Blackberry. By 2010 when the iPad launched, the shift was in full swing. And that’s when Microsoft’s current problems really began. Previous CEO Steve Ballmer went “all-in” on trying to defend and extend the PC platform with Windows 8 which began development in 2010. But by October, 2012 it was clear the design had so many trade-offs that it was destined to be an Edsel-like flop – a compromised product unable to please anyone.

By January, 2013 sales results were showing the abysmal failure of Windows 8 to slow the wholesale shift into mobile devices. Ballmer had played “bet the company” on Windows 8 and the returns were not good. It was the failure of Windows 8, and the ill-fated Surface tablet which became a notorious billion dollar write-off, that set the stage for the rapid demise of PCs.

And that demise is clear in the ecosystem. Microsoft has long depended on OEM manufacturers selling PCs as the driver of most sales. But now Lenovo, formerly the #1 PC manufacturer, is losing money – lots of money – putting its future in jeopardy. And Dell, one of the other top 3 manufacturers, recently pivoted from being a PC manufacturer into becoming a supplier of cloud storage by spending $67B to buy EMC. The other big PC manufacturer, HP, spun off its PC business so it could focus on non-PC growth markets.

And, worse, the entire OEM market is collapsing. For the largest 4 PC manufacturers sales last quarter were down 4.5%, while sales for the remaining smaller manufacturers dropped over 20%! With fewer and fewer sales, consolidation is wiping out many companies, and leaving those remaining in margin killing to-the-death competition.

And, worse, the entire OEM market is collapsing. For the largest 4 PC manufacturers sales last quarter were down 4.5%, while sales for the remaining smaller manufacturers dropped over 20%! With fewer and fewer sales, consolidation is wiping out many companies, and leaving those remaining in margin killing to-the-death competition.

Which means for Microsoft to grow it desperately needs Windows 10 to succeed on devices other than PCs. But here Microsoft struggles, because it long eschewed its “channel suppliers,” who create vertical market applications, as it relied on OEM box sales for revenue growth. Microsoft did little to spur app development, and rather wanted its developers to focus on installing standard PC units with minor tweaks to fit vertical needs.

Today Apple and Google have both built very large, profitable developer networks. Thus iOS offers 1.5M apps, and Google offers 1.6M. But Microsoft only has 500K apps largely because it entered the world of mobile too late, and without a commitment to success as it tried to defend and extend the PC. Worse, Microsoft has quietly delayed Project Astoria which was to offer tools for easily porting Android apps into the Windows 10 market.

Microsoft realized it needed more developers all the way back in 2013 when it began offering bonuses of $100,000 and more to developers who would write for Windows. But that had little success as developers were more keen to achieve long-term sales by building apps for all those iOS and Android devices now outselling PCs. Today the situation is only exacerbated.

By summer of 2014 it was clear that leadership in the developer world was clearly not Microsoft. Apple and IBM joined forces to build mobile enterprise apps on iOS, and eventually IBM shifted all its internal PCs from Windows to Macintosh. Lacking a strong installed base of Windows mobile devices, Microsoft was without the cavalry to mount a strong fight for building a developer community.

In January, 2015 Microsoft started its release of Windows 10 – the product to unify all devices in one O/S. But, largely, nobody cared. Windows 10 is lots better than Win8, it has a great virtual assistant called Cortana, and it now links all those Microsoft devices. But it is so incredibly late to market that there is little interest.

Although people keep talking about the huge installed base of PCs as some sort of valuable asset for Microsoft, it is clear that those are unlikely to be replaced by more PCs. And in other devices, Microsoft’s decisions made years ago to put all its investment into Windows 8 are now showing up in complete apathy for Windows 10 – and the new hybrid devices being launched.

AM Multigraphics and ABDick once had printing presses in every company in America, and much of the world. But when Xerox taught people how to “one click” print on a copier, the market for presses began to die. Many people thought the installed base would keep these press companies profitable forever. And it took 30 years for those machines to eventually disappear. But by 2000 both companies went bankrupt and the market disappeared.

Those who focus on Windows 10 and “universal windows apps” are correct in their assessment of product features, functions and benefits. But, it probably doesn’t matter. When Microsoft’s leadership missed the mobile market a decade ago it set the stage for a long-term demise. Now that Apple dominates the platform space with its phones and tablets, followed by a group of manufacturers selling Android devices, developers see that future sales rely on having apps for those products. And Windows 10 is not much more relevant than Blackberry.

by Adam Hartung | Apr 2, 2015 | Current Affairs, Defend & Extend, In the Rapids, Innovation, Leadership, Web/Tech

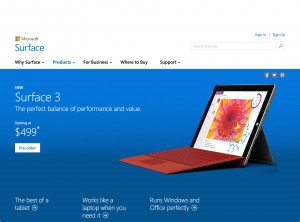

Microsoft launched its new Surface 3 this week, and it has been gathering rave reviews. Many analysts think its combination of a full Windows OS (not the slimmed down RT version on previous Surface tablets,) thinness and ability to operate as both a tablet and a PC make it a great product for business. And at $499 it is cheaper than any tablet from market pioneer Apple.

Meanwhile Apple keeps promoting the new Apple Watch, which was debuted last month and is scheduled to release April 24. It is a new product in a market segment (wearables) which has had very little development, and very few competitive products. While there is a lot of hoopla, there are also a lot of skeptics who wonder why anyone would buy an Apple Watch. And these skeptics worry Apple’s Watch risks diverting the company’s focus away from profitable tablet sales as competitors hone their offerings.

Looking at these launches gives a lot of insight into how these two companies think, and the way they compete. One clearly lives in red oceans, the other focuses on blue oceans.

Blue Ocean Strategy (Chan Kim and Renee Mauborgne) was released in 2005 by Harvard Business School Press. It became a huge best-seller, and remains popular today. The thesis is that most companies focus on competing against rivals for share in existing markets. Competition intensifies, features blossom, prices decline and the marketplace loses margin as competitors rush to sell cheaper products in order to maintain share. In this competitively intense ocean segments are niched and products are commoditized turning the water red (either the red ink of losses, or the blood of flailing competitors, choose your preferred metaphor.)

On the other hand, companies can choose to avoid this margin-eroding competitive intensity by choosing to put less energy into red oceans, and instead pioneer blue oceans – markets largely untapped by competition. By focusing beyond existing market demands companies can identify unmet needs (needs beyond lower price or incremental product improvements) and then innovate new solutions which create far more profitable uncontested markets – blue oceans.

Obviously, the authors are not big fans of operational excellence and a focus on execution, but instead see more value for shareholders and employees from innovation and new market development.

If we look at the new Surface 3 we see what looks to be a very good product. Certainly a product which is competitive. The Surface 3 has great specifications, a lot of adaptability and meets many user needs – and it is available at what appears to be a favorable price when compared with iPads.

But …. it is being launched into a very, very red ocean.

The market for inexpensive personal computing devices is filled with a lot of products. Don’t forget that before we had tablets we had netbooks. Low cost, scaled back yet very useful Microsoft-based PCs which can be purchased at prices that are less than half the cost of a Surface 3. And although Surface 3 can be used as a tablet, the number of apps is a fraction of competitive iOS and Android products – and the developer community has not yet embraced creating new apps for Windows tablets. So Surface 3 is more than a netbook, but also a lot more expensive.

Additionally, the market has Chromebooks which are low-cost devices using Google Chrome which give most of the capability users need, plus extensive internet/cloud application access at prices less than a third that of Surface 3. In fact, amidst the Microsoft and Apple announcements Google announced it was releasing a new ChromeBit stick which could be plugged into any monitor, then work with any Bluetooth enabled keyboard and mouse, to turn your TV into a computer. And this is expected to sell for as little as $100 – or maybe less!

This is classic red ocean behavior. The market is being fragmented into things that work as PCs, things that work as tablets (meaning run apps instead of applications,) things that deliver the functionality of one or the other but without traditional hardware, and things that are a hybrid of both. And prices are plummeting. Intense competition, multiple suppliers and eroding margins.

Ouch. The “winners” in this market will undoubtedly generate sales. But, will they make decent profits? At low initial prices, and software that is either deeply discounted or free (Google’s cloud-based MSOffice competitive products are free, and buyers of Surface 3 receive 1 year free of MS365 Office in the cloud, as well as free upgrade to Windows 10,) it is far from obvious how profitable these products will be.

Amidst this intense competition for sales of tablets and other low-end devices, Apple seems to be completely focused on selling a product that not many people seem to want. At least not yet. In one of the quirkier product launch messages that’s been used, Apple is saying it developed the Apple Watch because its other innovative product line – the iPhone – “is ruining your life.”

Apple is saying that its leaders have looked into the future, and they think today’s technology is going to move onto our bodies. Become far more personal. More interactive, more knowledgeable about its owner, and more capable of being helpful without being an interruption. They see a future where we don’t need a keyboard, mouse or other artificial interface to connect to technology that improves our productivity.

Right. That is easy to discount. Apple’s leaders are betting on a vision. Not a market. They could be right. Or they could be wrong. They want us to trust them. Meanwhile, if tablet sales falter….. if Surface 3 and ChromeBit do steal the “low end” – or some other segment – of the tablet market…..if smartphone sales slip….. if other “forward looking” products like ApplePay and iBeacon don’t catch on……

This week we see two companies fundamentally different methods of competing. Microsoft thinks in relation to its historical core markets, and engaging in bloody battles to win share. Microsoft looks at existing markets – in this case tablets – and thinks about what it has to do to win sales/share at all cost. Microsoft is a red ocean competitor.

Apple, on the other hand, pioneers new markets. Nobody needed an iPod… folks were happy enough with Sony Walkman and Discman. Everybody loved their Razr phones and Blackberries… until Apple gave them an iPhone and an armload of apps. Netbook sales were skyrocketing until iPads came along providing greater mobility and a different way of getting the job done.

Apple’s success has not been built upon defending historical markets. Rather, it has pioneered new markets that made existing markets obsolete. Its success has never looked obvious. Contrarily, many of its products looked quite underwhelming when launched. Questionable. And it has cannibalized its own products as it brought out new ones (remember when iPods were so new there was the iPod mini, iPod nano and iPod Touch? After 5 years of declining iPod sale Apple has stopped reporting them.) Apple avoids red oceans, and prefers to develop blue ones.

Which company will be more successful in 2020? Time will tell. But, since 2000 Apple has gone from nearly bankrupt to the most valuable publicly traded company in the USA. Since 1/1/2001 Microsoft has gone up 32% in value. Apple has risen 8,000%. While most of us prefer the competition in red oceans, so far Apple has demonstrated what Blue Ocean Strategy authors claimed, that it is more profitable to find blue oceans. And they’ve shown us they can do it.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.