by Adam Hartung | Aug 17, 2021 | Defend & Extend, Leadership, Politics, Strategy, Trends

Afghanistan’s Fall Was Foreseeable

After 20 years of American occupation, the Taliban retook Afghanistan in a matter of days. Pundits across the news channels are expressing extreme surprise. But they should not be surprised, this speed of change was entirely predictable. The chaos in Afghanistan may seem a world away, but this unfortunate situation can offer 2 significant lessons for business.

Lesson #1 – Failure (change) always happens faster than we expect.

It took 35 years to build the infrastructure for VHS tapes, then DVDs, to become a big market. We had to open a lot of stores, and put a lot of machines in homes. Then that all became pretty much worthless in 18 months when streaming came along. We used travel agents to book air flights and hotels for 40 years, but they practically all disappeared in a year when we could book on-line. We were ardent radio listeners until iTunes and streaming services pushed radio further toward obsolescence in 6 months when the pandemic magnified these trends. Radio consumption in cars came to an abrupt halt when commuting stopped.

Fringe competitors are constantly trying to become mainstream. They never give up. Innovators keep trying new ways to serve our customers. Then, when there’s a shift in technology, regulation or another major market component they leap forward in a huge step overtaking the marketplace. The Taliban never went away. They kept getting better and waited until the USA announced its planned withdrawal. That created the opportunity and in one big step they leapt forward. Business leaders continually believe that markets will shift gradually. Leaders underestimate how well fringe competitors are prepared to move forward, and leaders fail to anticipate how quickly customers will shift buying patterns (like Afghan troops dropping their guns and fleeing.)

It’s not gradual. Change happens fast. If you see a change on the horizon, don’t think it’ll come slowly. Think like the fellow pushed off a 20 story building. At the twelfth story it’s not “so far so good,” but rather “we better prepare for disaster.” When change is going to happen, pack your parachute. Figure out how you’ll keep pushing forward. Or you’ll find a swift, hard landing.

Lesson #2 – You are either growing, or you are dying. There is no “maintenance, status quo.”

Despite two decades fighting in Afghanistan, by no measure was America becoming more popular. America’s image, trade, world standing were not improving in Afghanistan. America was fighting merely to maintain. Watch “Charlie Wilson’s War” and it’s evident America had no plans to “heap any love” on Afghanistan. No schools, agricultural assistance, preservation of mosques or other religious sites, family assistance programs, immigration. America just kept working to preserve the situation after killing Osama bin Laden. The relationship wasn’t growing, improving, becoming something beneficial to both sides. Without growth in the relationship it was deteriorating. Afghans were increasingly weary of occupation, and in a great sense ready for change.

Too often, business leaders think they don’t need to focus on growth. According to recent Gartner research only 56% of chief executives see Growth as the top priority for their firms. They don’t think they need to think about how to launch new solutions, new services, new opportunities to please their customers. They drift into preserving the status quo business, perhaps working on doing things a little faster, a little better, a little cheaper. But as time passes needs change. New needs emerge. Markets don’t stay the same, new competitors challenge old norms – challenge the status quo. The customer relationship deteriorates as new unmet needs aren’t addressed. If we aren’t helping the customer to grow, and thus growing ourselves, the market becomes dull, and ready for a major shift. Poised to be overtaken by something new.

We used to think we could create a market, then erect entry barriers to keep out competitors. Things like scale advantages, control of distribution, control of technology, regulatory limitations became the “moats” that would protect the business. And we thought with those protections we had “competitive advantage” allowing revenues, and profits, to go on infinitely. But that simply isn’t true. Fringe competitors are constantly attacking the “moat.” Things happen in the world creating opportunities for new solutions. A “reinvention gap” emerges as the old business becomes stale and customers are looking for something new. And fringe competitors are waiting for the opportunity to take action – and market share.

The only way you can remain vital is to constantly grow. You have to keep up with economic growth (3%/yr) and overall inflation (3%/year) just to remain even – without any return to shareholders. Add on 3 more points of growth to keep investors and you need to grow 9-10%/year just to sustain. Leaders too often take for granted that customers are happy, their particular market is “low growth” and they focus on the bottom line. Wrong, and deadly. Instead focus on the top line. You have to constantly grow revenues. It’s the only way you can remain vital with your customers, and the only route to success.

This analogy is not to belittle the catastrophic circumstances in Afghanistan. Under the Taliban most people will be denied the things I personally hold dear. It is a human tragedy.

But the story is one told all too often. Focusing on the bottom line, forgetting the need to grow your organization and your relationship with customers. And then thinking that any transition will take some time, providing ample room to react. I see these errors regularly. Think of Sears, ToysRUs, Hostess Baking, Sun Microsystems, Wang, GM/Ford/Chrysler, Motorola….. it’s a very long list of companies that made these two mistakes. As the newscasters harp on how fast Afghanistan fell, remember that this was a failure many years in the making. Lots of defend and extend behavior (military might) by America, far too little innovation and not meeting unmet needs (food, shelter, clean water, education, protection from harm.)

Are you on “cruise control” running your business?

Ask yourself, Are you trying to defend and extend what you’ve always done? Or are you meeting unmet customer needs, helping customers to grow and in turn growing yourself? If you’re the former, get ready for a rude awakening.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jan 16, 2020 | Boards of Directors, Defend & Extend, Leadership, Software, Web/Tech

People who follow my speaking and writing – including my over 400 Forbes columns – know that I preach the importance of growth. Successful organizations are agile – and agility is the sum of learning + adaptability. Smart organizations are constantly looking externally, gathering data, learning about markets and shifts – then structured to adopt those learnings into their business model and adapt the organization to new market needs.

Steve Ballmer was the antithesis of agility. For his entire career he knew only that  Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

Windows and Office made all the money at Microsoft. So he kept investing in Windows and Office. He failed at everything else. False starts in phones, tablets, gaming – products came and went like ice cream cones on a hot August day. Ballmer laughed at the very notion of the iPhone ever being successful – while simultaneously throwing away $7.2B buying Nokia. Then there was $8.5B buying Skype. $400M buying the Borders Nook. Those were ridiculous acquisitions that just wasted shareholder money. To Ballmer, Microsoft’s future relied on maintaining Windows and Office.

So as the market went mobile, Ballmer kept over-investing. He spent billions launching Windows 8, which I predicted was obviously going to fail at growing the Windows market as early as 2012. And it was easy to predict that Win8 tablets were going to be a bust when launched in 2012 as well. But Ballmer was “all-in” on Windows and Office. He was completely locked-in, and unwilling to even consider any data indicating that the PC market was dying – effectively driving Microsoft over a cliff.

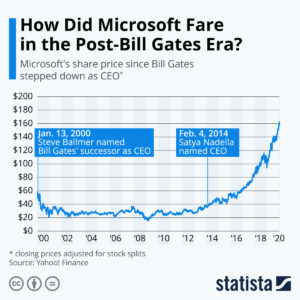

It was not hard to identify Steve Ballmer as the worst CEO in America in 2012. When Ballmer took over Microsoft it was worth $60/share. He drove that value down to $20. And the company valuation was almost unchanged his entire 14 years as CEO. He remained locked-in to trying to Defend & Extend PC sales, and it did Microsoft no good. But when the Board replaced Ballmer with Nadella the company moved quickly into growth in gaming, and especially cloud services. In just 6 years Nadella has improved the company’s value by 400%!!!

Success is NOT about defending the past. Success IS about growth. Don’t be locked in to what worked before. Focus on what markets want and need – learn how to understand these needs – and then adapt to giving customers new solutions. Don’t make the mistakes of Ballmer – be a Nadella to lead your organization into growth opportunities!

by Adam Hartung | Mar 13, 2018 | Defend & Extend, Growth Stall, Innovation, Investing, Software

In February, Berkshire Hathaway revealed it had dumped its IBM position. Good riddance to a stock that has gone down for 5 years while the S&P went up! What did Buffett do with the money? He loaded up on Apple – making that high-flyer Berkshire’s #1 holding. So, isn’t the smart thing now to buy Apple?

First, don’t confuse your investing goals with Berkshire Hathaway’s. It may seem that everyone has the same objective, to buy stocks that go up. But Berkshire is a very special case. As I pointed out in 2014, we mere mortals can’t invest like Buffett, and shouldn’t try. Berkshire Hathaway has the opportunity to make investments in special situations with tremendous return potential that we don’t have. Berkshire’s investment strategy is to invest where it can create cash to prepare for special situations, or to park money where it can make a decent return, and hopefully generate cash while it waits.

Apple is the #1 most cash-rich company on the planet, and with the new tax laws it can repatriate that cash. This is an opportunity for a “special dividend” to investors, and that is the kind of thing that Buffett loves. He isn’t a venture capitalist looking for a 10x price appreciation. He wants a decent 5% rate of return, and hopefully dividends, so he can grow cash for his special situation opportunities. Apple, the most valuable company on any exchange, is exactly the kind of company where he can place a few billion dollars without driving up the price and let it sit making a solid 5-6%, collect dividends and maybe get a few kickers from things like the cash repatriation.

Second, let’s not forget that Buffett’s IBM buying spree lost money. If he was a great tech investor, he never would have bought IBM. He bought it for the same reason he’s buying Apple, only he was wrong about what was going to happen to IBM as it continued to lose relevancy.

I pointed out in May, 2016 that Apple was showing us all a lot of sustaining innovations, with new rev levels of existing products, but almost no new disruptive innovations. The company that once gave us iPods, iTunes, iPhones and iPads was increasingly relying on the next version of everything to drive sales. Lots of incremental improvement. But little discussion about any breakthrough products, like iBeacon, ApplePay or even the Apple Watch. In a real way, Apple was looking a lot more like the old Microsoft with its Windows and Office fascination than the old Apple.

By October, 2016 Apple hit a Growth Stall. While this may have seemed like “no big deal,” recall that only 7% of the time do companies maintain a 2% growth rate after stalling. Is Apple going to be in that 7%? With the launch of the less-than-overwhelming iPhone X, and the actual drop in iPhone sales in Q4, 2017 it looks increasingly like Apple is on the same road as all other stalled companies.

In the short term Apple has said it is milking its installed base. By constantly bringing out new apps it has raised iTunes sales to over $30B/quarter. And it has a dedicated cadre of developers making over $25B/year creating new apps. So Apple is doing its best to get as much revenue out of that installed base of iPhones as it can, even if device sales slow (or decline.) For Buffett, this is no big deal. After all, he’s parking cash and hoping to get dividends. Milking the base is a cash generation strategy he would love – like a railroad, or Coca-Cola.

But if you’re interested in maintaining high returns in your portfolio, be aware of what’s happening. Apple is changing. It’s not going to falter and fail any time soon. But don’t be lulled by Berkshire’s big purchases into thinking Apple in 2018 is anything like it was in 2012 – or through 2014. Instead, keep your eyes on game changers like Netflix, Tesla and Amazon.

by Adam Hartung | Jan 5, 2018 | Defend & Extend, Innovation, Leadership

Fast Company just published 3 common behaviors that kill innovation. Congratulations! The editors reinforce that most management behavior and best practices are lethal to innovation.

All the way back in November, 2009, my Forbes column explained that organizations approach innovation entirely wrong- trying far too hard to build on historical company strengths, which leads to weak extensions that fail to generate sustainable growth. In November, 2011, my Forbes column identified the “killer comments” that leaders used to stop innovation. Fast Company’s list is remarkably similar to that 2011 column, though it is a shorter list. In June, 2015, my Forbes column described how HR best practices are designed to limit diversity in thinking- and always lead to killing innovation projects. Factually, as I wrote in February, 2011, almost nobody would hire the next Steve Jobs if he applied for a job!

Quite simply, we have built organizations that rigidly adhere to continuing past processes, and are hard wired to resist innovation. This phenomenon has been around for a long time, even though Fast Company just discovered it, and I’ve been writing about it for 9 years. Give my past columns a read and you’ll be forewarned of the risks to brainstorming, or throwing together innovation teams, without a system of new thinking.

Fortunately, smart leaders today see that by focusing on external data and cleverly using outside thinkers, innovation can create a high-growth future. The approach I’ve been teaching organizations for years. Only by overcoming outdated, historical management practices can a modern organization thrive. You can do it- if you smartly use trends and new approaches.

by Adam Hartung | Oct 17, 2017 | Defend & Extend, In the Swamp, Investing, Leadership, Retail

The Waltons Are Cashing Out Of Walmart — And You Should Be, Too

Employees restock shelves of school supplies at a Walmart Stores Inc. location in Burbank, CA. Bloomberg

Last week there was a lot of stock market excitement regarding WalMart. After a “favorable” earnings report analysts turned bullish and the stock jumped 4% in one day, WMT’s biggest rally in over a year, making it a big short-term winner. But the leadership signals indicate WalMart is probably not the best place to put your money.

WalMart has limited growth plans

WalMart is growing about 3%/year. But leadership acknowledged it was not growing its traditional business in the USA, and only has plans to open 25 stores in the next year. It hopes to add about 225 internationally, predominantly in Mexico and China, but unfortunately those markets have been tough places for WalMart to grow share and make profits. And the company has been plagued with bribery scandals, particularly in Mexico.

And, while WalMart touts its 40%+ growth rate on-line, margins online (including the free delivery offer) are even lower than in the traditional Wal-Mart stores, causing the company’s gross margin percentage to decline. The $11.5 billion on-line revenue projection for next year is up, but it is 2.5% of Walmart’s total, and a mere 7-8% of Amazon’s retail sales. Amazon remains the clear leader, with 62% of U.S. households having visited the company in the second quarter. And it is not a good sign that WalMart’s greatest on-line growth is in groceries, which amount to 26% of on-line salesalready. WalMart is investing in 1,000 additional at-store curb-side grocery pick-uplocations, but this effort to defend traditional store sales is in the products where margins are clearly the lowest, and possibly nonexistent.

It is not clear that WalMart has a strategy for competing in a shrinking traditional brick-and-mortar market where Costco, Target, Dollar General, et.al. are fighting for every dollar. And it is not clear WalMart can make much difference in Amazon’s giant on-line market lead. Meanwhile, Amazon continues to grow in valuation with very low profits, even as it grows its presence in groceries with the Whole Foods acquisition. In the 17 months from May 10, 2016 through October 10, 2017 WalMart’s market cap grew by $24 billion (10%,) while Amazon’s grew by $174 billion (57%.)

Even after recent gains for WalMart, its market capitalization remains only 53% of its much smaller on-line competitor. This creates a very difficult pricing problem for WalMart if it has to make traditional margins in order to keep analysts, and investors, happy.

Leadership is not investing to compete, but rather cashing out the business

To understand just how bad this growth problem is, investors should take a look at where WalMart has been spending its cash. It has not been investing in growing stores, growing sales per store, nor really even growing the on-line business. From 2007-2016 WalMart spent a whopping $67.3 billion in share buybacks. That is over 20 times what it spent on Jet.com. And it was 45% of total profits during that timeframe. Additionally WalMart paid out $51.2 billion in dividends, which amounted to 34% of profits. Altogether that is $118.5 billion returned to shareholders in the last decade. And a staggering 79% of profits. It shows that WalMart is really not investing in its future, but rather cashing out the company by returning money to shareholders.

So very large investors, who control huge voting blocks, recognize that things are not going well at WalMart. But, because of the enormity of the share buybacks, the Walton family now controls over half of WalMart stock. That makes it tough for an activist to threaten shaking up the company, and lets the Waltons determine the company’s future.

There will be marginal enhancements. But the vast majority of the money is being returned to them, via $20 billion in share repurchases and $1.5 billion in cash dividends annually.

Amazon spends nothing on share repurchases. Nor does it distribute cash to shareholders via dividends. Amazon’s largest shareholder, Jeff Bezos, invests all the company money in new growth opportunities. These nearly cover the retail landscape, and increasingly are in other growth markets like cloud services, software-as-a-service and entertainment. Comparing the owners of these companies, quite clearly Bezos has faith in Amazon’s ability to invest money for profitable future growth. But the Waltons are far less certain about the future success of WalMart, so they are pulling their money off the table, allowing investors to put their money in ventures outside WalMart.

Investing your money, do you think it is better to invest where the owner believes in the future of his company?

Or where the owners are cashing out?

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Sep 7, 2017 | Defend & Extend, Leadership

Months ago Trian’s Nelson Peltz began buying Procter & Gamble (P&G) shares. He invested about $3.5 billion, making Trian’s ownership 1.5%. Since then he has been lobbying, unsuccessfully, for a seat on P&G’s board of directors. He has said that although P&G already has 10 outside directors on its 11 member board, adding him would make a tremendous difference increasing P&G’s market valuation. P&G is now the largest company ever to engage in a proxy battle between the existing board and an outside investor.

P&G is dead set against adding Peltz, saying he would disrupt the board, and the company, in negative ways. CNBC.com reported Peltz’ claims the company is spending $100 million on the proxy fight to keep him off the board. P&G’s proxy statement puts that sum at $35 million. Either number indicates P&G is spending a lot of money to stop the appointment of Peltz.

Nelson Peltz, Founder Trian Partners, LLC

The company defended itself, saying leadership has been growing EPS (earnings per share,) making productivity improvements, growing sales organically at 2%/year and returning huge value to shareholders. They accuse Peltz of simply planning a split of the company into 3 parts so each can go public on its own – adding little value to shareholders while damaging the company’s ability to operate.

Unfortunately, P&G’s leadership has pretty much set itself up for this battle. And shareholders may have good reason to add Peltz to the board in hopes of additional change.

P&G’s financial performance has been poor

Firstly, in the last 10 years the value of P&G has risen about 44%. But the S&P 500 has grown by 154.5%. Shareholders would have done better owning the average than owning P&G. Claims about how well P&G have done since the CEO arrived 2 years ago overlook the fact that just prior to his arrival, in November, 2014 P&G shares traded at $90-$93.85/share, which is just about where they are now. So all that’s happened is a recovery to where things were previously, not a great success. Shareholders have a right to be frustrated.

EPS has risen, but that has everything to do with share buybacks rather than earnings growth. EPS has risen about 11%. But since 2nd quarter of 2007 P&G has spent ~$61billion on share repurchases, reducing the number of shares from 3.32 billion to 2.74 billion, or 17.5%. Rather than growing earnings, leadership has been making the capital structure smaller – and thus EPS has risen while earnings have not. This is actually a program that goes all the way back to 1995, which indicates a long-term approach of focusing on EPS, which are manipulated, rather than earnings.

P&G has favored divestitures and share repurchases over innovation and acquisitions for growth

Meanwhile, P&G’s buyback program has been financed by a dramatic divestiture program, selling off very large businesses to raise cash. Over the last decade major sales included:

2009 – selling the P&G pharma business

2012 – selling the water filtration business including Pur

2012 – selling Pringles (along with several other iconic brands)

2014 – selling the dog food business

2016 – selling the Duracell battery business

2016 – selling the beauty brand business

Management tried in its response to say that innovation was just fine at P&G. But what it cited were line extensions like Tide PODs, GAIN Flings, Pampers Pants, and Oral B power toothbrush. None of these are great new innovations launching significant sales. None are new product platforms for high growth. Rather they are typical sustaining innovations applied to brands that are long in the tooth.

This is typical of the long-term lack of valuable innovation at P&G. Do you recall in 2009 when the company lauded its development of the “P&G Public Toilet Database App?” Not exactly on the top 20 iTunes list. Or do you remember in 2014 when P&G launched its “Basic” line of products, where it literally sold a less-good quality product hoping to attract a brand-conscious but quality uncaring targeted niche? Peltz is making a good point, that leadership at P&G really has forgotten what good, long-term profit producing innovation is, while succumbing to the strategy of selling major business units (reducing revenue) then using the money to buy back shares rather than investing in future growth.

P&G has not shown it understands how trends are quickly changing its business

Meanwhile, the consumer goods industry is changing dramatically, and it is not clear that P&G’s leadership is really preparing for future changes. P&G still relies heavily on television advertising to sell its products. But that approach had stopped generating profitable growth as far back as 2010. Back then Colgate was holding its market share, and growing revenues, on all its brands that compete with P&G while spending 25% less, and often much less, on advertising.

P&G is still stuck using marketing strategies that have been outdated for almost a decade. Comcast lost 90,000 subscribers in Q2, and the stock lost 7% today when Comcast management alerted investors it expects to lose 150,000 more in Q3. And while viewership is declining, ad pricing is going up, making TV advertising a less effective and more expensive marketing tactic for consumer goods. As P&G brands have fallen further behind competitors in Instagram followers, and lack good social media programs like Wendy’s, Peltz has proposed a substantial increase in digitally savvy marketers.

Simultaneously, distribution is changing dramatically. Once P&G could rely on its product dominance to dictate space usage in grocery stores and discounters. But the rise of e-commerce has dramatically affected these historical distribution channels. Today the fastest growing grocer is Aldi, which eschews brands like P&G’s in favor of its own private label. And after stunting the growth of discounters like WalMart, the leading e-commerce company, Amazon.com, has now purchased Whole Foods. This is leading everyone to expect greater growth in on-line grocery shopping and additional at-home delivery, which undercuts the former strength P&G had in traditional brick-and-mortar stores with warehouse delivery models.

Management bragged of its $3 billion in e-commerce sales, but that is a drop in the bucket. Is P&G ready to compete for sales in future markets where social media is more important than advertising? Where mobile ads have more power than print, TV, radio and traditional internet banners? Where social media groups drive more consumption behavior than company-sponsored social media pages with coupons and use recommendations? Will P&G dominate product volume when it has to rely on Amazon.com and other sites to sell and deliver its products? If people move to daily home deliveries, and less stock-up purchasing what will happen to P&G’s former brand advantage via high numbers of SKUs (stock keeping units) and large packaging options?

This will be an interesting proxy battle. There is no doubt Peltz wants to shake up the board’s behavior, compensation plans, hiring programs, targets and many of the ways management runs the company. Simultaneously, the P&G board believes it is moving in the right direction. Large shareholders are conservative, and don’t like to create problems (P&G’s largest shareholders are Vanguard, Blackrock, State Street, BofA, Capital World, Trian, Northern Trust – which combined control 24% of P&G stock.)

But this isn’t about a complete change in the board. It’s just a vote to add one additional member who is not happy with things the way they are. Will these large shareholders see a need for someone to shake things up, or will they accept current leadership’s claims that things are on the right track?

It will be interesting to watch, because Peltz isn’t without some objective concerns about P&G’s future, given its performance the last decade and the amount of change facing the industry.

by Adam Hartung | Jun 12, 2017 | Defend & Extend, Innovation, Leadership

GE Chairman and CEO Jeff Immelt walks off stage after being interviewed during the Washington Ideas Forum at the Harmon Center for the Arts September 28, 2016 in Washington, DC. A proud Republican, Immelt said it would hurt the United States and cripple President Barack Obama — and the next president of the U.S. — not to agree to trade deals like theTrans Pacific Partnership (Photo by Chip Somodevilla/Getty Images)

Readers of this column know I’m not a fan of General Electric’s CEO, Jeffrey Immelt. In May, 2012 I listed CEO Immelt as the 4th worst CEO of a large publicly traded American company. Unfortunately, his continued tenure since then did nothing to help make GE a stronger, or more valuable company. GE’s lead director says this is the culmination of a transition plan first developed in 2011. One can only wonder why it took the board so incredibly long to replace the feckless CEO, and why they allowed GE’s leadership to continue destroying shareholder value.

The longer back you look, the worse Immelt’s performance appears.

Few company analysts can say they’ve followed a company for 3 years. Fewer yet can say 5 years. Nearly none can say a decade. Yet, CEO Immelt was in his job for 16 years – much longer than almost all business analysts or writers have followed GE. Therefore, their lack of long-term memory often leaves them unable to give a proper overview of the company’s fortunes under the long-lived CEO.

I have followed GE closely for almost 35 years. Ever since I graduated from HBS class of 1982 along with Mr. Immelt. Several fellow alumni worked at GE, and a large number of my BCG (Boston Consulting Group) colleagues joined GE in senior positions during the mid-1980s as GE grew exponentially. I have followed several of these alumni as the years passed allowing me to take the “long view” on GE’s performance, during Welch’s leadership and more recently since Mr. Immelt took the top job.

I was very pleased to include a positive case study of GE’s business practices in my book “Create Marketplace Distruption – How to Stay Ahead of the Competition” (Financial Times Press, 2007.) CEO Welch used a number of internal processes to help GE leaders identify disruptive opportunities to change industries – whether markets where GE already competed or new markets. He relentlessly encouraged entering new businesses where GE could bring something new to the game, and he put GE’s money to good use growing revenues, and market cap, enormously. No other CEO in American history made as much value for shareholders as Jack Welch. His leadership pushed GE to the top position in most industries, and his relentless focus on growth helped even rank-and-file employees build million dollar IRAs to go with well funded pension and retiree benefit plans.

GE’s performance could not have changed more dramatically than it has under Mr. Immelt. But there are now a number of apologists who would say GE’s smaller size, and lower valuation, are due to market conditions which were out of Mr. Immelt’s control. They contend CEO Immelt was a good steward of the company during difficult market conditions, and the results of his tenure – notably lower revenues, lower valuation, fewer markets, fewer employees and lower community involvement – are not his fault. They argue he did a good job, all things considered.

Balderdash. Immelt was a terrible CEO

There is an overall reluctance to say bad things about any huge American icon, and its CEO. After all, columnists and analysts who are non-congratulatory don’t usually get called by the company to be consultants, or advisors. Or to be on the board. And publishers of columnists who say negative things about big companies and their execs risk having ad dollars moved to more favorable journals, and often unfriendly relationships with their ad departments and agencies. So it is far easier, and more acceptable, to sugar coat bad strategy, bad leadership and bad results.

But we should move beyond that bias. Mr. Immelt was the CEO of the ONLY company on the Dow Jones Industrial Average (DJIA) to have been on that list since it was created. He inherited the most successful company at creating shareholder value during the 1980s and 1990s. He surely should be held to the highest of comparative bars.

Those who say CEO Immelt was “set up to fail” are somehow making the case that Immelt would have been more successful if he had inherited a company with a bad brand image, weak history, and inadequate performance. They are rewriting history to say Jack Welch was not a good CEO, and his outsized gains destined GE to do poorly under his successor. That simply defies the facts – and logic.

Looking at the last 16 years of “difficult times,” when GE has struggled under Immelt’s leadership, one should ask “why did so many other companies do so well?” After all, the DJIA has more than doubled. The S&P 500 has almost doubled. The Russell 2000 has almost tripled. Overall, far more companies have gone up in value than down. Why were Immelt’s circumstances so difficult that all of those CEOs did so much better? They dealt with the same financial meltdown, same Great Recession, same increase in regulations, same federal reserve, same government administration – yet they were able to adapt their companies, grow and increase value.

Yes, GE was huge in financial services when Immelt took the reigns, and financial services saw a major crash. But look at the performance of JPMorganChase under CEO Jamie Dimon (also a classmate of Mr. Immelt.) JPM is stronger today than ever, growing and gaining market share and increasing its value to shareholders. Prior to the crash, in spring 2007, GE was trading at $41/share, and now it is $29 – a decline of ~30%. Back then JPM was trading at $53, and now it is $93 – a gain of ~75%. There obviously was a strategy to adapt to market conditions and do well. Just not at GE.

Immelt reacted to market events, poorly, rather than having a prepared, proactive strategy

Let’s not rewrite history. Prior to the banking crash CEO Immelt was more than happy for GE to be in the “easy money” world of finance. Welch had created GE Capital, and Immelt had furthered its growth when lending was easy and profitable. And he supported the enormous growth in GE’s real estate division. When this industry faced the crash, GE faced a near-bankruptcy not because of Welch, but because of Immelt’s leadership during the over 6 years he had been CEO. If there were risks in the system CEO Immelt had ample time to re-arrange the portfolio, reduce lending, offload financial assets and reduce exposure to real estate and mortgages. But Immelt did not do those things. He did not prepare for a reversal in the markets, and he did not prepare the balance sheet for a significant change of events. It was his leadership that left GE exposed.

As GE shares fell to $7 Immelt made a famous deal with Berkshire Hathaway’s CEO Warren Buffet to increase GE’s capital base in order to stave off demise. And this deal saved GE. But this was an extremely sweet deal for Buffett, giving Berkshire very good interest (10%) on the preferred shares and warrants allowing Buffett to buy future shares of GE at a fixed price. Berkshire made a profit, over and above the interest, of $260M on the deal, and overall at least $1.2B. By being prepared Buffett saved GE and made a lot of money. GE’s investors paid the price for a CEO that was unprepared.

But the changes brought about by the crash, and Dodd-Frank, were more than CEO Immelt could manage. Thus GE exited the business selling many assets at fire sale prices. This “turn tale and run” strategy was sold to the public as a way for GE to “focus” on its “core manufacturing business.” Rather, it was a failure of leadership to understand how to manage this business to future success in changed markets. Where Welch’s GE had grasped for disruption as opportunity, Immelt’s GE gasped at disruption and fled, destroying billions in GE value.

Immelt could not grow GE’s businesses, so he divested GE of many.

GE was to be the “industrial internet giant.” GE was to be a leader in the internet-of-things (IoT) where sensors, the cloud and remote devices created greater productivity. And, to be sure, companies like Apple, Google and Samsung have made huge gains in this market. Even small companies, like Nest, were able to jump on this technology shift with new products for the residential market. But name one market where GE is the dominant IoT player. During 16 years the internet and remote services markets have exploded, yet GE is not the market leader. Rather it is barely recognized.

Rather than growing GE with disruptive innovations and visionary products in emerging technology markets, Immelt’s GE was primarily shrinking via divestitures. In dismantling GE Capital he eliminated the lending and real estate operations. After decades as a leader in appliances, that division was sold. Welch built the extremely successful entertainment division around NBC/Universal, which Immelt sold.

The water business that was to be a world leader under Immelt’s vision, likewise sold – and largely to make sure GE could close the deal on selling its oil & gas unit. Even the famed electrical distribution business, going back to the start of GE, is now close to being sold.

And what happened to all this money? Well, about $50B went into share buybacks – which ostensibly would help shareholders. Only it didn’t, because GE is still worth less than when buybacks started. So the money just disappeared. At least Immelt could have paid it to shareholders as a dividend – but then that would not have boosted his bonuses.

GE’s website says Mr. Immelt wanted to create a “simpler, more valuable industrial company.” Mr. Immelt is definitely leaving behind a simpler, much smaller and weaker company. The brand is gone from consumer products, and severely tarnished in commercial products. GE lacks a great product pipeline, and even a strong development pipeline due to the rampant divestitures. When Mr. Flannery takes over as CEO he will not inherit a powerhouse company. He will inherit a company that is shrinking and rudderless, and disconnected from most growth markets with almost no product, technology or brand advantages. And he will report to the Chairman that created this mess, Mr. Immelt.

The most likely outcome is that Mr. Peltz and his firm, Trian Partners, will buy more GE shares and seek directorships on the board. Then, in a move not unlike the deaths of DuPont and Dow, there will be a massive cost cutting effort to bring expenses in-line with the shrunken GE business. R&D will be discontinued, as will product development. Support groups will be shredded. Customer service will be downsized. Then the remaining pieces will be sold off to buyers, or taken public, leaving GE a dismantled piece of history.

While that may work for the capital markets, and some short-term investors will share in the higher valuation, what about the people? People who dedicated their careers to GE, and are pensioners or current employees? What about cities and counties where GE has been a major employer, and civic contributor? What about customers that bought GE industrial products, only to see those products dropped due to low profitability, or little growth opportunity? What about suppliers that invested in developing new technologies or products for GE to take to market? What will happen to the people who once relied on GE as America’s largest diversified industrial company?

These people all have an ax to grind with the very wealthy, and now departing, CEO Immelt. He inherited what may well have been the most successful company on earth. He leaves behind a far weaker company that may not survive.

by Adam Hartung | Mar 10, 2017 | Books, Defend & Extend, Employment, Leadership

Harvard Business Review Press just published an insightful new book by two senior partners at Bain & Company, one of the world’s three leading strategy consulting firms, entitled Time Talent Energy. The book’s great insight is that companies utilize a plethora of tools to manage money and financials to the nth degree, but that approach is less successful than putting a greater focus on managing employee time, talent and energy.

Harvard Business Review Press

Harvard Business Review Press

Time Talent Energy jacket cover

While managing financials is required in the modern organization, it is insufficient for success. Mankins and Garton discovered that organizations which focus more heavily on managing how employees spend their time and how they thoughtfully place people in their roles, create companies where employees are inspired and 40% more productive than their competition. And this pays off, with profit margins which are 30-50% higher than their industry average. The improvement is so great from focusing on employees that in today’s low cost and easily accessible capital world it is better to waste some cash in the process of better managing time and talent.

In most companies 25% of all productive time is wasted and can reach as high as 40% in complex organizations. Think of all the emails, texts, voice mails and meetings that absorb vast amounts of time. Yet, as the authors are fond of pointing out, nobody can create a 25 hour day. So if you can recapture that time, productivity will soar. The results are far greater than squeezing another 1% (or even 10%) out of your cost structure. If instead of spending so much time managing costs we spent more time eliminating complexity and unneeded tasks, competitiveness will soar.

Some people think that the best companies hire better people. Surprisingly, this is not true. About 15-16% of employees in every company are “A” players. But most companies squander this talent by spreading it around the organization. To achieve higher productivity and greater success, leading companies cluster their “A” players into teams focused on the most critical, important parts of the business. Thus, the best talent is working side-by-side on the most important challenges which can lead to the greatest gains. This talent clustering energizes the best workers, increasing productivity by 44%. But more than that, as the culture is inspired from building on its own gains productivity soars as much as 125%.

But in most organizations the focus still remains on finance. The CFO is frequently the second most powerful individual, behind only the CEO. The head of Human Resources (Chief Human Resources Officer — CHRO) rarely has the clout of a CFO. And the CFO job is seen as the route to CEO — far more CFOs than CHROs become CEOs. Simultaneously, organizations spend exorbitantly on financial control tools, such as ERP (Enterprise Resource Planning) from companies like Oracle and SAP — while very few have any kind of tool set for effectively managing employee time or talent deployment. The authors conclude it is apparent business leaders have significantly overshot on managing financial resources, while allowing their organization to be woefully incapable of managing its human resources.

I had the opportunity to interview Michael Mankins to obtain some additional insight about managing time, talent and energy:

Adam Hartung: Do businesses need to lessen the CFO role, and heighten the CHRO role?

Michael Mankins: The reality is that most human resource decisions, those that determine how people spend their time, and how talent is deployed, are made by line managers. Made within the bowels of the organization, with little more than senior leadership guidelines. There needs to be significantly more involvement by senior leadership in collecting and reviewing data on critical skills for the organization, “A” player performance and leadership development. If as much time was spent by senior leadership teams discussing human resources as spent on budgets there would be a tremendous improvement in productivity.

The CFO and CHRO should definitely be peers. To do that requires a cultural change from being an organization focused on preserving the status quo, reducing mistakes and keeping leadership out of jail to one that is far more future oriented. This can be done and in the book we highlight companies such as ABInBev, Ford, Nordstrom, Starbucks, IKEA, Netflix and others who have accomplished this.

Hartung: Companies spent enormous sums installing ERP systems and they spend a lot to maintain them. Yet, from reading your book it seems like this may have been misguided.

Mankins: All companies need to be able to change their business model as markets shift. ERP frequently creates a wiring that makes it hard to change with the competitive landscape, or as changes in capability are required. ERP locks in the business model at a point in time — but great performers develop ways to adapt.

All companies need a great general ledger. ERP goes far beyond the general ledger and in doing so can make a company too inflexible for today’s rate of change. There needs to be a flexible ERP system —which just doesn’t seem to exist right now. The ERP market seems ripe for a marketplace disrupter!

Simultaneously there aren’t any great tools out there for collecting data that can help a company reduce complexity and eliminate time wasters. Nor are there great tools for managing the performance of “A” players. The top performing companies do create a discipline around these tasks, collecting and analyzing data. Many companies would be helped by a tool that would do for time and talent management what we’ve done for financial management.

Hartung: You demonstrate that clustering “A” players creates dramatic improvement in productivity and company performance. Do great companies focus these clusters on improving the company as it is, or looking for the next “big thing?”

Mankins: We discovered that by and large the greatest gains come from focusing on the latter. Almost all MBA programs are maniacal about training managers to improve the existing business. For many years corporate planning systems have focused almost entirely on improving the operating model. The result is that in many, many industries leadership has almost no hope of improving operating margins by even 1%. There simply is nothing left to improve which can achieve significant results.

Simultaneously, 1% growth has a far, far greater return on investment than 1% operating margin improvement. So if companies focus their best talent on breakthroughs, in whole new ways of running the business, or creating new markets, the results are significantly greater.

Hartung: Many companies have clustered their top performers into “all star teams.” But this has been met by demotivation of employees not on these teams – feeling like “also rans” or “bench warmers.” And often there is a compensation difference between the all-star team members and others that is demotivating. How do leaders manage this conundrum?

Mankins: If this demotivation is driven by internal competitiveness — by ambition to move up the organization — there is a culture problem. Everyone is not on the same page about company needs and the talent to address those needs. Internal competitiveness should be addressed so everyone wants the company to succeed, so everyone individually can succeed. Rewards, compensation and non-compensation, need to be geared for groups to be motivated, not just individuals.

In the organization, leadership should work hard to make sure everyone knows they are important. There should be an effort to reward the “supporting cast” and not just the main characters. It is true that in today’s world many people have an exaggerated view of their own performance. We address this in the book with recommendations for how to give people feedback so they know the reality of their role and their performance in order to grow and do better. Today most companies have a very poorly performing review and training process, because they tie it to the compensation cycle thus limiting feedback to once per year and, unfortunately, doing feedback at the same time (often the same meeting) as compensation and bonus decisions. Addressing the performance feedback process can go a long way to avoid the demotivation problem.

Hartung: How do companies find “A” players?

Mankins: Search firms are the antithesis of finding “A” players. Their approach, their process, is not designed to deliver “A” candidates. To build a good group of “A” players requires the CEO, CHRO and senior leadership team understand what constitutes an “A” player in their organization. Then they can use the entire organization to seek out people with this behavioral signature in order to recruit them.

It is unfortunate that most company HR processes would not recognize an “A” player if one submitted a resume and would not hire one if they arrived for an interview. Most current processes focus too much on relationships (who candidates know,) narrow skills and prior specific experiences and not enough on what is needed for future success. And hiring decisions are often made by the wrong people; people too low in the organization and people who don’t know the desired behavioral signature. Google is one role model for knowing how to find and develop “A” players.

Unfortunately there is enormous ageism in hiring today. Especially in technology. Employers lack awareness of the value of generalizable experience they can bring into their company. The search for very specific experiences often leads to a very limited list of candidates with narrow experience and too often they do not perform at the “A” level when placed in the context of the new company and new competitive market requirements. Looking more broadly at candidates with great experience, even if not seemingly directly applicable (including candidates in their 50s and 60s) could lead to far greater success.

by Adam Hartung | Dec 17, 2016 | Defend & Extend, Investing, Retail, Trends

Sears recently announced it is closing another big batch of stores. Yawn. Who cares? Sears losses since 2010 are nearly $10 billion, with a $.75 billion loss in just the third quarter. As revenue fell another 13% overall and comparable store sales declined 7.4% investors have fled the stock for years.

Five years ago Sears had 3,510 stores. Now it has 1,687. It has 750 with leases expiring in the next five years and CFO Jason Hollar has said 550 of those are short-term enough they will let those close.

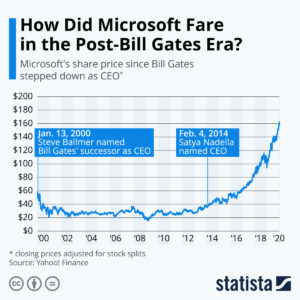

What’s striking about this statement is that Sears is a perfect candidate to file bankruptcy, renegotiate those leases, and start with a new plan for the future. Unless it has no plan. Lacking a plan to make its business successful and return those stores to profitability, the CFO is admitting the company has no choice but to keep shrinking assets as Sears simply disappears. Investors should view Sears as a microcosm of trends in traditional brick-and-mortar retailing across the industry. The business is shrinking. Fast

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

Just look at retail employment. Amidst another strong jobs report for November, retail employment actually shrank. This previously only happened in recessions – and 2016 is definitely not a recession year. And all the losses were in traditional store retailing. Kohl’s said it is hiring almost 13% fewer seasonal workers, and Macy’s says it is hiring 2.4% fewer.

Of course, Amazon seasonal hiring is up 20%.

In January, 2015 I wrote how the trend to e-commerce had taken hold, and traditional retailing would never again be the same. For the 2014 holiday season online retail grew 17%, but brick-and-mortar sales actually declined. This was a pivotal event. It clearly indicated a sea change in the marketplace, and it was clear valuations would be shifting accordingly. Surprising many, but not those who really understood the trends and market shifts, six months later (July, 2015) Amazon’s market cap exceeded that of much larger Wal-Mart.

ALL trends (including mobile use) reinforce on-line growth, brick and mortar decline.

The 2016 holiday season is further reinforcing this trend. The National Retail Federation reported that on black Friday 99 million people went to stores. 108.5million shopped online. Black Friday online sales jumped 21.6%.

And this . E-commerce apps are making the on-line experience constantly better. On Thanksgiving day 70% of all on-line retail traffic was mobile, and for the first time ever 53% of on-line orders were from mobile devices – exceeding the orders placed on PCs. With this kind of access, and easy shopping, the need to travel to physical stores accelerates their decline.

Sears is beyond rescue. Unfortunately, there are a number of retailers already so challenged by the on-line competition that they are “the walking dead.” They will falter, and fail, just like the former Dow Jones Industrial retailing giant. They will not make the shift to on-line effectively. They are unwilling to dramatically change their business model, unwilling to cannibalize store sales to create an aggressively competitive on-line business. Expect bad things at JCPenney, Kohl’s, Pier 1 – and weakness at giants Wal-Mart and even Target.

Christmas used to be the time when investors in traditional retail cheered. Results for the quarter could create great gains in stock values. But that time is long gone – passed during the 2014 inflection when traditional started declining while e-commerce continued double digit growth. One can understand the Scrooge-like mentality of those investors, who dread seeing the shift in customers, and valuation, away from their companies and toward the Amazon’s who embrace trends and market shifts.

by Adam Hartung | Oct 7, 2016 | Defend & Extend, Scenario Planning

As I write this in 2016, Hurricane Matthew is crashing into Daytona Beach. It is a monster storm, and far from over. But there already is a great lesson we can learn.

Shockingly, after passing nearly half of Florida, including densely populated areas like Miami, Fort Lauderdale and Palm Beach, only one person has died. Even as northeastern Florida awaits Matthew’s fury, damage assessments are underway in south Florida. Even though 600,000 homes are without power, utility companies are already restoring power to over 50,000 homes, and that number is growing. The Florida highway system is open, with all roads passable and people are able to reach safety, while realistically expecting they may soon be able to return to their homes. By all accounts, damage is considerable. Yet, few lives were lost and repair is already underway – long before the storm is ending.

Photo by Drew Angerer/Getty Images

The lesson here is that scenario planning is incredibly valuable. Florida’s leaders have been preparing for this storm for years. The many agencies, federal, state, county and municipal, built their scenarios, and prepared action plans. They talked about “what if” various things happened, and thought through the impacts – and actions they would take.

The result is a remarkable demonstration of capability and leadership. Even as the storm progresses, continuing to put more people in harm’s way, the leaders are simultaneously helping those folks prepare and beginning the recovery for those dealing with Matthew’s aftermath.

Then, there’s Brexit. The British currency has fallen to 30-plus year lows. This morning a “flash crash” happened with the currency falling 10% in minutes. Even though the pound recovered much of that loss, the crash left traders and those who do international business shaken. This was just the latest reaction to the British vote to exit the EU.

JUSTIN TALLIS/AFP/Getty Images

This week people in all parts of the international business community were trying to figure out how to react to Prime Minister May’s speech saying Britain would seek a “hard exit.” This seems to imply a faster, more drastic break from Europe. But as David Buik, market commentator at Panmure Gordon & Co. said, “The media decided very quickly what interpretation to put on the term ‘hard Brexit,’ when most of us are none the wiser as to what Brexit means yet.”

The key word here is “reacting.” It is clear that almost nobody had any plans for undertaking Britain’s departure from the EU, even as the effort to create a vote, and implement a vote, occurred. While there was a lot of talk, nobody in government or business had a plan for what to do if the vote to leave actually passed. Now everyone is reacting, and the consequences are significant fear, uncertainty and doubt (FUD), and wild swings in everything from currency values to equity values and even real estate.

Proper scenario planning separates leaders from wanna-bes, and winners from losers. Those who consider what might happen, and prepare for events, inevitably do far, far better than those who react. Lacking a preparedness plan, based on careful consideration of “what-ifs,” it is impossible to implement good decision-making, because you have no idea what markers, or metrics, to watch – and no idea of what actions to take as those metrics vary.

I observed a scenario-planning meeting where the head of planning was asking questions – “what-if…regulations go in this direction…technology accomplishes this level of performance…customer adoption of a substitute increase.” After a series of these propositions were discussed, the CEO said “This seems to be a waste of time. We don’t know what will happen. What if pigs could fly?” Given a lack of facts about the future, he proposed building a future plan based upon the market as it existed at the time, and reacting to changes only after they occurred.

The planning lead responded, “Whether or not pigs will fly has very little to do with the future performance of our company. And that is why we aren’t discussing flying pigs. These variables in the scenarios could have a major impact on future performance, and if we prepare for them we most likely will improve competitiveness, sales and profits.”

Scenario planning is not a wild exercise of imaginary happenings. Scenario planning uses known trends to identify key variables which can be measured. By looking forward on the trend, it is possible to predict possible outcomes – and prepare.

For example, famously, the leadership of Apple in 2000 looked at the trend toward high-speed internet implementation, including WiFi. They started tracking high-speed implementation, and realized that as bandwidth expanded and improved the desire to work on-line would grow as well. They began preparing products for much greater on-line use (iMac) and products based on widely available, low cost internet access. The result was a shift from near bankruptcy to the most valuable traded equity in America in just one decade.

Planning systems are biased toward using historical data, and do not consider big changes. Leadership must constantly fight the urge to assume the future will look like the past, and invest time building scenario plans. Building the skill to predict the future, using trends to build scenarios and plans, is a hallmark of the most successful companies.

Florida’s leaders could have assumed another big hurricane would not hit their state, and simply waited to react when it happened. By thinking through possible outcomes, they have shown an amazing level of preparedness. In contrast, Britain’s leaders did not think through the impact of a British exit, pushed for a vote prematurely, and now are lurching from point to point, reacting to events, unprepared for any outcome – and trying to create and implement a plan “on the fly.”

How prepared is your company? How often do you discuss future scenarios, and actually plan for them? Or do you plan based on history, hoping the future will look like the past? Are you going to use scenarios to be effective in future markets?

Or are you going to wait for events to unfold, react and hope you don’t drown?

Harvard Business Review Press

Harvard Business Review Press

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)

A closed retail store is viewed in Manhattan. (Photo by Spencer Platt/Getty Images)