by Adam Hartung | Jul 30, 2020 | In the Whirlpool, Innovation, Leadership, Marketing, Strategy, Trends

Yesterday (7/28/20), President Trump surprised a LOT of people announcing that via the Defense Production Act (DPA) the US government is going to give Kodak $765 million to make pharmaceuticals. The tie to current COVID-19 pandemic issues, for which the Act was invoked, is at best tenuous. Somehow the announcement seems to be more about moving pharma production back to the USA. Which is why it left me, and a lot of others, asking “why would you pick Kodak?”

Everyone knows the Kodak story. Great innovator, makes the Brownie and creates an entirely new market called “amateur photography.” From an era when almost nobody had a picture of themselves, Kodak made pictures commonplace. And the company was a wild success. The US Department of Defense asked Kodak to help them develop a way to send photos digitally from satellites to earth, and after spending a lot of taxpayer money Kodak invents digital photography. A very happy DOD allowed Kodak to keep the civilian rights to digital photography. Locked into the profits from film sales, Kodak never develops the products or market and licensed away the technology. Which doomed Kodak to the world of business history books as one of the classic business screw-ups of all time, riding film sales to death and missing the next big market wave.

Over the last 20 years there’s been nothing new to excite anyone about Kodak. They tried launching a blockchain technology-based business for photographers to manage picture rights. Way too late and poorly conceived, and lacking any demand, that went nowhere. Lacking any new ideas leadership grabbed the lightest “shiny new thing” and launched Kodak’s own cryptocurrency “KodakCoin.” Missed it? So did everyone else. In a word, Kodak was going nowhere.

I always recommend watching trends, and then pivoting your strategy to be on trend. So why didn’t the blockchain and cryptocurrency “pivots” work? Simply, Kodak brought nothing to the marketplace. They didn’t identify an un-met or under-met need and try to fill it with a better solution. Kotak just tried to jump into some shiny technology and throw it onto the marketplace hoping someone would think they needed it. They didn’t. So those pivots failed.

Big companies can pivot. IBM pivoted from a mainframe hardware company into a software and services company. And that worked because IBM understood customers had un-met and under-met needs for enterprise applications and Software-As-A-Service (SAAS) use. IBM moved from making expensive, over-developed hardware to meeting a very real customer need, and the pivot revitalized a nearly obsolete company.

Even before IBM, Singer was once a manufacturer of sewing machines. As the 1960s ended home sewing was in a tailspin, and commercial sewing was all going to Asia. Singer had nothing new to offer, while it’s primary competition (Brother) was innovating gobs of new features to make sewing better, faster, easier and cheaper. So Singer sold (all its products, manufacturing, brand name, etc) to Brother. Leadership studied the marketplace and identified a very big, growing and under-met need for defense electronics suppliers. Leadership carefully acquired leading companies with new technologies in forward looking infrared, heads up displays and others to build a leading-edge defense contractor. Note, they first identified an under-met need. Second, (via acquisition) they brought to market a lot of product innovation to improve customer performance in ways not previously utilized. The pivot was built on under-met needs and innovation.

So what is the plan for Kodak? Kodak knows nothing about pharmaceuticals, and their understanding of “chemistry” (to the extent it still exists) has NO application in pharma. (Ever heard of a joint venture called DuPont/Merck designed to apply DuPont chemistry expertise to pharma? I didn’t think so. It didn’t survive.) The plan is to build a company to make the most generic “pharmaceutical ingredients.” Not blockbuster pharmaceuticals. Literally, the very most generic ingredients. Not better ingredients. Not cheaper ingredients. Just make what already exists – and almost assuredly at a higher cost.

These Kodak ingredients are not innovative. Making them is not innovative. The reason “big pharma” doesn’t make these is because they are GENERIC products of low value, and production has moved to China and India where costs are lower. There is no innovation in these products. And Kodak has NO PLAN to add any innovation. None. Not in products, not in manufacturing process, not in markets served or customer service. Nope. Kodak plans to take 3 to 4 YEARS (any idea how fast markets move these days) to develop a plant to make a generic product that is sold on the basis of cost.

The only way this works, at all, is if the government forces, by regulation, U.S. pharma companies to buy from Kodak (in 3 to 4 years when they supposedly can make the stuff.) Otherwise, why pay the higher price? Today, American politicians constantly decry the high U.S. drug prices. So we are to expect that $765 million of taxpayer money will be spent on a plant, to make a generic compound, readily available in the world today, at a higher price, that will then be forced into American pharma products making them EVEN MORE EXPENSIVE! This is exactly how America ended up with the Bath Iron Works to make Navy ships which are the MOST expensive in the world – and thus wholly non-competitive in commercial ship production.

Does this not sound …… problematic? If we need U.S. based manufacturing for these products every single pharma company in the USA could open a plant faster, manufacturing at lower cost than Kodak, and with no quality or other regulatory concerns. There literally is no need for Kodak to become a supplier in this supply chain. And – absolutely no reason the U.S. taxpayer should be expected to teach Kodak how to “pivot” into becoming a new company. If the White House wants to use the D.P.A. to make more generic pharma compounds then it can push [insert any pharma company name you like here] to do it like they pushed G.M. to make ventilators!

Net/net – this is a pivot, and Kodak desperately needs to pivot. But this will not be a successful pivot. Because it is not targeting an unmet or under-met need. It is not utilizing innovation to create a better solution for meeting customer needs. This is making a generic product, that is readily available, at a higher cost than it is available today. Who wants this?

I’m sure Kodak shareholders are happy. Today. But this is a train wreck. Don’t expect this plant to ever make it to fruition, as the pharma companies will unwind this deal long before Kodak makes anything. And if we’re lucky, taxpayers will get some of their money back. But who knows, because this is a really stupid idea.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam@sparkpartners.com

by Adam Hartung | Jul 22, 2020 | Disruptions, Innovation, Leadership, Marketing, Trends

As the pandemic dropped on the USA with full force mid-April the price of oil dropped to less than $0. OK, it was something of a fluke. Demand dropped so fast that supply couldn’t fall fast enough, so oil was flowing into refineries and tanks and pipelines so fast that nobody knew where to put it – and that resulted in suppliers having to pay someone to take their oil.

But… the point was very real. Oil prices depend on demand – every bit as much as supply. Even though for a generation we’ve taken growing oil demand for granted, and focused on how to create additional supply, it is a fact that NOW declining demand will limit the value of oil and gas (which is, after all, a commodity.) The TREND has changed course, with demand in the USA barely, or not, growing – and globally demand growth primarily all in Asia (mostly China.) Overall, supply growth has beaten demand growth by a wide margin, and prices are not only low now – they will likely go lower. Even oil company CEOs are predicting US production will decline – but to lower demand

In 2015, I predicted that Tesla could put a big hurt on Exxon. Most people thought that was a joke. Tesla was a fraction the size of GM, and “small potatoes” in the car industry. Meanwhile Exxon was one of the world’s largest oil producers and refiners. That really would be a very small David smacking a very big Goliath – and with a very small rock. But what I pointed out in 2015 was that traditional analysts predicted a very gradual growth in electric cars, and a continued growth in petroleum powered cars, and pretty much constant growth in oil & gas consumption with economic growth. In other words,analysts were using old assumptions all around and expecting only a tiny impact from a few weirdos buying electric cars.

But I asked, what if those assumptions were wrong? In 2015, the world was awash in oil, inventories were then at record levels, and electric car sales were taking off. And the truth was, a lot was happening to reduce demand for oil. Renewable energy programs, conservation, and a change in economic activity from basic manufacturing and commodity processing to a knowledge economy. These trends were all putting big dampers on oil demand. And electric auto sales were poised for a big boom. I predicted demand for oil would drop substantially, inventories would skyrocket and industry problems would worsen as prices cratered.

Uh-hum – what was the price of oil in April?

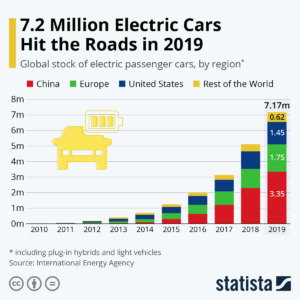

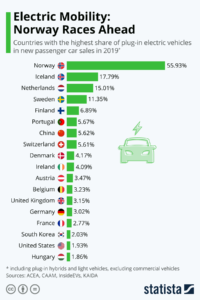

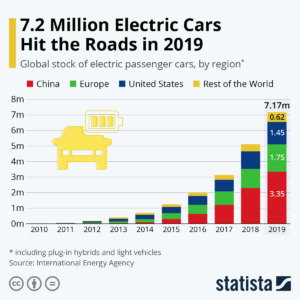

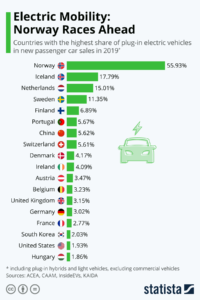

In 2009, I made the case that electric cars were a small base, but that geometric demand growth would make them an important economic impact . Today, most Americans still think that’s the case. In 2009 less than 100,000 new cars were electric. But by 2015, over 1 million electric cars had been sold. Then, with the help of game changers like the Tesla Model 3 in 2019 sales exceeded 7 million! A 7-fold increase in 5 years, or nearly 50%/year market growth!!

Americans aren’t aware of this phenomenon largely because the big growth centers are outside the USA. Where electrics are ~2% of US car sales, in some European countries they are well over 10% of the market. Even in China they represent over 5% of sales!

Remember what I said above about demand growth depending on China? Look again at who’s buying the most electric cars.

Lessons:

1 – Never think your product is beyond attack by market forces. Be paranoid.

2 – Very small, fringe competition can sneak up and steal your market faster than you think.

3 – Fringe changers don’t have to take a huge market share to make a BIG impact on your market and pricing.

4 – Disruptive events favor the upstarts, who are on trend, and hurt big incumbents, who depend on “business as usual.”

5 – Don’t expect markets to “return to normal.” Markets always move forward, with trends.

6 – Don’t plan from the past, plan for the future – and pay attention to disruptions, they can break you.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Jul 14, 2020 | Disruptions, Innovation, Leadership, Marketing, real estate, Retail, Trends

TRENDS: Covid-19 has accelerated a lot of trends. Few more than retail. Oddly some people have taken the view that Covid-19 changed retail. Actually, it didn’t. The pandemic has merely accelerated trends that have been driving industry change for almost two decades.

Back in 2004, Eddie Lampert bought all the bonds of defunct Kmart and used those assets to do a merger with Sears – creating Sears Holdings that encompassed both brands. The day of announcement Chicago Tribune asked for my opinion, and famously I predicted the merger would be a disaster. Clearly both Kmart and Sears were far, far off trends in retail, both were already struggling – and neither had a clue about emerging e-commerce.

Why in 2004 would I predict Sears would fail? The #1 trend in retail was e-commerce, which was all about individualized customer experience, problem solving for customer needs — and only, finally fulfillment. By increasing “scale” – primarily owning a lot more real estate – this new organization would NOT be more competitive. Walmart was already falling behind the growth curve, and everyone in retail was ignoring the elephant in the room – Amazon.com. Loading up on a lot more real estate, more inventory, more employees, more supplier relationships and more community commitments – old ideas about how to succeed related to fulfillment – would hurt more than help. Retail was an industry in transition. All of these factors were boat anchors on future success, which relied on aggressively moving to greater internet use.

Unfortunately, Eddie Lampert as CEO was like most CEOs. He thought success would come from doing more of what worked in the past. Be better, faster, cheaper at what you used to do. In 2011 Sears asked its HQ town (Hoffman Estates) and the state (Illinois) for tax subsidies to keep the HQ there. Sears had built what was once the world’s once tallest building, named the Sears Tower. But many years earlier Sears left, the building was renamed, and Sears was becoming a ghost of itself. I pleaded with government officials to “let Sears go” since the money would be wasted. And it was clear by 2016, that Lampert and his team’s bias toward old retail approaches had only served to hurt Sears more and guarantee its failure. Now – in 2020 – Hoffman Estates has taken the embarrassing act of removing the Sears name from the town’s arena, admitting Sears is washed up.

****

It was with a multi-year observation of trends that I told people in 2/2017 that retail real estate values would crumble . Now mall vacancies are at an 8 year high and 50% of mall department stores will permanently close within a year. We are “over-stored” and nothing will change the fast decline in retail real estate values. Who knows what will happen to all this empty space?

Trends led me in March 2017 to advise investors they should own NO traditional retail equities. Shortly after Sears filed bankruptcy Radio Shack and storied ToysRUs followed. And with the pandemic acting as gasoline fueling change, we’ve now seen the bankruptcies of Neiman Marcus, JCPenney, J Crew, Forever 21, GNC and Chuck e Cheese (but, really, weren’t you a bit surprised the last one was still even in business?) After 3 years of pre-Covid store closings, Industry pundits are finally predicting “record numbers of store closings”. And, after 15 years of predictions, I’m being asked by radio hosts to explain the impact of widespread failures of both local and national retailers ( ). Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

Ignominious ends are abounding in retail. But – it was all very predictable. The trends were obvious years ago. If you were smart, you moved early to avoid asset traps as valuations declined. You also moved early to get on the bandwagon of trend leaders – like Amazon.com – so you too could succeed.

As we move forward, what will happen to your business? Will you build on trends to create a new future where growth abounds? Will you align your strategy with the future so you “skate to where the puck will be?” Or will you – like Sears and so many others – find an ignominious end to your organization? Will the signs change, or will the signs come down? The trends have never been stronger, the markets have never moved faster and the rewards have never been greater. It’s time to plan for the future, and build your strategy on trends (not what worked in the past.)

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com

by Adam Hartung | Jun 30, 2020 | Culture, Leadership, Marketing, Politics, Web/Tech

In my recent “Rebooting Business” on-line conference I was asked if Black Lives Mattered and other protests should affect strategy. I said “of course!!” These demonstrations clearly show a segment of the marketplace with unserved and under-served needs. Needs so badly served people have taken to the streets!

Every organization needs to assess its strategy to determine if it is on this trend toward inclusion. Are you sensitive to the needs of these under-served segments? Or are you sloppily still out there with old stereo-tropes like the Aunt Jemima syrup – which Quaker Oats finally pulled. Do you know if your organization, products, suppliers, customers and communities are meeting market needs for inclusion? Or are you just assuming you’ll be OK?

Amazingly one of the biggest trend creating companies has demonstrated the cost of missing trends. Facebook is a remarkable company. Where MySpace failed, and countless others never created a marketplace, Facebook used its initial platform, then added Instagram, then Messenger, then WhatsApp to take an enormous lead in social media. Facebook built on trends in our desire to be mobile, and to communicate asynchronously, to attract billions of people to its platform – and as a result advertisers.

But…. Inexplicably…. the CEO Mark Zuckerberg and his leadership team have been tone-deaf to the events since George Floyd was killed. And they were remarkably blindsided, showing they truly weren’t prepared. Zuckerberg has long refused to even look for false information on Facebook – and never really considered removing it. Lies, falsehoods, misstatements – Facebook let people of all stripes (good, and very often bad) say anything they wanted on the platform. This wasn’t inclusion, it was allowing loud voices to present harmful content – and it was clearly disturbing a whole lot of people.

Now is the comeuppance. Advertisers have decided not to advertise on Facebook. They realize that their ads, presented next to false, and sometimes truly hateful, content gives the impression that they support this content. So, in droves, they have said their ad dollars will go somewhere else. Giant consumer goods companies Honda, Unilever, Proctor & Gamble, Coca-Cola, Diageo and Hershey as well as one of the world’s largest mobile providers Verizon, and mercantile suppliers North Face and Patagonia have joined retailers like Starbucks and REI as just some of the larger boycotters – out of over 100 on the growing list. So serious is this problem that some advertisers are “pausing” social media ads all together, suggesting another possible trend

Nobody can fight trends and hope to win. Nobody. No matter how big. And this is a sharp rebuke for one of the trendiest companies on the planet. That the leadership team didn’t see this coming is astonishing. In a late reversal, Facebook has made new efforts to identify hate content (including harmful posts by politicians), but that they didn’t react much quicker is just absurd. That they appeared to think they could platform political ads, and political content, and not have viewers associate Facebook with politics is downright bizarre. This has been the dumbest self-inflicted move by a big company in a very long time. And all they had to do to avoid this nightmare was admit that inclusion was a very big global trend that they had to build into their offering.

But don’t lose sight of the lesson. TRENDS MATTER. If you align with trends your business can do GREAT! Like Facebook. But if you don’t pay attention, and you miss a big trend (like demographic inclusion) the pain the market can inflict can be HUGE and FAST. Like Facebook. Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business https://adamhartung.com/assessments/

by Adam Hartung | Dec 7, 2019 | Entertainment, Innovation, Marketing, Strategy, Television, Trends

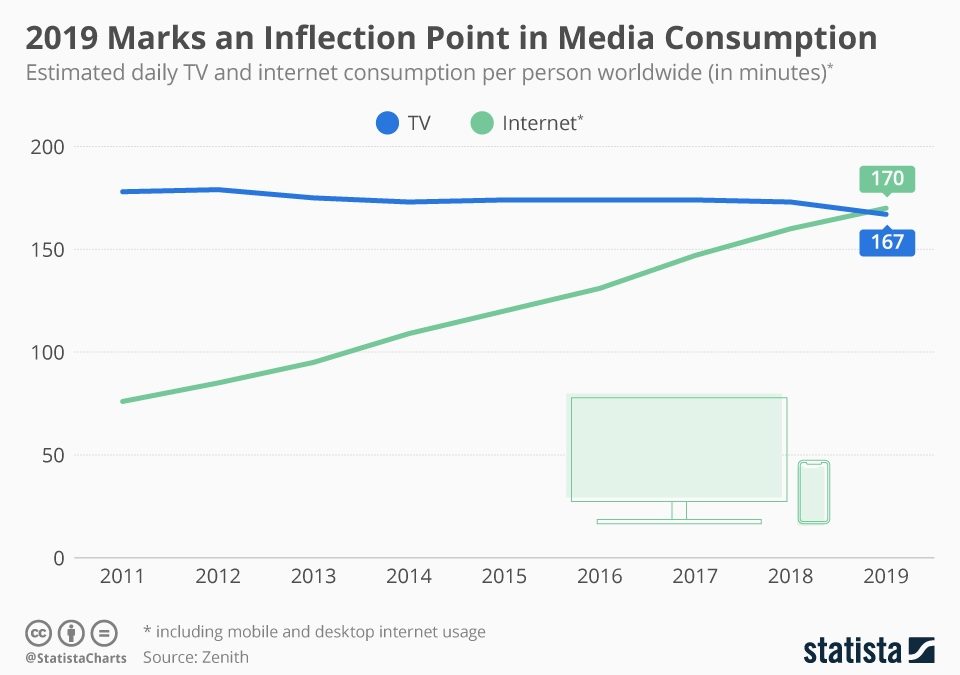

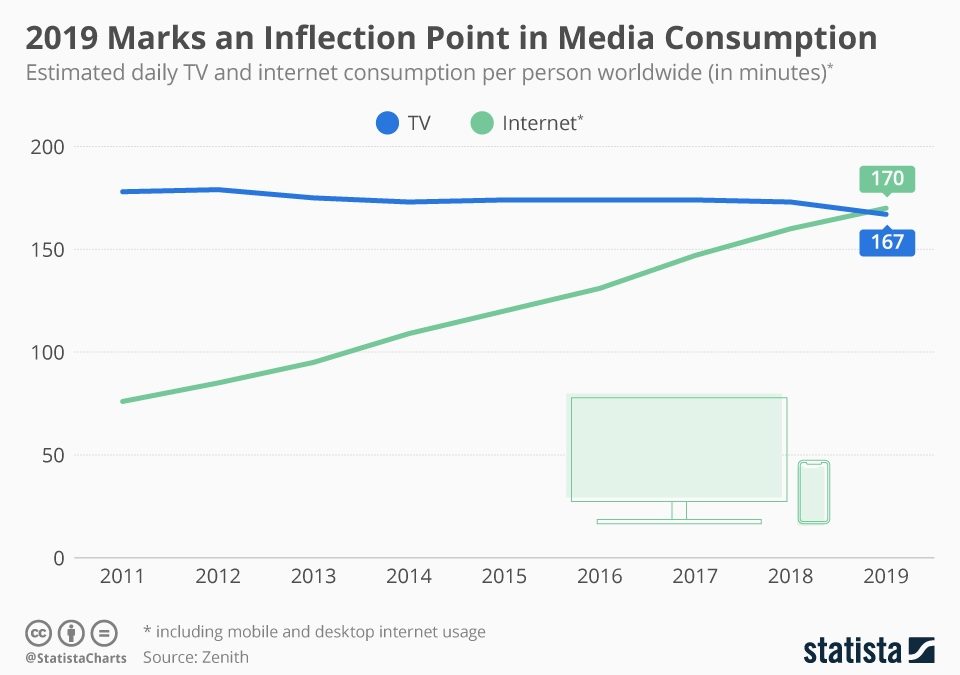

Seven years ago (12 December, 2012) I said it was “The Day TV Died.” There were a LOT of skeptics. At the time, TV was by far still the dominant medium. But the trends were absolutely clear – ad revenues were quickly moving toward on-line opportunities. Print was already well into the grave, and radio was sputtering along with no growth at all. Eyeball momentum had shifted on-line, and thus ads moved on-line, and it was obvious that programming dollars would soon follow – meaning that TV programming was already in Stage 4 termination.

Trends and Tech drove Netflix growth

Meanwhile, Netflix and its brethren were poised to have a fabulous, furious growth. These same trends led me to a full-throated pitch to buy Netflix nine years ago (Nov. 2010.) After Netflix made the decision to raise prices for DVD distribution in order to push people toward streaming the stock crashed, but trends indicated that customer preferences would lead Netflix to be the content winner so despite widespread despair, I called for people to buy the stock in Oct. 2011. In Jan. 2012, I made Netflix one of my top 4 picks for the year. So by Jan. 2013, I was making it clear that TV was has-been, and Netflix was the company to own.

Now, Statista has produced the numbers showing that in 2019 internet media consumption exceeded TV consumption – for the first time ever. And this trend will not stop. It was wholly predictable years ago – and the trends all say this will only accelerate. Where once the competition for entertainment was Netflix, now there is Amazon Prime, Disney+, Comcast Peacock, AT&T HBO Max and Apple TV+. The traditional networks simply don’t have a chance.

Impact of Trends

These trends are having an enormous impact on how we behave, how advertisers behave, what technology we buy, what entertainment we watch, how we use other technology like social media, how we absorb news — and more. So the question is, did you see the trends 7,8,9 years ago? Have you adjusted your strategy? Are you sure where trends are headed, and are you prepared for the future? Will you be a winner as the world changes – in a pretty predictable way – or will you lose out and say “you know, way back when……”

by Adam Hartung | Nov 2, 2019 | Disruptions, Food and Drink, Innovation, Marketing, Strategy, Trends

The newsletters of Adam Hartung.

Keynote Speaker, Managing Partner, Author on Trends

Mighty Oaks from Tiny Acorns Grow – Beyond Meat

TREND: Beyond Meat (BYND, NASDAQ)

A big, new trend is emerging. Sales of plant based protein products may be small, but growth is remarkable. Could Beyond Meat be the next Netflix?

In Q3 2019, Beyond Meat’s revenue is up 2.5x (250%) vs Q3 2018 — which was up 2.5x (250%) over Q3 2017. Yes, you can say this growth is on a small base, given that last quarter was $100M revenue.

Imagine what it’s like growing that fast. Imagine the exhilaration of solving problems – like funding your accounts receivable that’s growing with accelerating orders. Or amping up production faster than ever imagined. Or meeting needs of your customers, retailers and restaurants. Or paying out big bonuses due to beating all your planned metrics.

It’s not that much fun to work at Cargill. Or Tyson Foods. Or Smithfield. Or any other traditional company producing beef, or pork, or chicken. Those are huge companies, with lots of people. But they aren’t maxing out sales and profits – and bonuses – like Beyond Meat.

It’s easy to ignore a start up. But one has to look at the relative growth of a company to judge its future. There were cracks in the growth rate at Blockbuster 6 years before it failed. And during that time, Blockbuster kept saying Netflix was a nit that didn’t matter. But Netflix was growing like the proverbial weed. Netflix wasn’t even half the size of Blockbuster when Blockbuster filed for bankruptcy.

With growth like Beyond Meat it didn’t take long to upset an entire industry biz model. Amazon still doesn’t sell as much as WalMart, but it wiped out a significant number of retailers by changing volumes enough to erase their profits. Think about the changes wrought on the advertising industry by Google, which has pretty much killed print ads. Look at what’s happened to other media ad models, like TV and radio, by Facebook’s growth. And entertainment has been entirely changed – where today the onetime distributor is one of the biggest content producers – Netflix.

In traditional marketing theory, Beyond Meat, like Netflix, is selling new products to existing markets.

Most disruptors enter the markets in the new product/new market quadrant of the Ansoff matrix. They create the new market just by entering. If they even see them as competitors, established businesses dismiss these potential disruptors because of established focus on current markets/current products with sustaining innovations. Selling new products to existing customers is the first step companies take as they start to innovate.

Kraft was on this path when they acquired a new productc with its purchase of Boca Burger in 2000. Kellogg’s and General Foods jumped into the alternative meat products at about the same time. Vegetarian burger substitutes threatened the success formula of meat products and were relegated to niche products. In 2018, Kraft’s incubator tried to relaunch Boca, but the smaller, more nimble start-ups had already captured consumers’ attention and reframed the market.

Beyond Meat had morphed quickly into a direct competitor to the meat industry by selling this new product to existing meat customers!

Riding the trends of climate change, sustainability and organic foods, Beyond Meat is starting to look like a true game changer. It may be small, but those other companies were too (along with Tesla, don’t forget, considered immaterial by GM, et.al.) Those who are in the traditional protein market (beef especially) had better pay attention – their profit model is already under attack!!

“The creation of a thousand forests is in one acorn.”

What’s on your company’s radar today?

Spark Partners is here to help as your coach on trends and innovation. We bring years of experience studying trends, organizations, and how to implement. We bring nimbleness to your strategy, and help you maximize your ability to execute.

Let us do an opportunity assessment for your organization. For less than your annual gym cost, or auto insurance premium, we could likely identify some good opportunities your blinders are hiding. Read my Assessment Page to learn more.

For more on how to include trends in your planning, I’ve created a “how-to” that you can adapt for your team. See my

Status Quo Risk Management Playbook.

Give us a

call today, or send an email, so we can talk about how you can be a leader, rather than follower. Or check out the rest of the

website to read up on what we do so we can create the right level of engagement for you.

Hartung Recent Blog Posts on Leadership, Investing, Trends

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | May 9, 2019 | Innovation, Marketing, Strategy, Trends

Market Threat Assessment

Recent studies of senior managers have shown that being blindsided by a disruption is the largest unresolved concern in strategy development today.

That fear is too often real because disruption typically begins where it is least visible to management- on the fringes of the existing target markets. And, once the disruption “pirate ship” is sighted on the horizon, not only is it probably too late, but companies react poorly.

Some research of corporate responses to disruption has shown that most companies ignore the threat, fortify existing positions or attempt to buy innovation. The first choice is not an option for an ongoing business. Fortification through distribution changes, product model proliferation and discounting only buys some additional time while wasting resources. Once a disruption enters the market, there’s little time for organic innovation efforts so companies often make acquisitions attempting to buy innovation. Sadly, given the risk profile and limited experience in innovation, these are often sustaining innovations which are swept aside by the wave of disruption.

A very large example is when Microsoft fell behind in the mobile market in 2014 and purchased Nokia, a weak player in mobile phones to get access to this market. The joint project, the Lumina phone, failed to catch on and Microsoft’s share fell by 50%- fail. Cisco tried to catch up with the photography trend by acquiring Pure Digital, the maker of low cost Flip cameras. Unfortunately, shortly after the acquisition, the high-resolution sensors included in smartphones took photography to a new level. Bye, Flip! Trend monitoring would have predicted this natural evolution as a high risk threat.

To anticipate external changes, marketing departments have embraced big data as a powerful tool to help companies identify new markets and consumer preferences. These tools use the past to predict the short-term future which is reasonable in a steady market. The problem is that big data cannot anticipate dynamic disruption.

But, you and your staff can.

As a key input to your next strategy workshop, use trends! As a start, gather info from the people closest to your market and further using Porter’s five force model. See my articles on Scenarios to expand these trends to actionable goals.

What’s on your company’s radar today?

We are here to help as your coach on trends and innovation. We bring years of experience studying trends, organizations, and how to implement. We bring nimbleness to your strategy, and help you maximize your ability to execute.

Go the www.adamhartung.com and view the Assessment Page. Send me a reply to this email, or call me today, and let’s start talking about what trends will impact your organization and what you’ll need to do to pivot toward greater success.

by Adam Hartung | May 1, 2019 | Disruptions, Innovation, Marketing, Strategy

Find Opportunities Out of the Box

If your company is like most businesses, your list of new product or service ideas looks like a sales wish list- new features at a lower cost. Marketing or product management may go a step further and group the ideas into product line extensions or possibly entries into new market segments. Unfortunately, while generating revenue in the short run, this process leaves the company vulnerable to competition and missing opportunities in the long run.

Well, you are not alone. Since about 2012, the pace of innovation has slowed even in the popular market of social media. According to KeyMedia, “What was once a world of diversity and originality has slowly started to look like a bad case of déjà vu… (as platforms are) becoming more similar to each other…”

Most companies devote resources to a quadrant on the innovation matrix known as “sustaining innovation.” They improve existing products sold to existing customers. It’s low risk, true, but it’s also low return. Why do companies follow this death spiral? It’s because “innovation” has gotten a bad reputation.

According to Inc. magazine, “…many (business) people have come to equate the idea of innovation with disruptive innovation. But the fact is that for most businesses, placing big bets on high-risk ideas is not only unfeasible, it’s unwise.”

The Ansoff matrix of new and existing markets and products is usually interpreted as 4 quadrants. It is much more than that: it is a continuum between sustaining and disruptive innovation. .

Adam Hartung often tells clients, “Get out of the box, then think!” This applies directly to the Ansoff model. Once a company sees the matrix, not as fixed “boxes” but as a spectrum of opportunities, markets are viewed not as filled with risk, but filled with opportunities!

Consider Ricoh’s new “clickable paper” that combines the print channel, with an app and that integrates to social media or a website. Not disruptive in the classical sense, but an adjacent product and adjacent market segment that makes print relevant to tech savvy consumers. Or Dr. Dre’s Beats headphones that combine pre-equalized sound with noise cancellation and style- a clever and highly successful blend of existing technologies, vigorously marketed.

Uncovering these market opportunities that can deliver improved returns at a manageable risk for the firm. New products will also generate an increasing percentage of revenue leading to continued growth. Companies that master this process have a long range radar to identify potential opportunities in a process called, “continuous innovation”.

What’s on your company’s radar today?

We are here to help as your coach on trends and innovation. We bring years of experience studying trends, organizations, and how to implement. We bring nimbleness to your strategy, and help you maximize your ability to execute.

Go the website and view the Assessment Page. Send me a reply to this email, or call me today, and let’s start talking about what trends will impact your organization and what you’ll need to do to pivot toward greater success.

by Paul F | Sep 26, 2018 | eBooks, Innovation, Investing, Marketing, Software, Web/Tech

In the recently published, “Facebook- The Making of a Great Company”, Adam Hartung analyzes the rise of Facebook and its impact on the financial community, business marketing and innovation.

Adam’s posts over the years have predicted key milestones in Facebook’s growth and its transformation into a driver of social trends. He tells the story of this company that has overcome negativity and skepticism in the financial community and has adapted to its users.

“So last week, when Facebook reported that its user base hadn’t grown like the

past, investors fled. Facebook recorded the largest one day drop in valuation in

history; about $120B of market value disappeared. Just under 20%.

No other statistic mattered. The storyline was that people didn’t trust Facebook

any longer, so people were leaving the platform. Without the record growth numbers

of the past, many felt that it was time to sell. That Facebook was going to be

the next MySpace.”

“That was a serious over-reaction.”

Adam Hartung, “Facebook-The Making of a Great Company”

by Adam Hartung | Jul 19, 2018 | Entrepreneurship, In the Rapids, Innovation, Marketing, Medical

USA health care is ridiculously expensive. It’s good, but no statistics show that US healthcare is better than any other developed country. Nor any better than accredited facilities in large, developing countries. Look at these comparisons according to Medicaltourism.com:

Procedure USA cost India cost in accredited facility

Heart Bypass $123,000 $7,900

Heart Valve Replacement $170,000 $10,450

Hip Replacement $40,364 $7,200

Knee Replacement $35,000 $6,600

Spinal Fusion $110,000 $10,300

Hysterectomy $15,400 $3,200

Cornea Replacement $17,500 $2,800

Over 1/3 of Americans live with the myth that if they need medical care, somehow it will magically happen at no cost. The Affordable Care Act tried to fix that myth by making everyone buy health insurance. But Congress removed that government mandate. So most Americans that don’t have company-sponsored health insurance don’t buy insurance. Their primary source of health insurance is hope. When illness or accident happens these folks end up with extra-ordinary debt. And they can’t eliminate this debt because health care debt doesn’t go away in bankruptcy. So every year more and more people learn that an unexpected health incident means they will spend the rest of their lives paying for medical services that were 10x or 100x what they expected.

This is a trend that will not end soon. Costs keep going up. The political sides are too divided on what to do. And health insurance companies spend literally billions annually to make sure insurance for all (referred to as Medicare for all) never becomes reality.

This trend means there is opportunity. And that has become medical tourism. Literally, flying to foreign countries for medical procedures.

You may say “not me.” But if you have no money in the bank, and you let your health insurance lapse when you lost your last corporate job ended and you entered the gig economy, you could face a very tough situation. The same one almost all farmers face, and most small business owners, since their insurance is unaffordable. And most 1099 contract employees. When you have an unexpected heart attack at age 41 you wake up to hear a hospital admin say “you are alive, but you need surgery. If you want to live, we can do a heart bypass. Just sign this document and you’ll wake up somewhere north of $123,000 in debt.” Which means you’ll lose your house, for sure. Your kids won’t go to college. And you’ll never again buy a new car.

Or you blow out a hip, or knee,playing that Sunday basketball pick-up game – or golf. You’re 50-55, so too young for Medicare. But you lost health insurance years ago. Or you have a minimalistic plan which will cover a fraction of the cost. Finding the cost is $35,000 to $40,000 (or more likely $60,000 at a for-profit US hospital) are you really able to afford this? Or will you spend your life using crutches, or in a wheelchair? Or start an on–line begging campaign from your friends to cover the cost?

Suddenly, being a medical tourist doesn’t sound so unlikely. Saving $30,000 to $100,000 could determine your financial future. This trend was pretty clear back in 2010 when I pointed out that US medical tourists grew from 700,000 in 2007 to 1.2 million in just 3 years. The trend was actually obvious in 2005, when most people laughed at the idea of medical tourism – because they refused to look at the demographic and cost trends.

That’s why medical tourism is already a $20B business. And growing at 18% annually. Some analysts estimate the global market at almost $80B. Demographics are all in favor of future growth. The developed world population is aging. Health care costs are going up. Government ability to pay is going down. Insurers are charging outrageous rates. Fewer people are buying health care, and even fewer are buying “gold plated plans” that match the average plan in 1990. And American health care policies, in particular, keep driving up costs. It is EASY to see that as people can’t afford care at home, so they WILL be making more trips overseas.

There are already companies making the plunge. Some are matching services between patients and medical facilities. Some are building certified medical facilities in places like India, Singapore, Brazil, Malaysia, Thailand, Costa Rica and Mexico. The opportunities are as big as the health industry.

And this trend affects every business. Are you still stuck in the status quo thinking of extremely expensive insurance for employees, or none? Medical tourism offers a plethora of other opportunities. You can offer a bare-bones domestic plan, with augmented insurance to be a medical tourist. Or even a company sponsored plan, with the opportunity for employees to build a health-care bank, and a relationship with a medical tourism company to help employees find providers offshore. And gig-economy employees can drop the idea of domestic coverage (other than bare bones) for a mixed program including offshore insurance.

Fighting the health cost trend in the USA is foolish. Doing nothing hurts your competitiveness. Given the opportunities in medical tourism, are you thinking about how to build on this trend as a new business? Or a way to offer more to full time and 1099 contractors?