by Adam Hartung | Jul 19, 2021 | Entertainment, Entrepreneurship, Innovation, Strategy, Trends

Netflix Redefines The Pivot

Last week Netflix announced it was going to enter gaming . Interestingly, the analyst reaction was, at best, mixed. Most didn’t think it was a great idea. My favorite is this quote in AdAge came from a pair of Bernstein analysts.

“Bernstein analysts Todd Juenger and Gini Zhang said in a note that they were “tepid” about Netflix getting into gaming, partly because it would mean a lesser focus on the core business. They worry about creating a distraction.”

These untalented analysts went on to say:

“It’s hard not to imagine that if Netflix were to launch its own video games, the majority of the company’s energy would be focused on the success of that new, different, exciting thing (even among employees who aren’t involved in it),” according to the note. It’s also unclear how the company can capitalize on the video-game content without raising prices—and potentially turning away some users unwilling to pay extra, they said.”

A History of Pivoting to Meet Customer Needs

Wow, I’ve heard that before. Remember how Netflix started? Back when we all went to Blockbuster or another video store to rent a tape or dvd overnight, Netflix offered to send them to our house. And let us keep them as long as we wanted. This convenience was so powerful Netflix drove Blockbuster, Family Video and all other traditional video rental stores bankrupt.

After this big win analysts thought that Netflix should take on Amazon in general merchandise e-commerce. After all, Netflix was the largest customer of UPS, USPS and Fedex at the time. Most analysts thought Netflix had the infrastructure to ship things, so they wanted to build on that infrastructure. But Netflix didn’t to that at all. Keeping its eyes on its Value Proposition of “Delivering Entertainment” Netflix instead went headlong into video streaming. And the stock tumbled dramatically as analysts said streaming wasn’t the “core” of Netflix. Netflix wasn’t a tech company, or a telecom or cable company and streaming would be a huge distraction for people lacking proper skills. Netflix’ Value Delivery System was dominated by logistics expertise, and the analysts were focused on milking more out of the Value Delivery System.

Of course Netflix knew its value was in keeping customers happy, not milking its invested assets. Netflix’ “core” was in knowing entertainment, so it had to develop the skills in streaming, or its customers would drift away. Further, Netflix knew it had nowhere near the savvy of Amazon for general merchandise marketing and sales. If it followed Amazon it would fritter away its Value Proposition, and probably never make any money chasing Amazon by trying to devote more energy to its logistics Value Delivery System.

Of course, Netflix was right. Leadership jettisoned the physical distribution Value Delivery System and built a new one around streaming technology. Just as the Bernstein analysts feared, Netflix had to raise prices. Which it did on physical distribution in order to raise the money to invest in streaming, which turned out to be the shot allowing Netflix to dominate globally, not just in the USA. It was enormous win for gaining customers, selling more stuff, and making more money.

About 5 years ago, Netflix realized it yet again had to change its Value Delivery System if it was to maintain its customer Value Proposition. So it scaled back investing in streaming, as that technology was becoming available to everyone. And it invested heavily in content production. Even though it had long distributed other people’s content, Netflix saw that to be a leader in “Delivering Entertainment” it had to create its own. So the money was shifted into making “House of Cards,” which was a huge hit, and “Orange is the New Black.” Now Netflix is the most prolific video content creator in North America. So much good content Netflix has jeopardized the future of TV networks, major movie studios and even entire theatre chains.

Where once the big employment center, and resource hog, in Netflix was logistics, Netflix leadership pivoted its Value Delivery System into streaming technology. Then it pivoted again into content creation. And now, as gaming has become “the next big thing” Netflix is once again pivoting its resources — into fast growing gaming.

Given this is the third pivot, and 4th Value Delivery System, in Netflix, would you bet against CEO Reed Hastings and his leadership team? The negative analysts are as dead wrong now as they were before. Netflix has demonstrated a keen understanding of their Value Proposition, and demonstrated the skill set to adapt their Value Delivery System to meeting emerging customer needs. I believe it is almost a certainty Netflix will find its way in on-line gaming as the trend keeps growing exponentially. And like all the other pivots, they’ll attract even more customers, and sell more product, and make more money.

Are you adaptable to new Value Delivery Systems as technology makes them available?

Do you clearly know your Value Proposition, and are you focused on it — or are you focused on running your Value Delivery System. Are you trying to maximize your old business, or are you seeing how emerging trends are creating new opportunities to grow by entering new businesses, with new Value Delivery Systems? Netflix has demonstrated how to grow very large, very fast. Are your eyes open to Trends and Market Shifts – and are you adaptable to take advantage of emerging market needs? Now is a good time to learn from Netflix.

My calls on Netflix have historically been quite good. Check out these links to previous articles:

How Netflix became the King of Strategic Pivots, 4/2018

Predicting Netflix Would Dominate Entertainment Content, 4/2016

Explaining Why and How Netflix content creation would be good for investors, 3/2015

Explaining why investors should buy Netflix stock when it crashed after announcing its move into streaming, 10/2011

Explaining why you should buy Netflix, predicting it would be the next Apple or Google, 11/2010

Netflix ended last week at $530/share. Had you bought it when I recommended in 11/2010 the stock was $25. You would have had a 25X gain. Had you added to your position in October, 2011 the stock was $16.75. You would have a gain of 31.6X. Had you added in 3/2015 when I recommended higher valuation for investors from content you would have bought at $62, for a gain of 8.5X in 6 years.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jun 10, 2021 | Entrepreneurship, In the Rapids, Innovation, Strategy, Transportation, Trends

The Slow Decline of Two Famous Brands

Demographics have been causing the slow death of 2 very famous brands. Radio Flyer and Harley-Davidson. Now they are reacting, and maybe it won’t be too little too late for them. Here’s the story and a small dose of innovation theory for you to implement in your business.

Radio Flyer for 100 years has been famous for its little red wagons. Since before the Great Depression, children have enjoyed these wagons (and scooters, etc.) for recreation. But family formation has fallen precipitously the last decade, and the birth rate has fallen even faster. Further, lots of competitors have entered the market for small pull wagons and scooters. The net impact is fewer babies, and a big drop in demand for the traditional metal wagons. For a company manufacturing in Chicago, it looked like another slow slide into irrelevancy and failure.

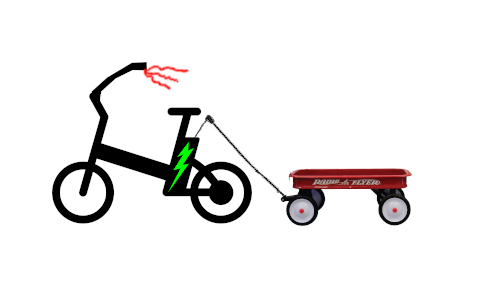

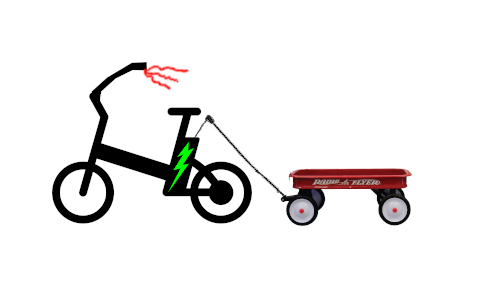

But now, Radio Flyer has announced its new e-bike and e-scooter products. This opens the door to an entirely new market and new customers. People of all ages have started purchasing e-bikes. They ride for pleasure, to run errands and even commuting. In some cities, electric scooter ride sharing rentals have soared faster than bicycle rentals. Sales have skyrocketed. Seeing the underlying trend in demographics, and the changing consumer behavior Radio Flyer is entering the market with new products – priced squarely in the market sweet spot – which just might make the company relevant again.

An even older company is Harley-Davidson. For years, Harley has dominated the market for large engine cruiser style motorcycles. In the 1970s and 1980s, this served the company well as motorcycle sales grew and customers would up-size to Harley bikes from smaller Japanese manufacturers. But the brand image wore old a long time ago. Images of “Hells Angels”, “Easy Rider” and accountants turned HOG (for Harley Owners Group) were not attractive to younger buyers. The average age of Harley buyers kept rising, until now it is almost 60 years old! The reality is that Harley’s market simply started dying off, aging out of buying new motorcycles (or any motorcycle for that matter.) And younger buyers were far less interested in the old-style cruiser in favor of the smaller sized, easier handling and mostly faster sport bikes made in Japan.

For years Harley-Davidson ignored the demographic trends and the impact on its business. Harley made an effort to update its product, and image, introducing the V-Rod with a Porsche manufactured engine. But dealers didn’t like it, and Harley never put in the promotion to bring in the new, younger rider the bike was designed to attract. Now, Harley-Davidson has launched its own e-bike, called the Serial 1. At $5,000 it’s a top-priced e-bike, I guess aligned with the company reputation for premium pricing. But the Serial 1 has garnered good reviews, and like the Radio Flyer e-bike it gives Harley a new technology and a new market with new customers. And most important, a chance to slow its slide into irrelevancy.

Will these products turn these companies around?

It’s hard to say. They aren’t creating a new market like Netflix did in streaming, or Apple did with apps on iPhones. They aren’t early to market. One could say they are a late entry into a crowded marketplace. And neither appear to be introducing any new technology, or enhanced functionality not already available. And the brands are outdated, loaded with nostalgia – which might be good, or bad. But at least they are reacting to trends.

Innovation Theory in Practice

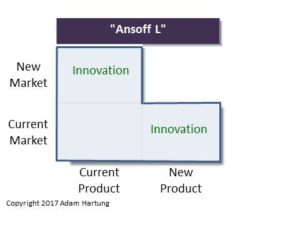

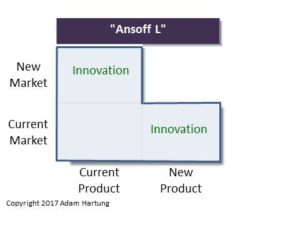

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.

Both Radio Flyer and Harley-Davidson have responded to trends by introducing electric personal transportation products. Both also have loyal core customer segments and strong brand awareness in non-customer segments. The new products allow both companies to launch to existing customers which is the lowest risk choice because the segments are well-known. From there, the brands can expand to new customer segments via word-of-mouth, visibility and ad campaigns. This follows the Ansoff matrix from Current Market/New Product to New Market/New Product.

The second issue is that the market for electric personal transportation is past Early Adopters and into the Growth stage which is when new brands jump in and the market starts to fragment. There is plenty of market share for both Radio Flyer and Harley-Davidson to become established. One key question is- Can these brands offer the products and brand desire to make the jump to segments of new customers?

Are the Brands Structured to Succeed?

To succeed, they must COMMIT resources and focus to these new markets, and create new developments. I wish they would have launched with White Space teams that had permission to develop a new brand image, new distribution, new ad campaigns – an entirely new approach designed to seek out market leadership. Harley-Davidson did create a version of a “skunkworks” with the spinoff of Serial 1, LLC. For now the PR sounds more like they are doing it “on the sly” as something they aren’t really sure will succeed. So it’s really up to senior leadership now. They either commit to a new future allowing product teams to build on the e-bike opportunity to develop new technology, new customers and new markets – or they can slip back into the slide downward. We’ll have to wait and see if they can jump the re-invention gap.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jul 19, 2018 | Entrepreneurship, In the Rapids, Innovation, Marketing, Medical

USA health care is ridiculously expensive. It’s good, but no statistics show that US healthcare is better than any other developed country. Nor any better than accredited facilities in large, developing countries. Look at these comparisons according to Medicaltourism.com:

Procedure USA cost India cost in accredited facility

Heart Bypass $123,000 $7,900

Heart Valve Replacement $170,000 $10,450

Hip Replacement $40,364 $7,200

Knee Replacement $35,000 $6,600

Spinal Fusion $110,000 $10,300

Hysterectomy $15,400 $3,200

Cornea Replacement $17,500 $2,800

Over 1/3 of Americans live with the myth that if they need medical care, somehow it will magically happen at no cost. The Affordable Care Act tried to fix that myth by making everyone buy health insurance. But Congress removed that government mandate. So most Americans that don’t have company-sponsored health insurance don’t buy insurance. Their primary source of health insurance is hope. When illness or accident happens these folks end up with extra-ordinary debt. And they can’t eliminate this debt because health care debt doesn’t go away in bankruptcy. So every year more and more people learn that an unexpected health incident means they will spend the rest of their lives paying for medical services that were 10x or 100x what they expected.

This is a trend that will not end soon. Costs keep going up. The political sides are too divided on what to do. And health insurance companies spend literally billions annually to make sure insurance for all (referred to as Medicare for all) never becomes reality.

This trend means there is opportunity. And that has become medical tourism. Literally, flying to foreign countries for medical procedures.

You may say “not me.” But if you have no money in the bank, and you let your health insurance lapse when you lost your last corporate job ended and you entered the gig economy, you could face a very tough situation. The same one almost all farmers face, and most small business owners, since their insurance is unaffordable. And most 1099 contract employees. When you have an unexpected heart attack at age 41 you wake up to hear a hospital admin say “you are alive, but you need surgery. If you want to live, we can do a heart bypass. Just sign this document and you’ll wake up somewhere north of $123,000 in debt.” Which means you’ll lose your house, for sure. Your kids won’t go to college. And you’ll never again buy a new car.

Or you blow out a hip, or knee,playing that Sunday basketball pick-up game – or golf. You’re 50-55, so too young for Medicare. But you lost health insurance years ago. Or you have a minimalistic plan which will cover a fraction of the cost. Finding the cost is $35,000 to $40,000 (or more likely $60,000 at a for-profit US hospital) are you really able to afford this? Or will you spend your life using crutches, or in a wheelchair? Or start an on–line begging campaign from your friends to cover the cost?

Suddenly, being a medical tourist doesn’t sound so unlikely. Saving $30,000 to $100,000 could determine your financial future. This trend was pretty clear back in 2010 when I pointed out that US medical tourists grew from 700,000 in 2007 to 1.2 million in just 3 years. The trend was actually obvious in 2005, when most people laughed at the idea of medical tourism – because they refused to look at the demographic and cost trends.

That’s why medical tourism is already a $20B business. And growing at 18% annually. Some analysts estimate the global market at almost $80B. Demographics are all in favor of future growth. The developed world population is aging. Health care costs are going up. Government ability to pay is going down. Insurers are charging outrageous rates. Fewer people are buying health care, and even fewer are buying “gold plated plans” that match the average plan in 1990. And American health care policies, in particular, keep driving up costs. It is EASY to see that as people can’t afford care at home, so they WILL be making more trips overseas.

There are already companies making the plunge. Some are matching services between patients and medical facilities. Some are building certified medical facilities in places like India, Singapore, Brazil, Malaysia, Thailand, Costa Rica and Mexico. The opportunities are as big as the health industry.

And this trend affects every business. Are you still stuck in the status quo thinking of extremely expensive insurance for employees, or none? Medical tourism offers a plethora of other opportunities. You can offer a bare-bones domestic plan, with augmented insurance to be a medical tourist. Or even a company sponsored plan, with the opportunity for employees to build a health-care bank, and a relationship with a medical tourism company to help employees find providers offshore. And gig-economy employees can drop the idea of domestic coverage (other than bare bones) for a mixed program including offshore insurance.

Fighting the health cost trend in the USA is foolish. Doing nothing hurts your competitiveness. Given the opportunities in medical tourism, are you thinking about how to build on this trend as a new business? Or a way to offer more to full time and 1099 contractors?

by Adam Hartung | May 2, 2018 | Entrepreneurship, Food and Drink, Innovation, Marketing, Strategy

Execution – Implementation – Delivering — These are table stakes today. If you can’t do them you don’t get a seat at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

Take for example a small company named NakedWine.com that created a potential death trap for its business by implementing one crucial execution mis-step.

The NakedWine value proposition is simple. They will find wines you never heard of and skip the costs of distributors and retailers by matching the customer and winemaker. Customers ostensibly get wines far cheaper because the winemaker’s cost of marketing and sales are avoided. Decent value proposition for both the customer, and the manufacturer.

The NakedWine strategy is to convince people that the NakedWine wines will be good, month after month. The NakedWine brand is crucial, as customer trust is now not in the hands of the winemaker, nor wine aficionados that rate known wines on a point scale, or even the local retail shop owner or employee. Customers must trust NakedWine to put a good product in their hands. Customers who most likely know little or nothing about wines. NakedWines wants customers to trust them so much they will buy the company’s boxed selections month after month, delivered to their home. These customers likely don’t know what they are getting, and don’t much care, because they trust NakedWine to give them a pleasurable product at a price point which makes them happy. When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

But, NakedWines blew the whole strategy with one simple execution mistake.

Not everyone lives where they can accept a case of wine, due to weather. As northern Californians, maybe NakedWine leaders just forget how cold it is in Minneapolis, Chicago, Buffalo and Boston. Or how hot it is in Tucson, Phoenix, Houston, Palm Springs and Las Vegas. In these climates a case of wine left on a truck for a day – or 2 if the first delivery is missed – spells the end of that wine. Ruined by the temperature. Especially heat, as everyone who drinks beer or wine knows that a couple of hours at 90 degrees can kill those products completely.

The only time the customer finally connects with NakedWine is when that wine enters the house, and over the lips. But that step, that final step of getting the perishable wine to the customer safely, in good quality, and aligned with customer expectations was not viewed as part of the brand-building strategy. Instead, leadership decided at this step NakedWines should instead focus on costs. They would view delivery as completely generic – divorced from the brand-building effort. They would use the low–cost vendor, regardless of the service provided.

NakedWine decided to use Fedex Ground, even though Fedex has a terrible package tracking system. Fedex is unwilling to make sure (say, by drivers using a cell phone) that customers will be there to receive a shipment. The driver rings a bell – no answer and he’s on the run in seconds to make sure he’s meeting Fedex efficiency standards, even if the customer was delayed to the door by a phone call or other issue. When the customer requests Fedex send the driver back around again, Fedex is unwilling to attempt a second delivery within short time, or even any time that same day, after delivery fails. If a customer calls about a missed delivery, Fedex is unwilling to route a failed delivery to a temperature local Fedex Office location for customer pick-up. Or to tell the customer where they can meet the driver along his route to accept delivery. Despite a range of good options, the NakedWine product is forced to sit on that Fedex truck, bouncing around all day in the heat, or cold, being ruined. Fedex uses its lowest cost approach to delivery to offer the lowest cost bid, regardless of the impact on the product and/or customer experience, and NakedWine didn’t think about the impact choosing that bid would have on its brand building.

Brand Building at Every Step

Simply put, in addition to flyers, advertising and product discounts, NakedWine should have followed through on its brand building strategy at every step. It must source wines its customers will enjoy. And it must deliver that perishable product in a way that builds the brand – not put it at risk. For example, NakedWine should screen all orders for delivery location, in order to make sure there are no delivery concerns. If there are, someone at NakedWine should contact the customer to discuss with them issues related to shipping, such as temperature. If it is to be too hot or cold, they could highly recommend using a temperature controlled pick-up location so as not to put the product at risk. And they should build in fail-safe’s with the shipping company to handle delivery problems. That is implementing a brand building strategy all the way from value-proposition to delivery.

Leaders Execute Plans

Too often leaders will work hard on a strategy, and create a good value proposition. But then, for some unknown reason, they turn over “execution” to people who don’t really understand the strategy. Worse, leadership often makes the egregious error of pushing those who create the value delivery system to largely to focus on costs, or other wrong metrics, with little concern for the value proposition and strategy. The result is a great idea that goes off the rails. Because the value delivery system simply does not live up to expectations of the value proposition.

by Paul F | Feb 20, 2018 | Entrepreneurship, Innovation, Investing, Science, Trends

Tesla has stuck a deal to put solar panels and Powerwall batteries on 50,000 homes in Southern Australia. The homeowners will not pay for the equipment. They won’t even own it. Instead the equipment will be owned by the utility company, and the 50,000 homes will become a “virtual” power plant – operating as independent pieces of a giant grid. For everyone in the system this will lower power costs by over 30%, and improve the performance where outages are a big problem.

This is really, really smart. The old way of thinking about power generation was a big plant, usually coal, gas or oil powered. Or, a giant group of solar panels in a desert, or a giant group of windmills. Or, a nuclear-powered plant. This centralized generation is then shipped over power lines to homes and businesses.

The problem is that transmission can lose anywhere from 20% to 80% of the power. Thus, the bigger the plant in theory the lower the power cost – but that is only for generation. After factoring in the cost of transmission losses, and the cost of building and maintaining transmission lines, the cost can be quite high. And thus the resulting never-ending increases in electricity prices even as traditional feedstocks go down in cost. Decentralized power generation, in a grid of small production, nearly eliminates transmission losses and uses renewable sources in the most favorable way.

Nobody should be surprised that Tesla is a leader in this program. Back in September, 2016 when Tesla took over (or merged) with Solar City I strongly made the case that this would be a good move. The ability to make solar shingles, solar panels and store large power amounts in whole-building batteries is a game changer for how we make, and consume, electricity. As utility commissions keep realizing the problems with building ever-larger centralized plants, decentralized systems that truly utilize grid management are simply a smarter, cheaper, better way to power our homes and offices.

Most people think of Solar City as “just another home solar system.” That would be wrong. Solar City has the ability to power entire towns and regions with their system of production, storage and grid management. And that is great for Tesla shareholders. Tesla has shown it is a game changer with products like the Model 3, and the combination with Solar City actually creates a utility industry game changer, as well as auto industry game changer, that could put a hurt on companies like Exxon. Now, like when I recommended buying Tesla in January, 2015, you should be thinking long term about the opportunity for outsized returns a game-changing company like Tesla provides.

by Adam Hartung | Aug 10, 2017 | Entrepreneurship, Leadership, Web/Tech

Recently, I wrote a column about 10 young entrepreneurs. Originally I titled it “10 under 20” but the Forbes editors thought that was too close to their “30 under 30” column so they changed it to “10 Great Lessons From Millennial Entrepreneurs.” I didn’t like that title, because it implied these were “great” entrepreneurs, and I really didn’t think they were all that great. Now that some time has gone by, I really regret having written the column.

I’ve written this column at Forbes for almost 7 years. So I am pitched for unsolicited columns every day by PR firms. On average, about 10 pitches every day. But nothing compared with the onslaught of emails I received after the millenial column. Firm after firm, and even individuals, contacted me by email, on Facebook, Linked-in, and Twitter to tell me about some incredible young person who just absolutely needed to be written about. You would think that every high school, and small university, in America had at least one, if not multiple, young prodigies all of which were destined to change the world. It was an avalanche of pitches, from which I could not even begin to fully read, much less respond.

But, almost universally these businesses were not that fantastic. Most were the modern day equivalent of someone opening a lawn service in 1960. Simple businesses that had little to distinguish them. Many had no revenues, and many were little more than somebody’s idea of a business they would like to build. Those that had revenues were so small as to be meaningless, and almost none made any impact on their industry or competition.

The pitches were, without a doubt, the most hyped pitches I have ever received. Over and over I kept asking “why would anyone think this is in the slightest interesting?

The only reason this is being pitched is because it involves someone under the age of 25. And usually that someone lacks any credentials and offers no new insight to the industry or product.”

2 -Not a sustainable business

Writing an app is not a business. Even if it sold a few thousand copies. Nor is trading baseball cards, or selling someone else’s stuff on eBay. Nor is buying bitcoins. By and large, 99% of the pitches were for one-product opportunities that clearly lacked any sense of being a sustainable business which could produce recurring revenue over multiple years. Almost none had any employees, and those that did had a mere handful with no plans to scale any larger.

At best most were simply a single shot situation which generated some revenue for the millennial founder. And most could only pay the founder because the business had no overhead and a highly subsidized cost structure due to support from parents. Many had no, or little, profits and there was nowhere near enough cash to repay traditional investors. Because there was no cost for financing, overhead or even variable activities like payroll, these businesses could not be considered a success in any traditional sense.

3 – These were not really entrepreneurs

French economist Jean-Baptiste Say coined the term entrepreneur. He used it to describe people who seek out inefficient uses of resources and capital then redeployed them into more productive, higher-profit uses. None of the pitched businesses actually redeployed any resources. And none really developed a new industry that created greater productivity. These were just ideas that manifested into a product that fit an immediate need. Most used an existing infrastructure, such as an app store, to do one thing – like sell an app. Maybe someday they’ll write another – but there was no indication any research was happening, customer analysis or market testing to create a long-term business.

Additionally, for entrepreneurs there is some element of risk-taking. For taking risk, by investing in something where others won’t invest, there is the opportunity for outsized returns. But these folks didn’t take any risk at all. It wasn’t their money they invested, but rather their family’s. Most either lived at home, or lived in housing paid for by family (such as a college dorm room.) Most had nothing invested in their “business” other than personal time, and if this failed there was almost nothing lost. And most had minimal gains relative to the size of the risk they undertook with other people’s resources.

And they all lacked any sense of a business plan. Now I’m all for innovation and trying new things, but business success requires the ability to generate ongoing revenue for a prolonged period that covers all costs and creates returns for investors. These folks simply promoted ideas with no description of how this was to be a long-term profitable venture that succeeded for customers, suppliers and financial backers. I found that I would not have been an investor in hardly any of these “businesses” and surely would not recommend readers to back them.

4 – These folks were big self-promoters, not business promoters

Almost to a pitch every story was about some individual – not a business success. I was told over and over and over about how some 17, 18, 19 or 20 year old was absolutely a genius; a modern miracle of incredible business insight. Yet, there was little to back-up these claims. In the end, these were just young folks who had some sense of ambition and fortitude that were doing a few experiments and had (in some instances, not all) sold a few things. But their stories really weren’t that interesting.

One young fellow washed vehicles. He got a contract to wash trucks. And he had expanded his truck washing capability to multiple trucking companies. OK, ambitious and hard working. But nothing fantastic. No technology breakthrough. Just a basic service that he sold cheaply enough to win some contracts. But, he was unwilling to discuss his margins, how much he paid himself or others and how he financed the company or paid a return to his backers. Yet, he was certain that he could franchise his truck washing business and soon enough he would be the next Ray Kroc. He, and his PR person (and it was unclear who paid her) failed to realize that his story might be interesting in 20 years after he proved he could build the next McDonald’s making himself, his investors and his franchisees rich.

Add onto this the fact that almost all of these people had nothing good to say about anyone older. For some reason I was informed over and again that nobody over 40 could really understand how brilliant this person is, and how guaranteed was future success. These people universally had no value for advice from people older than them,  no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

I kept saying to myself “get over yourself kid. You are working hard, but so are a lot of other people. You really haven’t accomplished anything of merit yet. And there’s not really anything here that indicates you will achieve great things. You may win awards for just showing up at school, or at the soccer match, but in business you have a LOT more to prove than you can show up and possibly accomplish some of the basics. Once..”

5 – No sense of how to build something, or even engage in quid pro quo

Bill Gates built a company that produced software millions of people wanted. Steve Jobs built a company that made devices (computers initially) that millions wanted. Henry Ford made cheap cars that millions of people wanted. Mark Zuckerberg created an interaction engine that millions of people wanted (and advertisers would pay to reach.) These founders understood that building a successful business meant combining multiple resources into an organization that functions capably to build products and markets.

If you asked them “why should I write about you?” they would answer, “to tell folks about the improvement in their life from my company’s products.”

When I asked these millennial entrepreneurs why I should write about them, the answer was “because I’m young and great and going places.”

Worse, when I pointed out that in today’s world columnists rely on readers, and therefore columnists want to know the topic will generate reads, they were without even a good idea of how a column on them would generate reads. When I asked “will you promote this through a large social media conduit to drive readers to the column?” they responded with “but isn’t that what Forbes does, bring in readers? I think you should write about me so Forbes readers can become enlightened. Why should I be asked to promote your column, isn’t that what you and Forbes do?”

It was completely unclear to me who was paying for these PR firms. But to them, and to the hundreds of millennials who sent me Facebook, Linked-in and Twitter messages:

- Quit focusing on yourself and actually accomplish something. Don’t be proud you’re a drop-out, go finish school.

- Listen more and talk less. You really don’t have much that’s interesting to say. Pay attention to those who are older, wiser and could help you reach your goals. You need them, and most of them don’t need you. You’re really not as interesting as you think you are.

- Get some education. Bill Gates and Steve Jobs are my age – not yours. Every generation needs more skills than the one before it. Mark Zuckerberg is THE exception, not the rule. Dropping out of Harvard did not make him great. Before you decide you have all the answers, go learn what the questions are. Learn how to think, how to reason, before you decide you know all that’s needed to take action.

- Quit living on subsidies. If your parents or grandparents or aunts and uncles are paying for your rent, or car, or supplies then you still don’t understand basic economics. Become self-sufficient. Make enough money to buy your own new car, buy your own house, and pay 100% of your bills – and even enough that you could afford to raise children. Until you are self-reliant it is very hard to take you seriously as a business leader.

- Life is NOT a one-round event. You are very likely to live 100 years. Do you have the skills to maintain your lifestyle for that full 100 years? Quit crowing about the 1 success (by your definition) you’ve had so far and instead figure out how you’ll lead a productive 100 year existence. You’re only 20% of the way there.

I hear folks say we need to advance millennials onto boards of directors for public companies. Or fund their new ventures without business plans or traditional benchmarks. Or put them into highly placed positions of major corporations. I can’t agree with that. From what I observed, millennials are similar to all other young people. They don’t know what they don’t know. And only time, failures, successes, education (formal and informal) and hard work will prepare them to be tomorrow’s leaders.

I started my entrepreneurial life while a college junior. I was lucky enough to hook up with several people at least a decade older, and they found investors that were a generation older. The company made computer hardware, and largely due to good luck as well as hard work the company was successfull, and was sold for a great return to the investors and some money for the founders. Simultaneously I completed my undergraduate degree in 4 years, summa cum laude. What made me most excited about that experience was not trying to be featured in any journal, but rather that the folks at the Harvard Business School felt this experience was good enough to admit me to their institution to complete an MBA. And there is no doubt in my mind that what I learned in college, and grad school, was incredibly important to generating a lifetime of ongoing business accomplishments – long after that first company disappeared into the dustbin of obsolete technology.

by Adam Hartung | Jul 7, 2017 | Entrepreneurship, Marketing

There has been a lot of press about Millennial entrepreneurs the last 2 years. Young folks – mostly boys – dropping out of high school to start their own businesses at ages as young as 15. One of these, Noah Miller, who started a sports web site at 15 and later a creative agency asked to join my network on Linked-in. Then he asked me to look into the topic of young entrepreneurs and see what lessons we could learn.

1 – If you are really good at something at a young age, continue to work at it

Ben Pasternak liked gaming, and he liked apps. So at 15 he wrote a game-like app and put it on iTunes. 1.3million downloads later he was a young superstar. Since then he’s created two more apps (Flogg and Monkey.) His young hobby led to building strong programming skills, which when linked to identifying what appeals to Millenials turned into apps people really use.

George Matus started flying drones at age 12. He loved it so much he started modifying drones, and building his own. He published videos of his exploits on YouTube, and convinced drone makers to let him be a tester. After 6 years of working on Drones he now has his own Peter Thiel funded company making drones. So far no products on the market, but he is working at it.

Whether iOS apps or drones will be a long-term career is hard to say. But by building strong skills in new technologies with large markets and high growth rates these fellows created business opportunities. You don’t have to be a Millenial to do that.

2 – Take advantage of trends while they are hot

Collecting sneakers is a remarkably big market. Most older folks would call it a fad, thinking nobody will collect sneakers for long. But, it doesn’t really matter if a trend is going to be long-lived, or not, if you are willing to jump in and help push the trend along.

Fifteen year old Ben Kapelushnik liked sneakers. He wanted money to buy more. So he started buying multiple pairs of collectible sneakers and selling the “extra” pairs at a profit. To grow he networked with sneaker sellers to figure out how he could get in line early and buy many pair. Then he networked hard as he could to find associations with big time sneaker collectors, like rappers and other creative artists. Now he has a business buying and selling sneakers. How long will the fad last? Who knows – but Ben is making money by taking advantage of a hot trend.

Connor O’Neil saw the same phenomenon. He thought “why don’t I go source things people want?” So he created a web site where buyers can request he source sneakers, T-shirts and other items. He then searches the web, sourcing the items manually and with bots that will make instantaneous purchases of hard to find items. He charges customers a fee to find what they want. By meeting customer needs for trendy items, he finds an opportunity for profit.

At 16 Casey Adams started networking on Snapchat, Facebook, Twitter and other social media. After he built up a following of several thousand followers he began offering them t-shirts and wristbands. Pretty soon he was generating $5k/month in revenue. While many older folks still think social media, and Snapchat in particular, is a time-waster, Casey is making money on the obvious trend toward all things social. He’s leveraging his social network to sell things – and teaching other people how to do the same.

Are Bitcoins long-term currency? Will crypto-currency replace things like Dollars and Euros? Most older generation folks don’t think so, and view this as another fad. But Erik Finman saw the trend at age 12, and started buying Bitcoins. A few trades later and he turned $1,000 into $100,000. A few more trades and Finman had a stash worth over $1,000,000. Are Bitcoins the next Tulip bulbs? You can research the economists for opinions on that. But as long as the trend is growing, Erik Finman is making money.

Peter Szabo was only 12 when he used a Google search to identify ways to make money on the internet. He discovered making Facebook ads for affiliates could pay off – in pennies at first, but as volume rose these became dollars. Since so few older people knew how to manage a Facebook ad budget, by age 18 he created an on-line agency focused on maximizing value (and return) for Facebook advertising. You don’t have to be a Millennial to recognize the growth of new platforms and help people use them to make money.

3 – There has never been a better time to be a self-promoter

Today anyone can claim to be “great” at anything using the web. There are so few genuine ways to measure quality and results when it comes to anything on the web that if you say it enough, and find enough testimonials, you can be very convincing.

Noah Miller started a sports web site at age 15 using a group of writers he amassed via Twitter connections. Sports Crave had some success with USAToday and Google before Noah closed it at age 17. Based on his claims of great success he’s now promoting his new creative agency, Colour Medium, which has nothing more than a flash page. But the web allows Noah to position himself at the forefront of creative.

Benji Taylor at age 18 has opened a new on-line creative agency named Next Exit focused on art for the music industry. By forging relationships with known young musicians he has positioned his agency at the top of the creative spectrum for his target customers. Given how fast musicians come and go in the limelight, who knows how long his testimonials will stand up. But as long as people know the name of those who know his name he is leveraging those associations to crown himself the king of that industry.

Eighteen year old Josh King Madrid, known as Jet, has built a business on seemingly nothing more than a lifestyle. It is wholly unclear if Jet has ever actually created a profitable business selling anything physical or digital. But what he has done is convince lots of Millenials that he knows the lifestyle they want to lead, and he can tell them how to lead it. So now, largely without any clear source of how he obtained any knowledge about succeeding at business, he is proselytizing how young people can be independent, self-actualized and living the “Jet Set” lifestyle at his events. Jet is one of the best descriptions of how self-promotion can succeed in today’s social-media world, leading people to believe they should listen to you primarily because of the image you portray.

Overall Lessons from these 10 under 20 entrepreneurs

There is precious little to support the grandiose success claims of most Millennial entrepreneurs. They claim huge revenues and wealth, but in most cases it is impossible to prove their claims, and most support comes down to number of followers, or testimonials of some celebrity. But, that does not mean we can’t learn from what they did to achieve their current fame:

- Use social media exhaustively. Over-communicate. Use Facebook, Instagram, YouTube, Snapchat, Twitter, etc. over and over and over to communicate your value and your message. These platforms are dirt cheap, so hard work there can make up for few dollars.

- Take big risks, especially if you have little to lose. Most folks are hamstrung by the commitments of family, mortgage, car payments, etc. If you remove these bindings you can take big risks, like rolling over thousands of dollars worth of crypto-currency. And if something fails, never call it a failure. Just a learning experience you’ve moved beyond.

- Don’t try to improve something that already exists. Do something new. Develop a new app, a new drone, a site focused on selling collectible sneakers. It is cheaper, and more likely to succeed, if you are an early entrant in something new and growing.

- Hype is good. Pre-announce everything. And announce that your next thing (whether a drone, a web site, an exchange site or something else) is going to be HUGE. It will be the VERY BEST EVER. Do not be deterred by feeling the need to prove any of your claims, just make big claims with tremendous bravado.

- Take credit for anything that goes right. None of these people ever say they were lucky. Whatever went right was always do to their inherent insight, skill or genius.

- Stay out of specifics. Talk in platitudes. Especially statements that appeal to other Millenials.

- “Live your own life if you want to succeed.”

- “Believe in yourself 1,000%. That’s what truly matters.”

- “Don’t trust employers or education. Trust only yourself.”

- “Self-education is better than schools. You can learn more on YouTube than any classroom. Teachers are nay-sayers.”

- “Do what you are passionate about.”

- “Millennials are special. Millennials are smarter and better than older people.”

- Select good parents. I was struck by the fact that almost all these young people had parents and/or grandparents that were physicians, PhDs, successful real estate developers, successful business people. There is no doubt they benefited at their young age from families that had resources and skills that are not available to the vast majority of folks.

Is ongoing success pre-ordained?

I remember the student counsel President of my school, Mr. Popularity, who dropped out of college to open a string of pizza shops. He received ample praise and publicity for his young entrepreneurial success. But after a few setbacks the pizza shops failed, he took work as a salesman for a liquor distributor, became an alcoholic and lost his family. I was glad he found success early, and saddened that he wasn’t the wunderkind many people foisted upon him.

Life is not a one round fight. It will be interesting to see who among these, if any, go on to do great things in business, politics or another arena. While they are full of chutzpah today, life has a way of throwing many derailing curves into everyone’s path. But…

…that does not mean their early success can’t teach us some important lessons that can be applied, regardless of our age.

by Adam Hartung | Jul 7, 2016 | Books, Entrepreneurship, Leadership, Marketing

Summer is here, and everyone needs a business book or two to read. I’m recommending The Founder’s Mentality – How To Overcome the Predictable Crises of Growth by two very senior partners and strategy practice heads at Bain & Company — Chris Zook and James Allen. Bain is one of the top three management consulting firms in the world, with 8,000 consultants in 55 offices, and has been ranked as one of the best places to work in America by Glass Ceiling.

Since both authors are still part of Bain, the book is somewhat bridled by their positions. No partner can bad mouth current or former clients, as it obviously could reveal confidential information — and it certainly isn’t good for finding new clients who would never want to risk being bad-mouthed by their consultant. So don’t expect a lambasting of poorly performing companies in this review of global cases. But after reviewing the work at their clients for over 20 years, and many other cases available via research, these fellows concluded that most companies lose the original founder’s mentality, get bound up in organizational complexity, and simply lose competitiveness due to the wrong internal focus. And they offer insights for how underperformers can regain a growth agenda.

Photo courtesy of Chris Zook

Moving From Mediocre To Good

I interviewed Chris Zook, and found him rather candid in his observations. When I asked why people should read The Founder’s Mentality I really liked his response, “Many people have read Good to Great. But, honestly, for many organizations the challenge today is simply to move from mediocre to good. They are struggling, and they need some straightforward advice on how to make progress toward growth when the situation likely appears almost impossible.”

You should read the book to understand the common root cause of corporate growth problems, and how a company can address those issues. This column offers some interesting thoughts from Chris about how to apply The Founder’s Mentality to eliminate unnecessary complexity and make your organization more successful.

Adam Hartung: What is the most critical step toward undoing needless, costly, time consuming complexity?

Chris Zook: The biggest problem is blockages built between the front line and the top staff. Honestly, the people at the top lose any sense of what is actually happening in the marketplace — what is happening with customers. 80% of the time successfully addressing this requires eliminating 30-40% of the staff. You need non-incremental change. Leaders have to get rid of managers wedded to past decisions, and intent on defending those decisions. Leaders have to get rid of those who focus on managing what exists, and find competent replacements who can manage a transition.

Hartung: Market shifts make companies non-competitive, why do you focus so much on internal organizational health?

Zook: You can’t respond to a market shift if the company is bound up in complex decision-making. Unless a leader attacks complexity, and greatly simplifies the decision-making process, a company will never do anything differently. Being aware of changes in the market is not enough. You have to internalize those changes and that requires reorganizing, and usually changing a lot of people. You won’t ever get the information from the front line to top management unless you change the internal company so that it is receptive to that information.

Hartung: You say simplification is critical to reversing a company’s stall-out. But isn’t focusing on the “core” missing market opportunities?

Zook: Analysts cheered Nardeli’s pro-growth actions at Home Depot. But the company stalled. The growth opportunities that external folks liked hearing about diverted attention from implementing what had made Home Depot great — the “orange army” of store employees that were so customer helpful. It is very, very hard to keep “growth projects” from diverting attention to good operations, and that’s why few founders are willing to chase those projects when someone brings them up for investment.

Hartung: You talk positively about Cisco and 3M, yet neither has done anything lately, in any market, to appear exemplary

Zook: It takes a long time to turn around a huge company. Cisco and 3M are still the largest in their defined markets, and profitable. Their long-term future is still to be determined, but so far they are making progress. Investors and market gurus look for turnarounds to happen fast, but that does not fit the reality of what it takes when these companies become very large.

Hartung: You talk about “Next Generation Leaders.” Isn’t that just more ageism? Aren’t you simply saying “out with the old leaders, you have to be young to “get it.”

Zook: Next Generation Leadership is not about age. It’s about mentality. It’s about being young, and flexible, in your thinking. What’s core to a company may well not be what a previous leader thinks, and a Next Gen Leader will dig out what’s core. For example, at Marvel the core was not comics. It was the raft of stories, all of which had the potential to be repurposed. Next Gen Leaders are using new eyes, dialed in with clarity to discover what is in the company that can be reused as the core for future growth. You don’t have to be young to do that, just mentally agile. Unfortunately, there aren’t nearly as many of these agile leaders as there are those stuck in the old ways of thinking.

Hartung: Give me your take on some big companies that aren’t in your book, but that are in the news today and on the minds of leaders and investors. Apply The Founder’s Mentality to these companies:

Microsoft

Zook: Did well due to its monopoly. Lost its Founder’s Mentality. Now suffering low growth rates relative to its industry, and in the danger zone of a growth stall-out. They have to refocus. Leadership needs to regain the position of attracting developers to their platform rather than being raided for developers by competitive platforms.

Apple

Zook: Jobs implemented The Founder’s Mentality brilliantly. Apple got close to its customers again with the retail stores, a great move to learn what customers really wanted, liked and would buy. But where will they turn next? Apple needs to make a big bet, and focus less on upgrades. They need to be thinking about a possible stall-out. But will Apple’s current leadership make that next big bet?

WalMart

Zook: One of the greatest founder-led companies of all time. Walton’s retail insurgency was unique, clear and powerful. Things appear to be a bit stale now, and the company would benefit from a refocusing on the insurgency mission, and taking it into renewal of the distribution system and all the stores.”

It’s been almost a decade since I wrote Create Marketplace Disruption – How To Stay Ahead of the Competition. In it I detailed how companies, in the pursuit of best practices build locked-in decision-making systems that perpetuate the past rather than prepare for the future. The Founder’s Mentality provides several case studies in how organizations, especially large ones, can attack that lock-in to rediscover what made them great and set a chart for a better future. Put it on your reading list for the next plane flight, or relaxation time on your holiday.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition.

at the table, much less a chance to play the game. But, unfortunately, all too often tactical implementation decisions are made by tactical “experts” without proper consideration of the strategy. And one bad tactical decision can kill the entire business by not living up to the value proposition. When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

When implementing this value proposition NakedWines doesn’t target wine enthusiasts, because those customers already have their wine sources, and they are varietal, geography and brand picky. Instead NakedWine pays on-line retailers like Saks Off 5th, and others, to put flyers into customer packages of semi-luxury goods. NakedWine provides deep discounts for initial purchases to entice someone to take that first purchase risk. NakedWine incurs big costs finding potential buyers, and hooking them to make an initial purchase so they can bring them into the brand-building cocoon. NakedWine wants to build a brand which keeps the allure of good wine, a sophisticated idea, for a customer who would rather trust NakedWine than become a wine expert. Or experiment with a local retailer.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.

no value for those with experience (all experience was seen as irrelevant to their brilliant insight,) and no value for education. There was no reason to study business practices, or even business history, much less anything like engineering, because they simply had taught themselves all they needed to know – and if they needed to know anything else they would teach that to themselves as well.