by Adam Hartung | Jan 12, 2022 | Boards of Directors, Leadership, Medical, Strategy, Trends

I was happy to end 2021 on a very high note. Kaiser Health Network interviewed me on the future of pharmacies, based on my historically accurate forecasts for retailers. READ MORE I was delighted when this went semi-viral, being picked up by Yahoo!News, Salon, Washington Post and about a dozen other publications.

I’ve had a nearly 2 decade relationship with Vistage and its global network of CEOs. I was delighted to be interviewed about the best short-term and long-term goal setting process, giving all Vistage members my insights for success and how to use their planning processes to build a road to greater profitable growth.

READ MORE I’m looking forward to working with more Vistage groups and individual members in 2022 as their ambition for success continues growing.

I kicked off 2022 with a live webcast interview with International Market & Competitive Intelligence

magazine, hosted by its Chief Editor Rom Gayoso. As the changing world remains in fast-shifting overdrive leaders are increasingly looking for insights about the future. I’m delighted more keep asking how they can use my 30+ years of trend tracking to help them find the right stars to follow. Let me know by email or phone if you’d like to talk about how I can help your business grow stronger every year, despite the seeming chaos around us. Here’s my

interview with Rom Gayoso.

Lesson – You are either growing, or you are dying. There is no “maintenance, status quo.”

For 2022, Spark Partners is offering its Master Class on strategic planning and innovation for HALF OFF! That’s right, for just $495 you can get this 28 module course that shows you how to identify and follow trends, then build plans that leverage those trends for faster, more profitable growth. There’s no similar tool in the marketplace. A year in the making, this course provides an overview of the process I’ve used to build successful forecasts for investors and business leaders across companies of all sizes.

https://www.sparkpartners.com/business-master-class-think-innovation-course

Respond to this email and I can arrange your limited time discount to get started building a stronger, more successful organization.

Are you on “cruise control” running your business?

Ask yourself, Are you trying to defend and extend what you’ve always done? Or are you meeting unmet customer needs, helping customers to grow and in turn growing yourself? If you’re the former, get ready for a rude awakening.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Aug 17, 2021 | Defend & Extend, Leadership, Politics, Strategy, Trends

Afghanistan’s Fall Was Foreseeable

After 20 years of American occupation, the Taliban retook Afghanistan in a matter of days. Pundits across the news channels are expressing extreme surprise. But they should not be surprised, this speed of change was entirely predictable. The chaos in Afghanistan may seem a world away, but this unfortunate situation can offer 2 significant lessons for business.

Lesson #1 – Failure (change) always happens faster than we expect.

It took 35 years to build the infrastructure for VHS tapes, then DVDs, to become a big market. We had to open a lot of stores, and put a lot of machines in homes. Then that all became pretty much worthless in 18 months when streaming came along. We used travel agents to book air flights and hotels for 40 years, but they practically all disappeared in a year when we could book on-line. We were ardent radio listeners until iTunes and streaming services pushed radio further toward obsolescence in 6 months when the pandemic magnified these trends. Radio consumption in cars came to an abrupt halt when commuting stopped.

Fringe competitors are constantly trying to become mainstream. They never give up. Innovators keep trying new ways to serve our customers. Then, when there’s a shift in technology, regulation or another major market component they leap forward in a huge step overtaking the marketplace. The Taliban never went away. They kept getting better and waited until the USA announced its planned withdrawal. That created the opportunity and in one big step they leapt forward. Business leaders continually believe that markets will shift gradually. Leaders underestimate how well fringe competitors are prepared to move forward, and leaders fail to anticipate how quickly customers will shift buying patterns (like Afghan troops dropping their guns and fleeing.)

It’s not gradual. Change happens fast. If you see a change on the horizon, don’t think it’ll come slowly. Think like the fellow pushed off a 20 story building. At the twelfth story it’s not “so far so good,” but rather “we better prepare for disaster.” When change is going to happen, pack your parachute. Figure out how you’ll keep pushing forward. Or you’ll find a swift, hard landing.

Lesson #2 – You are either growing, or you are dying. There is no “maintenance, status quo.”

Despite two decades fighting in Afghanistan, by no measure was America becoming more popular. America’s image, trade, world standing were not improving in Afghanistan. America was fighting merely to maintain. Watch “Charlie Wilson’s War” and it’s evident America had no plans to “heap any love” on Afghanistan. No schools, agricultural assistance, preservation of mosques or other religious sites, family assistance programs, immigration. America just kept working to preserve the situation after killing Osama bin Laden. The relationship wasn’t growing, improving, becoming something beneficial to both sides. Without growth in the relationship it was deteriorating. Afghans were increasingly weary of occupation, and in a great sense ready for change.

Too often, business leaders think they don’t need to focus on growth. According to recent Gartner research only 56% of chief executives see Growth as the top priority for their firms. They don’t think they need to think about how to launch new solutions, new services, new opportunities to please their customers. They drift into preserving the status quo business, perhaps working on doing things a little faster, a little better, a little cheaper. But as time passes needs change. New needs emerge. Markets don’t stay the same, new competitors challenge old norms – challenge the status quo. The customer relationship deteriorates as new unmet needs aren’t addressed. If we aren’t helping the customer to grow, and thus growing ourselves, the market becomes dull, and ready for a major shift. Poised to be overtaken by something new.

We used to think we could create a market, then erect entry barriers to keep out competitors. Things like scale advantages, control of distribution, control of technology, regulatory limitations became the “moats” that would protect the business. And we thought with those protections we had “competitive advantage” allowing revenues, and profits, to go on infinitely. But that simply isn’t true. Fringe competitors are constantly attacking the “moat.” Things happen in the world creating opportunities for new solutions. A “reinvention gap” emerges as the old business becomes stale and customers are looking for something new. And fringe competitors are waiting for the opportunity to take action – and market share.

The only way you can remain vital is to constantly grow. You have to keep up with economic growth (3%/yr) and overall inflation (3%/year) just to remain even – without any return to shareholders. Add on 3 more points of growth to keep investors and you need to grow 9-10%/year just to sustain. Leaders too often take for granted that customers are happy, their particular market is “low growth” and they focus on the bottom line. Wrong, and deadly. Instead focus on the top line. You have to constantly grow revenues. It’s the only way you can remain vital with your customers, and the only route to success.

This analogy is not to belittle the catastrophic circumstances in Afghanistan. Under the Taliban most people will be denied the things I personally hold dear. It is a human tragedy.

But the story is one told all too often. Focusing on the bottom line, forgetting the need to grow your organization and your relationship with customers. And then thinking that any transition will take some time, providing ample room to react. I see these errors regularly. Think of Sears, ToysRUs, Hostess Baking, Sun Microsystems, Wang, GM/Ford/Chrysler, Motorola….. it’s a very long list of companies that made these two mistakes. As the newscasters harp on how fast Afghanistan fell, remember that this was a failure many years in the making. Lots of defend and extend behavior (military might) by America, far too little innovation and not meeting unmet needs (food, shelter, clean water, education, protection from harm.)

Are you on “cruise control” running your business?

Ask yourself, Are you trying to defend and extend what you’ve always done? Or are you meeting unmet customer needs, helping customers to grow and in turn growing yourself? If you’re the former, get ready for a rude awakening.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jul 19, 2021 | Entertainment, Entrepreneurship, Innovation, Strategy, Trends

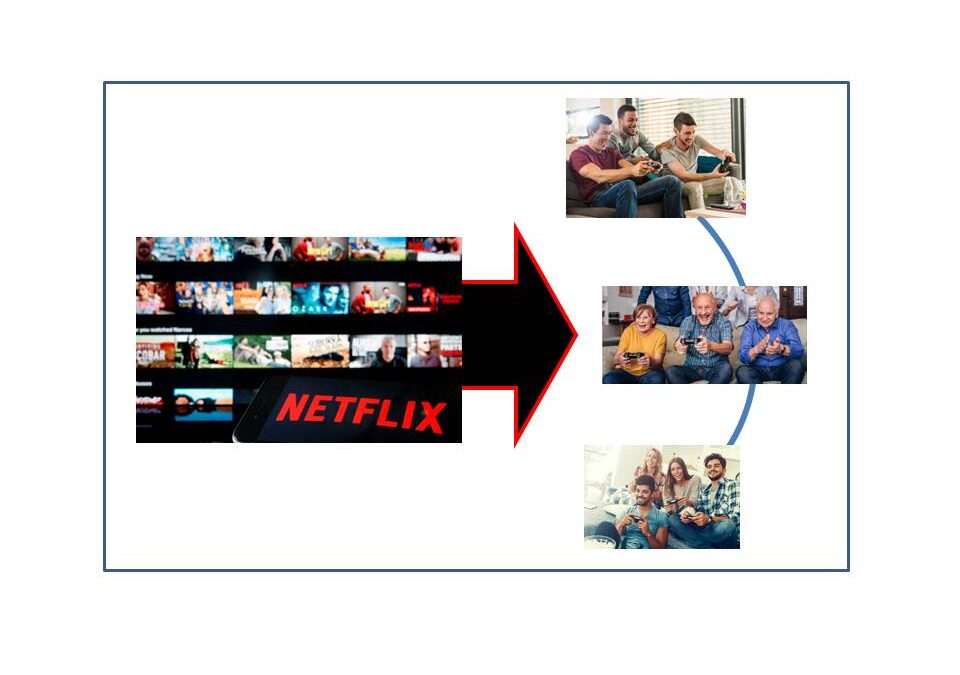

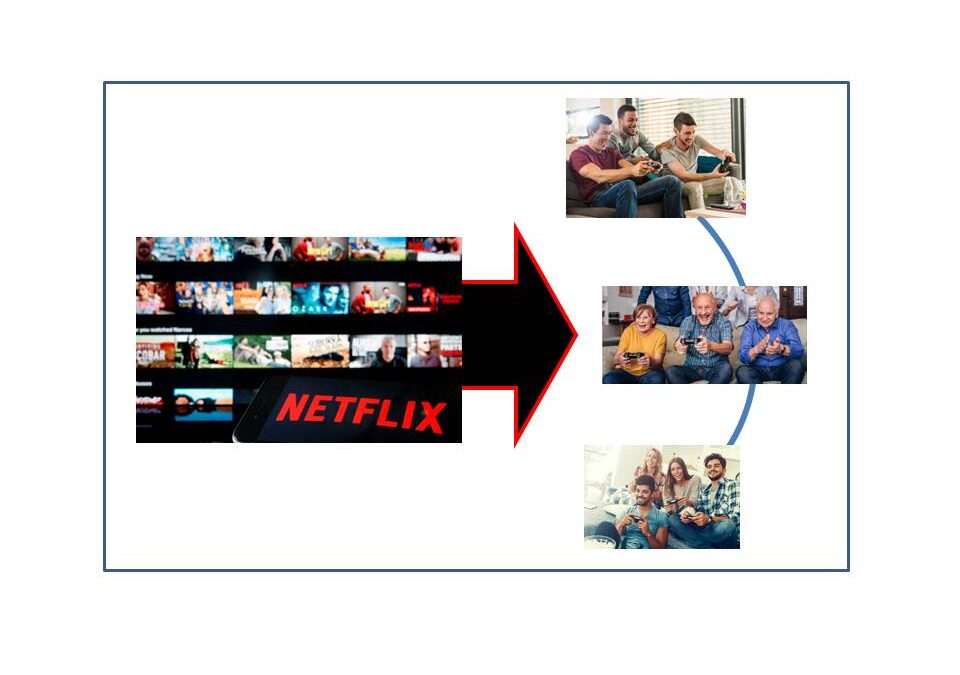

Netflix Redefines The Pivot

Last week Netflix announced it was going to enter gaming . Interestingly, the analyst reaction was, at best, mixed. Most didn’t think it was a great idea. My favorite is this quote in AdAge came from a pair of Bernstein analysts.

“Bernstein analysts Todd Juenger and Gini Zhang said in a note that they were “tepid” about Netflix getting into gaming, partly because it would mean a lesser focus on the core business. They worry about creating a distraction.”

These untalented analysts went on to say:

“It’s hard not to imagine that if Netflix were to launch its own video games, the majority of the company’s energy would be focused on the success of that new, different, exciting thing (even among employees who aren’t involved in it),” according to the note. It’s also unclear how the company can capitalize on the video-game content without raising prices—and potentially turning away some users unwilling to pay extra, they said.”

A History of Pivoting to Meet Customer Needs

Wow, I’ve heard that before. Remember how Netflix started? Back when we all went to Blockbuster or another video store to rent a tape or dvd overnight, Netflix offered to send them to our house. And let us keep them as long as we wanted. This convenience was so powerful Netflix drove Blockbuster, Family Video and all other traditional video rental stores bankrupt.

After this big win analysts thought that Netflix should take on Amazon in general merchandise e-commerce. After all, Netflix was the largest customer of UPS, USPS and Fedex at the time. Most analysts thought Netflix had the infrastructure to ship things, so they wanted to build on that infrastructure. But Netflix didn’t to that at all. Keeping its eyes on its Value Proposition of “Delivering Entertainment” Netflix instead went headlong into video streaming. And the stock tumbled dramatically as analysts said streaming wasn’t the “core” of Netflix. Netflix wasn’t a tech company, or a telecom or cable company and streaming would be a huge distraction for people lacking proper skills. Netflix’ Value Delivery System was dominated by logistics expertise, and the analysts were focused on milking more out of the Value Delivery System.

Of course Netflix knew its value was in keeping customers happy, not milking its invested assets. Netflix’ “core” was in knowing entertainment, so it had to develop the skills in streaming, or its customers would drift away. Further, Netflix knew it had nowhere near the savvy of Amazon for general merchandise marketing and sales. If it followed Amazon it would fritter away its Value Proposition, and probably never make any money chasing Amazon by trying to devote more energy to its logistics Value Delivery System.

Of course, Netflix was right. Leadership jettisoned the physical distribution Value Delivery System and built a new one around streaming technology. Just as the Bernstein analysts feared, Netflix had to raise prices. Which it did on physical distribution in order to raise the money to invest in streaming, which turned out to be the shot allowing Netflix to dominate globally, not just in the USA. It was enormous win for gaining customers, selling more stuff, and making more money.

About 5 years ago, Netflix realized it yet again had to change its Value Delivery System if it was to maintain its customer Value Proposition. So it scaled back investing in streaming, as that technology was becoming available to everyone. And it invested heavily in content production. Even though it had long distributed other people’s content, Netflix saw that to be a leader in “Delivering Entertainment” it had to create its own. So the money was shifted into making “House of Cards,” which was a huge hit, and “Orange is the New Black.” Now Netflix is the most prolific video content creator in North America. So much good content Netflix has jeopardized the future of TV networks, major movie studios and even entire theatre chains.

Where once the big employment center, and resource hog, in Netflix was logistics, Netflix leadership pivoted its Value Delivery System into streaming technology. Then it pivoted again into content creation. And now, as gaming has become “the next big thing” Netflix is once again pivoting its resources — into fast growing gaming.

Given this is the third pivot, and 4th Value Delivery System, in Netflix, would you bet against CEO Reed Hastings and his leadership team? The negative analysts are as dead wrong now as they were before. Netflix has demonstrated a keen understanding of their Value Proposition, and demonstrated the skill set to adapt their Value Delivery System to meeting emerging customer needs. I believe it is almost a certainty Netflix will find its way in on-line gaming as the trend keeps growing exponentially. And like all the other pivots, they’ll attract even more customers, and sell more product, and make more money.

Are you adaptable to new Value Delivery Systems as technology makes them available?

Do you clearly know your Value Proposition, and are you focused on it — or are you focused on running your Value Delivery System. Are you trying to maximize your old business, or are you seeing how emerging trends are creating new opportunities to grow by entering new businesses, with new Value Delivery Systems? Netflix has demonstrated how to grow very large, very fast. Are your eyes open to Trends and Market Shifts – and are you adaptable to take advantage of emerging market needs? Now is a good time to learn from Netflix.

My calls on Netflix have historically been quite good. Check out these links to previous articles:

How Netflix became the King of Strategic Pivots, 4/2018

Predicting Netflix Would Dominate Entertainment Content, 4/2016

Explaining Why and How Netflix content creation would be good for investors, 3/2015

Explaining why investors should buy Netflix stock when it crashed after announcing its move into streaming, 10/2011

Explaining why you should buy Netflix, predicting it would be the next Apple or Google, 11/2010

Netflix ended last week at $530/share. Had you bought it when I recommended in 11/2010 the stock was $25. You would have had a 25X gain. Had you added to your position in October, 2011 the stock was $16.75. You would have a gain of 31.6X. Had you added in 3/2015 when I recommended higher valuation for investors from content you would have bought at $62, for a gain of 8.5X in 6 years.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jun 10, 2021 | Entrepreneurship, In the Rapids, Innovation, Strategy, Transportation, Trends

The Slow Decline of Two Famous Brands

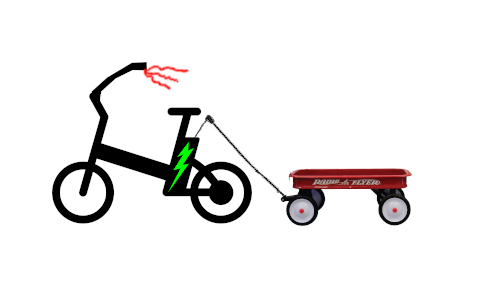

Demographics have been causing the slow death of 2 very famous brands. Radio Flyer and Harley-Davidson. Now they are reacting, and maybe it won’t be too little too late for them. Here’s the story and a small dose of innovation theory for you to implement in your business.

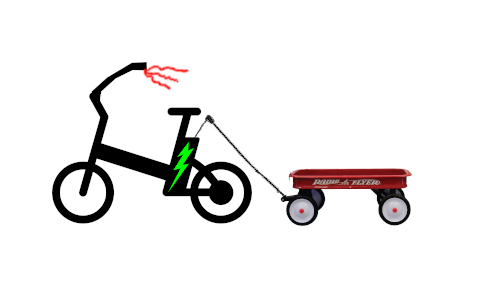

Radio Flyer for 100 years has been famous for its little red wagons. Since before the Great Depression, children have enjoyed these wagons (and scooters, etc.) for recreation. But family formation has fallen precipitously the last decade, and the birth rate has fallen even faster. Further, lots of competitors have entered the market for small pull wagons and scooters. The net impact is fewer babies, and a big drop in demand for the traditional metal wagons. For a company manufacturing in Chicago, it looked like another slow slide into irrelevancy and failure.

But now, Radio Flyer has announced its new e-bike and e-scooter products. This opens the door to an entirely new market and new customers. People of all ages have started purchasing e-bikes. They ride for pleasure, to run errands and even commuting. In some cities, electric scooter ride sharing rentals have soared faster than bicycle rentals. Sales have skyrocketed. Seeing the underlying trend in demographics, and the changing consumer behavior Radio Flyer is entering the market with new products – priced squarely in the market sweet spot – which just might make the company relevant again.

An even older company is Harley-Davidson. For years, Harley has dominated the market for large engine cruiser style motorcycles. In the 1970s and 1980s, this served the company well as motorcycle sales grew and customers would up-size to Harley bikes from smaller Japanese manufacturers. But the brand image wore old a long time ago. Images of “Hells Angels”, “Easy Rider” and accountants turned HOG (for Harley Owners Group) were not attractive to younger buyers. The average age of Harley buyers kept rising, until now it is almost 60 years old! The reality is that Harley’s market simply started dying off, aging out of buying new motorcycles (or any motorcycle for that matter.) And younger buyers were far less interested in the old-style cruiser in favor of the smaller sized, easier handling and mostly faster sport bikes made in Japan.

For years Harley-Davidson ignored the demographic trends and the impact on its business. Harley made an effort to update its product, and image, introducing the V-Rod with a Porsche manufactured engine. But dealers didn’t like it, and Harley never put in the promotion to bring in the new, younger rider the bike was designed to attract. Now, Harley-Davidson has launched its own e-bike, called the Serial 1. At $5,000 it’s a top-priced e-bike, I guess aligned with the company reputation for premium pricing. But the Serial 1 has garnered good reviews, and like the Radio Flyer e-bike it gives Harley a new technology and a new market with new customers. And most important, a chance to slow its slide into irrelevancy.

Will these products turn these companies around?

It’s hard to say. They aren’t creating a new market like Netflix did in streaming, or Apple did with apps on iPhones. They aren’t early to market. One could say they are a late entry into a crowded marketplace. And neither appear to be introducing any new technology, or enhanced functionality not already available. And the brands are outdated, loaded with nostalgia – which might be good, or bad. But at least they are reacting to trends.

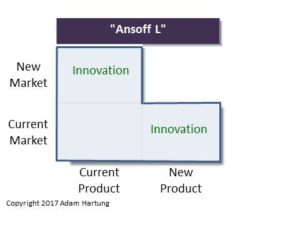

Innovation Theory in Practice

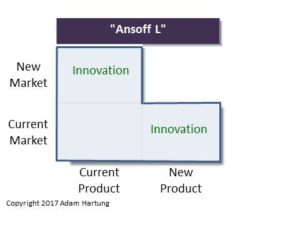

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.

The second issue is that the market for electric personal transportation is past Early Adopters and into the Growth stage which is when new brands jump in and the market starts to fragment. There is plenty of market share for both Radio Flyer and Harley-Davidson to become established. One key question is- Can these brands offer the products and brand desire to make the jump to segments of new customers?

Are the Brands Structured to Succeed?

To succeed, they must COMMIT resources and focus to these new markets, and create new developments. I wish they would have launched with White Space teams that had permission to develop a new brand image, new distribution, new ad campaigns – an entirely new approach designed to seek out market leadership. Harley-Davidson did create a version of a “skunkworks” with the spinoff of Serial 1, LLC. For now the PR sounds more like they are doing it “on the sly” as something they aren’t really sure will succeed. So it’s really up to senior leadership now. They either commit to a new future allowing product teams to build on the e-bike opportunity to develop new technology, new customers and new markets – or they can slip back into the slide downward. We’ll have to wait and see if they can jump the re-invention gap.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jun 2, 2021 | Economy, Innovation, Scenario Planning, Strategy, Trends

Nomadland art … IS Life

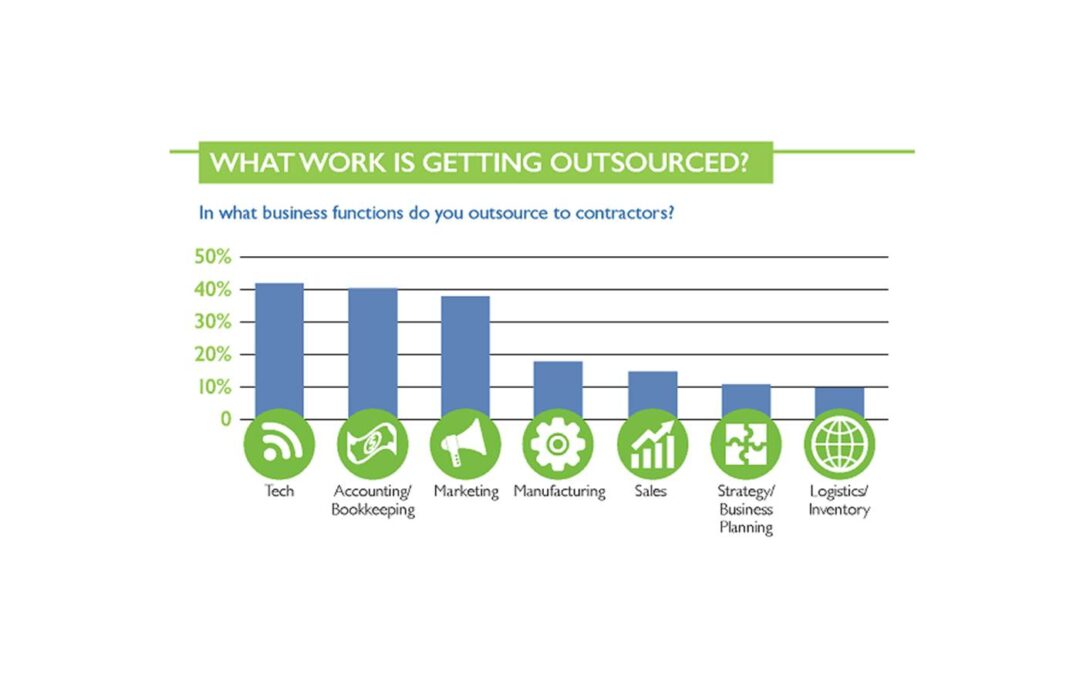

The Academy Award winning movie “Nomadland” portrays a woman whose town is decimated when its largest employer leaves. No jobs means homes go valueless, and people are forced to leave. Not only the economy, but lives are wrecked without money, healthcare and any sense of economic future. What follows is a pretty bleak overview of living in one’s vehicle, hustling for jobs of any kind and building networks of other nomads who give encouragement to each other – but not a lot of help. During the movie, the lead character is offered at least two very solid opportunities to move into a more stable situation (one with her family, and one with the family of another nomad.) Yet, she turns down both. Despite living what the filmmakers portray as a very difficult, lonely and economically bleak situation she chooses to continue the nomad lifestyle.Today’s Gig Workers, or Digital Nomads, are often thought of as bleak, lonely people. No permanent job, no permanent employer, no “corporate” home. The view is often of people who are on the stark edges of the economy, struggling to survive in an uncertain future. And that view would largely be wrong.

The Gig Economy, and its self-employed Digital Nomads, represented HALF the U.S. Workforce before the pandemic hit. The World Economic Forum, Ernst & Young and the U.S. Federal Reserve all said that the emergence of the self-employed Gig Economy Digital Nomad represented the largest single economic shift in several generations. All have said this trend for business is as big as the emergence of mobile and internet technologies. It is characterized as a fundamental change in how people work, and a dramatic change in the outdated Industrial Era “contract” between companies and employees.

Digital Nomads are NOT merely a pandemic artifact.

They are members of an enormous mega-Trend: (1)

- The gig economy is growing so fast its job creation alone can account for all the jobs created in the USA from 2005 through 2016 (corporate hirings/firings were a net no gain)

- In the last 40 years the employer/employee compact has disintegrated, leading fewer people to trust their employers, so they seek alternative cash flow sources

- It is estimated half of gig workers maintained full time jobs – but are actively seeking entrepreneurship. Thus the resulting unwillingness to return to low-pay jobs as the pandemic ends.

- The Gig workforce of Digital Nomads is growing 5x faster than growth in traditional jobs

- 63% of Gig workers say they started not due to economic requirements, but as a choice

- In 2017, 53 million Americans participated in gig work (36% of all employees)

- By 2027, trends project over half of all Americans will be involved in gig work. This pre-pandemic statistic is likely to understate the likely results due to pandemic changes.

- Prior to the pandemic at least 40% of the American work force made at least 40% of their income from Gig Economy work

- Digital Nomads cross all age groups? 44% of Boomers, 59% of GenX, 63% of Millennials

Digital Nomads mostly CHOOSE this work approach. In a fast-paced, quickly shifting world the idea that an employer can “protect” its employees is a façade. With the average corporation lifespans now a mere 8 years, no job and no employee can be protected. Neither pay nor benefits are ever a given in markets where companies acquire, merge, are acquired or fail with such regularity.

Employees Empower Themselves In Gig Work

Employees Empower Themselves In Gig Work

Being a Gig Worker actually fulfills the corporate goal, sought for 35 years, of “empowering employees.” Despite what managers said, organizations operate today in the militaristic style of the last 100 years. Unless you’re the CEO (dictating your own pay and terms) someone is your boss. And your #1 job is to please the boss. Success is less about results, and a lot more about politics, corporate behavior and luck. But as a Digital Nomad you are your own boss. You contract to do something, at a rate, on a timeline and then you deliver. You are empowered to do the work you want, when you want it. To lead the lifestyle you choose, making as much as you desire. Doing your own training, building your own skills, selling your services and reaping the rewards.

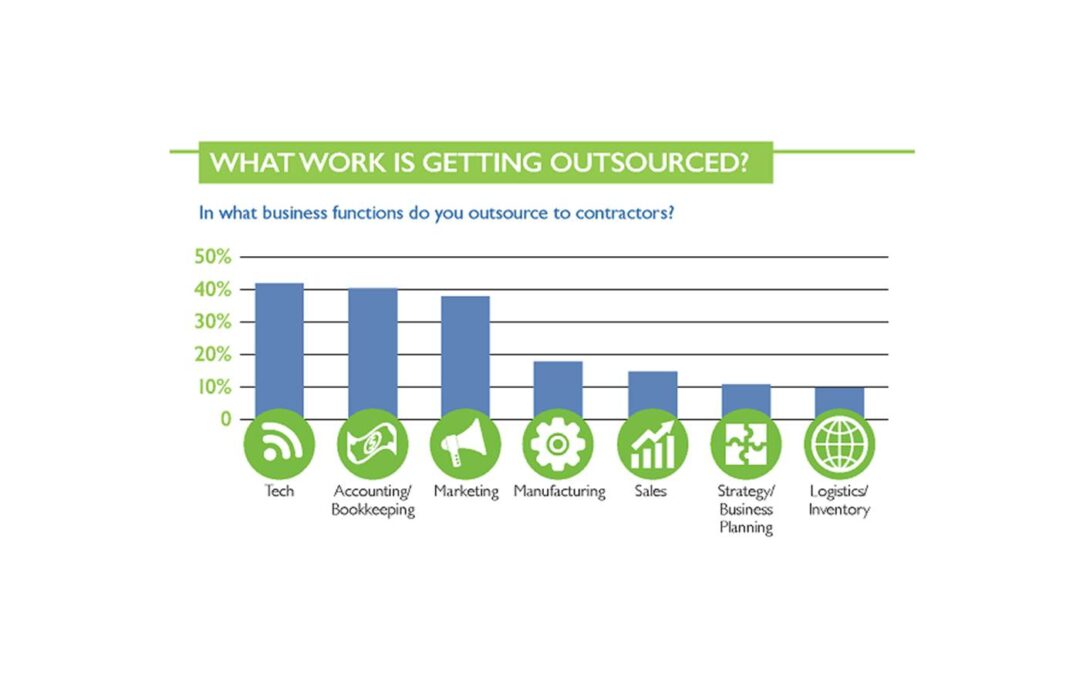

Corporate Nomadland is much, much bigger than the Nomadland of the movie. And it is largely comprised of people who want to work like Digital Nomads. It’s not bleak. Rather, in many ways it is the future of work. Especially for people who provide services — from accounting to marketing to sales to planning, to education, workshops, security, etc. It is a world built on networking, connectivity, individual accountability, and entrepreneurial behavior as it existed prior to the Industrial Era.

For Full image: JDP Employee Screening

Unfortunately, a lot of old-school employers and government officials still don’t understand this mega-Trend. They keep trying to force Digital Nomads into becoming employees, by altering work rules and regulations and promoting old-school style unions. Efforts attempting to force employers to do what they can’t – operate their business like it’s 1966. Business people today must be adaptable to market shifts, changing competition and fast moving customer needs. They can’t afford full-time employees and incumbent overhead costs on roles that simply are not economically suited to their needs. Trying to force this behavior hurts the Digital Nomads even worse than the employers, because they don’t want these changes. That’s why the effort to change laws making Gig Workers employees failed in California. That’s why employees failed to unionize an Amazon facility in Alabama. Even President Biden favors unions, “The policy of our government is to encourage union organizing.” (POTUS tweet 4 Feb 21) Those are not the right answers to today’s problems.

We are living a mega-Trend, accelerated by the pandemic

We now know we can work asynchronously and mobile. We know the results of our work are more important than physically attending meetings, or office politics. We know that we can be more efficient, and capable, when empowered to focus on results and not outdated policies, procedures and processes. And this trend will continue to grow. Despite the CEOs and other leaders that want to force everyone back in offices, in large droves people are choosing not to go.

That’s not to say the government couldn’t be a lot more effective if it accepted this mega-Trend and attempted to assist its citizenry with new approaches. There need to be entirely new approaches for implementing and regulating safety nets – like unemployment, health care and retirement programs. There need to be new regulations for contract negotiations and dispute resolutions between large corporate entities and Gig workers. New approaches for Digital Nomads to network in ways to set output standards, work standards, pricing standards for effectively working with their much bigger customers. There need to be new approaches for bringing on and eliminating transition teams for large projects. Basically, new approaches which support the adaptability and flexibility needed by both employees and Gig Digital Nomads. Digital Nomads are here to stay. Speaking of mega-Trends, have you seen the new AI-controlled, EV camper?

(1) Section reference

(2) Additional references

-MegaTrends by HP “The Future of Work – The Gig Economy”

-World Economic Forum – “The MegaTrend that Will Shape Our Working Future” the Gig Economy

-EY MegaTrends – “The Future of Work” the Gig Economy

-Supermoney – “The Growing Importance of the Gig Economy”

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | May 26, 2021 | Innovation, Investing, Software, Strategy, Trends

Free Trend Money!

Amazon is buying MGM film studios for something less than $9 B. Sounds like a lot of money. But since Amazon can make its own money, effectively this transaction is free. Now you must be wondering, how can Amazon make its own money? By creating “Trend Value.”

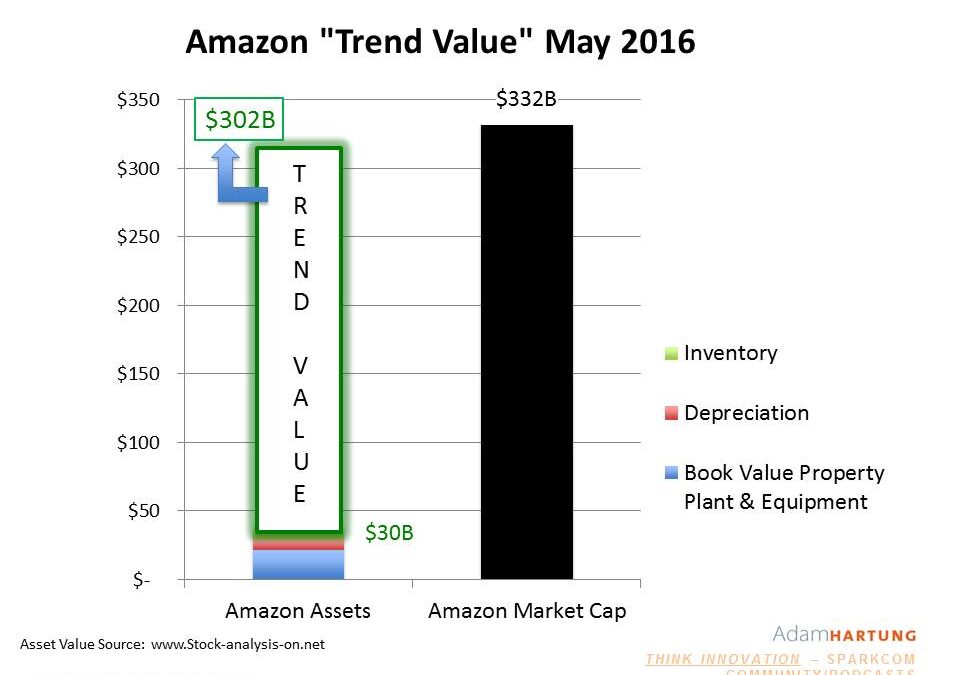

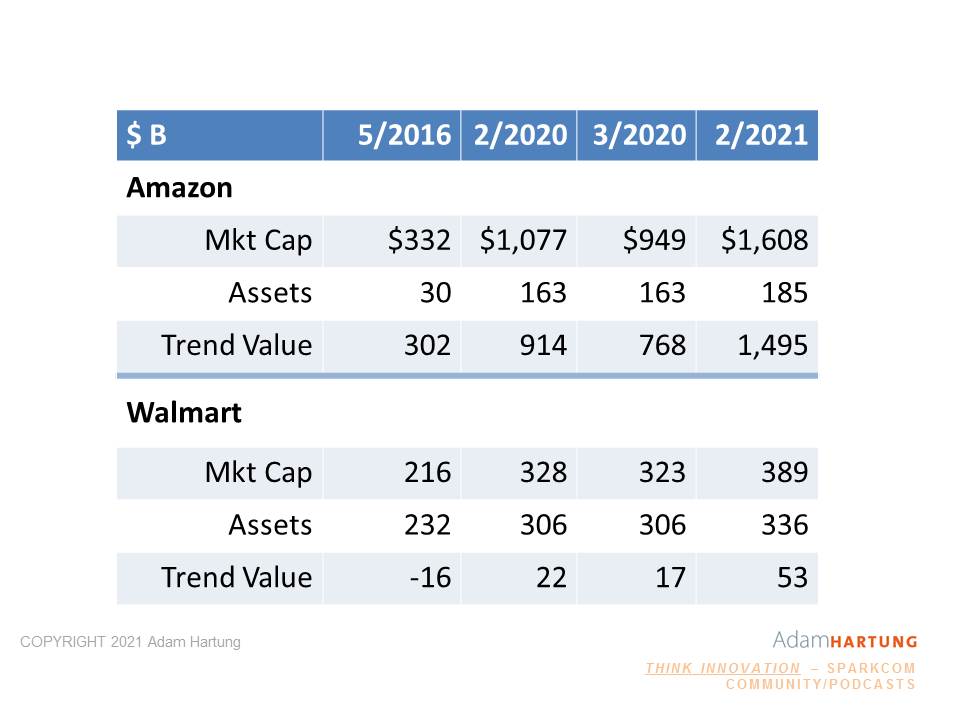

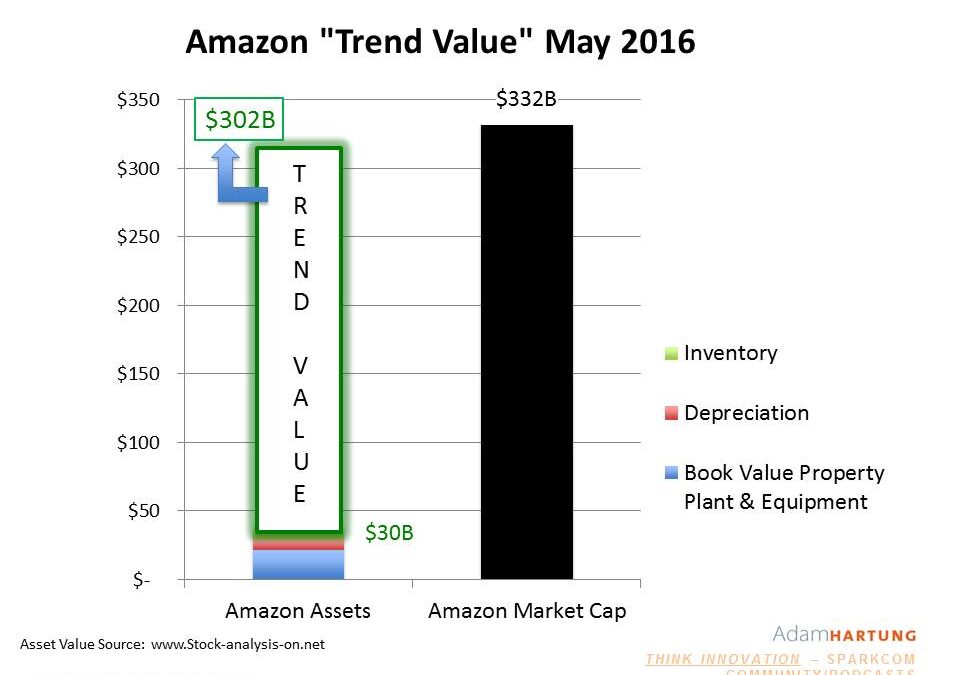

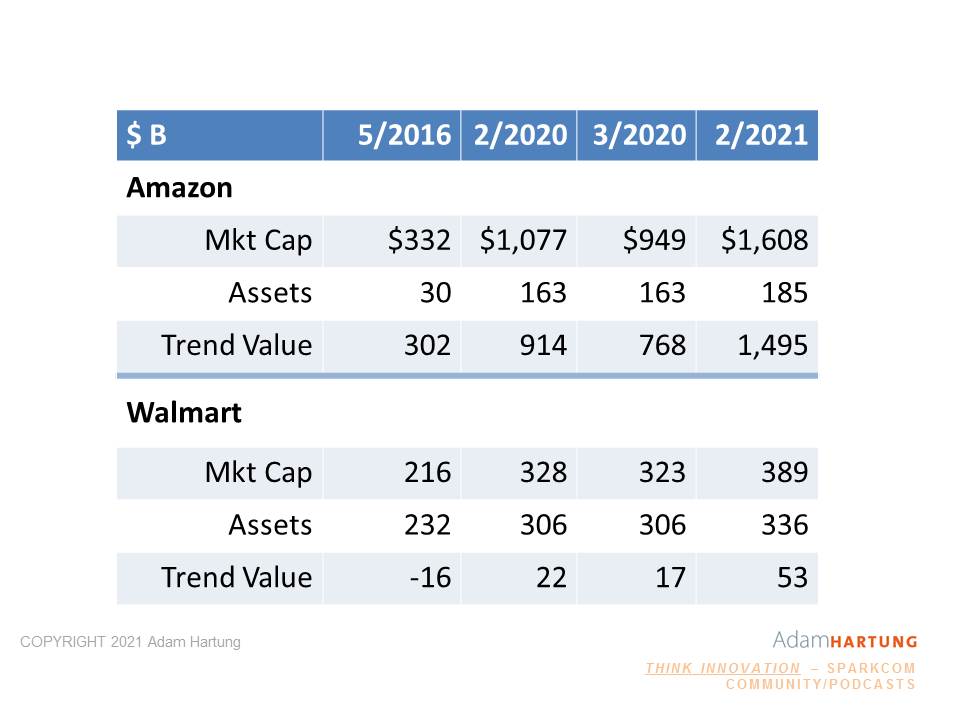

Back in 2016, before Amazon started making acquisitions like Whole Foods, its valuation (or market capitalization) was $332 B. But its assets were only worth $30 B. And remember, Amazon was not, and still isn’t, very profitable. Net income was only about $2 B at that time. That extra $300 B of valuation (10x the assets) wasn’t from earnings, but rather because Amazon was a global leader in e-commerce with about 40% market share in the USA. Because e-commerce and cloud computing were growing trends, investors gave Amazon an additional $300 B in value as a Trend Leader.

Because Amazon was riding the big trends to e-commerce it created $300 B of very real value. This very high share price allowed Amazon to keep investing in ways to grow, including making acquisitions.

Because Amazon was riding the big trends to e-commerce it created $300 B of very real value. This very high share price allowed Amazon to keep investing in ways to grow, including making acquisitions.

Compare with Walmart. In 2016 before, Walmart bought Jet, it had almost no e-commerce. Walmart had $232 B of assets (7 times the assets of Amazon,) but it’s valuation was only $216 B (2/3 Amazon’s.) Because Walmart’s assets (and business) were concentrated in the no-growth retail world of brick-and-mortar stores its value was less than its assets! Investors were basically saying that to create value Walmart would have to sell its assets – not grow its revenues. As a result, Walmart’s Trend Value was a NEGATIVE $16 B

Six years (and a pandemic) later, and the world of e-commerce has exploded. WalMart bought Jet, eschewing adding traditional stores and instead investing in e-commerce. As a result its assets grew very little, but its market valuation improved to $399 B, an 85% enhancement. And it’s Trend Value went up to $60 B. A good thing, but still only 1/5 the 2016 Trend Value of Amazon. A $9 B acquisition would be a very notable acquisition for Walmart using up over 50% of its cash. And taking out a 2.5% chunk of its market cap, and a whopping 15% of its enhanced Trend Value. Meanwhile, since 2016 Amazon has purchased an entire grocery chain (Whole Foods) and made enormous investments in distribution centers, trucks, and other supply chain assets. That has increased Amazon’s asset base 10-fold, to about $320B. But now Amazon’s publicly traded shares are worth $1.62 TRILLION. That’s right, with a “T.” By investing in Trends (e-commerce and cloud computing services [AWS]) Amazon’s Trend Value has risen to a whopping $1,300 Billion. Amazon’s Trend Value is 21.5x Walmart’s.

Meanwhile, since 2016 Amazon has purchased an entire grocery chain (Whole Foods) and made enormous investments in distribution centers, trucks, and other supply chain assets. That has increased Amazon’s asset base 10-fold, to about $320B. But now Amazon’s publicly traded shares are worth $1.62 TRILLION. That’s right, with a “T.” By investing in Trends (e-commerce and cloud computing services [AWS]) Amazon’s Trend Value has risen to a whopping $1,300 Billion. Amazon’s Trend Value is 21.5x Walmart’s.

By investing in Trends, Amazon created a cache of value

They used that value to make more acquisitions. Even though it made huge investments in assets – far beyond WalMart’s – its Trend Value grew even more. Now Amazon could purchase MGM for $9 B and use only 10% of its cash. But it won’t. It will use shares. But that $9 B is now only .55% of Amazon’s value – and only .7% of its Trend Value. Negligible on the balance sheet, but opening up tremendous revenue growth for Prime Video.

If you want to create money, invest in trends. Walmart was the renowned leader in retail, and computing for retail, until trends shifted the market. Now it is an also-ran compared to Amazon. And because Amazon is leading in the Trending markets of e-commerce and cloud computing it has created the money to buy MGM. Again, not with profits (which are still only $20 B) but with the Trend Value created by proper market selection and investing.

So are you creating money by investing in trends? You can literally create your own money, usable for all kinds of investments, when you invest in trends. Or are you grinding out the business, like Walmart with all those stores, but creating almost no value in the vast majority of what you do? The choice is really up to you.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | May 20, 2021 | Computing, Innovation, Investing, Leadership, Software, Strategy, Trends

Stuck on the Core

This week, to almost no fanfare, a Microsoft Vice President issued a statement saying that Windows 10X (planned for 2019) would not ship in 2021. In fact, it would never ship. The technology enhancements would be integrated into existing Windows, and other products. While this gained little press, it is great news for customers and investors.

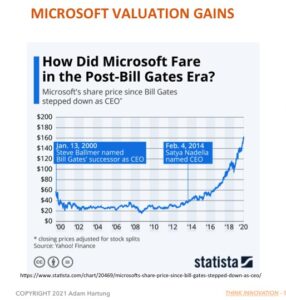

CEO Satya Nadella has officially changed the course of Microsoft. Under former CEO Ballmer the behemoth kept pouring money into Windows and Office. While the world was moving from PCs and PC servers to mobile devices and the cloud, Ballmer just kept pouring billions into old products. His slavish insistence on trying to defend & extend an old “core product line,” which every year was losing importance as PC sales slowed, was killing Microsoft — leading me to call Mr. Ballmer the worst CEO in America (my Forbes column that was by far the most read of any I ever penned.) After more than a decade as CEO, Ballmer had spent a lot of Microsoft money on new versions of its ancient product and bad acquisitions like Skype and Nokia, but he entirely missed the market shift in his customer base. In my blog post, “Microsoft, What Next?”, I described the challenges ahead to pull Microsoft out of the Growth Stall.

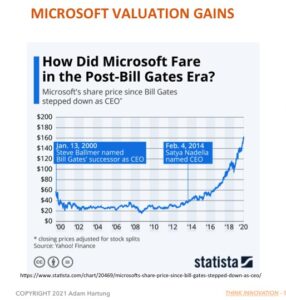

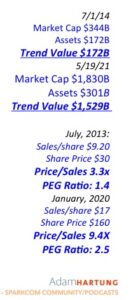

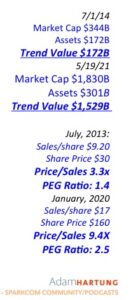

This chart shows just how much Microsoft has changed since Nadella took over. During Ballmer’s 13+ year leadership Microsoft’s valuation barely budged. (From left to small blue box.) But, Nadella rapidly shifted investments from Windows and Office to software as a service and cloud computing. (Graph rapidly increases.) That radical redirection enlivened both sales and earnings – and the company’s future growth prospects. In short, where the company had been locked-in to defending & extending its past, Nadella redirected the company onto trends. By doing so, he improved sales per/share 85%, the price/sales ratio from 3.3x to 9.4x, and the PEG ratio from 1.4 to 2.5. The company’s “trend value” (market cap increase over assets due to aligning with trends) since Nadella took charge has grown from $172 billion to a staggering $1.53 trillion!!! Now that is wealth creation!!!

This chart shows just how much Microsoft has changed since Nadella took over. During Ballmer’s 13+ year leadership Microsoft’s valuation barely budged. (From left to small blue box.) But, Nadella rapidly shifted investments from Windows and Office to software as a service and cloud computing. (Graph rapidly increases.) That radical redirection enlivened both sales and earnings – and the company’s future growth prospects. In short, where the company had been locked-in to defending & extending its past, Nadella redirected the company onto trends. By doing so, he improved sales per/share 85%, the price/sales ratio from 3.3x to 9.4x, and the PEG ratio from 1.4 to 2.5. The company’s “trend value” (market cap increase over assets due to aligning with trends) since Nadella took charge has grown from $172 billion to a staggering $1.53 trillion!!! Now that is wealth creation!!!

In the years leading up to Ballmer’s firing I was a very loud critic of Microsoft. In multiple Forbes columns, (republished as blogs on my web site) I pushed for his ouster. But even more importantly I gave the company little hope of long term viability. By over-investing in outdated products it seemed most likely Microsoft would go the way of Hostess Baking, Sears, DEC and Sun Microsystems – irrelevant leading to failure. I rabidly recommended not owning Microsoft.

Microsoft Stock

2014-2021

The Impossible Just Takes a little Longer…

But Nadella achieved the improbable. Much like Jobs when he retook the reigns at Apple, Nadella quit looking (and investing) in the rear view mirror. Like Jobs, he dropped investing in PC’s. Instead he focused on the future, and where Jobs invested in mobility, Nadella has invested in the cloud. Very few companies make this kind of radical shift in resourcing projects, even when it is the obviously right thing to do. And Nadella deserves the credit for making this radical change in Microsoft, saving the company from near-oblivion while creating a very viable, valuable company in a short time. Where once I saw a company heading for infamy, now Microsoft shows all signs of leadership toward the next technology wave and longevity. Quietly saying the company has no plans for a new Windows version, which nobody cares about anyway, is a tremendous demonstration of looking forward rather than backward.

Jump the Re-Invention Gap

Do you have the insight to know when you’re company is over-investing in past solutions as markets shift? Are you like Ballmer, always making the next version of what once made you great, or are you like CEO Nadella – ready to unload your past focus in order to seek future growth? Are you letting market trends guide your investing and solution development, allowing you to de-invest in outdated technologies and products? Like Reed Hastings at Netflix, do you see the need to pivot? Netflix changed from an outdated business model (shipping DVDs and tapes) to a new model (streaming) in order to keep your company viable, and an industry leader. You must be if you want to thrive in the rapidly changing competitive marketplace of the 2020’s.

Do you have the insight to know when you’re company is over-investing in past solutions as markets shift? Are you like Ballmer, always making the next version of what once made you great, or are you like CEO Nadella – ready to unload your past focus in order to seek future growth? Are you letting market trends guide your investing and solution development, allowing you to de-invest in outdated technologies and products? Like Reed Hastings at Netflix, do you see the need to pivot? Netflix changed from an outdated business model (shipping DVDs and tapes) to a new model (streaming) in order to keep your company viable, and an industry leader. You must be if you want to thrive in the rapidly changing competitive marketplace of the 2020’s.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | May 12, 2021 | Employment, Immigration, Scenario Planning, Strategy, Trends

Demographics is Destiny

Planning is all about the future. And the future is easiest to predict when we look at demographics. Population trends are easy to spot, and long-lived. So the recent U.S. census, which built on previous trends, gives us great insights for planning our investments. Let’s focus here on the two biggest demographic trends.

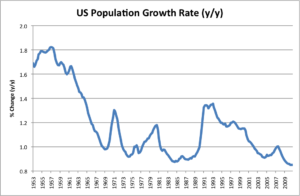

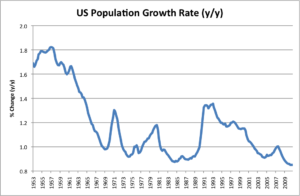

First, the U.S. population growth rate is terrible. Less than 1%/year. Its the 2nd worst decade  since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

In 2018, I wrote about the Japanese demographic “trend bomb.” Low birthrates and anti-immigration meant there were only 2 working people to support each retiree. And the situation was worsening. It’s time America starts considering what it will do if we don’t let immigrants return to spark growth. Growth can hide a multitude of sins, Source: Avondale Asset Management

because it creates demand for more goods and services – thus creating economic growth. People in China and

India aren’t starving any longer, because they’ve grown their economies out of poverty.

As wrote in 2017, it was America’s population growth – driven by immigration – that made 1800s and 1900s America the jewel of the world. Despite horrors at Ellis Island, those boatloads of immigrants created the agricultural and industrial America with its flourishing economy. Like I observed in 2016, unless we re–invigorate growth through immigration, the woes Trumpers complain about will get much, much worse. Soon Pakistan and Indonesia will have more people than the USA! China and India, with their growing populations, growing economies and growing diaspora are making an ever–bigger imprint on the global economy. Meanwhile, America is on its way to stagnant performance like most European countries.

U.S. Population is Mobile, Despite the Pandemic

Second, the trend south and west continues unabated. In 1970, the South and West accounted for less than half the population. Now they account for 62%. The Northeast is losing people rapidly, with 48 of 62 New York counties losing people. And Illinois has seen the problem in spades. Chicago and Illinois are already in a world of hurt due to declining population causing a declining economy causing real estate prices to fall and taxes to rise. (Though the pent-up pandemic housing demand is temporarily increasing housing prices, masking the long term trend.) When population trends down, it becomes a whirlpool of problems – just look at what’s happened in Detroit! You must have the people to build a strong economy.

Looking at both these trends, do you see the unabashed irony? We see no problem with cities and states competing for migrants from other cities and states. Local and state governments lure in companies and people with tax breaks, subsidies and other allowances. We think immigration within our country is good – and recognize losing people from our local area is bad. But at a national level, we still have people who object to immigration. They want the borders closed, and no new entries. We have politicians who want to freeze the economy in place. Yet we know from our past that the only solution to getting our economy to grow REQUIRES immigration. It is the #1 reason the economy was so sluggish coming out of the Great Recession – we cut immigration to unprecedented levels under Obama and continued the decline under Trump. We are unlikely to birth our way to growth, given trends in lifestyles and gender equality. But, we can bring in immigrants who can help the economy grow. We need to get over this hypocrisy and move toward greater immigration as a pro-America policy!

What does this mean for your business?

First – are you sure you want to do business only in the USA? The growth markets are elsewhere. Have you considered selling in China, India, Indonesia, Micronesia, Thailand, South America and Africa? These are growing markets where Chinese businesses (in particular) are making big investments. By going where the population is growing they are able to grow their revenues, and their influence. America isn’t the dominant international player it once was, and there’s never been a better time to look outside America for your next growth market.

Second – Take your business where you see the growth in America. Lots of businesses are going to Texas (and Nevada, Utah, Idaho and Arizona) because lots of people are going there! If you open a restaurant in a town losing people, to succeed you have to entice people to drive to your town and restaurant. You better be really good, and you’ll probably have to make price allowances to have repeat business. But if you have a restaurant in a locality where people are immigrating in large numbers you can do well even if your food is mediocre. Growth hides a multitude of sins!! Your food need not be fantastic, and you can price higher, and you can even have shorter hours because you’re where the people are! It’s simply a lot easier to succeed when you are in a growing marketplace. Are you planning to be someplace because that’s where you started, have family, or went to college? Or are you planning to be someplace where the people, and money, are?

Have you taken into account changes in demographics when making your plans? It is undoubtedly the #1 trend you should use for planning (Fleeing Illinois) . It is highly predictable, and has a lot to do with success. Simply going where the people are will help you succeed. There’s nothing more important to your scenario planning than obtaining a copy of the latest census and studying it really, really hard. It’ll jump start you on the road to greater sales and more success!

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465

by Adam Hartung | May 7, 2021 | Growth Stall, Innovation, Investing, Strategy, Telecom, Trends

Do you have any idea how powerful AOL and Yahoo once were, and how much they were once worth? Do you know how much shareholder value has been destroyed in these 2 companies in just 20 years? $221 Billion of destroyed wealth.

AOL pioneered the web as we know it today. Long before wireless, or broadband, there was “dial up service.” For young readers, that meant using a physical modem to connect your computer to a land-line telephone in order to literally dial up a connection to an internet service provider. AOL pioneered using the internet, and was the #1 connection with almost the entire marketplace. The phrase that made AOL famous back then was when you connected to AOL and it gave us the now iconic “You’ve got mail.” After connecting America, in 2000 AOL merged with Time Warner media in a deal valuing AOL at $111B.

Yahoo pioneered giving internet users news. It accumulated news from around the world on Sports, Economy and many other topics, making the news available to readers for free because it sold ads to pay the bills. In 2000 a publicly traded Yahoo was valued at $125B.

So in 2000, amidst a very extended NASDAQ internet hype, AOL and Yahoo were valued at $226B.

Image Source

This week Verizon agreed to sell the two companies to a private equity firm for $5B. That’s a loss in value of $221B in 21 years.

How does a loss of this magnitude happen? A lot of focusing on tactics, ignoring market trends and failing to adapt the company strategy to meet changing competitive dynamics. Broadband and wireless eventually made dial-up irrelevant. And despite buying some media company to try and add new content to AOL, it lost all meaning. Time Warner spun it out to the public at a value of $3.5B in 2009.

Then, Verizon thought it could build a proprietary content company to get more Verizon customers so it bought AOL in 2015 for $4.4B. Only, nobody needed another content provider by then. Google served up general content just fine, Facebook gave us content we looked at frequently, and specialized content sites like Finance (Marketwatch) and Sports (ESPN) made it impossible that late in the game to launch a general purpose content accumulator and reposter. It was a strategy for 2005, not 2015. Meanwhile, Yahoo made one tactical decision after another to shore up its old model that didn’t work. Google became vastly better at search, and vastly better at delivering content. Tactical oriented CEOs Carol Bartz and Marissa Mayer had no strategy to meet emerging needs of the 2010 decade and beyond – leading Yahoo into complete irrelevancy.

Undeterred, the Verizon owned AOL bought Yahoo in 2017 for $4.5B. After all, it seemed cheap compared to its once $125B value – right? The idea was to merge the two companies, create “cost synergies” and “scale” in users to sell more advertising. Only, neither platform had enough original content to stop the user bleed to other sites. Netflix and Google’s YouTube took everyone who wanted new content away, and there was nothing left for AOL/Yahoo to deliver. It became the internal combustion engine repair shop in a world full of EVs

Now, after spending $9.9B on the entities plus much more in acquisitions, Verizon is selling both entities to Apollo Global Management private equity for $5B – a loss of $4.4B. And Apollo thinks this is a good deal because “a high tide raises all boats” and it will win merely because the world is increasingly using the internet. Really? More people are using the web, and more often, but they’ve already shown not via AOL nor Yahoo. Facebook, Instagram, Google, Pinterest, Twitter, and a raft of other sites are gaining the traffic. What was once irrelevant remains irrelevant.

It is crucial to understand why these to GIANTS of the internet are now part of history’s dustbin. While they pioneered the market, gaining huge revenues, share and valuation, they did NOT keep their eyes on disruptive innovators who could change the market they pioneered. Broadband killed dial-up, and because AOL moved too late it died. Google overtook search, delivering more content faster and better, and Yahoo simply waited too long to react. Not unlike how Research in Motion (Blackberry) failed to see the “app wave” in mobile coming and lost its enormous lead in mobile phones to Apple and Samsung. All thought their strength in pioneering was enough – and failed to keep their eyes on external trends and new market shifts that would change competition.

I wrote a raft of columns about the mistakes made by these company CEOs from 2009 through 2017 – constantly telling readers not to buy the stocks (just search the blogs my website adamhartung.com for AOL or Yahoo.) It is extremely rare for a corporation locked into its business model and cost cutting to adjust to a rapidly shifting market. When a company does so – like Jobs turned around Apple and Nadella at Microsoft – it is the exception to be well applauded. But that is very, very rare.

And this is NOT what PE companies do. They aren’t visionary investors who put in lots of money to change companies. They cut costs, streamline operations, and add debt to get their investment back. Apollo is no different. It has no vision of the internet future that will slow Facebook, Apple, Netflix, Alphabet/Google or even Amazon. It has purchased two irrelevant brands with outdated business models, no new technology, no new market approaches and no new insight to future unmet needs. There is no doubt Apollo will not turn these around. Apollo will unload this newest Yahoo! over-leveraged to a public debt market dominated by pension funds and it will soon enough file bankruptcy, finishing the coffin.

Do you think you could turn these around? First, are you ready to turn around your own business? Are you focused on how market shifts, happening today, will change your market? Are you seeing trends, and changing your business model and technology to adjust? Are you building a business around future scenarios you’ve created to compete in 2025 and beyond with different competitors offering different solutions? Or are you relying on past strengths to carry you through the future? If you’re planning with your eyes firmly in the rear view mirror I highly recommend you learn the lesson from AOL and Yahoo – that approach will not work.

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jan 29, 2021 | Growth Stall, Innovation, Investing, Strategy, Trends

On Friday, January 22, 2021 IBM announced sales and earnings results. Revenues had fallen 6.5%. The stock dropped 11%. IBM alone caused an otherwise up Dow Jones Industrial Average to decline. And, as the NASDAQ rose, largely due to tech stock improvement, IBM was the lone loser. The new CEO, in his role only 1 quarter, predictably asked for more time and investor confidence that the future would look better than the past. Investors justifiably lost confidence a long time ago.

Unfortunately, IBM’s recent performance was just a continuation of its long-term trend. Since 2000, IBM stock has gone nowhere – up a mere 5.7% in 21 years – while Apple (for example) is up some 14,000%. IBM was the 7th largest company on the S&P500 in 1976 when Apple was born. Now Apple’s revenues are 3x IBM’s, and its market capitalization is 20x higher!

A lot of blame must be laid on the former CEO, Virginia (Ginny) Rometty.  CEO from 2012 to end of 2020, she took home pay of around $35M/year. But during her tenure IBM sales fell in 30 of 34 quarters! Starting shortly after being appointed, IBM suffered 20 consecutive quarters of declining revenues – a remarkably infamous achievement for any CEO!

CEO from 2012 to end of 2020, she took home pay of around $35M/year. But during her tenure IBM sales fell in 30 of 34 quarters! Starting shortly after being appointed, IBM suffered 20 consecutive quarters of declining revenues – a remarkably infamous achievement for any CEO!

In 2012, just as Rometty was settling into her new desk, I said Steve Ballmer was the worst CEO in America (link 1). Little did I know he would be replaced with a new CEO that would turn around Microsoft and save the company, while Rometty would replace Ballmer as absolutely the worst CEO in the tech world – and tie herself with Immelt of GE as the worst CEO in all of America.

By 2014, it was clear that Rometty was altogether wrong as CEO, and I told investors to avoid IBM altogether. In 2 years, revenues had begun their declining trend, and she was constantly on the defensive. Instead of investing in cloud computing and other emerging technology solutions, Rometty was selling IBM’s business in China (because we all know that China was not a growth market – except someone forget to tell Apple and Facebook,) and the PC business. Simultaneously Rometty was cutting R&D spending. And she took on more debt. Where was all the money going? Not into growth investments – but rather into stock buybacks where IBM had become the poster child for financial machinations and share manipulation in order to enhance executive bonuses.

Despite IBM bragging about its one-off supercomputers and interesting artificial intelligence uses, there were no new commercial products helping customers build out trends. So IBM partnered with Apple to build “enterprise apps” in iOS in late 2014. This was doomed. IBM brought nothing to this game. IBM was now wholesale saying its development would be on platforms driving revenue growth for Apple – not IBM. IBM was admitting it had a lot of resources (still) and customers, but no idea where the marketplace was headed. So IBM would help Apple grow its user base. This was great for Apple, bad for Microsoft Surface sales, but absolutely horrible for IBM.

So by 2017, IBM was in an irrecoverable Growth Stall. Twenty quarters into the job, and twenty quarters of declining sales meant IBM was in a Growth Stall which predicted a horrible future. But despite the horrific sales and earnings performance, and the resulting horrific stock performance which in no way kept up with the overall market or industry leaders, Rometty was being granted ever more compensation by a ridiculously out of touch Board of Directors. She was being rewarded for manipulating the financials, not running a good business. She clearly needed to be fired. I said so, and told investors not to expect any gains as IBM continued to shrink.

By 2018, even the most long-term of long-term investors, Warren Buffet of Berkshire Hathaway, had given up on Rometty and IBM. As I said then the writing was on the wall by 2014, so why it took him so long was hard to understand. But it was quite clear, falling revenues would lead to lower valuations, regardless how much effort CEO Rometty put into “managing earnings.” The big shock was it took the Board 2 more years to finally get rid of her — one of the 2 worst performing CEOs in American’ capitalism.

Why do I bring up all these old blogs of mine? First, to demonstrate that it IS possible to make accurate business predictions. It is straightforward, once the key trends are identified, to see what companies are building out trends, and which are not. Those who ignore trends are doomed to do poorly, and you don’t want to own their stock. If you are running your business looking internally, and thinking about how to squeeze out a few more dimes of cost you are NOT doing the right thing. You must look externally and build on trends to GROW YOUR REVENUE!

2nd, I have long preached that the #1 indicator of companies that are likely to succeed or fail lies in charting revenue growth. If revenues aren’t growing at 8-10%/year, then as an investor or company leader you need to worry. The company isn’t keeping up with inflation and general economic activity. Too few CEOs (and investors) pay enough attention to revenues. They are happy with lackluster sales while paying too much attention to expenses and managing earnings. That is never a winning strategy. If you don’t grow revenues you can’t grow cash.

3rd, you must consistently invest in innovation and new solutions that build on trends. All solutions become obsolete over time. It is imperative to constantly invest in new products, new offerings, that build on trends in order to keep revenues flowing your way. No company can succeed long unless it invests in innovation to keep itself current, and relevant with customers.

Along with Steve Ballmer and Jeffrey Immelt, Virginia Rometty will go down in history as one of the worst CEOs of this era. Like Immelt’s crushing of GE, Rometty led the demise of the once mighty IBM. You can do better. Keep your eyes on trends, focus on revenues and never stop innovating.

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.