by Adam Hartung | May 15, 2016 | In the Swamp, Investing, real estate, Retail

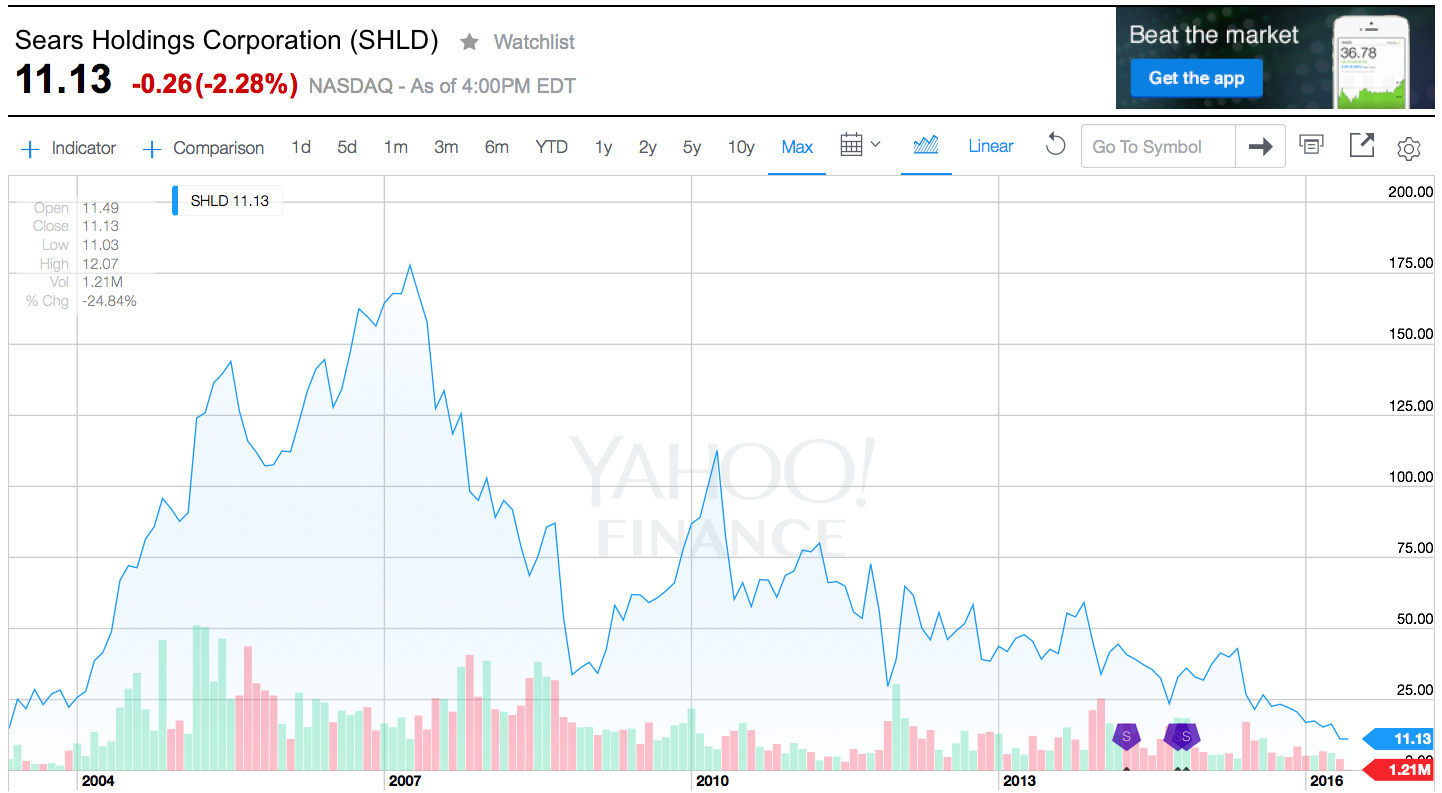

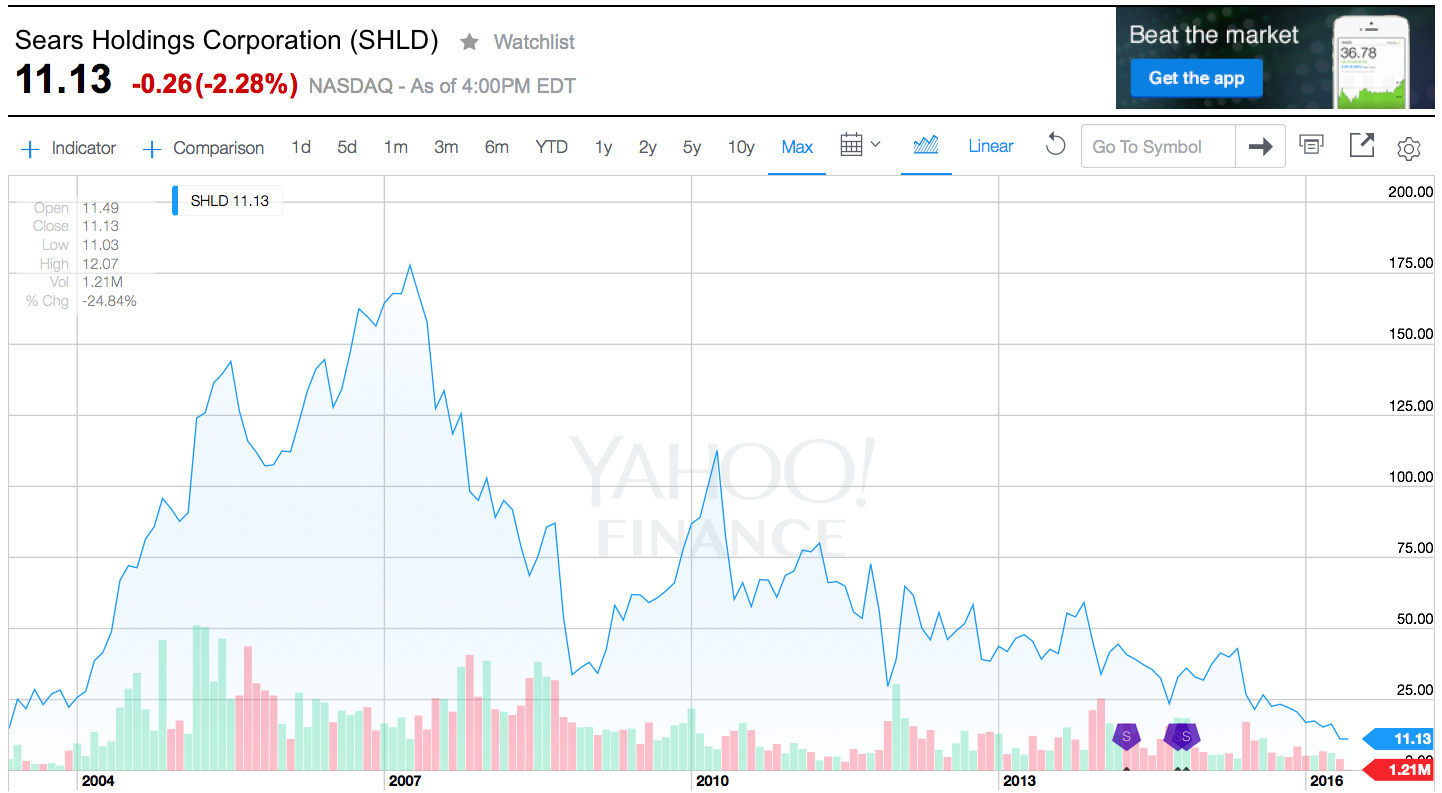

Last week Sears announced sales and earnings. And once again, the news was all bad. The stock closed at a record, all time low. One chart pretty much sums up the story, as investors are now realizing bankruptcy is the most likely outcome.

Chart Source: Yahoo Finance 5/13/16

Quick Rundown: In January, 2002 Kmart is headed for bankruptcy. Ed Lampert, CEO of hedge fund ESL, starts buying the bonds. He takes control of the company, makes himself Chairman, and rapidly moves through proceedings. On May 1, 2003, KMart begins trading again. The shares trade for just under $15 (for this column all prices are adjusted for any equity transactions, as reflected in the chart.)

Lampert quickly starts hacking away costs and closing stores. Revenues tumble, but so do costs, and earnings rise. By November, 2004 the stock has risen to $90. Lampert owns 53% of Kmart, and 15% of Sears. Lampert hires a new CEO for Kmart, and quickly announces his intention to buy all of slow growing, financially troubled Sears.

In March, 2005 Sears shareholders approve the deal. The stock trades for $126. Analysts praise the deal, saying Lampert has “the Midas touch” for cutting costs. Pumped by most analysts, and none moreso than Jim Cramer of “Mad Money” fame (Lampert’s former roommate,) in 2 years the stock soars to $178 by April, 2007. So far Lampert has done nothing to create value but relentlessly cut costs via massive layoffs, big inventory reductions, delayed payments to suppliers and store closures.

Homebuilding falls off a cliff as real estate values tumble, and the Great Recession begins. Retailers are creamed by investors, and appliance sales dependent Sears crashes to $33.76 in 18 months. On hopes that a recovering economy will raise all boats, the stock recovers over the next 18 months to $113 by April, 2010. But sales per store keep declining, even as the number of stores shrinks. Revenues fall faster than costs, and the stock falls to $43.73 by January, 2013 when Lampert appoints himself CEO. In just under 2.5 years with Lampert as CEO and Chairman the company’s sales keep falling, more stores are closed or sold, and the stock finds an all-time low of $11.13 – 25% lower than when Lampert took KMart public almost exactly 13 years ago – and 94% off its highs.

What happened?

Sears became a retailing juggernaut via innovation. When general stores were small and often far between, and stocking inventory was precious, Sears invented mail order catalogues. Over time almost every home in America was receiving 1, or several, catalogues every year. They were a major source of purchases, especially by people living in non-urban communities. Then Sears realized it could open massive stores to sell all those things in its catalogue, and the company pioneered very large, well stocked stores where customers could buy everything from clothes to tools to appliances to guns. As malls came along, Sears was again a pioneer “anchoring” many malls and obtaining lower cost space due to the company’s ability to draw in customers for other retailers.

To help customers buy more Sears created customer installment loans. If a young couple couldn’t afford a stove for their new home they could buy it on terms, paying $10 or $15 a month, long before credit cards existed. The more people bought on their revolving credit line, and the more they paid Sears, the more Sears increased their credit limit. Sears was the “go to” place for cash strapped consumers. (Eventually, this became what we now call the Discover card.)

In 1930 Sears expanded the Allstate tire line to include selling auto insurance – and consumers could not only maintain their car at Sears they could insure it as well. As its customers grew older and more wealthy, many needed help with financia advice so in 1981 Sears bought Dean Witter and made it possible for customers to figure out a retirement plan while waiting for their tires to be replaced and their car insurance to update.

To put it mildly, Sears was the most innovative retailer of all time. Until the internet came along. Focused on its big stores, and its breadth of products and services, Sears kept trying to sell more stuff through those stores, and to those same customers. Internet retailing seemed insignificantly small, and unappealing. Heck, leadership had discontinued the famous catalogues in 1993 to stop store cannibalization and push people into locations where the company could promote more products and services. Focusing on its core customers shopping in its core retail locations, Sears leadership simply ignored upstarts like Amazon.com and figured its old success formula would last forever.

But they were wrong. The traditional Sears market was niched up across big box retailers like Best Buy, clothiers like Kohls, tool stores like Home Depot, parts retailers like AutoZone, and soft goods stores like Bed, Bath & Beyond. The original need for “one stop shopping” had been overtaken by specialty retailers with wider selection, and often better pricing. And customers now had credit cards that worked in all stores. Meanwhile, for those who wanted to shop for many things from home the internet had taken over where the catalogue once began. Leaving Sears’ market “hollowed out.” While KMart was simply overwhelmed by the vast expansion of WalMart.

What should Lampert have done?

There was no way a cost cutting strategy would save KMart or Sears. All the trends were going against the company. Sears was destined to keep losing customers, and sales, unless it moved onto trends. Lampert needed to innovate. He needed to rapidly adopt the trends. Instead, he kept cutting costs. But revenues fell even faster, and the result was huge paper losses and an outpouring of cash.

To gain more insight, take a look at Jeff Bezos. But rather than harp on Amazon.com’s growth, look instead at the leadership he has provided to The Washington Post since acquiring it just over 2 years ago. Mr. Bezos did not try to be a better newspaper operator. He didn’t involve himself in editorial decisions. Nor did he focus on how to drive more subscriptions, or sell more advertising to traditional customers. None of those initiatives had helped any newspaper the last decade, and they wouldn’t help The Washington Post to become a more relevant, viable and profitable company. Newspapers are a dying business, and Bezos could not change that fact.

Mr. Bezos focused on trends, and what was needed to make The Washington Post grow. Media is under change, and that change is being created by technology. Streaming content, live content, user generated content, 24×7 content posting (vs. deadlines,) user response tracking, readers interactivity, social media connectivity, mobile access and mobile content — these are the trends impacting media today. So that was where he had leadership focus. The Washington Post had to transition from a “newspaper” company to a “media and technology company.”

So Mr. Bezos pushed for hiring more engineers – a lot more engineers – to build apps and tools for readers to interact with the company. And the use of modern media tools like headline testing. As a result, in October, 2015 The Washington Post had more unique web visitors than the vaunted New York Times. And its lead is growing. And while other newspapers are cutting staff, or going out of business, the Post is adding writers, editors and engineers. In a declining newspaper market The Washington Post is growing because it is using trends to transform itself into a company readers (and advertisers) value.

CEO Lampert could have chosen to transform Sears Holdings. But he did not. He became a very, very active “hands on” manager. He micro-managed costs, with no sense of important trends in retail. He kept trying to take cash out, when he needed to invest in transformation. He should have sold the real estate very early, sensing that retail was moving on-line. He should have sold outdated brands under intense competitive pressure, such as Kenmore, to a segment supplier like Best Buy. He then should have invested that money in technology. Sears should have been a leader in shopping apps, supplier storefronts, and direct-to-customer distribution. Focused entirely on defending Sears’ core, Lampert missed the market shift and destroyed all the value which initially existed in the great retail merger he created.

Impact?

Every company must understand critical trends, and how they will apply to their business. Nobody can hope to succeed by just protecting the core business, as it can be made obsolete very, very quickly. And nobody can hope to change a trend. It is more important than ever that organizations spend far less time focused on what they did, and spend a lot more time thinking about what they need to do next. Planning needs to shift from deep numerical analysis of the past, and a lot more in-depth discussion about technology trends and how they will impact their business in the next 1, 3 and 5 years.

Sears Holdings was a 13 year ride. Investor hope that Lampert could cut costs enough to make Sears and KMart profitable again drove the stock very high. But the reality that this strategy was impossible finally drove the value lower than when the journey started. The debacle has ruined 2 companies, thousands of employees’ careers, many shopping mall operators, many suppliers, many communities, and since 2007 thousands of investor’s gains. Four years up, then 9 years down. It happened a lot faster than anyone would have imagined in 2003 or 2004. But it did.

And it could happen to you. Invert your strategic planning time. Spend 80% on trends and scenario planning, and 20% on historical analysis. It might save your business.

by Adam Hartung | Jan 30, 2016 | Current Affairs, In the Rapids, Leadership, Web/Tech

Apple announced earnings for the 4th quarter this week, and the company was creamed. Almost universally industry analysts and stock analysts had nothing good to say about the company’s reports, and forecast. The stock ended the week down about 5%, and down a whopping 27.8% from its 52 week high.

Wow, how could the world’s #1 mobile device company be so hammered? After all, sales and earnings were both up – again! Apple’s brand is still one of the top worldwide brands, and Apple stores are full of customers. It’s PC sales are doing better than the overall market, as are its tablet sales. And it is the big leader in wearable devices with Apple Watch.

Yet, let’s compare the stock price to earnings (P/E) multiple of some well known companies (according to CNN Money 1/29/16 end of day):

- Apple – 10.3

- Used car dealer AutoNation – 10.7

- Food company Archer Daniel Midland (ADM) – 12.2

- Industrial equipment maker Caterpillar Tractor – 12.9

- Farm equipment maker John Deere – 13.3

- Defense equipment maker General Dynamics – 15.1

- Utility American Electric Power – 16.9

- Industrial product company Illinois Tool Works (ITW) – 17.7

- Industrial product company 3M – 19.5

What’s wrong with this picture? It all goes to future expectations. Investors watched Apple’s meteoric rise, and many wonder if it will have a similar, meteoric fall. Remember the rise and fall of Digital Equipment? Wang? Sun Microsystems? Palm? Blackberry (Research in Motion)? Investors don’t like companies where they fear growth has stalled.

What’s wrong with this picture? It all goes to future expectations. Investors watched Apple’s meteoric rise, and many wonder if it will have a similar, meteoric fall. Remember the rise and fall of Digital Equipment? Wang? Sun Microsystems? Palm? Blackberry (Research in Motion)? Investors don’t like companies where they fear growth has stalled.

And Apple’s presentation created growth stall fears. While iPhone sales are enormous (75million units/quarter,) there was little percentage growth in Q4. And CEO Tim Cook actually predicted a sales decline next quarter! iPod sales took off like a rocket years ago, but they have now declined for 6 straight quarters and there was no prediction of a return to higher sales volumes. And as for future products, the company seems only capable of talking about Apple Watch, and so far few people have seen any reason to buy one. Amidst this gloom, Apple presented an unclear story about a future based on services – a market that is at the very least vague, where Apple has no market presence, little experience and no brand position. And wasn’t that IBM’s story some 2.5 decades ago?

In other words, Apple fed investor’s worst fears. That growth had stopped. And usually, like in the examples above, when growth stops – especially in tech companies – it presages a dramatic reversal in sales and profits. Sales have been known to fall far, far faster than management predicts. Although Apple has not yet entered a Growth Stall (which is 2 consecutive quarters of declining sales and/or profits, or 2 consecutive quarters than the previous year’s sales or profits) investors are now worried that one is just around the corner.

Contrast this with Facebook. P/E – 113.3. Facebook said ad revenues rose 57%, and net income was up 2.2x the previous year’s quarter. But what was really important was Facebook’s story about its future:

- Facebook is now a “must buy” for advertisers

- Mobile is the #1 ad trend, and 80% of revenues are from mobile

- Revenue/user is up 33%, and growing

- There are multiple unmonetized new markets that Facebook is just developing – Instagram, WhatsApp, FB Messenger and Oculus

In other words, the past was great – but the future will be even better. The short-term result? FB stock rose 7.4% for the week, and intraday hit a new 52 week high. Facebook might have seemed like a fad 3 years ago, especially to older folks. But now the company’s story is all about market trends, and how Facebook is offering products on those trends that will drive future revenue and profit growth.

Amazon may be an even better example of smart communications. As everyone knows, Amazon makes no profit. So it sells for an astonishing P/E of 846.9. Amazon sales increased 22% in Q4, and Amazon continued gaining share of the fast growing, #1 trend in retail — ecommerce. While WalMart and Macy’s are closing stores, Amazon is expanding and even creating its own logistics system.

Profits were up, but only 2/3 of expectations – ouch! Anticipating higher sales and earnings announcements the stock had run up $40/share. But the earnings miss took all that away and more as the stock crashed about $70/share! A wild 12.5% peak-to-trough swing was capped at end of week down a mere 2.5%.

But, Amazon did a great job, once again, of selling its future. In addition to the good news on retail sales, there was ongoing spectacular growth in cloud services – meaning Amazon Web Services (AWS.) JPMorganChase, Wells Fargo, Raymond James and Benchmark all raised their future price forecasts after the announcement, based on future performance expectations. Even analysts who cut their price targets still kept price targets higher than where Amazon actually ended the week. And almost all analysts expect Amazon one year from now to be worth more than its historical 52 week high, which is 19% higher than current pricing.

So, despite bad earnings news, Amazon continued to sell its growth story. Growth can heal all wounds, if investors continue to believe. We’ll see how it plays out, but for now things appear at least stable.

Steve Jobs was, by most accounts, an excellent showman. But what he did particularly well was tell a great growth story. No matter Apple’s past results, or concerns about the company, when Steve Jobs took the stage his team had crafted a story about Apple’s future growth. It wasn’t about cash flow, cash in the bank, assets in place, market share or historical success – boring, boring. There was an Apple growth story. There was always a reason for investor’s to believe that competitors will falter, markets will turn to Apple, and growth will increase!

Should investors think Apple is without future growth? Unfortunately, the communications team at Apple last week let investors think so. It is impossible to believe this is true, but the communicators this week simply blew it. Because what they said led to nothing but headlines questioning the company’s future.

What should Apple have said?

- Give investors a great news story about wearables. Show applications in health care, retail, etc. that really makes investors think all those people with a Timex or Rolex will wear an AppleWatch in the future. Apple sold investors the future of iPhone apps long before most of people used anything other than maps and weather – and the story led investors to believe if people didn’t have an iPhone they would miss out on something important, so they were bound to go buy one. Where’s that story when it comes to wearables?

- ApplePay is going to change the world. While ApplePay is #1, investors are wondering if mobile payments is ever going to be big. What will make it big, when, and what is Apple doing to make this a multi-billion dollar business? ApplePay launched to a lot of hype, but very little has been said since. Is this going to be the Apple version of Microsoft’s Zune? Make investors believers in ApplePay. Convince them this is worth a lot of future value.

- iBeacons are one of the most important technology products in retail and inventory control. iBeacons were launched as a great tool for local businesses, but since then Apple has said almost nothing. B2B may not be as sexy as consumer markets, but Microsoft made investors believers in the value of enterprise products. Demonstrate that Apple’s technology is the best, and give investors some stories about how companies are winning. Most investors have forgotten about beacons and thus they no longer plan for substantial revenues.

- Apple has the #1 mobile developer community, and the best products are yet to come – so sales are far from stalling. Honestly, the developer war is critical. The platform with the most developers wins the most customers. Microsoft taught investors that. But Apple never talks about its developer community. IBM has made a huge commitment to develop iOS enterprise apps that should drive substantial future sales, but Apple isn’t exciting investors about that opportunity. Tell investors more stories about how Apple is king of the developer world, and will remain in the top spot – better than Android or anyone – for years. Tell investors this will turn users toward tablets from PCs faster, and iPod sales will start growing again as smartphone and wearable sales join suit.

- Apple will win big revenues in auto markets. There was lots of rumors about hiring people to design a car, and now firing the lead guy. What is going on? Google has been pretty clear about its plans, but Apple offers investors no encouragement to think the company will succeed at even winning the war to be in other manufacturer’s cars, much less build its own. Given that the story sounds limited for Apple’s “core” products, investors need some stories about Apple’s own “moonshot” projects.

- Apple is not a 1-pony, iPhone story. Make investors believe it.

Tim Cook and the rest of Apple leadership are obviously competent. But when it comes to storytelling, this week their messaging looked like it was created as a high school communications project. Growth is what matters, and Apple completely missed the target. And investors are moving on to better stories – fast.

by Adam Hartung | Jun 14, 2015 | Current Affairs, In the Rapids, Leadership, Web/Tech

Dick Costolo was let go from his role as CEO of Twitter, to be replaced by a former CEO that was also fired. Unfortunately, it looks very strongly as if the Board made this decision for the wrong reasons.

Even though investors have been unhappy with Twitter’s share price, as CEO Mr. Costolo was doing a decent job of growing the company and improving profits. And even though analysts keep offering reasons why he was fired, it looks mostly as if this was a political decision in a company with a “soap opera” executive culture. Investors should be worried.

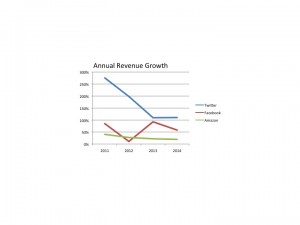

Let’s compare Mr. Costolo to CEO Zuckerberg’s performance at Facebook, and Mr. Bezos’ performance at Amazon. The latter two have been widely heralded for their leadership, so it sets a pretty good bar.

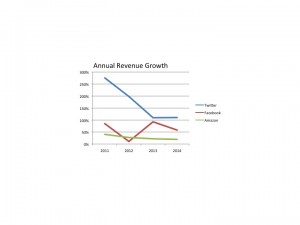

None of these three companies have enough earnings to matter. If you aren’t a growth investor, and you always value a company on earnings, then none of these are your cup of tea. All are evaluated on revenue and user metrics.

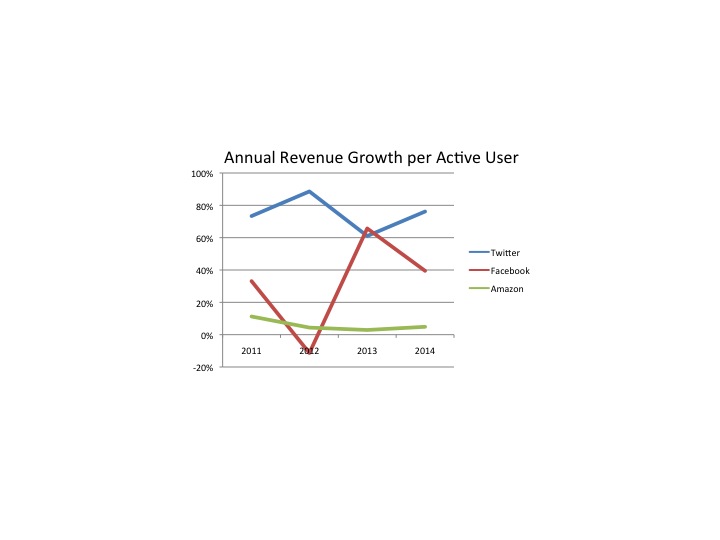

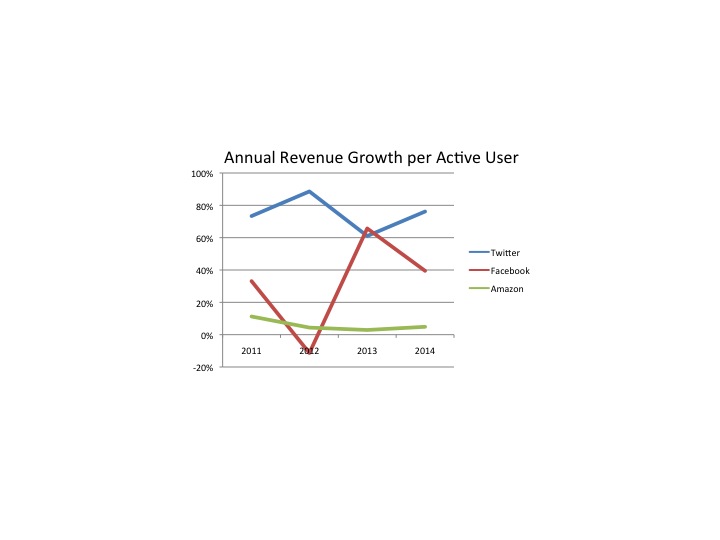

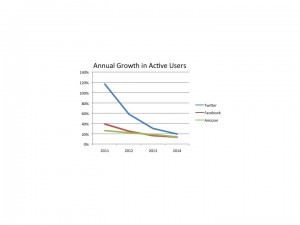

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon.

As you can see, Twitter’s revenue growth exceeds its comparators. Yes, its decline has been more dramatic, but we are comparing Twitter to companies that are much older and bigger. The net is to understand that revenues are growing, and at a better clip than Facebook and Amazon.

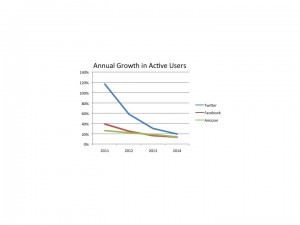

Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition.

Next we should look at active monthly users. Again, these numbers are growing at all 3. And some analysts have said it is the deceleration in the rate of new user growth that doomed Mr. Costolo. But this defies logic given that during his tenure Twitter has dramatically outperformed its competition.

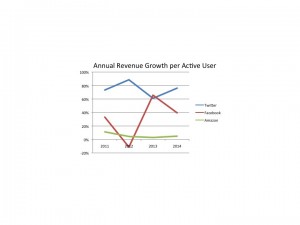

Lastly, let’s look at the “quality” of users. We can measure this by calculating the revenue per user. If this goes up, then the company is growing it top line by gaining more revenue per user – it is not “discounting” its way to higher volume. Instead,we can expect profits to improve based upon growth in this metric.

And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.

And here we can see that Twitter has wildly outperformed Facebook and Amazon. Twitter has grown its revenue per user by over 9-fold in the last 4 years, an excellent 75% per year compounded. Facebook, by comparison, roughly tripled its revenue/user (still very good) creating a 25%/year growth (certainly not to be sneezed at.) Amazon’s growth per user across the full 4 years was 25% – or about 4%/year.

It isn’t hard to see that Mr. Costolo has been doing a pretty good job leading Twitter.

But Twitter has had a very checkered past when it comes to leaders. Several articles have been written about the revolving door on the CEO office, with founders back-stabbing each other as money is raised and efforts are made to improve company performance technologically and financially.

The Board has shown a proclivity to spend too much time listening to rumors, and previous CEOs. Rather than focusing on exactly how many users are coming aboard, and how much revenue is generated on those users.

The returning CEO was himself previously replaced. And during his tenure there were many technical problems. Why he would be inserted, and the best performing CEO in company history shunted aside is completely unclear. But for investors, employees, users (of which I am one) and customers this change in leadership looks to be poorly conceived, and quite concerning. Mr. Costolo was doing a pretty good job.

Data on revenues came from Marketwatch for Twitter, Facebook and Amazon. Data on users (in Amazon’s case customers) came from Statista.com for Twitter, Facebook and Amazon. Charts were created by Adam Hartung (C).

by Adam Hartung | Feb 12, 2015 | Current Affairs, Disruptions, Innovation, Leadership, Web/Tech

Despite huge fanfare at launch, after a few brief months Google Glass is no longer on the market. The Amazon Fire Phone was also launched to great hype, yet sales flopped and the company recently took a $170M write off on inventory.

Fortune mercilessly blamed Fire Phone’s failure on CEO Jeff Bezos. The magazine blamed him for micromanaging the design while overspending on development, manufacturing and marketing. To Fortune the product was fatally flawed, and had no chance of success according to the article.

Similarly, the New York Times blasted Google co-founder and company leader Sergie Brin for the failure of Glass. He was held responsible for over-exposing the product at launch while not listening to his own design team.

Both these articles make the common mistake of blaming failed new products on (1) the product itself, and (2) some high level leader that was a complete dunce. In these stories, like many others of failed products, a leader that had demonstrated keen insight, and was credited with brilliant work and decision-making, simply “went stupid” and blew it. Really?

Unfortunately there are a lot of new products that fail. Such simplistic explanations do not help business leaders avoid a future product flop. But there are common lessons to these stories from which innovators, and marketers, can learn in order to do better in the future. Especially when the new products are marketplace disrupters; or as they are often called, “game changers.”

Do you remember Segway? The two wheeled transportation device came on the market with incredible fanfare in 2002. It was heralded as a game changer in how we all would mobilize. Founders predicted sales would explode to 10,000 units per week, and the company would reach $1B in sales faster than ever in history. But that didn’t happen. Instead the company sold less than 10,000 units in its first 2 years, and less than 24,000 units in its first 4 years. What was initially a “really, really cool product” ended up a dud.

There were a lot of companies that experimented with Segways. The U.S. Postal Service tested Segways for letter carriers. Police tested using them in Chicago, Philadelphia and D.C., gas companies tested them for Pennsylvania meter readers, and Chicago’s fire department tested them for paramedics in congested city center. But none of these led to major sales. Segway became relegated to niche (like urban sightseeing) and absurd (like Segway polo) uses.

Segway tried to be a general purpose product. But no disruptive product ever succeeds with that sort of marketing. As famed innovation guru Clayton Christensen tells everyone, when you launch a new product you have to find a set of unmet needs, and position the new product to fulfill that unmet need better than anything else. You must have a very clear focus on the product’s initial use, and work extremely hard to make sure the product does the necessary job brilliantly to fulfill the unmet need.

Nobody inherently needed a Segway. Everyone was getting around by foot, bicycle, motorcycle and car just fine. Segway failed because it did not focus on any one application, and develop that market as it enhanced and improved the product. Selling 100 Segways to 20 different uses was an inherently bad decision. What Segway needed to do was sell 100 units to a single, or at most 2, applications.

Segway leadership should have studied the needs deeply, and focused all aspects of the product, distribution, promotion, training, communications and pricing for that single (or 2) markets. By winning over users in the initial market Segway could have made those initial users very loyal, outspoken customers who would recommend the product again and again – even at a $4,000 price.

Segway should have pioneered an initial application market that could grow. Only after that could Segway turn to a second market. The first market could have been using Segway as a golfer’s cart, or as a walking assist for the elderly/infirm, or as a transport device for meter readers. If Segway had really focused on one initial market, developed for those needs, and won that market it would have started a step-wise program toward more applications and success. By thinking the general market would figure out how to use its product, and someone else would develop applications for specific market needs, Segway’s leaders missed the opportunity to truly disrupt one market and start the path toward wider success.

The Fire Phone had a great opportunity to grow which it missed. The Fire Phone had several features making it great for on-line shopping. But the launch team did not focus, focus, focus on this application. They did not keep developing apps, databases and ways of using the product for retailing so that avid shoppers found the Fire Phone superior for their needs. Instead the Fire Phone was launched as a mass-market device. Its retail attributes were largely lost in comparisons with other general purpose smartphones.

The Fire Phone had a great opportunity to grow which it missed. The Fire Phone had several features making it great for on-line shopping. But the launch team did not focus, focus, focus on this application. They did not keep developing apps, databases and ways of using the product for retailing so that avid shoppers found the Fire Phone superior for their needs. Instead the Fire Phone was launched as a mass-market device. Its retail attributes were largely lost in comparisons with other general purpose smartphones.

People already had Apple iPhones, Samsung Galaxy phones and Google Nexus phones. Simultaneously, Microsoft was pushing for new customers to use Nokia and HTC Windows phones. There were plenty of smartphones on the market. Another smartphone wasn’t needed – unless it fulfilled the unmet needs of some select market so well that those specific users would say “if you do …. and you need…. then you MUST have a FirePhone.” By not focusing like a laser on some specific application – some specific set of unmet needs – the “cool” features of the Fire Phone simply weren’t very valuable and the product was easy for people to pass by. Which almost everyone did, waiting for the iPhone 6 launch.

This was the same problem launching Google Glass. Glass really caught the imagination of many tech reviewers. Everyone I knew who put on Glass said it was really cool. But there wasn’t any one thing Glass did so well that large numbers of folks said “I have to have Glass.” There wasn’t any need that Glass fulfilled so well that a segment bought Glass, used it and became religious about wearing Glass all the time. And Google didn’t improve the product in specific ways for a single market application so that users from that market would be attracted to buy Glass. In the end, by trying to be a “cool tool” for everyone Glass ended up being something nobody really needed. Exactly like Segway.

Microsoft recently launched its Hololens. Again, a pretty cool gadget. But, exactly what is the target market for Hololens? If Microsoft proceeds down the road of “a cool tool that will redefine computing,” Hololens will likely end up with the same fate as Glass, Segway and Fire Phone. Hololens marketing and development teams have to find the ONE application (maybe 2) that will drive initial sales, cater to that application with enhancements and improvements to meet those specific needs, and create an initial loyal user base. Only after that can Hololens build future applications and markets to grow sales (perhaps explosively) and push Microsoft into a market leading position.

Microsoft recently launched its Hololens. Again, a pretty cool gadget. But, exactly what is the target market for Hololens? If Microsoft proceeds down the road of “a cool tool that will redefine computing,” Hololens will likely end up with the same fate as Glass, Segway and Fire Phone. Hololens marketing and development teams have to find the ONE application (maybe 2) that will drive initial sales, cater to that application with enhancements and improvements to meet those specific needs, and create an initial loyal user base. Only after that can Hololens build future applications and markets to grow sales (perhaps explosively) and push Microsoft into a market leading position.

All companies have opportunities to innovate and disrupt their markets. Most fail at this. Most innovations are thrown at customers hoping they will buy, and then simply dropped when sales don’t meet expectations. Most leaders forget that customers already have a way of getting their jobs done, so they aren’t running around asking for a new innovation. For an innovation to succeed launchers must identify the unmet needs of an application, and then dedicate their innovation to meeting those unmet needs. By building a base of customers (one at a time) upon which to grow the innovation’s sales you can position both the new product and the company as market leaders.

by Adam Hartung | Jan 14, 2015 | Investing, Retail, Trends

Retail sales fell .9% in December. Even excluding autos and gasoline, retail sales fell .3%. Further, November retail sales estimates were revised downward from an initial .7% gain to a meager .4%, and October sales advances were revised downward from a .5% gain to a mere .3%. Sales were down at electronic stores, clothing stores and department stores – all places we anticipated gains due to an improving economy, more jobs and more cash in consumer pockets.

Whoa, what’s happening? Wasn’t lower gasoline pricing going to free up cash for people to go crazy buying holiday gifts? Weren’t we all supposed to feel optimistic about our jobs, higher future wages and more money to spend after that horrible Great Recession thus leading us to splurge this holiday?

There were early signals that conventional wisdom was going to be wrong. Back on Black Friday (so named because it is supposedly the day when retailers turn a profit for the year) we learned sales came in a disappointing 11% lower than 2013. Barron’s analyzed press releases from Wal-Mart, and discerned that 2014 was a weaker Black Friday than 2013 and probably 2012. Simply put, fewer people went shopping on Black Friday than before, despite longer store hours, and they bought less.

So was this really a horrible holiday?

Retail store sales are only part of the picture. Increasingly, people are shopping on-line – and we all know it. According to ComScore, on-line sales made to users of PCs (this excludes mobile devices) were up 17% on Cyber Monday, in stark contrast to traditional brick-and-mortar. Exceeding $2B, it was the largest on-line retail day in history. The Day after Cyber Monday sales were up 27%, and the Green Monday (one week after Cyber Monday) sales were up 15% (all compared to year ago.) Overall, the week after Thanksgiving on-line sales rose 14%, and on Thanksgiving Day itself sales were up a whopping 32%. The week before Christmas (16th-21st) on-line sales surged 18%. According to IBM Digital Analytics the on-line November-December sales were up 13.9% vs. 2013.

The trend has never been more pronounced. Regardless of how much people are going to spend, they are spending less of it in traditional brick-and-mortar retail, and more of it on-line.

So, what about Wal-Mart? The chain remains mired in its traditional way of doing business. Even though same-store sales have been flat-to-down most of the last 2 years, and the number of full-line stores has declined in the USA, the chain remains committed quarter after quarter to defending its outdated success formula. Even in China, where Alibaba has demonstrated it can grow on-line ecommerce revenues more than 50%/year, Wal-Mart continues to try growing with a physical presence – even though it has been a tough, unsuccessful slog.

Yet, despite its bribery scandal in Mexico undertaken to prop up revenues, lawsuits due to over-worked, stressed truck drivers having accidents on double shifts killing and injuring people, and an inability to grow, Wal-Mart’s stock trades at near all-time highs. The stock has nearly doubled since 2011, even though the company is at odds with the primary retail, and demographic, trends.

On the other end of the spectrum is Amazon.com. Amazon is still growing revenues at over 20%/year. And introducing successful new publishing and internet service businesses, expanding same day delivery (and even one hour delivery) in urban markets like New York City, as well as expansion of its Prime service to include more original programming with famed director Woody Allen after winning the Golden Globe award for its original series Transparent.

However, several analysts were trash talking Amazon in 2014. 20% growth has them worried, given that the company once grew at 40%. Even though Amazon’s growth is a serious reason companies like Wal-Mart cannot grow. And there is the perennial lack of profitability – including a larger than expected loss in the second quarter ; a loss which included a $170M write-off on FirePhones which never really found a customer base. The latter item led to a Fast Company brutal lambasting of CEO Jeff Bezos as a micro-manager out-of-touch with customers.

This lack of analyst support has seriously hurt Amazon.com share performance. From 2010 to early 2014 the stock quadrupled in value from $100 to $400. But over the past year the stock has fallen back 25%. After dropping to $300/share in April, the stock has rallied but then retrenched no less than 3 times, and is now trading very close to its 52 week low. And, it shows no momentum, trading below its moving average.

Which is why investors in Wal-Mart should sell, and reinvest in Amazon.com.

All the trends point to Wal-Mart being overvalued. Its revenues show no signs of achieving any substantial growth. And, despite its sheer size, all retail trends are working against the behemoth. It has been trying to find a growth engine for 10 years, but nothing has come to fruition – including big investments in offshore markets. The company keeps trying to defend & extend its old success formula, thus creating a bigger and bigger gap between itself and future market success.

Simultaneously, Amazon.com continues to invest in major developing trends. From publishing to television programming to cloud/web services and even general retail, everything into which Amazon invests is growing. And even though this is a company with $100B in revenues, it is still growing at a remarkable 20%. While some analysts may wish the investment rate would slow, and that Amazon would never make mistakes (like Firephone,) the truth is that Amazon is putting money into projects which have pretty good odds of making sizable money as it helps change the game in multiple markets.

Think of investing like paddling a canoe. When you are investing against trends, it’s like paddling up the river. You can make progress, but it is hard. And, one little mistake and you easily slip backward. Lose any momentum at all and you could completely turn around and disappear (like happened to Circuit City, and now both Sears and JCPenney.) When you invest with the trends it is like paddling down the river. The trend, like a current, keeps you moving in the right direction. You can still make mistakes, but the odds are quite a lot higher you will make your destination easily, and with resources to spare. That’s why the sales results for December are important. The show traditional retailers are paddling up river, while on-line retailers are paddling down-river.

I don’t know if Wal-Mart’s stock value has peaked, but it is hard to understand why anybody would expect it to go higher. It could continue to rise, but there are ample reasons to expect investors will figure out how tough future profits will be for Wal-Mart and dispose of their positions. On the other hand, even though Amazon.com could continue to slide down further there are even more reasons to expect it will have great future quarters with revenue gains and – eventually – those long-sought-after profits that some analysts seek. Meanwhile, Amazon is investing in projects with internal rates of return far higher than most other companies because they are following major trends. Odds are pretty good that in a few years the trends will make investors happy they own Amazon, and dropped out of Wal-Mart.