Chart courtesy of Felix Richter, Statista.com https://www.statista.com/chart/9454/retail-space-per-1000-people/

Tuesday American celebrates Independence Day, and the decision to break away as a colony from England. Since then America has been on quite a growth journey, and today most Americans cannot imagine a world where the USA is not the dominant power. They were born post World War II and simply believe that America was once the great world power, and always will be. Like it is some God-given immutable right.

But it’s not.

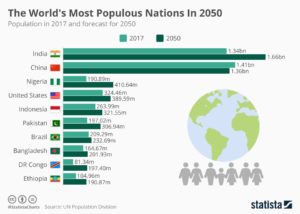

Statista, UN Division

From the early 1800s well into the middle 1900s America had one of the fastest population growth rates in the world. “Bring us your tired, your poor, your huddled masses yearning to breathe free” is on the Statue of Liberty for no small reason – America accepted floods of immigrants from around the world as westward expansion and the industrial age created huge opportunity for everyone. People flooded America, and many people had very large families. Well into the 1900s it was not uncommon for people to have 6, 8 or 10 siblings.

When the boomers were born America was rich in natural resources, had a growing economy, and had avoided the devastation that was left behind in Japan, Europe parts of southeast Asia and north Africa. India was an emerging country, finding its way after refuting colonialism. And China was off the world stage due to the inwardly focused leadership. So Americans have lived a very long time thinking that the world will always be a Christian, capitalist, democratic place where the USA’s domination could not be challenged.

But many things have changed dramatically, and many more changes are coming soon enough. In a few short years population growth will make America a relatively far smaller country. And both technology skill development and understanding how to use capitalism have unleashed dramatic growth in what were formerly derisively referred to as “emerging” countries. “Emerging” implying that America had nothing to concern itself as regards these countries.

Zulu were some of the most feared warriors in Africa. But, they had a practice of being inwardly focused. As they looked inward they did not fear external enemies, but only those who came into their inner circle. Approaching their internal circle could invite attack, and demolition. But, eventually the external enemies became too many, and too far reaching, and the inwardly focused Zulu were attacked on multiple fronts from a growing host of enemies. The Zulu lost their domination as Africa’s military leaders.

Americans must address their inclination for inwardly focusing on “what’s good for America.” It is naively affixing self-blinders to think policy decisions can be made independently of the world community, and without harmful retribution. There are a lot more “of them” than their are “of us.” And the majority of “them” have nuclear weapons just as powerful as “ours.” And “their” economies are just as strong as “ours.” In many cases actually a lot stronger. These countries can stand on their own without U.S. support, and they can implement policies which can be very destructive to U.S. economic interests globally. And they can form their own coalitions to avoid working with America.

As other countries grow, those that choose to ignore immigration and the global movement of people will be big losers. Today Japan is struggling, losing economic power annually, because it refuses to endorse a robust immigration policy. Unfortunately, the same thing cold happen to America as its population growth rate falls, and its economic growth falls with it. Outlawing sanctuary cities that help immigrants merge into American society is a misbegotten policy based on false assumptions about America’s lack of need for immigrants to remain globally competitive.

If America chooses to start all-out trade wars to protect its economy, America could be isolated and likely lose more than it gains. Where once American resources and technology were essential, that is far less true today. European countries have every bit the technology and investment skills of Americans, as do the Chinese and many other countries. Just look at how many of your beloved products, such as mobile phones, computers, TVs, and game consoles, are not made in America at all. There are ample trade opportunities between all countries to supply each other with goods and products, including commodities such as wheat, coal, oil, lumber and gold, that could bypass America entirely.

If America starts a shooting war it is far from clear that it will be as untouched as WWII. And far from clear who will “win,” especially if nuclear war ensues.

And while it is tempting to think that God is on the side of Christians, ignoring the growth of Islam is as foolish as the Romans attempting to ignore the growth of Christianity. Thinking that the growth of Islam is a “Middle Eastern problem” is a dramatic understatement of the situation. Population growth rates of Muslims are far greater globally than other religions. It is ridiculous to think that Islam will not be a major part of the world religious landscape. Thinking that Islam is a problem is hyperbole. Thinking America can isolate itself from Islam is simply an hallucination.

Demographic trends are powerful forecasters. They are very easy to predict, and almost always correct. And they foretell a lot about how we will live and work in the future. The key to good policy making is understanding these trends and working to take advantage of them for growth. Ignoring them is a perilous journey that always ends very badly. Since many of the trends are obvious, isn’t it time to plan for them effectively?

People like to discuss “strategic pivots” in tech companies. The term refers to changing a company’s strategy dramatically in reaction to market shifts. Like when Apple pivoted in 2000 from being the Mac company to its focus on mobile, which lead to the iPod, iPhone, and other mobile products. But everyone needs to know how to pivot, and some of the most important pivots haven’t even been in tech.

Take for example Netflix. Netflix won the war in video distribution, annihilating Blockbuster. But then, when it seemed Netflix owned video distribution, CEO Reed Hastings pivoted from distribution to streaming. He cut investment in distribution assets, and raised prices. Then he spent the money learning how to become a tech company that could lead the world in streaming services. It was a big bet that cannibalized the old business in order to position Netflix for future success.

Analysts hated the idea, and the stock price sank. But CEO Hastings was proven right. By investing heavily in the next wave of technology and market growth Netflix soared toward far greater success than had it kept spending money in lower cost distribution of cassettes and DVDs.

(From L to R) Philippe Dauman, US actress and singer Selena Gomez, MTV President Stephen Friedman and US director Jon Chu attend a Viacom seminar during the 59th International Festival of Creativity – Cannes Lions 2012, on June 21, 2012 in Cannes, southeastern France. The Cannes Lions International Advertising Festival, running from June 17 to 23, is a world’s meeting place for professionals in the communications industry. (VALERY HACHE/AFP/GettyImages)

This week Arthur Sadoun, the CEO of the world’s third largest advertising agency (Publicis) announced he was betting on a strategic pivot. And most in the industry questioned if he made a good decision.

Simply put, CEO Sadoun announced at the largest ad agency awards conference, the Cannes International Festival of Creativity, that Publicis would no longer participate in Cannes. Nor would it participate in several other conferences including the very large South by Southwest (SXSW) and Consumer Electronics Show (CES.) Instead, he would save those costs to invest in AR (artificial or augmented reality.)

In an industry long dominated by highly creative people who love mixing with other agency folks and clients, this was an enormous shock. These conferences were where award winners marketed their creative capability, showing off how much they were admired by peers. And they wined and dined clients seeking to build on awards to gain new business. No one would expect any major agency to drop out, and most especially not an agency as large as Publicis.

In changing markets strategic pivots make sense.

And strategically this pivot makes a lot of sense. The ad industry was once dominated by ads placed in newspaper, magazines and on TV. But today print journalism is almost dead. The demand for print ads is a fraction of 20 years ago. And TV is no longer as prevalent as before. Today, people spend more time looking at their smartphone than they do their TV. The days of thinking high creativity would lead to high sales are in the past. Fewer and fewer big advertisers care about who wins awards, and fewer are going to these conferences to decide who they would like to hire.

Today advertising is going “programmatic.” Increasingly ads are placed by computers, on web and mobile sites. Advertising is about finding the right eyeballs, at the right time, next to the right content in order to find a buyer. Advertisers no longer spend money lavishly on mass media hoping for good results. Instead ads are targeted, measured for response and evaluated for ROI based on media, location, user and a raft of other metrics.

And the industry has changed. There still is an advertising agency business. But it is under attack from tech companies like Google, Facebook, Twitter and Snap that promote to advertisers their ability to target the right clients for high returns on money spent. The content is important, but today almost everyone in the industry will tell you success depends on your budget and how you spend it, not the creative. And that is a lot more about understanding how we’re all interconnected, knowing how to measure device usage, profiling user behavior and programming the computers to put those ads in the right place, at the right time.

To pivot you must stop doing the old to start doing the new

Publicis has something like $10B in revenue. Thus, dropping $20M on filing award applications at events like Cannes, and sending a contingent of employees to receive awards, meet people and have fun doesn’t sound like a lot. But multiple that across the year and the total amount could well come to $100M-$200M. That’s still only 2% of revenues – at most. It would seem like not that much money given what has been a core part of historical marketing.

But, if Publicis is to compete in the future with the tech leaders, and emerging digital-oriented agencies, it has to develop technology that will make it a leader. Publicis can’t invent money out of thin air, so it has to stop doing something to create the funds for investing in what’s coming next. And stopping investing in something as “old school” as Cannes actually sounds really smart. As boomer ad execs retire the newer generation is not going to conventions to find agencies, they are looking under the hood at the technology engines these companies provide.

In new strategic areas a little money can go a long way

And while $100M to $200M may not sound like a lot, it is enough money to make a difference in creating a tech team that can work on future-oriented technology like AI. If spent wisely, that could truly move the needle. If Publicis could demonstrate an ability to use proprietary AI technology to better place ads and manage the budget for higher returns it can survive, and perhaps thrive, in a digitally dominated ad industry future. At the very least it can find its place next to Facebook and Google.

WPP, Omnicom and Interpublic should take serious notice. Will they succeed in 2025 if they keep marketing the way they did in 1985? Will this spending grow revenues if customers really don’t care about creative awards? Will they remain relevant if they lack their own technology to develop ads, campaigns and demonstrate positive rates of return on ad dollars spent?

CEO Sadoun’s approach to make the announcement without a lot of preliminary employee discussion shocked a lot of folks. And it shocked the festival owners who now have to wonder what the future of their business will be. But strategic pivots are shocking. They demonstrate a dramatic shift in how resources are deployed to position a company for the future, rather than simply trying to defend and extend the past.

It’s a lot smarter to try what you don’t know than hope everything will stay the same.

Will this work? There is no way to know if the Publicis leadership team can maneuver through the technology maze toward something great. But, at least they are trying. And that alone gives them a lot better shot at longevity than if they simply decided to do in 2018 what they have always done. Is your company ready to reassess its preparation for the future and address your strategy like you’re a tech company? Are you spending money on market shifts, or simply doing the same thing you’ve always done?

Whole Food flagship store in Austin, Texas.

Amazon announced it was paying $13.7B to buy Whole Foods. While not without risks, there are a lot of reasons this is a great idea:

Building any retail chain takes a long time. Due to the intensity of competition, and low margins, building a grocery chain takes even longer. Amazon would have spent decades trying to create its own chain. Now it won’t lose all that time, and it won’t give competitors more time to figure out their strategies.

Few people realize that no grocer makes money selling groceries. Revenues do not cover the costs of inventory, buildings and labor. On its own, selling groceries loses money. Grocers survive on manufacturer “deal dollars.”

Companies like P&G, Nabisco, etc. pay grocers slotting fees to obtain shelf space, they pay premiums for eye level shelves and end caps, they pay new product fees to have grocers stock new items, they pay inventory fees to have grocers keep inventory on shelf and in back, they pay advertising fees to have signs in the stores and products in circulars, and they pay volume rebates for meeting, and exceeding, volume goals. It is these manufacturer “deal dollars” that cover the losses on the store operations and create a profit for investors.

One reason Whole Foods prices are so high is they stock less of the mass market goods and thus receive fewer deal dollars. Now Amazon can use Whole Foods to increase its volume in all products and dramatically increase its deal dollar inflow. Something that Amazon sorely missed as a “delivery only” grocer.

Grocery distribution is unique. For decades grocers have worked with manufacturers, cooperatives, growers and other suppliers to create the shortest, most efficient distribution of food with the lowest inventory. In many instances replenishment quantities are shipped based on manufacturer access to real grocer sales data. Amazon is the best at what it does, but to compete in groceries it needed a grocery distribution system – and with Whole Foods it obtains one at scale without having to create it.

Additionally Amazon will obtain the corporate infrastructure of a grocer, without having to build one on its own. All those buyers, merchandisers, real estate professionals, local ad buyers, etc. are there and ready to execute – something building would be very hard to do.

Whole Foods has 460 stores, and almost all are in great locations. Whole Foods focused on upscale, growing and often urban or suburban locations – all great for Amazon to grow its distribution footprint. And hard sites to find.

These can be used to sell other products, such as other grocery items, or some selection of Amazon products if that makes sense. Or these can be used to augment Amazon’s distribution system for local delivery – or as neighborhood drop-off locations for people who don’t want at-home delivery to pick up Amazon-purchased products. Or they can be sold/leased at very attractive prices.

“Whole Paycheck” has long been the knock on Whole Foods. As mentioned before, the lack of mass market items meant their products lacked deal dollars and thus had to be priced higher. And their stores are large, and not the best use of space. The result has been a lot of trouble keeping customers, and one of the lowest sales per square foot in the grocery industry.

Amazon can easily use its low-price position to alter the Whole Foods brand concept to include things like Pepsi, Coke, Bounty, Gain – a slew of branded consumer goods previously eschewed by Whole Foods. Adding these products could make the stores more useful to more customers, and greatly lower the average cost of a cart full of goods. On its own, this brand transition has been impossible for Whole Foods. As part of Amazon remaking the brand will be vastly easier.

If you shopped Amazon you know they really figure out your needs, and help you find what you want. Amazon keeps track of your searches and purchases, and makes recommendations that often help the shopping experience and delight us as customers.

But today all that information on grocery shopping is un-mined. Despite using a loyalty card, traditional grocers (and WalMart) have been unable to actually mine that information for better marketing. Now Whole Foods will be able to use Amazon’s incredible technology skills, including big data mining and artificial (or augmented) intelligence to actually help us make the grocery shopping experience better – less time intensive, and most likely less costly while still allowing us to fill our carts with what we need and what makes us happy.

$13.7B is only 65% of the cash Amazon had on hand end of last quarter. And Amazon has only $7.7B in long-term debt. With a $460B market cap Amazon could easily take on more debt without adding significant financial risk.

But even more important, Amazon has the amazingly cheap currency that is Amazon stock. Even at the offering price, Whole Foods trades at 34x earnings. Amazon trades at 185x earnings. Thus by swapping Amazon shares for Whole Foods shares Amazon lowers the price 80%! Amazon isn’t spending real dollars, it is using its stock – which is an incredibly valuable move for its shareholders.

For the last several years WalMart’s general merchandise sales have been declining due to the Amazon Effect and growing on-line competitor sales. For the last 3 years overall revenues have not grown at all. To maintain revenue Walmart has shifted increasingly to groceries – which account for well over half of all WalMart revenues. By purchasing Whole Foods, Amazon takes direct aim at the only part of WalMart’s “core” business that it has not attacked.

Walmart’s net profit before taxes is ~4%. If Amazon can use Whole Foods to combine stores and on-line sales to take just 3% of WalMart’s grocery business away it could remove from Walmart ($485B revenues * 60% grocery * 3% market share loss) a net revenue decline of ~$9B. Given that the cost of grocery goods sold is about 50% – that would mean a net loss in contribution of $4.5B – which would cut almost 25% out of Amazon’s $20B pre-tax income. Raise the share taken to 5% and Amazon could cut WalMart’s pre-tax income by $7.25B, or ~35%.

The negative impact of declining store sales on the fixed costs of WalMart is atrocious. Even small revenue drops mean cutting staff, cutting inventory, cutting store size and eventually closing stores. Look at how fast Sears and Kmart fell apart when sales started declining. Like dominoes falling, declining sales sets off a series of bad events that dooms almost all retailers – as the quickened pace of retail bankruptcy filings has proven.

The above analysis, taking 3-5% out of Walmart’s grocery sales, say over 3 years, would be a huge gain attributed to the creation of a new Whole Foods combined with Amazon’s e-commerce. Growing grocery revenues by $9-$14B would mean practically a doubling of Whole Foods. Which sounds enormous – and most likely impossible for Whole Foods to do on its own, even if it did launch some kind of e-commerce initiative.

But this is not so unlikely given Amazon’s track record. Amazon has been growing at over 25%/year, adding between $20-$25B of new revenues annually. In 3 years between 2013 and 2016 Amazon doubled its revenues. So it is not that unlikely to expect Amazon puts forward an extremely ambitious push to turn around Whole Foods, increase store sales and use the combined entities to grow delivery sales of groceries and other general merchandise.

Is there risk in this acquisition? Of course. Combining any two companies is fraught with peril – combining IT systems, distribution systems, customer systems and cultures leaves enormous opportunities for missteps and disaster. But the upsides are enormous. Overall, this is a bet Amazon investors should be glad leadership is making – and it is a great benefit for Whole Foods investors.

GE Chairman and CEO Jeff Immelt walks off stage after being interviewed during the Washington Ideas Forum at the Harmon Center for the Arts September 28, 2016 in Washington, DC. A proud Republican, Immelt said it would hurt the United States and cripple President Barack Obama — and the next president of the U.S. — not to agree to trade deals like theTrans Pacific Partnership (Photo by Chip Somodevilla/Getty Images)

Readers of this column know I’m not a fan of General Electric’s CEO, Jeffrey Immelt. In May, 2012 I listed CEO Immelt as the 4th worst CEO of a large publicly traded American company. Unfortunately, his continued tenure since then did nothing to help make GE a stronger, or more valuable company. GE’s lead director says this is the culmination of a transition plan first developed in 2011. One can only wonder why it took the board so incredibly long to replace the feckless CEO, and why they allowed GE’s leadership to continue destroying shareholder value.

The longer back you look, the worse Immelt’s performance appears.

Few company analysts can say they’ve followed a company for 3 years. Fewer yet can say 5 years. Nearly none can say a decade. Yet, CEO Immelt was in his job for 16 years – much longer than almost all business analysts or writers have followed GE. Therefore, their lack of long-term memory often leaves them unable to give a proper overview of the company’s fortunes under the long-lived CEO.

I have followed GE closely for almost 35 years. Ever since I graduated from HBS class of 1982 along with Mr. Immelt. Several fellow alumni worked at GE, and a large number of my BCG (Boston Consulting Group) colleagues joined GE in senior positions during the mid-1980s as GE grew exponentially. I have followed several of these alumni as the years passed allowing me to take the “long view” on GE’s performance, during Welch’s leadership and more recently since Mr. Immelt took the top job.

I was very pleased to include a positive case study of GE’s business practices in my book “Create Marketplace Distruption – How to Stay Ahead of the Competition” (Financial Times Press, 2007.) CEO Welch used a number of internal processes to help GE leaders identify disruptive opportunities to change industries – whether markets where GE already competed or new markets. He relentlessly encouraged entering new businesses where GE could bring something new to the game, and he put GE’s money to good use growing revenues, and market cap, enormously. No other CEO in American history made as much value for shareholders as Jack Welch. His leadership pushed GE to the top position in most industries, and his relentless focus on growth helped even rank-and-file employees build million dollar IRAs to go with well funded pension and retiree benefit plans.

GE’s performance could not have changed more dramatically than it has under Mr. Immelt. But there are now a number of apologists who would say GE’s smaller size, and lower valuation, are due to market conditions which were out of Mr. Immelt’s control. They contend CEO Immelt was a good steward of the company during difficult market conditions, and the results of his tenure – notably lower revenues, lower valuation, fewer markets, fewer employees and lower community involvement – are not his fault. They argue he did a good job, all things considered.

Balderdash. Immelt was a terrible CEO

There is an overall reluctance to say bad things about any huge American icon, and its CEO. After all, columnists and analysts who are non-congratulatory don’t usually get called by the company to be consultants, or advisors. Or to be on the board. And publishers of columnists who say negative things about big companies and their execs risk having ad dollars moved to more favorable journals, and often unfriendly relationships with their ad departments and agencies. So it is far easier, and more acceptable, to sugar coat bad strategy, bad leadership and bad results.

But we should move beyond that bias. Mr. Immelt was the CEO of the ONLY company on the Dow Jones Industrial Average (DJIA) to have been on that list since it was created. He inherited the most successful company at creating shareholder value during the 1980s and 1990s. He surely should be held to the highest of comparative bars.

Those who say CEO Immelt was “set up to fail” are somehow making the case that Immelt would have been more successful if he had inherited a company with a bad brand image, weak history, and inadequate performance. They are rewriting history to say Jack Welch was not a good CEO, and his outsized gains destined GE to do poorly under his successor. That simply defies the facts – and logic.

Looking at the last 16 years of “difficult times,” when GE has struggled under Immelt’s leadership, one should ask “why did so many other companies do so well?” After all, the DJIA has more than doubled. The S&P 500 has almost doubled. The Russell 2000 has almost tripled. Overall, far more companies have gone up in value than down. Why were Immelt’s circumstances so difficult that all of those CEOs did so much better? They dealt with the same financial meltdown, same Great Recession, same increase in regulations, same federal reserve, same government administration – yet they were able to adapt their companies, grow and increase value.

Yes, GE was huge in financial services when Immelt took the reigns, and financial services saw a major crash. But look at the performance of JPMorganChase under CEO Jamie Dimon (also a classmate of Mr. Immelt.) JPM is stronger today than ever, growing and gaining market share and increasing its value to shareholders. Prior to the crash, in spring 2007, GE was trading at $41/share, and now it is $29 – a decline of ~30%. Back then JPM was trading at $53, and now it is $93 – a gain of ~75%. There obviously was a strategy to adapt to market conditions and do well. Just not at GE.

Immelt reacted to market events, poorly, rather than having a prepared, proactive strategy

Let’s not rewrite history. Prior to the banking crash CEO Immelt was more than happy for GE to be in the “easy money” world of finance. Welch had created GE Capital, and Immelt had furthered its growth when lending was easy and profitable. And he supported the enormous growth in GE’s real estate division. When this industry faced the crash, GE faced a near-bankruptcy not because of Welch, but because of Immelt’s leadership during the over 6 years he had been CEO. If there were risks in the system CEO Immelt had ample time to re-arrange the portfolio, reduce lending, offload financial assets and reduce exposure to real estate and mortgages. But Immelt did not do those things. He did not prepare for a reversal in the markets, and he did not prepare the balance sheet for a significant change of events. It was his leadership that left GE exposed.

As GE shares fell to $7 Immelt made a famous deal with Berkshire Hathaway’s CEO Warren Buffet to increase GE’s capital base in order to stave off demise. And this deal saved GE. But this was an extremely sweet deal for Buffett, giving Berkshire very good interest (10%) on the preferred shares and warrants allowing Buffett to buy future shares of GE at a fixed price. Berkshire made a profit, over and above the interest, of $260M on the deal, and overall at least $1.2B. By being prepared Buffett saved GE and made a lot of money. GE’s investors paid the price for a CEO that was unprepared.

But the changes brought about by the crash, and Dodd-Frank, were more than CEO Immelt could manage. Thus GE exited the business selling many assets at fire sale prices. This “turn tale and run” strategy was sold to the public as a way for GE to “focus” on its “core manufacturing business.” Rather, it was a failure of leadership to understand how to manage this business to future success in changed markets. Where Welch’s GE had grasped for disruption as opportunity, Immelt’s GE gasped at disruption and fled, destroying billions in GE value.

Immelt could not grow GE’s businesses, so he divested GE of many.

GE was to be the “industrial internet giant.” GE was to be a leader in the internet-of-things (IoT) where sensors, the cloud and remote devices created greater productivity. And, to be sure, companies like Apple, Google and Samsung have made huge gains in this market. Even small companies, like Nest, were able to jump on this technology shift with new products for the residential market. But name one market where GE is the dominant IoT player. During 16 years the internet and remote services markets have exploded, yet GE is not the market leader. Rather it is barely recognized.

Rather than growing GE with disruptive innovations and visionary products in emerging technology markets, Immelt’s GE was primarily shrinking via divestitures. In dismantling GE Capital he eliminated the lending and real estate operations. After decades as a leader in appliances, that division was sold. Welch built the extremely successful entertainment division around NBC/Universal, which Immelt sold.

The water business that was to be a world leader under Immelt’s vision, likewise sold – and largely to make sure GE could close the deal on selling its oil & gas unit. Even the famed electrical distribution business, going back to the start of GE, is now close to being sold.

And what happened to all this money? Well, about $50B went into share buybacks – which ostensibly would help shareholders. Only it didn’t, because GE is still worth less than when buybacks started. So the money just disappeared. At least Immelt could have paid it to shareholders as a dividend – but then that would not have boosted his bonuses.

GE’s website says Mr. Immelt wanted to create a “simpler, more valuable industrial company.” Mr. Immelt is definitely leaving behind a simpler, much smaller and weaker company. The brand is gone from consumer products, and severely tarnished in commercial products. GE lacks a great product pipeline, and even a strong development pipeline due to the rampant divestitures. When Mr. Flannery takes over as CEO he will not inherit a powerhouse company. He will inherit a company that is shrinking and rudderless, and disconnected from most growth markets with almost no product, technology or brand advantages. And he will report to the Chairman that created this mess, Mr. Immelt.

The most likely outcome is that Mr. Peltz and his firm, Trian Partners, will buy more GE shares and seek directorships on the board. Then, in a move not unlike the deaths of DuPont and Dow, there will be a massive cost cutting effort to bring expenses in-line with the shrunken GE business. R&D will be discontinued, as will product development. Support groups will be shredded. Customer service will be downsized. Then the remaining pieces will be sold off to buyers, or taken public, leaving GE a dismantled piece of history.

While that may work for the capital markets, and some short-term investors will share in the higher valuation, what about the people? People who dedicated their careers to GE, and are pensioners or current employees? What about cities and counties where GE has been a major employer, and civic contributor? What about customers that bought GE industrial products, only to see those products dropped due to low profitability, or little growth opportunity? What about suppliers that invested in developing new technologies or products for GE to take to market? What will happen to the people who once relied on GE as America’s largest diversified industrial company?

These people all have an ax to grind with the very wealthy, and now departing, CEO Immelt. He inherited what may well have been the most successful company on earth. He leaves behind a far weaker company that may not survive.

Originally posted: May 31, 2017

On the day after Memorial Day Amazon stock hit $1,000/share — a new record high. Amazon is up about 40% the last year. It’s market capitalization doubles Wal-mart. And the vast majority of investment analysts expect Amazon to rise further.

Amazon competes in dozens of international markets, as do many on-line retailers, yet the ‘Amazon Effect’ is far greater in the USA than anywhere else. And there’s a good reason — America is vastly over-served when it comes to traditional retail.

Chart courtesy of Felix Richter, Statista.com https://www.statista.com/chart/9454/retail-space-per-1000-people/

America is enormously over-built with retail space

Looking at square feet of retail space per 1,000 people, this infographic shows that, adjusted for population size, the USA has 8x the retail of Spain, 9x the retail of Italy, 11x the retail of Germany, 22x the retail of Mexico, 51x the retail of China and 400x the retail of India! Overall, this is remarkable. I’ve been to all of these countries, and in none did I feel that I was unable to buy things I needed. Clearly, the USA has had such a robust retail sector that it has dramatically over-expanded – with individual stores, suburban strip malls, elaborate horizontal malls, vertical urban malls and multi-floor urban retail complexes far outpacing the needs of American shoppers.

All these stores created a very competitive retail environment. This competition, and the lack of any sort of national value added tax (VAT,) kept prices for most things in America among the lowest in the world. Simultaneously according to the Department of Labor, Retail is the third largest employer in America. Couple that with the enormous wholesale distribution networks of warehouses and truck fleets — and selling things becomes the country’s largest employer — even bigger than the sum total of all federal, state and local government employees .

Additionally, retail has produced the largest local taxes of any industry, combining local sales taxes with property taxes, which has funded schools and public works projects for decades. And this retail space has helped drive demand for all kinds of support services from utilities to maintenance.

U.S. retail consumers are tremendously over-served, and the market is set to collapse

But now retail is wildly overbuilt. Organic demand for all retail grows about equal to population growth, so about 3%/year. But retail real estate grew far faster since World War II as developers kept building more malls, and large retailers like Sears, KMart, Walmart, Target, Lowe’s and Home Depot built more stores. Now demand for products through traditional retail is declining. People are simply ordering on-line.

Net/net, America’s consumers are now over-served by retailers. There is too much space, and inventory. And now that store-to-home distribution has faded as a problem, with multiple carriers offering overnight service, people are increasingly happy to avoid stores altogether, greatly exacerbating the overcapacity problem. Thus, the ‘Amazon Effect’ has emerged, where stores are closing at a rapid rate and many retailers are failing altogether leaving vast amounts of empty retail space.

Foreign markets are under-served, and benefit from Amazon’s entry

Contrarily, in other countries consumers were to some extent under-served. They actually dealt with local stock-outs on desirable items. And frequently lived in a world with a lot less product choice. And, generally, international consumers expected to travel farther to shop at the few larger stores, malls and urban shopping centers with greater selections.

In those countries local economies became far less dependent on retail real estate for jobs — and for taxes. Most have little or no property taxes as deployed in the USA. Additionally, rather than adding a local sales tax to the price of goods, most countries use some sort of national VAT to collect the tax during distribution. When Amazon starts distributing in these markets it is seen as a good thing! Consumers have more choice, less hassle and often better service. Also, Amazon collects the VAT so no taxes are lost.

Contrarily, American communities could never stop adding retail space. Whenever Walmart or Best Buy wanted a new store, no community leaders turned down the potential local economic gains. But it led to too much space being built for a healthy sector, and certainly far too much given the market shift to on-line retail. Now retail is a classic over-served market, sort of like the need for stagecoaches and livery barns after the railroads were built.

Expect 50-67% of retail space to go vacant within a decade

How much retail space could go vacant in the USA? Just invert the multiples from above. For the USA to have the same retail space as Spain implies an 87.5% reduction, Italy -89%, Germany -91%, Mexico -95.5%. Thus it is not hard to imagine a full 50-67% of America’s retail space to be empty in just 5 or 10 years. Americans would still have 2-3 times the retail space of other developed markets.

There is no doubt Amazon is a good employer, and on-line sales growth will employ hundreds of thousands at Amazon, and millions across the marketplace. Further, most of those jobs will pay a lot better than traditional retail jobs. But there is no sugar-coating the huge impact the ‘Amazon Effect’ will have on local economies and jobs. America is vastly overbuilt and over-supplied by retailers. There will be a huge shake-out, with dozens of retail failures. And there will be enormous amounts of vacant property sitting around, looking for some kind of alternative use. And local communities will find it difficult to meet constituent needs as sales tax and property tax receipts fall dramatically.

As I wrote in my column on February 28, this is going to be an enormous shift. Far bigger than the offshoring of manufacturing. The ‘Amazon Effect’ is automating retailing in ways never imagined by those who built all that retail space. As people keep buying on-line there will be a collapse of retail space pricing, and a collapse of industry participants. Industry players always greatly under-estimate these shifts, so they aren’t projecting retail armaggedon. But in short order the need for retail will be like the need for dedicated, raised-floor computer centers to house mainframes, and later network hubs. It’s just going to go away.

Last week Microsoft announced its new Surface Pro 5 tablet would be available June 15. Did you miss it? Do you care?

Do you remember when it was a big deal that a major tech company released a new, or upgraded, device? Does it seem like increasingly nobody cares?

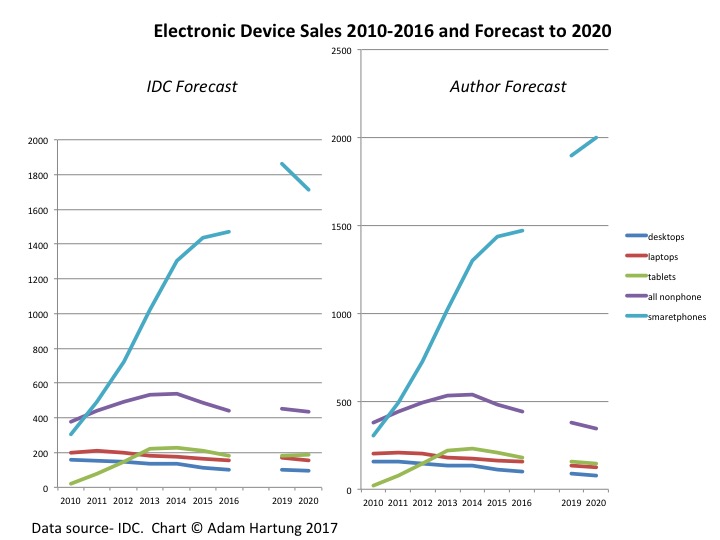

Non-phone device sales are declining, while smartphone sales accelerate

This chart compares IDC sales data, and forecasts, with adjustments to the forecast made by the author. The adjustments offer a fix to IDC’s historical underestimates of PC and tablet sales declines, while simultaneously underestimating sales growth in smartphones.

Since 2010 people are buying fewer desktops and laptops. And after tablet sales ramped up through 2013, tablet purchases have declined precipitously as well. Meanwhile, since 2014 sales of smartphones have doubled, or more, sales of all non-phone devices. And it’s also pretty clear that these trends show no signs of changing.

Why such a stark market shift? After all desktop and laptop sales grew consistently for some 3 decades. Why are they in such decline? And why did the tablet market make such a rapid up, then down movement? It seems pretty clear that people have determined they no longer need large internal hard drives to work locally, nor big keyboards and big screens of non-phone devices. Instead, they can do so much with a phone that this device is becoming the only one they need.

Today a new desktop starts at $350-$400. Laptops start as low as $180, and pretty powerful ones can be had for $500-$700. Tablets also start at about$180, and the newest Microsoft Surface 5 costs $800. Smartphones too start at about $150, and top of the line are $600-$800. So the purchase decision today is not based on price. All devices are more-or-less affordable, and with a range of capabilities that makes price not the determining factor.

Smartphones let most people do most of what they need to do

Every month the Internet-of-Things (IoT) is putting more data in the cloud. And developers are figuring out how to access that data from a smartphone. And smartphone apps are making it increasingly easy to find data, and interact with it, without doing a lot of typing. And without doing a lot of local processing like was commonplace on PCs. Instead, people access the data – whether it is financial information, customer sales and order data, inventory, delivery schedules, plant performance, equipment performance, maintenance specs, throughput, other operating data, web-based news, weather, etc. — via their phone. And they are able to analyze the data with apps they either buy, or that their companies have built or purchased, that don’t rely on an office suite.

Additionally, people are eschewing the old forms of connecting — like email, which benefits from a keyboard — for a combination of texting and social media sites. Why type a lot of words when a picture and a couple of emojis can do the trick?

And nobody listens to CD-based, or watches DVD-based, entertainment any longer. They either stream it live from an app like Pandora, Spotify, StreamUp, Ustream, GoGo or Facebook Live, or they download it from the cloud onto their phone.

To obtain additional insight into just how prevalent this shift to smartphones has become look beyond the USA. According to IDC there are about 1.8 billion smartphone users globally. China has nearly 600M users, and India has over 300 million users — so they account for at least half the market today. And those markets are growing by far the fastest, increasing purchases every quarter in the range of 15-25% more than previous years.

Chinese manufacturers are rapidly catching up to Apple and Samsung – there will be losers

Clayton Christensen often discusses how technology developers “overshoot” user needs. Early market leaders keep developing enhancements long after their products do all people want, producing upgrades that offer little user benefit. And that has happened with PCs and most tablets. They simply do more than people need today, due to the capabilities of the cloud, IoT and apps. Thus, in markets like China and India we see the rapid uptake of smartphones, while demand for PCs, laptops and tablets languish. People just don’t need those capabilities when the smartphone does what they want — and provides greater levels of portability and 24×7 access, which are benefits greatly treasured.

And that is why companies like Microsoft, Dell and HP really have to worry. Their “core” products such as Windows, Office, PCs, laptops and tablets are getting smaller. And these companies are barely marginal competitors in the high growth sales of smartphones and apps. As the market shifts, where will their revenues originate? Cloud services, versus Amazon AWS? Game consoles?

Even Apple and Samsung have reasons to worry. In China Apple has 8.4% market share, while Samsung has 6%. But the Chinese suppliers Oppo, Vivo, Huawei and Xiaomi have 58.4%. And as 2016 ended Chinese manufacturers, including Lenovo, OnePlus and Gionee, were grabbing over 50% of the Indian market, while Samsung has about 20% and Apple is yet to participate. How long will Apple and Samsung dominate the global market as these Chinese manufacturers grow, and increase product development?

When looking at trends it’s easy to lose track of the forest while focusing on individual trees. Don’t become mired in the differences, and specs, comparing laptops, hybrids, tablets and smartphones. Recognize the big shift is away from all devices other than smartphones, which are constantly increasing their capabilities as cloud services and IoT grows. So buy what suits your, and your company’s, needs — without “overbuying” because capabilities just keep improving. And keep your eyes on new, emerging competitors because they have Apple and Samsung in their sites.

Writing on trends, I frequently profile tech companies that use trends to outperform competitors. But using trends is not restricted to tech companies.

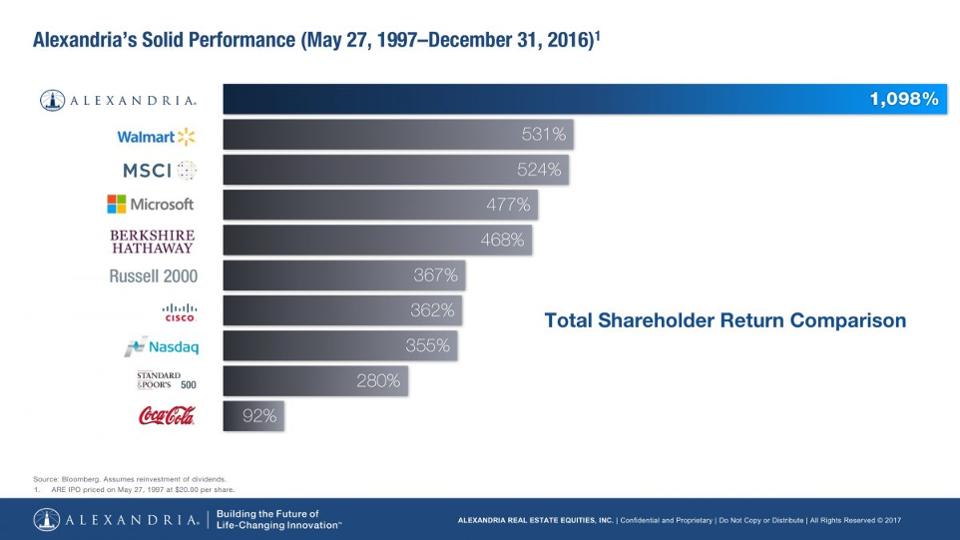

By following trends, since 1998 Alexandria Real Estate Equities has tripled the performance of the NASDAQ, quadrupled returns of the S&P 500, and quintupled the Russell 2000. Alexandria has even outperformed technology stalwart Microsoft, and investment guru Berkshire Hathaway by 230%.

Although you probably never heard of it, Alexandria has trounced its real estate peers. Over the last three years Alexandria has returned double the FTSE NAREIT Equity Office Index, and double the SNL US REIT Office Index. Alexandria’s value has almost doubled during this time, and produced returns 2.3 times better than such well known competitors as Vornado Realty Trust and Boston Properties.

In 1983, Joel Marcus was a lawyer in the IPO market when he noticed the high value launch of biotech firms like Amgen and Genentech. He began tracking the growth of biotechs to see what kind of opportunity might appear to serve these high growth companies.

By 1994 Marcus realized that these companies were struggling to find appropriate real estate to serve their unique needs for laboratory space, and the infrastructure these labs require. It was a classic under-served market, and it was growing fast.

Jacobs Engineering (NYSE:JEC) was serving some of these companies’ needs, including erecting structures for them. But Jacobs did not own any buildings or consider itself a real estate developer. So Marcus approached Jacobs about starting a company to meet the real estate needs of this high growth biotech industry. Marcus put up some money, Jacobs put up some money, and other friends/associates combined to raise $19 million. There was no professionally managed money involved – and no real estate developers.

Focusing on the rapidly expanding biotech scene in San Diego, the newly created Alexandria bought 4 buildings. They refocused the buildings on the unserved needs of local biotech companies and did a quick flip, breaking even on the transaction. With just a bit of money Alexandria had proven that the market existed, the trend was real and users were under-served.

But, like any idea based on an emerging trend, growing was not easy. Using their first transaction as “proof of concept” CEO Marcus and his team set out to raise $100 million. Quickly Paine Webber (now UBS) secured $75 million in debt financing. But moving forward required raising $25 million in equity.

Over the next few weeks Alexandria pitched a slew of nay-sayers. From GE Capital to CALPERS investors felt that their first deal was a “1-trick pony,” and this “niche market” was not a sustainable business. Finally, after 29 failed pitches, the AEW pension fund, an early stage real estate investor, saw the trend and invested.

The Alexandria team realized that fast client growth meant there was no time to develop from ground up. They focused on high growth geographies for biotech, places where the trend was more pronounced, and bought 11 existing properties:

Realizing that companies needing labs tended to cluster, leadership focused on finding locations where clusters were likely to emerge. They bought land in San Francisco, San Diego, New York and Worcester, MA. What looked like risky locations to others looked like profitable opportunities to Alexandria due to their superior trend research.

Historically pharma companies built their headquarters, and labs, in suburban locations where development was easy, and labs were welcome. Alexandria realized the new trend for emerging companies was to be near universities in urban environments, and although land was costly — and development more difficult — this was the right place to leverage the trend.

Today Alexandria is the bona fide market leader in labs and tech facilities in the USA. By seeing the trend early they bought land which is now so expensive it is practically untouchable – even for $1 billion. Their development pipeline includes Mission Bay, Kendall Square, the Manhattan borough of New York City and RTP (Research Triangle Park.) Today companies want to be where the lab is — and frequently the lab space is now owned, or being developed, by Alexandria.

This didn’t happen by accident. Not at the beginning nor as Alexandria plans its future growth. The company maintains a team of 13 researchers studying market trends in technology, and under-served real estate needs. They constantly track employers of tech/research people, competitors, historical and emerging customers — and identify prospective tech tenants who will need specialized real estate. A few of the leading trends Alexandria follows include:

Alexandria’s historical and ongoing successes relied first and foremost on using trends to understand underserved markets where needs will soon be the greatest. This is an important lesson for all businesses. No matter what you do, what you sell, or your industry you can generate higher returns, outperform your peers, and outperform the market rewarding investors by identifying trends and investing in them.

Thanks to Joel Marcus for providing an interview to explain the history and current practices at Alexandria.

(Photo: General Electric CEO Jeffrey Immelt, ERIC PIERMONT/AFP/Getty Images)

General Electric stock had a small pop recently when investors thought CEO Jeffrey Immelt might be pushed out. Obviously more investors hope the CEO leaves than stays. And it appears clear that activist investor Nelson Peltz of Trian Partners thinks it is time for a change in CEO atop the longest running member of the Dow Jones Industrial Average (DJIA.)

You can’t blame investors, however. Since he took over the top job at General Electric in 2001 (16 years ago) GE’s stock value has dropped 38%. Meanwhile, the DJIA has almost doubled. Over that time, GE has been the greatest drag on the DJIA, otherwise the index would be valued even higher! That is terrible performance — especially as CEO of one of America’s largest companies.

But, after 16 years of Immelt’s leadership, there’s a lot more wrong than just the CEO at General Electric these days. As the JPMorgan Chase analyst Stephen Tusa revealed in his analysis, these days GE is actually overvalued, “cash is weak, margins/share of customer wallet are already at entitlement, the sum of the parts valuation points to a low 20s stock price.” He goes on to share his pessimism in GE’s ability to sell additional businesses, or create cost lowering synergies or tax strategies.

Former Chairman and CEO of General Electric Jack Welch. (AP Photo/Richard Drew)

What went so wrong under Immelt? Go back to 1981. GE installed Jack Welch as its new CEO. Over the next 20 years there wasn’t a business Neutron Jack wouldn’t buy, sell or trade. CEO Welch understood the importance of growth. He bought business after business, in markets far removed from traditional manufacturing, building large positions in media and financial services. He expanded globally, into all developing markets. After businesses were acquired the pressure was relentless to keep growing. All had to be no. 1 or no. 2 in their markets or risk being sold off. It was growth, growth and more growth.

Under Welch, GE was in the rapids of growth. Welch understood that good operating performance was not enough. GE had to grow. Investors needed to see a path to higher revenues in order to believe in long term value creation. Immediate profits were necessary but insufficient to create value, because they could be dissipated quickly by new competitors. So Welch kept the headquarters team busy evaluating opportunities, including making some 600 acquisitions. They invested in things that would grow, whether part of historical GE, or not.

Jeff Immelt as CEO took a decidedly different approach to leadership. During his 16 year leadership GE has become a significantly smaller company. He sold off the plastics, appliances and media businesses — once good growth providers — in the name of “refocusing the company.” Plans currently exist to sell off the electrical distribution/grid business (Industrial Solutions) and water businesses, eliminating another $5 billion in annual revenue. He has dismantled the entire financial services and real estate businesses that created tremendous GE value, because he could not figure out how to operate in a more regulated environment. And cost cutting continues. In the GE Transportation business, which is supposed to remain, plans have been announced to double down on cost cutting, eliminating another 2,900 jobs.

Under Immelt GE has focused on profits. Strategy turned from looking outside, for new growth markets and opportunities, to looking inside for ways to optimize the company via business sales, asset sales, layoffs and other cost cutting. Optimizing the business against some sense of an historical “core” caused nearsighted — and shortsighted — quarterly actions, financial gyrations and transactions rather than building a sustainable, growing revenue stream. Under Immelt sales did not just stagnate, sales actually declined while leadership pursued higher margins.

By focusing on the “core” GE business (as defined by Immelt) and pursuing short term profit maximization, leadership significantly damaged GE. Nobody would have ever imagined an activist investor taking a position in Welch’s GE in an effort to restructure the company. Its sales growth was so good, its prospects so bright, that its P/E (price to earnings) multiple kept it out of activist range.

But now the vultures see the opportunity to do an even bigger, better job of whacking up GE — of tearing it into small bits while killing off all R&D and innovation — like they did at DuPont. Over 16 years Immelt has weakened GE’s business — what was the most omnipresent industrial company in America, if not the world – to the point that it can be attacked by outsiders ready to chop it up and sell it off in pieces to make a quick buck.

Thomas Edison, one of the world’s great inventors, innovators and founder of GE, would be appalled. That GE needs now, more than ever, is a leader who understands you cannot save your way to prosperity, you have to invest in growth to create future value and increase your equity valuation.

In May, 2012 (five years ago) I warned investors that Immelt was the wrong CEO. I listed him as the fourth worst CEO of a publicly traded company in America. While he steered GE out of trouble during the financial crisis, he also simply steered the company in circles as it used up its resources. Then was the time to change CEOs, and put in place someone with the fortitude to develop a growth strategy that would leverage the resources, and brand, of GE. But, instead, Immelt remained in place, and GE became a lot smaller, and weaker.

At this point, it is probably too late to save GE. By losing sight of the need to grow, and instead focusing on optimizing the old business while selling assets to raise cash for reorganizations, Immelt has destroyed what was once a great innovation engine. Now that the activists have GE in their sites it is unlikely they will let it ever return to the company it once was – creating whole new markets by developing new technologies that people never before imagined. The future looks a lot more like figuring out how to maximize the value of each piece of meat as it’s carved off the GE carcass.

It’s been over a decade since the Internet transformed print media.

Very quickly the web’s ability to rapidly disseminate news, and articles, made newspapers and magazines obsolete. Along with their demise went the ability for advertisers to reach customers via print. What was once an “easy buy” for the auto or home section of a paper, or for magazines targeting your audience, simply disappeared. Due to very clear measuring tools, unlike print, Internet ads were far cheaper and more appealing to advertisers – so that’s where at least some of the money went.

In 2012 Google surpassed all print media in generating ad revenue. Source Statista courtesy of NewspaperDeathWatch.com

While this trend was easy enough to predict, few expected the unanticipated consequences.

1. First was the trend to automated ad buying. Instead of targeting the message to groups, programmatic buying tools started targeting individuals based upon how they navigated the web. The result was a trolling of web users, and ad placements in all kinds of crazy locations.

2. Which led to the next unanticipated consequence, the rising trend of bad – and even fake – journalism.

Now anybody, without any credentials, could create their own web site and begin publishing anything they want. The need for accuracy is no longer as important as the willingness to do whatever is necessary to obtain eyeballs. Learning how to “go viral” with click-bait keywords and phrases became more critical than fact checking. Because ads are bought by programs, the advertiser is no longer linked to the content or the publisher, leaving the world awash in an ocean of statements – some accurate and some not. Thus, what were once ads that supported noteworthy journals like the New York Times now support activistpost.com.

3. The next big trend is the continuing rise of paid entertainment sites that are displacing broadcast and cable TV.

Netflix is now spending $6 billion per year on original content. According to SymphonyAM’s measurement of viewership, which includes streaming as well as time-shifted viewing, Netflix had the no. 1 most viewed show (Orange is the New Black) and three of the top four most viewed shows in 2016.

Increasingly, purchased streaming services (Netflix, Hulu, et.al.) are displacing broadcast and cable, making it harder for advertisers to reach their audience on TV. As Barry Diller, founder of Fox Broadcasting, said at the Consumer Electronics Show, people who can afford it will buy content – and most people will be able to afford it as prices keep dropping. Soon traditional advertisers will “be advertising to people who can’t afford your goods.”

4. And, lastly, there is the trend away from radio.

Radio historically had an audience of people who listened to their favorite programming at home or in their car. But according to BuzzAngle that too is changing quickly. Today the trend is to streaming audio programming, which jumped 82.6% in 2016, while downloading songs and albums dropped 15-24%. With Apple, Amazon and Google all entering the market, streaming audio is rapidly displacing real-time radio.

Declining free content will affect all consumers and advertisers.

Thus, the assault on advertisers which began with the demise of print continues. This will impact all consumers, as free content increasingly declines. Because of these trends, users will have a lot more options, but simultaneously they will have to be much more aware of the source of their content, and actively involved in selecting what they read, listen to and view. They can’t rely on the platforms (Facebook, etc.) to manage their content. It will require each person select their sources.

Meanwhile, consumer goods companies and anyone who depends on advertising will have to change their success formulas due to these trends. Built-in audiences – ready made targets – are no longer a given. Costs of traditional advertising will go up, while its effectiveness will go down. As the old platforms (print, TV, radio) die off these companies will be forced to lean much, much heavier on social media (Facebook, Snapchat, etc.) and sites like YouTube as the new platforms to push their product message to potential customers.

There will be big losers, and winners, due to these trends.

These market shifts will favor those who aggressively commit early to new communications approaches, and learn how to succeed. Those who dally too long in the old approach will lose awareness, and eventually market share. Lack of ad buying scale benefits, which once greatly favored the very large consumer goods companies (Kraft, P&G, Nestle, Coke, McDonalds) means it will be harder for large players to hold onto dominance. Meanwhile, the easy access and low cost of new platforms means more opportunities will exist for small market disrupters to emerge and quickly grow.

And these trends will impact the fortunes of media and tech companies for investors The decline in print, radio and TV will continue, hurting companies in all three media. When Gannet tried to buy Tronc the banks balked at the price, killing the deal, fearing that forecasted revenues would not materialize.

Just as print distributors have died off, cable’s role as a programming distributor will decline as customers opt for bandwidth without buying programming. Thus trends put the growth prospects of companies such as Comcast and DirecTV/AT&T at peril, as well as their valuations.

Privatized content will benefit Netflix, Amazon and other original content creators. While traditionalists question the wisdom of spending so much on original content, it is clearly the trend and attracts customers. And these trends will benefit streaming services that deliver paid content, like Apple, Amazon and Google. It will benefit social media networks (Facebook and Alphabet) who provide the new platforms for reaching audiences.

Media has changed dramatically from the business it was in 2000. And that change is accelerating. It will impact everyone, because we all are consumers, altering what we consume and how we consume it. And it will change the role, placement and form of advertising as the platforms shift dramatically. So the question becomes, is your business (and your portfolio) ready?

2016 was an election year, and Americans were inundated with talk. Unfortunately, a lot of it was pure hubris.

President-elect Donald Trump inspired people to “make America great again.” In doing so, he developed the theme that the reason America wasn’t so great had to do with too much work being done offshore, rather than onshore. And that there were far too many immigrants, which harmed the economy and the country. This became rather popular with a significant voting block, led in particular by white males – and within that group those lacking higher education. These people expressed, with their votes and with their words at many rallies, that they were economically depressed by America’s policies allowing work to be completed by people not born in America.

Source: With permission of Metacool

Oh, if it was only so simple.

Any time something is manufactured offshore there is a cost to supply the raw materials, often the equipment, and frequently the working capital. These are added costs, not incurred by U.S. manufacturing. The reason manufacturing jobs went offshore had everything to do with (1) Americans unwilling to work at jobs for the pay offered, and (2) an unwillingness for Americans to invest in their skill sets so they could do the work.

Since the 1980s America has lost some five million manufacturing jobs (from about 17.5 million to 12.5million). That sounds terrible, until you realize that the amount of goods manufactured in America is near an all-time. While it may sound backwards, the honest truth is that automation has greatly improved the output of plant and equipment with less labor. America isn’t making less stuff. Productivity more than doubled between 1985 and 2009. As the Great Recession has abated, output is again back to all-time highs. It just doesn’t take nearly as many people as it once did.

Manufacturing today isn’t about sweat shops. Not in the USA, and not in Mexico, China or India. The plants in all these countries are equally high-tech, sophisticated and automated. Just look at the images of workers at the Chinese Foxconn plants, or the Mexican auto parts plants, and you’ll see something that could just as easily be in the USA. The reality is that those plants are in those countries because the workers in those countries train themselves to be very productive, and they make great products at very high quality.

And don’t blame regulations and unions for creating offshoring.

For almost all U.S. companies, their offshore plants comply with the U.S. regulations. Most require the same level of safety and working conditions globally.

Union membership has been declining for 75 years. Fifty years ago one in three workers was in a union. Today, it’s less than one in 10. In 2015 the Bureau of Labor reported that only 6.7% of private sector workers were unionized – an all time modern era low. Unions are almost unimportant today. It hasn’t been union obstructionism that has driven jobs oversees – it’s largely been an inability to hire qualified workers.

Much was made the last few years of a lower labor participation rate. Many Trump followers said that the Obama administration was failing to create jobs, so people stayed home. But that simply was not true. While the economy was recovering, the unemployment rate fell to its lowest level since the super-heated economy of 2001. To find this low level of unemployment prior to that you have to go all the way back to 1970!

There are plenty of jobs. The issue is getting people trained to do the work.

And here is the real rub. You can’t sit home complaining and moping, you have to study hard and train. Before today’s level of computerization and automation, when work was a lot more manual, it didn’t matter how much education you had, nor how well you could read and do math and science. But today, work is not manual. It takes minimal manual skill to operate equipment. Today it takes computer programming skills, engineering skills and math skills.

Trump appealed to those who have let their skills lapse, and shown an unwillingness to study hard to make themselves more employable. He took the Lake Wobegon approach of claiming that U.S. workers were like the people of that famous fictional city – “where all the women are strong, all the men are good looking and all the children are above average.” As much as these “angry white men” who voted for Trump would like to think they are smarter and better trained than immigrants and offshore workers – that just is not true. The problem is not “them.” To the extent there is an American problem, it is U.S.

The Organization for Economic Cooperation and Development (OECD) does an annual Program for International Student Assessment (PISA) study. This looks at test scores across the world to see where students fair best. Of course, economically displaced Americans are sure that Americans are at the top of these test results – because it is easy to assume so.

Americans are in the bottom half of the planet’s educational performance .

The 2015 results are here, and in reading, science and math America doesn’t even crack the top 10. In fact, the poorest 10% of Vietnamese students did better than the average American teen. In all three categories, the USA scored below the global average. American’s are not above average – they are now below average.

American’s have simply gotten lazy. For far too long, when somebody did poorly Americans have blamed the teacher, blamed the test, blamed the “system” — blamed everyone and everything except the person themselves. It has become unacceptable to tell someone they are doing a below-average job. It is unacceptable to tell someone their skills don’t match up to the needs of the job. Instead, we simply give out trophies for participation to everyone, imply that everyone is good, nobody is bad and let mediocrity blossom.

Instead of forcing people to work hard – really hard – and expecting that each and every person will work hard to compete in a global economy – just to keep up – the expectation has developed that hard work is not necessary, and everyone should do really well. Instead of thinking that hard mental effort, ongoing education and additional training are the minimal acceptable standards to maintaining a job, it is expected that high paying jobs should just be there for everyone – even if they lack the skills to perform. American no longer want to admit that someone is being outperformed.

In 1988 Nike set the company on a growth trajectory with their trademarked phrase “Just Do It.” Just get up off the couch and do it. Quit complaining about being out of shape – just do it.

And that’s my wish for America in 2017. Quit blaming foreigners for working harder at school than we do. Quit blaming immigrants for being better trained, and harder working, than Americans. Quit pretending like the problem with the labor participation rate is some kind of problem created by the government. Quit finger-pointing and blaming someone else for being better than us.

Instead, get up off the couch and do it. Go back to school and study hard – harder than the competition. Grades matter. Learn geometry, trigonometry and calculus so you can make things – or operate equipment that makes things. Gain some engineering skills so you can learn to program, in order to improve productivity with a mobile device – or even a personal computer. Become facile in more than one language so you can operate and compete in a global economy.

Hey Americans, instead of blaming everyone else for workers lacking a job, or a higher income, quit talking about the problems. If you want to “make America great again” quit complaining and just do it.