by Adam Hartung | May 7, 2021 | Growth Stall, Innovation, Investing, Strategy, Telecom, Trends

Do you have any idea how powerful AOL and Yahoo once were, and how much they were once worth? Do you know how much shareholder value has been destroyed in these 2 companies in just 20 years? $221 Billion of destroyed wealth.

AOL pioneered the web as we know it today. Long before wireless, or broadband, there was “dial up service.” For young readers, that meant using a physical modem to connect your computer to a land-line telephone in order to literally dial up a connection to an internet service provider. AOL pioneered using the internet, and was the #1 connection with almost the entire marketplace. The phrase that made AOL famous back then was when you connected to AOL and it gave us the now iconic “You’ve got mail.” After connecting America, in 2000 AOL merged with Time Warner media in a deal valuing AOL at $111B.

Yahoo pioneered giving internet users news. It accumulated news from around the world on Sports, Economy and many other topics, making the news available to readers for free because it sold ads to pay the bills. In 2000 a publicly traded Yahoo was valued at $125B.

So in 2000, amidst a very extended NASDAQ internet hype, AOL and Yahoo were valued at $226B.

Image Source

This week Verizon agreed to sell the two companies to a private equity firm for $5B. That’s a loss in value of $221B in 21 years.

How does a loss of this magnitude happen? A lot of focusing on tactics, ignoring market trends and failing to adapt the company strategy to meet changing competitive dynamics. Broadband and wireless eventually made dial-up irrelevant. And despite buying some media company to try and add new content to AOL, it lost all meaning. Time Warner spun it out to the public at a value of $3.5B in 2009.

Then, Verizon thought it could build a proprietary content company to get more Verizon customers so it bought AOL in 2015 for $4.4B. Only, nobody needed another content provider by then. Google served up general content just fine, Facebook gave us content we looked at frequently, and specialized content sites like Finance (Marketwatch) and Sports (ESPN) made it impossible that late in the game to launch a general purpose content accumulator and reposter. It was a strategy for 2005, not 2015. Meanwhile, Yahoo made one tactical decision after another to shore up its old model that didn’t work. Google became vastly better at search, and vastly better at delivering content. Tactical oriented CEOs Carol Bartz and Marissa Mayer had no strategy to meet emerging needs of the 2010 decade and beyond – leading Yahoo into complete irrelevancy.

Undeterred, the Verizon owned AOL bought Yahoo in 2017 for $4.5B. After all, it seemed cheap compared to its once $125B value – right? The idea was to merge the two companies, create “cost synergies” and “scale” in users to sell more advertising. Only, neither platform had enough original content to stop the user bleed to other sites. Netflix and Google’s YouTube took everyone who wanted new content away, and there was nothing left for AOL/Yahoo to deliver. It became the internal combustion engine repair shop in a world full of EVs

Now, after spending $9.9B on the entities plus much more in acquisitions, Verizon is selling both entities to Apollo Global Management private equity for $5B – a loss of $4.4B. And Apollo thinks this is a good deal because “a high tide raises all boats” and it will win merely because the world is increasingly using the internet. Really? More people are using the web, and more often, but they’ve already shown not via AOL nor Yahoo. Facebook, Instagram, Google, Pinterest, Twitter, and a raft of other sites are gaining the traffic. What was once irrelevant remains irrelevant.

It is crucial to understand why these to GIANTS of the internet are now part of history’s dustbin. While they pioneered the market, gaining huge revenues, share and valuation, they did NOT keep their eyes on disruptive innovators who could change the market they pioneered. Broadband killed dial-up, and because AOL moved too late it died. Google overtook search, delivering more content faster and better, and Yahoo simply waited too long to react. Not unlike how Research in Motion (Blackberry) failed to see the “app wave” in mobile coming and lost its enormous lead in mobile phones to Apple and Samsung. All thought their strength in pioneering was enough – and failed to keep their eyes on external trends and new market shifts that would change competition.

I wrote a raft of columns about the mistakes made by these company CEOs from 2009 through 2017 – constantly telling readers not to buy the stocks (just search the blogs my website adamhartung.com for AOL or Yahoo.) It is extremely rare for a corporation locked into its business model and cost cutting to adjust to a rapidly shifting market. When a company does so – like Jobs turned around Apple and Nadella at Microsoft – it is the exception to be well applauded. But that is very, very rare.

And this is NOT what PE companies do. They aren’t visionary investors who put in lots of money to change companies. They cut costs, streamline operations, and add debt to get their investment back. Apollo is no different. It has no vision of the internet future that will slow Facebook, Apple, Netflix, Alphabet/Google or even Amazon. It has purchased two irrelevant brands with outdated business models, no new technology, no new market approaches and no new insight to future unmet needs. There is no doubt Apollo will not turn these around. Apollo will unload this newest Yahoo! over-leveraged to a public debt market dominated by pension funds and it will soon enough file bankruptcy, finishing the coffin.

Do you think you could turn these around? First, are you ready to turn around your own business? Are you focused on how market shifts, happening today, will change your market? Are you seeing trends, and changing your business model and technology to adjust? Are you building a business around future scenarios you’ve created to compete in 2025 and beyond with different competitors offering different solutions? Or are you relying on past strengths to carry you through the future? If you’re planning with your eyes firmly in the rear view mirror I highly recommend you learn the lesson from AOL and Yahoo – that approach will not work.

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jan 29, 2021 | Growth Stall, Innovation, Investing, Strategy, Trends

On Friday, January 22, 2021 IBM announced sales and earnings results. Revenues had fallen 6.5%. The stock dropped 11%. IBM alone caused an otherwise up Dow Jones Industrial Average to decline. And, as the NASDAQ rose, largely due to tech stock improvement, IBM was the lone loser. The new CEO, in his role only 1 quarter, predictably asked for more time and investor confidence that the future would look better than the past. Investors justifiably lost confidence a long time ago.

Unfortunately, IBM’s recent performance was just a continuation of its long-term trend. Since 2000, IBM stock has gone nowhere – up a mere 5.7% in 21 years – while Apple (for example) is up some 14,000%. IBM was the 7th largest company on the S&P500 in 1976 when Apple was born. Now Apple’s revenues are 3x IBM’s, and its market capitalization is 20x higher!

A lot of blame must be laid on the former CEO, Virginia (Ginny) Rometty.  CEO from 2012 to end of 2020, she took home pay of around $35M/year. But during her tenure IBM sales fell in 30 of 34 quarters! Starting shortly after being appointed, IBM suffered 20 consecutive quarters of declining revenues – a remarkably infamous achievement for any CEO!

CEO from 2012 to end of 2020, she took home pay of around $35M/year. But during her tenure IBM sales fell in 30 of 34 quarters! Starting shortly after being appointed, IBM suffered 20 consecutive quarters of declining revenues – a remarkably infamous achievement for any CEO!

In 2012, just as Rometty was settling into her new desk, I said Steve Ballmer was the worst CEO in America (link 1). Little did I know he would be replaced with a new CEO that would turn around Microsoft and save the company, while Rometty would replace Ballmer as absolutely the worst CEO in the tech world – and tie herself with Immelt of GE as the worst CEO in all of America.

By 2014, it was clear that Rometty was altogether wrong as CEO, and I told investors to avoid IBM altogether. In 2 years, revenues had begun their declining trend, and she was constantly on the defensive. Instead of investing in cloud computing and other emerging technology solutions, Rometty was selling IBM’s business in China (because we all know that China was not a growth market – except someone forget to tell Apple and Facebook,) and the PC business. Simultaneously Rometty was cutting R&D spending. And she took on more debt. Where was all the money going? Not into growth investments – but rather into stock buybacks where IBM had become the poster child for financial machinations and share manipulation in order to enhance executive bonuses.

Despite IBM bragging about its one-off supercomputers and interesting artificial intelligence uses, there were no new commercial products helping customers build out trends. So IBM partnered with Apple to build “enterprise apps” in iOS in late 2014. This was doomed. IBM brought nothing to this game. IBM was now wholesale saying its development would be on platforms driving revenue growth for Apple – not IBM. IBM was admitting it had a lot of resources (still) and customers, but no idea where the marketplace was headed. So IBM would help Apple grow its user base. This was great for Apple, bad for Microsoft Surface sales, but absolutely horrible for IBM.

So by 2017, IBM was in an irrecoverable Growth Stall. Twenty quarters into the job, and twenty quarters of declining sales meant IBM was in a Growth Stall which predicted a horrible future. But despite the horrific sales and earnings performance, and the resulting horrific stock performance which in no way kept up with the overall market or industry leaders, Rometty was being granted ever more compensation by a ridiculously out of touch Board of Directors. She was being rewarded for manipulating the financials, not running a good business. She clearly needed to be fired. I said so, and told investors not to expect any gains as IBM continued to shrink.

By 2018, even the most long-term of long-term investors, Warren Buffet of Berkshire Hathaway, had given up on Rometty and IBM. As I said then the writing was on the wall by 2014, so why it took him so long was hard to understand. But it was quite clear, falling revenues would lead to lower valuations, regardless how much effort CEO Rometty put into “managing earnings.” The big shock was it took the Board 2 more years to finally get rid of her — one of the 2 worst performing CEOs in American’ capitalism.

Why do I bring up all these old blogs of mine? First, to demonstrate that it IS possible to make accurate business predictions. It is straightforward, once the key trends are identified, to see what companies are building out trends, and which are not. Those who ignore trends are doomed to do poorly, and you don’t want to own their stock. If you are running your business looking internally, and thinking about how to squeeze out a few more dimes of cost you are NOT doing the right thing. You must look externally and build on trends to GROW YOUR REVENUE!

2nd, I have long preached that the #1 indicator of companies that are likely to succeed or fail lies in charting revenue growth. If revenues aren’t growing at 8-10%/year, then as an investor or company leader you need to worry. The company isn’t keeping up with inflation and general economic activity. Too few CEOs (and investors) pay enough attention to revenues. They are happy with lackluster sales while paying too much attention to expenses and managing earnings. That is never a winning strategy. If you don’t grow revenues you can’t grow cash.

3rd, you must consistently invest in innovation and new solutions that build on trends. All solutions become obsolete over time. It is imperative to constantly invest in new products, new offerings, that build on trends in order to keep revenues flowing your way. No company can succeed long unless it invests in innovation to keep itself current, and relevant with customers.

Along with Steve Ballmer and Jeffrey Immelt, Virginia Rometty will go down in history as one of the worst CEOs of this era. Like Immelt’s crushing of GE, Rometty led the demise of the once mighty IBM. You can do better. Keep your eyes on trends, focus on revenues and never stop innovating.

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jul 11, 2018 | Computing, Growth Stall, Innovation, Investing, Software

The last few quarters sales growth has not been as good for Apple as it once was. The iPhone X didn’t sell as fast as they hoped, and while the Apple Watch outsells the entire Swiss watch industry it does not generate the volumes of an iPhone. And other new products like Apple Pay and iBeacon just have not taken off.

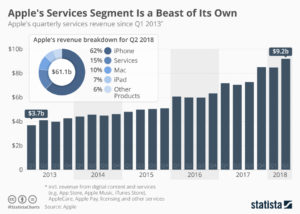

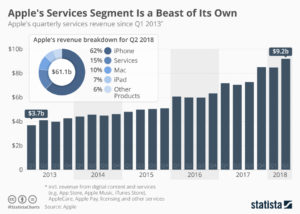

Amidst this slowness, the big winner has been “Apple Services” revenue. This is largely sales of music, videos and apps from iTunes and the App store. In Q2, 2018 revenues reached $9.2B, 15% of total revenues and second only to iPhone sales. Although Apple does not have a majority of smartphone users, the user base it has spends a lot of money on things for Apple devices. A lot of money.

In a bit of “get them the razor so they will buy the razor blades” CEO Tim Cook’s Apple is increasingly relying upon farming the “installed base” of users to drive additional revenues. Leveraging the “installed base” of users is now THE primary theme for growing Apple sales. And even old-tech guys like Warren Buffett at Berkshire Hathaway love it, as they gobble up Apple shares. As do many analysts, and investors. Apple has paid out over $100B to developers for its services, and generated over $40B in revenues for itself – and with such a large base willing to buy things developers are likely to keep providing more products and working to grow sales.

In a bit of “get them the razor so they will buy the razor blades” CEO Tim Cook’s Apple is increasingly relying upon farming the “installed base” of users to drive additional revenues. Leveraging the “installed base” of users is now THE primary theme for growing Apple sales. And even old-tech guys like Warren Buffett at Berkshire Hathaway love it, as they gobble up Apple shares. As do many analysts, and investors. Apple has paid out over $100B to developers for its services, and generated over $40B in revenues for itself – and with such a large base willing to buy things developers are likely to keep providing more products and working to grow sales.

But the risks here should not be taken lightly. At one time Apple’s Macintosh was the #1 selling PC. But it was “closed” and required users buy their applications from Apple. Microsoft offered its “open architecture” and suddenly lots of new applications were available for PCs, which were also cheaper than Macs. Over a few years that “installed base” strategy backfired for Apple as PC sales exploded and Mac sales shrank until it became a niche product with under 10% market share.

Today, Android phones are the #1 smartphone market share platform, and Android devices (like the PC) are much cheaper. Even cheaper are Chinese made products. Although there are problems, the risk exists that someday apps, etc for Android and/or other platforms could become more standard and the larger Android base could “flip” the market.

The history of companies relying on an installed base to grow their company has not gone well. Going back 30 years, AM Multigraphics an ABDick sold small printing presses to schools, government agencies and businesses. After the equipment sale these companies made most of their growth on the printing supplies these presses used. But competitors whacked away at those sales, and eventually new technologies displaced the small presses. The installed base shrank, and both companies disappeared.

Xerox would literally give companies a copier if they would just pay a “per click” charge for service on the machine, and use Xerox toner. Xerox grew like the proverbial weed. Their service and toner revenue built the company. But then people started using much cheaper copiers they could buy, and supply with cheaper consumables. And desktop publishing solutions caused copier use to decline. So much for Xerox growth – and the company rapidly lost relevance. Now Xerox is on the verge of disappearing into Fuji.

HP loved to sell customers cheap ink-jet printer so they bought the ink. But now images are mostly transferred as .jpg, .png or .pdf files and not printed at all. The installed base of HP printers drove growth, until the need for any printing started disappearing.

The point? It is very risky to rely on your installed platform base for your growth. Why? Because competitors with cheaper platforms can come along and offer cheaper consumables, making your expensive platform hard to keep forefront in the market. That’s the classic “innovator’s dilemma” – someone comes along with a less-good solution but it’s cheaper and people say “that’s good enough” thus switching to the cheaper platform. This leaves the innovator stuck trying to defend their expensive platform and aftermarket sales as the market switches to ever better, cheaper solutions.

It’s great that Apple is milking its installed base. That’s smart. But it is not a viable long-term strategy. That base will, someday, be overtaken by a competitor or a new technology. Like, maybe, smart speakers. They are becoming ubiquitous. Yes, today Siri is the #1 voice assistant. But as Echo and Google speaker sales proliferate, can they do to smartphones what smartphones did to PCs? What if one of these companies cooperates with Microsoft to incorporate Cortana, and link everything on the network into the Windows infrastructure? If these scenarios prevail, Apple could/will be in big trouble.

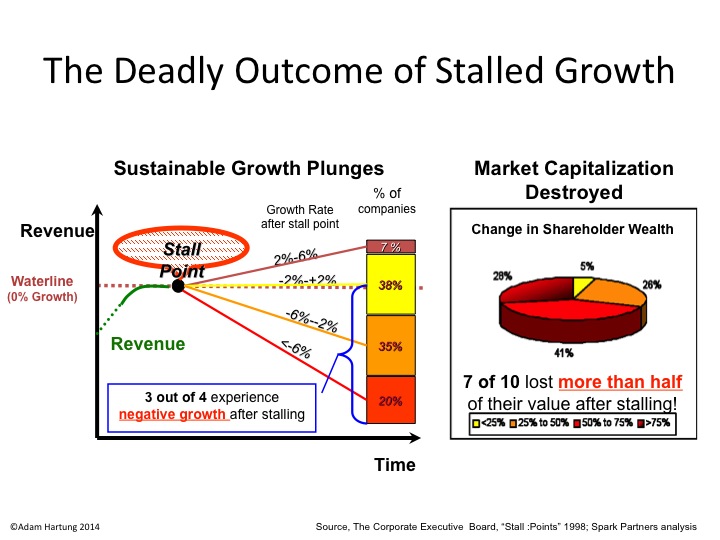

I pointed out in October, 2016 that Apple hit a Growth Stall. When that happens, maintaining 2% growth long-term happens only 7% of the time. I warned investors to be wary of Apple. Why? Because a Growth Stall is an early indicator of an innovation gap developing between the company’s products and emerging products. In this case, it could be a gap between ever enhanced (beyond user needs) mobile devices and really cheap voice activated assistant devices in homes, cars, offices, everywhere. Apple can milk that installed base for a goodly while, but eventually it needs “the next big thing” if it is going to continue being a long-term winner.

by Adam Hartung | Jun 20, 2018 | Boards of Directors, Growth Stall, Investing, Manufacturing, Strategy

An American epoch has ended. General Electric was part of the first ever Dow Jones Index in 1896. When the Dow Jones Industrial Average was formed in 1907 GE was a participant. GE has been the only company to remain on the index. All other original companies long ago completely disappeared.

GE did so well because its leadership had been able to constantly change the company to keep it relevant, and growing. During the century prior to hiring Jeff Immelt as CEO GE went from light bulbs to generating electricity and making all kinds of electrical infrastructure equipment, electric locomotives, mainframe computers, medical equipment, computer services, financial services, entertainment…. The list is very long.

Although not all GE CEOs were great, the Board was able to place CEOs in office who could sense market shifts and make good decisions. GE leadership thoughtfully analyzed markets, and made investment decisions to sell businesses that were not growing. And they made investment decisions to invest in trends which created growth. One of the best of these was Jack Welch, who developed the nickname “Neutron Jack” for his willingness to jettison businesses that were not growing and leading their industry, while willingly investing in entirely new growth markets where trends showed high rates of return like financial services and entertainment – wildly “non-industrial” markets.

But CEO Immelt was completely tone-deaf to the outside world. He was wholly unable to understand how to lead a team that could make good investments. Instead under Immelt’s leadership GE over-invested in historical products where they were losing advantage but trying to “keep up.” Selling businesses that were growing but faced stiff competition, rather than investing in growth. And refusing to invest in new external growth opportunities that could keep revenues increasing – and drive a higher GE market capitalization.

All the way back in 2009 I pointed out that GE was in a Growth Stall, and had only a 7% chance of consistently growing at 2%. I warned investors. At the time I said GE had to go all-out on a growth strategy, or things would turn ugly. But a lot of investors, employees – and apparently the Board of Directors – were ready to blame the Growth Stall on the economy. And blame it on Welch, who had been gone for 8 years. And say GE was lucky Immelt saved the company from bankruptcy with a loan from Warren Buffett’s Berkshire Hathaway.

Say what? Saved the company? Why did Immelt, and the Board, let GE get into such terrible shape? It was time to replace the CEO, not double down on his failed strategy.

Six years ago, May, 2012, I published in Forbes “5 CEOs that Should Have Already Been Fired.” At the time I said Immelt was the 4th worst CEO in America. I cited the 2009 column, and pointed out things really weren’t any better in 2012 than in 2009. That column had well over 1million reads. There was no way GE’s board was not aware of the column, and the realization that Immelt was a horrible CEO.

The Board of #3 (Walmart) fired Mike Duke. And the Board of #1 (Microsoft) fired Steve Ballmer. There is no real board at #2 Sears (which will file bankruptcy soon enough) because the CEO is also the largest shareholder (via his hedge fund) and he controls all board decisions. He should have fired himself, but had too much ego. But the board of GE – well it did nothing. Even though GE almost went bankrupt under Immelt, and its value was being destroyed quarter after quarter it left him in place.

I revisited the performance of these five CEOs and their companies in August, 2014 and reminded hundreds of thousands of readers – which I’m sure included GE’s Board of Directors – that company revenues had declined every year since 2009. And this string of failures had caused the company’s value to decline by 2/3. Yet, the board did nothing to replace this horrific CEO.

By March, 2017 I was so exasperated I finally titled my column “GE Needs a New Strategy and a New CEO.” Again, I detailed all the things that went wrong. It took 7 more months before the Board pushed Immelt out. But the new CEO failed to offer a better strategy, continuing to promote the notion of selling businesses to raise cash to “fix” the broken businesses – without identifying any growth strategy at all.

The only thing that can “fix” GE – save it from being dismembered and sold off – is a growth strategy. I offered how the new CEO could undertake this effort in October, 2017. But the Board, still wholly incompetent, still isn’t listening. Nobody should be surprised that GE is now removed from the Dow, and the new CEO is clearly without a clue how to find a path back to relevancy.

Too bad for investors, employees, suppliers, customers and the communities where the GE businesses reside. This didn’t have to happen. But due to an incompetent Board of Directors, which did nothing to properly govern an incompetent CEO, it did. And there’s little doubt it won’t be long before GE meets the same end as DuPont.

by Adam Hartung | May 8, 2018 | Computing, Growth Stall, Innovation, Investing, Software, Trends, Web/Tech

One in five American homes with wifi now has an Amazon Alexa. And the acceptance rate is growing. To me that seems remarkable. I remember when we feared Google keeping all those searches we did. Then the fears people seemed to have about Facebook knowing our friends, families and what we talked about. Now it appears that people have no fear of “big brother” as they rapidly adopt a technology into their homes which can hear pretty near everything that is said, or that happens.

It goes to show that for most people, convenience is still incredibly important. Give us mobile phones and we let land-lines go, because mobile is so convenient – even if more expensive and lower quality. Give us laptops we let go of the traditional office, taking our work everywhere, even at a loss of work-life balance. Give us e-commerce and we start letting retailers keep our credit card information, even if it threatens our credit security. Give us digital documents via Kindle, or a smart device on the web grabbing short articles and pdf files, and we get rid of paper books and magazines. Give us streaming and we let go of physical entertainment platforms, choosing to download movies for one-time use, even though we once thought “owning” our entertainment was important.

With each new technology we make the trade-off between convenience and something we formerly thought was important. Such as quality, price, face-to-face communications, shopping in a store, owning a book or our entertainment – and even security and privacy. For all the hubbub that regulators, politicians and the “old guard” throws up about how important these things were, it did not take long for these factors to not matter as convenience outweighed what we used to think we wanted.

Now, voice activation is becoming radically important. With Google Assistant and Alexa we no longer have to bother with a keyboard interface (who wants to type?) or even a small keypad – we can just talk to our smart device. There is no doubt that is convenient. Especially when that device learns from what we say (using augmented intelligence) so it increasingly is able to accurately respond to our needs with minimal commands. Yes, this device is invading our homes, our workplaces and our lives – but it is increasingly clear that for the convenience offered we will make that trade-off. And thus what Alexa can do (measured in number of skills) has grown from zero to over 45,000 in just under 3 years.

And now, Amazon is going to explode the things Alexa can do for us. Historically Amazon controlled Alexa’s Skills market, allowing very few companies to make money off Alexa transactions. But going forward Amazon is monetizing Alexa, and developers can keep 70% of the in-skill purchase revenues customers make. Buy a product or service via Alexa and developers can now make a lot of money. And, simultaneously, Amazon is offering a “code-free” skills developer, expanding the group of people who can write skills in just minutes. In other words, Amazon is setting off a gold rush for Alexa skills development, while simultaneously making the products remarkably cheap to own.

This is horrible news for Apple. Apple’s revenue stagnated in 2016, declining year over year for 3 consecutive quarters. I warned folks then that this was a Growth Stall, which often implies a gap is developing between the company and the market. While Apple revenues have recovered, we can now see that gap. Apple still relies on iPhone and iPad sales, coupled with the stuff people buy from iTunes, for most of its revenue and growth. But many analysts think smartphone sales may have peaked. And while focusing on that core, Apple has NOT invested heavily in Siri, its voice platform. Today, Siri lags all other voice platforms in quality of recognition, quality of understanding, and number of services. And Apple’s smart speaker sales are a drop in the ocean of Amazon Echo and Echo Dot sales.

By all indications the market for a lot of what we use our mobile devices for is shifting to voice interactivity. And Apple is far behind the leader Amazon, and the strong #2 Google. Even Microsoft’s Cortana quality is considered significantly better than Siri. If this market moves as fast as the smartphone market grew it will rob sales of smartphones and iTunes, and Apple could be in a lot of trouble faster than most people think. Relevancy is a currency quickly lost in the competitive personal technology business.

by Adam Hartung | Apr 3, 2018 | Computing, Growth Stall, Innovation, Investing, Mobile, Music

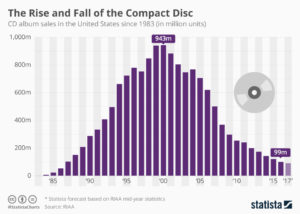

Do you still have a pile of compact discs? If so, why? When was the last time you listened to one? Like almost everyone else, you probably stream your music today. If you are just outdated, you listen to music you bought from iTunes or GooglePlay and store on your mobile device. But it would be considered prehistoric to tell people you carry around CDs for listening in your car – because you surely don’t own a portable CD player.

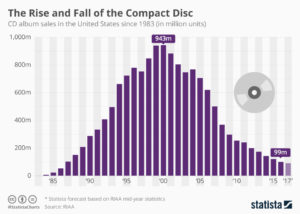

As the chart shows, CD sales exploded from nothing in 1983 to nearly 1B units in 2000. Now sales are less than 1/10th that number, due to the market shift expanded bandwidth allowed.

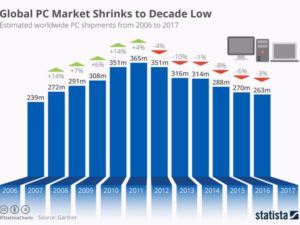

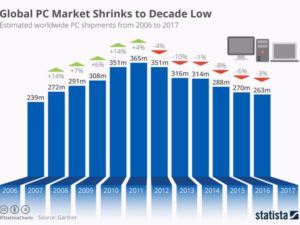

Do you still carry a laptop? If so, you are a dying minority. As PCs became more portable they became indispensable. Nobody left the office, or attended a meeting, without their laptop. That trend exploded until 2011, when PC sales peaked at 365M units. As the chart shows, in the 6 years since, PC sales have dropped by over 100M units, a 30% decline. The advent of mobile devices (smartphones and tablets) coupled with expanded connectivity and growing cloud services allowed mobility to reach entirely new levels – and people stopped carrying their PCs. And just like CDs are disappearing, so will PCs.

These charts dramatically show how quickly a new technology, or package of technologies, can change the way we behave. Simultaneously, they change the competitive landscape. Sony dominated the music industry, as a producer and supplier of hardware, when CDs dominated. But, as I wrote in 2012, the shift to more portable music caused Sony to fall into a rapid decline, and the company suffered 6 consecutive years (24 quarters) of falling sales and losses. The one-time giant was crippled by a technology shift they did not adopt. And they weren’t alone, as big box retailers such as Best Buy and Circuit City also faltered when these sales disappeared.

Once, Microsoft was synonymous with personal technology. Nobody maximized the value in PC growth more than Microsoft. But changing technology altered the competitive landscape, with Apple, Google, Samsung and Amazon emerging as the leaders. Microsoft, as the almost unnoticed launch of Windows 10 demonstrated, is struggling to maintain relevancy.

Too often we discount trends. Like Sony and Microsoft we think historical growth will continue, unabated. We find ways to discount market shifts, saying the products are “niche” and denigrating their quality. We will express our view that the market has “hiccuped” and will return to growth again. By the time we admit the shift is permanent new competitors have overtaken the lead, and we risk becoming totally obsolete. Like Toys-R-Us, Radio Shack, Sears and Motorola.

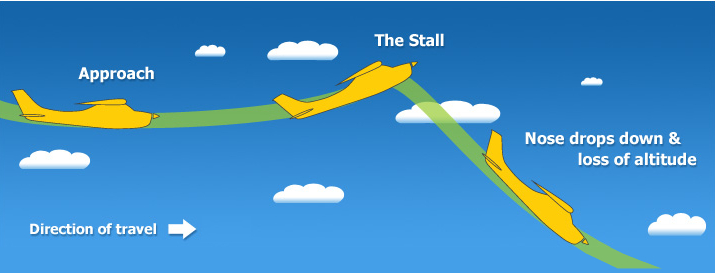

Aircraft stalls when not enough power to climb

The time for action is when the very first signs of shift happened. I’ve written a lot about “Growth Stalls” and they occur in just 2 quarters. 93% of the time a stalled company never again grows at a mere 2%/year. Look at how fast GE went from the best company in America to the worst. It is incredibly important that leadership react FAST when trends push customers toward new solutions, because it often takes very little time for the trend to make dying markets completely untenable.

by Adam Hartung | Mar 13, 2018 | Defend & Extend, Growth Stall, Innovation, Investing, Software

In February, Berkshire Hathaway revealed it had dumped its IBM position. Good riddance to a stock that has gone down for 5 years while the S&P went up! What did Buffett do with the money? He loaded up on Apple – making that high-flyer Berkshire’s #1 holding. So, isn’t the smart thing now to buy Apple?

First, don’t confuse your investing goals with Berkshire Hathaway’s. It may seem that everyone has the same objective, to buy stocks that go up. But Berkshire is a very special case. As I pointed out in 2014, we mere mortals can’t invest like Buffett, and shouldn’t try. Berkshire Hathaway has the opportunity to make investments in special situations with tremendous return potential that we don’t have. Berkshire’s investment strategy is to invest where it can create cash to prepare for special situations, or to park money where it can make a decent return, and hopefully generate cash while it waits.

Apple is the #1 most cash-rich company on the planet, and with the new tax laws it can repatriate that cash. This is an opportunity for a “special dividend” to investors, and that is the kind of thing that Buffett loves. He isn’t a venture capitalist looking for a 10x price appreciation. He wants a decent 5% rate of return, and hopefully dividends, so he can grow cash for his special situation opportunities. Apple, the most valuable company on any exchange, is exactly the kind of company where he can place a few billion dollars without driving up the price and let it sit making a solid 5-6%, collect dividends and maybe get a few kickers from things like the cash repatriation.

Second, let’s not forget that Buffett’s IBM buying spree lost money. If he was a great tech investor, he never would have bought IBM. He bought it for the same reason he’s buying Apple, only he was wrong about what was going to happen to IBM as it continued to lose relevancy.

I pointed out in May, 2016 that Apple was showing us all a lot of sustaining innovations, with new rev levels of existing products, but almost no new disruptive innovations. The company that once gave us iPods, iTunes, iPhones and iPads was increasingly relying on the next version of everything to drive sales. Lots of incremental improvement. But little discussion about any breakthrough products, like iBeacon, ApplePay or even the Apple Watch. In a real way, Apple was looking a lot more like the old Microsoft with its Windows and Office fascination than the old Apple.

By October, 2016 Apple hit a Growth Stall. While this may have seemed like “no big deal,” recall that only 7% of the time do companies maintain a 2% growth rate after stalling. Is Apple going to be in that 7%? With the launch of the less-than-overwhelming iPhone X, and the actual drop in iPhone sales in Q4, 2017 it looks increasingly like Apple is on the same road as all other stalled companies.

In the short term Apple has said it is milking its installed base. By constantly bringing out new apps it has raised iTunes sales to over $30B/quarter. And it has a dedicated cadre of developers making over $25B/year creating new apps. So Apple is doing its best to get as much revenue out of that installed base of iPhones as it can, even if device sales slow (or decline.) For Buffett, this is no big deal. After all, he’s parking cash and hoping to get dividends. Milking the base is a cash generation strategy he would love – like a railroad, or Coca-Cola.

But if you’re interested in maintaining high returns in your portfolio, be aware of what’s happening. Apple is changing. It’s not going to falter and fail any time soon. But don’t be lulled by Berkshire’s big purchases into thinking Apple in 2018 is anything like it was in 2012 – or through 2014. Instead, keep your eyes on game changers like Netflix, Tesla and Amazon.

by Adam Hartung | Feb 27, 2018 | Growth Stall, Innovation, Investing, Software

This February, Warren Buffett admitted he had no faith in IBM. After accumulating a huge position, by 4th quarter of 2017 he sold out almost the entire Berkshire Hathaway position. He lost faith in the IBM CEO Virginia (Ginni) Rometty, who talked big about a turnaround, but it never happened.

Mr. Buffett would have been wise to stopped having “faith” long ago. All the way back in May, 2014 I wrote that IBM was not going to be a turnaround. CEO Rommetty was spending ALL its money on share buybacks, rather than growing its business. The Washington Post made IBM the “poster child” for stupid share buybacks, pointing out that spending over $8B on repurchases had maintained earnings-per-share, and propped up the stock price, but giving IBM the largest debt-to-equity ratio of comparable companies.

IBM was already in a Growth Stall, something about which I’ve written often. Once a company stalls, its odds  of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.

of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.

By April, 2017 it was clear IBM was a disaster. By then we had 20 consecutive quarters of declining revenue. Amazing. How Rometty kept her job was completely unclear. Five years of shrinkage, while all investments were in buying the stock of its shrinking enterprise – intended to hide the shrink! CEO Rometty continued promising a turnaround, with vague references to the “wonderful” Watson program. But it was clear, Buffett (and everyone else) needed to get out in 2014. So Berkshire ate its losses, took the money and ran.

Have you learned your lesson? As an investor are you holding onto stocks long after leadership has shown they have no idea how to grow revenues? If so, why? Hope is not a strategy.

As a leader, are you still forecasting hockey stick turnarounds, while continuing to invest in outdated products and businesses? Are you hoping your past will somehow create your future, even though competitors and markets have moved on? Are you leading like Rometty, hoping you can hide your failures with financial machinations and Powerpoint presentations about how things will turn your way in the future – even though those assumptions are made out of hole cloth?

It’s time to get real about your investments, and your business. When revenues are challenged, something bad is happening. It’s time to do something. Fast. Before a bad quarter becomes 20, and everyone is giving up.

by Adam Hartung | Oct 30, 2017 | Food and Drink, Growth Stall, Investing, Leadership, Retail

Understand Growth Stalls So You Can Avoid GM, JCPenney and Chipotle

Companies, like aircraft, stall when they don’t have enough “power” to continue to climb.

Everybody wants to be part of a winning company. As investors, winners maximize portfolio returns. As employees winners offer job stability and career growth. As communities winners create real estate value growth and money to maintain infrastructure. So if we can understand how to avoid the losers, we can be better at picking winners.

It has been 20 years since we recognized the predictive power of Growth Stalls. Growth Stalls are very easy to identify. A company enters a Growth Stall when it has 2 consecutive quarters, or 2 successive quarters vs the prior year, of lower revenues or profits. What’s powerful is how this simple measure indicates the inability of a company to ever grow again.

Only 7% of the time will a company that has a Growth Stall ever grow at greater than 2%/year. 93% of these companies will never achieve even this minimal growth rate. 38% will trudge along with -2% to 2% growth, losing relevancy as it develops no growth opportunities. But worse, 55% of companies will go into decline, with sales dropping at 2% or more per year. In fact 20% will see sales drop at 6% or more per year. In other words, 93% of companies that have a Growth Stall simply will not grow, and 55% will go into immediate decline.

Growth Stalls happen because the company is somehow “out of step” with its marketplace. Often this is a problem with the product line becoming less desirable. Or it can be an increase in new competitors. Or a change in technology either within the products or in how they are manufactured. The point is, something has changed making the company less competitive, thus losing sales and/or profits.

Unfortunately, leadership of most companies react to a Growth Stall by doubling down on what they already do. They vow to cut costs in order to regain lost margin, but this rarely works because the market has shifted. They also vow to make better products, but this rarely matters because the market is moving toward a more competitive product. So the company in a Growth Stall keeps doing more of the same, and fortunes worsen.

But, inevitably, this means someone else, some company who is better aligned with market forces, starts doing considerably better.

This week analysts at Goldman Sachs lowered GM to a sell rating. This killed a recent rally, and the stock is headed back to $40/share, or lower, values it has not maintained since recovering from bankruptcy after the Great Recession. GM is an example of a company that had a Growth Stall, was saved by a government bailout, and now just trudges along, doing little for employees, investors or the communities where it has plants in Michigan.

Tesla- enough market power to gain share “uphill”?

By understanding that GM, Ford and Chrysler (now owned by Fiat) all hit Growth Stalls we can start to understand why they have simply been a poor place to invest one’s resources. They have tried to make cars cheaper, and marginally better. But who has seen their fortunes skyrocket? Tesla. While GM keeps trying to make a lot of cars using outdated processes and technologies Tesla has connected with the customer desire for a different auto experience, selling out its capacity of Model S sedans and creating an enormous backlog for Model 3. Understanding GM’s Growth Stall would have encouraged you to put your money, career, or community resources into the newer competitor far earlier, rather than the no growth General Motors.

This week, JCPenney’s stock fell to under $3/share. As JCPenney keeps selling real estate and clearing out inventory to generate cash, analysts now say JCPenney is the next Sears, expecting it to eventually run out of assets and fail. Since 2012 JCP has lost 93% of its market value amidst closing stores, laying off people and leaving more retail real estate empty in its communities.

In 2010 JCPenney entered a Growth Stall. Hoping to turn around the board hired Ron Johnson, leader of Apple’s retail stores, as CEO. But Mr. Johnson cut his teeth at Target, and he set out to cut costs and restructure JCPenney in traditional retail fashion. This met great fanfare at first, but within months the turnaround wasn’t happening, Johnson was ousted and the returning CEO dramatically upped the cost cutting.

The problem was that retail had already started changing dramatically, due to the rapid growth of e-commerce. Looking around one could see Growth Stalls not only at JCPenney, but at Sears and Radio Shack. The smart thing to do was exit those traditional brick-and-mortar retailers and move one’s career, or investment, to the huge leader in on-line sales, Amazon.com. Understanding Growth Stalls would have helped you make a good decision much earlier.

This recent quarter Chipotle Mexican Grill saw analysts downgrade the company, and the stock took another hit, now trading at a value not seen since the end of 2012. Chipotle leadership blamed bad results on higher avocado prices, temporary store closings due to hurricanes, paying out damages due to a “one time event” of hacking, and public relations nightmares from rats falling out of a store ceiling in Texas and a norovirus outbreak in Virginia. But this is the typical “things will all be OK soon” sorts of explanations from a leadership team that failed to recognize Chipotle’s Growth Stall.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

But ever since that problem was discovered, management has failed to recognize its Growth Stall required a significant set of changes at Chipotle. They have attacked each problem like it was something needing individualized attention, and could be rectified quickly so they could “get back to normal.” And they hoped to turn around public opinion by launching nationwide a new cheese dip product in 2017, despite less than good social media feedback on the product from early customers. They kept attempting piecemeal solutions when the Growth Stall indicated something much bigger was engulfing the company.

What’s needed at Chipotle is a recognition of the wholesale change required to meet customer demands amidst a shift to more growth in independent restaurants, and changing millennial tastes. From the menu options, to app ordering and immediate delivery, to the importance of social media branding programs and customer testimonials as well as demonstrating commitment to social causes and healthier food Chipotle has fallen out-of-step with its marketplace. The stock has now lost 66% of its value in just 2 years amidst sales declines and growth stagnation.

We don’t like to study losers. But understanding the importance of Growth Stalls can be very helpful for your career and investments. If you identify who is likely to do poorly you can avoid big negatives. And understanding why the market shifted can lead you to finding a job, or investing, where leadership is headed in the right direction.

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

by Adam Hartung | Oct 27, 2017 | Food and Drink, Growth Stall, Investing, Leadership, Retail

The Three Steps GE Should Take Now – And The Lessons For Your Business

Monitor displays General Electric Co. (GE) at the New York Stock Exchange (NYSE) October, 2017. Photographer: Michael Nagle/Bloomberg

For years I have been negative on GE’s leadership. CEO Immelt led the dismantling of the once-great GE, making it a smaller company and one worth quite a bit less. The process has been devastating to many employees who lost their jobs, pensioners who have seen their benefits shrivel, communities with GE facilities that have suffered from investment atrophy, suppliers that have been squeezed out or displaced and investors that have seen the value of GE shares plummet.

But now there is a new CEO, a new leadership team and even some new faces on the Board of Directors. Some readers have informed me that it is easier to attack a weak leader than recommend a solution, and they have inquired as to what I think GE should do now. I do not see the GE situation as hopeless. The company still has an enormous revenue base, and vast assets it can use to fund a directional shift. And that’s what GE must do – make a serious shift in how it allocates resources.

Step 1 – Apply the First Rule of Holes

The first rule of holes is “when you find yourself in a hole, stop digging.” (Will Rogers, 1911) This seems simple. But far too many companies have their resourcing process on auto-pilot. Businesses that have not been growing, and often are not producing good returns on investment, continue to receive funding. Possibly because they are a legacy business that nobody wants to stop. Or possibly because leadership remains ever hopeful that tomorrow will somehow look like yesterday and the next round of money, or hiring, will change things to the way they were.

In fact, these businesses are in a hole, and spending more on them is continuing to dig. The investment hole just keeps getting bigger. The smart thing to do is just stop. Quit adding resources to a business that’s not adding value to the market capitalization. Just stop investing.

When Steve Jobs took over Apple he discontinued several Macintosh models, and cut funding for Macintosh development. The Mac was not going to save Apple’s declining fortunes. Apple needed new products for new markets, and the only way to make that happen was to stop putting so much money into the Mac business.

When streaming emerged CEO Reed Hastings of Netflix quit spending money on the traditional DVD/Video distribution business even though Netflix dominated it. He even raised the price. Only by stopping investments in traditional distribution could he turn the company toward streaming.

Step 2 – Identify the Trend that will Guide Your Strategy

All growth strategies build on trends. After receiving funding from Microsoft to avoid bankruptcy in 2000, Apple spent a year deciding its future lied in building on the trend to mobile. Once the trend was identified, all product development, and new product introductions, were targeted at being a leader in the mobile trend.

When the internet emerged GE CEO Jack Welch required all business units to create “DestroyYourBusiness.com” teams. This forced every business to look at the impact the internet would have on their business, including business model changes and emergence of new competitors. By focusing on the internet trend GE kept growing even in businesses not inherently thought of as “internet” businesses.

GE has to decide what trend it will leverage to guide all new growth projects. Given its large positions in manufacturing and health care it would make sense to at least start with IoT opportunities, and new opportunities to restructure America’s health care system. But even if not these trends, GE needs to identify the trend that it can build upon to guide its investments and grow.

Step 3 – Place Your Bets and Monetize

When Facebook CEO Mark Zuckerberg realized the trend in communications was toward pictures and video he took action to keep users on the company platform. First he bought Instagram for $1 billion, even though it had no revenues. Two years later he paid $19 billion for WhatsApp, gaining many new users as well as significant OTT technology. Both seemed very expensive acquisitions, but Facebook rapidly moved to increase their growth

and monetize their markets. Leaders of the acquired companies were given important roles in Facebook to help guide growth in users, revenues and profits.

Netflix leads the streaming war, but it has tough competition. So Netflix has committed spending over $6billion on new original content to keep customers from going to Amazon Prime, Hulu and others. This large expenditure is intended to allow ongoing subscriber growth domestically and internationally, as well as raise subscription prices.

This week CVS announced it is planning to acquire Aetna Health for $66 billion. On the surface it is easy to ask “why?” But quickly analysts offered support for the deal, ranging from fighting off Amazon in prescription sales to restructuring how health care costs are paid and how care is delivered. The fact that analysts see this acquisition as building on industry trends gives support to the deal and expectations for better future returns for CVS.

During the Immelt era, there were attempts to grow, such as in the “water business.” But the investments were not consistent, and there was insufficient effort placed on understanding how to monetize the business short- and long-term. Leadership did not offer a compelling vision for how the trends would turn into revenues and profits. Acquisitions were made, but lacking a strong vision of how to grow revenues, and an outsider’s perspective on how to lead the trend, very quickly short-term financial metrics built into GE’s review process led to bad decisions crippling these opportunities for growth. And today the consensus is that GE will likely sell its healthcare businessrather than make the necessary investments to grow it as CVS is doing.

Successful leadership means moving beyond traditional financial management to invest for growth

In the Welch era, GE made dozens of acquisitions. These were driven by a desire to build on trends. Welch did not fear investing in growth businesses, and he held leaders’ feet to the fire to produce successful results. If they didn’t achieve goals he let the people and/or the business go. Hence his nickname “Neutron Jack.”

For example, although GE had no background in entertainment, GE bought NBC at a time when viewership was growing and ad prices were growing even faster. This led to higher revenues and market cap for GE. On the other hand, when leaders at CALMA did not anticipate the shift in CAD/CAM from dedicated workstations to PCs, Welch saw them overly tied to old technology and unable to recognize the trend, so he immediately sold the business. He invested in businesses that added to valuation, and sold businesses that lacked a clear path to building on trends for higher value.

Being a caretaker, or steward, is no longer sufficient for business leadership. Competitors, and markets, shift too quickly. Leaders must anticipate trends, reduce investments in products, services and projects that are off the trend, and put resources to work where growth can create higher returns.

This is all possible at GE – if the new leadership has a vision for the future and starts allocating resources effectively. For now, all we can do is wait and see……

Adam's book reveals the truth about how to use strategy to outpace the competition.

Follow Adam's coverage in the press and in other media.

Follow Adam's column in Forbes.

of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.

of growing at 2%/year fall to a mere 7%. But it was clear then that the CEO was more interested in financial machinations, borrowing money to repurchase shares and prop up the stock, rather than actually investing in growing the company. The once great IBM was out of step with the tech market, and had no programs in place to make it an industry leader in the future.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.