The #1 Real Estate Stock To Own Is Built On Trends – Alexandria Real Estate Equities (NYSE:ARE)

Writing on trends, I frequently profile tech companies that use trends to outperform competitors. But using trends is not restricted to tech companies.

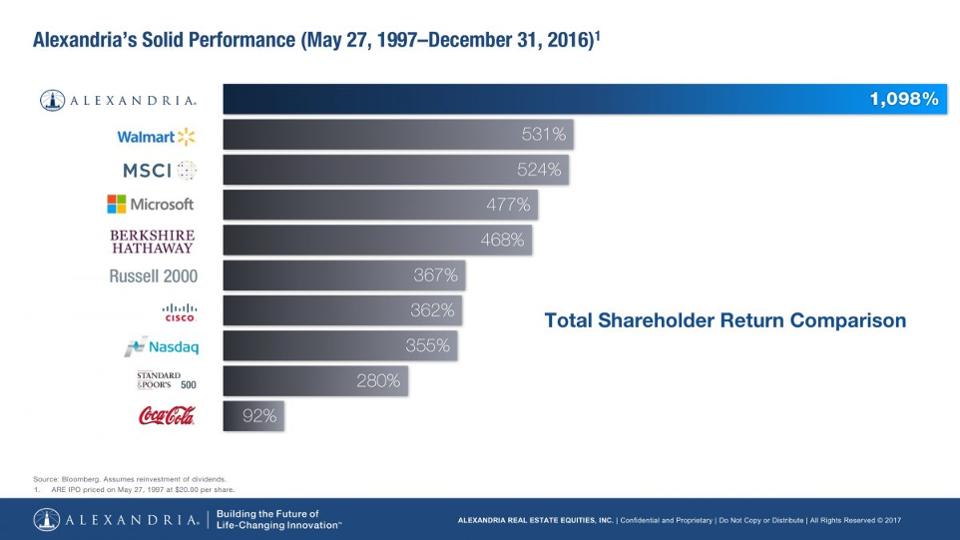

By following trends, since 1998 Alexandria Real Estate Equities has tripled the performance of the NASDAQ, quadrupled returns of the S&P 500, and quintupled the Russell 2000. Alexandria has even outperformed technology stalwart Microsoft, and investment guru Berkshire Hathaway by 230%.

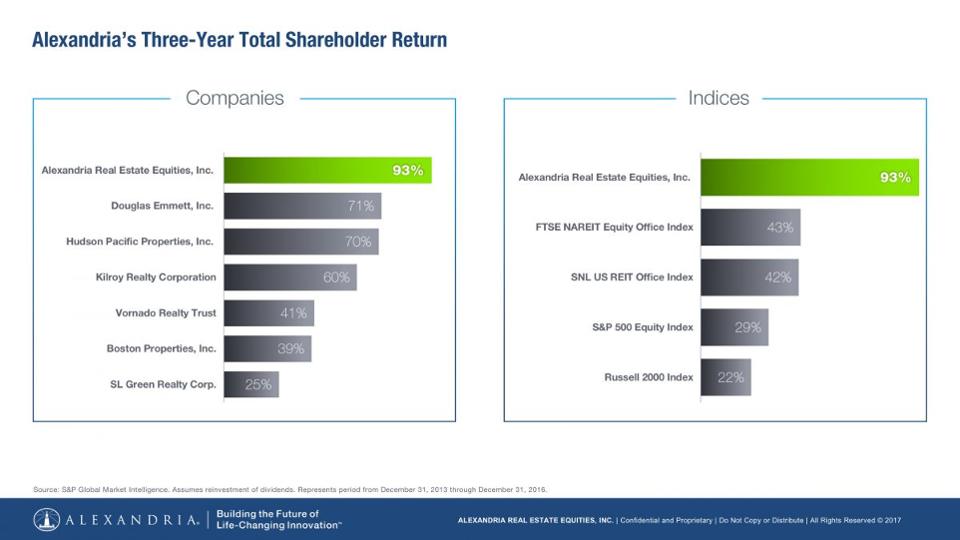

Although you probably never heard of it, Alexandria has trounced its real estate peers. Over the last three years Alexandria has returned double the FTSE NAREIT Equity Office Index, and double the SNL US REIT Office Index. Alexandria’s value has almost doubled during this time, and produced returns 2.3 times better than such well known competitors as Vornado Realty Trust and Boston Properties.

In 1983, Joel Marcus was a lawyer in the IPO market when he noticed the high value launch of biotech firms like Amgen and Genentech. He began tracking the growth of biotechs to see what kind of opportunity might appear to serve these high growth companies.

By 1994 Marcus realized that these companies were struggling to find appropriate real estate to serve their unique needs for laboratory space, and the infrastructure these labs require. It was a classic under-served market, and it was growing fast.

Jacobs Engineering (NYSE:JEC) was serving some of these companies’ needs, including erecting structures for them. But Jacobs did not own any buildings or consider itself a real estate developer. So Marcus approached Jacobs about starting a company to meet the real estate needs of this high growth biotech industry. Marcus put up some money, Jacobs put up some money, and other friends/associates combined to raise $19 million. There was no professionally managed money involved – and no real estate developers.

Focusing on the rapidly expanding biotech scene in San Diego, the newly created Alexandria bought 4 buildings. They refocused the buildings on the unserved needs of local biotech companies and did a quick flip, breaking even on the transaction. With just a bit of money Alexandria had proven that the market existed, the trend was real and users were under-served.

But, like any idea based on an emerging trend, growing was not easy. Using their first transaction as “proof of concept” CEO Marcus and his team set out to raise $100 million. Quickly Paine Webber (now UBS) secured $75 million in debt financing. But moving forward required raising $25 million in equity.

Over the next few weeks Alexandria pitched a slew of nay-sayers. From GE Capital to CALPERS investors felt that their first deal was a “1-trick pony,” and this “niche market” was not a sustainable business. Finally, after 29 failed pitches, the AEW pension fund, an early stage real estate investor, saw the trend and invested.

The Alexandria team realized that fast client growth meant there was no time to develop from ground up. They focused on high growth geographies for biotech, places where the trend was more pronounced, and bought 11 existing properties:

- In Seattle they found a cancer center they could buy, improve and do a sale-leaseback

- In San Francisco they identified a portfolio of properties in Alameda they could improve, lease to biotech companies and even suit the needs of the FDA as a tenant

- In Maryland they identified opportunities to support the lab needs of the Army Corps of Engineers forensic research lab, and ATF testing lab for imported vodka, and a medical testing lab near Dulles – which is now leased to Quest Diagnostics

Realizing that companies needing labs tended to cluster, leadership focused on finding locations where clusters were likely to emerge. They bought land in San Francisco, San Diego, New York and Worcester, MA. What looked like risky locations to others looked like profitable opportunities to Alexandria due to their superior trend research.

Historically pharma companies built their headquarters, and labs, in suburban locations where development was easy, and labs were welcome. Alexandria realized the new trend for emerging companies was to be near universities in urban environments, and although land was costly — and development more difficult — this was the right place to leverage the trend.

Today Alexandria is the bona fide market leader in labs and tech facilities in the USA. By seeing the trend early they bought land which is now so expensive it is practically untouchable – even for $1 billion. Their development pipeline includes Mission Bay, Kendall Square, the Manhattan borough of New York City and RTP (Research Triangle Park.) Today companies want to be where the lab is — and frequently the lab space is now owned, or being developed, by Alexandria.

This didn’t happen by accident. Not at the beginning nor as Alexandria plans its future growth. The company maintains a team of 13 researchers studying market trends in technology, and under-served real estate needs. They constantly track employers of tech/research people, competitors, historical and emerging customers — and identify prospective tech tenants who will need specialized real estate. A few of the leading trends Alexandria follows include:

- Urbanization — The siloed campuses set in bucolic suburbs is the past

- Innovation externalization — Over 50% of innovation in big pharma is now outsourced. And universities are spinning out innovations faster than ever into development centers for testing and commercialization

- Nutrition and disease management — These are emerging markets ripe with new products making their way to commercialization, and needing space to grow

Alexandria’s historical and ongoing successes relied first and foremost on using trends to understand underserved markets where needs will soon be the greatest. This is an important lesson for all businesses. No matter what you do, what you sell, or your industry you can generate higher returns, outperform your peers, and outperform the market rewarding investors by identifying trends and investing in them.

Thanks to Joel Marcus for providing an interview to explain the history and current practices at Alexandria.