by Adam Hartung | Jan 22, 2021 | eBooks, Politics, Strategy, Trends

Click for ebook

Thrive to the Future – 4 top trends for 2021 and beyond.

Businesses need to plan for the future. And part of planning are the assumptions you make. As Biden takes office, there is a lot of talk about whether the “movement” that Trump led is at its end, or just beginning. The good news is we have the tools to be predictive when answering that question, and those tools tell us that for the most part Trumpism is over.

As I wrote in August when California put to vote its “Gig Economy Law,” not even a state legislature can stop a trend. The Gig Economy is one of the biggest mega-trends out there, so trying to legislate away the trend and return to old methods of employment was simply not going to work. California needed to make changes that aligned with needs of gig workers, not try to outlaw the practice. And the measure failed.

It’s this same logic that makes me confident the policies that applied the last 4 years will go away, and any “movement” to try and return to that course will not succeed. Like California’s effort, the policies of Trumpism were anti-trend. While these policies could be enforced for a short time, they simply could not withstand the power of the long-term trends, and thus were doomed from the outset. Let’s take a look at some of those policies and trends, and review why they were (at best) short-term actions. {Note, this is not predicting an end to the Republican Party, nor Conservative politics. This discussion is focused on the American policies of the last 4 years during the Trump administration.}

-

- Anti-globalization is doomed to fail. We have the internet now. Everybody can see what’s happening in the world, and everybody can talk to everybody else. Borders have meaning, but trade across borders cannot be stopped. We all buy and sell products internationally daily. Even the Trump website sold apparel made in China. To try and stop trade is impossible, and tools like tariffs are simply woefully out of date. Those who try to interfere with globalization will have economic suffering, while allowing stronger international traders to grow. { Side note read column on why Brexit is Economic Destruction vs. Creative Destruction }

- Anti-immigration is doomed to fail. America, like almost all mature economies, is an aging demography. If you don’t add new people economic activity will suffocate under the weight of caring for the aged. You need demographic growth, and it needs to be younger people who are working. Simultaneously, companies that need skills need access to international markets to recruit people to work under visas. Immigration is good for economic growth, and an inherent part of globalization. Simply put, America needs immigration to keep growing. { Side note read column on why Japan’s aging demographics is an economic “time bomb”. }

- Chronic tax cuts without equal (or greater) investment is doomed to fail. The argument for low taxes is to provide more money for investing in business to grow – thus creating jobs that see higher pay due to increased demand for workers. However, recent tax cuts did not have associated policies for re-investment, and thus much of the money was used to repurchase shares of stock, make acquisitions of existing businesses and simply build a cash hoard. Simultaneously, tax cuts led to a reduction in government spending on infrastructure and other jobs creating projects, which further worsened the economic growth opportunity. This led to enormous income inequality – which has quite literally led to people “taking to the streets.” At some point policies have to shift toward investment to generate economic growth. { Side note read column on why share buybacks are not good for the economy nor good for shareholders. }

- Isolating China only makes them stronger. We have a balance of trade deficit with China, but tariffs and attempts to stop trade only made the balance of trade WORSE. The net is we want Chinese labor, and products, a lot more than they need American products. Retaliation is very real, and the USA is woefully unprepared for economic retaliation. The biggest market hurt by Chinese retaliation is agriculture, as witnessed by the incredible number of farm failures last 4 years. Them not buying from us doesn’t affect them nearly as much as it affects us. Meanwhile, China keep investing in global projects, their economy keeps growing, and now China’s economy is larger than the USA’s. We desperately need to focus on how to compete with China in global markets, not blindly think we can simply walk away. { Side note column on changing economic positions and how China’s growth is impacting global positions including currency valuations. }

- Sanctions and other policies to try controlling middle-east behavior are doomed. US policy was historically built on petroleum demand. But now these countries must move beyond oil sales to grow, and they desperately know this. The only successful long-term policy is to help these nations grow diversified economies so they can create jobs and keep their citizens happy. {Side note column on how falling petroleum demand is affecting global markets and changing the winners. }

- These are just some of the long-term trends that Trumpism ignored. Short-term shear force of will, lying about the data and ignoring the obvious could allow naysayers to hope they would change the trajectory of history. But long-term, trends always win. Evolution always moves forward, never backward. While Trumpism was a very interesting effort to fight trends, it was doomed to fail. And now that we can see the almost wholly negative economic implications of these policies it is extremely unlikely any such “movement” can re-establish itself. People do not act against their own self interest very long.

-

Winners don’t fear trends and the change they create. Rather they accept the trends on build on them to grow. Looking forward business should not plan for Trumpism to return in any meaningful way. As a set of policies they are as likely to succeed as storming the capital was likely to change the course of an election. Short term a lot of noise, long-term meaningless. So we can move forward building our plans based on trends, and a shift to economic policies much more aligned with long-term trends.

Key lessons?

First, the world is growing and leading businesses will grow. If you’re not growing, you’re dying. Second, never plan from past success, but instead plan for the future. You don’t grow value by being operationally excellent, because the world is forever changing and it will make your past business less valuable even if you do run it well. Third, make sure your plans are all built on trends. Let trends be the wind in your sales, or the current under your boat, or whatever analogy you like – just be sure you’re using TRENDS to drive you business planning, product development and solutions generation. Customers buy trends and help for them to achieve the future.

- Here at Spark Partners, we are experts at trend analysis, trend planning and effective resource allocation. Don’t let a comfort level on doing more of the same get in the way of your future growth. Embrace trends in the market and let us help you identify critical trends and invest smarter to build on trends and grow.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Jan 14, 2021 | eBooks, Investing, Politics, Strategy, Trends

Chicago, and Illinois, are in big economic trouble.

- 7th straight year of population decline. Losing 235,000 people in 10 years, 3x the amount of any other state. Last year saw a decline of 79,500 people – second only to much larger New York – and the rate of people leaving is accelerating.

- Illinois has, on average, property taxes 2x the national average. If you owned the “Home Alone” house in suburban Chicago, since the movie was made in 1990 you would have paid $890,000 in property taxes.

- Chicago is the worst residential real estate market of any large city in America. While values have been rising elsewhere since the Great Recession, in the last decade, property values in Chicago have declined 20%.

- Sales tax is 9%, and on some products 10%+, one of the highest rates in the USA. On-line purchases are taxed at 10.25%, for example. Illinois is one of only 7 states to charge sales tax on gasoline. And Illinois has the highest cell phone tax in the country.

- Illinois roadway toll fees are widespread, and among the highest in the USA, with the majority of those funds going NOT to road improvement but rather into the general budget to cover state expenses.

- Illinois is 46th in private sector job growth – and would be 50th except the #1 source of job growth is government jobs. And 40% of the government workforce makes $100k+/year. The total number of jobs in Illinois December, 2019 was 6.2M – unchanged since 2015 – and up only slightly from 5.9M in 2010 – yielding a pathetically low growth rate for jobs of 1/2 of 1% (.5%) per year

- 1/3 of the state budget is pension payments, and pension debt is 26% of state GDP – highest in the country. Lots of retirees, very few new jobs to pay their pensions.

Thrive to the Future – 4 top trends for 2021 and beyond.

Gibbon wrote “The Decline and Fall of the Roman Empire” as a treatise to uncover how such a powerful empire could lose its greatness. There is no doubt, Chicago and Illinois were once great. The area was known for great jobs, great infrastructure, great transportation system, great homeownership – and for many decades considered one of the best places to live in America. Back when agriculture and manufacturing dominated the economy. But quite obviously, as the world changed, and the sources of economic value (including jobs) changed, the late, great state of Illinois kept pushing on with “business as usual” instead of changing policies and investments to re-orient for the Information Era.

Things were not destined to become this bleak. Chicago could be Austin today – but obviously it isn’t. Where Austin, and Texas, looked at trends and made investments beyond the old “core” of oil and gas, Chicago and Illinois completely failed to look at trends that indicated a clear need to change. Problems, and the path to solve them, have been obvious for years. It was easy to predict this would happen. But a chronic focus on the short-term, rather than the long-term, combined with a complete unwillingness to change how investments were made caused state and city leaders to consistently ignore warning signs and make one bad decision after another.

Indicators of Decline

I’m an expert on trend-based planning, so let’s take a look at the telltales this was coming and how those telltale indicators were ignored:

- In February, 2006 (yes 15 years ago) I wrote that Illinois was the #1 net job loss market in the country. This factoid highlighted an emerging problem in the underlying economy. The state was still considerably dependent on old-line agriculture/food giants, those businesses were crumbling and unlikely to recover as the economy shifted. Notably Kraft was in its 5th year of what was to be a turnaround (that never happened) and Sara Lee was under incompetent leadership that kept selling businesses to shore up declining revenues and earnings. The state, and city, had failed to develop an infrastructure for investment in start-up companies. There was a total lack of investment money for entrepreneurs from paternalistic large companies such as Motorola and Ameritech. And a lack of money for innovation from banks, venture capital and private equity firms. Existing businesses were aging, cutting jobs and none were focused on investing in new companies to keep the local economy tied to the emerging Information Economy [ link ]

- In February, 2009 Forbes selected Chicago as the 3rd most miserable city in the USA, citing high taxes, no job growth, infrastructure decay, congestion and bad weather. An uproar ensued – but no change. I then noted my 2006 column, and recommended a very serious Disruption in how Chicago was managing its resources. Clearly the “more of the same” strategy trying to defend its past was not working. Unless there was a disruption, Chicago would get worse – not remain the same, and certainly not get better. The signs were clear that from ’06 to ’09 nobody was thinking about the big changes needed [ link ]

- In June, 2010 it was reported that Illinois lost 260,000 jobs between 2000 and 2010 – and that was an indicator of why Chicago and the state were having so many economic problems. I recommended the city and state make significant changes in resource allocation to keep more start-ups local. The University of Illinois was the #4 engineering school in the US, but the vast majority of graduates left to one or the other coasts. Local businesses were not developing new businesses, thus not hiring these top students. Start-ups at the universities, and by recent grads, could not obtain funding, so they fled to where the money was. Economic reliance on stalled companies like Kraft, Sara Lee, Motorola, Lucent, Sears and United had created a Growth Stall that was sure to lead to additional job losses – when the best talent was right there in the state! [link ]

- I followed up a week later that same June with a column on how Mayor Daley was very popular with voters and local businesses, but he was setting up the city (and state) for failure. There was a focus on keeping the “old guard” happy, and doing so by completely ignoring opportunities for future growth. Offering tax breaks and subsidies to recruit corporate headquarters (like Boeing) created very few jobs, and was a poor use of resources that should be diverted to funding start-up tech and bio-tech companies. And financial machinations, like selling the city’s parking rights, gave a short-term lift to the budget, hiding significant weaknesses, while creating massive long-term problems. Chicago and Illinois politicians were focused on short-term actions to get votes, and ignoring the very real jobs problem that was tanking the economy. [ link ]

- By April, 2014 I was able to clearly demonstrate that my predicted economic stagnation spiral had taken hold in Illinois. Defend & Extend investments to shore up declining companies – like Sears – robbed local governments of funds for job creating programs. And a decade + of no job creation was forcing taxes up – at a remarkable rate – which kept businesses from moving to Illinois; kept them from opening software labs, coding facilities, research centers, pharma and bio-pharma production plants, etc. With no growth, but rising costs, the death spiral had begun and needed immediate attention [ link ]

- In September, 2016 the outward migration from Chicago and Illinois had become a powerful trend. Looking at demographics, the market was aging. Rising costs and no growth had pinched budgets to the limit, while pension costs had become an unsustainable burden on the state’s citizens. Just like Japan was in an aging crisis, Illinois was in an aging crisis. And this was destined to create even more problems for the economic death spiral that began before 2006. [ link ]

- So by January, 2017 the demographic tailspin was clearly creating a vacuum pulling people out of Chicago and Illinois. Fully 4 years ago it was obvious that the predicted trends had taken hold, and nothing short of an incredible disruption would save Chicago from becoming the next Detroit. Using the simplest trend planning tools made it clear that unless there was radical change in investments the Chicago empire was at its end. [ link ]

Lessons for business?

Far too many businesses act like Chicago. “Business as usual” dominates. Resources are automatically routed to defending old business lines, rather than investing in new products and solutions. Focusing plans on historical customers, products and markets create blindness to market shifts, and a reluctance to move forward to new technologies and markets. Very little energy is put into trend analysis, and plans are not built based on trends and likely future outcomes (planning from the past dominates over planning for the future.) People who point out likely future bad outcomes unless serious change is undertaken are ignored, or shouted down, or removed entirely. Short-term financial machinations (selling assets, or a business, or offering deep discounts to keep customers) create an illusion of security while long-term trends are undermining the business’ foundation.

We are experts at trend analysis, trend planning and effective resource allocation. It was clear 15 years ago that major resource reallocation was necessary for Chicago to continue growing its economy. Don’t let a fixation on doing more of the same get in the way of your future growth, like Chicago. Let us help you identify critical trends and invest smarter to build on trends and grow.

Key lessons?

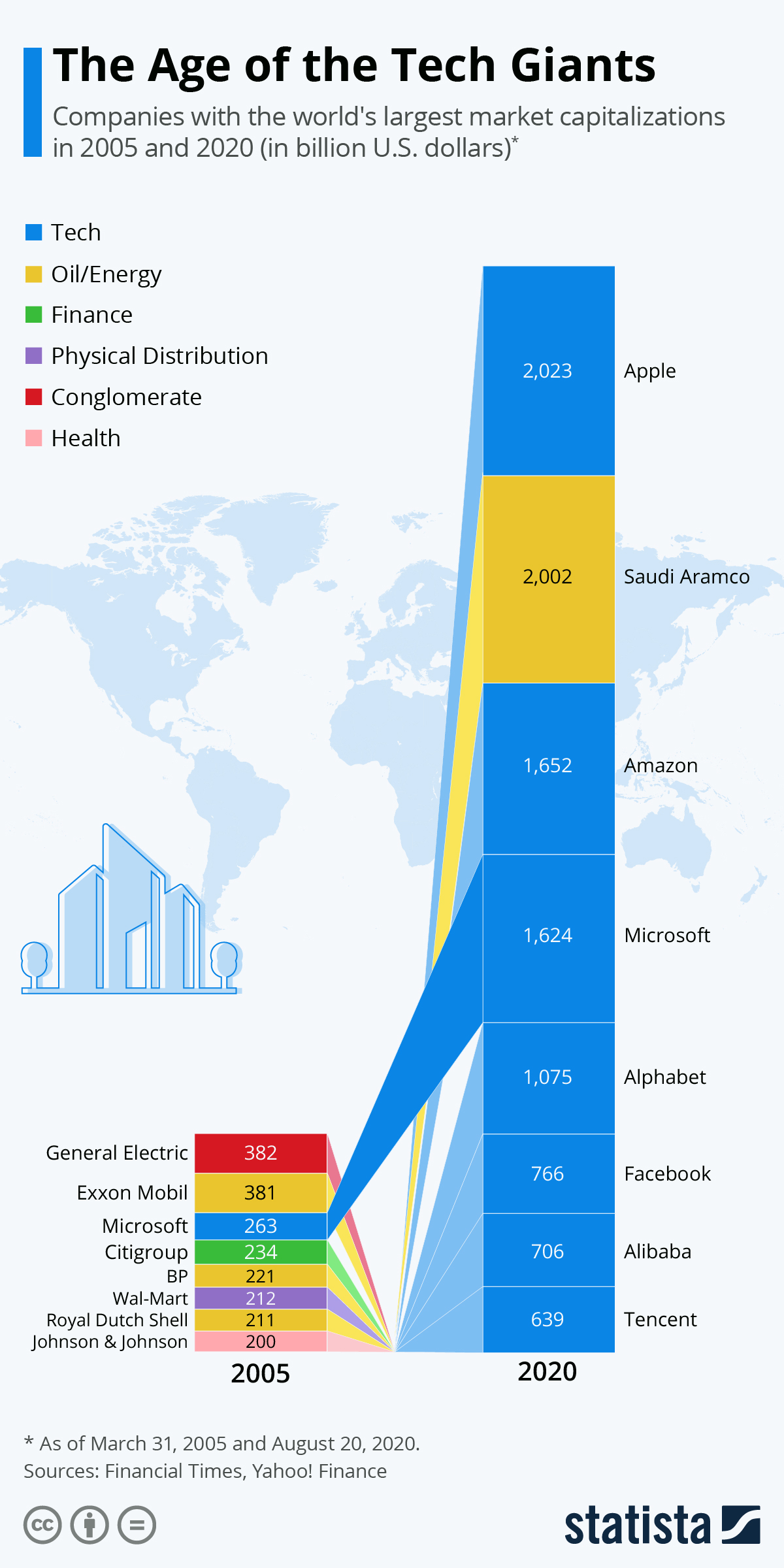

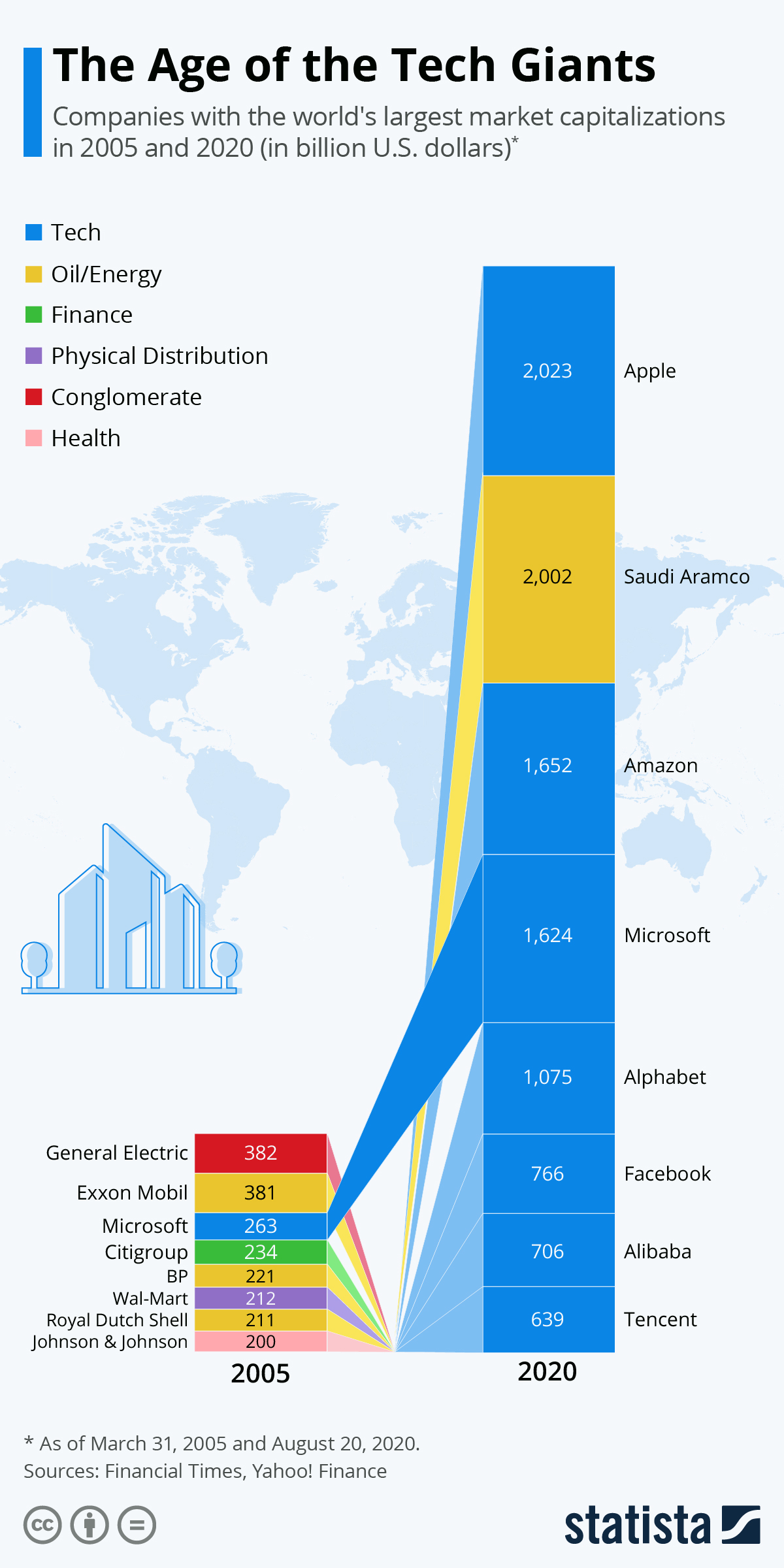

First, the world is growing and leading businesses will grow. If you’re not growing, you’re dying. Just like GE and Exxon. Second, never plan from past success, but instead plan for the future. You don’t grow value by being operationally excellent, because the world is forever changing and it will make your past business less valuable even if you do run it well. Third, make sure your plans are all built on trends. Let trends be the wind in your sales, or the current under your boat, or whatever analogy you like – just be sure you’re using TRENDS to drive you business planning, product development and solutions generation. Customers buy trends and help for them to achieve the future.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-726-8465.

by Adam Hartung | Dec 29, 2020 | eBooks, Innovation, Investing, Strategy, Trends

Thrive to the Future – 4 top trends for 2021 and beyond.

When looking at America’s 8 largest companies, a LOT has changed in 15 years. Back in 2005 the most valuable company was GE. The list was dominated by oil & gas companies; ExxonMobil, BP, Royal Dutch Shell. The biggest bank (Citi) and biggest retailer (Walmart) and 1 pharma company (J&J.) There was only 1 tech company on the list (Microsoft.)

But the world has changed, and that has impacted these companies dramatically. Most had GREAT pasts, but they did not adapt to a changing world. GE’s market cap has fallen 75% as it failed to keep up with trends. Oil companies failed to move into renewables and other industries (like electric car production) and they’ve lost over HALF their value. Walmart is most noted for missing the e-commerce trend, the big banks were clobbered by the Great Recession and “big pharma” hasn’t produced a blockbuster for many years. All down significantly.

But, the value of the top 8 companies is MUCH higher than 15 years ago – 5X more. These losers were replaced by some very serious winners. From $2.1T in combined value, the top 8 are now worth $10.5T. But notably, only 1 company is still on that list – Microsoft – which is up 620%!

The list is now dominated by 7 technology companies.

And for good reason – they all followed trends. Apple, Amazon, Microsoft, Alphabet (Google,) Facebook, Alibaba and Tencent all built their strategies around developing solutions for people to follow the major trends of being mobile, operating asynchronously, supporting gig work and adding artificial intelligence (AI) to their customers. By refusing to rest on past laurels they have become the mega-giants of today. (Hartung, “Thrive to the Future – The 4 Top Trends for 2021 and Beyond)

That these companies would overtake old leaders was not a foregone conclusion – nor an obvious one to most people. Not only were the previous giants big, they had incredible reputations and extremely strong management teams. And these tech companies were not without problems.

That these companies would overtake old leaders was not a foregone conclusion – nor an obvious one to most people. Not only were the previous giants big, they had incredible reputations and extremely strong management teams. And these tech companies were not without problems.

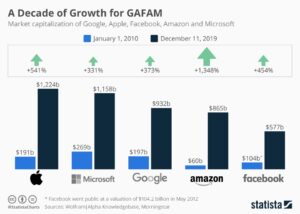

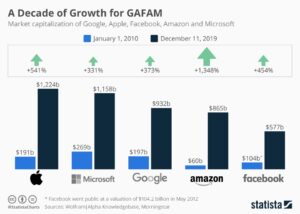

- Apple almost went bankrupt just a few years prior to 2005, trying to be the “Mac” company. But Apple built one innovation after another helping people meet the emerging big trends – until it became the most valuable company on the planet (10 yr value increase 540%)

- Microsoft was locked in to its Windows/Office domination and seemed unable (or unwilling) to acknowledge the big trends and its value languished under a terribly myopic CEO (Ballmer.) Yet, new leadership was able to see the trends and moved radically to build out cloud services and support for alternative customer solutions that changed the company and its fortunes (10 year value increase 330%)

- Amazon was a former book seller turned general merchandiser. But Amazon started applying technology to understand its customers and help them be better shoppers, using AI to make them the leader in all things e-commerce. Simultaneously Amazon built the worlds largest and most secure cloud services business (AWS) helping support all major trends (10 year value increase 1,350%)

- Google was a search engine, with an unclear business model. But Google went to unexpected lengths to make ALL forms of information digital, and accessible, and searchable. And it monetized that digitization in ways far beyond anyone expected leading to the end of newspapers and many other publishers (10 year value increase 370%)

- Facebook was considered a fad for young people. Most business leaders thought Facebook’s users would disappear, and its young leaders would learn there was no revenue in attracting eyeballs (just as News Corps learned and shut down MySpace.) But Facebook built out the trend for social contact in a mobile, asynchronous smart way creating an entirely new business market called “social media.” Facebook looked at trends in how people connected, making brilliant acquisitions early of Instagram and WhatsApp that allowed Facebook family of products to become the #1 use of the internet (10 year value increase 450%)

Key lessons?

First, the world is growing and leading businesses will grow. If you’re not growing, you’re dying. Just like GE and Exxon. Second, never plan from past success, but instead plan for the future. You don’t grow value by being operationally excellent, because the world is forever changing and it will make your past business less valuable even if you do run it well. Third, make sure your plans are all built on trends. Let trends be the wind in your sales, or the current under your boat, or whatever analogy you like – just be sure you’re using TRENDS to drive you business planning, product development and solutions generation. Customers buy trends and help for them to achieve the future.

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-331-6384

by Adam Hartung | Dec 22, 2020 | eBooks, Innovation, Investing, Strategy, Transportation, Trends

Thrive to the Future – 4 top trends for 2021 and beyond.

On December 7, Uber announced it is spinning out its autonomous car development effort to a new company- Aurora. On December 8, NASA announced a large flare from the sun was going to produce auroras over the northern hemisphere. NASA’s solar flare fizzled and there was no light show. What about Uber’s Aurora?

After spending what was likely a billion dollars on development, Uber is pushing its AGV out the door, along with $400 million, to be a separate company all on its own named Aurora. After a lot of development, serious steps forward in self-driving technology, and some problems, Uber is simply walking away. Expensively. It begs the question “what went wrong.”

The #1 problem with this investment was created at the outset. What is Uber’s value proposition? That was at the very least complicated, and at the worst never quite clear. Uber was always supposed to be a lot more than an alternative to taxi and limo services. Ostensibly Uber was a tech company that matched up unused resources with people who could use those resources – which is why Uber is often lumped into discussions with AirBnB. Both are supposedly tech companies that allow the unleashing of locked-up value in underused resources to marginal users who could benefit from the marginal increase in resource capacity.

If that’s the case, why would Uber invest in autonomous car technology? That’s what went wrong. People driving their own cars as gap-filling cabs is a value delivery mechanism. It is one use of the technology in one application. The value of Uber is supposed to be its matching technology with some elaborate pricing capabilities (surge pricing, for example.) But autonomous cars were an improvement in the delivery system – an effort to eliminate the costly driver and thus compete more specifically against taxis in ferrying around people. Uber confused its Value Proposition with its Value Delivery System – and thus it made huge investments in the latter when it should have remained focused on the former.

Uber needs to refocus on its Value Proposition.

How can Uber help me unlock value in my underused resources? How can Uber help me get better access to resources, help me access underused resources? Neither of those are met if I have to turn my car into an autonomous vehicle, at my own cost. In a way it actually defeats the Value Proposition, because rather than unleashing locked-up value in my resource (car) it causes me to invest in technology I don’t need and may not even want. And as an Uber user I get no additional value from the car being driverless – that doesn’t inherently help me meet my needs any better. Overall, autonomous vehicle technology really misses the point of the Uber Value Proposition.

Lots of companies make this mistake. They get so focused on how they are delivering value that they over-invest in the Value Delivery System, and lose sight of the Value Proposition. Encyclopedias got so focused on printing books they forgot their value proposition was instant information – thus letting Google drive them out of business. Newspapers were so focused on the process of daily newspaper prep and delivery they forgot their Value Proposition and let on-line news outlets kill them. Sears and ToysRUs got so focused on running traditional stores (and traditional retail metrics) they forgot their value proposition and let Amazon steal customers away. ABC, NBC, CBS, BBC got so focused on running broadcast television networks they let streaming services (Netflix, Disney+, Hulu) steal all the entertainment eyeballs.

Uber’s mistake just happens to be really costly, and really dumb.

They should never have invested in autonomous vehicle technology. Leave that for someone who identifies a very real unmet customer need that is fulfilled with an autonomous vehicle. The leadership of Aurora first and foremost have to define their value proposition – and then figure out how to deliver that value with their technology. Nobody succeeds by inventing a technology that solves no real problem – that’s how you get Segway! Or the Amphicar that turned itself into a boat. Instead, you identify the need then develop the delivery mechanism to fulfill that need.

Do you know your Value Proposition? Can you clearly state that Value Proposition without any linkage to your Value Delivery System? If not, you better get on that pretty fast. Otherwise, you’re very likely to end up like encyclopedias and newspaper companies. Or you’ll develop a neat technology that’s the next Segway. It’s always know your customer and their needs first, then create the solution. Don’t be a solution looking for an application. Hopefully Uber and Aurora will both now start heading in the right directions.

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-331-6384

by Adam Hartung | Dec 15, 2020 | eBooks, Investing, Strategy, Trends

Thrive to the Future – the 4 top trends for 2021 and beyond.

In February, Disney appointed a new CEO from inside the company. I was not a fan. He came from the traditional,old Disney businesses – studio movies and theme parks. Both of those businesses are historical artifacts, not growing, and clobbered by the acceleration of trends due to the pandemic. But…… after crashing almost 50% shortly after changing CEOs (and the pandemic hitting the USA) the stock just reached a new all time high – recovering all those losses and pushing ahead an additional 16%.

A lot of companies are complaining about how bad the pandemic has affected them. They were tied to their historical value delivery system, and working hard to keep optimizing that business model. They weren’t following trends, so when the pandemic accelerated trends to more mobile, more asynchronous work, greater use of gig resources and ever greater expectations for AI (artificial intelligence) they simply were not prepared.

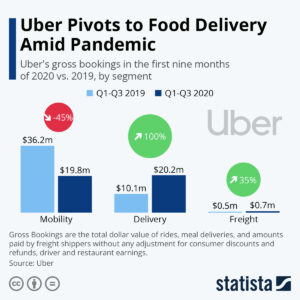

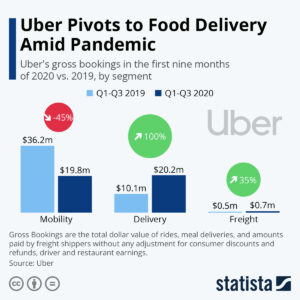

But smart companies moved really fast to implement their plans for new business based on trends. For example, while everyone thought of Uber as an alternative to taxis, leadership had already been looking at changes in package distribution. They could see problems in the post office, limitations (and pricing) to UPS and Fedex, and the “last mile” delivery problem everyone local had — as well as alternatives being tested by Amazon.com. So when demand for local deliveries picked up, Uber was ready to change. In a year demand for taxi type services fell 45%, but deliveries rose 100%!! And even though it was small, freight jumped 35%. The net was that in an extremely fast changing marketplace, gross bookings for the first 3 quarters of 2020 were $40.7M vs. $46.8M in 2019. In a terrible year, Uber was ready (and able) to move fast to implement changes to keep revenues moving forward.

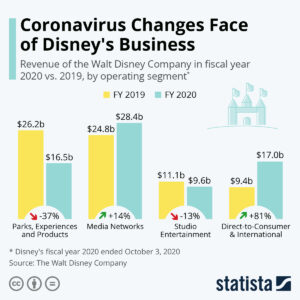

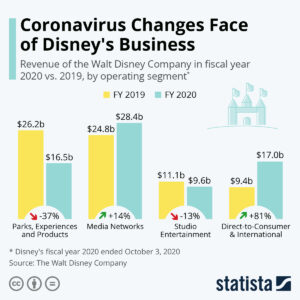

And Disney is another great example. Theme parks and studio entertainment seemed to be relics of a bygone era, and in 2020, demand was hit hard. Theme parks fell 37% and studio movies fell 13%. I thought Disney would go into cost cutting mode exclusively and start down the road to irrelevancy.

But I was wrong. Yes, Disney did cut employment in those two divisions. Extensively. But that was an acceleration of something bound to happen. Those businesses were shrinking and outdated. However, simultaneously, Disney poured resources into Media Networks and Direct-to-Customer, two business units highly aligned with trends! Basically, Disney went from that old-line movie and parks company to a very well positioned e-commerce vendor and competitor to Netflix!! In just 9 months. Already, Disney has 80M subscribers for Disney+, compared to Netflix 200M, and is targeting 260M by 2024!!! Disney has demonstrated it is ready to launch first run movies, at much higher prices, on its network – building out new pricing schemes as well as new business models for streaming content!

The lesson here is to be prepared for change! Don’t build your plans just on the past – past products and customers. Instead, look hard at trends and build scenarios for the future based on trends. Be ready for those trends to accelerate. And then TAKE ACTION. Don’t wait. Don’t stall. Go to the future by implementing those plans.

If you are planning based on trends you will be prepared for big changes in your “base” or “core” business. And you’ll develop plans for new solutions that meet emerging trends. So when the opportunity presents itself, like in a pandemic – or something a lot less dramatic – you’ll be ready to implement a new business. You can shift your value delivery system quickly to continue meeting the Value Proposition that you offer your customers.

Congratulations to Uber and Disney for doing good trend planning and being ready. Are you properly planning? Are you ready for change?

Did you see the trends, and were you expecting the changes that would happen to your demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, perhaps you should contact us, Spark Partners. We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info. Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.com

Give us a call or send an email. Adam@sparkpartners.com 847-331-6384

by Adam Hartung | Nov 3, 2020 | Finance, Investing, Strategy, Trends

In September, 2015 (5 years ago) I wrote that Tesla was going to change global oil demand. Why? Because Tesla had proven there was a market shift toward electric vehicles (EV’s). Yes, the market was small. But every major auto company had seen the trend emerge, and all had EV’s on the drawing tables. Simultaneously, this was showing a shift to “electrification” at the same time that solar energy costs were dropping in price similar to computer chips in the 1990s.

The combination of shifts away from internal combustion engine (ICE) automobiles operating on petroleum, and the growth in renewable energy production from solar and wind was becoming obvious. In sailing, there are small lengths of cloth attached to the sails specifically to obtain an early read on wind direction. These are called “telltales.” Looking at Tesla and growing renewable electricity generation, the telltales gave me confidence to specifically predict it would

really hurt Exxon.

Now, 5 years later, most pundits think the world has reached “peak oil” usage, and demand for oil will only fall.Since 2015 Exxon’s equity value (XOM) has declined 65%. Due to declining demand, the company is being forced to restructure and possibly

cut its dividend as the company shrinks.

Some would look only at short-term issues like the pandemic, but the economy in China has fully recovered – yet its demand for oil has not. Or some might say that oil prices are down only because Saudi Arabia and Russia are battling over market share – but this only portends more bad news for Exxon because 2 giants with the lowest cost battling for share will only make it harder for Exxon to sell products, even at a lower price and little or no margin.

Unfortunately, the pandemic has created an acceleration in the trends that are dooming profits for oil companies like Exxon. Once business happened in physical meetings where we transported ourselves by auto or plane fueled by oil. Now, meetings are being held on-line, virtually. Increasingly individuals, and companies, have learned not only how to use this technology but that they are more productive. Less wasted commuting time, less wasted hallway conversation time, fewer interruptions, and a recognition that it is possible to cut meeting time allowing attendees to better streamline work and decision-making. Speaking of work, virtual meetings are leading to better employee concentration due to better scheduling of time for meetings, and scheduling time for individual work.

Recall 2010 and the effort put into driving to work, or flying to meetings. Exxon, GM, Ford, Boeing, United Airlines and American Airlines were economic leaders, reflecting the work methods of the Industrial Era. Exxon was one of the 30 stocks on the Dow Jones Industrial Average. But the Great Recession had taken GM off the Dow, and now declining oil demand has removed Exxon – following the path I previously predicted.

Look at current 11/2020 market capitalizations:

Exxon – $133B

General Motors – $49B

Ford – $31B

Boeing – $83B

United Airlines – $10B

American Airlines – $6B

The world has changed. Trends have prevailed. We are now more mobile-oriented, work more asynchronously and use

more gig resources. Now we connect by Zoom and travel on electrons.

REUTERS/Lucy Nicholson

Zoom market cap – $146B

Tesla market cap – $380BWhy this walk down the path of recent history? Markets shift – often a lot faster than we would like to imagine. The economic hurt on those left behind is enormous. The opportunity for new leaders even more enormous. On the back end of trends is a LOT of pain. On the front end of trends is a lot of happy, happy. It is incredibly important to pick out the telltales and incorporate them into your planning. Earlier rather than later.Let trends direct your investments and your business decisions – look forward not backward. You want to be Zoom or Tesla (or own the stocks,) not Exxon, GM or Boeing (nor own those stocks.)

If you don’t have a clear line of sight to the future, ask for help – it’s my job. Do you remember anyone else predicting this enormous shift back in 2015? Back then oil was $100/barrel and Exxon was trading at $100/share. More pundits were expecting the future to look like the past than to make a radical shift. But we are always looking at the early telltales, always developing new scenarios, always preparing for market shifts and their implications.

Did you see the trends, and were you expecting the changes that would happen to oil demand? It IS possible to use trends to make good forecasts, and prepare for big market shifts. If you don’t have time to do it, maybe you should contact us!! We track hundreds of trends, and are experts at developing scenarios applied to your business to help you make better decisions.

Or, to keep up on trends, subscribe to our weekly podcasts and posts on trends and how they will affect the world of business at www.SparkPartners.comTRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business. Click for Assessment info.

Give us a call or send an email. Adam@sparkpartners.com 847-331-6384

by Adam Hartung | Sep 1, 2020 | Finance, Investing, Strategy, Trends

On 8/31/20, the Dow Jones Industrial Average went through a change in composition. Out went Exxon, Pfizer and Raytheon. In came Salesforce.com, Amgen and Honeywell. This is the 8th time the Index components have changed this decade, the 13th time since 2000 and the 55th change since created in 1896. So changes are not uncommon. But, are they meaningful? Ask any academic and you’ll get a resounding “NO.” There is no stated criteria for selection, no metrics for inclusion, no breadth to the number of companies (which has changed significantly over time,) and not even a weighting for market capitalization! The DJIA has no relationship to “the market,” which could well be measured better by the S&P 500, or the Russell 3000. And it doesn’t even link to any specific industry! To academics, “the Dow” is just a random number that reflects nothing worth measuring!!

The DJIA is (currently) a group of 30 stocks selected by the editors of Dow Jones (publisher of the Wall Street Journal, owned by News Corp – which also owns Fox News – and controlled by Rupert Murdock). Despite its lack of respect by academics and money managers, because of its age – and the prestige of being selected by these editors – being on the DJIA has been considered somewhat revered. Think of it as an “editorial award of achievement” for size, profitability and perceived stability. For these reasons, over time many investors have believed the index represents a low–risk way to invest in corporations and grow their wealth.

So the daily value of the DJIA is pretty much meaningless. And being on the DJIA is also pretty much meaningless. But, investors have followed this index every trading day for 124 years. So, it is at least interesting. And that’s because it is a track on what these editors think are important very long-term economic trends.

The original Index composition looks NOTHING like 2020. American Cotton Oil Company, American Spirits Manufacturing Company, American Sugar Refining Company, American Tobacco Company, Chicago Gas Light and Coke, General Electric, Leclede Gas, National Lead, Pacific Mail Steamship Company, Tennessee Coal Iron and Railroad Company, United State Cordage Company and United States Leather Company. Familiar household names? This initial list represents the era in 1896 – an agrarian economy just on the cusp of coming into the industrial age. Not forward looking, but rather somewhat reflective of what were the biggest parts of the economy historically with a not forward.

Over 124 years lots of companies left the DJIA — were replaced – and many replacements left. Some came on, went off, and came back on again – such as AT&T, Exxon (formerly Standard Oil of New Jersey) and Chevron (formerly Standard Oil of California.) Even the vaunted GE was inducted in 1899, only to be removed in 1901 – then added back in 1907 where it stayed until CEO Jeff Immelt imploded the company and it was removed for good in 2018.

But, there has been a theme to the changes. Originally, the index was largely agricultural companies. As the economy changed, the Index rotated into commodity companies like gas, coal, copper and nickel – the materials leading to a new era of tools. This gave way to component manufacturers, dominated by the big steel companies, which created the industrial era. Which, of course, led to big manufacturing companies like 3M and IBM. And, along the way, there was recognition for growth in new parts of the economy, by adding consumer goods companies like P&G, Coca-Cola, McDonald’s, Kraft (since removed,) and Nike along with retailers like Sears (later removed,) Walmart, Home Depot and Walgreens. The massively important role of financial services to the economy was reflected by including Travelers, JPMorgan Chase, American Express, Visa and Goldman Sachs. And as health care advanced, the Index added pharmaceutical companies like Pfizer, Johnson & Johnson and Merck.

Obviously, the word “industrial” no longer has any meaning in the Dow Jones Industrial Index.

Reading across the long history of the DJIA one recognizes the editors’ willingness to try and reflect what was growing in the American economy. But in a laggard way. Not selecting companies too early, preferring instead to see that they make a big difference and remain important for many years. And a tendency to keep them on the index long after the bloom is off the rose – like retaining Kraft until 2008 and still holding onto P&G and Coke today.

The bias has always been to be careful about adding companies, lest they not be sustainable. And not judge too hastily the demise of once great companies. Disney wasn’t added until 1991, long after it was an established entertainment leader. Boeing was added in 1987, after pioneering aviation for 30 years. Microsoft added in 1999, well after it had won the PC war. Thus, the index is a “lagging index.” It reflects a big chunk of what was great, while slowly adding what has recently been great – and never moving too quickly to add companies that just might be tomorrow’s leaders.

Sears added in 1924, wasn’t removed until 1999 when its viability is questionable. Phillip Morris Tobacco (became Altria) was added in 1985, and hung around until 2008 — long after we knew cigarettes were deadly and leadership didn’t know how to do anything else. Even today we see that United Aircraft was added in 1939, which became United Technologies in 1976 and then via merger Raytheon in 2020 – before it is now removed, as all things aircraft are screeching to a pandemic halt. And Boeing is still on the Index despite the 737 fiasco and plunging sales. IBM was added in 1939, and through the 1970s it was a leader in office equipment creating the computer industry. But IBM after years of declining sales and profits isn’t really relevant any longer, yet it is still on the Index.

As for adding growing stars, GM stays on the Index until it goes bankrupt, but Tesla is yet to make consideration (largely due to lack of profit history.) Likewise, Walmart remains even though the “big gun” in retail is obviously Amazon.com (another lacking the size and longevity of profits the editors like.) McDonald’s stays on the list, despite no growth for years and even as the Board investigates its HR department for hiding abhorrent leadership behavior – while Starbucks is eschewed. And Cisco is there, while we all use Zoom for pandemic-driven virtual meetings.

So what can we take away from today’s changes? First, the Index has changed dramatically over 20 years to reflect electronic technology. IBM, Microsoft and Apple are now joined by Salesforce. Pharma company Pfizer is being replaced by bio-pharma company Amgen in a nod to the future, although almost 40 years after Genentech went public. Exxon disappears as oil prices fall to sub-zero, demand declines globally and electric cars are on the cusp of taking market leadership. And conglomerate Honeywell is added just to show the editors still think conglomerates matter – even if GE has nearly disintegrated.

Is any of this meaningful? I don’t really think so. As an award for past performance, it’s a nice token to make the list. As business leaders, however, we need to be a LOT more concerned about developing businesses for the future, based on trends, than is indicated by the components of the DJIA. Driving revenue growth and higher margins comes from doing the next big thing, not the last big thing. And, as investors, if you want to make outsized returns you have to know that a basket of largely laggards (Apple, Microsoft and Salesforce excepted) is not the way to build your retirement nest. Instead, you have to invest in companies that are creating the future, making the trends a reality for businesses and consumers. Think FAANG.

Nonetheless, after 124 years it is still sort of interesting. I guess most of us do still care what the editors of big news companies think.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam@sparkpartners.com

by Adam Hartung | Aug 25, 2020 | Economy, Innovation, Leadership, Regulations, Strategy, Trends

In 2019, the California legislature passed Assembly Bill, AB5 “The Gig Economy Law.” It redefined “employee” in an effort to try and dramatically reduce “contract workers.” This law is intended to force people who work to become ”employees” (of someone), and thereby receive more rights. Simultaneously it forces those who pay for work to become “employers” covering additional costs forced onto them by the legal definition of an “employee”. In other words, AB5 attempts to set back the advancement of the Gig Economy 30+ years. Last week, that law was put on hold by a California court, and California citizens will vote in November on whether requirements of AB5 should remain, or be repealed.

Go back to 1900 and there were very few “employees.” Most people just worked. But the industrial economy boomed, and with it the need to put people into factories. Showing up on time, doing a job, was crucial to the industrial economy – whether you were making car parts or pushing invoices around. We’ve all seen pictures of assembly lines in factories making shirts or lawn mowers, and assembly lines of gray steel desks where people manually processed documentation. Being an “employee” meant showing up and was central to developing the industrial economy, where lots of cogs were needed for the machine to work.

There is one thing stronger than all the armies in the world, and that is an Idea whose time has come.

Victor Hugo

But we’re not in an industrial economy any more. Since 1990 we’ve been transforming into the information economy (or the knowledge economy, pick your preferred term.) Automation has replaced labor, with robots making trucks while computers process documents. People don’t stand in assembly lines – machines do. Work doesn’t happen with our hands, it happens with our brains – and machines do the manual labor. Managers don’t manage people, they manage processes. As a result, companies have been realizing they need a lot fewer people.

No longer can employers consider employees for life. Rather, companies need flexibility to adjust to the fast paced marketplace. Owning resources, including labor, can feel like dragging an anchor along with your business. Yes, people are needed people to do things. But every business leader knows that the brainpower needed today is probably not what was needed yesterday and not what will be needed tomorrow. Businesses need to access the knowledge workers they need quickly and shift their resources fast in order to meet changing market conditions- agility not stability. Relationships are transactional, not societal.

This is actually good for everyone. A hundred years ago studios controlled everything about movie making, including actor salaries. Many actors (i.e. Judy Garland & Mickey Rooney) made dozens of movies, yet had very little money. But that lock was broken, and it allowed actors to sell their services to the highest bidder – leading to today’s “star economy” where actors make what they can get producers to pay. There is a set scale to employment, but every actor is a free agent able to negotiate their terms of “employment” for each project.

This is actually good for everyone. A hundred years ago studios controlled everything about movie making, including actor salaries. Many actors (i.e. Judy Garland & Mickey Rooney) made dozens of movies, yet had very little money. But that lock was broken, and it allowed actors to sell their services to the highest bidder – leading to today’s “star economy” where actors make what they can get producers to pay. There is a set scale to employment, but every actor is a free agent able to negotiate their terms of “employment” for each project.

Major league sports is the same. Where once club owners dictated pay, today players negotiate across teams for the best contracts. It allows for negotiating the best price for the best service in an open, flexible economy. If you’re good at playing, or coaching, you negotiate with the teams to get your best price for your services.

Uber and Lyft aren’t much different from studios and sports franchisees. Once, taxi companies controlled the market. All of us spent time standing in lines, waiting on cabs, that too often were dirty and broken. Market access was controlled by taxi tokens, and so was pricing. So service deteriorated to as low as possible, while customers stood in line on Friday night hoping to get a cab home from the theatre. But Uber unleashed the market. Resources could be added, or removed, by market participants. Pricing was determined by the buyers and sellers. And pricing variability allowed for quality variations as drivers tried to acquire repeat business. Surge pricing meant you could get a ride on New Year’s eve, meeting the customer needs and with pricing to meet the supplier’s need for expanding short-term capacity.

Uber and Lyft aren’t much different from studios and sports franchisees. Once, taxi companies controlled the market. All of us spent time standing in lines, waiting on cabs, that too often were dirty and broken. Market access was controlled by taxi tokens, and so was pricing. So service deteriorated to as low as possible, while customers stood in line on Friday night hoping to get a cab home from the theatre. But Uber unleashed the market. Resources could be added, or removed, by market participants. Pricing was determined by the buyers and sellers. And pricing variability allowed for quality variations as drivers tried to acquire repeat business. Surge pricing meant you could get a ride on New Year’s eve, meeting the customer needs and with pricing to meet the supplier’s need for expanding short-term capacity.

You might not think of Kim Kardashian, Tom Brady and an Uber driver as gig workers. But they are. And this hasn’t been lost on most of us. As publishers have disappeared, writers now must sell their research and writing independently, no longer expecting a set salary and benefits from newspaper owners. Virtual office assistants abound. For almost 30 years we’ve been building a flourishing economy of “gig workers” who are looking to match their skills with market needs. Uber and Lyft are just platforms created to help match the sellers and buyers (as is FiveRR for graphics and other office services.) Their success has been due to meeting a very real market need.

Uber and Lyft have helped the trend toward individual economic independence grow, not created the trend. When you see managers, who work for a set wage, working 24x7x365 on their iPhone or other mobile device, what’s the difference between them and a “gig worker?” When it comes to getting the work done, nothing. Just how they are paid – and some serious illusions about the employee/employer compact that are wholly out of date. Increasingly, we are recognizing we are better off to maximize the value of our services working independently, and seeking out projects that can use our services as contractors, rather than going through the burden of “hiring” and “firing” across “employers” in a fast changing world. Uber didn’t put people out of work, the knowledge economy redefined work. Uber doesn’t create low pay, it just offers a market that allows for flexible capacity and variable pricing. Uber offers a platform matching buyers and sellers. And that’s something we need MORE as adaptability demands keep rising.

California legislators can see that work has changed. But their approach was backward. They are trying to push everyone – both workers and business people – into an outdated model. An industrial model of employment. That will never work. It won’t work because the economy has changed, the world has changed, needs have changed, and these trends will not reverse. Trying to rewind the clock will only cause employers to abandon markets, as Uber and Lyft did when they said they would leave California. Solutions must address trends for independence and accessibility, not try to apply 100 year old definitions to a modern problem.

Contract work is here to stay. It’s been growing for 30 years. What’s needed are better Gig Marketplace tools to help business people find the resources they need, for workers to find projects that fit their skills and that meet their societal needs.

The old model created the term “benefits” for societal needs comprised of unemployment pay, retirement pay, hazard compensation, health care, etc. and forced those costs onto the “employer.” In much of the world today these costs are born by the government, but in the USA they are still borne by “employers”. In a contractor relationship, no one is required to cover the costs of those benefits. In most businesses now, “employer” is a term with a lot less meaning since businesses need much more agility than they did in an industrial economy. During this transition from industrial to gig economy, those societal needs are not being met effectively, leading to individual suffering and much, much higher costs to society.

New solutions are required to meet these needs – instead of forcing the old model onto a new economy. Legislators and regulators need to recognize that old approaches need to be revamped. All of these problems need new solutions – not some effort to force the industrial model onto platform providers that do little more than match needs with skills.

And this requirement for change applies to labor representation as well. The Department of Labor is an industrial era dinosaur that has little to no value in a world of work-from-home employees, outsourced manufacturing plants and easily available offshore production. Industrial era labor unions make no sense when we don’t work on assembly lines. Yet, unions are a very important part of entertainment and professional sports. Because in the latter markets leaders have adapted the union’s services to meet modern needs. Whether they realize it or not, gig workers need help with representation. But that representation must be a lot more sophisticated at helping workers than the throngs of attorneys at the AFL-CIO.

Californians would be suffer negative impacts if Uber and Lyft leave the market. And they realize that. But the solution is not the blunt axe of AB5. Thus, the law will almost surely be reversed in the next election. Then, hopefully, California will step up to the challenge of leading the country with new approaches that meet gig worker needs – expanding their markets and opportunities while building social solutions to every day needs.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam@Sparkpartners.com

by Adam Hartung | Jul 30, 2020 | In the Whirlpool, Innovation, Leadership, Marketing, Strategy, Trends

Yesterday (7/28/20), President Trump surprised a LOT of people announcing that via the Defense Production Act (DPA) the US government is going to give Kodak $765 million to make pharmaceuticals. The tie to current COVID-19 pandemic issues, for which the Act was invoked, is at best tenuous. Somehow the announcement seems to be more about moving pharma production back to the USA. Which is why it left me, and a lot of others, asking “why would you pick Kodak?”

Everyone knows the Kodak story. Great innovator, makes the Brownie and creates an entirely new market called “amateur photography.” From an era when almost nobody had a picture of themselves, Kodak made pictures commonplace. And the company was a wild success. The US Department of Defense asked Kodak to help them develop a way to send photos digitally from satellites to earth, and after spending a lot of taxpayer money Kodak invents digital photography. A very happy DOD allowed Kodak to keep the civilian rights to digital photography. Locked into the profits from film sales, Kodak never develops the products or market and licensed away the technology. Which doomed Kodak to the world of business history books as one of the classic business screw-ups of all time, riding film sales to death and missing the next big market wave.

Over the last 20 years there’s been nothing new to excite anyone about Kodak. They tried launching a blockchain technology-based business for photographers to manage picture rights. Way too late and poorly conceived, and lacking any demand, that went nowhere. Lacking any new ideas leadership grabbed the lightest “shiny new thing” and launched Kodak’s own cryptocurrency “KodakCoin.” Missed it? So did everyone else. In a word, Kodak was going nowhere.

I always recommend watching trends, and then pivoting your strategy to be on trend. So why didn’t the blockchain and cryptocurrency “pivots” work? Simply, Kodak brought nothing to the marketplace. They didn’t identify an un-met or under-met need and try to fill it with a better solution. Kotak just tried to jump into some shiny technology and throw it onto the marketplace hoping someone would think they needed it. They didn’t. So those pivots failed.

Big companies can pivot. IBM pivoted from a mainframe hardware company into a software and services company. And that worked because IBM understood customers had un-met and under-met needs for enterprise applications and Software-As-A-Service (SAAS) use. IBM moved from making expensive, over-developed hardware to meeting a very real customer need, and the pivot revitalized a nearly obsolete company.

Even before IBM, Singer was once a manufacturer of sewing machines. As the 1960s ended home sewing was in a tailspin, and commercial sewing was all going to Asia. Singer had nothing new to offer, while it’s primary competition (Brother) was innovating gobs of new features to make sewing better, faster, easier and cheaper. So Singer sold (all its products, manufacturing, brand name, etc) to Brother. Leadership studied the marketplace and identified a very big, growing and under-met need for defense electronics suppliers. Leadership carefully acquired leading companies with new technologies in forward looking infrared, heads up displays and others to build a leading-edge defense contractor. Note, they first identified an under-met need. Second, (via acquisition) they brought to market a lot of product innovation to improve customer performance in ways not previously utilized. The pivot was built on under-met needs and innovation.

So what is the plan for Kodak? Kodak knows nothing about pharmaceuticals, and their understanding of “chemistry” (to the extent it still exists) has NO application in pharma. (Ever heard of a joint venture called DuPont/Merck designed to apply DuPont chemistry expertise to pharma? I didn’t think so. It didn’t survive.) The plan is to build a company to make the most generic “pharmaceutical ingredients.” Not blockbuster pharmaceuticals. Literally, the very most generic ingredients. Not better ingredients. Not cheaper ingredients. Just make what already exists – and almost assuredly at a higher cost.

These Kodak ingredients are not innovative. Making them is not innovative. The reason “big pharma” doesn’t make these is because they are GENERIC products of low value, and production has moved to China and India where costs are lower. There is no innovation in these products. And Kodak has NO PLAN to add any innovation. None. Not in products, not in manufacturing process, not in markets served or customer service. Nope. Kodak plans to take 3 to 4 YEARS (any idea how fast markets move these days) to develop a plant to make a generic product that is sold on the basis of cost.

The only way this works, at all, is if the government forces, by regulation, U.S. pharma companies to buy from Kodak (in 3 to 4 years when they supposedly can make the stuff.) Otherwise, why pay the higher price? Today, American politicians constantly decry the high U.S. drug prices. So we are to expect that $765 million of taxpayer money will be spent on a plant, to make a generic compound, readily available in the world today, at a higher price, that will then be forced into American pharma products making them EVEN MORE EXPENSIVE! This is exactly how America ended up with the Bath Iron Works to make Navy ships which are the MOST expensive in the world – and thus wholly non-competitive in commercial ship production.

Does this not sound …… problematic? If we need U.S. based manufacturing for these products every single pharma company in the USA could open a plant faster, manufacturing at lower cost than Kodak, and with no quality or other regulatory concerns. There literally is no need for Kodak to become a supplier in this supply chain. And – absolutely no reason the U.S. taxpayer should be expected to teach Kodak how to “pivot” into becoming a new company. If the White House wants to use the D.P.A. to make more generic pharma compounds then it can push [insert any pharma company name you like here] to do it like they pushed G.M. to make ventilators!

Net/net – this is a pivot, and Kodak desperately needs to pivot. But this will not be a successful pivot. Because it is not targeting an unmet or under-met need. It is not utilizing innovation to create a better solution for meeting customer needs. This is making a generic product, that is readily available, at a higher cost than it is available today. Who wants this?

I’m sure Kodak shareholders are happy. Today. But this is a train wreck. Don’t expect this plant to ever make it to fruition, as the pharma companies will unwind this deal long before Kodak makes anything. And if we’re lucky, taxpayers will get some of their money back. But who knows, because this is a really stupid idea.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam@sparkpartners.com

by Adam Hartung | Jul 22, 2020 | Disruptions, Innovation, Leadership, Marketing, Trends

As the pandemic dropped on the USA with full force mid-April the price of oil dropped to less than $0. OK, it was something of a fluke. Demand dropped so fast that supply couldn’t fall fast enough, so oil was flowing into refineries and tanks and pipelines so fast that nobody knew where to put it – and that resulted in suppliers having to pay someone to take their oil.

But… the point was very real. Oil prices depend on demand – every bit as much as supply. Even though for a generation we’ve taken growing oil demand for granted, and focused on how to create additional supply, it is a fact that NOW declining demand will limit the value of oil and gas (which is, after all, a commodity.) The TREND has changed course, with demand in the USA barely, or not, growing – and globally demand growth primarily all in Asia (mostly China.) Overall, supply growth has beaten demand growth by a wide margin, and prices are not only low now – they will likely go lower. Even oil company CEOs are predicting US production will decline – but to lower demand

In 2015, I predicted that Tesla could put a big hurt on Exxon. Most people thought that was a joke. Tesla was a fraction the size of GM, and “small potatoes” in the car industry. Meanwhile Exxon was one of the world’s largest oil producers and refiners. That really would be a very small David smacking a very big Goliath – and with a very small rock. But what I pointed out in 2015 was that traditional analysts predicted a very gradual growth in electric cars, and a continued growth in petroleum powered cars, and pretty much constant growth in oil & gas consumption with economic growth. In other words,analysts were using old assumptions all around and expecting only a tiny impact from a few weirdos buying electric cars.

But I asked, what if those assumptions were wrong? In 2015, the world was awash in oil, inventories were then at record levels, and electric car sales were taking off. And the truth was, a lot was happening to reduce demand for oil. Renewable energy programs, conservation, and a change in economic activity from basic manufacturing and commodity processing to a knowledge economy. These trends were all putting big dampers on oil demand. And electric auto sales were poised for a big boom. I predicted demand for oil would drop substantially, inventories would skyrocket and industry problems would worsen as prices cratered.

Uh-hum – what was the price of oil in April?

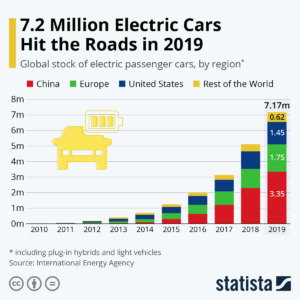

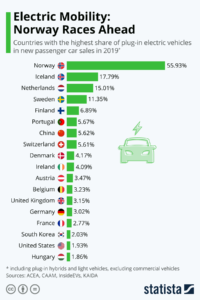

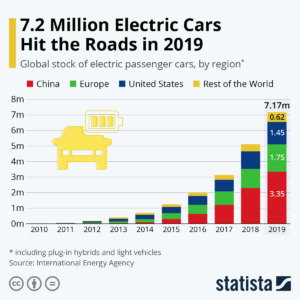

In 2009, I made the case that electric cars were a small base, but that geometric demand growth would make them an important economic impact . Today, most Americans still think that’s the case. In 2009 less than 100,000 new cars were electric. But by 2015, over 1 million electric cars had been sold. Then, with the help of game changers like the Tesla Model 3 in 2019 sales exceeded 7 million! A 7-fold increase in 5 years, or nearly 50%/year market growth!!

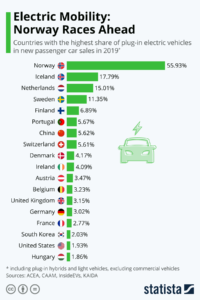

Americans aren’t aware of this phenomenon largely because the big growth centers are outside the USA. Where electrics are ~2% of US car sales, in some European countries they are well over 10% of the market. Even in China they represent over 5% of sales!

Remember what I said above about demand growth depending on China? Look again at who’s buying the most electric cars.

Lessons:

1 – Never think your product is beyond attack by market forces. Be paranoid.

2 – Very small, fringe competition can sneak up and steal your market faster than you think.

3 – Fringe changers don’t have to take a huge market share to make a BIG impact on your market and pricing.

4 – Disruptive events favor the upstarts, who are on trend, and hurt big incumbents, who depend on “business as usual.”

5 – Don’t expect markets to “return to normal.” Markets always move forward, with trends.

6 – Don’t plan from the past, plan for the future – and pay attention to disruptions, they can break you.

TRENDS MATTER. If you align with trends your business can do GREAT! Are you aligned with trends? What are the threats and opportunities in your strategy and markets? Do you need an outsider to assess what you don’t know you don’t know? You’ll be surprised how valuable an inexpensive assessment can be for your future business (https://adamhartung.com/assessments/)

Give us a call or send an email. Adam @Sparkpartners.com