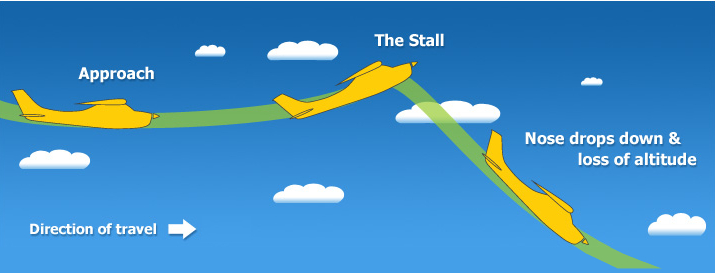

Only 7% of the time will a company that has a Growth Stall ever grow at greater than 2%/year. 93% of these companies will never achieve even this minimal growth rate. 38% will trudge along with -2% to 2% growth, losing relevancy as it develops no growth opportunities. But worse, 55% of companies will go into decline, with sales dropping at 2% or more per year. In fact 20% will see sales drop at 6% or more per year. In other words, 93% of companies that have a Growth Stall simply will not grow, and 55% will go into immediate decline.

Growth Stalls happen because the company is somehow “out of step” with its marketplace. Often this is a problem with the product line becoming less desirable. Or it can be an increase in new competitors. Or a change in technology either within the products or in how they are manufactured. The point is, something has changed making the company less competitive, thus losing sales and/or profits.

Unfortunately, leadership of most companies react to a Growth Stall by doubling down on what they already do. They vow to cut costs in order to regain lost margin, but this rarely works because the market has shifted. They also vow to make better products, but this rarely matters because the market is moving toward a more competitive product. So the company in a Growth Stall keeps doing more of the same, and fortunes worsen.

But, inevitably, this means someone else, some company who is better aligned with market forces, starts doing considerably better.

This week analysts at Goldman Sachs lowered GM to a sell rating. This killed a recent rally, and the stock is headed back to $40/share, or lower, values it has not maintained since recovering from bankruptcy after the Great Recession. GM is an example of a company that had a Growth Stall, was saved by a government bailout, and now just trudges along, doing little for employees, investors or the communities where it has plants in Michigan.

Tesla- enough market power to gain share “uphill”?

By understanding that GM, Ford and Chrysler (now owned by Fiat) all hit Growth Stalls we can start to understand why they have simply been a poor place to invest one’s resources. They have tried to make cars cheaper, and marginally better. But who has seen their fortunes skyrocket? Tesla. While GM keeps trying to make a lot of cars using outdated processes and technologies Tesla has connected with the customer desire for a different auto experience, selling out its capacity of Model S sedans and creating an enormous backlog for Model 3. Understanding GM’s Growth Stall would have encouraged you to put your money, career, or community resources into the newer competitor far earlier, rather than the no growth General Motors.

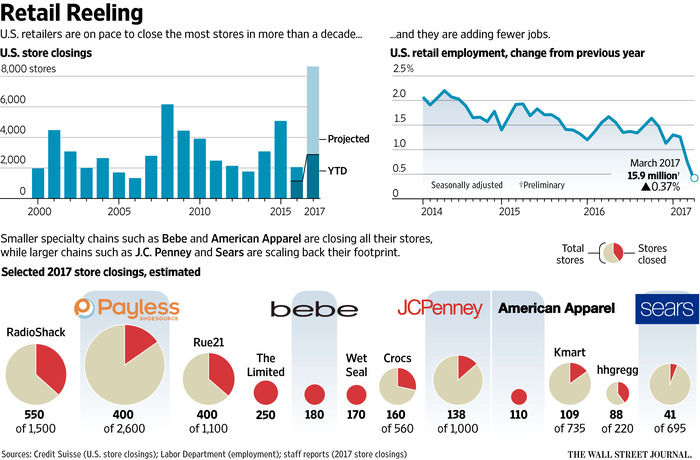

This week, JCPenney’s stock fell to under $3/share. As JCPenney keeps selling real estate and clearing out inventory to generate cash, analysts now say JCPenney is the next Sears, expecting it to eventually run out of assets and fail. Since 2012 JCP has lost 93% of its market value amidst closing stores, laying off people and leaving more retail real estate empty in its communities.

In 2010 JCPenney entered a Growth Stall. Hoping to turn around the board hired Ron Johnson, leader of Apple’s retail stores, as CEO. But Mr. Johnson cut his teeth at Target, and he set out to cut costs and restructure JCPenney in traditional retail fashion. This met great fanfare at first, but within months the turnaround wasn’t happening, Johnson was ousted and the returning CEO dramatically upped the cost cutting.

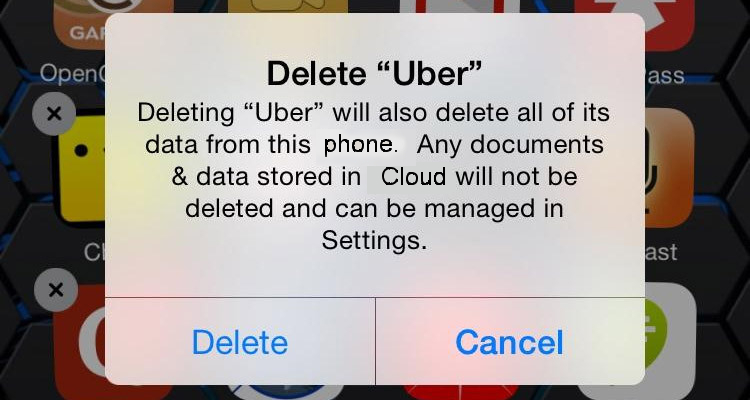

The problem was that retail had already started changing dramatically, due to the rapid growth of e-commerce. Looking around one could see Growth Stalls not only at JCPenney, but at Sears and Radio Shack. The smart thing to do was exit those traditional brick-and-mortar retailers and move one’s career, or investment, to the huge leader in on-line sales, Amazon.com. Understanding Growth Stalls would have helped you make a good decision much earlier.

This recent quarter Chipotle Mexican Grill saw analysts downgrade the company, and the stock took another hit, now trading at a value not seen since the end of 2012. Chipotle leadership blamed bad results on higher avocado prices, temporary store closings due to hurricanes, paying out damages due to a “one time event” of hacking, and public relations nightmares from rats falling out of a store ceiling in Texas and a norovirus outbreak in Virginia. But this is the typical “things will all be OK soon” sorts of explanations from a leadership team that failed to recognize Chipotle’s Growth Stall.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

But ever since that problem was discovered, management has failed to recognize its Growth Stall required a significant set of changes at Chipotle. They have attacked each problem like it was something needing individualized attention, and could be rectified quickly so they could “get back to normal.” And they hoped to turn around public opinion by launching nationwide a new cheese dip product in 2017, despite less than good social media feedback on the product from early customers. They kept attempting piecemeal solutions when the Growth Stall indicated something much bigger was engulfing the company.

What’s needed at Chipotle is a recognition of the wholesale change required to meet customer demands amidst a shift to more growth in independent restaurants, and changing millennial tastes. From the menu options, to app ordering and immediate delivery, to the importance of social media branding programs and customer testimonials as well as demonstrating commitment to social causes and healthier food Chipotle has fallen out-of-step with its marketplace. The stock has now lost 66% of its value in just 2 years amidst sales declines and growth stagnation.

We don’t like to study losers. But understanding the importance of Growth Stalls can be very helpful for your career and investments. If you identify who is likely to do poorly you can avoid big negatives. And understanding why the market shifted can lead you to finding a job, or investing, where leadership is headed in the right direction.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.

Prior to 2015, Chipotle was on a hot streak. It poured all its cash into new store openings, and the share price went from $50 from the 2006 IPO to over $700 by end of 2015; a 14x improvement in 9 years. But when it was discovered that ecoli was in Chipotle’s food the company’s sales dropped like a stone. It turned out that runaway growth had not been supported by effective food safety processes, nor effective store operations processes that would meet the demands of a very large national chain.