by Adam Hartung | Jun 2, 2021 | Economy, Innovation, Scenario Planning, Strategy, Trends

Nomadland art … IS Life

The Academy Award winning movie “Nomadland” portrays a woman whose town is decimated when its largest employer leaves. No jobs means homes go valueless, and people are forced to leave. Not only the economy, but lives are wrecked without money, healthcare and any sense of economic future. What follows is a pretty bleak overview of living in one’s vehicle, hustling for jobs of any kind and building networks of other nomads who give encouragement to each other – but not a lot of help. During the movie, the lead character is offered at least two very solid opportunities to move into a more stable situation (one with her family, and one with the family of another nomad.) Yet, she turns down both. Despite living what the filmmakers portray as a very difficult, lonely and economically bleak situation she chooses to continue the nomad lifestyle.Today’s Gig Workers, or Digital Nomads, are often thought of as bleak, lonely people. No permanent job, no permanent employer, no “corporate” home. The view is often of people who are on the stark edges of the economy, struggling to survive in an uncertain future. And that view would largely be wrong.

The Gig Economy, and its self-employed Digital Nomads, represented HALF the U.S. Workforce before the pandemic hit. The World Economic Forum, Ernst & Young and the U.S. Federal Reserve all said that the emergence of the self-employed Gig Economy Digital Nomad represented the largest single economic shift in several generations. All have said this trend for business is as big as the emergence of mobile and internet technologies. It is characterized as a fundamental change in how people work, and a dramatic change in the outdated Industrial Era “contract” between companies and employees.

Digital Nomads are NOT merely a pandemic artifact.

They are members of an enormous mega-Trend: (1)

- The gig economy is growing so fast its job creation alone can account for all the jobs created in the USA from 2005 through 2016 (corporate hirings/firings were a net no gain)

- In the last 40 years the employer/employee compact has disintegrated, leading fewer people to trust their employers, so they seek alternative cash flow sources

- It is estimated half of gig workers maintained full time jobs – but are actively seeking entrepreneurship. Thus the resulting unwillingness to return to low-pay jobs as the pandemic ends.

- The Gig workforce of Digital Nomads is growing 5x faster than growth in traditional jobs

- 63% of Gig workers say they started not due to economic requirements, but as a choice

- In 2017, 53 million Americans participated in gig work (36% of all employees)

- By 2027, trends project over half of all Americans will be involved in gig work. This pre-pandemic statistic is likely to understate the likely results due to pandemic changes.

- Prior to the pandemic at least 40% of the American work force made at least 40% of their income from Gig Economy work

- Digital Nomads cross all age groups? 44% of Boomers, 59% of GenX, 63% of Millennials

Digital Nomads mostly CHOOSE this work approach. In a fast-paced, quickly shifting world the idea that an employer can “protect” its employees is a façade. With the average corporation lifespans now a mere 8 years, no job and no employee can be protected. Neither pay nor benefits are ever a given in markets where companies acquire, merge, are acquired or fail with such regularity.

Employees Empower Themselves In Gig Work

Employees Empower Themselves In Gig Work

Being a Gig Worker actually fulfills the corporate goal, sought for 35 years, of “empowering employees.” Despite what managers said, organizations operate today in the militaristic style of the last 100 years. Unless you’re the CEO (dictating your own pay and terms) someone is your boss. And your #1 job is to please the boss. Success is less about results, and a lot more about politics, corporate behavior and luck. But as a Digital Nomad you are your own boss. You contract to do something, at a rate, on a timeline and then you deliver. You are empowered to do the work you want, when you want it. To lead the lifestyle you choose, making as much as you desire. Doing your own training, building your own skills, selling your services and reaping the rewards.

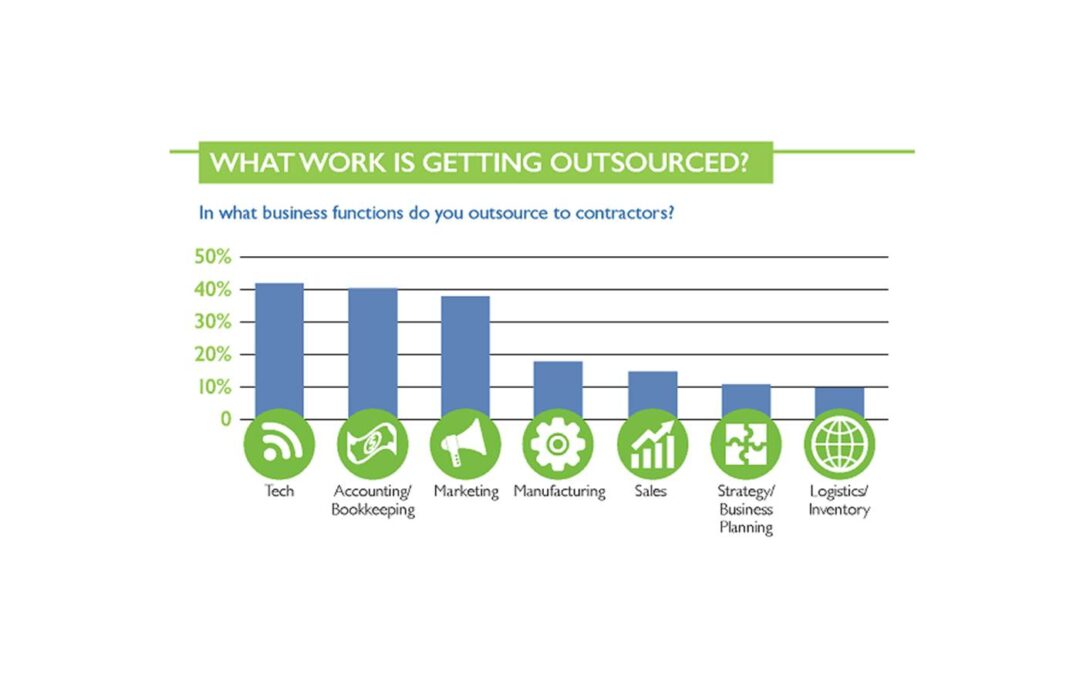

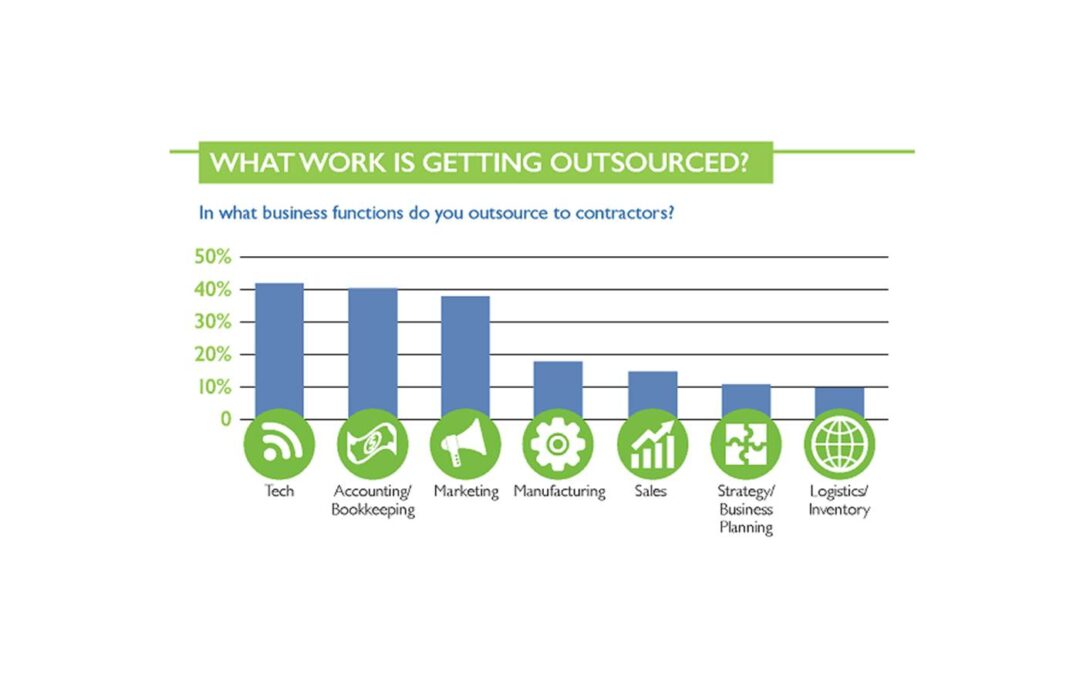

Corporate Nomadland is much, much bigger than the Nomadland of the movie. And it is largely comprised of people who want to work like Digital Nomads. It’s not bleak. Rather, in many ways it is the future of work. Especially for people who provide services — from accounting to marketing to sales to planning, to education, workshops, security, etc. It is a world built on networking, connectivity, individual accountability, and entrepreneurial behavior as it existed prior to the Industrial Era.

For Full image: JDP Employee Screening

Unfortunately, a lot of old-school employers and government officials still don’t understand this mega-Trend. They keep trying to force Digital Nomads into becoming employees, by altering work rules and regulations and promoting old-school style unions. Efforts attempting to force employers to do what they can’t – operate their business like it’s 1966. Business people today must be adaptable to market shifts, changing competition and fast moving customer needs. They can’t afford full-time employees and incumbent overhead costs on roles that simply are not economically suited to their needs. Trying to force this behavior hurts the Digital Nomads even worse than the employers, because they don’t want these changes. That’s why the effort to change laws making Gig Workers employees failed in California. That’s why employees failed to unionize an Amazon facility in Alabama. Even President Biden favors unions, “The policy of our government is to encourage union organizing.” (POTUS tweet 4 Feb 21) Those are not the right answers to today’s problems.

We are living a mega-Trend, accelerated by the pandemic

We now know we can work asynchronously and mobile. We know the results of our work are more important than physically attending meetings, or office politics. We know that we can be more efficient, and capable, when empowered to focus on results and not outdated policies, procedures and processes. And this trend will continue to grow. Despite the CEOs and other leaders that want to force everyone back in offices, in large droves people are choosing not to go.

That’s not to say the government couldn’t be a lot more effective if it accepted this mega-Trend and attempted to assist its citizenry with new approaches. There need to be entirely new approaches for implementing and regulating safety nets – like unemployment, health care and retirement programs. There need to be new regulations for contract negotiations and dispute resolutions between large corporate entities and Gig workers. New approaches for Digital Nomads to network in ways to set output standards, work standards, pricing standards for effectively working with their much bigger customers. There need to be new approaches for bringing on and eliminating transition teams for large projects. Basically, new approaches which support the adaptability and flexibility needed by both employees and Gig Digital Nomads. Digital Nomads are here to stay. Speaking of mega-Trends, have you seen the new AI-controlled, EV camper?

(1) Section reference

(2) Additional references

-MegaTrends by HP “The Future of Work – The Gig Economy”

-World Economic Forum – “The MegaTrend that Will Shape Our Working Future” the Gig Economy

-EY MegaTrends – “The Future of Work” the Gig Economy

-Supermoney – “The Growing Importance of the Gig Economy”

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | May 12, 2021 | Employment, Immigration, Scenario Planning, Strategy, Trends

Demographics is Destiny

Planning is all about the future. And the future is easiest to predict when we look at demographics. Population trends are easy to spot, and long-lived. So the recent U.S. census, which built on previous trends, gives us great insights for planning our investments. Let’s focus here on the two biggest demographic trends.

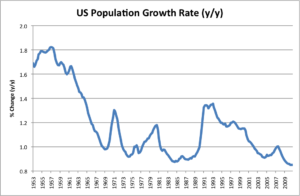

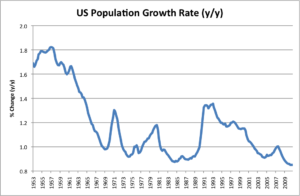

First, the U.S. population growth rate is terrible. Less than 1%/year. Its the 2nd worst decade  since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

In 2018, I wrote about the Japanese demographic “trend bomb.” Low birthrates and anti-immigration meant there were only 2 working people to support each retiree. And the situation was worsening. It’s time America starts considering what it will do if we don’t let immigrants return to spark growth. Growth can hide a multitude of sins, Source: Avondale Asset Management

because it creates demand for more goods and services – thus creating economic growth. People in China and

India aren’t starving any longer, because they’ve grown their economies out of poverty.

As wrote in 2017, it was America’s population growth – driven by immigration – that made 1800s and 1900s America the jewel of the world. Despite horrors at Ellis Island, those boatloads of immigrants created the agricultural and industrial America with its flourishing economy. Like I observed in 2016, unless we re–invigorate growth through immigration, the woes Trumpers complain about will get much, much worse. Soon Pakistan and Indonesia will have more people than the USA! China and India, with their growing populations, growing economies and growing diaspora are making an ever–bigger imprint on the global economy. Meanwhile, America is on its way to stagnant performance like most European countries.

U.S. Population is Mobile, Despite the Pandemic

Second, the trend south and west continues unabated. In 1970, the South and West accounted for less than half the population. Now they account for 62%. The Northeast is losing people rapidly, with 48 of 62 New York counties losing people. And Illinois has seen the problem in spades. Chicago and Illinois are already in a world of hurt due to declining population causing a declining economy causing real estate prices to fall and taxes to rise. (Though the pent-up pandemic housing demand is temporarily increasing housing prices, masking the long term trend.) When population trends down, it becomes a whirlpool of problems – just look at what’s happened in Detroit! You must have the people to build a strong economy.

Looking at both these trends, do you see the unabashed irony? We see no problem with cities and states competing for migrants from other cities and states. Local and state governments lure in companies and people with tax breaks, subsidies and other allowances. We think immigration within our country is good – and recognize losing people from our local area is bad. But at a national level, we still have people who object to immigration. They want the borders closed, and no new entries. We have politicians who want to freeze the economy in place. Yet we know from our past that the only solution to getting our economy to grow REQUIRES immigration. It is the #1 reason the economy was so sluggish coming out of the Great Recession – we cut immigration to unprecedented levels under Obama and continued the decline under Trump. We are unlikely to birth our way to growth, given trends in lifestyles and gender equality. But, we can bring in immigrants who can help the economy grow. We need to get over this hypocrisy and move toward greater immigration as a pro-America policy!

What does this mean for your business?

First – are you sure you want to do business only in the USA? The growth markets are elsewhere. Have you considered selling in China, India, Indonesia, Micronesia, Thailand, South America and Africa? These are growing markets where Chinese businesses (in particular) are making big investments. By going where the population is growing they are able to grow their revenues, and their influence. America isn’t the dominant international player it once was, and there’s never been a better time to look outside America for your next growth market.

Second – Take your business where you see the growth in America. Lots of businesses are going to Texas (and Nevada, Utah, Idaho and Arizona) because lots of people are going there! If you open a restaurant in a town losing people, to succeed you have to entice people to drive to your town and restaurant. You better be really good, and you’ll probably have to make price allowances to have repeat business. But if you have a restaurant in a locality where people are immigrating in large numbers you can do well even if your food is mediocre. Growth hides a multitude of sins!! Your food need not be fantastic, and you can price higher, and you can even have shorter hours because you’re where the people are! It’s simply a lot easier to succeed when you are in a growing marketplace. Are you planning to be someplace because that’s where you started, have family, or went to college? Or are you planning to be someplace where the people, and money, are?

Have you taken into account changes in demographics when making your plans? It is undoubtedly the #1 trend you should use for planning (Fleeing Illinois) . It is highly predictable, and has a lot to do with success. Simply going where the people are will help you succeed. There’s nothing more important to your scenario planning than obtaining a copy of the latest census and studying it really, really hard. It’ll jump start you on the road to greater sales and more success!

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465

by Adam Hartung | Mar 6, 2018 | In the Swamp, Investing, Retail, Scenario Planning

On February 20, 2018 Walmart’s stock had its biggest price drop ever. And the second biggest percentage decline ever. Even though same store sales improved, investors sold off the stock in droves. And after a pretty healthy recent valuation run-up.

What happened? Simply put, Walmart said its on-line sales slowed and its cost of operations rose, slowing growth and cramping margins. In other words, even though it bought Jet.com Walmart is still a long, long way from coming close to matching the customer relationship and growth of Amazon.com. And (surprise, surprise) margins in on-line aren’t an easy thing — as Amazon’s thin margins for 15 years have demonstrated.

In other words, this was completely to be expected. Walmart is a behemoth with no adaptability. For decades the company has been focused on how to operate its warehouses and stores, and beat up its suppliers. Management had to be drug, kicking and screaming, into e-commerce. And failing regularly it finally made an acquisition. But to think that Jet.com was going to change WalMart’s business model into a growing, high profit operation any time soon was foolish. Management still wants people in the store, first and foremost, and really doesn’t understand how to do anything else.

All the way back in 2005, I wrote that Walmart was too big to learn, and was unwilling to create white space teams to really explore growing e-commerce (hence the belated Jet-com acquisition.) In 2007, I wrote that calling Walmart a “mature” competitor with huge advantages was the wrong way to view the company already under attack by all the e-commerce players. In July, 2015 Amazon’s market cap exceeded Walmart’s, showing the importance of retail transformation on investor expectations. By February, 2016 there were 10 telltale signs Walmart was in big trouble by a changing retail market. And by October, 2017 it was clear the Waltons were cashing out of Walmart, questioning why any investor should remain holding the stock.

It really is possible to watch trends and predict future markets. And that can lead to good predictions about the fates of companies. The signs were all there that Walmart shouldn’t be going up in value. Hope had too many investors thinking that Walmart was too big to stumble – or fail. But hope is not how you should invest. Not for your portfolio, and not for your business. Walmart should have dedicated huge sums to e-commerce 15 years ago, now it is playing catch up with Amazon.com, and that’s a race it simply won’t win. Are you making the right investment decisions for your business early enough? Or will you stumble like Walmart?

by Adam Hartung | Jul 26, 2017 | Regulations, Scenario Planning, Trends

Leaders like to be deciders. Most leaders think of themselves as decision makers. In 2006 President George Bush, defending Donald Rumsfeld as his Defense Secretary said “I am the Decider. I decide what’s best.” It earned him the nickname “Decider-in-Chief.” Most CEOs echo this sentiment. Most leaders like to define themselves by their decisions.

But whether a decision is good or not is open to interpretation. Often immediately after a decision things may look great. It might appear as if that decision was obvious. And often decisions quickly make a lot of people happy.

As we enter the most intense part of the U.S. presidential election, both candidates are eager to tell potential voters what decisions they have made – and what decisions they will make if elected. And most people will look no further than the immediate expected impact of those decisions.

AP Photo/Chuck Burton, File

It takes time to determine the quality of any decision.

However, the quality of most decisions is not based on the immediate, or obvious, first implications. Rather, the quality of a decision is discovered over time, as the consequences are revealed – intended and unintended. Because quite often, what looked good at first can turn out to be very, very bad.

The people of North Carolina passed a law to control the use of public bathrooms. Most people of the state thought this was a good idea, including the governor. But some didn’t like the law, and many spoke up. Last week the NBA decided that it would cancel its All-Star game scheduled in Charlotte due to discrimination issues caused by this law. This change will cost Charlotte about $100 million.

That action by the NBA is what’s called

unintended consequences. Lawmakers didn’t really consider that the NBA might decide to take its

business elsewhere due to this state legislation. It’s what some people call, “Oops. I didn’t think about

that when I made my decision.”

Often unintended consequences are more important than first reactions to decisions.

Robert Reich, Secretary of Labor for President Clinton, was a staunch supporter of unions. In his book Locked in the Cabinet, he tells the story of visiting an auto plant in Oklahoma supporting the local union. He thought his support would incent the company’s leaders to negotiate more favorably. Instead, the company closed the plant. Laid-off everyone. Oops. The unintended consequences of what he thought was obvious support led to the worst possible worker outcome.

President Obama worked Congress hard to create the Affordable Care Act, or Obamacare, for everyone in America. One intention was to make sure employers covered all their workers, so the law required that if an employer had health care for any workers he had to offer that health care to all employees who worked over 30 hours per week. So almost all employers of part time workers suddenly said that none could work more than 30 hours. Those that worked 32 (four days per week) or 36 suddenly had their hours cut. Now those lower-income people not only had no health care, but less money in their pay envelopes. Oops. Unintended consequence.

President Reagan and his First Lady launched the “War on Drugs.” How could that be a bad thing? Illegal drugs are dangerous, as is the supply chain. But now, some 30 years later, the Federal Bureau of Prisons reports that almost half (46.3% or over 85,000) of inmates are there on drug charges. The U.S. now spends $51 billion annually on this drug war, which is about 20% more than is spent on the real war being waged with Afghanistan, Iraq and ISIS. There are now over 1.5 million arrests each year, with 83% of those merely for possession. Oops. Unintended consequences. It seemed like such a good idea at the time.

This is why it is so important leaders take their time to make thoughtful decisions, often with the input of many other people. Because the quality of a decision is not measured by how one views it immediately. Rather, the value is decided over time as the opportunity arises to observe the unintended consequences, and their impact. The best decisions are those in which the future consequences are identified, discussed and made part of the planning – so they aren’t unintended and the “decider” isn’t running around saying “oops.”

Think hard about the long-term complications of any decision.

As you listen to the politicians this cycle, keep in mind what could be the unintended consequences of implementing what they say:

- What would be the social impact, and transfer of wealth, from suddenly forgiving all student loans?

- What would be the consequences on trade, and jobs, of not supporting historical government trade agreements?

- What would be the consequences on national security of not supporting historically allied governments?

- What would be the long-term consequence of not allowing visitors based on race, religion or sexual orientation?

- What would be the consequence of not repaying the government’s bonds?

- What would be the long-term impact on economic growth of higher regulations on banks – that already have seen dramatic increases in regulation slowing the recovery?

- What would be the long-term consequences on food production, housing and lifestyles of failing to address global warming?

Business leaders should be very aware of the long-term consequences of their decisions. Every time a decision is necessary, is the best effort made to obtain all the information available on the topic? Are inputs and expectations obtained from detractors, as well as admirers? Is there a balance between not only what is popular, but what will happen months into the future? Did you consider the potential reaction by customers? Employees? Suppliers? Competitors?

There are very few “perfect decisions.” All decisions have consequences. Often, there is a trade-off between the good outcomes, and the bad outcomes. But the key is to know them all, and balance the interests and outcomes. Consider the consequences, good and bad, and plan for them. Only by doing that can you avoid later saying “oops.”

by Adam Hartung | Oct 7, 2016 | Defend & Extend, Scenario Planning

As I write this in 2016, Hurricane Matthew is crashing into Daytona Beach. It is a monster storm, and far from over. But there already is a great lesson we can learn.

Shockingly, after passing nearly half of Florida, including densely populated areas like Miami, Fort Lauderdale and Palm Beach, only one person has died. Even as northeastern Florida awaits Matthew’s fury, damage assessments are underway in south Florida. Even though 600,000 homes are without power, utility companies are already restoring power to over 50,000 homes, and that number is growing. The Florida highway system is open, with all roads passable and people are able to reach safety, while realistically expecting they may soon be able to return to their homes. By all accounts, damage is considerable. Yet, few lives were lost and repair is already underway – long before the storm is ending.

Photo by Drew Angerer/Getty Images

The lesson here is that scenario planning is incredibly valuable. Florida’s leaders have been preparing for this storm for years. The many agencies, federal, state, county and municipal, built their scenarios, and prepared action plans. They talked about “what if” various things happened, and thought through the impacts – and actions they would take.

The result is a remarkable demonstration of capability and leadership. Even as the storm progresses, continuing to put more people in harm’s way, the leaders are simultaneously helping those folks prepare and beginning the recovery for those dealing with Matthew’s aftermath.

Then, there’s Brexit. The British currency has fallen to 30-plus year lows. This morning a “flash crash” happened with the currency falling 10% in minutes. Even though the pound recovered much of that loss, the crash left traders and those who do international business shaken. This was just the latest reaction to the British vote to exit the EU.

JUSTIN TALLIS/AFP/Getty Images

This week people in all parts of the international business community were trying to figure out how to react to Prime Minister May’s speech saying Britain would seek a “hard exit.” This seems to imply a faster, more drastic break from Europe. But as David Buik, market commentator at Panmure Gordon & Co. said, “The media decided very quickly what interpretation to put on the term ‘hard Brexit,’ when most of us are none the wiser as to what Brexit means yet.”

The key word here is “reacting.” It is clear that almost nobody had any plans for undertaking Britain’s departure from the EU, even as the effort to create a vote, and implement a vote, occurred. While there was a lot of talk, nobody in government or business had a plan for what to do if the vote to leave actually passed. Now everyone is reacting, and the consequences are significant fear, uncertainty and doubt (FUD), and wild swings in everything from currency values to equity values and even real estate.

Proper scenario planning separates leaders from wanna-bes, and winners from losers. Those who consider what might happen, and prepare for events, inevitably do far, far better than those who react. Lacking a preparedness plan, based on careful consideration of “what-ifs,” it is impossible to implement good decision-making, because you have no idea what markers, or metrics, to watch – and no idea of what actions to take as those metrics vary.

I observed a scenario-planning meeting where the head of planning was asking questions – “what-if…regulations go in this direction…technology accomplishes this level of performance…customer adoption of a substitute increase.” After a series of these propositions were discussed, the CEO said “This seems to be a waste of time. We don’t know what will happen. What if pigs could fly?” Given a lack of facts about the future, he proposed building a future plan based upon the market as it existed at the time, and reacting to changes only after they occurred.

The planning lead responded, “Whether or not pigs will fly has very little to do with the future performance of our company. And that is why we aren’t discussing flying pigs. These variables in the scenarios could have a major impact on future performance, and if we prepare for them we most likely will improve competitiveness, sales and profits.”

Scenario planning is not a wild exercise of imaginary happenings. Scenario planning uses known trends to identify key variables which can be measured. By looking forward on the trend, it is possible to predict possible outcomes – and prepare.

For example, famously, the leadership of Apple in 2000 looked at the trend toward high-speed internet implementation, including WiFi. They started tracking high-speed implementation, and realized that as bandwidth expanded and improved the desire to work on-line would grow as well. They began preparing products for much greater on-line use (iMac) and products based on widely available, low cost internet access. The result was a shift from near bankruptcy to the most valuable traded equity in America in just one decade.

Planning systems are biased toward using historical data, and do not consider big changes. Leadership must constantly fight the urge to assume the future will look like the past, and invest time building scenario plans. Building the skill to predict the future, using trends to build scenarios and plans, is a hallmark of the most successful companies.

Florida’s leaders could have assumed another big hurricane would not hit their state, and simply waited to react when it happened. By thinking through possible outcomes, they have shown an amazing level of preparedness. In contrast, Britain’s leaders did not think through the impact of a British exit, pushed for a vote prematurely, and now are lurching from point to point, reacting to events, unprepared for any outcome – and trying to create and implement a plan “on the fly.”

How prepared is your company? How often do you discuss future scenarios, and actually plan for them? Or do you plan based on history, hoping the future will look like the past? Are you going to use scenarios to be effective in future markets?

Or are you going to wait for events to unfold, react and hope you don’t drown?

Employees Empower Themselves In Gig Work

Employees Empower Themselves In Gig Work