by Adam Hartung | May 12, 2021 | Employment, Immigration, Scenario Planning, Strategy, Trends

Demographics is Destiny

Planning is all about the future. And the future is easiest to predict when we look at demographics. Population trends are easy to spot, and long-lived. So the recent U.S. census, which built on previous trends, gives us great insights for planning our investments. Let’s focus here on the two biggest demographic trends.

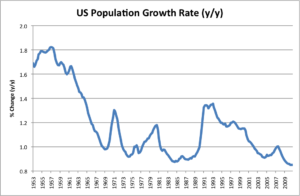

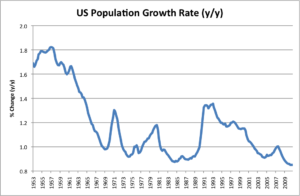

First, the U.S. population growth rate is terrible. Less than 1%/year. Its the 2nd worst decade  since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

In 2018, I wrote about the Japanese demographic “trend bomb.” Low birthrates and anti-immigration meant there were only 2 working people to support each retiree. And the situation was worsening. It’s time America starts considering what it will do if we don’t let immigrants return to spark growth. Growth can hide a multitude of sins, Source: Avondale Asset Management

because it creates demand for more goods and services – thus creating economic growth. People in China and

India aren’t starving any longer, because they’ve grown their economies out of poverty.

As wrote in 2017, it was America’s population growth – driven by immigration – that made 1800s and 1900s America the jewel of the world. Despite horrors at Ellis Island, those boatloads of immigrants created the agricultural and industrial America with its flourishing economy. Like I observed in 2016, unless we re–invigorate growth through immigration, the woes Trumpers complain about will get much, much worse. Soon Pakistan and Indonesia will have more people than the USA! China and India, with their growing populations, growing economies and growing diaspora are making an ever–bigger imprint on the global economy. Meanwhile, America is on its way to stagnant performance like most European countries.

U.S. Population is Mobile, Despite the Pandemic

Second, the trend south and west continues unabated. In 1970, the South and West accounted for less than half the population. Now they account for 62%. The Northeast is losing people rapidly, with 48 of 62 New York counties losing people. And Illinois has seen the problem in spades. Chicago and Illinois are already in a world of hurt due to declining population causing a declining economy causing real estate prices to fall and taxes to rise. (Though the pent-up pandemic housing demand is temporarily increasing housing prices, masking the long term trend.) When population trends down, it becomes a whirlpool of problems – just look at what’s happened in Detroit! You must have the people to build a strong economy.

Looking at both these trends, do you see the unabashed irony? We see no problem with cities and states competing for migrants from other cities and states. Local and state governments lure in companies and people with tax breaks, subsidies and other allowances. We think immigration within our country is good – and recognize losing people from our local area is bad. But at a national level, we still have people who object to immigration. They want the borders closed, and no new entries. We have politicians who want to freeze the economy in place. Yet we know from our past that the only solution to getting our economy to grow REQUIRES immigration. It is the #1 reason the economy was so sluggish coming out of the Great Recession – we cut immigration to unprecedented levels under Obama and continued the decline under Trump. We are unlikely to birth our way to growth, given trends in lifestyles and gender equality. But, we can bring in immigrants who can help the economy grow. We need to get over this hypocrisy and move toward greater immigration as a pro-America policy!

What does this mean for your business?

First – are you sure you want to do business only in the USA? The growth markets are elsewhere. Have you considered selling in China, India, Indonesia, Micronesia, Thailand, South America and Africa? These are growing markets where Chinese businesses (in particular) are making big investments. By going where the population is growing they are able to grow their revenues, and their influence. America isn’t the dominant international player it once was, and there’s never been a better time to look outside America for your next growth market.

Second – Take your business where you see the growth in America. Lots of businesses are going to Texas (and Nevada, Utah, Idaho and Arizona) because lots of people are going there! If you open a restaurant in a town losing people, to succeed you have to entice people to drive to your town and restaurant. You better be really good, and you’ll probably have to make price allowances to have repeat business. But if you have a restaurant in a locality where people are immigrating in large numbers you can do well even if your food is mediocre. Growth hides a multitude of sins!! Your food need not be fantastic, and you can price higher, and you can even have shorter hours because you’re where the people are! It’s simply a lot easier to succeed when you are in a growing marketplace. Are you planning to be someplace because that’s where you started, have family, or went to college? Or are you planning to be someplace where the people, and money, are?

Have you taken into account changes in demographics when making your plans? It is undoubtedly the #1 trend you should use for planning (Fleeing Illinois) . It is highly predictable, and has a lot to do with success. Simply going where the people are will help you succeed. There’s nothing more important to your scenario planning than obtaining a copy of the latest census and studying it really, really hard. It’ll jump start you on the road to greater sales and more success!

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465

by Adam Hartung | Jun 27, 2017 | Disruptions, Employment, Finance

Photo by Spencer Platt/Getty Images

I’m a believer in Disruptive Innovation. For almost 100 years economists have written about “Creative Destruction,” in which new technologies come along making old technologies — and the companies built on them — obsolete. In the last 20 years, largely thanks to the insights of faculty at the Harvard Business School, we’ve seen a dramatic increase in understanding how new companies use new technologies to disrupt markets and wipe out the profitability of companies that were once clearly successful. In a large way, we’ve come to accept that Disruptive Innovation is good, and the concomitant Creative Destruction of the old players leads to more rapid growth for the economy, increasing jobs and the wherewithal of everyone. Creative Destruction, in the pursuit of progress, is good because it helps economies to grow.

But, not really everyone benefits from Creative Destruction. The trickle down benefits to lots of people can be a long time coming. When market shifts happen, and people lose jobs to new competitors — domestic or offshore — they only know that their life, at least short term, is a lot worse. As they struggle to pay a mortgage, and find a new job, they often learn their skills are outdated. There are new jobs, but these folks are often not qualified. As they take lesser jobs, their incomes dwindle, and they may well lose their homes. And their healthcare.

Economists call this workplace transition “temporary economic dislocation.” Fancy term. They claim that eventually folks do enter the workplace who are properly trained, and those folks make more money than the workers associated with the previous, now inferior, technology. And, eventually, everyone finds new work – at something.

That’s great for economists. But terrible for the folks who lost their jobs. As someone once said “a recession is when your neighbor loses his job. A depression is when you lose your job.” And for a lot of people, the market shift from an industrial economy to an information economy has created severe economic depression in their lives.

A person learns to be a printer, or a printing plate maker, in the 1970s when they are 20-something. Good job, makes a great wage. Secure work, since printing demand just keeps rising. But then along comes the internet with PDF and JPEG documents that people read on a screen, and folks simply quit needing, or wanting, printed documents. In 2016, now age 50-something, this printer or plate-maker no longer has a job. Demand is down, and its really easy to send the printing to some offshore market like Thailand, Brazil or India where printing is cheaper.

What’s he or she to do now? Go back to school you may say. But to learn how to do what? Say it’s online (or digital) document production. OK, but since everyone in the 20s has been practicing this for over a decade it takes years to actually be skilled enough to be competitive. And then, what’s the pay for a starting digital graphic artist? A lot less than what they made as a printer. And who’s going to hire the 58-62 year old digital graphic artist, when there are millions of well trained 20-somethings who seem to be quicker, and more attuned to what the publishers want (especially when the boss ordering the work is 35-42, and really uncomfortable giving orders and feedback to someone her parents’ age.) Oh, and when you look around there are millions of immigrants who are able to do the work, and willing to do it for a whole lot less than anyone native born to your country.

In England last week these disaffected people made it a point to show their country’s leadership that their livelihoods were being “creatively destroyed.” How were they to keep up their standard of living with the flood of immigrants? And with the wealth of the country constantly shifting from the middle class to the wealthy business leaders and bankers? And with work going offshore to less developed countries? While folks who have done well the last 25 years voted overwhelmingly to remain in the EU (such as those who live in what’s called “The City”), those in the suburbs and outlying regions voted overwhelmingly to leave the EU. Sort of like their income gains, and jobs, left them.

A whole lot of anger. To paraphrase the famous line from the movie Network, they were mad as Hell and they weren’t going to take it any longer. Simply put, if they couldn’t participate in the wonderful economic growth of EU participation, they would take it away from those who did. The point wasn’t whether or not the currency might fall 10% or more, or whether stocks on the UK exchange would be routed. After all, these folks largely don’t go to Europe or America, so they don’t care that much what the Euro or dollar costs. And they don’t own stocks, because they aren’t rich enough to do so, so what does it hurt them if equities fall? If this all puts a lot of pain on the wealthy – well just maybe that is what they really wanted.

America is seeing this as well. It’s called the Donald Trump for president campaign. While unemployment is a remarkably low 5%, there are a lot of folks who are working for less money, or simply out of work entirely, because they don’t know how to get a job. They may laugh at Robert De Niro as a retired businessman now working for free in The Intern. But they really don’t think it’s funny. They can’t afford to work for free. They need more income to pay higher property taxes, sales taxes, health care and the costs of just about everything else. And mostly they know they are rapidly being priced out of their lifestyle, and their homes, and figuring they’ll be working well into their 70s just to keep from falling into poverty.

These people hate President Obama. They don’t care if the stock market has soared during his presidency – they don’t own stocks (and if they do in a 401K or similar program they don’t care because it does them no good today). They don’t care that he’s created more jobs than anyone since Reagan or Roosevelt, because they see their jobs gone, and they blame him if their recent college graduate doesn’t have a well-paying job. They don’t care if America is closing in on universal health care, because all they see is that health care is becoming ever more expensive – and often beyond their ability to pay. For them, their personal America is not as good as they expected it to be – and they are very, very angry. And the President is a very identifiable symbol they can blame.

Creative Destruction, and disruptive innovations, are great for the winners. But they can be wildly painful to the losers. And when the disruptive innovations are as big, and frequent, as what’s happened the last 30 years – globalized economy, nationwide and international super banks, outsourcing, offshoring and the entirety of the Internet of Things – it has left a lot of people really concerned about their future. As they see the top 1% live opulent lifestyles, they struggle to keep a 12 year old car running and pay the higher license plate fees. They really don’t care if the economy is growing, or the dollar is strong, or if unemployment is at near-record lows. They feel they are on the losing end of the stick. For them, well, America really isn’t all that great anymore.

So, hungry for revenge, they are happy to kill the goose for dinner that laid the golden eggs. They will take what they can, right now, and they don’t care if the costs are astronomical. They will let tomorrow sort out itself, in a bit of hyper-ignorance to evaluate the likely outcome of their own actions.

Despite their hard times, does this not sound at the least petty, and short-sighted? Doesn’t it seem rather selfish to damn everyone just because your situation isn’t so good? Is it really in the interest of your fellow man to create bad outcomes just because you’ve not done well?

by Adam Hartung | Apr 8, 2017 | Economy, Employment

The Labor Department March jobs report came out last week, and it disappointed a lot of people. At 98,000 new jobs, the number was about half what economists predicted. Simultaneously, the report revised January and February down a combined 38,000 jobs. Retail workers lost 30,000 jobs in March, which combined with February means 56,000 retailers lost jobs in just two months. There was ample disappointment to go around.

But, if we take a longer-term view the trend is much more pronounced, and we can easily see that overall the jobs market is very, very healthy – forcing employers to raise wages.

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

As the chart above indicates, America has recreated almost all the jobs lost in the Great Recession (chart courtesy of Kriston McIntosh of The Hamilton Project – Brookings). Almost 10 million jobs were lost between 2008 and 2010 as the financial crisis wiped out banks, and lending. That was a staggering decline of about 420,000 jobs per month.

Because businesses were loath to re-invest following the economic meltdown, the rate of job creation has been considerably slower than the speed with which executives laid off employees. However, since the end of 2011 the U.S. has been adding jobs at the rate of over 200,000 per month – a dramatic growth in job creation over an extraordinarily long-term period. Literally, unprecedented.

And, if we average the job creation rate the first three months of 2017 it comes to 178,000 per month. At this lower pace the jobs market will have fully recovered within the next four months (by August, 2017). This jobs growth rate may be less than the last six years, but it is far more than is necessary to maintain employment rates – including population gains.

We see this very healthy improvement in the jobs situation in other statistics. Those in part-time positions seeking full-time positions fell to the lowest in several years at 8.9%. And, unemployment declined to 4.5% from 4.7% – a clear indication that there were more people finding work than losing work, pulling more people into the workforce for yet another month. At 4.5%, this is the lowest unemployment rate in a decade.

Net/net, America is rapidly approaching “

full employment” – a term that means everyone who wants a job either has one, or is intentionally looking for a job and reasonably expects to find one in three months. Or, in other words, if you know somebody complaining they can’t find a job it is either because they aren’t really trying, or they are picky about what they want to do, or they can find a job but won’t take it because they want higher pay.

And hourly pay continues to rise, increasing 2.7% versus March, 2016. This is less than in good times, when pay tends to rise at 3-4%/year – but the fact that pay is going up means the labor market is tightening. And as the economy reaches higher levels of employment, and lower levels of unemployment, companies will have to pay more to find new workers – and increase wages on current workers to keep them from leaving. Thus, it is a surety that pay will rise throughout 2017, and probably into the foreseeable future.

Whether you liked President Obama or not, the policies of the last six years allowed America to escape the Great Recession. Today 78.5% of all working age people are in the workforce – that is the highest labor participation rate of working age people since 2008 – indicating a complete recovery from the job collapse.

Thus, it is time for changes in economic policy. To keep calling for job creation is, classically, “fighting the last war.” Even as government is reducing employment, and some industries (like traditional retail) are collapsing employment, there are other parts of the economy growing jobs. Amazon.com, for example, has announced it will be adding 100,000 U.S. jobs by the middle of 2018.

For President Trump to claim there are 100 million people in the USA looking for work is an impossibility. There are only 325 million people in America, and 26.4% of those are between under the age of 17 and over 65 – so 86 million. That only leaves 239 million people of working age in the country. We know that of those at least 78.5% are employed – which is 188 million. Thus, at its maximum, there are only 51 million people who could be looking for work. But we know that many are not because of ill-health, or simply choice. According to the Labor Department, there are about 5 million people looking for work in the U.S. at this time, which is just about the same number of job openings.

It’s time to get over the constant complaining about a job shortage. And here’s what this means for you:

1. After a long decade of stagnation, we can expect everyone to receive higher pay.

2. Job mobility will improve. If you don’t like your current job you can probably find another one.

3. Employers will have to stop burning out employees and do more to keep them as unemployment rates decline.

4. Immigration will be less of an issue, because America will need people to fill jobs (many employers are already complaining about changes to H1-B visa rules).

5. Employers will pay more for employee training and retraining.

6. People 30 and younger have struggled to build careers and start families during the recovery. Expect that situation to reverse.

7. More jobs, more money, a faster growing economy is better for tax receipts. This will relieve stress on government budgets.

8. Higher real estate prices. Some markets are already back to pre-recession levels, yet others have languished. Expect across the board increases.

9. Interest rates will go up (from record lows). Lock-in your mortgage now. Adjust your portfolio from bonds to stocks.

10. Expect the dollar to remain strong, so imports will be cheap and exporting will continue to be more difficult. It’s a good time to visit foreign destinations, and it will be a struggle to attract international tourists.

Look beyond short-term numbers. Month-to-month, even quarter-to-quarter, numbers often yield little analytical value. Look at the long-term trend. Then make sure you, and your business, are ready. Don’t keep fighting the last war, prepare to capture the next opportunity.

by Adam Hartung | Mar 10, 2017 | Books, Defend & Extend, Employment, Leadership

Harvard Business Review Press just published an insightful new book by two senior partners at Bain & Company, one of the world’s three leading strategy consulting firms, entitled Time Talent Energy. The book’s great insight is that companies utilize a plethora of tools to manage money and financials to the nth degree, but that approach is less successful than putting a greater focus on managing employee time, talent and energy.

Harvard Business Review Press

Harvard Business Review Press

Time Talent Energy jacket cover

While managing financials is required in the modern organization, it is insufficient for success. Mankins and Garton discovered that organizations which focus more heavily on managing how employees spend their time and how they thoughtfully place people in their roles, create companies where employees are inspired and 40% more productive than their competition. And this pays off, with profit margins which are 30-50% higher than their industry average. The improvement is so great from focusing on employees that in today’s low cost and easily accessible capital world it is better to waste some cash in the process of better managing time and talent.

In most companies 25% of all productive time is wasted and can reach as high as 40% in complex organizations. Think of all the emails, texts, voice mails and meetings that absorb vast amounts of time. Yet, as the authors are fond of pointing out, nobody can create a 25 hour day. So if you can recapture that time, productivity will soar. The results are far greater than squeezing another 1% (or even 10%) out of your cost structure. If instead of spending so much time managing costs we spent more time eliminating complexity and unneeded tasks, competitiveness will soar.

Some people think that the best companies hire better people. Surprisingly, this is not true. About 15-16% of employees in every company are “A” players. But most companies squander this talent by spreading it around the organization. To achieve higher productivity and greater success, leading companies cluster their “A” players into teams focused on the most critical, important parts of the business. Thus, the best talent is working side-by-side on the most important challenges which can lead to the greatest gains. This talent clustering energizes the best workers, increasing productivity by 44%. But more than that, as the culture is inspired from building on its own gains productivity soars as much as 125%.

But in most organizations the focus still remains on finance. The CFO is frequently the second most powerful individual, behind only the CEO. The head of Human Resources (Chief Human Resources Officer — CHRO) rarely has the clout of a CFO. And the CFO job is seen as the route to CEO — far more CFOs than CHROs become CEOs. Simultaneously, organizations spend exorbitantly on financial control tools, such as ERP (Enterprise Resource Planning) from companies like Oracle and SAP — while very few have any kind of tool set for effectively managing employee time or talent deployment. The authors conclude it is apparent business leaders have significantly overshot on managing financial resources, while allowing their organization to be woefully incapable of managing its human resources.

I had the opportunity to interview Michael Mankins to obtain some additional insight about managing time, talent and energy:

Adam Hartung: Do businesses need to lessen the CFO role, and heighten the CHRO role?

Michael Mankins: The reality is that most human resource decisions, those that determine how people spend their time, and how talent is deployed, are made by line managers. Made within the bowels of the organization, with little more than senior leadership guidelines. There needs to be significantly more involvement by senior leadership in collecting and reviewing data on critical skills for the organization, “A” player performance and leadership development. If as much time was spent by senior leadership teams discussing human resources as spent on budgets there would be a tremendous improvement in productivity.

The CFO and CHRO should definitely be peers. To do that requires a cultural change from being an organization focused on preserving the status quo, reducing mistakes and keeping leadership out of jail to one that is far more future oriented. This can be done and in the book we highlight companies such as ABInBev, Ford, Nordstrom, Starbucks, IKEA, Netflix and others who have accomplished this.

Hartung: Companies spent enormous sums installing ERP systems and they spend a lot to maintain them. Yet, from reading your book it seems like this may have been misguided.

Mankins: All companies need to be able to change their business model as markets shift. ERP frequently creates a wiring that makes it hard to change with the competitive landscape, or as changes in capability are required. ERP locks in the business model at a point in time — but great performers develop ways to adapt.

All companies need a great general ledger. ERP goes far beyond the general ledger and in doing so can make a company too inflexible for today’s rate of change. There needs to be a flexible ERP system —which just doesn’t seem to exist right now. The ERP market seems ripe for a marketplace disrupter!

Simultaneously there aren’t any great tools out there for collecting data that can help a company reduce complexity and eliminate time wasters. Nor are there great tools for managing the performance of “A” players. The top performing companies do create a discipline around these tasks, collecting and analyzing data. Many companies would be helped by a tool that would do for time and talent management what we’ve done for financial management.

Hartung: You demonstrate that clustering “A” players creates dramatic improvement in productivity and company performance. Do great companies focus these clusters on improving the company as it is, or looking for the next “big thing?”

Mankins: We discovered that by and large the greatest gains come from focusing on the latter. Almost all MBA programs are maniacal about training managers to improve the existing business. For many years corporate planning systems have focused almost entirely on improving the operating model. The result is that in many, many industries leadership has almost no hope of improving operating margins by even 1%. There simply is nothing left to improve which can achieve significant results.

Simultaneously, 1% growth has a far, far greater return on investment than 1% operating margin improvement. So if companies focus their best talent on breakthroughs, in whole new ways of running the business, or creating new markets, the results are significantly greater.

Hartung: Many companies have clustered their top performers into “all star teams.” But this has been met by demotivation of employees not on these teams – feeling like “also rans” or “bench warmers.” And often there is a compensation difference between the all-star team members and others that is demotivating. How do leaders manage this conundrum?

Mankins: If this demotivation is driven by internal competitiveness — by ambition to move up the organization — there is a culture problem. Everyone is not on the same page about company needs and the talent to address those needs. Internal competitiveness should be addressed so everyone wants the company to succeed, so everyone individually can succeed. Rewards, compensation and non-compensation, need to be geared for groups to be motivated, not just individuals.

In the organization, leadership should work hard to make sure everyone knows they are important. There should be an effort to reward the “supporting cast” and not just the main characters. It is true that in today’s world many people have an exaggerated view of their own performance. We address this in the book with recommendations for how to give people feedback so they know the reality of their role and their performance in order to grow and do better. Today most companies have a very poorly performing review and training process, because they tie it to the compensation cycle thus limiting feedback to once per year and, unfortunately, doing feedback at the same time (often the same meeting) as compensation and bonus decisions. Addressing the performance feedback process can go a long way to avoid the demotivation problem.

Hartung: How do companies find “A” players?

Mankins: Search firms are the antithesis of finding “A” players. Their approach, their process, is not designed to deliver “A” candidates. To build a good group of “A” players requires the CEO, CHRO and senior leadership team understand what constitutes an “A” player in their organization. Then they can use the entire organization to seek out people with this behavioral signature in order to recruit them.

It is unfortunate that most company HR processes would not recognize an “A” player if one submitted a resume and would not hire one if they arrived for an interview. Most current processes focus too much on relationships (who candidates know,) narrow skills and prior specific experiences and not enough on what is needed for future success. And hiring decisions are often made by the wrong people; people too low in the organization and people who don’t know the desired behavioral signature. Google is one role model for knowing how to find and develop “A” players.

Unfortunately there is enormous ageism in hiring today. Especially in technology. Employers lack awareness of the value of generalizable experience they can bring into their company. The search for very specific experiences often leads to a very limited list of candidates with narrow experience and too often they do not perform at the “A” level when placed in the context of the new company and new competitive market requirements. Looking more broadly at candidates with great experience, even if not seemingly directly applicable (including candidates in their 50s and 60s) could lead to far greater success.

by Adam Hartung | Feb 28, 2017 | E-Commerce, Employment, real estate, Retail

(Photo: JOHN MACDOUGALL/AFP/Getty Images)

Amazon.com has become an important part of the American economy, and the lives of people globally. But, far too few people still understand the repercussions of Amazon’s success on retailers, consumer goods manufacturers, real estate – and ultimately everyone’s lives. The implications are enormous. Smart leaders, and investors, will plan for these implications and take advantage of the market shift.

Invest in ecommerce, divest traditional retailers.

The first implication is just thinking about investing in Amazon and/or its competitors in retail. In May, 2016 I compared the market value of Wal-Mart, the world’s largest retailer, with Amazon. At the time Wal-Mart was worth $216 billion, and Amazon was worth $332 billion. The difference could be explained by realizing that Wal-Mart was the leader at brick-and-mortar sales, which were shrinking, while Amazon was the leader in e-commerce, which is growing. Since then Wal-Mart’s value has increased to $222 billion – up $6 billion, 2.8%. Meanwhile Amazon’s value has increased to $403 billion- up $71 billion, 21.4%. Over three years (starting 3/3/14) Wal-Mart’s per share value has declined from $74 to $71 (down 4%,) while Amazon’s has risen from $370 to $845 (up 128%.)

To put it mildly, investing in Amazon, which is the leader in e-commerce, has created a great return. Contrastingly that value increase has been fueled by declines in traditional retailers. The Amazon Effect has caused shares in companies like Sears Holdings, JCPenney, Kohl’s, Macy’s and many other stalwarts of the bygone era to be crushed. Over the last year investors in XRT (the retail industry spider) have increased 1.6%, while the S&P 500 spider has jumped 22%. The number of retailers with debt rated at Moody’s most distressed level has tripled since 2009 – and Moody’s predicts this list will worsen over the next five years.

There is vastly too much retail space, and nobody knows what to do with it.

And this has an impact on real estate. As online sales come to over 11% of all holiday sales in 2016, and Amazon accounts for 40% of all those sales, it is clear people just don’t go to stores any more anywhere near the way they once did. Historically prime retail real estate was considered valuable – and in 2007 many people thought Sears real estate was worth more than Sears as a retailer. But no longer. According to Morningstar, Sears store closings alone could cause 200 malls to close.

It is apparent the Amazon Effect has left America with far more storefronts than needed. Stand-alone stores are being shuttered, with no alternative use for most buildings. Malls and shopping centers go begging as traffic drops, tenants leave, lease rates collapse and the facilities end up wholly or nearly empty. This means you don’t want to invest in retail real estate REITs. But it also means that neighborhoods, and sometimes entire towns, will be impacted as these empty buildings reduce interest in housing and push down residential prices.

Tax receipts will fall, and nobody knows how to replace them.

For a long time governments gave handouts to retailers in the form of tax breaks to build stores or locate their headquarters. But as stores close the property tax receipts decline, putting a greater burden on homeowners to pay for schools and infrastructure. Same with sales taxes which disappear from the local government coffers. And tax breaks once given to hold onto jobs – like the ones the village of Hoffman Estates and state of Illinois, gave Sears in 2011 to not move its headquarters, look far less justified. In short, the Amazon Effect has an enormous impact on the local tax base – and those missing dollars will inevitably have to come from residents – or a significant curtailing of services.

The impact on job eliminations will be staggering.

The Amazon Effect also has an impact on jobs. Amazon’s growth keeps escalating, from 19% in 2014 to 20% in 2015 to 28% in 2016, which takes the jobs away from traditional retailers. Macy’s plans to shed 10,000 workers as it shrinks and streamlines. JCPenney will eliminate 6,000 employees via early retirement completely separate from its store closings, and HHGregg is shedding 1,500 jobs as stores close. And thousands more are being lost across traditional retail in stores, supply chain positions and headquarters facilities.

Traditional retail employs about 16.5 million Americans – nearly 10% of the entire workforce. 6.2 million are in the prime product lines targeted by e-commerce (GAFO – General, Apparel, Furniture and Other.) The Amazon Effect will continue to eliminate these positions. Over the next five years it is not unlikely that the decline of brick-and-mortar will cause 16% of GAFO jobs to disappear, which is almost 1 million jobs. Simultaneously this could easily cause 10% of the non-GAFO jobs (10.3 million) to disappear – which is another 1 million. This likely scenario would cause the loss of 2 million jobs in just five years, which is the entirety of all lost manufacturing jobs to China. The Trump administration has more employment concerns to face than just the return of manufacturing.

The Amazon Effect is changing grocery shopping, without even being a major competitor in that sector. Because Wal-Mart has lost so much general merchandise sales to e-commerce, the company has amped up grocery sales – which are now 56% of total revenue. To continue growing groceries Wal-Mart is undertaking a massive price war pitting itself against the long-running low cost grocer Aldi. This is creating even more intense profit pressure on Wal-Mart, which last year saw gross margins drop by eight points, as net income fell 18%. Such intense price competition is creating the need for even more cost cutting among all grocers – which means investors beware – and we can expect even more job cutting as the spiral downward continues.

Consumer Goods manufacturers, and their suppliers, will be stressed.

Of course this pushes the Amazon Effect onto consumer goods companies that supply grocery retailers. Wal-Mart has held meetings with P&G, Unilever, Conagra, Coca-Cola and other big name companies demanding across-the-board 15% price reductions at wholesale. And Wal-Mart expects these suppliers to help Wal-Mart beat its head-to-head competitors on price 8o% of the time. This will cause consumer goods manufacturers to cut their own costs, including jobs, as well as pressure their raw material suppliers to further reduce their costs – leading to an ongoing spiral of cost cutting, job eliminations and additional pressures for change.

The internet gave us e-commerce, and that birthed Amazon.com. Few predicted the enormous implications this would have on retail, and society. Every single American is affected by the Amazon Effect, which is now inescapable. The only remaining question is whether your business, your government leaders and you are planning for this and preparing for the inevitable changes which will continue coming?

by Adam Hartung | Aug 31, 2016 | Economy, Employment

(Photo: AP Photo/Mel Evans)

Tuesday, New Jersey Governor Chris Christie vetoed legislation which would have raised the state’s minimum wage to $15 per hour over five years. The current rate is $8.38, and he felt it was too big an increase, too fast.

Of course the governor makes quite a bit more than the minimum wage. And although he vetoed the legislation because he is “pro-business” he has never run a business and really has no idea what the economic impact of a higher minimum wage would be on New Jersey. He assumes because it would cost more to pay low-wage workers that it would harm businesses who are contributors to his re-election. Happy Labor Day all you minimum wage workers.

What he does not consider is the ability for those businesses to pass along those higher wages by raising prices. When everyone has to pay more then it becomes possible for everyone to raise prices. Simultaneously, the low income people who make more money, and spend 100% of what they make, pass along the higher wages in increased consumption which increases business revenues. So an argument can be made that a higher minimum wage could help businesses to have happier employees who spend more and actually improve the economy overall, and for their business.

Remember

Henry Ford and his $5 day? In 1914, by cutting work hours and doubling pay Ford greatly motivated his workforce, reducing turnover and training cost. Simultaneously he improved the ability of his workers to spend more and thus grow sales for many businesses. He was just one company, but his higher pay was so successful that it caused other companies to pay more, and everyone benefited. Many historians think of this as an important event in the birth of the American middle class.

The other contributor to the growth of the middle class was unions. By WWI unions had become far more prevalent in the U.S. Unions improved working conditions, fought for the abolition of child labor, eliminated employer discrimination, improved benefits like health care and allowed employees to negotiate for higher wages. By banding together in unions employees were able to negotiate with their employer much more powerfully than for each employee to negotiate individually.

In 1928, the height of the “Gilded Age” of America, the bottom 90% of Americans earned 50.7% of the nation’s income, while the top 1% earned 23.9%. Affects of the Great Depression, and increased unionization, changed this so that by 1944 the bottom 90% was earning 67.5% of the income, while the income of the top 1% had plummeted to 11.3%.

Of course, unions and their bosses were far from perfect. Over time union clout grew, and management increasingly caved to union demands in order to avoid debilitating strikes. Some companies were drowned in worker demands, and became unproductive with feather-bedded workers and work rules that seriously harmed productivity. Meanwhile, rampant corruption among union leadership led to intense mob involvement and increased crime. Which led to a lot less support for unions among Americans — often even among the workers who were union members.

In 1979, four years after famed union leader Jimmy Hoffa disappeared after a dust-up with the mob, 34% of American workers were unionized. Today only 10% are unionized, and a large percentage of those are in government positions like teaching, law enforcement, firefighting, postal service, etc. Thirty-eight percent of workers without a college degree were unionized in 1979. Today, 11% are unionized.

And today, we have returned to the Gilded Age. Union dislike has led to implementing Right to Work laws in several states, which makes it far easier for private employers to avoid, or eliminate, unions. And changes in jobs from largely factory line work to far more desk-related (shifting from manufacturing to tech and health care) has made it less easy to find common ground among workers for unionizing. Additionally, sharp cuts in progressive income taxes, which were replaced by dramatic increases in regressive sales and property taxes, coupled with a huge increase in social security and other worker taxes has transformed America’s income portrait. Once again (2012) the top 1% take home 22.5% of America’s income, while the bottom 90% take home only 50.7%.

This dramatic shift in incomes is very prevalent in today’s election contests. There is ample talk about the displaced workers, under-employed workers and hidden unemployment. It is clear there are a lot of very wealthy people who have a lot of power to affect elections — including one candidate who won his party’s candidacy without even raising external funds! Simultaneously, there are a lot of very angry, frustrated people who want significant change — and express an aggressive dislike for the candidates of both major parties.

What is clear is that America prospered when the disparity between rich and poor was not as it is today. There was a greater sense of commonality, even as people disagreed on policies, when workers could identify with the heads of their companies and the bankers. Today, the difference between the haves and have-nots is so great that a large percentage of Americans believe they can only retire if they hit the lottery!

Throughout history income inequality has led to national overthrow, ouster of government heads, and riots. The French overturned their monarchy and became a republic when their king and queen ignored the impoverished. Filipinos threw out the Marcos regime. And home-grown American terrorists are often disenchanted with lifestyles far from their expectations.

There is clearly a need to find ways to reduce income inequality. It is incumbent upon leaders to seek out ways to improve the lives of their constituents, including their customers, suppliers and employees. And one, small act that any governor can do is simply abandon old assumptions about the horribleness of minimum wage laws – and unions as responsible for a currently weak economy — and instead take action to put a few more dollars into the hands of those who work, yet have the least.

Most Americans, including white collar workers and executives, will take the day off next Monday to celebrate Labor Day. This national holiday was created by labor unions in the 1880s, and made a national holiday in 1894 after the U.S. Army and U.S. Marshal’s Service killed multiple workers at the Pullman strike. Labor Day was instituted as a celebration of the American worker, and the economic and social achievements they accomplished. It is a time to honor those who work hard, often for not enough pay, and yet make America great.

Happy Labor Day!

by Adam Hartung | Jul 13, 2016 | Employment, Leadership, Regulations, Trends

This week Starbucks and JPMorganChase announced they were raising the minimum pay of many hourly employees. For about 168,000 lowly paid employees, this is really good news. And both companies played up the planned pay increases as benefitting not only the employees, but society at large. The JPMC CEO, Jamie Dimon, went so far as to say this was a response to a national tragedy of low pay and insufficient skills training now being addressed by the enormous bank.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

Since 2014 there has been an undeniable trend toward raising the minimum wage, now set nationally at $7.25. Fourteen states actually raised their minimum wage starting in 2016 (Massachusetts, California, New York, Nebraska, Connecticut, Michigan, Hawaii, Colorado, Nebraska, Vermont, West Virginia, South Dakota, Rhode Island and Alaska.) Two other states have ongoing increases making them among the states with fastest growing minimum wages (Maryland and Minnesota.) And there are 4 additional states that promoters of a $15 minimum wage think will likely pass within months (Illinois, New Jersey, Oregon and Washington.) That makes 20 states raising the minimum wage, with 46.4% of the U.S. population. And they include 5 of the largest cities in the USA that have already mandated a $15 minimum wage (New York, Washington D.C., Seattle, San Francisco and Los Angeles.)

In other words, the minimum wage is going up. And decisively so in heavily populated states with big cities where Starbucks and JPMC have lots of employees. And the jigsaw puzzle of different state requirements is actually a threat to any sort of corporate compensation plan that would attempt to treat employees equally for common work. Simultaneously the unemployment rate keeps dropping – now below 5% – causing it to take longer to fill open positions than at any time in the last 15+ years. Simply put, to meet local laws, find and retain decent employees, and have any sort of equitable compensation across regions both companies had no choice but to take action to raise the pay for these bottom-level jobs.

Starbucks pointed out that this will increase pay by 5-15% for its 150,000 employees. But at least 8.5% of those employees had already signed a petition demanding higher pay. Time will tell if this raise is enough to keep the stores open and the coffee hot. However, the price increases announced the very next day will probably be more meaningful for the long term revenues and profits at Starbucks than this pay raise.

At JPMC the average pay increase is about $4.10/hour – from $10.15 to $12-$16.50/hour. Across all 18,000 affected employees, this comes to about $153.5million of incremental cost. Heck, the total payroll of these 18,000 employees is only $533.5M (after raises.) Let’s compare that to a few other costs at JPMC:

Wow, compared to these one-off instances, the recent pay raises seem almost immaterial. While there is probably great sincerity on the part of these CEOs for improving the well being of their employees, and society, the money here really isn’t going to make any difference to larger issues. For example, the JPMC CEO’s 2015 pay of $27M is about the same as 900 of these lowly paid employees. Thus the impact on the bank’s financials, and the impact on income inequality, is — well — let’s say we have at least added one drop to the bucket.

The good news is that both companies realize they cannot fight trends. So they are taking actions to help shore up employment. That will serve them well competitively. And some folks are getting a long-desired pay raise. But neither action is going to address the real problems of income inequality.

by Adam Hartung | Sep 5, 2014 | Employment, Investing, Politics

The Bureau of Labor Statistics (BLS) just issued America’s latest jobs report covering August. And it’s a disappointment. The economy created an additional 142,000 jobs last month. After 6 consecutive months over 200,000, most pundits expected the string to continue, including ADP which just yesterday said 204,000 jobs were created in August. So, despite the lower than expected August jobs number, America will create about 2.5 million new jobs in 2014.

One month variation does not change a trend

Even thought the plus-200k monthly string was broken (unless revised upward at a future date,) unemployment did continue to decline and is now reported at only 6.1%. Jobless claims were just over 300k; lowest since 2007. And that is great news.

Back in May, 2013 (15 months ago) the Dow was out of its recession doldrums and hitting new highs. I asked readers if Obama could, economically, be the best modern President? Through discussion of that question, the #1 issue raised by readers was whether the stock market was a good economic barometer for judging “best.” Many complained that the measure they were watching was jobs – and that too many people were still looking for work.

To put this week’s jobs report in economic perspective I reached out to Bob Deitrick, CEO of Polaris Financial Partners and author of “Bulls, Bears and the Ballot Box” (which I profiled in October, 2012 just before the election) for some explanation. Since then Polaris’ investor newsletters have consistently been the best predictor of economic performance. Better than all the major investment houses.

This is the best private sector jobs creation performance in American history

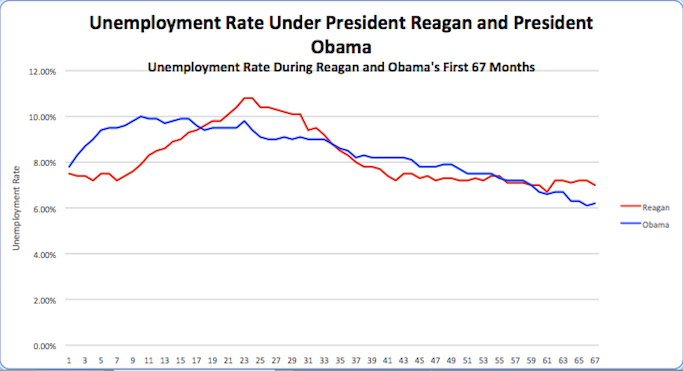

Bob Deitrick – “President Reagan has long been considered the best modern economic President. So we compared his performance dealing with the oil-induced recession of the 1980s with that of President Obama and his performance during this ‘Great Recession.’

Bob Deitrick – “President Reagan has long been considered the best modern economic President. So we compared his performance dealing with the oil-induced recession of the 1980s with that of President Obama and his performance during this ‘Great Recession.’

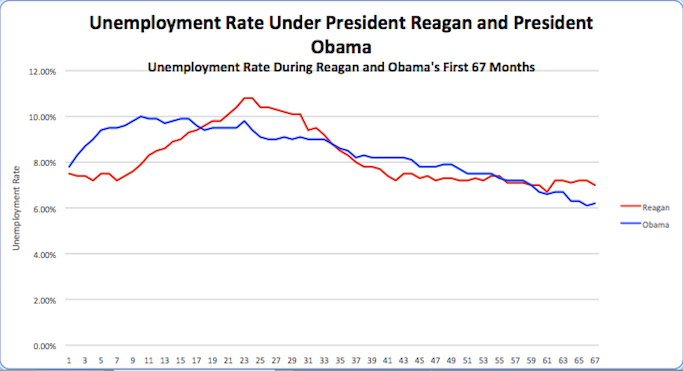

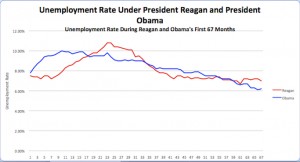

As this unemployment chart shows, President Obama’s job creation kept unemployment from peaking at as high a level as President Reagan, and promoted people into the workforce faster than President Reagan.

President Obama has achieved a 6.1% unemployment rate in his 6th year, fully one year faster than President Reagan did. At this point in his presidency, President Reagan was still struggling with 7.1% unemployment, and he did not reach into the mid-low 6% range for another full year. So, despite today’s number, the Obama administration has still done considerably better at job creating and reducing unemployment than did the Reagan administration.

We forecast unemployment will fall to around 5.4% by summer, 2015. A rate President Reagan was unable to achieve during his two terms.”

What about the Labor Participation Rate?

Much has been made about the poor results of the labor participation rate, which has shown more stubborn recalcitrance as this rate remains higher even as jobs have grown.

Source: Polaris Financial Partners Using BLS Data

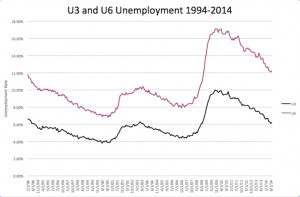

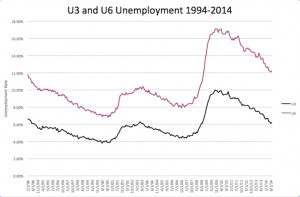

Bob Deitrick: “The labor participation rate adds in jobless part time workers and those in marginal work situations with those seeking full time work. This is not a “hidden” unemployment. It is a measure tracked since 1900 and called ‘U6.’ today by the BLS.

As this chart shows, the difference between reported unemployment and all unemployment – including those on the fringe of the workforce – has remained pretty constant since 1994.

Source: BLS Databases, Tables and Calculators by Subject – Labor Participation

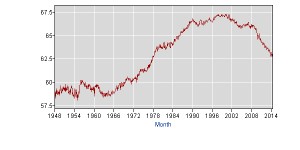

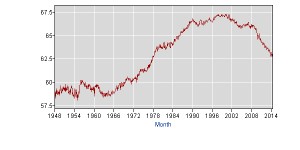

Labor participation is affected much less by short-term job creation, and much more by long-term demographic trends. As this chart from the BLS shows, as the Baby Boomers entered the workforce and societal acceptance of women working changed labor participation grew.

Now that ‘Boomers’ are retiring we are seeing the percentage of those seeking employment decline. This has nothing to do with job availability, and everything to do with a highly predictable aging demographic.

What’s now clear is that the Obama administration policies have outperformed the Reagan administration policies for job creation and unemployment reduction. Even though Reagan had the benefit of a growing Boomer class to ignite economic growth, while Obama has been forced to deal with a retiring workforce developing special needs. During the 8 years preceding Obama there was a net reduction in jobs in America. We now are rapidly moving toward higher, sustainable jobs growth.”

Economic growth, including manufacturing, is driving jobs

When President Obama took office America was gripped in an offshoring boom, started years earlier, pushing jobs to the developed world. Manufacturing was declining, and plants were closing across the nation.

This week the Institute for Supply Management (ISM) released its manufacturing report, and it surprised nearly everyone. The latest Purchasing Managers Index (PMI) scored 59, 2 points higher than July and about that much higher than prognosticators expected. This represents 63 straight months of economic expansion, and 25 consecutive months of manufacturing expansion.

New orders were up 3.3 points to 66.7, with 15 consecutive months of improvement and reaching the highest level since April, 2004 – 5 years prior to Obama becoming President. Not surprisingly, this economic growth provided for 14 consecutive months of improvement in the employment index. Meaning that the “grass roots” economy made its turn for the better just as the DJIA was reaching those highs back in 2013 – demonstrating that index is still the leading indicator for jobs that it has famously always been.

As the last 15 months have proven, jobs and economy are improving, and investors are benefiting

The stock market has converted the long-term growth in jobs and GDP into additional gains for investors. Recently the S&P has crested 2,000 – reaching new all time highs. Gains made by investors earlier in the Obama administration have further grown, helping businesses raise capital and improving the nest eggs of almost all Americans. And laying the foundation for recent, and prolonged job growth.

Source: Polaris Financial Partners

Bob Deitrick: While most Americans think they are not involved with the stock market, truthfully they are. Via their 401K, pension plan and employer savings accounts 2/3 of Americans have a clear vested interest in stock performance.

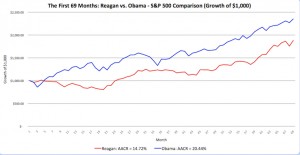

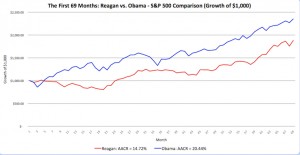

As this chart shows, over the first 67 months of their presidencies there is a clear “winner” from an investor’s viewpoint. A dollar invested when Reagan assumed the presidency would have yielded a staggering 190% return. Such returns were unheard of prior to his leadership.

However, it is undeniable that President Obama has surpassed the previous president. Investors have gained a remarkable 220% gain over the last 5.5 years! This level of investor growth is unprecedented by any administration, and has proven quite beneficial for everyone.

In 2009, with pension funds underfunded and most private retirement accounts savaged by the financial meltdown and Wall Street losses, Boomers and Seniors were resigned to never retiring. The nest egg appeared gone, leaving the ‘chickens’ to keep working. But now that the coffers have been reloaded increasingly people age 55 – 70 are happily discovering they can quit their old jobs and spend time with family, relax, enjoy hobbies or start new at-home businesses from their laptops or tablets. It is due to a skyrocketing stock market that people can now pursue these dreams and reduce the labor participation rates for ‘better pastures.”

Where myth meets reality

There is another election in just 8 weeks. Statistics will be bandied about. Monthly data points will be hotly contested. There will be a lot of rhetoric by candidates on all sides. But, understanding the prevailing trends is critical. Recognizing that first the economy, then the stock market and now jobs are all trending upward is important – even as all 3 measures will have short-term disappointments.

Although economic performance has long been a trademark issue for Republican candidates, there was once a Democratic candidate that won the presidency by focusing on the economy and jobs (Clinton,) and his popularity has never been higher! President Obama’s popularity is not high, and seems to fall daily. This seems incongruous with his incredible performance on the economy and jobs, which has outperformed his party predecessor – and every other modern President.

There are a lot of reasons voters elect a candidate. Jobs and the economy are just one category of factors. But, for those who place a high priority on jobs, economic performance and the markets the data clearly demonstrates which presidential administration has performed best. And shows a very clear trend one can expect to continue into 2015.

Economically, President Obama’s administration has outperformed President Reagan’s in all commonly watched categories. Simultaneously the current administration has reduced the debt, which skyrocketed under Reagan. Additionally, Obama has reduced federal employment, which grew under Reagan (especially when including military personnel,) and truly delivered a “smaller government.” Additionally, the current administration has kept inflation low, even during extreme international upheaval, failure of foreign economies (Greece) and a dramatic slowdown in the European economy.

by Adam Hartung | Sep 7, 2011 | Employment, Innovation, Leadership, Politics, Transparency, Web/Tech

Friday we learned, as the New York Daily News headlined, “August 2011 Jobs Report: NO Net Jobs Created.” U.S. unemployment, and underemployment, remain stubbornly stuck at very high levels. This situation is unlikely to improve, as reported at 24×7 Wall Street in “August Lay-off Plans Up 47%” with the latest Challenger Gray report telling us 51,144 people are soon getting the axe. No wonder we saw a dramatic decline of nearly 15 points, to 44.5, in the Conference Board’s Consumer Confidence Index – near record-low levels.

This has all the Presidential candidates talking about jobs, and President Obama signed up to deliver a jobs speech to Congress.

The problem actually goes beyond just jobs. Buried within consumer concerns lies the fact that for most people, their incomes are going nowhere. Adjusted for inflation, almost everyone is making less now than they did when the millenium turned. Generally speaking, about 15% less than 11 years ago! Most family incomes are about where they were in 1998. For the wealthiest, income since the mid-1960s has grown only about 1.5%/year on average. For everyone else the improvement has only been about .5%/year. And universally almost all of that increase occurred between 1992 and 2000 (for anyone who wonders about Bill Clinton’s resurgent popularity, just look at incomes during his Presidency compared to every other administration on this chart!)

Source: “U.S. Household Incomes: A 42 Year Perspective” Doug Short, BusinessInsider.com

But will anything the President, or the candidates, recommend make a difference?

So far, the politicos keep fighting the last war, and seem surprised that nothing is improving. The recommendations for putting people back to work in factories, such as autos and heavy equipment, or building roads simply defies the reality of work today. America has not been a manufacturing-dominated jobs country for over 60 years! All job creation has been in services!

Source:”Charting the Incredible Shift From Manufacturing to Services” Doug Short, BusinessInsider.com

For this entire period, productivity has been climbing. Just 50 years ago most people spent 1/3 to 1/2 their income on food. No longer. Today, few spend more than 5 to 10%, and everyone can enjoy an automobile, telephone, television and computer – regardless of their income! We have all the stuff anyone could want, and in many cases a lot more of some stuff than we need – or want!

The old notion of “what’s good for G.M. (General Motors) is good for America” is simply no longer true! As we recently witnessed, a multi-billion dollar bail-out of the largest American auto maker may have saved some unemployment – but it did not create an economic turn-around, or create a slew of jobs!

Today’s jobs are all in information – the accumulation, assimilation, analysis and use of information. Few “managers” actually manage people any more – most manage a data set, or a computer program, or some sort of analysis. The vast majority of “managers” have no direct reports at all! The jobs – and incomes – are all in information. Job growth is in places like Facebook, Google, Linked-in, Groupon, Amazon and Apple (the latter of which outsources all its manufacturing.)

No President or economist can manufacture jobs today. As we’ve seen, interest rates are at unprecedent low levels – yet nobody wants to take a loan to hire a new employee! In fact, business productivity is at record high levels as business keeps accomplishing more and more with fewer and fewer workers!

Source: “Corporate Efficiency is Getting Absurd” BusinessInsider.com

Public companies aren’t going broke, by and large. Most have cash balances at record levels. Only they keep using the money to buy back their own stock! Every month sees a wave of new stock buy back commitments, as 24×7 Wall Street reported “August’s New Massive Stock Buybacks… Over $30 Billion!” Business leaders find it less risky to buy back their own stock (supporting their own bonuses, by the way) than invest in any sort of growth program – something that might create jobs.

So what’s the President to do?

We need to radically jack up the investment in innovation! Think about that last period of very low unemployment and growing incomes – in the 1990s. We had the explosion in technology as people began using PCs, the internet, mobile phones, etc. New technology introduced new business ideas (mostly services) and created a rash of growth! And that created new jobs – and higher incomes. Innovation is the jobs engine – not trying to save another tired manufacturing company, or pave another highway or extend another bridge! Today those projects simply do not employ very many people, and the “trickle down” affect of a highway project creating more jobs has disappeared!

Bloomberg/BusinessWeek reported in “Failing at Innovation? Bank On It“

- Government spending on higher education has been declining since the 1970s reducing the number of graduate students and innovation projects

- Federal share of R&D has been less than 1% since 1992 – all while corporate R&D spending has declined dramatically! The days of spending “to put a man on the moon” has disappeared, as we fairly quietly mothballed the space program and commence to dismantle NASA

- The number of entrepreneurs is actually declining! There were fewer startups with 1 or more employees in 2007 (before the financial collapse and ensuing economic mayhem) than in 1990

- New companies are not employing people. In the 1990s the average startup employed 7.5 people, but now the number is 4.9

- Meanwhile “infrastructure” spending today is the same as it was in 1968!

We’ve done a great job of cutting taxes, but we’ve simultaneoously gutted our investment in R&D, innovation and doing anything new! If you wonder where the jobs went it wasn’t oversees, it was into higher corporate cash levels, more stock buybacks, increased bank reserves and dramatically higher executive compensation!

We don’t need more tax cuts – because nobody is investing in any new projects! We don’t need more unemployment insurance, because that – at best – delays the day of reconning without a solution.

Here’s what we do need today:

- Implement a tax on corporate stock buybacks. At least as great as the tax on corporate dividends. Buybacks simply drain the economy of investment funds, with no benefit. At least dividends give returns back to shareholders – who might invest in a new company! And if buybacks are taxed, executives might start investing in projects again!

- Quit giving such large depreciation allowances for physical assets. We don’t need more buildings – we’re overbuilt as we are right now! Again, it’s not “things” that make up our economy, it’s services!

- Re-introduce R&D credits! Give businesses a $3 tax break for every dollar spent in R&D and new product development! Prior to President Reagan this was considered normal. It’s not a new idea, just one that’s been forgotten. If we can give credits for oil and gas drilling, which creates almost no jobs, why not innovation?

- Cut payroll taxes on the self-employed and small business. Today self-employed pay 2x the payroll taxes, so it’s a big dis-incentive to entrepreneurship. Give start-ups a break by lowering employment taxes on small employers – say less than 50 employees.

- Allow investors in start-ups to write off up to 2x their losses. It takes away a lot of the risk if you can get most of your money back from a tax break should your investment fail. And for all those corporations that abhore taxes this would incent them to invest in small enterprises that have new ideas they’d like to see developed.

- Remember the Small Business Administration (SBA)? Re-activate it by giving it $100B (maybe $200B) to guarantee bank loans of small businesses. Bank lending has ground to a halt as banks eliminate risk – so let’s get them back into their primary business again. In WWII the government guaranteed every loan for the construction of the Liberty Ships – and behold business built 2,751 of the things in 4 years!

- Increase funding for higher education. Increase the grants for science, engineering and new product research at America’s universities. Increase grants for students in science and engineering, and allow students to deduct out-of-pocket educational expenses from their taxes. Allow corporations to deduct all the expense of employee education – uncapped! Allow corporations to deduct the university grants they make!

- Invest in today’s digital infrastructure. Once we paid to send men to the moon – and a flood of innovation (from microwave ovens to powdered drinks and frozen food) followed. Today we should invest in a nationwide WiFi network that’s everywhere from rural forests to city buildings – and make it all FREE. Digital networks are the highways we need today – not concrete ribbons. Create tax deductions for people to buy smartphones, tablets and other products that drive innovation, and make it easy for innovators to network for solutions to emerging needs.

- Streamline the process for small companies to test and sell new bio-engineered products. The existing complicated process is a legacy of big companies and traditional pharmaceutical research. Make it easy for entrepreneurs to test and launch the next wave of medical technology based on the new bio-sciences. Offer federal-backed safety insurance to protect small businesses that show efficacy in new solutions.

These are just 9 ideas. I’m sure readers can think up 90 more (in fact, I challenge you to offer them as comments to this blog.) If we invest in innovation, we can create a lot of jobs. But we need to start NOW!

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

Brookings – Hamilton Project – Kristton McIntosh, Managing Director

since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

since stats started in 1790. And this included the rebounding post Great Recession economy! Simply put, fewer babies and a lot fewer immigrants. So now, there are more people over 80 years old in America than under 2 years old. Partially the result of efforts designed to boost employment and pay, a decade of anti-immigration policies has left us with fewer people to get things done. It didn’t boost employment nor pay, but it has meant there are fewer people around to support the aged and infirm – and to pay taxes.

Harvard Business Review Press

Harvard Business Review Press

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.

However, both actions look a lot more like reacting to undeniable trends in an effort to simply keep their organizations functioning than any sort of corporate altruism.