by Adam Hartung | Aug 10, 2017 | Entrepreneurship, Leadership, Web/Tech

Recently, I wrote a column about 10 young entrepreneurs. Originally I titled it “10 under 20” but the Forbes editors thought that was too close to their “30 under 30” column so they changed it to “10 Great Lessons From Millennial Entrepreneurs.” I didn’t like that title, because it implied these were “great” entrepreneurs, and I really didn’t think they were all that great. Now that some time has gone by, I really regret having written the column.

I’ve written this column at Forbes for almost 7 years. So I am pitched for unsolicited columns every day by PR firms. On average, about 10 pitches every day. But nothing compared with the onslaught of emails I received after the millenial column. Firm after firm, and even individuals, contacted me by email, on Facebook, Linked-in, and Twitter to tell me about some incredible young person who just absolutely needed to be written about. You would think that every high school, and small university, in America had at least one, if not multiple, young prodigies all of which were destined to change the world. It was an avalanche of pitches, from which I could not even begin to fully read, much less respond.

But, almost universally these businesses were not that fantastic. Most were the modern day equivalent of someone opening a lawn service in 1960. Simple businesses that had little to distinguish them. Many had no revenues, and many were little more than somebody’s idea of a business they would like to build. Those that had revenues were so small as to be meaningless, and almost none made any impact on their industry or competition.

The pitches were, without a doubt, the most hyped pitches I have ever received. Over and over I kept asking “why would anyone think this is in the slightest interesting?

The only reason this is being pitched is because it involves someone under the age of 25. And usually that someone lacks any credentials and offers no new insight to the industry or product.”

2 -Not a sustainable business

Writing an app is not a business. Even if it sold a few thousand copies. Nor is trading baseball cards, or selling someone else’s stuff on eBay. Nor is buying bitcoins. By and large, 99% of the pitches were for one-product opportunities that clearly lacked any sense of being a sustainable business which could produce recurring revenue over multiple years. Almost none had any employees, and those that did had a mere handful with no plans to scale any larger.

At best most were simply a single shot situation which generated some revenue for the millennial founder. And most could only pay the founder because the business had no overhead and a highly subsidized cost structure due to support from parents. Many had no, or little, profits and there was nowhere near enough cash to repay traditional investors. Because there was no cost for financing, overhead or even variable activities like payroll, these businesses could not be considered a success in any traditional sense.

3 – These were not really entrepreneurs

French economist Jean-Baptiste Say coined the term entrepreneur. He used it to describe people who seek out inefficient uses of resources and capital then redeployed them into more productive, higher-profit uses. None of the pitched businesses actually redeployed any resources. And none really developed a new industry that created greater productivity. These were just ideas that manifested into a product that fit an immediate need. Most used an existing infrastructure, such as an app store, to do one thing – like sell an app. Maybe someday they’ll write another – but there was no indication any research was happening, customer analysis or market testing to create a long-term business.

Additionally, for entrepreneurs there is some element of risk-taking. For taking risk, by investing in something where others won’t invest, there is the opportunity for outsized returns. But these folks didn’t take any risk at all. It wasn’t their money they invested, but rather their family’s. Most either lived at home, or lived in housing paid for by family (such as a college dorm room.) Most had nothing invested in their “business” other than personal time, and if this failed there was almost nothing lost. And most had minimal gains relative to the size of the risk they undertook with other people’s resources.

And they all lacked any sense of a business plan. Now I’m all for innovation and trying new things, but business success requires the ability to generate ongoing revenue for a prolonged period that covers all costs and creates returns for investors. These folks simply promoted ideas with no description of how this was to be a long-term profitable venture that succeeded for customers, suppliers and financial backers. I found that I would not have been an investor in hardly any of these “businesses” and surely would not recommend readers to back them.

4 – These folks were big self-promoters, not business promoters

Almost to a pitch every story was about some individual – not a business success. I was told over and over and over about how some 17, 18, 19 or 20 year old was absolutely a genius; a modern miracle of incredible business insight. Yet, there was little to back-up these claims. In the end, these were just young folks who had some sense of ambition and fortitude that were doing a few experiments and had (in some instances, not all) sold a few things. But their stories really weren’t that interesting.

One young fellow washed vehicles. He got a contract to wash trucks. And he had expanded his truck washing capability to multiple trucking companies. OK, ambitious and hard working. But nothing fantastic. No technology breakthrough. Just a basic service that he sold cheaply enough to win some contracts. But, he was unwilling to discuss his margins, how much he paid himself or others and how he financed the company or paid a return to his backers. Yet, he was certain that he could franchise his truck washing business and soon enough he would be the next Ray Kroc. He, and his PR person (and it was unclear who paid her) failed to realize that his story might be interesting in 20 years after he proved he could build the next McDonald’s making himself, his investors and his franchisees rich.

Add onto this the fact that almost all of these people had nothing good to say about anyone older. For some reason I was informed over and again that nobody over 40 could really understand how brilliant this person is, and how guaranteed was future success. These people universally had no value for advice from people older than them,  no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

I kept saying to myself “get over yourself kid. You are working hard, but so are a lot of other people. You really haven’t accomplished anything of merit yet. And there’s not really anything here that indicates you will achieve great things. You may win awards for just showing up at school, or at the soccer match, but in business you have a LOT more to prove than you can show up and possibly accomplish some of the basics. Once..”

5 – No sense of how to build something, or even engage in quid pro quo

Bill Gates built a company that produced software millions of people wanted. Steve Jobs built a company that made devices (computers initially) that millions wanted. Henry Ford made cheap cars that millions of people wanted. Mark Zuckerberg created an interaction engine that millions of people wanted (and advertisers would pay to reach.) These founders understood that building a successful business meant combining multiple resources into an organization that functions capably to build products and markets.

If you asked them “why should I write about you?” they would answer, “to tell folks about the improvement in their life from my company’s products.”

When I asked these millennial entrepreneurs why I should write about them, the answer was “because I’m young and great and going places.”

Worse, when I pointed out that in today’s world columnists rely on readers, and therefore columnists want to know the topic will generate reads, they were without even a good idea of how a column on them would generate reads. When I asked “will you promote this through a large social media conduit to drive readers to the column?” they responded with “but isn’t that what Forbes does, bring in readers? I think you should write about me so Forbes readers can become enlightened. Why should I be asked to promote your column, isn’t that what you and Forbes do?”

It was completely unclear to me who was paying for these PR firms. But to them, and to the hundreds of millennials who sent me Facebook, Linked-in and Twitter messages:

- Quit focusing on yourself and actually accomplish something. Don’t be proud you’re a drop-out, go finish school.

- Listen more and talk less. You really don’t have much that’s interesting to say. Pay attention to those who are older, wiser and could help you reach your goals. You need them, and most of them don’t need you. You’re really not as interesting as you think you are.

- Get some education. Bill Gates and Steve Jobs are my age – not yours. Every generation needs more skills than the one before it. Mark Zuckerberg is THE exception, not the rule. Dropping out of Harvard did not make him great. Before you decide you have all the answers, go learn what the questions are. Learn how to think, how to reason, before you decide you know all that’s needed to take action.

- Quit living on subsidies. If your parents or grandparents or aunts and uncles are paying for your rent, or car, or supplies then you still don’t understand basic economics. Become self-sufficient. Make enough money to buy your own new car, buy your own house, and pay 100% of your bills – and even enough that you could afford to raise children. Until you are self-reliant it is very hard to take you seriously as a business leader.

- Life is NOT a one-round event. You are very likely to live 100 years. Do you have the skills to maintain your lifestyle for that full 100 years? Quit crowing about the 1 success (by your definition) you’ve had so far and instead figure out how you’ll lead a productive 100 year existence. You’re only 20% of the way there.

I hear folks say we need to advance millennials onto boards of directors for public companies. Or fund their new ventures without business plans or traditional benchmarks. Or put them into highly placed positions of major corporations. I can’t agree with that. From what I observed, millennials are similar to all other young people. They don’t know what they don’t know. And only time, failures, successes, education (formal and informal) and hard work will prepare them to be tomorrow’s leaders.

I started my entrepreneurial life while a college junior. I was lucky enough to hook up with several people at least a decade older, and they found investors that were a generation older. The company made computer hardware, and largely due to good luck as well as hard work the company was successfull, and was sold for a great return to the investors and some money for the founders. Simultaneously I completed my undergraduate degree in 4 years, summa cum laude. What made me most excited about that experience was not trying to be featured in any journal, but rather that the folks at the Harvard Business School felt this experience was good enough to admit me to their institution to complete an MBA. And there is no doubt in my mind that what I learned in college, and grad school, was incredibly important to generating a lifetime of ongoing business accomplishments – long after that first company disappeared into the dustbin of obsolete technology.

by Adam Hartung | Dec 19, 2015 | Books, Current Affairs, Ethics, Lifecycle

America’s middle class has been decimated. Ever since Ronald Reagan rewrote the tax code, dramatically lowering marginal rates on wealthy people and slashing capital gains taxes, America’s wealthy have been amassing even greater wealth, while the middle class has gone backward and the poor have remained poor. Losing 30% of their wealth, and for many most of their home equity, has left what were once middle class families actually closer to definitions of working poor than a 1950s-1960s middle class.

When Charles Dickens wrote “A Christmas Carole” he brought to life for readers the striking difference between those who “have” from those who “have not” in early England. If you had money England was a great place to be. If you relied on your labors then you were struggling to make ends meet, and regularly disappointing yourself and your family.

For a great many American’s that is the situation in 2015 USA.

At the book’s outset, Mr. Ebenezer Scrooge felt that his wealth was all due to his own great skill. He gave himself 100% of the credit for amassing a fortune, and he felt that it was wrong of laborers, such as his bookkeeper Mr. Cratchit, to expect to pay when seeking a day off for Christmas.

Unfortunately, this sounds far too often like the wealthy and 1%ers. They feel as if their wealth is 100% due to their great intelligence, skill, hard work or conniving. And they don’t think they owe anyone anything as they work to keep unions at bay as they campaign to derail all employee bargaining. Nor do they think they should pay taxes on their wealth as many actively seek to destroy the role of government.

Meanwhile, there are employers today who have taken a page right out of Mr. Scrooge’s book of worklife desolation. Ever since President Reagan fired the Air Traffic Controllers Union employee rights have been on the downhill. Employers increasingly do not allow employees to have any say in their work hours or workplace conditions – such as Marissa Mayer eliminating work from home at Yahoo, yet expecting 3 year commitments from all managers.

Just as Mr. Scrooge refused to put more coal in the office stove as Mr. Cratchit’s fingers froze, employers like WalMart rigidly control the workplace environment – right down to the temperature in every single building and office – in order to save cost regardless of employee satisfaction. Workplace comfort has little voice when implementing the CEOs latest cost-saving regimen.

Just as Mr. Scrooge refused to put more coal in the office stove as Mr. Cratchit’s fingers froze, employers like WalMart rigidly control the workplace environment – right down to the temperature in every single building and office – in order to save cost regardless of employee satisfaction. Workplace comfort has little voice when implementing the CEOs latest cost-saving regimen.

Just as Mr. Scrooge objected to giving the 25th December as a paid holiday (picking his pocket once a year was his viewpoint,) many employers keep cutting sick leave and holidays – or, worse, they allow days off but expect employees to respond to texts, voice mails, emails and social media 24x7x365. “Take all the holiday you want, just respond within minutes to the company’s every need, regardless of day or time.”

Increasingly, those who “go to work” have less and less voice about their work. How many of you readers will check your work voice mail and/or email on Christmas Day? Is this not the modern equivalent of your employer, like Scrooge, treating you like a filcher if you don’t work on the 25th December? But, do you dare leave the smartphone, tablet or laptop alone on this day? Do you risk falling behind on your job, or angering your boss on the 26th if something happened and you failed to respond?

Like many with struggling economic uncertainty, Bob Cratchit had a very ill son. But Mr. Scrooge could not be bothered by such concerns. Mr. Scrooge had a business to run, and if an employee’s family was suffering then it was up to social services to take care of such things. If those social services weren’t up to standards, well it simply was not his problem. He wasn’t the government – although he did object to any and all taxes. And he had no value for the government offering decent prisons, or medical care to everyone.

Today, employers right and left have dropped employee health insurance, recommending employees go on the exchanges; even though these same employers do not offer any incremental income to cover the cost of exchange-based employee insurance. And many employers are cutting employee hours to make sure they are not able to demand health care coverage. And the majority of employers, and employer associations such as the Chamber of Commerce, want to eliminate the Affordable Care Act entirely, leaving their employees with no health care at all – as was the case for many prior to ACA passage.

Even worse, there are employers (especially in retail, fast food and other minimum wage environments) with employees earning so little pay that as employers they recommend their employees file for government based Medicaid in order to receive the bottom basics of healthcare. Employees are a necessity, but not if they are sick or if the employer has to help their families maintain good health.

But things changed for Mr. Scrooge, and we can hope they do for a lot more of America’s employers and wealthy elite.

Mr. Scrooge’s former partner, Mr. Jakob Marley, visits Mr. Scrooge in a dream and reminds him that, in fact, there was a lot more to his life, and wealth creation, than just Ebenezer’s toils. Those around him helped him become successful, and others in his life were actually very important to his happiness. He reminds Mr Scrooge that as he isolated himself in the search for ever greater wealth he gained money, but lost a lot of happiness.

Today we have some business leaders taking the cue from Mr. Marley, and speaking out to the Scrooges. In particular, we can be thankful for folks like Warren Buffet who consistently points out the great luck he had to be born with certain skills at this specific point in time. Mr. Buffett regularly credits his wealth creation with the luck to receive a good education, learning from academics such as Ben Graham, and having a great network of colleagues to help him invest.

Further, amplifying his role as a modern day Jacob Marley, Mr. Buffett recognizes the vast difference between his situation and those around him. He has pointed out that his secretary pays a higher percent of her income in taxes than himself, and he points out this is a remarkably unfair situation. Additionally, he makes it clear that for many wealth is a gift of birth – and “winning the ovarian lottery” does not make that wealthy person smarter, harder working or more valuable to society. Rather, just lucky.

What we need is for more wealthy Americans to have a vision of Christmas future – as it appeared to Mr. Scrooge. He saw how wealth inequality would worsen young Tiny Tim’s health, leaving him crippled and dying. He saw his employee Mr. Cratchet struggle and become ill. These visions scared him. Scared him so much, he offered a bounty upon his community, sharing his wealth.

Mr. Scrooge realized that great wealth, preserved just for him, was without merit. He was doomed to a future of being rich, but without friends, without a great world of colleagues and without the sharing of riches among everyone in order that all in society could be healthy and grow. Many would suffer, and die, if society overall did not take actions to share success.

These days we do have a few of these visionary 1%ers, such as Bill Gates, Warren Buffett and recently Mark Zuckerberg, who are either currently, or in the future, planning to disseminate their vast wealth for the good of mankind.

Yet, middle class Americans have been watching their dreams evaporate. Over the last 50 years America has changed, and they have been left behind. Hard work, well…….. it just doesn’t give people what it once did. Policy changes that favored the wealthy with Ayn Rand style tax programs have made the rich ever richer, supported the legal rights of big corporations and left the middle class with a lot less money and power. Incomes that did not come close to matching inflation, and home values that too often are more anchors than balloons have beset 2015’s strivers.

It will take more than philanthropic foundations and a few standout generous donors to rebuild America’s middle class. It will take policies that provide more (more safety nets, more health care, more education, more pension protection, more job protections and more political power) for those in the middle, and give them economic advantages today offered only wealthier Americans.

Let us hope that in 2016 we see a re-awakening of the need to undertake such rebuilding by policymakers, corporate leaders and the 1%. Let us hope this Christmas for a stronger, more robust, healthier and disparate, shared economy “for each and every one.”

by Adam Hartung | Feb 18, 2015 | Current Affairs, Leadership

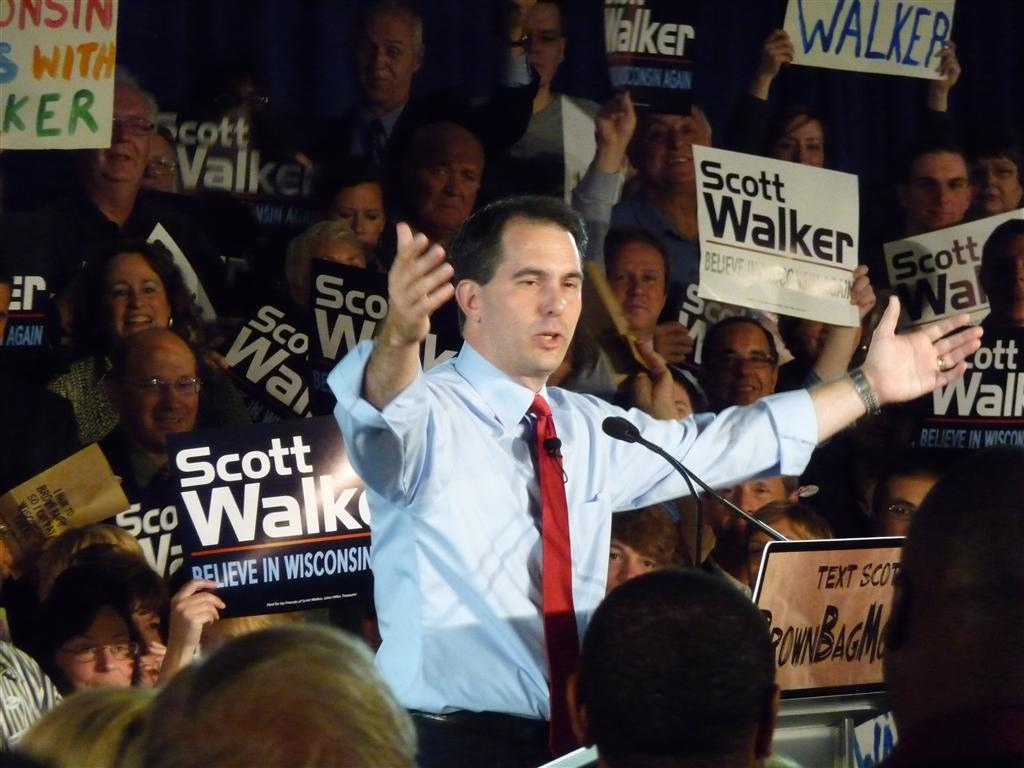

There has been a hullabaloo lately about Wisconsin Governor Walker’s lack of a degree. Some think this is a big deal, while others think almost nobody cares. In the end, we all should care about the formal education of any of our leaders. In government, business and elsewhere.

In Forbes magazine, 1998, famed management guru Peter Drucker wrote, “Get the assumptions wrong and everything that follows from them is wrong.” This is really important, because most leaders make most of their decisions based on assumptions. And many of those assumptions are based on how much, and how broad, that leader’s education.

We all make decisions on beliefs. It is easy to have incorrect beliefs. Early doctors believed that infections were due to bad blood, so they used bleeding as a cure-all for many wounds and illnesses. Untold millions of people died from this practice. A bad assumption, based on belief rather than formal study (in this case of the circulatory system) proved fatal.

In business, for thousands of years most sailors had no education about the curvature of the earth and its rotation the sun, thus they believed the world was flat and refused to sail further out to sea than the ability to keep their eyes on a shoreline. This limited trade, and delayed expansion into new markets.

Or, more recently, Steve Ballmer assumed that anyone using a smartphone would want a keyboard – because Blackberry dominated the market and had a keyboard. Thus he laughed at the iPhone launch. Oops. His assumption, and belief about the user experience, caused Microsoft to delay its entry into mobile markets and smartphones several years. Even though he had not studied smartphone user needs. Now Apple has half the smartphone market, while Blackberry and Microsoft each have less than 5%.

There are countless examples of bad decisions made when people use the wrong assumptions. At this time in Oklahoma, Texas and Colorado politicians are voting to refuse upgrading history education because the new curriculum is unacceptable to them. Their assumptions about America’s history are so strong that any factual evidence which might change those assumptions is so threatening that these politicians would prefer students be taught a fictitious history.

Our assumptions are built early in life. All through childhood our parents, aunts, uncles, religious leaders, mentors and teachers fill us with information. We process this information and build layers of assumptions. These assumptions help us to make decisions by allowing us to react based upon what we believe, rather than having to scurry around and do a research project every time a decision is required. Thus, the older we become the deeper these assumptions lie – and the more we rely on them as we undertake less and less education. As we age we decide based upon our beliefs, and less based upon any observable facts. Actually, we’ll often choose to ignore facts which indicate our assumptions and beliefs might be wrong (we call this a bias in others, and common sense when we do it ourselves.)

The more education you have, the more you can build assumptions that are likely to align with reality. It is no accident that the U.S. military uses education as a basis for promotions – rather than battlefield heroics. To move up requires officers go to war college and learn about history, politics, leadership and battles going back to long before the birth of Jesus. Good knowledge helps officers to be smarter about how to prepare for battle, organize for battle, conduct warfare, lead troops, treat a vanquished enemy and talk to the politicians for whom they work. Just look at the degrees amongst our military’s Colonels and General Officers and you find a plethora of masters and doctorate degrees. Education has long proven to be a superior warfare skill – especially when the enemy is operating on belief, guts and fight.

There are many accomplished people lacking degrees. But we should note they were successful very narrowly, and frequently in business. Steve Jobs, Bill Gates and Mark Zuckerberg are clearly high IQ people. But their success was based on founding a business at a time of technological revolution, and then building that business with zealousness. And the luck of being in the right place at the right time with a new piece of technology. They were/are not asked to be widely acclaimed in a broad spectrum of capabilities such as diplomacy, historical accuracy, legal limitations, cultural differences, the arts, scientific advances in multiple fields, warfare tactics, etc. They were not asked to develop a turnaround plan for a bankrupt auto manufacturer at the height of the Great Recession. For all their great wealth creation, they would not be what were once called “Renaissance men.”

When Governor Walker attacks the educated, and labels them as “elites,” it should be noted that their backgrounds often mean they have more points of view to evaluate, and are more considered about the various risks which are being created by taking any specific action. Many Harvard or Columbia MBAs could never be entrepreneurs because they see the many reasons a business would likely fail, and thus they are reticent to commit. Yet, that same wider knowledge allows them to be more thoughtful when evaluating the options and making decisions regarding opening new plants, negotiating with unions, expanding distribution and financing options.

Further, while it is true that you can be smart and not have a degree, the number of those who have degrees yet lack intelligence is a much, much smaller number. If one is to err in picking those you want to have advise you, or represent you, the degree(s) is not a bad first step toward identifying who is likely to provide the best insight and offer the most help.

Further, there is nothing about a degree which limits one’s ability to fight. Look at Senator Cruz from Texas. Senator Cruz’s politics seem to be somewhat aligned with Governor Walker’s, and he is widely acknowledged as a serious fighter, yet he boasts an undergraduate degree from Princeton as well as graduating from Harvard Law School. An educational background anyone would label as “elitist” and remarkably similar to President Obama’s – whose background Governor Walker has thoroughly maligned.

We expect our leaders to be widely read, and keenly aware of the complexities of life. We want our attorney’s to have law degrees and pass the bar exam. We want our physicians to have medical degrees and pass the Boards. Increasingly we want our business leaders to have MBAs. We understand that education informs our minds, and helps us develop assumptions for making good decisions. We should not belittle this, nor be accepting of someone who implies that lacking a formal education is meaningless.

by Adam Hartung | May 30, 2014 | Current Affairs, In the Swamp, In the Whirlpool, Leadership, Sports, Web/Tech

Anyone who reads my column knows I’ve been no fan of Steve Ballmer as CEO of Microsoft. On multiple occasions I chastised him for bad decisions around investing corporate funds in products that are unlikely to succeed. I even called him the worst CEO in America. The Washington Post even had difficulty finding reputable folks to disagree with my argument.

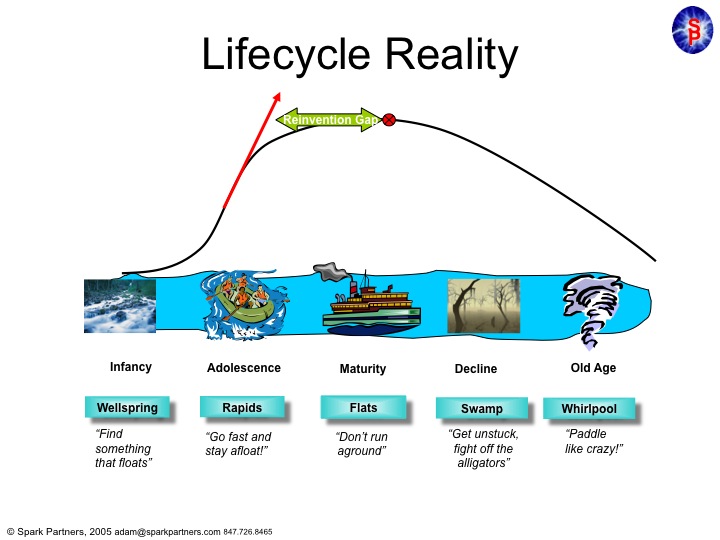

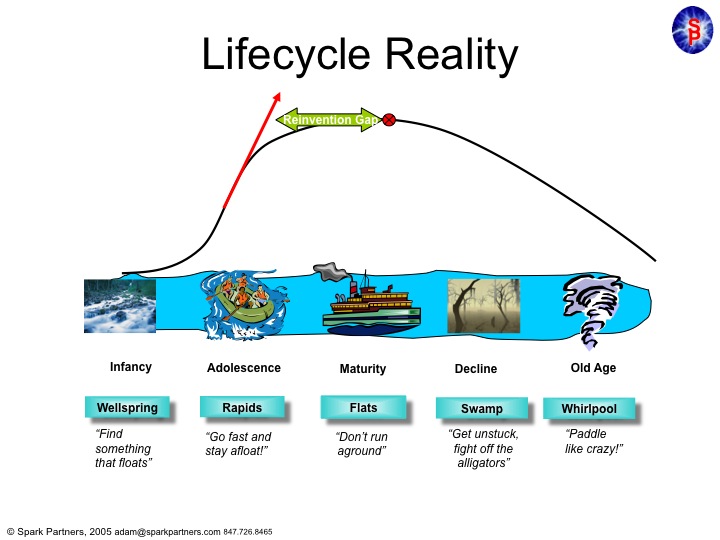

Unfortunately, Microsoft suffered under Mr. Ballmer. And Windows 8, as well as the Surface tablet, have come nowhere close to what was expected for their sales – and their ability to keep Microsoft relevant in a fast changing personal technology marketplace. In almost all regards, Mr. Ballmer was simply a terrible leader, largely because he had no understanding of business/product lifecycles.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Microsoft was founded by Bill Gates, who did a remarkable job of taking a start-up company from the Wellspring of an idea into one of the fastest growing adolescents of any American company.

Under Mr. Gates leadership Microsoft single-handedly overtook the original PC innovator – Apple – and left it a niche company on the edge of bankruptcy in little over a decade.

Mr. Gates kept Microsoft’s growth constantly in the double digits by not only making superior operating system software, but by pushing the company into application software which dominated the desktop (MS Office.) And when the internet came along he had the vision to be out front with Internet Explorer which crushed early innovator, and market maker, Netscape.

But then Mr. Gates turned the company over to Mr. Ballmer. And Mr. Ballmer was a leader lacking vision, or innovation. Instead of pushing Microsoft into new markets, as had Mr. Gates, he allowed the company to fixate on constant upgrades to the products which made it dominant – Windows and Office. Instead of keeping Microsoft in the Rapids of growth, he offered up a leadership designed to simply keep the company from going backward. He felt that Microsoft was a company that was “mature” and thus in need of ongoing enhancement, but not much in the way of real innovation. He trusted the market to keep growing, indefinitely, if he merely kept improving the products handed him.

As a result Microsoft stagnated. A “Reinvention Gap” developed as Vista, Windows 7, then Windows 8 and one after another Office updates did nothing to develop new customers, or new markets. Microsoft was resting on its old laurels – monopolistic control over desktop/laptop markets – without doing anything to create new markets which would keep it on the old growth trajectory of the Gates era.

Things didn’t look too bad for several years because people kept buying traditional PCs. And Ballmer famously laughed at products like Linux or Unix – and then later at entertainment devices, smart phones and tablets – as Microsoft launched, but then abandoned products like Zune, Windows CE phones and its own tablet. Ballmer kept thinking that all the market wanted was a faster, cheaper PC. Not anything really new.

And he was dead wrong. The Reinvention Gap emerged to the public when Apple came along with the iPod, iTunes, iPhone and iPad. These changed the game on Microsoft, and no longer was it good enough to simply have a better edition of an outdated technology. As PC sales began declining it was clear that Ballmer’s leadership had left the company in the Swamp, fighting off alligators and swatting at mosquitos with no strategy for how it would regain relevance against all these new competitors.

So the Board pushed him out, and demoted Gates off the Chairman’s throne. A big move, but likely too late. Fewer than 7% of companies that wander into the Swamp avoid the Whirlpool of demise. Think Univac, Wang, Lanier, DEC, Cray, Sun Microsystems (or Circuit City, Montgomery Wards, Sears.) The new CEO, Satya Nadella, has a much, much more difficult job than almost anyone thinks. Changing the trajectory of Microsoft now, after more than a decade creating the Reinvention Gap, is a task rarely accomplished. So rare we make heros of leaders who do it (Steve Jobs, Lou Gerstner, Lee Iacocca.)

So what will happen at the Clippers?

Critically, owning an NBA team is nothing like competing in the real business world. It is a closed marketplace. New competitors are not allowed, unless the current owners decide to bring in a new team. Your revenues are not just dependent upon you, but are even shared amongst the other teams. In fact your revenues aren’t even that closely tied to winning and losing. Season tickets are bought in advance, and with so many games away from home a team can do quite poorly and still generate revenue – and profit – for the owner. And this season the Indiana Pacers demonstrated that even while losing, fans will come to games. And the Philadelphia 76ers drew crowds to see if they would set a new record for the most consecutive games lost.

In America the major sports only modestly overlap, so you have a clear season to appeal to fans. And even if you don’t make it into the playoffs, you still share in the profits from games played by other teams. As a business, a team doesn’t need to win a championship to generate revenue – or make a profit. In fact, the opposite can be true as Wayne Huizenga learned owning the Championship winning Florida Marlins baseball team. He payed so much for the top players that he lost money, and ended up busting up the team and selling the franchise!

In short, owning a sports franchise doesn’t require the owner to understand lifecycles. You don’t have to understand much about business, or about business competition. You are protected from competitors, and as one of a select few in the club everyone actually works together – in a wholly uncompetitive way – to insure that everyone makes as much money as possible. You don’t even have to know anything about managing people, because you hire coaches to deal with players, and PR folks to deal with fans and media. And as said before whether or not you win games really doesn’t have much to do with how much money you make.

Most sports franchise owners are known more for their idiosyncrasies than their business acumen. They can be loud and obnoxious all they want (with very few limits.) And now that Mr. Ballmer has no investors to deal with – or for that matter vendors or cooperative parties in a complex ecosystem like personal technology – he doesn’t have to fret about understanding where markets are headed or how to compete in the future.

When it comes to acting like a person who knows little about business, but has a huge ego, fiery temper and loves to be obnoxious there is no better job than being a sports franchise owner. Mr. Ballmer should fit right in.

by Adam Hartung | Dec 28, 2009 | Current Affairs, In the Rapids, Innovation, Leadership

I was intrigued when I read on the Harvard Business Review web site “Do we celebrate the wrong CEOs?” The article quickly pointed out that many of the best known CEOs – and often named as most respected – didn’t come close to making the list of the top 100 best performing CEOs. Some of those on Barron’s list of top 30 most respected that did not make the cut as best performing include Immelt of GE, Dimon of JPMorganChase, Palmesano of IBM and Tillerson of ExxonMobil. It did seem striking that often business people admire those who are at the top of organizations, regardless of their performance.

I was delighted when HBR put out the full article “The Best Performing CEOs in the World.” And it is indeed an academic exercise of great value. The authors looked at CEOs who came into their jobs either just before 2000, or during the decade, and the results they obtained for shareholders. There were 1,999 leaders who fit the timeframe. As has held true for a long time in the marketplace, the top 100 accounted for the vast majority of wealth creation – meaning if you were invested with them you captured most of the decade’s return – while the bulk of CEOs added little value and a great chunk created negative returns. (It does beg the question – why do Boards of Directors keep on CEOs who destroy shareholder value – like Barnes of Sara Lee, for example? It would seem something is demonstrably wrong when CEOs remain in their jobs, usually with multi-million dollar compensation packages, when year after year performance is so bad.)

The list of “Top 50 CEOs” is available on the HBR website. This group created 32% average gains every year! They created over $48.2B of value for investors. Comparatively, the bottom 50 had negative 20% annual returns, and lost over $18.3B. As an investor, or employee, it is much, much better to be with the top 5% than to be anywhere else on the list. However, only 5 of the top best performers were on the list of top 50 highest paid — demonstrating again that CEO pay is not really tied to performance (and perhaps at least part of the explanation for why business leaders are less admired now than the previous decade.)

Consistent among the top 50 was the ability to adapt. Especially the top 10. Steve Jobs of Apple was #1, a leader and company I’ve blogged about several times. As readers know, Apple went from a niche producer of PCs to a leader in several markets completely unrelated to PCs under Mr. Jobs leadership. His ability to keep moving his company back into the growth Rapids by rejecting “focus on the core” and instead using White Space to develop new products for growth markets has been a model well worth following. And in which to be invested.

Similarly, the leaders of Cisco, Amazon, eBay and Google have been listed here largely due to their willingness to keep moving into new markets. Cisco was profiled in my book Create Marketplace Disruption for its model of Disruption that keeps the company constantly opening White Space. Amazon went from an obscure promoter of non-inventoried books to the leader in changing how books are sold, to the premier on-line retailer of all kinds of products, to the leader in digitizing books and periodicals with its Kindle launch. eBay has to be given credit for doing much more than creating a garage sale – they are now the leader in independent retailing with eBay stores. And their growth of PayPal is on the vanguard of changing how we spend money – eliminating checks and making digital transactions commonplace. Of course Google has moved from a search engine to a leader in advertising (displacing Yahoo!) as well as offering enterprise software (such as Google Wave), cloud applications to displace the desktop applications, and emerging into the mobile data/telephony marketplace with Android. All of these company leaders were willing to Disrupt their company’s “core” in order to use White Space that kept the company constantly moving into new markets and GROWTH.

We can see the same behavior among other leaders in the top 10 not previously profiled here. Samsung has moved from a second rate radio/TV manufacturer to a leader in multiple electronics marketplaces and the premier company in rapid product development and innovation implementation. Gilead Sciences is a biopharmaceutical company that has returned almost 2,000% to investors – while the leaders of Merck and Pfizer have taken their companies the opposite direction. By taking on market challenges with new approaches Gilead has used flexibility and adaptation to dramatically outperform companies with much greater resources — but an unwillingness to overcome their Lock-ins.

Three names not on the list are worth noting. Jack Welch was a great Disruptor and advocate of White Space (again, profiled in my book). But his work was in the 1990s. His replacement (Mr. Immelt) has fared considerably more poorly – as have investors – as the rate of Disruption and White Space has fallen off a proverbial cliff. Even though much of what made GE great is still in place, the willingness to Defend & Extend, as happened in financial services, has increased under Mr. Immelt to the detriment of investors.

Bill Gates and Warren Buffett are now good friends, and also not on the list. Firstly, they created their investor fortunes in previous decades as well. But in their cases, they remained as leaders who moved into the D&E world. Microsoft has become totally Locked-in to its Gates-era Success Formula, and under Steve Ballmer the company has done nothing for investors, employees — or even customers. And Berkshire Hathaway has spent the last decade providing very little return to shareholders, despite all the great press for Mr. Buffett and his success in previous eras. Each year Mr. Buffett tells investors that what worked for him in previous years doesn’t work any more, and they should not expect previous high rates of return. And he keeps proving himself right. Until both Microsoft and Berkshire Hathaway undertake significant Disruptions and implement considerably more White Space we should not expect much for investors.

This has been a tough decade for far too many investors and employees. As we end the year, the list of television programs bemoaning how badly the decade has gone is long. Show after show laments the poor performance of the stock market, as well as employers. We end the year with official unemployment north of 10%, and unofficial unemployment some say near 20%. But what this HBR report us is that it is possible to have a good decade. We need leaders who are willing to look to the future for their planning (not the past), obsess about competitors to discover market shifts, be willing to Disrupt old Success Formulas by attacking Lock-in, and using White Space to keep the company in the growth Rapids. When businesses overcome old notions of “best practice” that keeps them trying to Defend & Extend then business performs marvelously well. It’s just too bad so few leaders and companies are willing to follow The Phoenix Principle.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.