by Adam Hartung | Mar 13, 2016 | In the Swamp, Leadership, Travel

United Continental Holdings is the most recent public company to come under attack by hedge funds. Last week Altimeter Capital and PAR Capital announced they were using their combined 7.1% ownership of United to propose a slate of 6 new directors to the company’s board. As is common in such hedge fund moves, they expressed strongly their lack of confidence in United’s board, and pointed out multiple years of underperformance.

United’s leadership is certainly in a tough place. The airline consistently ranks near the bottom in customer satisfaction, and on-time performance. It has struggled for years with labor strife, and the mechanics union just rejected their proposed contract – again. The flight attendant’s union has been in mediation for months. And few companies have had more consistently bad public relations, as customers have loudly complained about how they are treated – including one fellow making a music and speaking career out of how he was abused by United personnel for months after they destroyed his guitar.

United’s leadership is certainly in a tough place. The airline consistently ranks near the bottom in customer satisfaction, and on-time performance. It has struggled for years with labor strife, and the mechanics union just rejected their proposed contract – again. The flight attendant’s union has been in mediation for months. And few companies have had more consistently bad public relations, as customers have loudly complained about how they are treated – including one fellow making a music and speaking career out of how he was abused by United personnel for months after they destroyed his guitar.

But is changing the directors going to change the company? Or is it just changing the guest list for an haute couture affair? Should customers, employees, suppliers and investors expect things to really improve, or is this a selection between the devil and the deep blue sea?

Much was made of the fact that one of the proposed new directors is the former CEO of Continental, Gordon Bethune, who was very willing to speak out loudly and negatively regarding United’s current board. But Mr. Bethune is 74 years old. Today most companies have mandatory director retirement somewhere between age 68 and 72. Retired since 2004, is Mr. Bethune really in step with the needs of airline customers today? Does he really have a current understanding of how the best performing airlines keep customers happy while making money?

And, don’t forget, Mr. Bethune hand picked Mr. Jeff Smisek to replace him at Continental. Mr. Smisek was the fellow who took over Mr. Bethune’s board seat in 2004 after being appointed President and COO when Mr. Bethune retired. Smisek became CEO in 2010, and CEO of United Continental after the merger, and led the ongoing deterioration in United’s performance as well as declining employee moral. And then there’s that pesky problem of Mr. Smisek bribing government officials to improve United’s gate situation in Newark, NJ which caused him to be fired by the current board. Is it coincidental that this attack on the Board did not happen for years, but happens now that there is a new CEO – who happens to be recently recovering from a heart replacement?

Although Mr. Bethune has commented that the new board would be one that understands the airline industry, the slate does not reflect this. Mr. Gerstner is head of Altimiter and by all accounts appears to be a finance expert. That was the background Ed Lampert brought to Sears, another big Chicago company, when he took over that board. And that has not worked out too well at all for any constituents – including investors.

One can give great kudos to the hedge funds for proposing a very diverse slate. Half the proposed directors are either female or of color. And, other than Mr. Bethune, the slate is pretty young – with 2 proposed directors under age 50. Congratulations on achieving diversification! But a deeper look can cause us to wonder exactly what these directors bring to the challenges, and what they are likely to want to change at United.

Rodney O’Neal was the former CEO of Delphi Automotive. A lifelong automotive manager and executive, he graduated from the General Motors Institute and spent his career at GM before going to the parts unit GM had created in 1997 as a Vice President. Many may have forgotten that Delphi famously filed for bankruptcy in 2005, and proceeded to close over half its U.S. plants, then close or sell almost all of the other half in 2006. Mr. O’Neal became CEO in 2007, after which the company closed its plants in Spain despite having signed a commitment letter not to do so. He was CEO in 2008 when the company sued its shareholders. And in 2009 when the company sold its core assets to private investors, then dumped assets into the bankrupt GM, cancelled the stock and renamed the old Delphi DPH Holdings. Cutting, selling and reorganizing seem to be his dominant executive experience.

Barney Harford is a young, talented tech executive. He headed Orbitz, where Mr. Gerstner was on the board. Orbitz was originally created as the Travelocity and Expedia killer by the major airlines. Unfortunately, it never did too well and Mr. Harford actually changed the company direction from primarily selling airline tickets to selling hotel rooms.

It is always good to see more women proposed for board positions. However, Ms. Brenda Yester Baty is an executive with Lennar, a very large Florida-based home builder. And Ms. Tina Stark leads Sherpa Foundry which has a 1 page web site saying “Sherpa Foundry builds

bridges between the world’s leading Corporations and the Innovation Economy.” What that means leaves a lot of room for one’s imagination, and precious little specifics. What either of these people have to do with creating a major turnaround in the operations of United is unclear.

There is no doubt that United is ripe for change. Replacing the CEO was clearly a step in the right direction – if a bit late. But one has to wonder if the new directors are there to make some specific change? If so, what kind of change? Despite the rough rhetoric, there has been no proclamation of what the new director slate would actually do differently. No discussion of a change in strategy – or any changes in any operating characteristics. Just vague statements about better governance.

Historically most activists take firm aim at cutting costs. And this is probably why the 2 largest unions have already denounced the new slate, and put their full support behind the existing board of directors. After so many years of ill-will between management and labor at United, one would wonder why these unions would not welcome change. Unless they fear the new board will be mostly focused on cost-cutting, and further attempts at downsizing and pay/benefits reductions.

Investors will most likely get to vote on this decision. Keep existing board members, or throw them out in favor of a new slate? One would like to see United’s reputation, and operations, improve dramatically. But is changing out 6 directors the answer? Or are investors facing a vote that has them selecting between 2 less than optimal options? It would be good if there was less rhetoric, and more focus on actual proposals for change.

by Adam Hartung | Feb 24, 2016 | Defend & Extend, In the Swamp, Leadership

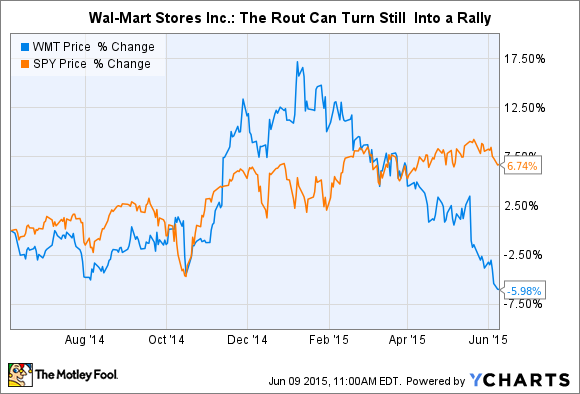

Walmart announced quarterly financial results last week, and they were not good. Sales were down $500million vs the previous year, and management lowered forecasts for 2016. And profits were down almost 8% vs. the previous year. The stock dropped, and pundits went negative on the company.

But if we take an historical look, despite how well WalMart’s value has done between 2011 and 2014, there are ample reasons to forecast a very difficult future. Sailors use small bits of cloth tied to their sails in order to get early readings on the wind. These small bits, called telltales, give early signs that good sailors use to plan their navigation forward. If we look closely at events at WalMart we can see telltales of problems destined to emerge for the retailing giant:

1 – In March, 2008 WalMart sued a brain damaged employee. The employee was brain damaged by a truck accident. WalMart’s insurance paid out $470,000 in health care cost. The employee’s family sued the trucking company, at their own expense, and won a $417,000 verdict for lost future wages, pain and suffering and future care needs. Then, WalMart decided it would sue the employee to recover the health care costs it had previously paid. As remarkable as this seems, it is a great telltale. It demonstrates a company so focused on finding ways to cut costs, and so insensitive to its employees and the plight of its customers that it loses all common sense. Not to mention the questionable ethics of this action, it at the very least demonstrates blatant disregard for the PR impact of its actions. It shows a company where management feels it is unquestionable, and a believe its brand is untouchable.

1 – In March, 2008 WalMart sued a brain damaged employee. The employee was brain damaged by a truck accident. WalMart’s insurance paid out $470,000 in health care cost. The employee’s family sued the trucking company, at their own expense, and won a $417,000 verdict for lost future wages, pain and suffering and future care needs. Then, WalMart decided it would sue the employee to recover the health care costs it had previously paid. As remarkable as this seems, it is a great telltale. It demonstrates a company so focused on finding ways to cut costs, and so insensitive to its employees and the plight of its customers that it loses all common sense. Not to mention the questionable ethics of this action, it at the very least demonstrates blatant disregard for the PR impact of its actions. It shows a company where management feels it is unquestionable, and a believe its brand is untouchable.

2 – In March, 2010 AdAge ran a column about WalMart being “stuck in the middle” and effectively becoming the competitive “bulls-eye” of retailing. After years of focusing on its success formula, “dollar store” competition was starting to undermine it on cost and price at the low end, while better merchandise and store experience boxed WalMart from higher end competitors – that often weren’t any more expensive. This was the telltale sign of a retailer that had focused on beating up its suppliers for years, cutting them out of almost all margin, without thinking about how it might need to change its business model to grow as competitors chopped up its traditional marketplace.

3 – In October, 2010 Fortune ran an article profiling then-CEO Mike Duke. It described an executive absolutely obsessive about operational minutia. Banana pricing, underwear inventory, cereal displays – there was no detail too small for the CEO. Another telltale of a company single-mindedly focused on execution, to the point of ignoring market shifts created by changing consumer tastes, improvements at competitors and the rapid growth of on-line retailing. There was no strategic thinking happening at WalMart, as executives believed there would never be a need to change the strategy.

4 – In April, 2012 WalMart found itself mired in a scandal regarding bribing Mexican government officials in its effort to grow sales. WalMart had never been able to convert its success formula into a growing business in any international market, but Mexico was supposedly its breakout. However, we learned the company had been paying bribes to obtain store sites and hold back local competitors. A telltale of a company where pressure to keep defending and extending the old business was so great that very highly placed executives do the unethical, and quite likely the illegal, to make the company look like it is performing better.

5 – In July, 2014 a WalMart truck driver hits a car seriously injuring comedian Tracy Morgan and killing his friend. While it could be taken as a single incident, the truth was that the driver had been driving excessive hours and excessive miles, not complying with government mandated rest periods, in order to meet WalMart distribution needs. This telltale showed how the company was stressed all the way down into the heralded distribution environment to push, push, push a bit harder to do more with less in order to find extra margin opportunities. What once was successful was showing stress at the seams, and in this case it led to a fatal accident by an employee.

6 – In January, 2015 we discovered traditional brick-and-mortar retail sales fell 1% from the previous year. The move to on-line shopping was clearly a force. People were buying more on-line, and less in stores. This telltale bode very poorly for all traditional retailers, and it would be clear that as the biggest WalMart was sure to face serious problems.

7 – In July, 2015 Amazon’s market value exceeds WalMart’s. Despite being quite a bit smaller, Amazon’s position as the on-line retail leader has investors forecasting tremendous growth. Even though WalMart’s value was not declining, its key competition was clearly being forecast to grow impressively. The telltale implies that at least some, if not a lot, of that growth was going to eventually come directly from the world’s largest traditional retailer.

8 – In January, 2016 we learn that traditional retail store sales declined in the 2015 holiday season from 2014. This was the second consecutive year, and confirmed the previous year’s numbers were the start of a trend. Even more damning was the revelation that Black Friday sales had declined in 2013, 2014 and 2015 strongly confirming the trend away from Black Friday store shopping toward Cyber Monday e-commerce. A wicked telltale for the world’s largest store system.

9 – In January, 2016 we learned that WalMart is reacting to lower sales by closing 269 stores. No matter what lipstick one would hope to place on this pig, this telltale is an admission that the retail marketplace is shifting on-line and taking a toll on same-store sales.

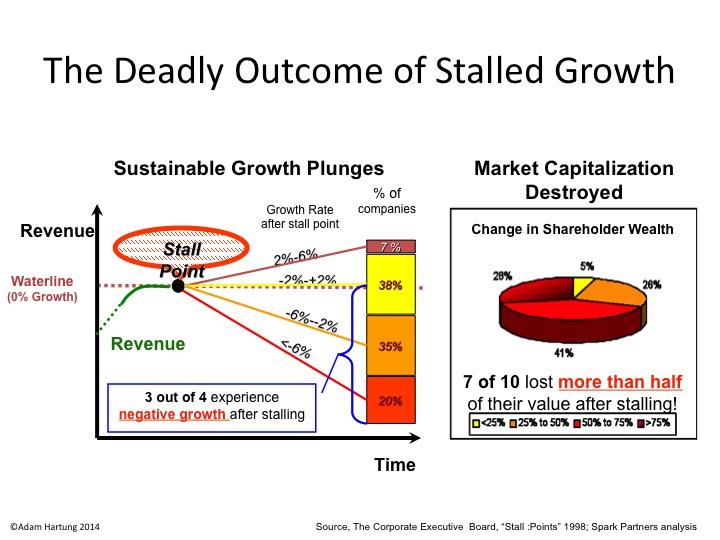

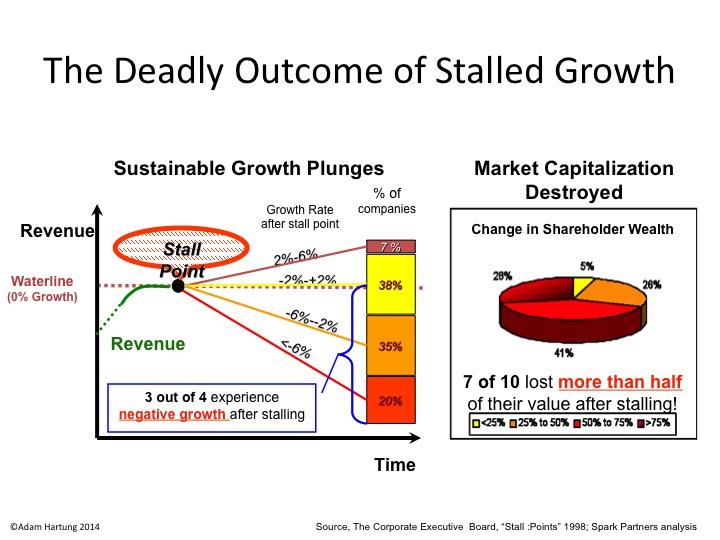

10 – We now know WalMart is in a Growth Stall. A Growth Stall occurs any time a company has two consecutive quarters of lower sales versus the previous year (or two consecutive declining back-to-back quarters.) In the 3rd quarter of 2015 Walmart sales were $117.41B vs. same quarter in 2014 $119.00B – a decline of $1.6B. Last quarter WalMart sales were $129.67B vs. year ago same quarter sales of $131.56B – a decline of $1.9B. While these differences may seem small, and there are plenty of explanations using currency valuations, store changes, etc., the fact remains that this is a telltale of a company that is already in a declining sales trend. And according to The Conference Board companies that hit a Growth Stall only maintain a mere 2% growth rate 7% of the time – the likelihood of having a lower growth rate is 93%. And 95% of stalled companies lose 25% of their market value, while 69% of companies lose over half their value.

WalMart is huge. And its valuation has actually gone up since the Great Recession began. It’s valuation also rose from 2011- 2014 as Amazon exploded in size. But the telltale signs are of a company very likely on the way downhill.

by Adam Hartung | Feb 9, 2016 | Current Affairs, In the Swamp, Leadership, Web/Tech

Verizon tipped its hand that it would be interested to buy Yahoo back in December. In the last few days this possibility drew more attention as Verizon’s CFO confirmed interest on CNBC, and Bloomberg reported that AOL’s CEO Tim Armstrong is investigating a potential acquisition. There are some very good reasons this deal makes sense:

First, this acquisition has the opportunity to make Verizon distinctive. Think about all those ads you see for mobile phone service. Pretty much alike. All of them trying to say that their service is better than competitors, in a world where customers don’t see any real difference. 3G, 4G – pretty soon it feels like they’ll be talking about 10G – but users mostly don’t care. The service is usually good enough, and all competitors seem the same.

First, this acquisition has the opportunity to make Verizon distinctive. Think about all those ads you see for mobile phone service. Pretty much alike. All of them trying to say that their service is better than competitors, in a world where customers don’t see any real difference. 3G, 4G – pretty soon it feels like they’ll be talking about 10G – but users mostly don’t care. The service is usually good enough, and all competitors seem the same.

So, that leads to the second element they advertise – price. How many different price programs can anyone invent? And how many phone or tablet give-aways. What is clear is that the competition is about price. And that means the product has become generic. And when products are generic, and price is the #1 discussion, it leads to low margins and lousy investor returns.

But a Yahoo acquisition would make Verizon differentiated. Verizon could offer its own unique programming, at a meaningful level, and make it available only on their network. And this could offer price advantages. Like with Go90 streaming, Verizon customers could have free downloads of Verizon content, while having to pay data fees for downloads from other sites like YouTube, Facebook, Vine, Instagram, Amazon Prime, etc. The Verizon customer could have a unique experience, and this could allow Verizon to move away from generic selling and potentially capture higher margins as a differentiated competitor.

Second, Yahoo will never be a lead competitor and has more value as a supporting player. Yahoo has lost its lead in every major competitive market, and it will never catch up. Google is #1 in search, and always will be. Google is #1 in video, with Facebook #2, and Yahoo will never catch either. Ad sales are now dominated by adwords and social media ads – and Yahoo is increasingly an afterthought. Yahoo’s relevance in digital advertising is at risk, and as a weak competitor it could easily disappear.

But, Verizon doesn’t need the #1 player to put together a bundled solution where the #2 is a big improvement from nothing. By integrating Yahoo services and capabilities into its unique platform Verizon could take something that will never be #1 and make it important as part of a new bundle to users and advertisers. As supporting technology and products Yahoo is worth quite a bit more to Verizon than it will ever be as an independent competitor to investors – who likely cannot keep up the investment rates necessary to keep Yahoo alive.

Third, Yahoo is incredibly cheap. For about a year Yahoo investors have put no value on the independent Yahoo. The company’s value has been only its stake in Alibaba. So investors inherently have said they would take nothing for the traditional “core” Yahoo assets.

Additionally, Yahoo investors are stuck trying to capture the Alibaba value currently locked-up in Yahoo. If they try to spin out or sell the stake then a $10-12Billion tax bill likely kicks in. By getting rid of Yahoo’s outdated business what’s left is “YaBaba” as a tracking stock on the NASDAQ for the Chinese Alibaba shares. Or, possibly Alibaba buys the remaining “YaBaba” shares, putting cash into the shareholder pockets — or giving them Alibaba shares which they may prefer. Etiher way, the tax bill is avoided and the Alibaba value is unlocked. And that is worth considerably more than Yahoo’s “core” business.

So it is highly unlikely a deal is made for free. But lacking another likely buyer Verizon is in a good position to buy these assets for a pretty low value. And that gives them the opportunity to turn those assets into something worth quite a lot more without the overhang of huge goodwill charges left over from buying an overpriced asset – as usually happens in tech.

Fourth, Yahoo finally gets rid of an ineffectual Board and leadership team. The company’s Board has been trying to find a successful leader since the day it hired Carol Bartz. A string of CEOs have been unable to define a competitive positioning that works for Yahoo, leading to the current lack of investor enthusiasm.

The current CEO Mayer and her team, after months of accomplishing nothing to improve Yahoo’s competitiveness and growth prospects, is now out of ideas. Management consulting firm McKinsey & Company has been brought in to engineer yet another turnaround effort. Last week we learned there will be more layoffs and business closings as Yahoo again cannot find any growth prospects. This was the turnaround that didn’t, and now additional value destruction is brought on by weak leadership.

Most of the time when leaders fail the company fails. Yahoo is interesting because there is a way to capture value from what is currently a failing situation. Due to dramatic value declines over the last few years, most long-term investors have thrown in the towel. Now the remaining owners are very short-term, oriented on capturing the most they can from the Alibaba holdings. They are happy to be rid of what the company once was. Additionally, there is a possible buyer who is uniquely positioned to actually take those second-tier assets and create value out of them, and has the resources to acquire the assets and make something of them. A real “win/win” is now possible.

by Adam Hartung | Nov 18, 2015 | Current Affairs, Defend & Extend, In the Swamp, In the Whirlpool, Leadership, Web/Tech

Microsoft recently announced it was offering Windows 10 on xBox, thus unifying all its hardware products on a single operating system – PCs, mobile devices, gaming devices and 3D devices. This means that application developers can create solutions that can run on all devices, with extensions that can take advantage of inherent special capabilities of each device. Given the enormous base of PCs and xBox machines, plus sales of mobile devices, this is a great move that expands the Windows 10 platform.

Only it is probably too late to make much difference. PC sales continue falling – quickly. Q3 PC sales were down over 10% versus a year ago. Q2 saw an 11% decline vs year ago. The PC market has been steadily shrinking since 2012. In Q2 there were 68M PCs sold, and 66M iPhones. Hope springs eternal for a PC turnaround – but that would seem increasingly unrealistic.

The big market shift to mobile devices started back in 2007 when the iPhone began challenging Blackberry. By 2010 when the iPad launched, the shift was in full swing. And that’s when Microsoft’s current problems really began. Previous CEO Steve Ballmer went “all-in” on trying to defend and extend the PC platform with Windows 8 which began development in 2010. But by October, 2012 it was clear the design had so many trade-offs that it was destined to be an Edsel-like flop – a compromised product unable to please anyone.

The big market shift to mobile devices started back in 2007 when the iPhone began challenging Blackberry. By 2010 when the iPad launched, the shift was in full swing. And that’s when Microsoft’s current problems really began. Previous CEO Steve Ballmer went “all-in” on trying to defend and extend the PC platform with Windows 8 which began development in 2010. But by October, 2012 it was clear the design had so many trade-offs that it was destined to be an Edsel-like flop – a compromised product unable to please anyone.

By January, 2013 sales results were showing the abysmal failure of Windows 8 to slow the wholesale shift into mobile devices. Ballmer had played “bet the company” on Windows 8 and the returns were not good. It was the failure of Windows 8, and the ill-fated Surface tablet which became a notorious billion dollar write-off, that set the stage for the rapid demise of PCs.

And that demise is clear in the ecosystem. Microsoft has long depended on OEM manufacturers selling PCs as the driver of most sales. But now Lenovo, formerly the #1 PC manufacturer, is losing money – lots of money – putting its future in jeopardy. And Dell, one of the other top 3 manufacturers, recently pivoted from being a PC manufacturer into becoming a supplier of cloud storage by spending $67B to buy EMC. The other big PC manufacturer, HP, spun off its PC business so it could focus on non-PC growth markets.

And, worse, the entire OEM market is collapsing. For the largest 4 PC manufacturers sales last quarter were down 4.5%, while sales for the remaining smaller manufacturers dropped over 20%! With fewer and fewer sales, consolidation is wiping out many companies, and leaving those remaining in margin killing to-the-death competition.

And, worse, the entire OEM market is collapsing. For the largest 4 PC manufacturers sales last quarter were down 4.5%, while sales for the remaining smaller manufacturers dropped over 20%! With fewer and fewer sales, consolidation is wiping out many companies, and leaving those remaining in margin killing to-the-death competition.

Which means for Microsoft to grow it desperately needs Windows 10 to succeed on devices other than PCs. But here Microsoft struggles, because it long eschewed its “channel suppliers,” who create vertical market applications, as it relied on OEM box sales for revenue growth. Microsoft did little to spur app development, and rather wanted its developers to focus on installing standard PC units with minor tweaks to fit vertical needs.

Today Apple and Google have both built very large, profitable developer networks. Thus iOS offers 1.5M apps, and Google offers 1.6M. But Microsoft only has 500K apps largely because it entered the world of mobile too late, and without a commitment to success as it tried to defend and extend the PC. Worse, Microsoft has quietly delayed Project Astoria which was to offer tools for easily porting Android apps into the Windows 10 market.

Microsoft realized it needed more developers all the way back in 2013 when it began offering bonuses of $100,000 and more to developers who would write for Windows. But that had little success as developers were more keen to achieve long-term sales by building apps for all those iOS and Android devices now outselling PCs. Today the situation is only exacerbated.

By summer of 2014 it was clear that leadership in the developer world was clearly not Microsoft. Apple and IBM joined forces to build mobile enterprise apps on iOS, and eventually IBM shifted all its internal PCs from Windows to Macintosh. Lacking a strong installed base of Windows mobile devices, Microsoft was without the cavalry to mount a strong fight for building a developer community.

In January, 2015 Microsoft started its release of Windows 10 – the product to unify all devices in one O/S. But, largely, nobody cared. Windows 10 is lots better than Win8, it has a great virtual assistant called Cortana, and it now links all those Microsoft devices. But it is so incredibly late to market that there is little interest.

Although people keep talking about the huge installed base of PCs as some sort of valuable asset for Microsoft, it is clear that those are unlikely to be replaced by more PCs. And in other devices, Microsoft’s decisions made years ago to put all its investment into Windows 8 are now showing up in complete apathy for Windows 10 – and the new hybrid devices being launched.

AM Multigraphics and ABDick once had printing presses in every company in America, and much of the world. But when Xerox taught people how to “one click” print on a copier, the market for presses began to die. Many people thought the installed base would keep these press companies profitable forever. And it took 30 years for those machines to eventually disappear. But by 2000 both companies went bankrupt and the market disappeared.

Those who focus on Windows 10 and “universal windows apps” are correct in their assessment of product features, functions and benefits. But, it probably doesn’t matter. When Microsoft’s leadership missed the mobile market a decade ago it set the stage for a long-term demise. Now that Apple dominates the platform space with its phones and tablets, followed by a group of manufacturers selling Android devices, developers see that future sales rely on having apps for those products. And Windows 10 is not much more relevant than Blackberry.

by Adam Hartung | Oct 31, 2015 | Current Affairs, Games, In the Swamp, In the Whirlpool

I was born the 1950s. In my youth of the ’60s there was no doubt that the #1 sport in America was baseball. Almost every boy owned a bat, ball and glove and played baseball. When we went out for recess there was always a softball game somewhere on the playground.

Fathers told stories about how on the battlefields of WWII they would shout questions about baseball players and World Series statistics to each other to determine if the “other guy out there” was an American, or a German trying to sucker the Americans into the open. Baseball was so relevant every American was expected to know the details of players, games and series.

In that era, lots of baseball was played in the daytime, since the game and its parks preceded the era of great field lighting. Men regularly took off work to attend ball games, and it was considered fairly normal. People listened to baseball games on the radio at work.

And when the World Series came along, which was played around Labor Day, it was so beloved that people took TVs to work, hooked up makeshift antenna and watched the games. Even schools would set up a TV on the gymnasium stage and let the students watch the game — and some enterprising teachers would set up televisions in their classrooms and eschew teaching in favor of watching the series. It was even bigger than today’s Super Bowl, as pretty nearly everyone watched or listened to the World Series.

And when the World Series came along, which was played around Labor Day, it was so beloved that people took TVs to work, hooked up makeshift antenna and watched the games. Even schools would set up a TV on the gymnasium stage and let the students watch the game — and some enterprising teachers would set up televisions in their classrooms and eschew teaching in favor of watching the series. It was even bigger than today’s Super Bowl, as pretty nearly everyone watched or listened to the World Series.

No longer. World Series viewership has been on a decline for at least 40 years. According to Wikipedia, World Series viewership was about 35million in the 1986-1991 timeframe. By 1998-2005 viewership was down to averaging 20million – a 40% decline. By 2008-2014 viewership had declined to 12million -another 40% decline – or a loss of 2/3 the viewership in 25 years.

By comparison, regular season games in the NFL 2014 season averaged about 18million viewers, and 114million people watched the February, 2015 Superbowl – almost 10 times World Series viewership. Even the women’s FIFA World Cup soccer match last July drew 25million American viewers – twice the World Series.

Are you aware the World Series is happening now? I will forgive you if you didn’t know. Marketwatch.com headlined “This Is the Most Exciting World Series No One is Watching.” From what was the #1 sporting event in America, and possibly the world, 50 years ago the World Series has become nearly irrelevant for most people.

Why? Trends have made the World Series, and really baseball, obsolete.

Big Trend #1 – We’re out of time. The pace of life is far, far different today than it was in 1965. Laconic weekday afternoons lounging in a ballpark to watch a game are a thing of the past. The fact that baseball has no time limit is probably its most negative feature. Games are a minimum of 9 innings, but in case of a tie they can last many, many more. Further, if it rains the game is delayed, which can extend the time an hour or more. Thirdly, you have no idea how long an inning may take. 15 minutes, or an hour, all depending on a raft of variables that are impossible to predict.

Game 1 of this current series is a great example of the problem this creates. The game lasted 14 innings. There was a rain delay in the middle of the game. Overall, it was a 5 hour 9 minute event. While this set a new record for a World Series game length, it clearly demonstrates the problem of a sporting event which has no clock.

The most popular games are highly clock bound. Football and basketball not only have limits on the game length, there is a clock limiting the time between plays (or shots.) Soccer is timebound, and there are no time outs. In these games that have greatly grown popularity people know how long a game will take, and that is important.

Big Trend #2 – Action. When was the last time you played a board game, like Monopoly or Life? Do you even own one any longer? Today games are action intensive. In the 1960s a pinball machine was the closest thing anyone had to an “action game.” Look at any game today, via console, computer or mobile device, and there is action. Even Tetris had action to it, and that is nothing compared to the modern video game. People now like action.

Then there is baseball. A “perfect game” – the ultimate for this sport – happens when 21 people bat, and every one walks back to the dugout without reaching base. Quite literally, nothing happens. A pitcher and catcher play catch, while the batters watch. The next most vaunted game is a “no-hitter,” in which people reach base via a walk or an error – but it again reflects a lack of action in that no batter achieved a hit. The third most celebrated game is a “shutout,” meaning one team literally ended the game with a score of Zero. Goose egg.

Baseball is a game of very little action. A really good game often ends with each team having less than 10 hits. It is rare for there to be more than 2 home runs in a game, and often there are games with no home runs at all. Heck, even in golf at least the athletes are hitting the ball 60+ times apiece!

We live in a world today where people run for fun. Or ride bicycles. Where people join gyms to work out on treadmills, rowers, stationary bikes and weight machines. Nobody did this kind of thing in the 1960s. People today are active, and being active is a sign of health, vitality and well-being. Sedentary behaviors are frowned upon. There is no sport with less action than baseball (except maybe darts.)

Big Trend #3 – Globalization. Despite Mr. Donald Trump’s xenophobic appeal, globalization is an unstoppable trend. Our businesses and our lives are increasingly global, as it is doubtful any American goes a day without touching a product or service delivered from an offshore source. And unlikely most Americans live any given day without talking to someone born in a foreign country, or entertaining them with news, information, sports or programming from outside the USA.

There is no sport which makes this clearer than soccer. Due to its global appeal, 715million people watched the final game of the 2006 World Cup (55 times the World Series.) 909million people watched the final 2010 World Cup game (71.5 times the current World Series.) [note: FIFA has not published numbers for the 2014 final game in Brazil, but it is surely going to exceed 1B viewers.]

American impact? There were almost as many Americans (11million) that watched the first round match between the USA and Ghana in the 2014 World Cup as are now watching a World Series Game. And the 2014 World Cup final game had 17.3M U.S. viewers – 34% more than are watching the World Series this year.

Basketball has some international appeal, as there are leagues across Europe and some in South America. And my son was shocked at how much people watched and played basketball on his trip to China. And we see globalization reflected in the players names now in the NBA.

We also see globalization reflected in the NHL, which has many players from outside the USA. And viewership is growing for NHL Stanley Cup games, although it is still only about half the World Series. But given the trajectories of viewership, and the fact that hockey is both a timed sport as well as action-filled, Stanley Cup watchers could exceed World Series watchers in just a few years.

Simply put, baseball has never extended strongly beyond the USA and Japan. Lacking competitive teams and viewers outside the USA, as well as limited non-USA player recruitment, this “most American of sports” is off one of the country’s (and planet’s) major trends.

In short, the world moved and baseball did not change with the times. People don’t live today like they did in the 1930s-1960s. Trends are vastly different. New sports that were better linked to major trends, and which adapted to trends (by adding things like shot clocks and play clocks, for example) have gained viewers, while baseball has declined.

Baseball didn’t do anything wrong. It just didn’t adapt. And competitors have moved in. Just like happens in business — which, of course, is the reason we have professional sports – you either adapt or you become obsolete.

The World Series was once the most relevant sporting event on the globe. No longer. And lacking some major changes in the game, its ability to ever grow again is seriously questionable.

by Adam Hartung | Oct 25, 2015 | Current Affairs, Defend & Extend, Food and Drink, In the Swamp, In the Whirlpool, Leadership, Web/Tech

This week McDonald’s and Microsoft both reported earnings that were higher than analysts expected. After these surprise announcements, the equities of both companies had big jumps. But, unfortunately, both companies are in a Growth Stall and unlikely to sustain higher valuations.

McDonald’s profits rose 23%. But revenues were down 5.3%. Leadership touted a higher same store sales number, but that is completely misleading.

McDonald’s leadership has undertaken a back to basics program. This has been used to eliminate menu items and close “underperforming stores.” With fewer stores, loyal customers were forced to eat in nearby stores – something not hard to do given the proliferation of McDonald’s sites. But some customers will go to competitors. By cutting stores and products from the menu McDonald’s may lower cost, but it also lowers the available revenue capacity. This means that stores open a year or longer could increase revenue, even though total revenues are going down.

Profits can go up for a raft of reasons having nothing to do with long-term growth and sustainability. Changing accounting for depreciation, inventory, real estate holdings, revenue recognition, new product launches, product cancellations, marketing investments — the list is endless. Further, charges in a previous quarter (or previous year) could have brought forward costs into an earlier report, making the comparative quarter look worse while making the current quarter look better.

Confusing? That’s why accounting changes are often called “financial machinations.” Lots of moving numbers around, but not necessarily indicating the direction of the business.

McDonald’s asked its “core” customers what they wanted, and based on their responses began offering all-day breakfast. Interpretation – because they can’t attract new customers, McDonald’s wants to obtain more revenue from existing customers by selling them more of an existing product; specifically breakfast items later in the day.

Sounds smart, but in reality McDonald’s is admitting it is not finding new ways to grow its customer base, or sales. The old products weren’t bringing in new customers, and new products weren’t either. As customer counts are declining, leadership is trying to pull more money out of its declining “core.” This can work short-term, but not long-term. Long-term growth requires expanding the sales base with new products and new customers.

Perhaps there is future value in spinning off McDonald’s real estate holdings in a REIT. At best this would be a one-time value improvement for investors, at the cost of another long-term revenue stream. (Sort of like Chicago selling all its future parking meter revenues for a one-time payment to bail out its bankrupt school system.) But if we look at the Sears Holdings REIT spin-off, which ostensibly was going to create enormous value for investors, we can see there were serious limits on the effectiveness of that tactic as well.

MIcrosoft also beat analysts quarterly earnings estimate. But it’s profits were up a mere 2%. And revenues declined 12% versus a year ago – proving its Growth Stall continues as well. Although leadership trumpeted an increase in cloud-based revenue, that was only an 8% improvement and obviously not enough to offset significant weakness in other markets:

It is a struggle to see the good news here. Office 365 revenues were up, but they are cannibalizing traditional Office revenues – and not fast enough to replace customers being lost to competitive products like Google OfficeSuite, etc.

Azure sales were up, but not fast enough to replace declining Windows sales. Further, Azure competes with Amazon AWS, which had remarkable results in the latest quarter. After adding 530 new features, AWS sales increased 15% vs. the previous quarter, and 78% versus the previous year. Margins also increased from 21.4% to 25% over the last year. Azure is in a growth market, but it faces very stiff competition from market leader Amazon.

We build our companies, jobs and lives around successful products and services. We want these providers to succeed because it makes our lives much easier. We don’t like to hear about large market leaders losing their strength, because it signals potentially difficult change. We want these companies to improve, and we will clutch at any sign of improvement.

As investors we behave similarly. We were told large companies have vast customer bases, strong asset bases, well known brands, high switching costs, deep pockets – all things Michael Porter told us in the 1980s created “moats” protecting the business, keeping it protected from market shifts that could hurt sales and profits. As investors we want to believe that even though the giant company may slip, it won’t fall. Time and size is on its side we choose to believe, so we should simply “hang on” and “ride it out.” In the future, the company will do better and value will rise.

As a result we see that Growth Stall companies show a common valuation pattern. After achieving high valuation, their equity value stagnates. Then, hopes for a turn-around and recovery to new growth is stimulated by a few pieces of good news and the value jumps again. Only after a few years the short-term tactics are used up and the underlying business weakness is fully exposed. Then value crumbles, frequently faster than remaining investors anticipated.

McDonald’s valuation rose from $62/share in 2008 to reach record $100/share highs in 2011. But valuation then stagnated. It is only this last jump that has caused it to reach new highs. But realize, this is on a smaller number of stores, fewer products and declining revenues. These are not factors justifying sustainable value improvement.

Microsoft traded around $25/share from March, 2003 through November, 2011 – 8.5 years. When the CEO was changed value jumped to $48/share by October, 2014. After dipping, now, a year later Microsoft stock is again reaching that previous valuation ($50/share). Microsoft is now valued where it was in December, 2002 (which is half its all-time high.)

The jump in value of McDonald’s and Microsoft happened on short-term news regarding beating analysts earnings expectations for one quarter. The underlying businesses, however, are still suffering declining revenue. They remain in Growth Stalls, and the odds are overwhelming that their values will decline, rather than continue increasing.

by Adam Hartung | Oct 16, 2015 | Current Affairs, Defend & Extend, In the Swamp, Lifecycle

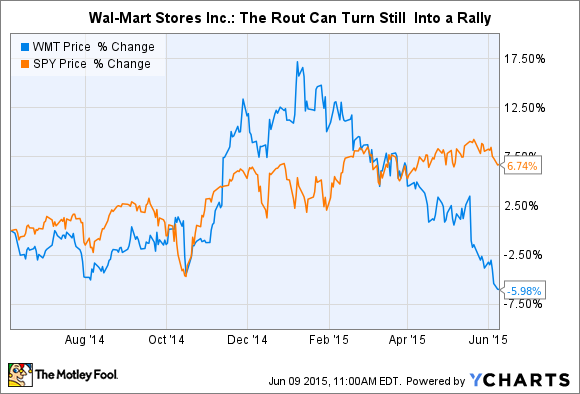

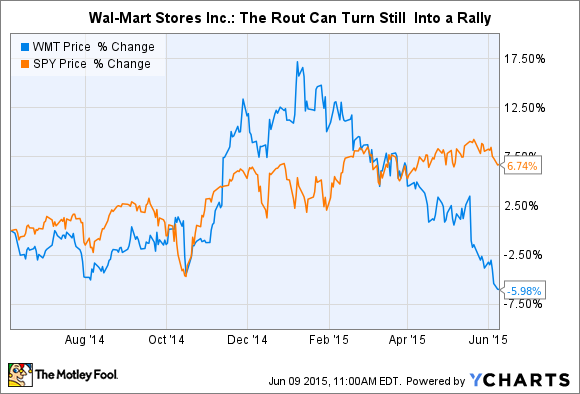

Wal-Mart market value took a huge drop on Wednesday. In fact, the worst valuation decline in its history. That decline continued on Thursday. Since the beginning of 2015 Wal-Mart has lost 1/3 of its value. That is an enormous ouch.

But, if you were surprised, you should not have been. The telltale signs that this was going to happen have been there for years. Like most stock market moves, this one just happened really fast. The “herd behavior” of investors means that most people don’t move until some event happens, and then everyone moves at once carrying out the implications of a sea change in thinking about a company’s future.

But, if you were surprised, you should not have been. The telltale signs that this was going to happen have been there for years. Like most stock market moves, this one just happened really fast. The “herd behavior” of investors means that most people don’t move until some event happens, and then everyone moves at once carrying out the implications of a sea change in thinking about a company’s future.

All the way back in October, 2010 I wrote about “The Wal-Mart Disease.” This is the disease of constantly focusing on improving your “core” business, while market shifts around you increasingly make that “core” less relevant, and less valuable. In the case of Wal-Mart I pointed out that an absolute maniacal focus on retail stores and low-cost operations, in an effort to be the low price retailer, was being made obsolete by on-line retailers who had costs that are a fraction of Wal-Mart’s expensive real estate and armies of employees.

At that time WMT was about $54/share. I recommended nobody own the stock.

In May, 2011 I reiterated this problem at Wal-Mart in a column that paralleled the retailer with software giant Microsoft, and pointed out that because of financial machinations not all earnings are equal. I continued to say that this disease would cripple Wal-Mart. Six months had passed, and the stock was about $55.

By February, 2012 I pointed out that the big reorganization at Wal-Mart was akin to re-arranging deck chairs on a sinking ship and said nobody should own the stock. It was up, however, trading at $61.

At the end of April, 2012 the Wal-Mart Mexican bribery scandal made the press, and I warned investors that this was a telltale sign of a company scrambling to make its numbers – and pushing the ethical (if not legal) envelope in trying to defend and extend its worn out success formula. The stock was $59.

Then in July, 2014 a lawsuit was filed after an overworked Wal-Mart truck driver ran into a car killing James McNair and seriously injuring comedian Tracy Morgan. Again, I pointed out that this was a telltale sign of an organization stretching to try and make money out of a business model that was losing its ability to sustain profits. Market shifts were making it ever harder to keep up with emerging on-line competitors, and accidents like this were visible cracks in the business model. But the stock was now $77. Most investors focused on short-term numbers rather than the telltale signs of distress.

In January, 2015 I pointed out that retail sales were actually down 1% for December, 2014. But Amazon.com had grown considerably. The telltale indication of a rotting traditional retail brick-and-mortar approach was showing itself clearly. Wal-Mart was hitting all time highs of around $87, but I reiterated my recommendation that investors escape the stock.

By July, 2015 we learned that the market cap of Amazon now exceeded that of Wal-Mart. Traditional retail struggles were apparent on several fronts, while on-line growth remained strong. Bigger was not better in the case of Wal-Mart vs. Amazon, because bigger blinded Wal-Mart to the absolute necessity for changing its business model. The stock had fallen back to $72.

Now Wal-Mart is back to $60/share. Where it was in January, 2012 and only 10% higher than when I first said to avoid the stock in 2010. Five years up, then down the roller coaster.

From October of 2010 through January, 2015 I looked dead wrong on Wal-Mart. And the folks who commented on my columns here at this journal and on my web site, or emailed me, were profuse in pointing out that my warnings seemed misguided. Wal-Mart was huge, it was strong and it would dominate was the feedback.

But I kept reiterating the point that long-term investors must look beyond short-term reported sales and earnings. Those numbers are subject to considerable manipulation by management. Further, short-term operating actions, like shorter hours, lower pay, reduced benefits, layoffs and gouging suppliers can all prop up short-term financials at the expense of recognizing the devaluation of the company’s long-term strategy.

Investors buy and hold. They hold until they see telltale signs of a company not adjusting to market shifts. Short-term traders will say you could have bought in 2010, or 2012, and held into 2014, and then jumped out and made a profit. But, who really can do that with forethought? Market timing is a fools game. The herd will always stay too long, then run out too late. Timers get trampled in the stampede more often than book gains.

In this week’s announcement Wal-Mart executives provided more telltale signs of their problems, and the fact that they don’t know how to fix them, and therefore won’t.

- Wal-Mart is going to spend $20B to buy back stock in order to prop up the price. This is the most obvious sign of a company that doesn’t know how to keep up its valuation by growing profits.

- Wal-Mart will spend $11B on sprucing up and opening stores. Really. The demand for retail space has been declining at 4-6%/year for a decade, and retail business growth is all on-line, yet Wal-Mart is still massively investing in its old “core” business.

- Wal-Mart will spend $1.1B on e-commerce. That is the proverbial “drop in the competitors bucket.” Amazon.com alone spent $8.9B in 2014 growing its on-line business.

- Wal-Mart admits profits will decline in the next year. It is planning for a growth stall. Yet, we know that statistically only 7% of companies that have a growth stall ever go on to maintain a consistent growth rate of a mere 2%. In other words, Wal-Mart is projecting the classic “hockey stick” forecast. And investors are to believe it?

The telltale signs of an obsolete business model have been present at Wal-Mart for years, and continue.

In 2003 Sears Holdings was $25/share. In 2004 Sears bought K-Mart, and the stock was $40. I said don’t go near it, as all the signs were bad and the merger was ill-conceived. Despite revenue declines, consistent losses, a revolving door at the executive offices and no sign of any plan to transform the battered, outdated retail giant against growing on-line competition investors believed in CEO Ed Lampert and bid the stock up to $77 in early 2011. (I consistently pointed out the telltale signs of trouble and recommended selling the stock.)

By the end of 2012 it was clear Sears was irrelevant to holiday shoppers, and the stock was trading again at $40. Now, SHLD is $25 – where it was 12 years ago when Mr. Lampert started his machinations. Again, only a market timer could have made money in this company. For long-term investors, the signs were all there that this was not a place to put your money if you want to have capital growth for retirement.

There will be plenty who will call Wal-Mart a “value” stock and recommend investors “buy on weakness.” But Wal-Mart is no value. It is becoming obsolete, irrelevant – increasingly looking like Sears. The likelihood of Wal-Mart falling to $20 (where it was at the beginning of 1998 before it made an 18 month run to $50 more than doubling its value) is far higher than ever trading anywhere near its 2015 highs.

by Adam Hartung | Sep 11, 2015 | Current Affairs, Defend & Extend, In the Swamp, Leadership

Jeff Smisek, CEO of United Continental Holdings, was fired this week. It appears he was making deals with public officials (specifically the Chairman of the Port Authority of New York and New Jersey) to keep personally favored flights of politicians in the air, even when unprofitable, in a quid-pro-quo exchange for government subsidies to move a taxiway and better airport transit.

Wow, horse-trading of the kind that put the governor of Illinois in the penitentiary.

But you have to ask yourself, couldn’t you see it coming? Or are we just so used to lousy leadership that we think there’s no end to it?

But you have to ask yourself, couldn’t you see it coming? Or are we just so used to lousy leadership that we think there’s no end to it?

United has been beset with a number of problems. Since Mr. Smisek organized the merger of Continental (his former employer) with United, creating the world’s largest airline at the time, things have not gone well. Since announcing the merger in 2010, more has gone wrong than right at United:

The merged airline didn’t start in a great position. It was in 2009 that a budding musician watched United baggage handlers destroy his guitar, leading to a series of videos on bad customer service that took to the top of YouTube and iTunes and his book on the culture of customer abuse at United underscored a major PR nightmare.

How could things seem to constantly become worse? It was clear that at the top, United’s leadership cared only about cost control (ironically code named Project Quality.) Operational efficiency was seen as the only strategy, and it did not matter how much this strategy disaffected employees, suppliers or customers. In 2013 United ranked dead last in the quality ranking of all airlines by Wichita State University, and the airline replied by saying it really didn’t care.

The power of thinking that if you focus on pennies and nickels the quarters and dollars will take care of themselves is strong. It encourages you be very focused on details, even myopic, and operate your business very narrowly. And it can set you up to make really dumb mistakes, like possibly trading airline flights for construction subsidies.

Focus, focus, focus often leads to being blind, blind, blind to the world around you.

There were ample signs of all the things going wrong at United, and the need for a change. The open question is why it took a criminal investigation into bribing government officials for the airline’s Board to fire the CEO? Bad performance apparently didn’t matter? Do you have to be an accused lawbreaker to be shown the door?

The story broke in February, so the Board has had a few months to find a replacement CEO. Mr. Oscar Munoz will now take the reigns. But one has to wonder if he is up for the challenges. As a former railroad President, his world of relationships was much smaller than the millions of customers and 84,000 employees at United.

United’s top brass has a serious need “to get over itself.” United’s internal focus, driven by costs, has disenfranchised its brand embassadors, its customer base, and many industry analysts.

United needs to become a lot clearer about what customers really need and want. Years of overly simplistic “all customers care about is price” has commoditized United’s approach to air travel. Customers have been smart enough to see through lower seat prices, only to be stuck with seat assignment and baggage fees raising total trip cost. And charging for everything on the plane, including cheesy TV shows, has customers wondering just how far from Spirit Airlines’ approach United would drift before someone reminded leadership what their customers want and why they used to choose United.

Unfortunately, it is a bit unsettling that CEO Munoz said his first action will be to take 90 days “traveling the system and listening and talking to our people and working with our management team.” Sounds like a lot more internal focus. Spending more time talking to customers at United’s hubs, and seeing how they are treated from check-in to baggage, might do him a lot more good.

United became big via acquisition. That is much different than building an airline, like say Southwest did. Growth via purchase is not the same as growth via loyal customers and an attractive brand proposition. United has clearly lost its way. It has a lot of problems to solve, but first among them should be understanding what customers want. Then designing the model to profitably deliver it.

by Adam Hartung | Aug 2, 2015 | Current Affairs, In the Rapids, In the Swamp, Leadership, Web/Tech

eBay was once a game changer. When the internet was very young, and few businesses provided ecommerce, eBay was a pioneer. From humble beginnings selling Pez dispensers, eBay grew into a powerhouse. Things we used to sell via garage sale we could now list on eBay. Small businesses could create stores on eBay to sell goods to customers they otherwise would never reach. And collectors as well as designers suddenly discovered all kinds of products they formerly could not find. eBay sales exploded, as traditional retail started it slide downward.

To augment growth eBay realized those selling needed a simple way to collect money from people who lacked a credit card. Many customers simply had no card, or didn’t trust giving out the information across the web. So eBay bought fledgling PayPal for $1.5B in 2002, in order to grease the wheels for faster ecommerce growth. And it worked marvelously.

But times have surely changed. Now eBay and Paypal have roughly the same revenue. About $8B/year each. eBay has run into stiff competition, as CraigsList has grown to take over the “garage sale” and small local business ecommerce. Simultaneously, powerhouse Amazon has developed its storefront business to a level of sophistication, and ease of use, that makes it viable for businesses from smallest to largest to sell products on-line. And far more companies have learned they can go it alone with internet sales, using search engine optimization (SEO) techniques as well as social media to drive traffic directly to their stores, bypassing storefronts entirely.

eBay was a game changer, but now is stuck in practices that have become far less relevant. The result has been 2 consecutive quarters of declining revenue. By definition that puts eBay in a growth stall, and fewer than 7% of companies ever recover from a growth stall to consistently increase revenue by a mere 2%/year. Why not? Because once in a growth stall the company has already missed the market shift, and competition is taking customers quickly in new directions. The old leader, like eBay, keeps setting aggressive targets for its business, and tells everyone it will find new customers in remote geographies or vertical markets. But it almost never happens – because the market shift is making their offering obsolete.

eBay was a game changer, but now is stuck in practices that have become far less relevant. The result has been 2 consecutive quarters of declining revenue. By definition that puts eBay in a growth stall, and fewer than 7% of companies ever recover from a growth stall to consistently increase revenue by a mere 2%/year. Why not? Because once in a growth stall the company has already missed the market shift, and competition is taking customers quickly in new directions. The old leader, like eBay, keeps setting aggressive targets for its business, and tells everyone it will find new customers in remote geographies or vertical markets. But it almost never happens – because the market shift is making their offering obsolete.

On the other hand, Paypal has blossomed into a game changer in its own right. Not only does it support cash and credit card transactions for the growing legions of on-line shoppers, but it is providing full payment systems for providers like Uber and AirBnB. It’s tools support enterprise transactions in all currencies, including emerging bitcoin, and even provides international financial transactions as well as working capital for businesses.

Paypal is increasingly becoming a threat to traditional banks. Today most folks use a bank for depositing a pay check, and making payments. There are loans, but frequently that is shopped around irrespective of where you bank. Much like your credit cards, which most people acquire for their benefits rather than a relationship with the issuing bank. If customers increasingly make payments via Paypal, and borrow money via operations like Quicken Loans (a division of Intuit,) why do you need a bank? Discover Services, which now does offer cash deposits and loans on top of credit card services, has found that it can grow substantially by displacing traditional banks.

Paypal is today at the forefront of digital payments processing. It is a fast growing market, which will displace many traditional banks. And emerging competitors like Apple Pay and Google Wallet will surely change the market further – while aiding its growth. How it will shake out is unclear. But it is clear that Paypal is growing its revenue at 60% or greater since 2012, and at over 100%/quarter the last 2 quarters.

Paypal is now valued at about $47B. That is roughly the same as the #5 bank in America (according to assets) Bank of New York Mellon, and number 8 massive credit card issuer Capital One, as well as #9 PNC Bank – and over 50% higher valuation than #10 State Street. It is also about 50% higher than Intuit and Discover. Based on its current market leadership and position as likely game changer for the banking sector, Paypall is selling for about 8 times revenue. If its revenue continues to grow at 100%/quarter, however, revenues will reach over $38B in a year making the Price/Revenue multiple of today only 1.25.

Meanwhile, eBay is valued at about $34B. Given that all which is left in eBay is an outdated on-line ecommerce conglomerator, stuck in a growth stall, that valuation is far harder to justify. It is selling at about 4.25x revenue. But if revenues continue declining, as they have for 2 consecutive quarters, this multiple will expand. And values will be harder and harder to justify as investors rely on hope of a turnaround.

eBay was a game changer. But leadership became complacent, and now it is very likely overvalued. Just as Yahoo became when its value relied on its holdings of Alibaba rather as its organic business shrank. Meanwhile Paypal is the leader in a rapidly growing market that is likely to change the face of not just how we pay, but how we do personal and business finance. There is no doubt which is more valuable today, and likely to be in the future.

by Adam Hartung | Jul 17, 2015 | Current Affairs, General, In the Swamp, Leadership, Lifecycle

Most analysts, and especially “chartists,” put a lot of emphasis on earnings per share (EPS) and stock price movements when determining whether to buy a stock. Unfortunately, these are not good predictors of company performance, and investors should beware.

Most analysts are focused on short-term, meaning quarter-to-quarter, performance. Their idea of long-term is looking back 1 year, comparing this quarter to same quarter last year. As a result, they fixate on how EPS has done, and will talk about whether improvements in EPS will cause the “multiple” (meaning stock price divided by EPS) will “expand.” They forecast stock price based upon future EPS times the industry multiple. If EPS is growing, they expect the stock to trade at the industry multple, or possibly somewhat better. Grow EPS, hope to grow the multiple, and project a higher valuation.

Analysts will also discuss the “momentum” (meaning direction and volume) of a stock. They look at charts, usually less than one year, and if price is going up they will say the momentum is good for a higher price. They determine the “strength of momentum” by looking at trading volume. Movements up or down on high volume are considered more meaningful than on low volume.

But, unfortunately, these indicators are purely short-term, and are easily manipulated so that they do not reflect the actual performance of the company.

At any given time, a CEO can decide to sell assets and use that cash to buy shares. For example, McDonald’s sold Chipotle and Boston Market. Then leadership took a big chunk of that money and repurchased company shares. That meant McDonalds took its two fastest growing, and highest value, assets and sold them for short-term cash. They traded growth for cash. Then leadership spent that cash to buy shares, rather than invest in in another growth vehicle.

This is where short-term manipulation happens. Say a company is earning $1,000 and has 1,000 shares outstanding, so its EPS is $1. The industry multiple is 10, so the share price is $10. The company sells assets for $1,000 (for purposes of this exercise, let’s assume the book value on those assets is $1,000 so there is no gain, no earnings impact and no tax impact.)

This is where short-term manipulation happens. Say a company is earning $1,000 and has 1,000 shares outstanding, so its EPS is $1. The industry multiple is 10, so the share price is $10. The company sells assets for $1,000 (for purposes of this exercise, let’s assume the book value on those assets is $1,000 so there is no gain, no earnings impact and no tax impact.)

Company leadership says its shares are undervalued, so to help out shareholders it will “return the money to shareholders via a share repurchase” (note, it is not giving money to shareholders, just buying shares. $1,000 buys 100 shares. The number of shares outstanding now falls to 900. Earnings are still $1,000 (flat, no gain,) but dividing $1,000 by 900 now creates an EPS of $1.11 – a greater than 10% gain! Using the same industry multiple, the analysts now say the stock is worth $1.11 x 10 = $11.10!

Even though the company is smaller, and has weaker growth prospects, somehow this “refocusing” of the company on its “core” business and cutting extraneous noise (and growth opportunities) has led to a price increase.

Worse, the company hires a very good investment banker to manage this share repurchase. The investment banker watches stock buys and sells, and any time he sees the stock starting to soften he jumps in and buys some shares, so that momentum remains strong. As time goes by, and the repurchase program is not completed, selectively he will make large purchases on light trading days, thus adding to the stock’s price momentum.

The analysts look at these momentum indicators, now driven by the share repurchase program, and deem the momentum to be strong. “Investors love the stock” the analysts say (even though the marginal investors making the momentum strong are really company management) and start recommending to investors they should anticipate this company achieving a multiple of 11 based on earnings and stock momentum. The price now goes to $1.11 x 11 = $12.21.

Yet the underlying company is no stronger. In fact one could make the case it is weaker. But, due to the higher EPS, better multiple and higher share price the CEO and her team are rewarded with outsized multi-million dollar bonuses.

But, companies the last several years did not even have to sell assets to undertake this kind of manipulation. They could just spend cash from earnings. Earnings have been at record highs, and growing, for several years. Yet most company leaders have not reinvested those earnings in plant, equipment or even people to drive further growth. Instead they have built huge cash hoards, and then spent that cash on share buybacks – creating the EPS/Multiple expansion – and higher valuations – described above.

This has been so successful that in the last quarter untethered corporations have spent $238B on buybacks, while earning only $228B. The short-term benefits are like corporate crack, and companies are spending all the money they have on buybacks rather than reinvesting in growth.

Where does the extra money originate? Many companies have borrowed money to undertake buybacks. Corporate interest rates have been at generational (if not multi-generational) lows for several years. Interest rates were kept low by the Federal Reserve hoping to spur borrowing and reinvestment in new products, plant, etc to drive economic growth, more jobs and higher wages. The goal was to encourage companies to take on more debt, and its associated risk, in order to generate higher future revenues.

Many companies have chosen to borrow money, but rather than investing in growth projects they have bought shares. They borrow money at 2-3%, then buy shares – which can have a much higher immediate impact on valuation – and drive up executive compensation.

This has been wildly prevalent. Since the Fed started its low-interest policy it has added $2.37trillion in cash to the economy. Corporate buybacks have totaled $2.41trillion.

This is why a company can actually have a crummy business, and look ill-positioned for the future, yet have growing EPS and stock price. For example, McDonald’s has gone through rounds of store closures since 2005, sold major assets, now has more stores closing than opening, and has its largest franchisees despondent over future prospects. Yet, the stock has tripled since 2005! Leadership has greatly weakened the company, put it into a growth stall (since 2012,) and yet its value has gone up!

Microsoft has seen its “core” PC market shrink, had terrible new product launches of Vista and Windows 8, wholly failed to succeed with a successful mobile device, written off billions in failed acquisitions, and consistently lost money in its gaming division. Yet, in the last 10 years it has seen EPS grow and its share price double through the power of share buybacks from its enormous cash hoard and ability to grow debt. While it is undoubtedly true that 10 years ago Microsoft was far stronger, as a PC monopolist, than it is today – its value today is now higher.

Share buybacks can go on for several years. Especially in big companies. But they add no value to a company, and if not exceeded by re-investments in growth markets they weaken the company. Long term a company’s value will relate to its ability to grow revenues, and real profits. If a company does not have a viable, competitive business model with real revenue growth prospects, it cannot survive.

Look no further than HP, which has had massive buybacks but is today worth only what it was worth 10 years ago as it prepares to split. Or Sears Holdings which is now worth 15% of its value a decade ago. Short term manipulative actions can fool any investor, and actually artificially keep stock prices high, so make sure you understand the long-term revenue trends, and prospects, of any investment. Regardless of analyst recommendations.

United’s leadership is certainly in a tough place. The airline consistently ranks near the bottom in customer satisfaction, and on-time performance. It has struggled for years with labor strife, and the mechanics union just rejected their proposed contract – again. The flight attendant’s union has been in mediation for months. And few companies have had more consistently bad public relations, as customers have loudly complained about how they are treated – including one fellow making a music and speaking career out of how he was abused by United personnel for months after they destroyed his guitar.

United’s leadership is certainly in a tough place. The airline consistently ranks near the bottom in customer satisfaction, and on-time performance. It has struggled for years with labor strife, and the mechanics union just rejected their proposed contract – again. The flight attendant’s union has been in mediation for months. And few companies have had more consistently bad public relations, as customers have loudly complained about how they are treated – including one fellow making a music and speaking career out of how he was abused by United personnel for months after they destroyed his guitar.

1 –

1 –