by Adam Hartung | Jul 27, 2016 | Food and Drink, Growth Stall, In the Swamp, Leadership, Web/Tech

Growth Stalls are deadly for valuation, and both Mcdonald’s and Apple are in one.

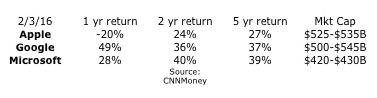

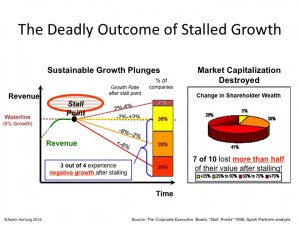

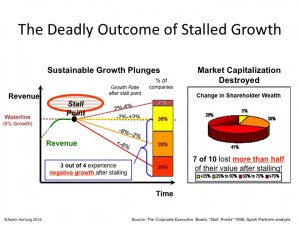

August, 2014 I wrote about McDonald’s Growth Stall. The company had 7 straight months of revenue declines, and leadership was predicting the trend would continue. Using data from several thousand companies across more than 3 decades, companies in a Growth Stall are unable to maintain a mere 2% growth rate 93% of the time. 55% fall into a consistent revenue decline of more than 2%. 20% drop into a negative 6%/year revenue slide. 69% of Growth Stalled companies will lose at least half their market capitalization in just a few years. 95% will lose more than 25% of their market value. So it is a long-term concern when any company hits a Growth Stall.

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also closed 700 stores in 2015, and 500 in 2016. And he announced the company would move its headquarters from suburban Oakbrook to downtown Chicago, IL. While doing something, none of these actions addressed the fundamental problem of customers switching to competitive options that meet modern consumer food trends far better than McDonald’s.

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also closed 700 stores in 2015, and 500 in 2016. And he announced the company would move its headquarters from suburban Oakbrook to downtown Chicago, IL. While doing something, none of these actions addressed the fundamental problem of customers switching to competitive options that meet modern consumer food trends far better than McDonald’s.

McDonald’s stock languished around $94/share from 8/2014 through 8/2015 – but then broke out to $112 in 2 months on investor hopes for a turnaround. At the time I warned investors not to follow the herd, because there was nothing to indicate that trends had changed – and McDonald’s still had not altered its business in any meaningful way to address the new market realities.

Yet, hopes remained high and the stock peaked at $130 in May, 2016. But since then, the lack of incremental revenue growth has become obvious again. Customers are switching from lunch food to breakfast food, and often switching to lower priced items – but these are almost wholly existing customers. Not new, incremental customers. Thus, the company trumpets small gains in revenue per store (recall, the number of stores were cut) but the growth is less than the predicted 2%. The only incremental growth is in China and Russia, 2 markets known for unpredictable leadership. The stock has now fallen back to $120.

Given that the realization is growing as to the McDonald’s inability to fundamentally change its business competitively, the prognosis is not good that a turnaround will really happen. Instead, the common pattern emerges of investors hoping that the Growth Stall was a “blip,” and will be easily reversed. They think the business is fundamentally sound, and a little management “tweaking” will fix everything. Small changes will lead to the classic hockey-stick forecast of higher future growth. So the stock pops up on short-term news, only to fall back when reality sets in that the long-term doesn’t look so good.

Unfortunately, Apple’s Q3 2016 results (reported yesterday) clearly show the company is now in its own Growth Stall. Revenues were down 11% vs. last year (YOY or year-over-year,) and EPS (earnings per share) were down 23% YOY. 2 consecutive quarters of either defines a Growth Stall, and Apple hit both. Further evidence of a Growth Stall exists in iPhone unit sales declining 15% YOY, iPad unit sales off 9% YOY, Mac unit sales down 11% YOY and “other products” revenue down 16% YOY.

This was not unanticipated. Apple started communicating growth concerns in January, causing its stock to tank. And in April, revealing Q2 results, the company not only verified its first down quarter, but predicted Q3 would be soft. From its peak in May, 2015 of $132 to its low in May, 2016 of $90, Apple’s valuation fell a whopping 32%! One could say it met the valuation prediction of a Growth Stall already – and incredibly quickly!

But now analysts are ready to say “the worst is behind it” for Apple investors. They are cheering results that beat expectations, even though they are clearly very poor compared to last year. Analysts are hoping that a new, lower baseline is being set for investors that only look backward 52 weeks, and the stock price will move up on additional company share repurchases, a successful iPhone 7 launch, higher sales in emerging countries like India, and more app revenue as the installed base grows – all leading to a higher P/E (price/earnings) multiple. The stock improved 7% on the latest news.

So far, Apple still has not addressed its big problem. What will be the next product or solution that will replace “core” iPhone and iPad revenues? Increasingly competitors are making smartphones far cheaper that are “good enough,” especially in markets like China. And iPhone/iPad product improvements are no longer as powerful as before, causing new product releases to be less exciting. And products like Apple Watch, Apple Pay, Apple TV and IBeacon are not “moving the needle” on revenues nearly enough. And while experienced companies like HBO, Netflix and Amazon grow their expanding content creation, Apple has said it is growing its original content offerings by buying the exclusive rights to “Carpool Karaoke“ – yet this is very small compared to the revenue growth needs created by slowing “core” products.

Like McDonald’s stock, Apple’s stock is likely to move upward short-term. Investor hopes are hard to kill. Long-term investors will hold their stock, waiting to see if something good emerges. Traders will buy, based upon beating analyst expectations or technical analysis of price movements. Or just belief that the P/E will expand closer to tech industry norms. But long-term, unless the fundamental need for new products that fulfill customer trends – as the iPad, iPhone and iPod did for mobile – it is unclear how Apple’s valuation grows.

by Adam Hartung | Jul 26, 2016 | Leadership, Marketing, Sports

Most leaders think of themselves as decision makers. Many people remember in 2006 when President George Bush, defending Donald Rumsfeld as his Defense Secretary said “I am the Decider. I decide what’s best.” It earned him the nickname “Decider-in-Chief.” Most CEOs echo this sentiment, Most leaders like to define themselves by the decisions they make.

But whether a decision is good, or not, has a lot of interpretations. Often the immediate aftermath of a decision may look great. It might appear as if that decision was obvious. And often decisions make a lot of people happy. As we are entering the most intense part of the U.S. Presidential election, both candidates are eager to tell you what decisions they have made – and what decisions they will make if elected. And most people will look no further than the immediate expected impact of those decisions.

However, the quality of most decisions is not based on the immediate, or obvious, first implications. Rather, the quality of decisions is discovered over time, as we see the consequences – intended an unintended. Because quite often, what looked good at first can turn out to be very, very bad.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law. This change will cost Charlotte about $100M.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law. This change will cost Charlotte about $100M.

That action by the NBA is what’s called unintended consequences. Lawmakers didn’t really consider that the NBA might decide to take its business elsewhere due to this state legislation. It’s what some people call “oops. I didn’t think about that when I made my decision.”

Robert Reich, Secretary of Labor for President Clinton, was a staunch supporter of unions. In his book “Locked in the Cabinet” he tells the story of visiting an auto plant in Oklahoma supporting the union and workers rights. He thought his support would incent the company’s leaders to negotiate more favorably with the union. Instead, the company closed the plant. Laid-off everyone. Oops. The unintended consequences of what he thought was an obvious move of support led to the worst possible outcome for the workers.

President Obama worked the Congress hard to create the Affordable Care Act, or Obamacare, for everyone in America. One intention was to make sure employers covered all their workers, so the law required that if an employer had health care for any workers he had to offer that health care to all employees who work over 30 hours per week. So almost all employers of part time workers suddenly said that none could work more than 30 hours. Those that worked 32 (4 days/week) or 36 suddenly had their hours cut. Now those lower-income people not only had no health care, but less money in their pay envelopes. Oops. Unintended consequence.

President Reagan and his wife launched the “War on Drugs.” How could that be a bad thing? Illegal drugs are dangerous, as is the supply chain. But now, some 30 years later, the Federal Bureau of Prisons reports that almost half (46.3% or over 85,000) inmates are there on drug charges. The USA now spends $51B annually on this drug war, which is about 20% more than is spent on the real war being waged with Afghanistan, Iraq and ISIS. There are now over 1.5M arrests each year, with 83% of those merely for possession. Oops. Unintended consequences. It seemed like such a good idea at the time.

This is why it is so important leaders take their time to make thoughtful decisions, often with the input of many other people. Because the quality of a decision is not measured by how one views it immediately. Rather, the value is decided over time as the opportunity arises to observe the unintended consequences, and their impact. The best decisions are those in which the future consequences are identified, discussed and made part of the planning – so they aren’t unintended and the “decider” isn’t running around saying “oops.”

As you listen to the politicians this cycle, keep in mind what would be the unintended consequences of implementing what they say:

- What would be the social impact, and transfer of wealth, from suddenly forgiving all student loans?

- What would be the consequences on trade, and jobs, of not supporting historical government trade agreements?

- What would be the consequences on national security of not supporting historically allied governments?

- What would be the long-term consequence not allowing visitors based on race, religion or sexual orientation?

- What would be the consequence of not repaying the government’s bonds?

- What would be the long-term impact on economic growth of higher regulations on banks – that already have seen dramatic increases in regulation slowing the recovery?

- What would be the long-term consequences on food production, housing and lifestyles of failing to address global warming?

Business leaders should follow the same practice. Every time a decision is necessary, is the best effort made to obtain all the information you could on the topic? Do you obtain input from your detractors, as well as admirers? Do you think through not only what is popular, but what will happen months into the future? Do you consider the potential reaction by your customers? Employees? Suppliers? Competitors?

There are very few “perfect decisions.” All decisions have consequences. Often, there is a trade-off between the good outcomes, and the bad outcomes. But the key is to know them all, and balance the interests and outcomes. Consider the consequences, good and bad, and plan for them. Only by doing that can you avoid later saying “oops.”

by Adam Hartung | Jul 15, 2016 | Defend & Extend, Entertainment, Games, Innovation, Lock-in, Mobile, Trends

Poke’Mon Go is a new sensation. Just launched on July 6, the app is already the #1 app in the world – and it isn’t even available in most countries. In less than 2 weeks, from a standing start, Nintendo’s new app is more popular than both Facebook and Snapchat. Based on this success, Nintendo’s equity valuation has jumped 90% in this same short time period.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

A bit of history

Nintendo launched the Wii in 2006 and it was a sensation. Gamers could do things not previously possible. Unit sales exceeded 20m units/year for 2006 through 2009. But Sony (PS4) and Microsoft (Xbox) both powered up their game consoles and started taking share from Nintendo. By 2011 Nintendo sale were down to 11.6m units, and in 2012 sales were off another 50%. The Wii console was losing relevance as competitors thrived.

Sony and Microsoft both invested heavily in their competition. Even though both were unprofitable at the business, neither was ready to concede the market. In fall, 2014 Microsoft raised the competitive ante, spending $2.5B to buy the maker of popular game Minecraft. Nintendo was becoming a market afterthought.

Meanwhile, back in 2009 Nintendo had 70% of the handheld gaming market with its 3DS product. But people started carrying the more versatile smartphones that could talk, text, email, execute endless apps and even had a lot of games – like Tetrus. The market for handheld games pretty much disappeared, dealing Nintendo another blow.

Competitor strategic errors

Fortunately, the bitter “fight to the death” war between Sony and Microsoft kept both focused on their historical game console business. Both kept investing in making the consoles more powerful, with more features, supporting more intense, lifelike games. Microsoft went so far as to implement in Windows 10 the capability for games to be played on Xbox and PCs, even though the PC gaming market had not grown in years. These massive investments were intended to defend their installed base of users, and extend the platform to attract new growth to the traditional, nearly 4 decade old market of game consoles that extends all the way back to Atari.

Both companies did little to address the growing market for mobile gaming. The limited power of mobile devices, and the small screens and poor sound systems made mobile seem like a poor platform for “serious gaming.” While game apps did come out, these were seen as extremely limited and poor quality, not at all competitive to the Sony or Microsoft products. Yes, theoretically Windows 10 would make gaming possible on a Microsoft phone. But the company was not putting investment there. Mobile gaming was simply not serious, and not of interest to the two Goliaths slugging it out for market share.

Building on trends makes all the difference

Back in 2014 I recognized that the console gladiator war was not good for either big company, and recommended Microsoft exit the market. Possibly seeing if Nintendo would take the business in order to remove the cash drain and distraction from Microsoft. Fortunately for Nintendo, that did not happen.

Nintendo observed the ongoing growth in mobile gaming. While Candy Crush may have been a game ignored by serious gamers, it nonetheless developed a big market of users who loved the product. Clearly this demonstrated there was an under-served market for mobile gaming. The mobile trend was real, and it’s gaming needs were unmet.

Simultaneously Nintendo recognized the trend to social. People wanted to play games with other people. And, if possible, the game could bring people together. Even people who don’t know each other. Rather than playing with unseen people located anywhere on the globe, in a pre-organized competition, as console games provided, why not combine the social media elements of connecting with those around you to play a game? Make it both mobile, and social. And the basics of Poke’Mon Go were born.

Then, build out the financial model. Don’t charge to play the game. But once people are in the game charge for in-game elements to help them be more successful. Just as Facebook did in its wildly successful social media game Farmville. The more people enjoyed meeting other people through the game, and the more they played, the more they would buy in-app, or in-game, elements. The social media aspect would keep them wanting to stay connected, and the game is the tool for remaining connected. So you use mobile to connect with vastly more people and draw them together, then social to keep them playing – and spending money.

The underserved market is vastly larger than the over-served market

Nintendo recognized that the under-served mobile gaming market is vastly larger than the overserved console market. Those console gamers have ever more powerful machines, but they are in some ways over-served by all that power. Games do so much that many people simply don’t want to take the time to learn the games, or invest in playing them sitting in a home or office. For many people who never became serious gaming hobbyists, the learning and intensity of serious gaming simply left them with little interest.

But almost everyone has a mobile phone. And almost everyone does some form of social media. And almost everyone enjoys a good game. Give them the right game, built on trends, to catch their attention and the number of potential customers is – literally – in the billions. And all they have to do is download the app. No expensive up-front cost, not much learning, and lots of fun. And thus in two weeks you have millions of new users. Some are traditional gamers. But many are people who would never be a serious gamer – they don’t want a new console or new complicated game. People of all ages and backgrounds could become immediate customers.

David can beat Goliath if you use trends

In the Biblical story, smallish David beat the giant Goliath by using a sling. His new technology allowed him to compete from far enough away that Goliath couldn’t reach David. And David’s tool allowed for delivering a fatal blow without ever touching the giant. The trend toward using tools for hunting and fighting allowed the younger, smaller competitor to beat the incumbent giant.

In business trends are just as important. Any competitor can study trends, see what people want, and then expand their thinking to discover a new way to compete. Nintendo lost the console war, and there was little value in spending vast sums to compete with Sony and Microsoft toe-to-toe. Nintendo saw the mobile game market disintegrate as smartphones emerged. It could have become a footnote in history.

But, instead Nintendo’s leaders built on trends to deliver a product that filled an unmet need – a game that was mobile and social. By meeting that need Nintendo has avoided direct competition, and found a way to dramatically grow its revenues. This is a story about how any competitor can succeed, if they learn how to leverage trends to bring out new products for under-served customers, and avoid costly gladiator competition trying to defend and extend past products.

by Adam Hartung | Apr 27, 2016 | Food and Drink, In the Rapids, In the Swamp, Retail, Software, Web/Tech

Growth fixes a multitude of sins. If you grow revenues enough (you don’t even need profits, as Amazon has proven) investors will look past a lot of things. With revenue growth high enough, companies can offer employees free meals and massages. Executives and senior managers can fly around in private jets. Companies can build colossal buildings as testaments to their brand, or pay to have thier names on public buildings. R&D budgets can soar, and product launches can fail. Acquisitions are made with no concerns for price. Bonuses can be huge. All is accepted if revenues grow enough.

Just look at Facebook. Today Facebook announced today that for the quarter ended March, 2016 revenues jumped to $5.4B from $3.5B a year ago. Net income tripled to $1.5B from $500M. And the company is basically making all its revenue – 82% – from 1 product, mobile ads. In the last few years Facebook paid enormous premiums to buy WhatsApp and Instagram – but who cares when revenues grow this fast.

Anticipating good news, Facebook’s stock was up a touch today. But once the news came out, after-hours traders pumped the stock to over $118//share, a new all time high. That’s a price/earnings (p/e) multiple of something like 84. With growth like that Facebook’s leadership can do anything it wants.

But, when revenues slide it can become a veritable poop puddle. As Apple found out.

Rumors had swirled that Apple was going to say sales were down. And the stock had struggled to make gains from lows earlier in 2016. When the company’s CEO announced Tuesday that sales were down 13% versus a year ago the stock cratered after-hours, and opened this morning down 10%. Breaking a streak of 51 straight quarters of revenue growth (since 2003) really sent investors fleeing. From trading around $105/share the last 4 days, Apple closed today at ~$97. $40B of equity value was wiped out in 1 day, and the stock trades at a p/e multiple of 10.

The new iPhone 6se outsold projections, iPads beat expectations. First year Apple Watch sales exceeded first year iPhone sales. Mac sales remain much stronger than any other PC manufacturer. Apple iBeacons and Apple Pay continue their march as major technologies in the IoT (Internet of Things) market. And Apple TV keeps growing. There are about 13M users of Apple’s iMusic. There are 1.5M apps on the iTunes store. And the installed base keeps the iTunes store growing. Share buybacks will grow, and the dividend was increased yet again. But, none of that mattered when people heard sales growth had stopped. Now many investors don’t think Apple’s leadership can do anything right.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Yet, that was just one quarter. Many companies bounce back from a bad quarter. There is no statistical evidence that one bad quarter is predictive of the next. But we do know that if sales decline versus a year ago for 2 consecutive quarters that is a Growth Stall. And companies that hit a Growth Stall rarely (93% of the time) find a consistent growth path ever again. Regardless of the explanations, Growth Stalls are remarkable predictors of companies that are developing a gap between their offerings, and the marketplace.

Which leads us to Chipotle. Chipotle announced that same store sales fell almost 30% in Q1, 2016. That was after a 15% decline in Q4, 2015. And profits turned to losses for the quarter. That is a growth stall. Chipotle shares were $750/share back in early October. Now they are $417 – a drop of over 44%.

Customer illnesses have pointed to a company that grew fast, but apparently didn’t have its act together for safe sourcing of local ingredients, and safe food handling by employees. What seemed like a tactical problem has plagued the company, as more customers became ill in March.

Whether that is all that’s wrong at Chipotle is less clear, however. There is a lot more competition in the fast casual segment than 2 years ago when Chipotle seemed unable to do anything wrong. And although the company stresses healthy food, the calorie count on most portions would add pounds to anyone other than an athlete or construction worker – not exactly in line with current trends toward dieting. What frequently looks like a single problem when a company’s sales dip often turns out to have multiple origins, and regaining growth is nearly always a lot more difficult than leadership expects.

Growth is magical. It allows companies to invest in new products and services, and buoy’s a stock’s value enhancing acquisition ability. It allows for experimentation into new markets, and discovering other growth avenues. But lack of growth is a vital predictor of future performance. Companies without growth find themselves cost cutting and taking actions which often cause valuations to decline.

Right now Facebook is in a wonderful position. Apple has investors rightly concerned. Will next quarter signal a return to growth, or a Growth Stall? And Chipotle has investors heading for the exits, as there is now ample reason to question whether the company will recover its luster of yore.

by Adam Hartung | Mar 13, 2016 | In the Swamp, Leadership, Travel

United Continental Holdings is the most recent public company to come under attack by hedge funds. Last week Altimeter Capital and PAR Capital announced they were using their combined 7.1% ownership of United to propose a slate of 6 new directors to the company’s board. As is common in such hedge fund moves, they expressed strongly their lack of confidence in United’s board, and pointed out multiple years of underperformance.

United’s leadership is certainly in a tough place. The airline consistently ranks near the bottom in customer satisfaction, and on-time performance. It has struggled for years with labor strife, and the mechanics union just rejected their proposed contract – again. The flight attendant’s union has been in mediation for months. And few companies have had more consistently bad public relations, as customers have loudly complained about how they are treated – including one fellow making a music and speaking career out of how he was abused by United personnel for months after they destroyed his guitar.

United’s leadership is certainly in a tough place. The airline consistently ranks near the bottom in customer satisfaction, and on-time performance. It has struggled for years with labor strife, and the mechanics union just rejected their proposed contract – again. The flight attendant’s union has been in mediation for months. And few companies have had more consistently bad public relations, as customers have loudly complained about how they are treated – including one fellow making a music and speaking career out of how he was abused by United personnel for months after they destroyed his guitar.

But is changing the directors going to change the company? Or is it just changing the guest list for an haute couture affair? Should customers, employees, suppliers and investors expect things to really improve, or is this a selection between the devil and the deep blue sea?

Much was made of the fact that one of the proposed new directors is the former CEO of Continental, Gordon Bethune, who was very willing to speak out loudly and negatively regarding United’s current board. But Mr. Bethune is 74 years old. Today most companies have mandatory director retirement somewhere between age 68 and 72. Retired since 2004, is Mr. Bethune really in step with the needs of airline customers today? Does he really have a current understanding of how the best performing airlines keep customers happy while making money?

And, don’t forget, Mr. Bethune hand picked Mr. Jeff Smisek to replace him at Continental. Mr. Smisek was the fellow who took over Mr. Bethune’s board seat in 2004 after being appointed President and COO when Mr. Bethune retired. Smisek became CEO in 2010, and CEO of United Continental after the merger, and led the ongoing deterioration in United’s performance as well as declining employee moral. And then there’s that pesky problem of Mr. Smisek bribing government officials to improve United’s gate situation in Newark, NJ which caused him to be fired by the current board. Is it coincidental that this attack on the Board did not happen for years, but happens now that there is a new CEO – who happens to be recently recovering from a heart replacement?

Although Mr. Bethune has commented that the new board would be one that understands the airline industry, the slate does not reflect this. Mr. Gerstner is head of Altimiter and by all accounts appears to be a finance expert. That was the background Ed Lampert brought to Sears, another big Chicago company, when he took over that board. And that has not worked out too well at all for any constituents – including investors.

One can give great kudos to the hedge funds for proposing a very diverse slate. Half the proposed directors are either female or of color. And, other than Mr. Bethune, the slate is pretty young – with 2 proposed directors under age 50. Congratulations on achieving diversification! But a deeper look can cause us to wonder exactly what these directors bring to the challenges, and what they are likely to want to change at United.

Rodney O’Neal was the former CEO of Delphi Automotive. A lifelong automotive manager and executive, he graduated from the General Motors Institute and spent his career at GM before going to the parts unit GM had created in 1997 as a Vice President. Many may have forgotten that Delphi famously filed for bankruptcy in 2005, and proceeded to close over half its U.S. plants, then close or sell almost all of the other half in 2006. Mr. O’Neal became CEO in 2007, after which the company closed its plants in Spain despite having signed a commitment letter not to do so. He was CEO in 2008 when the company sued its shareholders. And in 2009 when the company sold its core assets to private investors, then dumped assets into the bankrupt GM, cancelled the stock and renamed the old Delphi DPH Holdings. Cutting, selling and reorganizing seem to be his dominant executive experience.

Barney Harford is a young, talented tech executive. He headed Orbitz, where Mr. Gerstner was on the board. Orbitz was originally created as the Travelocity and Expedia killer by the major airlines. Unfortunately, it never did too well and Mr. Harford actually changed the company direction from primarily selling airline tickets to selling hotel rooms.

It is always good to see more women proposed for board positions. However, Ms. Brenda Yester Baty is an executive with Lennar, a very large Florida-based home builder. And Ms. Tina Stark leads Sherpa Foundry which has a 1 page web site saying “Sherpa Foundry builds

bridges between the world’s leading Corporations and the Innovation Economy.” What that means leaves a lot of room for one’s imagination, and precious little specifics. What either of these people have to do with creating a major turnaround in the operations of United is unclear.

There is no doubt that United is ripe for change. Replacing the CEO was clearly a step in the right direction – if a bit late. But one has to wonder if the new directors are there to make some specific change? If so, what kind of change? Despite the rough rhetoric, there has been no proclamation of what the new director slate would actually do differently. No discussion of a change in strategy – or any changes in any operating characteristics. Just vague statements about better governance.

Historically most activists take firm aim at cutting costs. And this is probably why the 2 largest unions have already denounced the new slate, and put their full support behind the existing board of directors. After so many years of ill-will between management and labor at United, one would wonder why these unions would not welcome change. Unless they fear the new board will be mostly focused on cost-cutting, and further attempts at downsizing and pay/benefits reductions.

Investors will most likely get to vote on this decision. Keep existing board members, or throw them out in favor of a new slate? One would like to see United’s reputation, and operations, improve dramatically. But is changing out 6 directors the answer? Or are investors facing a vote that has them selecting between 2 less than optimal options? It would be good if there was less rhetoric, and more focus on actual proposals for change.

by Adam Hartung | Feb 11, 2016 | Current Affairs, In the Whirlpool, Leadership, Lock-in

USAToday alerted investors that when Sears Holdings reports results 2/25/16 they will be horrible. Revenues down another 8.7% vs. last year. Same store sales down 7.1%. To deal with ongoing losses the company plans to close another 50 stores, and sell another $300million of assets. For most investors, employees and suppliers this report could easily be confused with many others the last few years, as the story is always the same. Back in January, 2014 CNBC headlined “Tracking the Slow Death of an Icon” as it listed all the things that went wrong for Sears in 2013 – and they have not changed two years later. The brand is now so tarnished that Sears Holdings is writing down the value of the Sears name by another $200million – reducing intangible value from the $4B at origination in 2004 to under $2B.

This has been quite the fall for Sears. When Chairman Ed Lampert fashioned the deal that had formerly bankrupt Kmart buying Sears in November, 2004 the company was valued at $11billion and 3,500 stores. Today the company is valued at $1.6billion (a decline of over 85%) and according to Reuters has just under 1,700 stores (a decline of 51%.) According to Bloomberg almost no analysts cover SHLD these days, but one who does (Greg Melich at Evercore ISI) says the company is no longer a viable business, and expects bankruptcy. Long-term Sears investors have suffered a horrible loss.

When I started business school in 1980 finance Professor Bill Fruhan introduced me to a concept that had never before occurred to me. Value Destruction. Through case analysis the good professor taught us that leadership could make decisions that increased company valuation. Or, they could make decisions that destroyed shareholder value. As obvious as this seems, at the time I could not imagine CEOs and their teams destroying shareholder value. It seemed anathema to the entire concept of business education. Yet, he quickly made it clear how easily misguided leaders could create really bad outcomes that seriously damaged investors.

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well:

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well:

1 – Micro-management in lieu of strategy. Mr. Lampert has been merciless in his tenacity to manage every detail at Sears. Daily morning phone calls with staff, and ridiculously tight controls that eliminate decision making by anyone other than the top officers. Additionally, every decision by the officers was questioned again and again. Explanations took precedent over action as micro-management ate up management’s time, rather than trying to run a successful company. While store employees and low- to mid-level managers could see competition – both traditional and on-line – eating away at Sears customers and core sales, they were helpless to do anything about it. Instead they were forced to follow orders given by people completely out of touch with retail trends and customer needs. Whatever chance Sears and Kmart had to grow the chain against intense competition it was lost by the Chairman’s need to micro-manage.

2 – Manage-by-the-numbers rather than trends. Mr. Lampert was a finance expert and former analyst turned hedge fund manager and investor. He truly believed that if he had enough numbers, and he studied them long enough, company success would ensue. Unfortunately, trends often are not reflected in “the numbers” until it is far, far too late to react. The trend to stores that were cleaner, and more hip with classier goods goes back before Lampert’s era, but he completely missed the trend that drove up sales at Target, H&M and even Kohl’s because he could not see that trend reflected in category sales or cost ratios. Merchandising – from buying to store layout and shelf positioning – are skills that go beyond numerical analysis but are critical to retail success. Additionally, the trend to on-line shopping goes back 20 years, but the direct impact on store sales was not obvious until customers had long ago converted. By focusing on numbers, rather than trends, Sears was constantly reacting rather than being proactive, and thus constantly retreating, cutting stores and cutting product lines.

3 – Seeking confirmation rather than disagreement. Mr. Lampert had no time for staff who did not see things his way. Mr. Lampert wanted his management team to agree with him – to confirm his Beliefs, Interpretations, Assumptions and Strategies — to believe his BIAS. By seeking managers who would confirm his views, and execute, rather than disagree Mr. Lampert had no one offering alternative data, interpretations, strategies or tactics. And, as Mr. Lampert’s plans kept faltering it led to a revolving door of managers. Leaders came and went in a year or two, blamed for failures that originated at the Chairman’s doorstep. By forcing agreement, rather than disagreement and dialogue, Sears lacked options or alternatives, and the company had no chance of turning around.

4 – Holding assets too long. In 2004 Sears had a LOT of assets. Many that could likely be redeployed at a gain for shareholders. Sears had many owned and leased store locations that were highly valuable with real estate prices climbing from then through 2008. But Mr. Lampert did not spin out that real estate in a REIT, capturing the value for SHLD shareholders while the timing was good. Instead he held those assets as real estate in general plummeted, and as retail real estate fell even further as more revenue shifted to e-commerce. By the time he was ready to sell his REIT much of the value was depleted.

Additionally, Sears had great brands in 2004. DieHard batteries, Craftsman tools, Kenmore appliances and Lands End apparel were just 4 household brands that still had high customer appeal and tremendous value. Mr. Lampert could have sold those brands to another retailer (such as selling DieHard to WalMart, for example) as their house brands, capturing that value. Or he could have mass marketd the brand beyond the Sears store to increase sales and value. Or he could have taken one or more brands on-line as a product leader and “category killer” for ecommerce customers. But he did not act on those options, and as Sears and Kmart stores faded, so did these brands – which largely no longer have any value. Had he sold when value was high there were profits to be made for investors.

5 – Hubris – unfailingly believing in oneself regardless the outcomes. In May, 2012 I wrote that Mr. Lampert was the 2nd worst CEO in America and should fire himself. This was not a comment made in jest. His initial plans had all panned out very badly, and he had no strategy for a turnaround. All results, from all programs implemented during his reign as Chairman had ended badly. Yet, despite these terrible numbers Mr. Lampert refused to recognize he was the wrong person in the wrong job. While it wasn’t clear if anyone could turn around the problems at Sears at such a late date, it was clear Mr. Lampert was not the person to do it. If Mr. Lampert had been as self-analytical as he was critical of others he would have long before replaced himself as the leader at Sears. But hubris would not allow him to do this, he remained blind to his own failings and the terrible outcome of a failed company was pretty much sealed.

From $11B valuation and a $92/share stock price at time of merging KMart and Sears, to a $1.6B valuation and a $15/share stock price. A loss of $9.4B (that’s BILLION DOLLARS). That is amazing value destruction. In a world where employees are fired every day for making mistakes that cost $1,000, $100 or even $10 it is a staggering loss created by Mr. Lampert. At the very least we should learn from his mistakes in order to educate better, value creating leaders.

by Adam Hartung | Feb 9, 2016 | Current Affairs, In the Swamp, Leadership, Web/Tech

Verizon tipped its hand that it would be interested to buy Yahoo back in December. In the last few days this possibility drew more attention as Verizon’s CFO confirmed interest on CNBC, and Bloomberg reported that AOL’s CEO Tim Armstrong is investigating a potential acquisition. There are some very good reasons this deal makes sense:

First, this acquisition has the opportunity to make Verizon distinctive. Think about all those ads you see for mobile phone service. Pretty much alike. All of them trying to say that their service is better than competitors, in a world where customers don’t see any real difference. 3G, 4G – pretty soon it feels like they’ll be talking about 10G – but users mostly don’t care. The service is usually good enough, and all competitors seem the same.

First, this acquisition has the opportunity to make Verizon distinctive. Think about all those ads you see for mobile phone service. Pretty much alike. All of them trying to say that their service is better than competitors, in a world where customers don’t see any real difference. 3G, 4G – pretty soon it feels like they’ll be talking about 10G – but users mostly don’t care. The service is usually good enough, and all competitors seem the same.

So, that leads to the second element they advertise – price. How many different price programs can anyone invent? And how many phone or tablet give-aways. What is clear is that the competition is about price. And that means the product has become generic. And when products are generic, and price is the #1 discussion, it leads to low margins and lousy investor returns.

But a Yahoo acquisition would make Verizon differentiated. Verizon could offer its own unique programming, at a meaningful level, and make it available only on their network. And this could offer price advantages. Like with Go90 streaming, Verizon customers could have free downloads of Verizon content, while having to pay data fees for downloads from other sites like YouTube, Facebook, Vine, Instagram, Amazon Prime, etc. The Verizon customer could have a unique experience, and this could allow Verizon to move away from generic selling and potentially capture higher margins as a differentiated competitor.

Second, Yahoo will never be a lead competitor and has more value as a supporting player. Yahoo has lost its lead in every major competitive market, and it will never catch up. Google is #1 in search, and always will be. Google is #1 in video, with Facebook #2, and Yahoo will never catch either. Ad sales are now dominated by adwords and social media ads – and Yahoo is increasingly an afterthought. Yahoo’s relevance in digital advertising is at risk, and as a weak competitor it could easily disappear.

But, Verizon doesn’t need the #1 player to put together a bundled solution where the #2 is a big improvement from nothing. By integrating Yahoo services and capabilities into its unique platform Verizon could take something that will never be #1 and make it important as part of a new bundle to users and advertisers. As supporting technology and products Yahoo is worth quite a bit more to Verizon than it will ever be as an independent competitor to investors – who likely cannot keep up the investment rates necessary to keep Yahoo alive.

Third, Yahoo is incredibly cheap. For about a year Yahoo investors have put no value on the independent Yahoo. The company’s value has been only its stake in Alibaba. So investors inherently have said they would take nothing for the traditional “core” Yahoo assets.

Additionally, Yahoo investors are stuck trying to capture the Alibaba value currently locked-up in Yahoo. If they try to spin out or sell the stake then a $10-12Billion tax bill likely kicks in. By getting rid of Yahoo’s outdated business what’s left is “YaBaba” as a tracking stock on the NASDAQ for the Chinese Alibaba shares. Or, possibly Alibaba buys the remaining “YaBaba” shares, putting cash into the shareholder pockets — or giving them Alibaba shares which they may prefer. Etiher way, the tax bill is avoided and the Alibaba value is unlocked. And that is worth considerably more than Yahoo’s “core” business.

So it is highly unlikely a deal is made for free. But lacking another likely buyer Verizon is in a good position to buy these assets for a pretty low value. And that gives them the opportunity to turn those assets into something worth quite a lot more without the overhang of huge goodwill charges left over from buying an overpriced asset – as usually happens in tech.

Fourth, Yahoo finally gets rid of an ineffectual Board and leadership team. The company’s Board has been trying to find a successful leader since the day it hired Carol Bartz. A string of CEOs have been unable to define a competitive positioning that works for Yahoo, leading to the current lack of investor enthusiasm.

The current CEO Mayer and her team, after months of accomplishing nothing to improve Yahoo’s competitiveness and growth prospects, is now out of ideas. Management consulting firm McKinsey & Company has been brought in to engineer yet another turnaround effort. Last week we learned there will be more layoffs and business closings as Yahoo again cannot find any growth prospects. This was the turnaround that didn’t, and now additional value destruction is brought on by weak leadership.

Most of the time when leaders fail the company fails. Yahoo is interesting because there is a way to capture value from what is currently a failing situation. Due to dramatic value declines over the last few years, most long-term investors have thrown in the towel. Now the remaining owners are very short-term, oriented on capturing the most they can from the Alibaba holdings. They are happy to be rid of what the company once was. Additionally, there is a possible buyer who is uniquely positioned to actually take those second-tier assets and create value out of them, and has the resources to acquire the assets and make something of them. A real “win/win” is now possible.

by Adam Hartung | Feb 3, 2016 | Current Affairs, Leadership, Lifecycle, Web/Tech

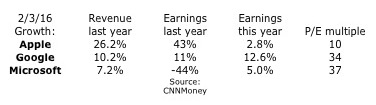

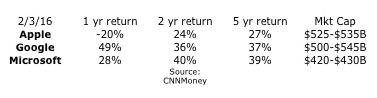

The three highest valued publicly traded companies today (2/3/16) are Google/Alphabet, Apple and Microsoft. All 3 are tech companies, and they compete – although with different business models – in multiple markets. However, investor views as to their futures are wildly different. And that has everything to do with how the leadership teams of these 3 companies have explained their recent results, and described their futures.

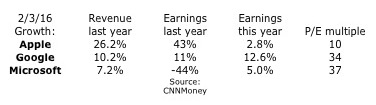

Looking at the financial performance of these companies, it is impossible to understand the price/earnings multiple assigned to each. Apple clearly had better revenue and earnings performance in all but the most recent year. Yet, both Alphabet and Microsoft have price to earnings (P/E) multiples that are 3-4 times that of Apple.

Much was made this week about Alphabet’s valuation exceeding that of Apple’s. But the really big story is the difference in multiples. If Apple had a multiple even half that of Alphabet or Microsoft it’s value would be much, much higher.

But, as we can see, investors did the best over both 2 years and 5 years by investing in Microsoft. And Apple investors have fared the poorest of all 3 companies regardless of time frame. Looking at investment performance, one would think that the revenue and earnings performance of these companies would be the reverse of what’s seen in the first chart.

The missing piece, of course, is future expectations. In this column a few days ago, I pointed out that Apple has done a terrible job explaining its future. In that column I pointed out how Facebook and Amazon both had stratospheric P/E multiples because they were able to keep investors focused on their future growth story, even more than their historical financial performance.

Alphabet stole the show, and at least briefly the #1 valuation spot, from Apple by convincing investors they will see significant, profitable growth. Starting even before earnings announcements the company was making sure investors knew that revenues and profits would be up. But even more they touted the notion that Alphabet has a lot of growth in non-monetized assets. For example, vastly greater ad sales should be expected from YouTube and Google Maps, as well as app sales for Android phones through Google Play. And someday on the short horizon profits will emerge from Fiber transmission revenues, smart home revenues via Nest, and even auto market sales now that the company has logged over 1million driverless miles.

This messaging clearly worked, as Alphabet’s value shot up. Even though 99% of the company’s growth was in “core” products that have been around for a decade! Yes, ad revenue was up 15%, but most of that was actually on the company’s own web sites. And most was driven by further price erosion. The number of paid clicks were up 30%, but price/click was actually down yet another 15% – a negative price trend that has been happening for years. Eventually prices will erode enough that volume will not make up the difference – and what will investors do then? Rely on the “moonshot” projects which still have almost no revenue, and no proven market performance!

But, the best performer has been Microsoft. Investors know that PC sales have been eroding for years, that PC sales will continue eroding as users go mobile, and that PC’s are the core of Microsoft’s revenue. Investors also knows that Microsoft missed the move to mobile, and has practically no market share in the war between Apple’s iOS and Google’s Android. Further, investors have known forever that gaming (xBox,) search and entertainment products have always been a money-loser for Microsoft. Yet, Microsoft investors have done far better than Apple investors, and long-term better than Google investors!

Microsoft has done an absolutely terrific job of constantly trumpeting itself as a company with a huge installed base of users that it can leverage into the future. Even when investors don’t know how that eroding base will be leveraged, Microsoft continually makes the case that the base is there, that Microsoft is the “enterprise” brand and that those users will stay loyal to Microsoft products.

Forget that Windows 8 was a failure, that despite the billions spent on development Win8 never reached even 10% of the installed base and the company is even dropping support for the product. Forget that Windows 10 is a free upgrade (meaning no revenue.) Just believe in that installed base.

Microsoft trumpeted that its Surface tablet sales rose 22% in the last quarter! Yay! Of course there was no mention that in just the last 6 weeks of the quarter Apple’s newly released iPad Pro actually sold more units than all Surface tablets did for the entire quarter! Or that Microsoft’s tablet market share is barely registerable, not even close to a top 5 player, while Apple still maintains 25% share. And investors are so used to the Microsoft failure in mobile phones that the 49% further decline in sales was considered acceptable.

Instead Microsoft kept investors focused on improvements to Windows 10 (that’s the one you can upgrade to for free.) And they made sure investors knew that Office 365 revenue was up 70%, as 20million consumers now use the product. Of course, that is a cumulative 20million – compared to the 75million iPhones Apple sold in just one quarter. And Azure revenue was up 140% – to something that is almost a drop in the bucket that is AWS which is over 10 times the size of all its competitors combined.

To many, this author included, the “growth story” at Microsoft is more than a little implausible. Sales of its core products are declining, and the company has missed the wave to mobile. Developers are writing for iOS first and foremost, because it has the really important installed base for today and tomorrow. And they are working secondarily on Android, because it is in some flavor the rest of the market. Windows 10 is a very, very distant third and largely overlooked. xBox still loses money, and the new businesses are all relatively quite small. Yet, investors in Microsoft have been richly rewarded the last 5 years.

Meanwhile, investors remain fearful of Apple. Too many recall the 1980s when Apple Macs were in a share war with Wintel (Microsoft Windows on Intel processors) PCs. Apple lost that war as business customers traded off the Macs ease of use for the lower purchase cost of Windows-based machines. Will Apple make the same mistake? Will iPad sales keep declining, as they have for 2 years now? Will the market shift to mobile favor lower-priced Android-based products? Will app purchases swing from iTunes to Google Play as people buy lower cost Android-based tablets? Have iPhone sales really peaked, and are they preparing to fall? What’s going to happen with Apple now? Will the huge Apple mobile share be eroded to nothing, causing Apple’s revenues, profits and share price to collapse?

This would be an interesting academic discussion were the stakes not so incredibly high. As I said in the opening paragraph, these are the 3 highest valued public companies in America. Small share price changes have huge impacts on the wealth of individual and institutional investors. It is rather quite important that companies tell their stories as good as possible (which Apple clearly has not, and Microsoft has done extremely well.) And likewise it is crucial that investors do their homework, to understand not only what companies say, but what they don’t say.

by Adam Hartung | Jan 30, 2016 | Current Affairs, In the Rapids, Leadership, Web/Tech

Apple announced earnings for the 4th quarter this week, and the company was creamed. Almost universally industry analysts and stock analysts had nothing good to say about the company’s reports, and forecast. The stock ended the week down about 5%, and down a whopping 27.8% from its 52 week high.

Wow, how could the world’s #1 mobile device company be so hammered? After all, sales and earnings were both up – again! Apple’s brand is still one of the top worldwide brands, and Apple stores are full of customers. It’s PC sales are doing better than the overall market, as are its tablet sales. And it is the big leader in wearable devices with Apple Watch.

Yet, let’s compare the stock price to earnings (P/E) multiple of some well known companies (according to CNN Money 1/29/16 end of day):

- Apple – 10.3

- Used car dealer AutoNation – 10.7

- Food company Archer Daniel Midland (ADM) – 12.2

- Industrial equipment maker Caterpillar Tractor – 12.9

- Farm equipment maker John Deere – 13.3

- Defense equipment maker General Dynamics – 15.1

- Utility American Electric Power – 16.9

- Industrial product company Illinois Tool Works (ITW) – 17.7

- Industrial product company 3M – 19.5

What’s wrong with this picture? It all goes to future expectations. Investors watched Apple’s meteoric rise, and many wonder if it will have a similar, meteoric fall. Remember the rise and fall of Digital Equipment? Wang? Sun Microsystems? Palm? Blackberry (Research in Motion)? Investors don’t like companies where they fear growth has stalled.

What’s wrong with this picture? It all goes to future expectations. Investors watched Apple’s meteoric rise, and many wonder if it will have a similar, meteoric fall. Remember the rise and fall of Digital Equipment? Wang? Sun Microsystems? Palm? Blackberry (Research in Motion)? Investors don’t like companies where they fear growth has stalled.

And Apple’s presentation created growth stall fears. While iPhone sales are enormous (75million units/quarter,) there was little percentage growth in Q4. And CEO Tim Cook actually predicted a sales decline next quarter! iPod sales took off like a rocket years ago, but they have now declined for 6 straight quarters and there was no prediction of a return to higher sales volumes. And as for future products, the company seems only capable of talking about Apple Watch, and so far few people have seen any reason to buy one. Amidst this gloom, Apple presented an unclear story about a future based on services – a market that is at the very least vague, where Apple has no market presence, little experience and no brand position. And wasn’t that IBM’s story some 2.5 decades ago?

In other words, Apple fed investor’s worst fears. That growth had stopped. And usually, like in the examples above, when growth stops – especially in tech companies – it presages a dramatic reversal in sales and profits. Sales have been known to fall far, far faster than management predicts. Although Apple has not yet entered a Growth Stall (which is 2 consecutive quarters of declining sales and/or profits, or 2 consecutive quarters than the previous year’s sales or profits) investors are now worried that one is just around the corner.

Contrast this with Facebook. P/E – 113.3. Facebook said ad revenues rose 57%, and net income was up 2.2x the previous year’s quarter. But what was really important was Facebook’s story about its future:

- Facebook is now a “must buy” for advertisers

- Mobile is the #1 ad trend, and 80% of revenues are from mobile

- Revenue/user is up 33%, and growing

- There are multiple unmonetized new markets that Facebook is just developing – Instagram, WhatsApp, FB Messenger and Oculus

In other words, the past was great – but the future will be even better. The short-term result? FB stock rose 7.4% for the week, and intraday hit a new 52 week high. Facebook might have seemed like a fad 3 years ago, especially to older folks. But now the company’s story is all about market trends, and how Facebook is offering products on those trends that will drive future revenue and profit growth.

Amazon may be an even better example of smart communications. As everyone knows, Amazon makes no profit. So it sells for an astonishing P/E of 846.9. Amazon sales increased 22% in Q4, and Amazon continued gaining share of the fast growing, #1 trend in retail — ecommerce. While WalMart and Macy’s are closing stores, Amazon is expanding and even creating its own logistics system.

Profits were up, but only 2/3 of expectations – ouch! Anticipating higher sales and earnings announcements the stock had run up $40/share. But the earnings miss took all that away and more as the stock crashed about $70/share! A wild 12.5% peak-to-trough swing was capped at end of week down a mere 2.5%.

But, Amazon did a great job, once again, of selling its future. In addition to the good news on retail sales, there was ongoing spectacular growth in cloud services – meaning Amazon Web Services (AWS.) JPMorganChase, Wells Fargo, Raymond James and Benchmark all raised their future price forecasts after the announcement, based on future performance expectations. Even analysts who cut their price targets still kept price targets higher than where Amazon actually ended the week. And almost all analysts expect Amazon one year from now to be worth more than its historical 52 week high, which is 19% higher than current pricing.

So, despite bad earnings news, Amazon continued to sell its growth story. Growth can heal all wounds, if investors continue to believe. We’ll see how it plays out, but for now things appear at least stable.

Steve Jobs was, by most accounts, an excellent showman. But what he did particularly well was tell a great growth story. No matter Apple’s past results, or concerns about the company, when Steve Jobs took the stage his team had crafted a story about Apple’s future growth. It wasn’t about cash flow, cash in the bank, assets in place, market share or historical success – boring, boring. There was an Apple growth story. There was always a reason for investor’s to believe that competitors will falter, markets will turn to Apple, and growth will increase!

Should investors think Apple is without future growth? Unfortunately, the communications team at Apple last week let investors think so. It is impossible to believe this is true, but the communicators this week simply blew it. Because what they said led to nothing but headlines questioning the company’s future.

What should Apple have said?

- Give investors a great news story about wearables. Show applications in health care, retail, etc. that really makes investors think all those people with a Timex or Rolex will wear an AppleWatch in the future. Apple sold investors the future of iPhone apps long before most of people used anything other than maps and weather – and the story led investors to believe if people didn’t have an iPhone they would miss out on something important, so they were bound to go buy one. Where’s that story when it comes to wearables?

- ApplePay is going to change the world. While ApplePay is #1, investors are wondering if mobile payments is ever going to be big. What will make it big, when, and what is Apple doing to make this a multi-billion dollar business? ApplePay launched to a lot of hype, but very little has been said since. Is this going to be the Apple version of Microsoft’s Zune? Make investors believers in ApplePay. Convince them this is worth a lot of future value.

- iBeacons are one of the most important technology products in retail and inventory control. iBeacons were launched as a great tool for local businesses, but since then Apple has said almost nothing. B2B may not be as sexy as consumer markets, but Microsoft made investors believers in the value of enterprise products. Demonstrate that Apple’s technology is the best, and give investors some stories about how companies are winning. Most investors have forgotten about beacons and thus they no longer plan for substantial revenues.

- Apple has the #1 mobile developer community, and the best products are yet to come – so sales are far from stalling. Honestly, the developer war is critical. The platform with the most developers wins the most customers. Microsoft taught investors that. But Apple never talks about its developer community. IBM has made a huge commitment to develop iOS enterprise apps that should drive substantial future sales, but Apple isn’t exciting investors about that opportunity. Tell investors more stories about how Apple is king of the developer world, and will remain in the top spot – better than Android or anyone – for years. Tell investors this will turn users toward tablets from PCs faster, and iPod sales will start growing again as smartphone and wearable sales join suit.

- Apple will win big revenues in auto markets. There was lots of rumors about hiring people to design a car, and now firing the lead guy. What is going on? Google has been pretty clear about its plans, but Apple offers investors no encouragement to think the company will succeed at even winning the war to be in other manufacturer’s cars, much less build its own. Given that the story sounds limited for Apple’s “core” products, investors need some stories about Apple’s own “moonshot” projects.

- Apple is not a 1-pony, iPhone story. Make investors believe it.

Tim Cook and the rest of Apple leadership are obviously competent. But when it comes to storytelling, this week their messaging looked like it was created as a high school communications project. Growth is what matters, and Apple completely missed the target. And investors are moving on to better stories – fast.

by Adam Hartung | Jan 23, 2016 | Current Affairs, Ethics, Food and Drink, Web/Tech

Cheating in sports is now officially prevalent. The World Anti-Doping Agency (WADA) last week issued its report, and confirmed that across the International Association of Athletics Federation (IAAF) athletes were cheating. And very frequently doing so under the supervision of those leading major sports operations at a national, and international level.

Quite simply, those responsible for the future of various sports were responsible for organizing and enabling the illegal doping of athletes. This behavior is now so commonplace that corruption is embedded in the IAAF, making cheating by far the norm rather than the exception.

Wow, we all thought that after Lance Armstrong was found guilty of doping this had all passed. Sounds like, to the contrary, Lance was just the poor guy who got caught. Perhaps he was pilloried because he was an early doping innovator, at a time when few others lacked access. As a result of his very visible take-down for doping, today’s competitors, their coaches and sponsors have become a lot more sophisticated about implementation and cover-ups.

Accusations of steroid use for superior performance have been around a long time. Major league baseball held hearings, and accused several players of doping. The long list of MLB players accused of cheating includes several thought destined for the Hall of Fame including Barry Bonds, Jose Conseco, Roger Clemens, Mark McGwire, Manny Ramirez, Alex Rodriguez, and Sammy Sosa. Even golf has had its doping accusations, with at least one top player, Vijay Sing, locked in a multi-year legal battle due to admitting using deer antler spray to improve his performance.

The reason is, of course, obvious. The stakes are, absolutely, so incredibly high. If you are at the top the rewards are in the hundreds of millions of dollars (or euros.) Due to not only enormously high salaries, but also the incredible sums paid by manufacturers for product endorsements, being at the top of all sports is worth 10 to 100 times as much as being second.

For example – name any other modern golfer besides Tiger Woods. Bet you even know his primary sponsor – Nike. Yet, he didn’t even play much in 2015. Name any other Tour de France rider other than Lance Armstrong. And he made the U.S. Postal Service recognizable as a brand. I travel the world and people ask me, often in their native language or broken English, where I live. When I say “Chicago” the #1 response – by a HUGE margin is “Michael Jordan.” And everyone knows Air Nike.

We know today that some competitors are blessed with enormous genetic gifts. Regardless of what you may have heard about practicing, in reality it is chromosomes that separate the natural athletes from those who are merely extremely good. Practicing does not hurt, but as the good doctor described to Lance Armstrong, if he wanted to be great he had to overcome mother nature. And that’s where drugs come in. Regardless of the sport in which an athlete competes, greatness simply requires very good genes.

If the payoff is so huge why wouldn’t you cheat? If mother nature didn’t give you the perfect genes, why not alter them? It is not hard to imagine anyone realizing that they are very, very, very good – after years of competing from childhood through their early 20s – but not quite as good as the other guy. The lifetime payoff between the other guy and you could be $1Billion. A billion dollars! If someone told you that they could help, and it might take a few years off your life some time in the distant future, would you really hesitate? Would the daily pain of drugs be worse than the pain of constant training?

The real question is, should we call it cheating? If lots and lots of people are doing it, as the WADA report and multiple investigations tell us, is it really cheating?

The real question is, should we call it cheating? If lots and lots of people are doing it, as the WADA report and multiple investigations tell us, is it really cheating?

After all, isn’t this a personal decision? Where should regulators draw the line?

We allow athletes to drink sports drinks. Once there was only Gatorade, and it was only available to Florida athletes. Because they didn’t dehydrate as quickly as other teams these athletes performed better. But obviously sports drinks were considered OK. How many cups of coffee should be allowed? How about taking vitamins?

Exactly who should make these decisions? And why? Why “outlaw” some products, and not others? How do you draw the line?

After watching “The Program” about Lance Armstrong’s doping routine it was clear to me I would never do it, and I would hope those I love would never do it. But I also hope they don’t smoke cigarettes, drink too much liquor or make a porno movie. Yet, those are all personal decisions we allow. And the first two can certainly lead to an early grave. As painful as doping was to biker Armstrong and his team, it was their decision to do it. As bad as it was, why isn’t it their decision? Why is someone put in a position to say it is cheating?

After all, we love winners. When Lance was winning the Tour de France he was very, very popular. Even as allegations swirled around him fans, and sponsors, pretty much ignored them. Even the reporter who chased the story was shunned by his colleagues, and degraded by his publisher, as he systematically built the undeniable case that Armstrong was cheating. Nobody wanted to hear that Lance was cheating – even if he was.

Fans and sponsors really don’t care how athletes win, just that they win. If athletes do something wrong fans pretty much just hope they don’t get caught. Just look at how fans overwhelming supported Armstrong for years. Or how football fans have overwhelming supported Patriots quarterback Tom Brady, and ridiculed the NFL’s commissioner Roger Goodall, over the Deflategate cheating charges and investigation. Fans support a winner, regardless how they win.

So, now we know performance enhancing drugs are endemic in professional sports. Why do we still make them against the rules? If they are common, should we be trying to change behavior, or change the rules?

Go back 150 years in sports and frequently the best were those born to upper middle class families. They had the luck to receive good, healthy food. They had time to actually practice. So when these athletes were able to be paid for their play, we called them professionals. As professionals we would not allow them to compete with the local amateurs. Nor could they compete in international competitions, such as the Olympics.

Jim Thorpe won 2 Olympic gold medals in 1912, received a ticker-tape Broadway parade for his performance and was considered “the greatest athlete of all time.” He was also stripped years later of his medals because it was determined he had been paid to play in a couple of professional baseball games. He was considered a cheater because he had the luxury of practicing, as a professional, while other Olympic athletes did not. Today we consider this preposterous, as professional athletes compete freely in the Olympics. But what really changed? Primarily the rules.

It is impossible to think that we will ever roll back the great rewards given to modern athletes. Too many people love their top athletes, and relish in seeing them earn superstar incomes. Too many people love to buy products these athletes endorse, and too many companies obtain brand advantage with those highly paid endorsements. In other words, the huge prize will never go away.

What is next? Genetic engineering, of course. The good geneticists will continue to figure out how to build stronger bodies, and their results will be out there for athletes to use. Splice a gorilla gene into a wrestler, or a gazelle gene into a long-distance runner. It’s not pure fantasy. This will likely be illegal. But, over time, won’t those gene-altering programs become as common to professional athletes as steroids and human growth hormone are today? Exactly when does anyone think performance enhancement will stop?

And if the drugs keep becoming better, and athletes have such a huge incentive to use them, how are we ever to think a line can be drawn — or ever enforced?

Thus, the effort to stop doping would appear, at best, Quixotic.

Instead, why not simply say that at the professional level, anything goes? No more testing. If you are a pro, you can do whatever you want to win. “It’s your life brother and sister,” the decision is up to you.

If you are an amateur then you will be subjected to intense testing, and you will be caught. Testing will go up dramatically, and you will be caught if you cross any line we draw. And banned from competition for life. If you want to go that extra mile, just go pro.

Of course, one could imagine that there could be 2 pro circuits. One that allows all performance enhancing drugs, and one that does not. But we all know that will fail. Like minor league competition, nobody really cares about the second stringers. Fans want to see real amateurs, often competing locally and reinforcing pride. And they like to see pros — the very best of the very best. And in this latter category, the fans consistently tell us via their support and dollars, they don’t really care how those folks made it to the top.

So a difficult ethical dilemma now confronts sports fans – and those who monitor athletics:

1 – Do we pretend doping doesn’t exist and keep lying about it, but realize what we’re doing is a sham and waste of time?

2 – Do we spend millions of dollars in an upgraded “war on drugs” that is surely going to fail (and who will pay for this increased vigilance, by the way?)

3 – Do we realize that with the incentives that exist today, we need to change the rules on doping? Allow it, educate about its use, but give up trying to stop it. Just like pros now compete in the Olympics, enhancement drugs would no longer be banned.

This one’s above my pay grade. What do you readers think?

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also closed 700 stores in 2015, and 500 in 2016. And he announced the company would move its headquarters from suburban Oakbrook to downtown Chicago, IL. While doing something, none of these actions addressed the fundamental problem of customers switching to competitive options that meet modern consumer food trends far better than McDonald’s.

A new CEO was hired, and he implemented several changes. He implemented all-day breakfast, and multiple new promotions. He also closed 700 stores in 2015, and 500 in 2016. And he announced the company would move its headquarters from suburban Oakbrook to downtown Chicago, IL. While doing something, none of these actions addressed the fundamental problem of customers switching to competitive options that meet modern consumer food trends far better than McDonald’s.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the Governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All Star game scheduled in Charlotte due to discrimination issues caused by this law.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its

United’s leadership is certainly in a tough place. The airline consistently ranks near the bottom in customer satisfaction, and on-time performance. It has struggled for years with labor strife, and the mechanics union just rejected their proposed contract – again. The flight attendant’s union has been in mediation for months. And few companies have had more consistently bad public relations, as customers have loudly complained about how they are treated – including one fellow making a music and speaking career out of how he was abused by United personnel for months after they destroyed his guitar.

United’s leadership is certainly in a tough place. The airline consistently ranks near the bottom in customer satisfaction, and on-time performance. It has struggled for years with labor strife, and the mechanics union just rejected their proposed contract – again. The flight attendant’s union has been in mediation for months. And few companies have had more consistently bad public relations, as customers have loudly complained about how they are treated – including one fellow making a music and speaking career out of how he was abused by United personnel for months after they destroyed his guitar.

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well:

As a case study in bad leadership, Sears under Chairman Lampert offers great lessons in Value Destruction that would serve Professor Fruhan’s teachings well: