by Adam Hartung | Jul 26, 2016 | Leadership, Marketing, Sports

Most leaders think of themselves as decision makers. Many people remember in 2006 when President George Bush, defending Donald Rumsfeld as his Defense Secretary said “I am the Decider. I decide what’s best.” It earned him the nickname “Decider-in-Chief.” Most CEOs echo this sentiment, Most leaders like to define themselves by the decisions they make.

But whether a decision is good, or not, has a lot of interpretations. Often the immediate aftermath of a decision may look great. It might appear as if that decision was obvious. And often decisions make a lot of people happy. As we are entering the most intense part of the U.S. Presidential election, both candidates are eager to tell you what decisions they have made – and what decisions they will make if elected. And most people will look no further than the immediate expected impact of those decisions.

However, the quality of most decisions is not based on the immediate, or obvious, first implications. Rather, the quality of decisions is discovered over time, as we see the consequences – intended an unintended. Because quite often, what looked good at first can turn out to be very, very bad.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law. This change will cost Charlotte about $100M.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law. This change will cost Charlotte about $100M.

That action by the NBA is what’s called unintended consequences. Lawmakers didn’t really consider that the NBA might decide to take its business elsewhere due to this state legislation. It’s what some people call “oops. I didn’t think about that when I made my decision.”

Robert Reich, Secretary of Labor for President Clinton, was a staunch supporter of unions. In his book “Locked in the Cabinet” he tells the story of visiting an auto plant in Oklahoma supporting the union and workers rights. He thought his support would incent the company’s leaders to negotiate more favorably with the union. Instead, the company closed the plant. Laid-off everyone. Oops. The unintended consequences of what he thought was an obvious move of support led to the worst possible outcome for the workers.

President Obama worked the Congress hard to create the Affordable Care Act, or Obamacare, for everyone in America. One intention was to make sure employers covered all their workers, so the law required that if an employer had health care for any workers he had to offer that health care to all employees who work over 30 hours per week. So almost all employers of part time workers suddenly said that none could work more than 30 hours. Those that worked 32 (4 days/week) or 36 suddenly had their hours cut. Now those lower-income people not only had no health care, but less money in their pay envelopes. Oops. Unintended consequence.

President Reagan and his wife launched the “War on Drugs.” How could that be a bad thing? Illegal drugs are dangerous, as is the supply chain. But now, some 30 years later, the Federal Bureau of Prisons reports that almost half (46.3% or over 85,000) inmates are there on drug charges. The USA now spends $51B annually on this drug war, which is about 20% more than is spent on the real war being waged with Afghanistan, Iraq and ISIS. There are now over 1.5M arrests each year, with 83% of those merely for possession. Oops. Unintended consequences. It seemed like such a good idea at the time.

This is why it is so important leaders take their time to make thoughtful decisions, often with the input of many other people. Because the quality of a decision is not measured by how one views it immediately. Rather, the value is decided over time as the opportunity arises to observe the unintended consequences, and their impact. The best decisions are those in which the future consequences are identified, discussed and made part of the planning – so they aren’t unintended and the “decider” isn’t running around saying “oops.”

As you listen to the politicians this cycle, keep in mind what would be the unintended consequences of implementing what they say:

- What would be the social impact, and transfer of wealth, from suddenly forgiving all student loans?

- What would be the consequences on trade, and jobs, of not supporting historical government trade agreements?

- What would be the consequences on national security of not supporting historically allied governments?

- What would be the long-term consequence not allowing visitors based on race, religion or sexual orientation?

- What would be the consequence of not repaying the government’s bonds?

- What would be the long-term impact on economic growth of higher regulations on banks – that already have seen dramatic increases in regulation slowing the recovery?

- What would be the long-term consequences on food production, housing and lifestyles of failing to address global warming?

Business leaders should follow the same practice. Every time a decision is necessary, is the best effort made to obtain all the information you could on the topic? Do you obtain input from your detractors, as well as admirers? Do you think through not only what is popular, but what will happen months into the future? Do you consider the potential reaction by your customers? Employees? Suppliers? Competitors?

There are very few “perfect decisions.” All decisions have consequences. Often, there is a trade-off between the good outcomes, and the bad outcomes. But the key is to know them all, and balance the interests and outcomes. Consider the consequences, good and bad, and plan for them. Only by doing that can you avoid later saying “oops.”

by Adam Hartung | Jul 1, 2014 | Current Affairs, Defend & Extend, Leadership, Religion

Yesterday the U.S. Supreme Court ruled in favor of Hobby Lobby and against the U.S. government in a case revolving around health care for employees. I’m a business person, not a lawyer, so to me it was key to understand from a business viewpoint exactly what Hobby Lobby “won.”

It appears Hobby Lobby’s leaders “won” the right to refuse to provide certain kinds of health care to their employees as had been mandated by the Affordable Care Act. The justification primarily being that such health care (all associated with female birth control) violated religious beliefs of the company owners.

As a business person I wondered what the outcome would be if the next case is brought to the court by a business owner who happens to be a Christian Scientist. Would this next company be allowed to eliminate offering vaccines – or maybe health care altogether – because the owners don’t believe in modern medical treatments?

This may sound extreme, and missing the point revolving around the controversy over birth control. But not really. Because the point of business is to legally create solutions for customer needs at a profit. Doing this requires doing a lot of things right in order to attract and retain the right employees, the right suppliers and customers by making all of them extremely happy. I don’t recall Adam Smith, Milton Friedman, Peter Drucker, Edward Demming, John Galbraith or any other historically noted business writer saying the point of business to set the moral compass of its customers, suppliers or employees.

I’m not sure where enforcing the historical religious beliefs of founders or owners plays a role in business. At all. Even if they have the legal right to do so, is it smart business leadership?

Hobby Lobby Store

Hobby Lobby competes in the extraordinarily tough retail market. The ground is littered with failures, and formerly great companies which are struggling such as Sears, KMart, JCPenney, Best Buy, etc. And recently the industry has been rocked with security breaches, reducing customer faith in stalwarts like Target. And profits are being challenged across all brick-and-mortar traditional retailers by on-line companies led by Amazon, who have much lower cost structures.

All the trends in retail bode poorly for Hobby Lobby. Hobby Lobby does almost no business on-line, and even closes its stores on Sunday. Given consumer desires to have what they want, when they want it, unfettered by time or location, a traditional retailer like Hobby Lobby already has its hands full just figuring out how to keep competitors at bay. Customers don’t need much encouragement to skip any particular store in search of easily available products and instant price information across retailers.

Social trends are also very clear in the USA. The great majority of Americans support health care for everyone. Including offering birth control, and all other forms of women’s health needs. This has nothing to do with the Affordable Care Act. Health care, and women’s rights to manage their individual reproductiveness, is something that is clearly a majority viewpoint – and most people think it should be covered by health insurance.

So, given the customer options available, is it smart for any retailer to brag that they are unwilling to offer employees health care? Although not tied to any specific social issues, Wal-Mart has long dealt with customer and employee defections due to policies which reduce employee benefits, such as health care. Is this an issue which is likely to help Hobby Lobby grow?

Is it smart, as Hobby Lobby competes for merchandise from suppliers, negotiates on leases with landlords, seeks new store permits from local governments, recruits employees as buyers, merchandisers, store managers and clerks, and seeks customers who can shop on-line or at competitors to brandish the sword of intolerance on a specific issue which upsets the company owner? And one where this owner is on the opposite side of public opinion?

Long ago a group of retired U.S. military Generals told me that in Vietnam America won every battle, but lost the war. Through overwhelming firepower and manpower, there was no way we would not win any combat mission. But that missed the point. As a result of focusing on the combat, America’s leaders missed the opportunity win “the hearts and minds” of most Vietnamese. In the end America left Vietnam in a rushed abandonment of Saigon, and the North Vietnamese took over all of South Vietnam. Although we did what leaders believed was “right,” and fought each battle to a win, in the end America lost the objective of maintaining a free, independent and democratic Vietnam.

The leaders of Hobby Lobby won this battle. But is this good for the customers, suppliers, communities where stores are located, and employees of Hobby Lobby? Will these constituents continue to support Hobby Lobby, or will they possibly choose alternatives? If in its actions, including legal arguing at the Supreme Court, Hobby Lobby may have preserved what its leaders think is an important legal precedent. But, have their strengthened their business competitiveness so they will be a long-term success?

Perhaps Hobby Lobby might want to listen to the CEO of Chick-fil-A, which suffered a serious media firestorm when it became public their owners donated money to anti-gay organizations. CEO Cathy decided it was best to “just shut up and go sell chicken.” Business is tough enough, loaded with plenty of battles, without looking for fights that are against trends.

by Adam Hartung | Jan 15, 2014 | Current Affairs, Leadership

The S&P 500 had a great 2013. Up 29.7% – its best performance since 1997. The Dow Jones Industrial Average (DJIA) ended the year up 26.5% – its best performance since 1995. And this happened as economic growth lowered the unemployment rate to 6.7% in December – the lowest rate in 5 years. And overall real estate had double-digit price gains, lowering significantly the number of underwater mortgages.

But if we go back to the beginning of 2013, most Wall Street forecasters were predicting a very different outcome. Long suffering bear Harry Dent predicted a stock crash in 2013 that would last through 2014, and ongoing cratering in real estate values. And bear Gina Martin Adams of Wells Fargo Securities predicted a market decline in 2013, a forecast she clung to and fully supported, despite a rising market, when predicting an imminent crash in September. Morgan Stanley’s Adam Parker also predicted a flat market, as did UBS analyst Jonathan Golub.

How could professionals who are paid so much money, have so many resources and the backing of such outstanding large and qualified institutions be so wrong?

An over-reliance on quantitative analysis, combined with using the wrong assumptions.

The conventional approach to Wall Street forecasting is to use computers to amass enormously complex spreadsheets combining reams of numbers. Computer models are built with thousands of inputs, and tens of millions of data points. Eventually the analysts start to believe that the sheer size of the models gives them validity. In the analytical equivalent of “mine is bigger than yours” the forecasters rely on their model’s complexity and sheer size to self-validate their output and forecasts.

In the end these analysts come up with specific forecast numbers for interest rates, earnings, momentum indicators and multiples (price/earnings being key.) Their faith that the economy and market can be reduced to numbers on spreadsheets leads them to similar faith in their forecasts.

But, numbers are often the route to failure. In the late 1990s a team of Wall Street traders and Nobel economists became convinced their ability to model the economy and markets gave them a distinct investing advantage. They raised $1billion and formed Long Term Capital (LTC) to invest using their complex models. Things worked well for 3 years, and faith in their models grew as they kept investing greater amounts.

But then in 1998 downdrafts in Asian and Russian markets led to a domino impact which cost Long Term Capital $4.6B in losses in just 4 months. LTC lost every dime it ever raised, or made. But worse, the losses were so staggering that LTC’s failure threatened the viability of America’s financial system. The banks, and economy, were saved only after the Federal Reserve led a bailout financed by 14 of the leading financial institutions of the time.

Incorrect assumptions played a major part in how Wall Street missed the market prediction for 2013. All models are based on assumptions. And, as Peter Drucker famously said, “if you get the assumptions wrong everything you do thereafter will be wrong as well” — regardless how complex and vast the models.

Conventional wisdom held that conservative economic policies underpin market growth, and the more liberal Democratic fiscal policies combined with a liberal federal reserve monetary program would bode poorly for investors and the economy in 2013. These deeply held assumptions were, of course, reinforced by a slew of conservative commentators that supported the notion that America was on the brink of runaway inflation and economic collapse. The BIAS (Beliefs, Interpretations, Assumptions and Strategies) of the forecasters found reinforcement almost daily from the rhetoric on CNBC, Bloomberg, Fox News and other programs widely watched by business people from Wall Street to Main Street.

Interestingly, when Obama was re-elected in 2012 a not-so-well-known investment firm in Columbus, OH – far from Wall Street – took an alternative look at the data when forecasting 2013. Polaris Financial Partners took a deep dive into the history of how markets perform when led by traditional conservative vs. liberal policies and reached the startling conclusion that Obama’s programs, including the Affordable Care Act, would actually spur investment, market growth, jobs and real estate! They had forecast a double digit increase in all major averages for 2012 and extended that same double digit forecast into 2013 – far more optimistic than anyone on Wall Street.

CEO Bob Deitrick and partner Steven Morgan concluded that the millenium’s first decade had been lost. Despite Republican leadership, the eqity markets were, at best, sideways. There were fewer people actually working in 2008 than in 2000; a net decrease in jobs. After a near-collapse in the banking system, due to deregulated computer-model based trading in complex derivatives, real estate and equity prices had collapsed.

“Fourteen years of stock market gains were wiped out in 17 months from October, 2007 to March, 2009” lamented Deitrick.

Polaris Partners concluded the situation was eerily similar to the 1920s at the end of Hoover’s administration. A situation which was eventually resolved via Keynesian policies of increased fiscal spending while interest rates were low, and federal reserve intervention to both expand the money supply and increase the velocity of money under Republican Fed chief Marriner Eccles and Democratic President Franklin Roosevelt.

While most people conventionally think that tax cuts led to economic growth during the Reagan administration, Polaris Financial turned that assumption upside down and put the biggest positive economic impact on the roll-back of tax cuts a year after being pushed by Reagan and passing Congress. Their analysis of the 1980 recovery focused on higher defense and infrastructure spending (fiscal policy,) a massive increase in debt (the largest peacetime debt increase ever) coupled with a more balanced tax code post-TEFRA.

Thus, eschewing complex econometric models, elaborately detailed spreadsheets of earnings and rolling momentum indicators, Polaris Financial focused instead on identifying the assumptions they believeed would most likely drive the economy and markets in 2013. They focused on the continuation of Chairman Bernanke’s easy monetary policy, and long-term fiscal policies designed to funnel money into investments which would incent job creation and GDP growth leading to an improvement in house values, and consumer spending, while keeping interest rates at historically low levels. All of which would bode extremely well for thriving equity markets.

The vitriol has been high amongst those who support, and those who oppose, the economic policies of Obama’s administration since 2008. But vitriol does not support, nor replace, good forecasting. Too often forecasters predict what they want to happen, what they hope will happen, based upon their view of history, their traing and background, and their embedded assumptions. They believe in the certainty of long-held assumptions, and forecast from that base.

But as Polaris Financial pointed out, in beating every major Wall Street firm over the last 2 years, good forecasting relies on looking carefully at historical outcomes, and understanding the context in which those results happened. Rather than relying on an interpretation of the outcome,they looked instead at the facts and the situation; the actions and the outcomes in its context. In an economy, everything is relative to the context. There are no absolute programs that are universally the right thing to do. Every policy action, and every monetary action, is dependent upon initial conditions as well as the action itself.

Too few forecasters take into account both the context as well as the action. And far too few do enough analysis of assumptions, preferring instead to rely on reams of numerical analysis which may, or may not, relate to the current situation. And are often linked to assumptions underlying the model’s construction – assumptions which could be out of date or simply wrong.

The folks at Polaris Financial Partners remain optimistic about the economy and markets for the next two years. They point out that unemployment has dropped faster under Obama, and from a much higher level, than during the Reagan administration. They see the Affordable Care Act opening more flexibility for health care, creating a rise in entrepreneurship and innovation (especially biotechnology) that will spur economic growth. Deitrick and Morgan see tax programs, and rising minimum wage trends, working toward better income balancing, and greater monetary velocity aiding GDP growth. Their projection is for improving real estate values, jobs growth, and minimal inflation leading to higher indexes – such as 20,000 on the DJIA and 2150 on the S&P.

Bob Deitrick co-authored, with Lew Goldfarb, “Bulls, Bears and the Ballot Box” in 2012 analyzing Presidential economic policies, Federal Reserve policies and stock market performance.

by Adam Hartung | Dec 3, 2013 | Current Affairs, Leadership, Web/Tech

“A horse, a horse, my Kingdom for a Horse” King Richard cried out just before he was murdered (Richard III by Billy Shakespeare ~ 1592.)

King Richard of England was really, really unpopular. He was accused of ascending to the throne via various Michiavellian behaviors. Eventually he was trapped on the battlefield by his enemies, his horse was slain, and he uttered the above line – metaphorically begging for a way out of the trapped world that was his kingdom. He didn’t get the horse – and he died.

After over 20 years of fighting about health care the U.S. Congress passed the Affordable Care Act and the President signed it into law in 2010. About the only agreement in the country was that the ACA appealed to almost no one due to the compromises required to get it passed. It was fought by wide ranging constituencies, until in 2012 the Supreme Court upheld the law.

But not even that was the end of the fight, because in October, 2013 Congress shut down the government as groups fought about whether the act would receive any funding to implement its own provisions. Eventually an agreement was reached, the government re-opened, and it looked like the ACA was going into practice.

Oh, but wait…

In today’s world everyone uses the internet. Face-to-face meetings are largely gone, and forests by the score are being saved as we refuse to use paper when a digital screen will accomplish our tasks. So it only made sense that when the U.S. population was to sign up for the benefits of this new law they would do so on the World Wide Web.

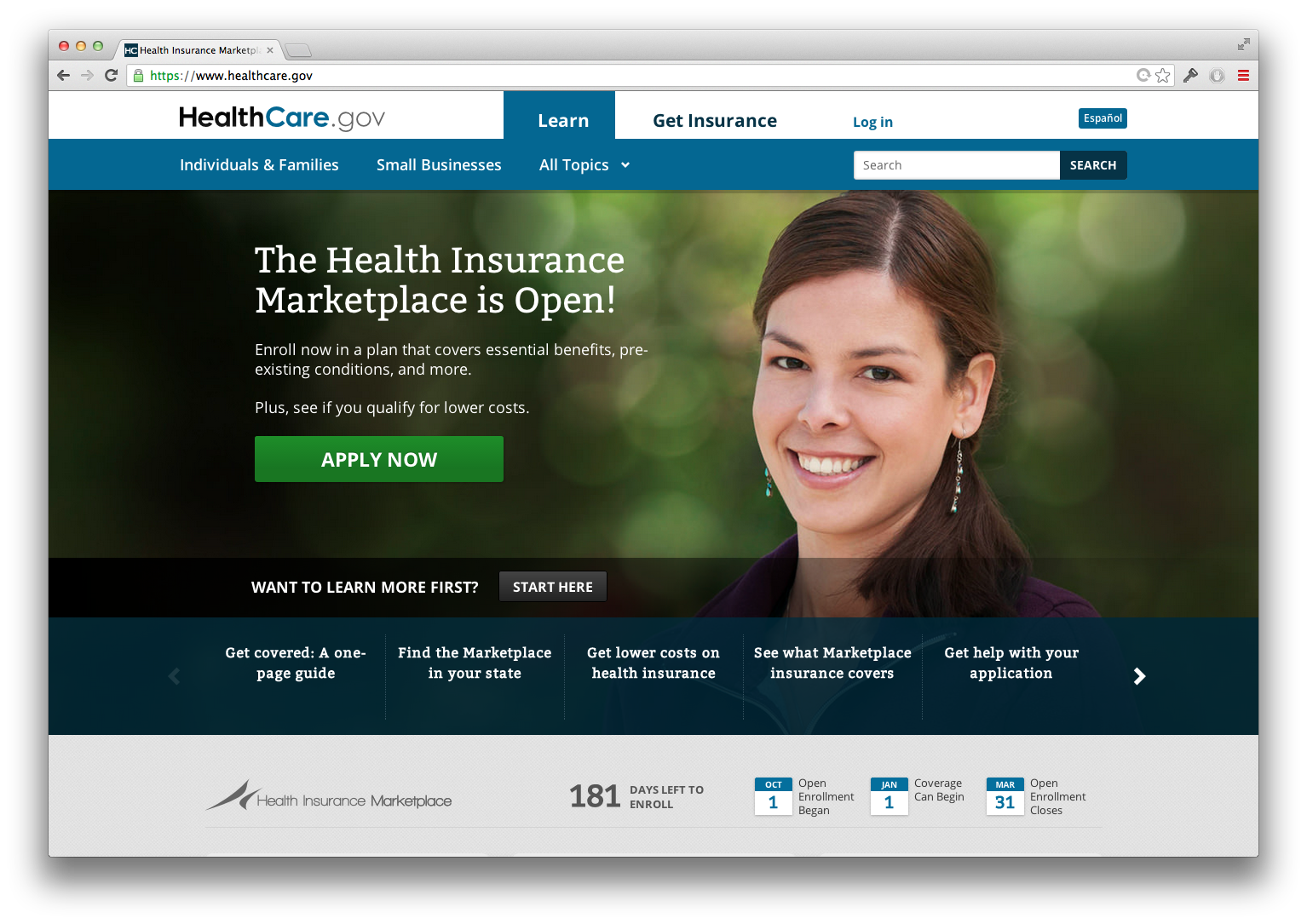

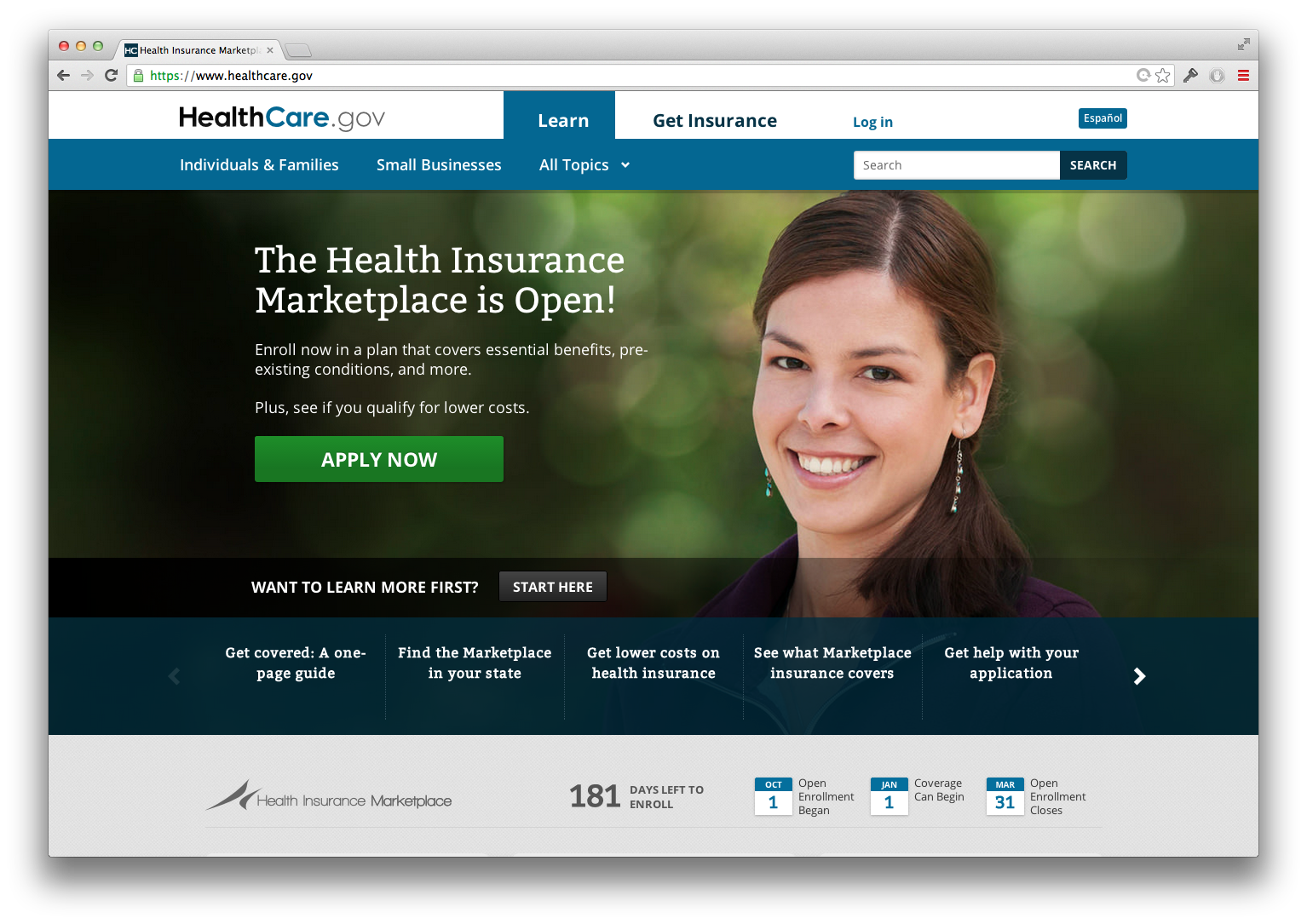

Folks would buy health insurance just like they buy books and clothes, and download movies, from a web site. Billions of transactions have happened over the web the last decade. Why, Google alone does over 5 billion searches each and every day. So it seemed easily practical, and doable, for implementation to be as easy as opening a new web site. We all expected that come November we’d simply hit the search button, go to the web site, price out the options and make our health insurance decisions.

Of course we all know how that worked out. Or didn’t. The site didn’t work for spit. Apple may be able to track about a million apps on its site, and it seems able to deliver about 4 million per day at an average price of about a buck. But the U.S. government web site – after spending over $400million (maybe even $1B) – couldn’t seem to process but a few thousand applications a day. So Congressional hearings started – cries for firing Secretary Sebelius rang out – and President Obama’s favorability plummeted faster than the failed effort messages came up in browsers at Healthcare.gov.

You could almost hear the President on the steps of the White House “A web site, a working web site, my Presidency for a working web site.”

There was a Chicago mayor who lost an election because he couldn’t clear the streets of snow. Something as simple as removing snow in a 1979 blizzard overtook everything Mayor Bilandic’s administration did, and wanted to do, for his great city. When Chicagoans couldn’t access their streets for 3 days they “threw the bastard out” by electing a new candidate (Jane Byrne) in the next primary – and she went on to be the next mayor.

And the only thing anyone remembers about Mayor Bilandic was he didn’t get the snow off the streets.

This lesson is not lost on any local mayor. You can have grand plans, and vision, but if you can’t keep the streets clean you get thrown out.

We’ve entered a new era of political expectations. Citizens now expect their politicians to build and operate functional web sites. They expect their government to do as least as good a job as private industry at everything digital. And if politicians, or administrators, flub a web implementation it can have signficant, damaging implications.

Failure to build a functional web site, meeting the average person’s expectations, is a terrible, terrible falure these days. Perhaps enough to lose the voters’ trust. Perhaps enough to breath new life into those who want to overturn your “landmark legislation.” And perhaps enough to kill your place in history.

by Adam Hartung | Sep 30, 2013 | Current Affairs, Defend & Extend, Leadership, Lock-in

Last week we learned that there is no doubt, the world is warming. A U.N. report affirmed by some 1,000 scientists asserted 95% confidence as to the likely outcomes, as well as the cause. We must expect more volatility in weather, and that the oceans will continue rising.

Yet, most people really could have cared less. And a vocal minority still clings to the notion that because the prior decade saw a slower heating, perhaps this will all just go away.

Incredibly, for those of us who don't live and work in Florida, there was CNN news footage of daily flooding in Miami's streets due to current sea levels which have risen over last 50 years. Given that we can now predict the oceans will rise between 1 and 6 feet in the next 50 years, it is possible to map the large areas of Miami streets which are certain to be flooded.

There is just no escaping the fact that the long-term trend of global warming will have a remarkable impact on everyone. It will affect transportation, living locations, working locations, electricity generation and distribution, agriculture production, textile production – everything will be affected. And because it is happening so slowly, we actually can do lots of modeling about what will happen.

Yet, I never hear any business leaders talk about how they are planning for global warning. No comments about how they are making changes to keep their business successful. Nor comments about the new opportunities this will create. Even though the long-term impacts will be substantial, the weather and how it affects us is treated like the status quo.

What does this have in common with the government shutdown?

America has known for decades that its healthcare system was dysfunctional; to be polite. It was incredibly expensive (by all standards) and yet had no better outcomes for citizens than other modern countries. For over 20 years efforts were attempted to restructure health care. Yet as the morass of regulations ballooned, there was no effective overhaul that addressed basic problems built into the system. Costs continued to soar, and more people joined the ranks of those without health care, while other families were bankrupted by illness.

Finally, amidst enormous debate, the Affordable Care Act was passed. Despite wide ranging opinions from medical doctors, nurses, hospital and clinic administrators, patient advocacy groups, pharmaceutical companies, medical device companies and insurance companies (to name just some of those with a vested interest and loud, competing, viewpoints) Congress passed the Affordable Care Act which the President signed.

Like most such things in America, almost nobody was happy. No one got what they wanted. It was one of those enormous, uniquely American, compromises. So, like unhappy people do in America, we sued! And it took a few years before finally the Supreme Court ruled that the legislation was constitutional. The Affordable Care Act would be law.

But, people remain who simply do not want to accept the need for health care change. So, in a last ditch effort to preserve the status quo, they are basically trying to kidnap the government budget process and hold it hostage until they get their way. They have no alternative plan to replace the Affordable Care Act. They simply want to stop it from moving forward.

What global warming and the government shut down have in common are:

- Very long-term problems

- No quick solution for the problem

- No easy solution for the problem

- If you do nothing about the problem today, you have no immediate calamity

- Doing anything about the problem affects almost everyone

- Doing anything causes serious change

So, in both cases, people have emerged as the Status Quo Police. They take on the role of stopping change. They will do pretty much anything to defend & extend the status quo:

- Ignore data that is contradictory to the best analytical views

- Claim that small probability outcomes (that change may not be necessary) justifies doing nothing

- Delay, delay, delay taking any action until a disaster requires action

- Constantly claim that the cost of change is not justified

- Claim that the short-term impact of change is more deleterious than the long-term benefits

- Assume that the status quo will somehow resolve itself favorably – with no supporting evidence or analysis

- Undertake any action that preserves the status quo

- Threaten a "scorched earth policy" (that they will create big, immediate problems if forced to change the status quo)

The earth is going to become warmer. The oceans will rise, and other changes will happen. If you don't incorporate this in your plans, and take action, you can expect this trend will harm you.

U.S. health care is going to be reformed. How it will happen is just starting. How it will evolve is still unclear. Those who create various scenarios in their plans to prepare for this change will benefit. Those who do nothing, hoping it goes away, will find themselves struggling.

The Status Quo Police, trying their best to encourage people to ignore the need for change – the major, important trends – are helping nobody. By trying to preserve the status quo they inhibit effective planning, and action, to prepare for a different (better) future.

Does your organization have Status Quo Police? Are their functions, groups or individuals who are driven to defend and extend the status quo – even in the face of trends that demonstrate change is necessary? Can they stop conversations around substantial change? Are they allowed to stop future planning for scenarios that are very different from the past? Can they enforce cultural norms that stop considering new alternatives? Can they control resources resulting in less innovation and change?

Let's learn from these 2 big issues. Change is inevitable. It is even necessary. Trying to preserve the status quo is costly, and inhibits taking long-term effective action. Status Quo Police are obstructionists who keep us from facing, and solving, difficult problems. They don't help our organizations create a new, more successful future. Only by overcoming them can we reach our full potential, and create opportunities out of change.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law. This change will cost Charlotte about $100M.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law. This change will cost Charlotte about $100M.