by Adam Hartung | Dec 6, 2016 | Disruptions, Innovation, Investing, Leadership, Retail

(Photo by Spencer Platt/Getty Images)

But, is it right to hand-wring over Schultz’s departure as CEO? After all, things have not been pretty for investors since Mr. Jobs turned over Apple to his hand-picked successor Tim Cook. However, could this change mean something better is in store for shareholders?

First, let’s address the very – and Starbucks was saved only by Mr. Schultz returning with his tremendous creativity and servant leadership. While it is great propaganda for making the Schultz as hero story more appealing, it isn’t exactly accurate.

Starting in 1982, Howard Schultz built Starbucks from four stores to over 2,800 (and over $2 billion revenue) in 16 years. That was a tremendous success. And he is to be lauded. But when he left,

Starbucks had only 35o stores outside the USA. It was an American phenomenon, a place to buy and drink coffee, with every store company owned, every employee company trained, and not an ounce of variability in the business model. Not exactly diversified. At the time, the stock traded for roughly (split adjusted) $4 per share.

His successor, Orin Smith, far outperformed Mr. Schultz, more than tripling the chain to over 9,000 stores and expanding revenue to over $5 billion in just four years! He expanded the original model internationally, began adding many new varieties of coffee and other drinks, and even added food. These enhancements were tremendously successful at bringing in additional revenue, even if the average store revenue fell as smaller stores were added in places like airports, hotels and entertainment venues.

In 2005, Jim Donald replaced Mr. Smith. By 2007 (in just teo years) he added a staggering additional 4,000 stores. He expanded the menu. And he even branched out to selling branded Starbucks coffee on airplanes, in hotels and even retailed in grocery stores. Further, he launched a successful international coffee liqueur under the Starbucks brand. And he moved the company into entertainment, creating an artist representation company and even producing movies (Akeelah and the Bee) which won multiple awards.

In 2007 Starbucks fourth quarter saw 22% revenue increase, and for the year 21% growth. Comparable store sales grew 5%. International margins expanded, and net earnings grew over 19% from $564 million to $673 million.

Starbucks’ stock, from 2000 when Mr. Schultz departed into 2006 rose 375%, from $4 to just under $19 per share. Not the ruination that some seem to think was happening.

But Mr. Schultz did not like the diversification, even if it produced more revenue and profit. He joined the chorus of analysts that beat down the P/E ratio, and the stock price, as the company expanded beyond its “core” coffee store business.

When the Great Recession hit, and people realized they could live without $4 per cup of coffee and a $50 per day habit, revenues plummeted, as they did for many restaurants and retailers. Mr. Schultz seized the opportunity to return to his old job as CEO. That the downturn in Starbucks had far more to do with the greatest economic debacle since the 1930s was overlooked as Mr. Schultz blamed everything on the previous CEO and his leadership team – firing them all.

Since 2012 Starbucks has returned to doing what it did prior to 2000 – opening more stores. Growing from 17,000 to 25,000 stores. Refocused on its very easy to understand, if dated, business model analysts loved the simpler company and bid up the P/E to over 30 – creating a trough (2008) to peak (2016) increase in adjusted stock price from $4 to $60 – an incredible 15 times!

But, more realistically one should compare the price today to that of 2006, before the entire market crashed and analysts turned negative on the profitable Starbucks diversification and business model expansion. That gain is a more modest 300% – basically a tripling over a decade – far less a gain for investors than happened under the 2000-2006 era of Mr. Schultz’s successors.

Mr. Schultz succeeded in returning Starbucks to its “core.” But now he’s leaving a much more vulnerable company. As my fellow Forbes contributor Richard Kestenbaum has noted, retail success requires innovation. Starbucks is now almost everywhere, leaving little room for new store expansion. Yet it has abandoned other revenue opportunities pioneered under Messrs. Smith and Donald. And competition has expanded dramatically – both via direct coffee store competitors and the emergence of new gathering spots like smoothie stores, tech stores and fast casual restaurants that are attracting people away from a coffee addiction.

At some point Starbucks and its competition will saturate the market. And tastes will change. And when that happens, growth will be a lot harder to find. As McDonald’s and WalMart have learned, . Exciting new competitors emerge, like Starbucks once was, and Amazon.com is increasingly today.

Mr. Schultz has said he is vastly more confident in this change of leadership than he was the last time he left – largely because he feels this hand-picked team (as if he didn’t pick the last team, by the way) will continue to remain tightly focused on defending and extending Starbucks “core” business. This approach sounds all too familiar – like Jobs selection of Cook – and the risks for investors are great.

A focus on the core has real limits. Diminishing returns do apply. And P/E compression (from the very high 30+ today) could cause Starbucks to lose any investor upside, possibly even cause the stock to decline. If Mr. Schultz’s departure was opening the door for more innovation, new business expansion and a change to new trends that sparked growth one could possibly be excited. But there is real reason for concern – just as happened at Apple.

by Adam Hartung | Nov 17, 2016 | Food and Drink, In the Swamp, Innovation, Marketing, Trends

(PAUL J. RICHARDS/AFP/Getty Images)

McDonald’s has been trying for years to re-ignite growth. But, unfortunately for customers and investors alike, leadership keeps going about it the wrong way. Rather than building on new trends to create a new McDonald’s, they keep trying to defend extend the worn out old strategy with new tactics.

Recently McDonald’s leadership tested a new version of the Big Mac,first launched in 1967. They replaced the “special sauce” with Sriracha sauce in order to make the sandwich a bit spicier. They are now rolling it out to a full test market in central Ohio with 128 stores. If this goes well – a term not yet defined – the sandwich could roll out nationally.

This is a classic sustaining innovation. Take something that exists, make a minor change, and offer it as a new version. The hope is that current customers keep buying the original version, and the new version attracts new customers. Great idea, if it works. But most of the time it doesn’t.

Unfortunately, most people who buy a product like it the way it is. Slower Big Mac sales aren’t due to making bad sandwiches. They’re due to people changing their buying habits to new trends. Fifty years ago a Big Mac from McDonald’s was something people really wanted. Famously, in the 1970s a character on the TV series Good Times used to become very excited about going to eat his weekly Big Mac.

People who are still eating Big Macs know exactly what they want. And it’s the old Big Mac, not a new one. Thus the initial test results were “mixed” – with many customers registering disgust at the new product. Just like the failure of New Coke, a New Big Mac isn’t what customers are seeking.

After 50 years, times and trends have changed. Fewer people are going to McDonald’s, and fewer are eating Big Macs. Many new competitors have emerged, and people are eating at Panera, Panda Express, Zaxby’s, Five Guys and even beleaguered Chipotle. Customers are looking for a very different dining experience, and different food. While a version two of the Big Mac might have driven incremental sales in 1977, in 2017 the product has grown tired and out of step with too many people and there are too many alternative choices.

Similarly, McDonald’s CEO’s effort to revitalize the brand by adding ordering kiosks and table service in stores, in a new format labeled the “Experience of the Future,” will not make much difference. Due to the dramatic reconfiguration, only about 500 stores will be changed – roughly 3.5% of the 14,500 McDonald’s. It is an incremental effort to make a small change when competitors are offering substantially different products and experiences.

When a business, brand or product line is growing it is on a trend. Like McDonald’s was in the 1960s and 1970s, offering quality food, fast and at a consistent price nationwide at a time when customers could not count on those factors across independent cafes. At that time, offering new products – like a Big Mac – that are variations on the theme that is riding the trend is a good way to expand sales.

But over time trends change, and adding new features has less and less impact. These sustaining innovations, as Clayton Christensen of Harvard calls them, have “diminishing marginal returns.” That’s an academic’s fancy way of saying that you have to spend ever greater amounts to create the variations, but their benefits keep having less and less impact on growing, or even maintaining, sales. Yet, most leaders keep right on trying to defend & extend the old business by investing in these sustaining measures, even as returns keep falling.

Over time a re-invention gap is created between the customer and the company. Customers want something new and different, which would require the business re-invent itself. But the business keeps trying to tweak the old model. And thus the gap. The longer this goes on, the bigger the re-invention gap. Eventually customers give up, and the product, or company, disappears.

Think about portable hand held AM radios. If someone gave you the best one in the world you wouldn’t care. Same for a really good portable cassette tape player. Now you listen to your portable music on a phone. Companies like Zenith were destroyed, and Sony made far less profitable, as the market shifted from radios and cathode-ray televisions to more portable, smarter, better products.

Motorola, one of the radio pioneers, survived this decline by undertaking a “strategic pivot.” Motorola invested in cell phone technology and transformed itself into something entirely new and different – from a radio maker into a pioneer in mobile phones. (Of course leadership missed the transition to apps and smart phones, and now Motorola Solutions is a ghost of the former company.)

McDonald’s could have re-invented itself a decade ago when it owned Chipotle’s. Leadership could have stopped investing in McDonald’s and poured money into Chipotle’s, aiding the cannibalization of the old while simultaneously capturing a strong position on the new trend. But instead of pivoting, leadership sold Chipotle’s and used the money to defend & extend the already tiring McDonald’s brand.

Strategic pivots are hard. Just look at Netflix, which pivoted from sending videos in the mail to streaming, and is pivoting again into original content. But, they are a necessity if you want to keep growing. Because eventually all strategies become out of step with changing trends, and sustaining innovations fail to keep customers.

McDonald’s needs a very different strategy. It has hit a growth stall, and has a very low probability of ever growing consistently at even 2%. The company needs a lot more than sriracha sauce on a Big Mac if it is to spice up revenue and profit growth.

by Adam Hartung | Oct 26, 2016 | Growth Stall, Innovation, Investing, Leadership, Web/Tech

Apple AAPL -0.72% announced sales and earnings yesterday. For the first time in 15 years, ever since it rebuilt on a strategy to be the leader in mobile products, full year sales declined. After three consecutive down quarters, it was not unanticipated. And Apple’s guidance for next quarter was for investors to expect a 1% or 2% improvement in sales or earnings. That’s comparing to the disastrous quarter reported last January, which started this terrible year for Apple investors.

Yet, most analysts remain bullish on Apple stock. At a price/earnings (P/E) of 13.5, it is by far the cheapest tech stock. iPad sales are stagnant, iPhone sales are declining, Apple Watch sales dropped some 70% and Chromebook breakout sales caused a 20% drop in Mac Sales. Yet most analysts believe that something will improve and Apple will get its mojo back.

Only, the odds are against Apple. As I pointed out last January, Apple’s value took a huge hit because stagnating sales caused the company to completely lose its growth story. And, the message that Apple doesn’t know how to grow just keeps rolling along. By last quarter – July – I wrote Apple had fallen into a Growth Stall. And that should worry investors a lot.

Ten Deadly Sins Of Networking

Companies that hit growth stalls almost always do a lot worse before things improve – if they ever improve. Seventy-five percent of companies that hit a growth stall have negative growth for several quarters after a stall. Only 7% of companies grow a mere 6%. To understand the pattern, think about companies like Sears, Sony, RIM/Blackberry, Caterpillar Tractor. When they slip off the growth curve, there is almost always an ongoing decline.

And because so few regain a growth story, 70% of the companies that hit a growth stall lose over half their market capitalization. Only 5% lose less than 25% of their market cap.

Why? Because results reflect history, and by the time sales and profits are falling the company has already missed a market shift. The company begins defending and extending its old products, services and business practices in an effort to “shore up” sales. But the market shifted, either to a competitor or often a new solution, and new rev levels do not excite customers enough to create renewed growth. But since the company missed the shift, and hunkered down to fight it, things get worse (usually a lot worse) before they get better.

Think about how Microsoft MSFT -0.42% missed the move to mobile. Too late, and its Windows 10 phones and tablet never captured more than 3% market share. A big miss as the traditional PC market eroded.

Right now there is nothing which indicates Apple is not going to follow the trend created by almost all growth stalls. Yes, it has a mountain of cash. But debt is growing faster than cash now, and companies have shown a long history of burning through cash hoards rather than returning the money to shareholders.

Apple has no new products generating market shifts, like the “i” line did. And several products are selling less than in previous quarters. And the CEO, Tim Cook, for all his operational skills, offers no vision. He actually grew testy when asked, and his answer about a “strong pipeline” should be far from reassuring to investors looking for the next iPhone.

Will Apple shares rise or fall over the next quarter or year? I don’t know. The stock’s P/E is cheap, and it has plenty of cash to repurchase shares in order to manipulate the price. And investors are often far from rational when assessing future prospects. But everyone would be wise to pay attention to patterns, and Apple’s Growth Stall indicates the road ahead is likely to be rocky.

by Adam Hartung | Sep 23, 2016 | Disruptions, In the Rapids, Innovation, Leadership, Television, Web/Tech

In early August Tesla announced it would be buying SolarCity. The New York Times discussed how this combination would help CEO Elon Musk move toward his aspirations for greater clean energy use. But the Los Angeles Times took the companies to task for merging in the face of tremendous capital needs at both, while Tesla was far short of hitting its goals for auto and battery production.

Since then the press has been almost wholly negative on the merger. Marketwatch’s Barry Randall wrote that the deal makes no sense. He argues the companies are in two very different businesses that are not synergistic – and he analogizes this deal to GM buying Chevron. He also makes the case that SolarCity will likely go bankrupt, so there is no good reason for Tesla shareholders to “bail out” the company. And he argues that the capital requirements of the combined entities are unlikely to be fundable, even for its visionary CEO.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

But short-sellers are clearly not long-term investors. And there is a lot more ability for this deal to succeed and produce tremendous investor returns than anyone could ever glean from studying historical financial statements of both companies.

GM buying Chevron is entirely the wrong analogy to compare with Tesla buying SolarCity. Instead, compare this deal to what happened in the creation of television after General Sarnoff, who ran RCA, bought what he renamed NBC.

The world already had radio (just as we already have combustion powered cars.) The conundrum was that nobody needed a TV, especially when there were no TV programs. But nobody would create TV programs if there were no consumers with TVs. General Sarnoff realized that both had to happen simultaneously – the creation of both demand, and supply. It would only be by the creation, and promotion, of both that television could be a success. And it was General Sarnoff who used this experience to launch the first color televisions at the same time as NBC launched the first color programming – which fairly quickly pushed the industry into color.

Skeptics think Mr. Musk and his companies are in over their heads, because there are manufacturing issues for the batteries and the cars, and the solar panel business has yet to be profitable. Yet, the older among us can recall all the troubles with launching TV.

Early sets were not only expensive, they were often problematic, with frequent component failures causing owners to take the TV to a repairman. Often reception was poor, as people relied on poor antennas and weak network signals. It was common to turn on a set and have “snow” as we called it – images that were far from clear. And there was often that still image on the screen with the words “Technical Difficulties,” meaning that viewers just waited to see when programming would return. And programming was far from 24×7 – and quality could be sketchy. But all these problems have been overcome by innovation across the industry.

Yes, the evolution of electric cars will involve a lot of ongoing innovation. So judging its likely success on the basis of recent history would be foolhardy. Today Tesla sells 100% of its cars, with no discounts. The market has said it really, really wants its vehicles. And everybody who is offered electric panels with (a) the opportunity to sell excess power back to the grid and (b) financing, takes the offer. People enjoy the low cost, sustainable electricity, and want it to grow. But lacking a good storage device, or the inability to sell excess power, their personal economics are more difficult.

Electricity production, electricity storage (batteries) and electricity consumption are tightly linked technologies. Nobody will build charging stations if there are no electric cars. Nobody will build electric cars if there are not good batteries. Nobody will make better batteries if there are no electric cars. Nobody will install solar panels if they can’t use all the electricity, or store what they don’t immediately need (or sell it.)

This is not a world of an established marketplace, where GM and Chevron can stand alone. To grow the business requires a vision, business strategy and technical capability to put it all together. To make this work someone has to make progress in all the core technologies simultaneously – which will continue to improve the storage capability, quality and safety of the electric consuming automobiles, and the electric generating solar panels, as well as the storage capabilities associated with those panels and the creation of a new grid for distribution.

This is why Mr. Musk says that combining Tesla and SolarCity is obvious. Yes, he will have to raise huge sums of money. So did such early pioneers as Vanderbilt (railways,) Rockefeller (oil,) Ford (autos,) and Watson (computers.) More recently, Steve Jobs of Apple became heroic for figuring out how to simultaneously create an iPhone, get a network to support the phone (his much maligned exclusive deal with AT&T,) getting developers to write enough apps for the phone to make it valuable, and creating the retail store to distribute those apps (iTunes.) Without all those pieces, the ubiquitous iPhone would have been as successful as the Microsoft Zune.

It is fair for investors to worry if Tesla can raise enough money to pull this off. But, we don’t know how creative Mr. Musk may become in organizing the resources and identifying investors. So far, Tesla has beaten all the skeptics who predicted failure based on price of the cars (Tesla has sold 100% of its production,) lack of range (now up to nearly 300 miles,) lack of charging network (Tesla built one itself) and charging time (now only 20 minutes.) It would be shortsighted to think that the creativity which has made Tesla a success so far will suddenly disappear. And thus remarkably thoughtless to base an analysis on the industry as it exists today, rather than how it might well look in 3, 5 and 10 years.

The combination of Tesla and SolarCity allows Tesla to have all the components to pursue greater future success. Investors with sufficient risk appetite are justified in supporting this merger because they will be positioned to receive the future rewards of this pioneering change in the auto and electric utility industries.

by Adam Hartung | Sep 14, 2016 | Immigration, In the Rapids, Innovation, Telecom, Trends

I’m amazed about Americans’ debate regarding immigration. And all the rhetoric from candidate Trump about the need to close America’s borders.

I was raised in Oklahoma, which prior to statehood was called The Indian Territory. I was raised around the only real Native Americans. All the rest of us are immigrants. Some voluntarily, some as slaves. But the fact that people want to debate whether we allow people to become Americans seems to me somewhat ridiculous, since 98% of Americans are immigrants. The majority within two generations.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

And almost since the beginning, immigrants have been not only abused but scammed. Those who have resources frequently took advantage of the newcomers that did not. And this persists. Immigrants that lack a social security card are unable to obtain a driver’s license, unable to open bank accounts, unable to apply for credit cards, unable to even sign up for phone service. Thus they remain at the will of others to help them, which creates the opportunity for scamming.

Take for example an immigrant trying to make a phone call to his relatives back home. For most immigrants this means using a calling card. Only these cards are often a maze of fees, charges and complex rules that result in much of the card’s value being lost. A 10-minute call to Ghana can range from $2.86 to $8.19 depending on which card you use. This problem is so bad that the FCC has fined six of the largest card companies for misleading consumers about calling cards. They continue to advise consumers about fraud. And even Congress has held hearings on the problem.

One outcome of immigrants’ difficulties has been the ingenuity and innovativeness of Americans. To this day around the world people marvel at how clever Americans are, and how often America leads the world in developing new things. As a young country, and due to the combination of resources and immigrants’ tough situation, America frequently is first at developing new solutions to solve problems – many of which are problems that clearly affect the immigrant population.

So, back to that phone call. Some immigrants can use Microsoft Skype to talk with their relatives, using the Internet rather than a phone. But this requires the people back home have a PC and an internet connection. Both of which could be dicey. Another option would be to use something like Facebook’s WhatsApp, but this requires the person back home have either a PC or mobile device, and either a wireless connection or mobile coverage. And, again, this is problematic.

But once again, ingenuity prevails. A Romanian immigrant named Daniel Popa saw this problem, and set out to make communications better for immigrants and their families back home. In 2014 he founded QuickCall.com to allow users to make a call over wireless technology, but which can then interface with the old-fashioned wired (or wireless) telecom systems around the world. No easy task, since telephone systems are a complex environment of different international, national and state players that use a raft of different technologies and have an even greater set of complicated charging systems.

But this new virtual phone network, which links the internet to the traditional telecom system, is a blessing for any immigrant who needs to contact someone in a rural, or poor, location that still depends on phone service. If the person on the other end can access a WiFi system, then the calls are free. If the connection is to a phone system then the WiFi interface on the American end makes the call much cheaper – and performs far, far better than any other technology. QuickCall has built the carrier relationships around the world to make the connections far more seamless, and the quality far higher.

But like all disruptive innovations, the initial market (immigrants) is just the early adopter with a huge need. Being able to lace together an internet call to a phone system is pretty powerful for a lot of other users. Travelers heading to a remote location, like Micronesia, Africa or much of South America — and even Eastern Europe – can lower the cost of planning their trip and connect with locals by using QuickCall.com. And for most Americans traveling in non-European locations their cell phone service from Sprint, Verizon, AT&T or another carrier simply does not work well (if at all) and is very expensive when they arrive. QuickCall.com solves that problem for these travelers.

Small businesspeople who have suppliers, or customers, in these locations can use QuickCall.com to connect with their business partners at far lower cost. Businesses can even have their local partners obtain a local phone number via QuickCall.com and they can drive the cost down further (potentially to zero). This makes it affordable to expand the offshore business, possibly even establishing small scale customer support centers at the local supplier, or distributor, location.

In The Innovator’s Dilemma Clayton Christensen makes the case that disruptive innovations develop by targeting a customer with an unmet need. Usually the innovation isn’t as good as the current “standard,” and is also more costly. Today, making an international call through the phone system is the standard, and it is fairly cheap. But this solution is often unavailable to immigrants, and thus QuickCall.com fills their unmet need, and at a cost substantially lower than the infamous calling cards, and with higher quality than a pure WiFi option.

But now that it is established, and expanding to more countries – including developed markets like the U.K. – the technology behind QuickCall.com is becoming more mainstream. And its uses are expanding. And it is reducing the need for people to have international calling service on their wired or wireless phone because the available market is expanding, the quality is going up, and the cost is going down. Exactly the way all disruptive innovations grow, and thus threaten the entrenched competition.

The end-game may be some form of Facebook in-app solution. But that depends on Facebook or one of its competitors seizing this opportunity quickly, and learning all QuickCall.com already knows about the technology and customers, and building out that network of carrier relationships. Notice that Skype was founded in 2003, and acquired by Microsoft in 2011, and it still doesn’t have a major presence as a telecom replacement. Will a social media company choose to make the investment and undertake developing this new solution?

As small as QuickCall.com is – and even though you may have never heard of it – it is an example of a disruptive innovation that has been successfully launched, and is successfully expanding. It may seem like an impossibility that this company, founded by an immigrant to solve an unmet need of immigrants, could actually change the way everyone makes international calls. But, then again, few of us thought the iPhone and its apps would cause us to give up Blackberries and quit carrying our PCs around.

America is known for its ingenuity and innovations. We can thank our heritage as immigrants for this, as well as the immigrant marketplace that spurs new innovation. America’s immigrants have the need to succeed, and the unmet needs that create new markets for launching new solutions. For all those conservatives who fear “European socialism,” they would be wise to realize the tremendous benefits we receive from our immigrant population. Perhaps these naysayers should use QuickCall.com to connect with a few more immigrants and understand the benefits they bring to America.

by Adam Hartung | Aug 12, 2016 | Diversity, Innovation, Teamwork, Television

Most of the time “diversity” is a code word for adding women or minorities to an organization. But that is only one way to think about diversity, and it really isn’t the most important. To excel you need diversity in thinking. And far too often, we try to do just the opposite.

“Mythbusters” was a television series that ran 14 seasons across 12 years. The thesis was to test all kinds of things people felt were facts, from historical claims to urban legends, with sound engineering approaches to see if the beliefs were factually accurate – or if they were myths. The show’s ability to bust, or prove, these myths made it a great success.

The show was led by 2 engineers who worked together on the tests and props. Interestingly, these two fellows really didn’t like each other. Despite knowing each other for 20 years, and working side-by-side for 12, they never once ate a meal together alone, or joined in a social outing. And very often they disagreed on many aspects of the show. They often stepped on each others toes, and they butted heads on multiple issues. Here’s their own words:

The show was led by 2 engineers who worked together on the tests and props. Interestingly, these two fellows really didn’t like each other. Despite knowing each other for 20 years, and working side-by-side for 12, they never once ate a meal together alone, or joined in a social outing. And very often they disagreed on many aspects of the show. They often stepped on each others toes, and they butted heads on multiple issues. Here’s their own words:

“We get on each other’s nerves and everything all the time, but whenever that happens, we say so and we deal with it and move on,” he explained. “There are times that we really dislike dealing with each other, but we make it work.”

The pair honestly believed it is their differences which made the show great. They challenged each other continuously to determine how to ask the right questions, and perform the right tests, and interpret the results. It was because they were so different that they were so successful. Individually each was good. But together they were great. It was because they were of different minds that they pushed each other to the highest standards, never had an integrity problem, and achieved remarkable success.

Yet, think about how often we select people for exactly the opposite reason. Think about “knock-out” comments and questions you’ve heard that were used to keep from increasing the diversity:

- I wouldn’t want to eat lunch with that person, so why would I want to work with them?

- We find that people with engineering (or chemical, or fine arts, etc.) backgrounds do well here. Others don’t.

- We like to hire people from state (or Ivy League, etc) colleges because they fit in best

- We always hire for industry knowledge. We don’t want to be a training ground for the basics in how our industry works

- Results are not as important as how they were obtained – we have to be sure this person fits our culture

- Directors on our Board need to be able to get along or the Board cannot be effective

- If you weren’t trained in our industry, how could you be helpful?

- We often find that the best/top graduates are unable to fit into our culture

- We don’t need lots of ideas, or challenges. We need people that can execute our direction

- He gets things done, but he’s too rough around the edges to hire (or promote.) If he leaves he’ll be someone else’s problem.

In 2011 I wrote in Forbes “Why Steve Jobs Couldn’t Find a Job Today.” The column pointed out that hiring practices are designed for the lowest common denominator, not the best person to do a job. Personalities like Steve Jobs would be washed out of almost any hiring evaluation because he was too opinionated, and there would be concerns he would cause too much tension between workers, and be too challenging for his superiors.

Simply put, we are biased to hire people that think like us. It makes us comfortable. Yet, it is a myth that homogeneous groups, or cultures, are the best performing. It is the melding of diverse ways of thinking, and doing, that leads to the best solutions. It is the disagreement, the arguing, the contention, the challenging and the uncomfortableness that leads to better performance. It leads to working better, and smarter, to see if your assumptions, ideas and actions can perform better than your challengers. And it leads to breakthroughs as challenges force us to think differently when solving problems, and thus developing new combinations and approaches that yield superior returns.

What should we do to hire better, and develop better talent that produces superior results?

- Put results and accomplishments ahead of culture or fit. Those who succeed usually keep succeeding, and we need to build on those skills for everyone to learn how to perform better

- Don’t let ego into decisions or discussions. Too many bad decisions are made because someone finds their assumptions or beliefs challenged, and thus they let “hurt feelings” keep them from listening and considering alternatives.

- Set goals, not process. Tell someone what they need to accomplish, and not how they should do it. If how someone accomplishes their goals offends you, think about your own assumptions rather than attacking the other person. There can be no creativity if the process is controlled.

- Set big goals, and avoid the desire to set a lot of small goals. When you break down the big goal into sub-goals you effectively kill alternative approaches – approaches that might not apply to these sub-goals. In other words, make sure the big objective is front and center, then “don’t sweat the small stuff.”

- Reward people for thinking differently – and be very careful to not punish them. It is easy to scoff at an idea that sounds foreign, and in doing so kill new ideas. Often it’s not what they don’t know that is material, but rather what you don’t know that is most important.

- Be blind to gender, skin color, historical ancestry, religion and all other elements of background. Don’t favor any background, nor disfavor another. This doesn’t mean white men are the only ones who need to be aware. It is extremely easy for what we may call any minority to favor that minority. Assumptions linked to physical attributes and history run deep, and are hard to remove from our bias. But it is not these historical physical and educational elements that matter, it is how people think that matters – and the results they achieve.

by Adam Hartung | Jul 15, 2016 | Defend & Extend, Entertainment, Games, Innovation, Lock-in, Mobile, Trends

Poke’Mon Go is a new sensation. Just launched on July 6, the app is already the #1 app in the world – and it isn’t even available in most countries. In less than 2 weeks, from a standing start, Nintendo’s new app is more popular than both Facebook and Snapchat. Based on this success, Nintendo’s equity valuation has jumped 90% in this same short time period.

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its user base stalled and the valuation fell by about 50% as growth in users, time on app and income all fell short of expectations. And, isn’t the world of gaming dominated by the likes of Sony and Microsoft?

A bit of history

Nintendo launched the Wii in 2006 and it was a sensation. Gamers could do things not previously possible. Unit sales exceeded 20m units/year for 2006 through 2009. But Sony (PS4) and Microsoft (Xbox) both powered up their game consoles and started taking share from Nintendo. By 2011 Nintendo sale were down to 11.6m units, and in 2012 sales were off another 50%. The Wii console was losing relevance as competitors thrived.

Sony and Microsoft both invested heavily in their competition. Even though both were unprofitable at the business, neither was ready to concede the market. In fall, 2014 Microsoft raised the competitive ante, spending $2.5B to buy the maker of popular game Minecraft. Nintendo was becoming a market afterthought.

Meanwhile, back in 2009 Nintendo had 70% of the handheld gaming market with its 3DS product. But people started carrying the more versatile smartphones that could talk, text, email, execute endless apps and even had a lot of games – like Tetrus. The market for handheld games pretty much disappeared, dealing Nintendo another blow.

Competitor strategic errors

Fortunately, the bitter “fight to the death” war between Sony and Microsoft kept both focused on their historical game console business. Both kept investing in making the consoles more powerful, with more features, supporting more intense, lifelike games. Microsoft went so far as to implement in Windows 10 the capability for games to be played on Xbox and PCs, even though the PC gaming market had not grown in years. These massive investments were intended to defend their installed base of users, and extend the platform to attract new growth to the traditional, nearly 4 decade old market of game consoles that extends all the way back to Atari.

Both companies did little to address the growing market for mobile gaming. The limited power of mobile devices, and the small screens and poor sound systems made mobile seem like a poor platform for “serious gaming.” While game apps did come out, these were seen as extremely limited and poor quality, not at all competitive to the Sony or Microsoft products. Yes, theoretically Windows 10 would make gaming possible on a Microsoft phone. But the company was not putting investment there. Mobile gaming was simply not serious, and not of interest to the two Goliaths slugging it out for market share.

Building on trends makes all the difference

Back in 2014 I recognized that the console gladiator war was not good for either big company, and recommended Microsoft exit the market. Possibly seeing if Nintendo would take the business in order to remove the cash drain and distraction from Microsoft. Fortunately for Nintendo, that did not happen.

Nintendo observed the ongoing growth in mobile gaming. While Candy Crush may have been a game ignored by serious gamers, it nonetheless developed a big market of users who loved the product. Clearly this demonstrated there was an under-served market for mobile gaming. The mobile trend was real, and it’s gaming needs were unmet.

Simultaneously Nintendo recognized the trend to social. People wanted to play games with other people. And, if possible, the game could bring people together. Even people who don’t know each other. Rather than playing with unseen people located anywhere on the globe, in a pre-organized competition, as console games provided, why not combine the social media elements of connecting with those around you to play a game? Make it both mobile, and social. And the basics of Poke’Mon Go were born.

Then, build out the financial model. Don’t charge to play the game. But once people are in the game charge for in-game elements to help them be more successful. Just as Facebook did in its wildly successful social media game Farmville. The more people enjoyed meeting other people through the game, and the more they played, the more they would buy in-app, or in-game, elements. The social media aspect would keep them wanting to stay connected, and the game is the tool for remaining connected. So you use mobile to connect with vastly more people and draw them together, then social to keep them playing – and spending money.

The underserved market is vastly larger than the over-served market

Nintendo recognized that the under-served mobile gaming market is vastly larger than the overserved console market. Those console gamers have ever more powerful machines, but they are in some ways over-served by all that power. Games do so much that many people simply don’t want to take the time to learn the games, or invest in playing them sitting in a home or office. For many people who never became serious gaming hobbyists, the learning and intensity of serious gaming simply left them with little interest.

But almost everyone has a mobile phone. And almost everyone does some form of social media. And almost everyone enjoys a good game. Give them the right game, built on trends, to catch their attention and the number of potential customers is – literally – in the billions. And all they have to do is download the app. No expensive up-front cost, not much learning, and lots of fun. And thus in two weeks you have millions of new users. Some are traditional gamers. But many are people who would never be a serious gamer – they don’t want a new console or new complicated game. People of all ages and backgrounds could become immediate customers.

David can beat Goliath if you use trends

In the Biblical story, smallish David beat the giant Goliath by using a sling. His new technology allowed him to compete from far enough away that Goliath couldn’t reach David. And David’s tool allowed for delivering a fatal blow without ever touching the giant. The trend toward using tools for hunting and fighting allowed the younger, smaller competitor to beat the incumbent giant.

In business trends are just as important. Any competitor can study trends, see what people want, and then expand their thinking to discover a new way to compete. Nintendo lost the console war, and there was little value in spending vast sums to compete with Sony and Microsoft toe-to-toe. Nintendo saw the mobile game market disintegrate as smartphones emerged. It could have become a footnote in history.

But, instead Nintendo’s leaders built on trends to deliver a product that filled an unmet need – a game that was mobile and social. By meeting that need Nintendo has avoided direct competition, and found a way to dramatically grow its revenues. This is a story about how any competitor can succeed, if they learn how to leverage trends to bring out new products for under-served customers, and avoid costly gladiator competition trying to defend and extend past products.

by Adam Hartung | Jun 9, 2016 | Innovation, Investing, Software, Teamwork

Last week Bloomberg broke a story about how Microsoft’s Chairman, John Thompson, was pushing company management for a faster transition to cloud products and services. He even recommended changes in spending might be in order.

Really? This is news?

Let’s see, how long has the move to mobile been around? It’s over a decade since Blackberry’s started the conversion to mobile. It was 10 years ago Amazon launched AWS. Heck, end of this month it will be 9 years since the iPhone was released – and CEO Steve Ballmer infamously laughed it would be a failure (due to lacking a keyboard.) It’s now been 2 years since Microsoft closed the Nokia acquisition, and just about a year since admitting failure on that one and writing off $7.5B And having failed to achieve even 3% market share with Windows phones, not a single analyst expects Microsoft to be a market player going forward.

So just now, after all this time, the Board is waking up to the need to change the resource allocation? That does seem a bit like looking into barn lock acquisition long after the horses are gone, doesn’t it?

The problem is that historically Boards receive almost all their information from management. Meetings are tightly scheduled affairs, and there isn’t a lot of time set aside for brainstorming new ideas. Or even for arguing with management assumptions. The work of governance has a lot of procedures related to compliance reporting, compensation, financial filings, senior executive hiring and firing – there’s a lot of rote stuff. And in many cases, surprisingly to many non-Directors, the company’s strategy may only be a topic once a year. And that is usually the result of a year long management controlled planning process, where results are reviewed and few challenges are expected. Board reviews of resource allocation are at the very, very tail end of management’s process, and commitments have often already been made – making it very, very hard for the Board to change anything.

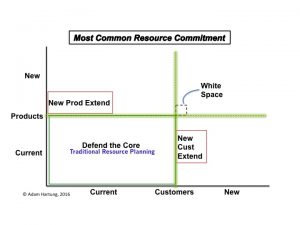

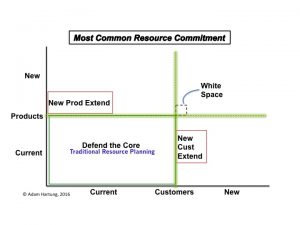

And these planning processes are backward-oriented tools, designed to defend and extend existing products and services, not predict changes in markets. These processes originated out of financial planning, which used almost exclusively historical accounting information. In later years these programs were expanded via ERP (Enterprise Resource Planning) systems (such as SAP and Oracle) to include other information from sales, logistics, manufacturing and procurement. But, again, these numbers are almost wholly historical data. Because all the data is historical, the process is fixated on projecting, and thus defending, the old core of historical products sold to historical customers.

Copyright Adam Hartung

Efforts to enhance the process by including extensions to new products or new customers are very, very difficult to implement. The “owners” of the planning processes are inherent skeptics, inclined to base all forecasts on past performance. They have little interest in unproven ideas. Trying to plan for products not yet sold, or for sales to customers not yet in the fold, is considered far dicier – and therefore not worthy of planning. Those extensions are considered speculation – unable to be forecasted with any precision – and therefore completely ignored or deeply discounted.

And the more they are discounted, the less likely they receive any resource funding. If you can’t plan on it, you can’t forecast it, and therefore, you can’t really fund it. And heaven help some employee has a really novel idea for a new product sold to entirely new customers. This is so “white space” oriented that it is completely outside the system, and impossible to build into any future model for revenue, cost or – therefore – investing.

Take for example Microsoft’s recent deal to sell a bunch of patent rights to Xiaomi in order to have Xiaomi load Office and Skype on all their phones. It is a classic example of taking known products, and extending them to very nearby customers. Basically, a deal to sell current software to customers in new markets via a 3rd party. Rather than develop these markets on their own, Microsoft is retrenching out of phones and limiting its investments in China in order to have Xiaomi build the markets – and keeping Microsoft in its safe zone of existing products to known customers.

The result is companies consistently over-investment in their “core” business of current products to current customers. There is a wealth of information on those two groups, and the historical info is unassailable. So it is considered good practice, and prudent business, to invest in defending that core. A few small bets on extensions might be OK – but not many. And as a result the company investment portfolio becomes entirely skewed toward defending the old business rather than reaching out for future growth opportunities.

This can be disastrous if the market shifts, collapsing the old core business as customers move to different solutions. Such as, say, customers buying fewer PCs as they shift to mobile devices, and fewer servers as they shift to cloud services. These planning systems have no way to integrate trend analysis, and therefore no way to forecast major market changes – especially negative ones. And they lack any mechanism for planning on big changes to the product or customer portfolio. All future scenarios are based on business as it has been – a continuation of the status quo primarily – rather than honest scenarios based on trends.

How can you avoid falling into this dilemma, and avoiding the Microsoft trap? To break this cycle, reverse the inputs. Rather than basing resource allocation on financial planning and historical performance, resource allocation should be based on trend analysis, scenario planning and forecasts built from the future backward. If more time were spent on these plans, and engaging external experts like Board Directors in discussions about the future, then companies would be less likely to become so overly-invested in outdated products and tired customers. Less likely to “stay at the party too long” before finding another market to develop.

If your planning is future-oriented, rather than historically driven, you are far more likely to identify risks to your base business, and reduce investments earlier. Simultaneously you will identify new opportunities worthy of more resources, thus dramatically improving the balance in your investment portfolio. And you will be far less likely to end up like the Chairman of a huge, formerly market leading company who sounds like he slept through the last decade before recognizing that his company’s resource allocation just might need some change.

by Adam Hartung | Jan 17, 2016 | Current Affairs, In the Rapids, Innovation, Leadership, Web/Tech

Stocks are starting 2016 horribly. To put it mildly. From a Dow (DJIA or Dow Jones Industrial Average) at 18,000 in early November values of leading companies have fallen to under 16,000 – a decline of over 11%. Worse, in many regards, has been the free-fall of 2016, with the Dow falling from end-of-year close 17,425 to Friday’s 15,988 – almost 8.5% – in just 10 trading days!

With the bottom apparently disappearing, it is easy to be fearful and not buy stocks. After all, we’re clearly seeing that one can easily lose value in a short time owning equities.

But if you are a long-term investor, then none of this should really make any difference. Because if you are a long-term investor you do not need to turn those equities into cash today – and thus their value today really isn’t important. Instead, what care about is the value in the future when you do plan to sell those equities.

Investors, as opposed to traders, buy only equities of companies they think will go up in value, and thus don’t need to worry about short-term volatility created by headline news, short-term politics or rumors. For investors the most important issue is the major trends which drive the revenues of those companies in which they invest. If those trends have not changed, then there is no reason to sell, and every reason to keep buying.

(1) Buy Amazon

Take for example Amazon. Amazon has fallen from its high of about $700/share to Friday’s close of $570/share in just a few weeks – an astonishing drop of over 18.5%. Yet, there is really no change in the fundamental market situation facing Amazon. Either (a) something dramatic has changed in the world of retail, or (b) investors are over-reacting to some largely irrelevant news and dumping Amazon shares.

Everyone knows that the #1 retail trend is sales moving from brick-and-mortar stores to on-line. And that trend is still clearly in place. Black Friday sales in traditional retail stores declined in 2013, 2014 and 2015 – down 10.4% over the Thanksgiving Holiday weekend. For all December, 2015 retail sales actually declined from 2014. Due to this trend, mega-retailer Wal-Mart announced last week it is closing 269 stores. Beleaguered KMart also announced more store closings as it, and parent Sears, continues the march to non-existence. Nothing in traditional retail is on a growth trend.

However, on-line sales are on a serious growth trend. In what might well be the retail inflection point, the National Retail Federation reported that more people shopped on line Black Friday weekend than those who went to physical stores (and that counts shoppers in categories like autos and groceries which are almost entirely physical store based.) In direct opposition to physical stores, on-line sales jumped 10.4% Black Friday.

And Amazon thoroughly dominated on-line retail sales this holiday season. On Black Friday Amazon sales tripled versus 2014. Amazon scored an amazing 35% market share in e-commerce, wildly outperforming number 2 Best Buy (8%) and ten-fold numbers 3 and 4 Macy’s and WalMart that accomplished just over 3% market share each.

Clearly the market trend toward on-line sales is intact. Perhaps accelerating. And Amazon is the huge leader. Despite the recent route in value, had you bought Amazon one year ago you would still be up 97% (almost double your money.) Reflecting market trends, Wal-Mart has declined 28.5% over the last year, while the Dow dropped 8.7%.

Amazon may not have bottomed in this recent swoon. But, if you are a long-term investor, this drop is not important. And, as a long-term investor you should be gratified that these prices offer an opportunity to buy Amazon at a valuation not available since October – before all that holiday good news happened. If you have money to invest, the case is still quite clear to keep buying Amazon.

(2) Buy Facebook

(2) Buy Facebook

The trend toward using social media has not abated, and Facebook continues to be the gorilla in the room. Nobody comes close to matching the user base size, or marketing/advertising opportunities Facebook offers. Facebook is down 13.5% from November highs, but is up 24.5% from where it was one year ago. With the trend toward internet usage, and social media usage, growing at a phenomenal clip, the case to hold what you have – and add to your position – remains strong. There is ample opportunity for Facebook to go up dramatically over the next few years for patient investors.

(3) Buy Netflix

When was the last time you bought a DVD? Rented a DVD? Streamed a movie? How many movies or TV programs did you stream in 2015? In 2013? Do you see any signs that the trend to streaming will revert? Or even decelerate as more people in more countries have access to devices and high bandwidth?

Last week Netflix announced it is adding 130 new countries to its network in 2016, taking the total to 190 overall. By 2017, about the only place in the world you won’t be able to access Netflix is China. Go anywhere else, and you’ve got it. Additionally, in 2016 Netflix will double the number of its original programs, to 31 from 16. Simultaneously keeping current customers in its network, while luring ever more demographics to the Netflix platform.

Netflix stock is known for its wild volatility, and that remains in force with the value down a whopping 21.8% from its November high. Yet, had you bought 1 year ago even Friday’s close provided you a 109% gain, more than doubling your investment. With all the trends continuing to go its way, and as Netflix holds onto its dominant position, investors should sleep well, and add to their position if funds are available.

(4) Buy Google

Ever since Google/Alphabet overwhelmed Yahoo, taking the lead in search and on-line advertising the company has never looked back. Despite all attempts by competitors to catch up, Google continues to keep 2/3 of the search market. Until the market for search starts declining, trends continue to support owning Google – which has amassed an enormous cash hoard it can use for dividends, share buybacks or growing new markets such as smart home electronics, expanded fiber-optic internet availability, sensing devices and analytics for public health, or autonomous cars (to name just a few.)

The Dow decline of 8.7% would be meaningless to a shareholder who bought one year ago, as GOOG is up 37% year-over year. Given its knowledge of trends and its investment in new products, that Google is down 12% from its recent highs only presents the opportunity to buy more cheaply than one could 2 months ago. There is no trend information that would warrant selling Google now.

(5) Buy Apple

Despite spending most of the last year outperforming the Dow, a one-year investor would today be down 10.7% in Apple vs. 8.7% for the Dow. Apple is off 27.6% from its 52 week high. With a P/E (price divided by earnings) ratio of 10.6 on historical earnings, and 9.3 based on forecasted earnings, Apple is selling at a lower valuation than WalMart (P/E – 13). That is simply astounding given the discussion above about Wal-mart’s operations related to trends, and a difference in business model that has Apple producing revenues of over $2.1M/employee/year while Walmart only achieve $220K/employee/year. Apple has a dividend yield of 2.3%, higher than Dow companies Home Depot, Goldman Sachs, American Express and Disney!

Apple has over $200B cash. That is $34.50/share. Meaning the whole of Apple as an operating company is valued at only $62.50/share – for a remarkable 6 times earnings. These are the kind of multiples historically reserved for “value companies” not expected to grow – like autos! Even though Apple grew revenues by 26% in fyscal 2015, and at the compounded rate of 22%/year from 2011- 2015.

Apple has a very strong base market, as the world leader today in smartphones, tablets and wearables. Additionally, while the PC market declined by over 10% in 2015, Apple’s Mac sales rose 3% – making Apple the only company to grow PC sales. And Apple continues to move forward with new enterprise products for retail such as iBeacon and ApplePay. Meanwhile, in 2016 there will be ongoing demand growth via new development partnerships with large companies such as IBM.

Unfortunately, Apple is now valued as if all bad news imaginable could occur, causing the company to dramatically lose revenues, sustain an enormous downfall in earnings and have its cash dissipated. Yet, Apple rose to become America’s most valuable publicly traded company by not only understanding trends, but creating them, along with entirely new markets. Apple’s ability to understand trends and generate profitable revenues from that ability seems to be completely discounted, making it a good long-term investment.

In August, 2015 I recommended FANG investing. This remains the best opportunity for investors in 2016 – with the addition of Apple. These companies are well positioned on long-term trends to grow revenues and create value for several additional years, thereby creating above-market returns for investors that overlook short-term market turbulence and invest for long-term gains.

by Adam Hartung | Dec 13, 2015 | In the Whirlpool, Innovation, Leadership

DuPont is one of America’s oldest corporations. Founded by Eleuthere Irenee duPont as a gunpowder manufacturer for the Revolutionary War, the company has long been one of America’s leading business institutions. From humble beginnings, DuPont became well known as a leader in Research & Development, a consistent leader in patent applications, and the inventor of products that proliferate in our lives from nylon to Teflon pans plastic bottles to Kevlar vests.

But in a series of fast actions during 2015, DuPont as it has been known is going away. And it is too bad the leadership wasn’t in place to save it. Now there will be a short-term bump to investors, but long-term cost cutting will decimate a once great innovation leader. When the bankers take over, it’s never pretty for employees, suppliers, customers or the local community.

But in a series of fast actions during 2015, DuPont as it has been known is going away. And it is too bad the leadership wasn’t in place to save it. Now there will be a short-term bump to investors, but long-term cost cutting will decimate a once great innovation leader. When the bankers take over, it’s never pretty for employees, suppliers, customers or the local community.

It has been a long time since DuPont was the kind of business leader that gathered attention like, say, Apple or Google. From dynamic roots, the company had become quite stodgy and unexciting. Many felt leadership was over-spending on overhead costs like R&D,product development and headquarters personnel.

Thus Trian Fund, led by activist investor Nelson Peltz, set its sites on DuPont, buying 2.7% of the shares and launching a proxy campaign to place its slate of directors on the Board. The objective? Slash R&D and other costs, sell some divisions, raise cash in a hurry and dress up the P&L for a higher short-term valuation.

These sort of attacks almost always work. But DuPont’s CEO, Ellen Kullman, dug in her heels and fought back. She aligned her Board, spent $15M making her case to shareholders, and in a surprising victory beat back Mr. Peltz keeping the board and management intact. In a great rarity, this May DuPont’s management convinced enough shareholders to back their efforts for improving the P&L via their own restructuring and cost improvements, planned divestitures and organic growth that existing leadership remained intact.

But this victory was quite short-lived. By October, Ms. Kullman was forced out as CEO. A few days later the CFO reported quarterly profits that were only half the previous year. Sales had continued a history of declining in almost all divisions and across almost all geographic segments – with total revenue down to $5B from $7.5B a year ago. As it had done in July and previous quarters end-of-year projections were again lowered.

Net/net – CEO Kullman and management may have won the Trian battle, but they clearly lost the business war. Unable to actually profitably grow the company, the Board lost patience. They were willing to support management, but when that team could not produce the innovations to keep growing they were willing to accelerate cost cutting ($1B in 2015 alone) in order to prop up short-term stock valuation.

Now the newly placed transaction-oriented CEO of Dupont has cooked up a deal the bankers simply love. Merge DuPont with Saran Wrap and Ziploc inventor Dow Chemical, which itself has been the target of Third Point’s activist leader Dan Loeb (which Dow settled by giving Third Point 2 board seats rather than risk a proxy battle.) Then whack even more costs – some $3B – and lay off some 20,000 of the combined companies’ 110,000 employees. Then split the remaining operations into 3 new companies and spin those out publicly.

Sounds so good on paper. So simple. And think of the size of the investment banking and legal fees!!!! That will create some great partner bonuses in 2016!

Theoretically, this will create 3 companies that are more profitable, even though sales are not improving at all. Improved P&L’s will be projected into the future, and higher P/E (price to earnings) multiples on the stock should yield investors a very nice short-term gain. A one-time investor “Christmas present.”

But what will investors actually own? The lower cost companies will now be largely without R&D, new product development, internal patent departments, university research grant management programs, and many of the finance, marketing and sales personnel. Exactly how will future growth be assured? What will happen to these once-great sources of invention and innovation?

Nothing about this mega-transaction actually makes business better for anyone:

- The companies are no closer aligned with market trends than before. In fact, lacking people in innovation positions (product development, R&D and marketing) they are very likely to become even further removed from the leading trends that could create breakthrough products.

- Competition will be reduced short-term, so there will be less price pressure. But longer-term innovation will shift to smaller companies like Monsanto and Syngenta, or even companies currently not on the industry radar – as well as universities. These big companies will be removed from the leading edge of competition, the innovation edge, and will much more likely miss the next wave of products in all markets as new competitors emerge.

- There will be no resources to develop or manage new innovations that emerge internally, or externally. The much smaller staffs will have no bandwidth to explore new technologies, new products, new go-to-market channels or new ways of doing business. There will be no resources for white space teams to explore market shifts, consider major threats to their “core,” or develop potentially disruptive businesses that will generate future growth.

A very smart CFO once told me “when the finance guys are figuring out how to make money, rather than the business guys, you need to be very worried.” Clever transactions, like the one proposed between DuPont and Dow, do not replace great leadership. These are one-time events, and almost always leave the remaining assets weaker and less competitive than before.

Leadership requires understanding markets, managing innovation, creating new solutions, disrupting old businesses by launching new ones, and generating recurring profitable sales growth. Unfortunately, DuPont suffered from a lack of great leadership for several years, which left it vulnerable. Now the bankers are in charge, busy managing spreadsheets rather than products, customers and sales.

Don’t be confused. In no way does this merger and reorganization improve the competitiveness of these businesses. And for that reason, it will not offer a long-term value enhancement for shareholders. But even more obvious is the outcome negative outcome we can expect for employees, suppliers, customers and the communities in which these companies have operated. Bad leadership let the hyenas in, and they will pick the best meat off the bone for themselves first – leaving seriously damaged carcasses for everyone else.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Fortune quotes legendary short seller Jim Chanos as saying the deal is “crazy.” He argues that SolarCity has an uneconomic business model based on his analysis of historical financial statements. And now Fortune is reporting that shareholder lawsuits to block the deal could delay, or kill, the merger.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

Throughout America’s history, being an immigrant has been tough. The first ones had to deal with bad weather, difficult farming techniques, hostile terrain, wild animals – it was very difficult. As time passed immigrants continued to face these issues, expanding westward. But they also faced horrible living conditions in major cities, poor food, bad pay, minimal medical care and often abuse by the people already that previously immigrated.

The show was led by 2 engineers who worked together on the tests and props. Interestingly,

The show was led by 2 engineers who worked together on the tests and props. Interestingly,

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its

Some think this is just a fad, after all it is just 2 weeks old. Candy Crush came along and it seemed really popular. But after initial growth its

But in a series of fast actions during 2015, DuPont as it has been known is going away. And it is too bad the leadership wasn’t in place to save it. Now there will be a short-term bump to investors, but long-term cost cutting will decimate a once great innovation leader. When the bankers take over, it’s never pretty for employees, suppliers, customers or the local community.

But in a series of fast actions during 2015, DuPont as it has been known is going away. And it is too bad the leadership wasn’t in place to save it. Now there will be a short-term bump to investors, but long-term cost cutting will decimate a once great innovation leader. When the bankers take over, it’s never pretty for employees, suppliers, customers or the local community.